|

|

市場調査レポート

商品コード

1463569

北米の豚用診断:2030年市場予測-地域別分析-製品タイプ、サンプルタイプ、疾患、エンドユーザー別North America Swine Diagnostics Market Forecast to 2030 - Regional Analysis - by Product Type, Sample Type, Disease, and End User |

||||||

|

|||||||

| 北米の豚用診断:2030年市場予測-地域別分析-製品タイプ、サンプルタイプ、疾患、エンドユーザー別 |

|

出版日: 2024年01月24日

発行: The Insight Partners

ページ情報: 英文 95 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の豚用診断市場は、2022年の6,038万米ドルから2030年には1億2,135万米ドルに成長すると予測されています。2022~2030年のCAGRは9.1%と推定されます。

好ましい政府の取り組みが北米豚用診断市場を牽引

感染症は家畜の生産能力を低下させる。世界中の政府は、養豚農業従事者に最も一般的で悲惨な感染症について認識させることを重視し、これらの病気のスクリーニングや集団診断を促進する取り組みを行っています。また、国内外の企業と協力し、動物用医薬品を普及させています。これらのイニシアチブは、意思決定者、規制機関、標準試験機関、その他のエンドユーザーに家畜診断の重要性を伝えるのに役立っています。家畜診断に関して実施された顕著な政府のイニシアチブのいくつかを以下に挙げます。2020年12月、米国農務省(USDA)の動植物検疫局(APHIS)は、動物疾病の早期診断の改善と、全米動物衛生研究所ネットワーク(NAHLN)の獣医診断ラボの緊急対応能力の強化に焦点を当てた76のプロジェクトに1,440万米ドルを供与しました。プロジェクトはまた、ASFと古典的豚熱の診断試験の改善にも焦点を当てています。2022年8月、カナダ農業・農業食品省は、カナダにおけるASFの発生を予防し、潜在的な流行に備える取り組みを強化するため、最大3,334万米ドルを投資しました。この資金は、カナダにおけるASFウイルスの侵入と蔓延のリスクを低減するために極めて重要です。カナダ政府は、AFSに対する豚肉業界の予防・緩和努力を支援するため、最大1,722万米ドルを投資しました。このような政府の取り組みは、北米の豚用診断薬市場に参入している企業や、ASF関連の調査プロジェクトを実施している組織にとって、実行可能な機会を生み出しています。

北米豚用診断市場概要

米国は、世界レベルでも地域レベルでも最大の養豚用診断市場です。この国における豚用診断市場の成長は、企業による製品開拓、豚病サーベイランスの増加、診断キットの購入に対する政府投資によるものです。米国の豚病サーベイランスは時代とともに大きく発展してきました。同国の豚の個体数は多く複雑で、政府機関は古典的豚熱やアフリカ豚熱などの疾病の予防サーベイランスの実施に注力しています。さらに米国農務省(USDA)は、国内の養豚業界が、重大な影響を及ぼす外来動物伝染病(FADs)に対応できるよう準備することに注力しています。

2023年2月、米国農務省動植物検疫局(APHIS)は、アフリカ豚コレラ熱(ASF)と口蹄疫(FMD)を診断する試験キットを、国立動物ワクチン・獣医対策銀行(NAVVCB)向けに購入すると発表しました。このように、米国政府による診断キットの大量購入は、北米の豚用診断薬市場の成長を支えています。

米国の北米豚用診断市場に参入している企業は、継続的に製品を開発・導入しており、より高度な診断を可能にしています。また、動物検体が取り扱われる、すでに清浄化された場所での病原性を診断するための製品も開発されています。2023年4月、バイオチェック社は、豚または家畜の培養から10秒で結果が得られるリアルタイムのバイオセキュリティ診断ツール、VetAssureを発売しました。VetAssureは、スワビングを行うあらゆる場所のATP(すべての細胞のエネルギー源)量を検出するスワビング・システムで、迅速な意思決定を可能にし、病気の蔓延を防ぎ、バイオセキュリティを維持します。VetAssureの結果は、輸送中の実験棟の消毒の必要性や、スタッフが施設に入る前にシャワーを浴びる必要があるかどうかを特定するのに役立ちます。したがって、このような製品の利用可能性が高まることは、動物や農場、研究室、その他の関連する場所で働く人々の健康を維持するのに役立つと考えられます。

北米の豚用診断市場の収益と2030年までの予測(金額)

北米豚用診断市場のセグメンテーション

北米の豚用診断市場は、製品タイプ、サンプルタイプ、疾患、エンドユーザー、国に区分されます。

製品タイプ別では、北米の豚用診断市場はイムノアッセイキット、PCRキット、血球凝集阻害(HI)、その他に区分されます。2022年には、イムノアッセイキットセグメントが北米の豚用診断市場で最大のシェアを記録しました。

北米の豚診断市場は、サンプルの種類により、血液、口腔液、鼻腔スワブ、組織サンプル、その他に区分されます。2022年には、血液セグメントが北米の豚用診断市場で最大のシェアを記録しました。

疾患別では、北米の豚診断市場は、アフリカ豚熱(ASF)/古典的豚熱(CSF)、呼吸器疾患、豚サーコウイルス、豚流行性下痢、豚赤痢、その他に区分されます。2022年には、アフリカ豚熱(ASF)/古典的豚熱(CSF)セグメントが北米豚用診断市場で最大のシェアを記録しました。

エンドユーザー別に見ると、北米の豚診断市場は動物病院、動物クリニック、その他のエンドユーザーに区分されます。2022年には、動物病院セグメントが北米の豚用診断市場で最大のシェアを記録しました。

国別では、北米の豚診断市場は米国、カナダ、メキシコに区分されます。2022年には、米国が北米の豚用診断市場で最大のシェアを記録しました。

BioCheck BV、Bionote Inc、Idexx Laboratories Inc、INDICAL BIOSCIENCE GmbH、Innovative Diagnostics SAS、Neogen Corp、Ring Biotechnology Co Ltd、SAN Group GmbH、Thermo Fisher Scientific Inc、Zoetis Incは、北米の豚用診断市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米豚用診断市場情勢

- イントロダクション

- 北米PEST分析

- 規制シナリオ

- 米国

第5章 北米豚用診断市場-主要産業力学

- 主要市場の促進要因

- 豚肉と豚肉製品の需要増加

- 豚疾病の流行増加

- 市場抑制要因

- 豚肉の健康維持にかかるコストの高さ

- 市場機会

- 政府の積極的な取り組み

- 今後の動向

- 新規医薬品の研究開発努力の高まり

- 影響分析

第6章 豚用診断市場:北米市場分析

- 北米の豚用診断市場収益、2022~2030年

第7章 北米の豚用診断市場:2030年までの収益と予測:製品タイプ別

- イントロダクション

- 北米の豚用診断市場、2022年と2030年の製品タイプ別売上高シェア(%)

- 免疫測定キット

- PCRキット

- 血球凝集阻害(HI)キット

- その他

第8章 北米豚用診断市場:2030年までの収益と予測:サンプルタイプ別

- イントロダクション

- 北米豚用診断市場、2022年と2030年のサンプルタイプ別売上高シェア(%)

- 血液

- 口腔液

- 鼻腔スワブ

- 組織サンプル

- その他

第9章 北米豚用診断市場:2030年までの収益と予測:疾患別

- イントロダクション

- 北米豚用診断市場、2022年と2030年の疾患別売上高シェア(%)

- アフリカ豚熱(ASF)/古典的豚熱(CSF)

- 呼吸器疾患

- 豚サーコウイルス

- 豚流行性下痢症

- 豚赤痢

- その他

第10章 北米豚用診断市場:2030年までの収益と予測:エンドユーザー別

- イントロダクション

- 北米の豚用診断市場、2022年と2030年のエンドユーザー別売上高シェア(%)

- 動物病院

- 動物クリニック

- その他

第11章 北米の豚用診断市場:国別分析

- 米国

- カナダ

- メキシコ

第12章 北米豚用診断市場の業界情勢

- イントロダクション

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- BioCheck BV

- Idexx Laboratories Inc

- Thermo Fisher Scientific Inc

- Zoetis Inc

- INDICAL BIOSCIENCE GmbH

- Ring Biotechnology Co Ltd

- Innovative Diagnostics SAS

- Neogen Corp

- SAN Group GmbH

- Bionote Inc

第14章 付録

List Of Tables

- Table 1. North America Swine Diagnostics Market Segmentation

- Table 2. US Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Product Type

- Table 3. US Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Sample Type

- Table 4. US Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Disease

- Table 5. US North America Swine Diagnostics Market Revenue And Forecast to 2030 (US$ Mn) - End User

- Table 6. Canada Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Product Type

- Table 7. Canada Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Sample Type

- Table 8. Canada Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Disease

- Table 9. Canada North America Swine Diagnostics Market Revenue And Forecast to 2030 (US$ Mn) - End User

- Table 10. Mexico Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Product Type

- Table 11. Mexico Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Sample Type

- Table 12. Mexico Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - Disease

- Table 13. Mexico Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn) - End User

- Table 14. Recent Organic Growth Strategies in North America Swine Diagnostics Market

- Table 15. Recent Inorganic Growth Strategies in the North America swine diagnostics market

- Table 16. Glossary of Terms, North America Swine Diagnostics Market

List Of Figures

- Figure 1. North America Swine Diagnostics Market Segmentation, By Country

- Figure 2. North America - PEST Analysis

- Figure 3. North America Swine Diagnostics Market - Key Industry Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Swine Diagnostics Market Revenue (US$ Mn), 2022 - 2030

- Figure 6. North America Swine Diagnostics Market Revenue Share, by Product Type 2022 & 2030 (%)

- Figure 7. Immunoassays Kits: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

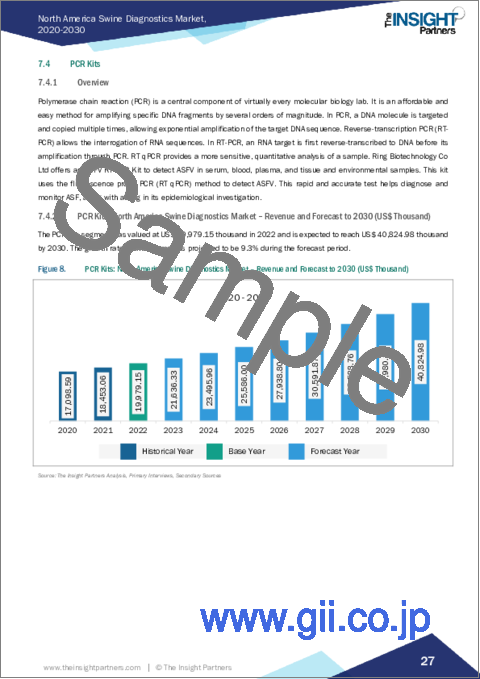

- Figure 8. PCR Kits: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 9. Hemagglutination-inhibition (HI): North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 10. Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 11. North America Swine Diagnostics Market Revenue Share, by Services 2022 & 2030 (%)

- Figure 12. Blood: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 13. Oral Fluids: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 14. Nasal Swab: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 15. Tissue Samples: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 16. Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 17. North America Swine Diagnostics Market Revenue Share, by Disease 2022 & 2030 (%)

- Figure 18. African swine fever (ASF)/Classical swine fever (CSF): North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 19. Respiratory Disease: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 20. Porcine Circovirus: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 21. Porcine Epidemic Diarrhea: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 22. Swine Dysentery: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 23. Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 24. North America Swine Diagnostics Market Revenue Share, by End User 2022 & 2030 (%)

- Figure 25. Veterinary Hospitals: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 26. Veterinary Clinics: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 27. Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- Figure 28. North America Swine Diagnostics Market, 2022 ($Thousand)

- Figure 29. North America Swine Diagnostics Market, By Key Countries, 2022 And 2030 (%)

- Figure 30. US Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn)

- Figure 31. Canada Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn)

- Figure 32. Mexico Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn)

The North America swine diagnostics market is expected to grow from US$ 60.38 million in 2022 to US$ 121.35 million by 2030. It is estimated to grow at a CAGR of 9.1% from 2022 to 2030.

Favourable Government Initiatives Drive North America Swine Diagnostics Market

Infectious diseases cause loss of production ability in farm animals. Governments across the world are emphasizing on making pig farmers aware of the most common and disastrous infectious diseases by undertaking initiatives to promote screening or mass diagnosis of these diseases. They are working with domestic and international companies to promote animal health products. These initiatives help convey the significance of livestock diagnosis to decision-makers, regulatory agencies, reference laboratories, and other end users. A few of the remarkable government initiatives undertaken with regard to livestock diagnostics are mentioned below. In December 2020, the Animal and Plant Health Inspection Service (APHIS) of the US Department of Agriculture (USDA) granted US$ 14.4 million to 76 projects focused on improving the early diagnosis of animal diseases and enhancing emergency response abilities of veterinary diagnostic laboratories from the National Animal Health Laboratory Network (NAHLN). The projects also focus on the betterment of ASF and classical swine fever diagnostic testing. In August 2022, the Ministry of Agriculture and Agri-Food of Canada invested up to US$ 33.34 million to enhance efforts to prevent the emergence of ASF in Canada and prepare for a potential outbreak. The funding is crucial for reducing the risk of the entry and spread of the ASF virus in Canada. The Canadian government invested up to US$$ 17.22 million to support prevention and mitigation efforts by the pork industry against AFS. Such government efforts are creating viable opportunities for companies in the North America swine diagnostics market and organizations conducting ASF-related research projects.

North America Swine Diagnostics Market Overview

The US is the largest market for swine diagnostics at a global and regional level. The swine diagnostic market growth in this country is attributed to product developments by companies, increasing swine disease surveillance, and government investments in purchasing diagnostics kits. Swine disease surveillance in the US has evolved significantly over time. Pig populations in the country are large and complex, and government entities are focusing on conducting preventive surveillance for diseases such as classical swine fever and African swine fever. In addition, the US Department of Agriculture (USDA) focuses on preparing the pig industry in the country to respond to high-consequence, foreign animal diseases (FADs).

In February 2023, the Animal and Plant Health Inspection Service (APHIS) of the USDA announced purchasing of test kits to diagnose African swine fever (ASF) and foot-and-mouth disease (FMD) for the National Animal Vaccine and Veterinary Countermeasures Bank (NAVVCB). Thus, such measures by the US government to purchase diagnostics kits in large volumes support the North America swine diagnostics market growth.

Companies operating in the North America swine diagnostics market in the US continuously develop and introduce their products, enabling enhanced diagnostics. They are also developing products to diagnose pathogenicity in already cleaned areas wherein animal samples are handled. In April 2023, BioCheck launched VetAssure, a real-time biosecurity diagnostic tool that provides results in 10 seconds from swine or animal culture. VetAssure is a swabbing system that detects the amount of ATP (energy source of all cells) in any area where swabbing is done, allowing quick decision-making, preventing disease spread, and keeping biosecurity intact. The results of VetAssure help identify the need for disinfection of lab buildings during transports or if the staff needs to take shower before they enter the facilities. Thus, the increasing availability of such products would help maintain the good health of animals and people working in farms, labs, and other relevant places.

North America Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Million)

North America Swine Diagnostics Market Segmentation

The North America swine diagnostics market is segmented into product type, sample type, disease, end user, and country.

Based on product type, the North America swine diagnostics market is segmented into immunoassays kits, PCR kits, hemagglutination inhibition (HI), and others. In 2022, the immunoassays kits segment registered the largest share in the North America swine diagnostics market.

Based on sample type, the North America swine diagnostics market is segmented into blood, oral fluids, nasal swabs, tissue samples, and others. In 2022, the blood segment registered the largest share in the North America swine diagnostics market.

Based on disease, the North America swine diagnostics market is segmented into African swine fever (ASF)/classical swine fever (CSF), respiratory diseases, porcine circovirus, porcine epidemic diarrhea, swine dysentery, and others. In 2022, the African swine fever (ASF)/classical swine fever (CSF) segment registered the largest share in the North America swine diagnostics market.

Based on end user, the North America swine diagnostics market is segmented into veterinary hospitals, veterinary clinics, and other end users. In 2022, the veterinary hospitals segment registered the largest share in the North America swine diagnostics market.

Based on country, the North America swine diagnostics market is segmented into the US, Canada, Mexico. In 2022, the US registered the largest share in the North America swine diagnostics market.

BioCheck BV, Bionote Inc, Idexx Laboratories Inc, INDICAL BIOSCIENCE GmbH, Innovative Diagnostics SAS, Neogen Corp, Ring Biotechnology Co Ltd, SAN Group GmbH, Thermo Fisher Scientific Inc, and Zoetis Inc are some of the leading companies operating in the North America swine diagnostics market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Swine Diagnostics Market Landscape

- 4.1 Overview

- 4.2 North America PEST Analysis

- 4.3 Regulatory Scenario

- 4.3.1 United States

5. North America Swine Diagnostics Market - Key Industry Dynamics

- 5.1 Key Market Drivers:

- 5.1.1 Rising Demand for Pork and Pork Products

- 5.1.2 Increasing Prevalence of Swine Diseases

- 5.2 Market Restraints

- 5.2.1 High Costs Involved in Pork Health Maintenance

- 5.3 Market Opportunities

- 5.3.1 Favourable Government Initiatives

- 5.4 Future Trends

- 5.4.1 Rising R&D Efforts to Create Novel Pharmaceuticals

- 5.5 Impact Analysis:

6. Swine Diagnostics Market - North America Market Analysis

- 6.1 North America Swine Diagnostics Market Revenue (US$ Mn), 2022 - 2030

7. North America Swine Diagnostics Market - Revenue and Forecast to 2030 - by Product Type

- 7.1 Overview

- 7.2 North America Swine Diagnostics Market Revenue Share, by Product Type 2022 & 2030 (%)

- 7.3 Immunoassays Kits

- 7.3.1 Overview

- 7.3.2 Immunoassays Kits: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 7.4 PCR Kits

- 7.4.1 Overview

- 7.4.2 PCR Kits: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 7.5 Hemagglutination-Inhibition (HI)

- 7.5.1 Overview

- 7.5.2 Hemagglutination-inhibition (HI): North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

8. North America Swine Diagnostics Market - Revenue and Forecast to 2030 - by Sample Type

- 8.1 Overview

- 8.2 North America Swine Diagnostics Market Revenue Share, by Services 2022 & 2030 (%)

- 8.3 Blood

- 8.3.1 Overview

- 8.3.2 Blood: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 8.4 Oral Fluids

- 8.4.1 Overview

- 8.4.2 Oral Fluids: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 8.5 Nasal Swab

- 8.5.1 Overview

- 8.5.2 Nasal Swab: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 8.6 Tissue Samples

- 8.6.1 Overview

- 8.6.2 Tissue Samples: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

9. North America Swine Diagnostics Market - Revenue and Forecast to 2030 - by Disease

- 9.1 Overview

- 9.2 North America Swine Diagnostics Market Revenue Share, by Disease 2022 & 2030 (%)

- 9.3 African Swine Fever (ASF)/Classical Swine Fever (CSF)

- 9.3.1 Overview

- 9.3.2 African swine fever (ASF)/Classical swine fever (CSF): North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 9.4 Respiratory Diseases

- 9.4.1 Overview

- 9.4.2 Respiratory Diseases: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 9.5 Porcine Circovirus

- 9.5.1 Overview

- 9.5.2 Porcine Circovirus: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 9.6 Porcine Epidemic Diarrhea

- 9.6.1 Overview

- 9.6.2 Porcine Epidemic Diarrhea: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 9.7 Swine Dysentery

- 9.7.1 Overview

- 9.7.2 Swine Dysentery: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 9.8 Others

- 9.8.1 Overview

- 9.8.2 Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

10. North America Swine Diagnostics Market - Revenue and Forecast to 2030 - by End User

- 10.1 Overview

- 10.2 North America Swine Diagnostics Market Revenue Share, by End User 2022 & 2030 (%)

- 10.3 Veterinary Hospitals

- 10.3.1 Overview

- 10.3.2 Veterinary Hospitals: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 10.4 Veterinary Clinics

- 10.4.1 Overview

- 10.4.2 Veterinary Clinics: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

- 10.5 Others

- 10.5.1 Overview

- 10.5.2 Others: North America Swine Diagnostics Market - Revenue and Forecast to 2030 (US$ Thousand)

11. North America Swine Diagnostics Market - Country Analysis

- 11.1 Overview

- 11.1.1 North America Swine Diagnostics Market, by Country

- 11.1.1.1 US

- 11.1.1.1.1 Overview

- 11.1.1.1.2 US Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn)

- 11.1.1.1.3 US Swine Diagnostics Market, by Product Type

- 11.1.1.1.4 US Swine Diagnostics Market, by Sample Type

- 11.1.1.1.5 US North America Swine Diagnostics Market, by Disease

- 11.1.1.1.6 US North America Swine Diagnostics Market, by End User

- 11.1.1.2 Canada

- 11.1.1.2.1 Overview

- 11.1.1.2.2 Canada Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn)

- 11.1.1.2.3 Canada Swine Diagnostics Market, by Product Type

- 11.1.1.2.4 Canada Swine Diagnostics Market, by Sample Type

- 11.1.1.2.5 Canada Swine Diagnostics Market, by Disease

- 11.1.1.2.6 Canada North America Swine Diagnostics Market, by End User

- 11.1.1.3 Mexico

- 11.1.1.3.1 Overview

- 11.1.1.3.2 Mexico Swine Diagnostics Market Revenue and Forecast to 2030 (US$ Mn)

- 11.1.1.3.3 Mexico Swine Diagnostics Market, by Product Type

- 11.1.1.3.4 Mexico Swine Diagnostics Market, by Sample Type

- 11.1.1.3.5 Mexico Swine Diagnostics Market, by Disease

- 11.1.1.3.6 Mexico Swine Diagnostics Market, by End User

- 11.1.1.1 US

- 11.1.1 North America Swine Diagnostics Market, by Country

12. North America Swine Diagnostics Market Industry Landscape

- 12.1 Overview

- 12.2 Organic Growth Strategies

- 12.2.1 Overview

- 12.3 Inorganic Growth Strategies

- 12.3.1 Overview

13. Company Profiles

- 13.1 BioCheck BV

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Idexx Laboratories Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Thermo Fisher Scientific Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Zoetis Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 INDICAL BIOSCIENCE GmbH

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Ring Biotechnology Co Ltd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Innovative Diagnostics SAS

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Neogen Corp

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 SAN Group GmbH

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Bionote Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About Us

- 14.2 Glossary of Terms