|

|

市場調査レポート

商品コード

1450864

米国の冷蔵倉庫 - 市場規模と予測、地域のシェア、動向、成長機会分析レポート:用途別、温度タイプ別、倉庫タイプ別US Cold Storage Market Size and Forecasts, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Application, Temperature Type, and Warehouse Type |

||||||

|

|||||||

| 米国の冷蔵倉庫 - 市場規模と予測、地域のシェア、動向、成長機会分析レポート:用途別、温度タイプ別、倉庫タイプ別 |

|

出版日: 2024年02月26日

発行: The Insight Partners

ページ情報: 英文 110 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国の冷蔵倉庫市場規模は2022年に409億7,222万米ドルと評価され、2030年には1,486億2,344万米ドルに達すると予測され、2022~2030年のCAGRは17.5%と予測されます。

消費者のコンビニエンス食品需要の増加が米国の冷蔵倉庫市場の成長を後押し

長年にわたり、消費者のライフスタイルは劇的に進化しており、その結果、消費者は利便性を求めて缶詰や加工食品に傾倒しています。缶詰食品は、保存状態が良くないと数日から数週間で腐敗する傾向が高いため、低温貯蔵施設は見逃せないです。これらの施設は、加工食品や缶詰食品の賞味期限を延ばすために、最適な温度と適切な保存条件を維持するのに役立ちます。さらに、加工食品のマーケティングへの露出が増えたことで、若い世代が加工食品を消費するようになった。このように、都市化の進展、可処分所得の増加、多忙なライフスタイルの台頭による簡便食品への需要の増加が、米国の冷蔵倉庫市場の成長を加速させています。

倉庫のタイプに基づき、米国の冷蔵倉庫市場シェアは公的、私的、半私的に区分されます。通常、政府機関、半政府機関、民間の第三者会社が倉庫を所有しています。消費者の生鮮品志向の高まりと冷凍食品需要の拡大は、米国の冷蔵倉庫市場規模の成長をもたらす主要因のいくつかです。また、予期せぬ自然災害やその他の危機の増加も、食品やその他の医薬品を保管する冷蔵倉庫の必要性を高めています。

柔軟なスペースと利用規定を提供企業は倉庫の開発や賃借に費用をかけたくないため、同じ施設を利用する他の企業と運営費や維持費を共有することを選ぶ。加えて、公開倉庫は、企業がフレキシブルに保管スペースを活用することを可能にします。公共倉庫サービス・プロバイダーは、ロジスティクスと倉庫管理にも特化しています。公共倉庫はハイエンドのシステムを備え、在庫を効果的に維持するプロセスを伴うため、企業の業務生産性の向上につながります。さらに、公共倉庫は多くの場合、交通ルート、ハブ、港、または主要都市の近くに位置しています。これにより、輸送コストと時間が削減され、企業は迅速に顧客に対応することができます。製品の需要が変化する企業は、在庫管理を最適化するのに役立つ公共倉庫の主要なエンドユーザーです。さらに、夏物や冬物の衣料品、祭りの装飾品など季節商品を扱う企業は、ピーク時の在庫保管に公共倉庫の恩恵を受けることができます。さらに、倉庫に投資するレバレッジを持っていない新興会社は、在庫を管理するために公共倉庫を利用することができます。さらに、国際的な企業は、主要な港湾都市に近い公共倉庫を利用することで、対象市場に商品を迅速に流通させることができます。

米国の冷蔵倉庫市場の分析は、同市場の主要プレーヤーを特定・評価することで行われます。Americold Logistics Inc.、Lineage Logistics LLC、United States Cold Storage Inc.、Interstate Warehousing Inc.、Newcold Cooperatief、Kloosterboer、Arcadia Cold Storage &Logistics、CTW Logistics、Burris Logistics、VersaCold Logistics Servicesなどが、米国の冷蔵倉庫市場レポートで分析されている主要企業です。また、米国の冷蔵倉庫市場レポートには、現在の米国の冷蔵倉庫市場動向と市場成長に影響を与える促進要因に照らした成長展望も含まれています。

米国の冷蔵倉庫市場で事業を展開する企業は、M&Aなどの無機戦略を採用することが多いです。市場イニシアチブは、世界中に拠点を拡大し、増大する顧客需要に対応するために企業が採用する戦略です。同市場に参入している企業は主に、先進的な機能や技術を自社の製品に組み込むことで製品やサービスを強化し、米国の冷蔵倉庫市場のシェアを拡大することに注力しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 米国の冷蔵倉庫市場情勢

- PEST分析

- エコシステム分析

- ストレージプロバイダー

- エンドユーザー

第5章 米国の冷蔵倉庫市場:主要市場力学

- 米国の冷蔵倉庫市場- 主な市場力学

- 市場促進要因

- 食品廃棄物の増加

- 米国におけるeコマース食料品販売の成長

- 消費者のコンビニエンス食品需要の増加

- 市場抑制要因

- 冷蔵施設が環境に与える悪影響

- コールドチェーン価格の上昇

- 市場機会

- 新しいコールドチェーン倉庫の建設

- 今後の動向

- 冷蔵倉庫の自動化

- 促進要因と抑制要因の影響

第6章 米国の冷蔵倉庫市場:米国市場分析

- 米国の冷蔵倉庫市場の収益、2022年~2030年

- 米国の冷蔵倉庫市場の予測分析

第7章 米国の冷蔵倉庫市場分析:用途別

- 乳製品

- 肉・魚介類

- 果物・野菜

- 医薬品

- 加工食品

第8章 米国の冷蔵倉庫市場分析:温度タイプ別

- チルド

- 冷凍

第9章 米国の冷蔵倉庫市場分析:倉庫タイプ別

- 公共

- 民間・半民間

第10章 米国の冷蔵倉庫市場-COVID-19パンデミックの影響

- COVID-19前後の影響

第11章 競合情勢

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 合併と買収

第13章 企業プロファイル

- Americold Realty Trust Inc

- Lineage Logistics Holdings LLC

- United States Cold Storage Inc

- NewCold Cooperatief UA

- Burris Logistics Co

- Consolidated Transfer and Warehouse Co Inc

- EVO Logistics Worldwide Corp

- Tippmann Group

- Arcadia Cold LLC

- ColdPoint Logistics

第14章 付録

List Of Tables

- Table 1. US Cold Storage Market Segmentation

- Table 2. US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

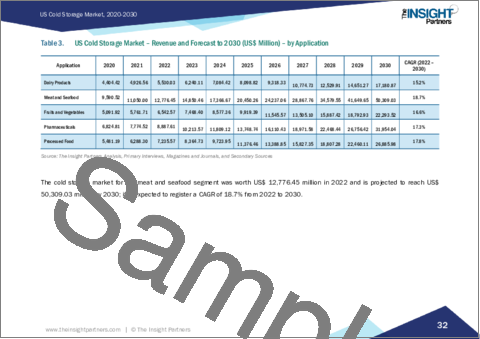

- Table 3. US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 4. US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million) - by Temperature Type

- Table 5. US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million) - by Warehouse Type

List Of Figures

- Figure 1. US Cold Storage Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Ecosystem Analysis

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. US Cold Storage Market Revenue (US$ Million), 2022-2030

- Figure 6. US Cold Storage Market Share (%) - by Application (2022 and 2030)

- Figure 7. Dairy Products: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Meat and Seafood: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Fruits and Vegetables: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Pharmaceuticals: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Processed Food: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. US Cold Storage Market Share (%) - by Temperature Type (2022 and 2030)

- Figure 13. Chilled: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Frozen: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. US Cold Storage Market Share (%) - by Warehouse Type (2022 and 2030)

- Figure 16. Public: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Private and Semi-Private: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Company Positioning & Concentration

The US cold storage market size was valued at US$ 40,972.22 million in 2022 and is projected to reach US$ 148,623.44 million by 2030; it is expected to register a CAGR of 17.5% during 2022-2030.

Increasing Demand for Convenience Food Among Consumers is Boosting the US Cold Storage Market Growth

Over the years, consumers' lifestyles have evolved drastically, owing to which consumers are inclining toward canned and processed food for convenience. As canned food items have a high tendency to get rotten within a few days or weeks if not preserved well, cold storage facilities cannot be overlooked. These facilities help maintain optimal temperature and proper storage conditions to extend the shelf life of processed or canned food. Further, increased marketing exposure of processed food is attracting the younger generation toward consuming processed food. Thus, the increasing demand for convenience food items due to rising urbanization, increasing disposable income, and rising busy lifestyles are accelerating the US cold storage market growth.

Based on warehouse type, the US cold storage market share is segmented into public, private, and semi-private. Government entities, semi-government bodies, and private third-party companies usually own warehouses. Increasing consumer inclination for perishable products and growing demand for frozen food items are a few of the key factors leading to the growth of US cold storage market size. Also, the rising incidents of unwanted natural calamities and other crises are boosting the need for cold storage facilities to store food and other pharmaceutical products.

provide flexible space and usage provisions. Companies prefer not to spend on developing or renting their warehouse and choose to share operational and maintenance costs with other companies using the same facility. In addition, public warehouses allow companies to leverage their storage space on a flexible basis. Public warehouse service providers also specialize in logistics and warehouse management. Public warehouses are equipped with high-end systems and involve processes that maintain inventory effectively, which leads to improved operational productivity for businesses. Moreover, public warehouses are often located at transportation routes, hubs, ports, or near major cities. This decreases transportation costs and time, which allows companies to attend to their customers quickly. Companies with changing demand for their products are the major end users of public warehouses that help them optimize inventory management. In addition, businesses that deal in seasonal products, such as summer or winter clothing or festival decorative items, can benefit from public warehousing for storing their inventory during peak times. Moreover, startup companies that do not have the leverage to invest in their warehouse can utilize public warehousing to manage their inventory. Furthermore, international companies can benefit from public warehousing near major port cities for fast distribution of their goods in target markets.

The US cold storage market analysis is carried out by identifying and evaluating key players in the market. Americold Logistics Inc., Lineage Logistics LLC, United States Cold Storage Inc, Interstate Warehousing Inc, Newcold Cooperatief, Kloosterboer, Arcadia Cold Storage & Logistics, CTW Logistics, Burris Logistics, and VersaCold Logistics Services are among the key players analyzed in the US cold storage market report. The US cold storage market report also includes growth prospects in light of current US cold storage market trends and driving factors influencing the market growth.

Companies operating in the US cold storage market highly adopt inorganic strategies such as mergers and acquisitions. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The players present in the market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings to increase their US cold storage market share.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. US Cold Storage Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Storage Providers

- 4.3.2 End Users

5. US Cold Storage Market - Key Market Dynamics

- 5.1 US Cold Storage Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Rise in Food Waste

- 5.2.2 Growth in E-Commerce Grocery Sales Across the US

- 5.2.3 Increasing Demand for Convenience Food Among Consumers

- 5.3 Market Restraints

- 5.3.1 Adverse Impact of Cold Storage Facilities on Environment

- 5.3.2 Rising Cold Chain Prices

- 5.4 Market Opportunities

- 5.4.1 Construction of New Cold Chain Warehouses

- 5.5 Future Trends

- 5.5.1 Automation in Cold Storage Facilities

- 5.6 Impact of Drivers and Restraints:

6. US Cold Storage Market - US Market Analysis

- 6.1 US Cold Storage Market Revenue (US$ Million), 2022-2030

- 6.2 US Cold Storage Market Forecast Analysis

7. US Cold Storage Market Analysis - by Application

- 7.1 Dairy Products

- 7.1.1 Overview

- 7.1.2 Dairy Products: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Meat and Seafood

- 7.2.1 Overview

- 7.2.2 Meat and Seafood: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Fruits and Vegetables

- 7.3.1 Overview

- 7.3.2 Fruits and Vegetables: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Pharmaceuticals

- 7.4.1 Overview

- 7.4.2 Pharmaceuticals: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Processed Food

- 7.5.1 Overview

- 7.5.2 Processed Food: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

8. US Cold Storage Market Analysis - by Temperature Type

- 8.1 Chilled

- 8.1.1 Overview

- 8.1.2 Chilled: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Frozen

- 8.2.1 Overview

- 8.2.2 Frozen: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

9. US Cold Storage Market Analysis - by Warehouse Type

- 9.1 Public

- 9.1.1 Overview

- 9.1.2 Public: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Private and Semi-Private

- 9.2.1 Overview

- 9.2.2 Private and Semi-Private: US Cold Storage Market - Revenue and Forecast to 2030 (US$ Million)

10. US Cold Storage Market - Impact of COVID-19 Pandemic

- 10.1 Pre & Post COVID-19 Impact

11. Competitive Landscape

- 11.1 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Merger and Acquisition

13. Company Profiles

- 13.1 Americold Realty Trust Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Lineage Logistics Holdings LLC

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 United States Cold Storage Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 NewCold Cooperatief UA

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Burris Logistics Co

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Consolidated Transfer and Warehouse Co Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 EVO Logistics Worldwide Corp

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Tippmann Group

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Arcadia Cold LLC

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 ColdPoint Logistics

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners