|

|

市場調査レポート

商品コード

1450865

北米の硬質フォームパネル - 市場規模と予測、地域のシェア、動向、成長機会分析レポート:材料別、用途別、最終用途別North America Rigid Foam Panels Market Size and Forecasts, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Material, Application, and End Use |

||||||

|

|||||||

| 北米の硬質フォームパネル - 市場規模と予測、地域のシェア、動向、成長機会分析レポート:材料別、用途別、最終用途別 |

|

出版日: 2024年02月21日

発行: The Insight Partners

ページ情報: 英文 111 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の硬質フォームパネル市場規模は、2022年に63億6,000万米ドルと評価され、2030年には91億3,000万米ドルに達すると予測され、2022年から2030年までのCAGRは4.6%と推定されます。

硬質フォームパネルは、ポリウレタン(PUR)、ポリイソシアヌレート(PIR)、ポリスチレンなどの発泡プラスチックや、ガラス繊維、スラグウールなどの繊維素材から作られます。硬質フォームパネルは、サーマルブリッジを低減するために建物外壁の断熱材として使用されることが多いです。この市場は、建設業界の拡大により、今後数年間で大きな成長が見込まれています。

北米の硬質フォームパネル市場は、素材別にポリウレタン、ポリスチレン、ポリイソシアヌレート、その他に分類されます。2022年には、ポリスチレンセグメントが北米の硬質フォームパネル市場で大きなシェアを占めました。ポリスチレン硬質フォームパネルは、EPS発泡パネルとしても知られ、熱性能、耐湿性、汎用性を兼ね備えた人気の断熱材です。このパネルは発泡ポリスチレンから作られており、軽量で硬いプラスチックフォームです。R値が高く、熱の流れに対して優れた抵抗力を発揮します。そのため、エネルギー消費を抑え、建物の冷暖房コストを下げることができます。さらに、EPS発泡パネルは熱伝導率が低く、i.壁、屋根、床を通る熱の伝わりを最小限に抑えます。ポリスチレンフォームパネルのもう一つの重要な特徴は、その耐湿性です。EPSフォームは独立気泡の断熱材であるため、水や湿気を吸収しにくいです。そのため、地下室やクロールスペース、外壁など、湿気の侵入が懸念される場所での使用に適しています。用途に基づき、市場は断熱材、構造材、装飾材、その他に細分化されます。北米の硬質フォームパネル市場で最大のシェアを占めるのは断熱分野です。硬質フォームパネルは断熱性が高く、断熱が必要な建築物やその他の用途に最適です。硬質フォームパネルは、建築・建設業界の屋根、壁、床の断熱材として一般的に使用されています。

2022年、北米の硬質フォームパネル市場は米国が独占しました。住宅や商業建築、飲食品の保冷庫、自動車など様々な用途で硬質フォームパネルの需要が高まっていることなどが、北米の硬質フォームパネル市場の成長を牽引しています。同地域では米国が硬質フォームパネルの主要市場です。北米ではインフラ整備が急速に進み、硬質フォームパネルの需要が急増しています。また、北米では住宅や商業施設の建設が盛んであり、建設業界の成長も硬質フォームパネルの需要を押し上げています。硬質フォームパネルは、屋根、壁、床の断熱材として建設業界で多く使用されています。さらに、構造安定性、断熱性、高強度などの特性を併せ持つ硬質フォームパネルは、さまざまな用途で優れた選択肢となっています。

北米の硬質フォームパネル市場では、Owens Corning、Perma R Products Inc、Carlisle Companies Inc、Kingspan Group Plc、DuPont de Nemours Inc、General Plastics Manufacturing Co、Insulation Depot Inc、Metro Home Insulation LLC、Gold Star Insulation LP、Johns Manville Corp.が主要なプレーヤーです。市場のプレーヤーは、顧客の需要を満たすために高品質の製品を提供することに注力しています。また、研究開発活動への投資や新製品の発売といった戦略を採用しています。

北米の硬質フォームパネル市場全体の規模は、一次情報と二次情報の両方を用いて算出されています。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関するより分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、北米の硬質フォームパネル市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の硬質フォームパネル市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の硬質フォームパネル市場:主要市場力学

- 市場促進要因

- 建築・建設業界における硬質フォームパネル需要の増加

- 発泡硬質パネルの保冷用途の拡大

- 市場抑制要因

- 原材料の環境への悪影響

- 市場機会

- 市場プレイヤーの戦略的取り組み

- 今後の動向

- 持続可能な硬質フォーム製品の開発

- 影響分析

第6章 硬質フォームパネル市場:北米市場分析

- 北米の硬質フォームパネル市場収益

- 北米の硬質フォームパネル市場数量(百万平方フィート)

- 北米の硬質フォームパネル市場の予測と分析

第7章 北米の硬質フォームパネル市場分析:材料

- ポリウレタン

- ポリスチレン

- 発泡ポリスチレン

- 押出法ポリスチレン

- ポリイソシアヌレート

- その他

第8章 北米の硬質フォームパネル市場分析:用途

- 断熱材

- 構造用

- 装飾

- その他

第9章 北米の硬質フォームパネル市場分析:用途別

- 建築用

- 冷蔵倉庫

- 飲食品

- 医薬品

- 自動車

- その他

第10章 北米の硬質フォームパネル市場:地域別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 COVID-19パンデミック:北米の硬質フォームパネル市場への影響

- COVID-19前後の影響

第12章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第13章 業界情勢

- 新製品開発

- 合併と買収

第14章 企業プロファイル

- Owens Corning

- Perma R Products Inc

- Carlisle Companies Inc

- Kingspan Group Plc

- DuPont de Nemours Inc

- General Plastics Manufacturing Co

- Insulation Depot Inc

- Metro Home Insulation LLC

- Gold Star Insulation LP

- Johns Manville Corp

第15章 付録

List Of Tables

- Table 1. North America Rigid Foam Panels Market Segmentation

- Table 2. List of Vendors in the Value Chain

- Table 3. North America Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million)

- Table 4. North America Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Table 5. North America Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - Material

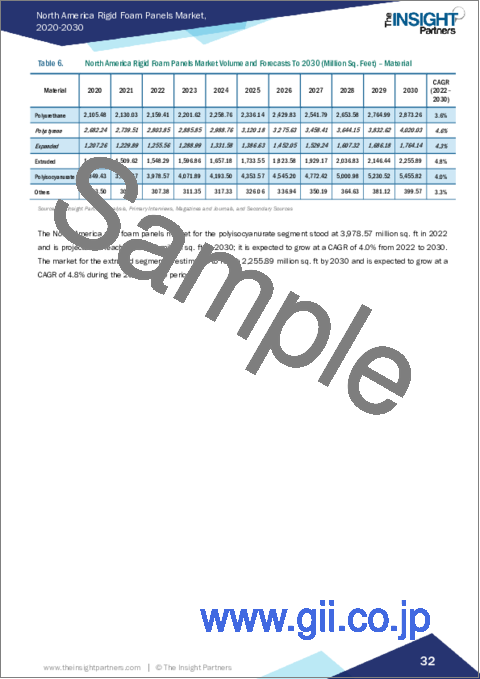

- Table 6. North America Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet) - Material

- Table 7. North America Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - Application

- Table 8. North America Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - End-Use

- Table 9. US Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By Material

- Table 10. US Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet) - By Material

- Table 11. US Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 12. US Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use

- Table 13. Canada Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By Material

- Table 14. Canada Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet) - By Material

- Table 15. Canada Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 16. Canada Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use

- Table 17. Mexico Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By Material

- Table 18. Mexico Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet) - By Material

- Table 19. Mexico Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By Application

- Table 20. Mexico Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use

List Of Figures

- Figure 1. North America Rigid Foam Panels Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Rigid Foam Panels Market

- Figure 4. Market Dynamics: North America Rigid Foam Panels Market

- Figure 5. North America Rigid Foam Panels Market Impact Analysis of Drivers and Restraints

- Figure 6. North America Rigid Foam Panels Market Revenue (US$ Million), 2020 - 2030

- Figure 7. North America Rigid Foam Panels Market Volume (Million Sq. Feet), 2020 - 2030

- Figure 8. North America Rigid Foam Panels Market Share (%) - Material, 2022 and 2030

- Figure 9. Polyurethane Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Polyurethane Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 11. Polystyrene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Polystyrene Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 13. Expanded Polystyrene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Expanded Polystyrene Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 15. Extruded Polystyrene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Extruded Polystyrene Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 17. Polyisocyanurate Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Polyisocyanurate Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 19. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Others Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 21. North America Rigid Foam Panels Market Share (%) - Application, 2022 and 2030

- Figure 22. Insulation Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Structural Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Decorative Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. North America Rigid Foam Panels Market Share (%) - End-Use, 2022 and 2030

- Figure 27. Construction Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. Cold Storage Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 29. Food and Beverage Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 30. Pharmaceutical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 31. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 32. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 33. North America Rigid Foam Panels Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 34. US Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 35. US Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 36. Canada Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 37. Canada Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 38. Mexico Rigid Foam Panels Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 39. Mexico Rigid Foam Panels Market Volume and Forecasts To 2030 (Million Sq. Feet)

- Figure 40. Heat Map Analysis by Key Players

- Figure 41. Company Positioning & Concentration

The North America rigid foam panels market size was valued at US$ 6.36 billion in 2022 and is expected to reach US$ 9.13 billion by 2030; it is estimated to register a CAGR of 4.6% from 2022 to 2030.

Rigid foam panels are made from foam plastics such as polyurethane (PUR), polyisocyanurate (PIR), and polystyrene, or from fibrous materials such as fiberglass and slag wool. Rigid foam panels are often used to provide thermal insulation in the building envelope in order to reduce thermal bridging. The market is expected to experience significant growth in the coming years owing to the expanding construction industry.

Based on material, the North America rigid foam panels market is categorized into polyurethane, polystyrene, polyisocyanurate, and others. In 2022, the polystyrene segment accounted for a significant share of the North America rigid foam panels market. Polystyrene rigid foam panels, also known as EPS foam panels, are a popular insulation material that offers a combination of thermal performance, moisture resistance, and versatility. These panels are made from expanded polystyrene, a lightweight and rigid plastic foam. They have a high R-value, which means they provide excellent resistance to heat flow. This helps reduce energy consumption and lower heating and cooling costs in buildings. Additionally, EPS foam panels have a low thermal conductivity, i.e., they minimize the transfer of heat through walls, roofs, and floors. Another important characteristic of polystyrene rigid foam panels is their moisture resistance. EPS foam is a closed-cell insulation material, which means it does not readily absorb water or moisture. This makes it suitable for use in areas where moisture intrusion is a concern, such as basements, crawl spaces, and exterior walls. Based on application, the market is subsegmented into insulation, structural, decorative, and others. The insulation segment accounts for the largest North America rigid foam panels market share. Rigid foam panels have a high insulation value, which makes them ideal for use in buildings and other applications where thermal insulation is needed. Rigid foam panels are commonly used as insulation materials in roofs, walls, and floors in the building and construction industry.

In 2022, the US dominated the North America rigid foam panels market. Factors such as the rising demand for rigid foam panels from various applications such as residential and commercial construction, cold storage of food and beverages, and automotive are driving the rigid foam panels market growth in North America. In the region, the US is a major market for rigid foam panels. North America has experienced massive growth in infrastructural development, which has surged the demand for rigid foam panels. Additionally, the growth of the construction industry in North America due to growing residential and commercial construction activities is also driving the demand for rigid foam panels. The rigid foam panels are highly used in the construction industry as insulation materials in roofs, walls, and floors. Further, the unique combination of structural stability, insulation, high strength, and other properties makes rigid foam panels an excellent choice for a range of applications.

Owens Corning, Perma R Products Inc, Carlisle Companies Inc, Kingspan Group Plc, DuPont de Nemours Inc, General Plastics Manufacturing Co, Insulation Depot Inc, Metro Home Insulation LLC, Gold Star Insulation LP, and Johns Manville Corp. are key players operating in the North America rigid foam panels market. Market players focus on providing high-quality products to fulfill customer demand. They are also adopting strategies such as investments in research and development activities and new product launches.

The overall North America rigid foam panels market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders specializing in the North America rigid foam panels market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

- 1.3 Limitations and Assumptions

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Rigid Foam Panels Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Rigid Foam Panels Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Rigid Foam Panels in Building and Construction Industry

- 5.1.2 Growing Cold Storage Applications of Rigid Foam Panels

- 5.2 Market Restraints

- 5.2.1 Harmful Impact of Raw Materials on Environment

- 5.3 Market Opportunities

- 5.3.1 Strategic Initiatives by Market Players

- 5.4 Future Trends

- 5.4.1 Development of Sustainable Rigid Foam Products

- 5.5 Impact Analysis

6. Rigid Foam Panels Market - North America Market Analysis

- 6.1 North America Rigid Foam Panels Market Revenue (US$ Million)

- 6.2 North America Rigid Foam Panels Market Volume (Million Sq. Feet)

- 6.3 North America Rigid Foam Panels Market Forecast and Analysis

7. North America Rigid Foam Panels Market Analysis - Material

- 7.1 Polyurethane

- 7.1.1 Overview

- 7.1.2 Polyurethane Market Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Polyurethane Market Volume and Forecast to 2030 (Million Sq. Feet)

- 7.2 Polystyrene

- 7.2.1 Polystyrene Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.2 Polystyrene Market Volume and Forecast to 2030 (Million Sq. Feet)

- 7.2.3 Expanded Polystyrene

- 7.2.3.1 Overview

- 7.2.3.2 Expanded Polystyrene Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.3.3 Expanded Polystyrene Market Volume and Forecast to 2030 (Million Sq. Feet)

- 7.2.4 Extruded Polystyrene

- 7.2.4.1 Overview

- 7.2.4.2 Extruded Polystyrene Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.4.3 Extruded Polystyrene Market Volume and Forecast to 2030 (Million Sq. Feet)

- 7.3 Polyisocyanurate

- 7.3.1 Overview

- 7.3.2 Polyisocyanurate Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.3 Polyisocyanurate Market Volume and Forecast to 2030 (Million Sq. Feet)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others Market Revenue and Forecast to 2030 (US$ Million)

- 7.4.3 Others Market Volume and Forecast to 2030 (Million Sq. Feet)

8. North America Rigid Foam Panels Market Analysis - Application

- 8.1 Insulation

- 8.1.1 Overview

- 8.1.2 Insulation Market Revenue and Forecast to 2030 (US$ Million)

- 8.2 Structural

- 8.2.1 Overview

- 8.2.2 Structural Market Revenue and Forecast to 2030 (US$ Million)

- 8.3 Decorative

- 8.3.1 Overview

- 8.3.2 Decorative Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. North America Rigid Foam Panels Market Analysis - End-Use

- 9.1 Construction

- 9.1.1 Overview

- 9.1.2 Construction Market Revenue and Forecast to 2030 (US$ Million)

- 9.2 Cold Storage

- 9.2.1 Overview

- 9.2.2 Cold Storage Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Food and Beverage

- 9.3.1 Overview

- 9.3.2 Food and Beverage Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Pharmaceutical

- 9.4.1 Overview

- 9.4.2 Pharmaceutical Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Automotive

- 9.5.1 Overview

- 9.5.2 Automotive Market Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. North America Rigid Foam Panels Market - Geographical Analysis

- 10.1 North America

- 10.1.1 Overview

- 10.1.2 North America Rigid Foam Panels Market Revenue and Forecasts and Analysis - By Countries

- 10.1.2.1 North America Rigid Foam Panels Market Breakdown by Country

- 10.1.2.2 US Rigid Foam Panels Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.3 US Rigid Foam Panels Market Volume and Forecasts to 2030 (Million Sq. Feet)

- 10.1.2.3.1 US Rigid Foam Panels Market Breakdown by Material

- 10.1.2.3.2 US Rigid Foam Panels Market Breakdown by Application

- 10.1.2.3.3 US Rigid Foam Panels Market Breakdown by End-Use

- 10.1.2.4 Canada Rigid Foam Panels Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.5 Canada Rigid Foam Panels Market Volume and Forecasts to 2030 (Million Sq. Feet)

- 10.1.2.5.1 Canada Rigid Foam Panels Market Breakdown by Material

- 10.1.2.5.2 Canada Rigid Foam Panels Market Breakdown by Application

- 10.1.2.5.3 Canada Rigid Foam Panels Market Breakdown by End-Use

- 10.1.2.6 Mexico Rigid Foam Panels Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.7 Mexico Rigid Foam Panels Market Volume and Forecasts to 2030 (Million Sq. Feet)

- 10.1.2.7.1 Mexico Rigid Foam Panels Market Breakdown by Material

- 10.1.2.7.2 Mexico Rigid Foam Panels Market Breakdown by Application

- 10.1.2.7.3 Mexico Rigid Foam Panels Market Breakdown by End-Use

11. Impact of COVID-19 Pandemic on North America Rigid Foam Panels Market

- 11.1 Pre & Post Covid-19 Impact

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 New Product Development

- 13.3 Merger and Acquisition

14. Company Profiles

- 14.1 Owens Corning

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Perma R Products Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Carlisle Companies Inc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Kingspan Group Plc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 DuPont de Nemours Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 General Plastics Manufacturing Co

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Insulation Depot Inc

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Metro Home Insulation LLC

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Gold Star Insulation LP

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Johns Manville Corp

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments