|

|

市場調査レポート

商品コード

1450857

中東の防食コーティング - 市場規模と予測、地域のシェア、動向、成長機会分析レポート:樹脂タイプ別、技術別、最終用途別Middle East Anticorrosion Coatings Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Resin Type, Technology, End Use |

||||||

|

|||||||

| 中東の防食コーティング - 市場規模と予測、地域のシェア、動向、成長機会分析レポート:樹脂タイプ別、技術別、最終用途別 |

|

出版日: 2024年02月20日

発行: The Insight Partners

ページ情報: 英文 172 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

中東の防食コーティング市場規模は2022年に9億5,312万米ドルと評価され、2030年には14億7,049万米ドルに達すると予測され、2022年から2030年までのCAGRは5.6%と推定されます。

中東の防食コーティング市場は、石油・ガス、石油化学、発電、上下水道処理、海洋など様々な産業における防食需要の増加により、著しい成長を遂げています。同地域では、高温、多湿、海水への暴露などの過酷な環境条件のため、腐食が大きな懸念事項となっています。石油・ガス産業は中東における防食コーティング市場の主要促進要因のひとつです。この地域には世界最大級の石油・ガス埋蔵量があり、石油・ガスの探査、生産、精製、輸送に必要なインフラは腐食しやすいです。

樹脂タイプによって、市場はエポキシ、ポリウレタン、アクリル、アルキド、ビニルエステル、その他に区分されます。2022年の中東防食コーティング市場シェアはエポキシセグメントが最大でした。エポキシ樹脂を主成分として配合されたエポキシ防食コーティングは、熱硬化性ポリマーの一種に属し、形成される保護層に堅牢性と耐久性を与えます。石油・ガス、海運、自動車、インフラストラクチャーなど多様な産業で採用されているエポキシ防食コーティングは、金属表面の最前線防御メカニズムとして機能します。塗布プロセスでは、エポキシ樹脂と硬化剤を正確に融合させることで、耐薬品性と粘着性を備えたコンパウンドを形成します。塗布後、これらのコーティング剤は固化し、金属表面を腐食剤から保護する強靭で不浸透性のバリアとなり、長期間にわたって酸化や劣化を防ぎます。防食コーティング市場は技術によって溶剤型、水性、その他に区分されます。溶剤型防食コーティングは、特に金属表面の腐食による有害な影響に対して強固な保護を提供するように設計された高度な配合です。

2022年、中東の防食コーティング市場はサウジアラビアが独占しました。サウジアラビアは世界の石油・ガスセクターの中心的存在であり、これが先進的な防食コーティングの需要を高める大きな要因となっています。パイプライン、製油所、石油化学施設の広範なネットワークにより、これらの重要資産を腐食から保護する必要性が最も高いです。高温多湿を含む過酷な環境条件が、堅牢な防食ソリューションの必要性をさらに際立たせています。石油輸出国機構によると、サウジアラビアは世界の確認石油埋蔵量の17%を保有しています。世界最大の原油輸出国です。サウジアラビアは、クウェートと共有する中立地帯の生産能力を含め、日量約1,200万バレルという世界最大の原油生産能力を有しています。同国の石油・ガス部門はGDPの~50%、輸出収益の70%を占めています。

RPM International Inc、The Sherwin-Williams Co、Akzo Nobel NV、Jotun AS、PPG Industries Inc、3M Co、The Progressive Center Co for Construction Chemicals Ltd、Nippon Paint Holdings Co Ltd、BASF SE、HB Fuller Coが中東防食コーティング市場で事業を展開する主要企業です。市場のプレーヤーは、顧客の需要を満たすために高品質の製品を提供することに注力しています。また、研究開発活動への投資や新製品の発売といった戦略を採用しています。

中東の防食コーティング市場全体の規模は、一次情報と二次情報の両方を用いて算出されています。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関するより分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、研究開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、中東の防食コーティング市場を専門とする評価専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 中東の防食コーティング市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

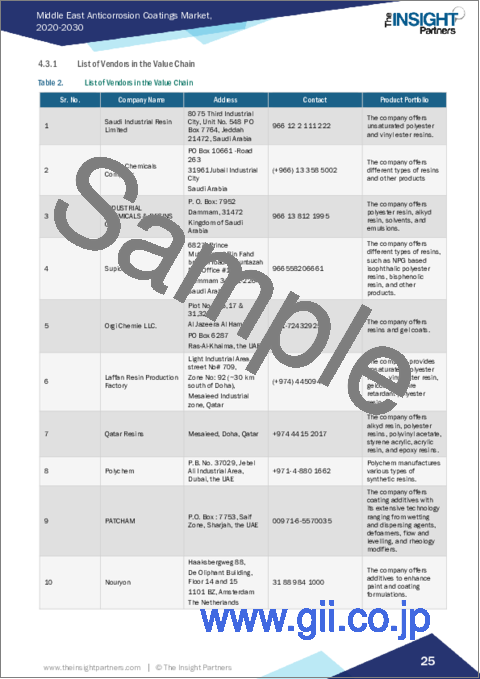

- バリューチェーンのベンダー一覧

第5章 中東の防食コーティング市場:主要市場力学

- 市場促進要因

- 石油・ガス産業の強い存在感

- 建築・建設産業の力強い成長

- 市場抑制要因

- 防食コーティングに関する安全衛生上の懸念

- 市場機会

- 自動車産業からの防食コーティングの需要拡大

- 今後の動向

- 環境に優しいバイオベースの防食コーティングへの嗜好の高まり

- 影響分析

第6章 防食コーティング市場:中東市場分析

- 中東の防食コーティング市場収益

- 中東の防食コーティング市場規模(キロトン)

- 中東の防食コーティング市場の予測と分析

第7章 中東の防食コーティング市場の分析:樹脂タイプ

- エポキシ樹脂

- ポリウレタン

- アクリル

- アルキド

- ビニルエステル

- その他

第8章 中東の防食コーティング市場分析-技術

- 溶剤型

- 水性

- その他

第9章 中東の防食コーティング市場分析:最終用途

- 海洋

- 石油・ガス

- 電力

- 自動車

- 建築・建設

- 航空宇宙・防衛

- その他

第10章 中東の防食コーティング市場:地域別分析

- 中東

- サウジアラビア

- アラブ首長国連邦

- イラン

- カタール

- その他中東

第11章 COVID-19パンデミック:中東の防食コーティング市場への影響

- COVID-19前後の影響

第12章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第13章 業界情勢

- 合併と買収

第14章 企業プロファイル

- RPM International Inc

- The Sherwin-Williams Co

- Akzo Nobel NV

- Jotun AS

- PPG Industries Inc

- 3M Co

- The Progressive Center Co for Construction Chemicals Ltd

- Nippon Paint Holdings Co Ltd

- BASF SE

- HB Fuller Co

第15章 付録

List Of Tables

- Table 1. Middle East Anticorrosion Coatings Market Segmentation

- Table 2. List of Vendors in the Value Chain

- Table 3. Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Table 4. Middle East Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons)

- Table 5. Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - Resin Type

- Table 6. Middle East Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons) - Resin Type

- Table 7. Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - Technology

- Table 8. Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - End Use

- Table 9. Saudi Arabia Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 10. Saudi Arabia Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 11. Saudi Arabia Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Technology

- Table 12. Saudi Arabia Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By End Use

- Table 13. UAE Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 14. UAE Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 15. UAE Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Technology

- Table 16. UAE Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By End Use

- Table 17. Iran Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 18. Iran Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 19. Iran Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Technology

- Table 20. Iran Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By End Use

- Table 21. Qatar Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 22. Qatar Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 23. Qatar Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Technology

- Table 24. Qatar Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By End Use

- Table 25. Rest of Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Resin Type

- Table 26. Rest of Middle East Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons) - By Resin Type

- Table 27. Rest of Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By Technology

- Table 28. Rest of Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million) - By End Use

List Of Figures

- Figure 1. Middle East Anticorrosion Coatings Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Anticorrosion Coatings Market

- Figure 4. Market Dynamics: Middle East Anticorrosion Coatings Market

- Figure 5. Middle East Anticorrosion Coatings Market Impact Analysis of Drivers and Restraints

- Figure 6. Middle East Anticorrosion Coatings Market Revenue (US$ Million), 2020 - 2030

- Figure 7. Middle East Anticorrosion Coatings Market Volume (Kilo Tons), 2020 - 2030

- Figure 8. Middle East Anticorrosion Coatings Market Share (%) - Resin Type, 2022 and 2030

- Figure 9. Epoxy Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Epoxy Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 11. Polyurethane Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Polyurethane Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 13. Acrylic Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Acrylic Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 15. Alkyd Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Alkyd Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 17. Vinyl Ester Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Vinyl Ester Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 19. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Others Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 21. Middle East Anticorrosion Coatings Market Share (%) - Technology, 2022 and 2030

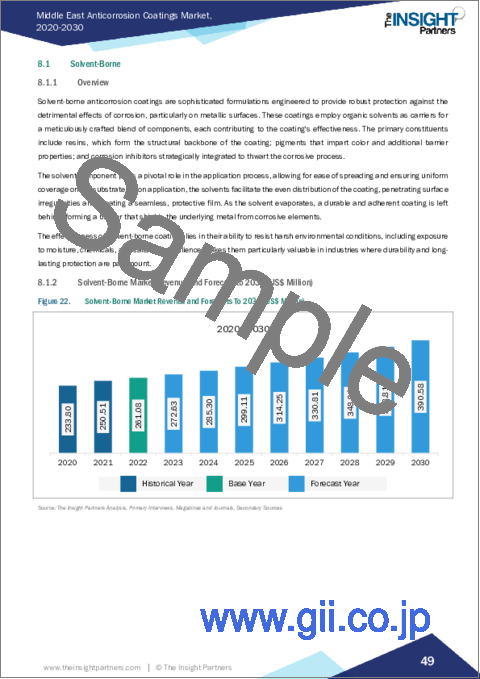

- Figure 22. Solvent-Borne Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Water-Borne Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Middle East Anticorrosion Coatings Market Share (%) - End Use, 2022 and 2030

- Figure 26. Marine Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 27. Oil and Gas Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 28. Power Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 29. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 30. Building and Construction Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 31. Aerospace and Defense Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 32. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 33. Middle East Anticorrosion Coatings Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 34. Saudi Arabia Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 35. Saudi Arabia Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 36. UAE Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 37. UAE Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 38. Iran Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 39. Iran Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 40. Qatar Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 41. Qatar Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 42. Rest of Middle East Anticorrosion Coatings Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 43. Rest of Middle East Anticorrosion Coatings Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 44. Heat Map Analysis by Key Players

- Figure 45. Company Positioning & Concentration

The Middle East anticorrosion coatings market size was valued at US$ 953.12 million in 2022 and is expected to reach US$ 1,470.49 million by 2030; it is estimated to register a CAGR of 5.6% from 2022 to 2030.

The Middle East anticorrosion coatings market is experiencing significant growth due to the increasing demand for corrosion protection in various industries such as oil and gas, petrochemicals, power generation, water and wastewater treatment, and marine. Corrosion is a major concern in the region due to the harsh environmental conditions, including high temperatures, humidity, and exposure to saltwater. The oil and gas industry is one of the major drivers of the anticorrosion coatings market in the Middle East. The region is home to some of the largest oil and gas reserves in the world, and the infrastructure required for exploration, production, refining, and transportation of oil and gas is prone to corrosion.

Based on resin type, the market is segmented into epoxy, polyurethane, acrylic, alkyd, vinyl ester, and others. The epoxy segment accounted for the largest Middle East anticorrosion coatings market share in 2022. Epoxy anticorrosion coatings, formulated with epoxy resins as their primary constituents, belong to the class of thermosetting polymers, imparting robustness and durability to the protective layer they create. Deployed across diverse industries such as oil & gas, maritime, automotive, and infrastructure, epoxy anticorrosion coatings serve as a frontline defense mechanism for metal surfaces. The application process involves the precise amalgamation of epoxy resins with curing agents, resulting in a chemically resistant and adhesive compound. Upon application, these coatings solidify into a tough, impermeable barrier that shields metal surfaces from corrosive agents, preventing oxidation and deterioration over extended periods. Based on technology, the anticorrosion coatings market is segmented into solvent-borne, water-borne, and others. Solvent-borne anticorrosion coatings are sophisticated formulations engineered to provide robust protection against the detrimental effects of corrosion, particularly on metallic surfaces.

In 2022, the Saudi Arabia dominated the Middle East anticorrosion coatings market. Saudi Arabia's position as a key player in the global oil & gas sector has been a significant driver for the heightened demand for advanced anticorrosion coatings. With an extensive network of pipelines, refineries, and petrochemical facilities, the need to protect these critical assets from corrosion is paramount. The harsh environmental conditions, including high temperatures and humidity, further underscore the need for robust anticorrosion solutions. According to the Organization of the Petroleum Exporting Countries, Saudi Arabia possesses ~17% of the world's proven petroleum reserves. It is the largest exporter of crude oil globally. Saudi Arabia holds the world's largest crude oil production capacity at ~12 million barrels per day, including capacity from the Neutral Zone shared with Kuwait. The country's oil & gas sector accounts for ~50% of the GDP and 70% of export earnings.

RPM International Inc, The Sherwin-Williams Co, Akzo Nobel NV, Jotun AS, PPG Industries Inc, 3M Co, The Progressive Center Co for Construction Chemicals Ltd, Nippon Paint Holdings Co Ltd, BASF SE, and HB Fuller Co are key players operating in the Middle East anticorrosion coatings market. Market players focus on providing high-quality products to fulfill customer demand. They are also adopting strategies such as investments in research and development activities and new product launches.

The overall Middle East anticorrosion coatings market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders specializing in the Middle East anticorrosion coatings market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Middle East Anticorrosion Coatings Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. Middle East Anticorrosion Coatings Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Strong Presence of Oil & Gas Industry

- 5.1.2 Strong Growth of Building & Construction Industry

- 5.2 Market Restraints

- 5.2.1 Safety and Health Concerns Regarding Anticorrosion Coatings

- 5.3 Market Opportunities

- 5.3.1 Growing Demand for Anticorrosion Coatings from Automotive Industry

- 5.4 Future Trends

- 5.4.1 Rising Preferences for Environment-Friendly and Bio-Based Anticorrosion Coatings

- 5.5 Impact Analysis

6. Anticorrosion Coatings Market - Middle East Market Analysis

- 6.1 Middle East Anticorrosion Coatings Market Revenue (US$ Million)

- 6.2 Middle East Anticorrosion Coatings Market Volume (Kilo Tons)

- 6.3 Middle East Anticorrosion Coatings Market Forecast and Analysis

7. Middle East Anticorrosion Coatings Market Analysis - Resin Type

- 7.1 Epoxy

- 7.1.1 Overview

- 7.1.2 Epoxy Market Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Epoxy Market Volume and Forecast to 2030 (Kilo Tons)

- 7.2 Polyurethane

- 7.2.1 Overview

- 7.2.2 Polyurethane Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Polyurethane Market Volume and Forecast to 2030 (Kilo Tons)

- 7.3 Acrylic

- 7.3.1 Overview

- 7.3.2 Acrylic Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.3 Acrylic Market Volume and Forecast to 2030 (Kilo Tons)

- 7.4 Alkyd

- 7.4.1 Overview

- 7.4.2 Alkyd Market Revenue and Forecast to 2030 (US$ Million)

- 7.4.3 Alkyd Market Volume and Forecast to 2030 (Kilo Tons)

- 7.5 Vinyl Ester

- 7.5.1 Overview

- 7.5.2 Vinyl Ester Market Revenue and Forecast to 2030 (US$ Million)

- 7.5.3 Vinyl Ester Market Volume and Forecast to 2030 (Kilo Tons)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

- 7.6.3 Others Market Volume and Forecast to 2030 (Kilo Tons)

8. Middle East Anticorrosion Coatings Market Analysis - Technology

- 8.1 Solvent-Borne

- 8.1.1 Overview

- 8.1.2 Solvent-Borne Market Revenue and Forecast to 2030 (US$ Million)

- 8.2 Water-Borne

- 8.2.1 Overview

- 8.2.2 Water-Borne Market Revenue and Forecast to 2030 (US$ Million)

- 8.3 Others

- 8.3.1 Overview

- 8.3.2 Others Market Revenue and Forecast to 2030 (US$ Million)

9. Middle East Anticorrosion Coatings Market Analysis - End Use

- 9.1 Marine

- 9.1.1 Overview

- 9.1.2 Marine Market Revenue and Forecast to 2030 (US$ Million)

- 9.2 Oil and Gas

- 9.2.1 Overview

- 9.2.2 Oil and Gas Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Power

- 9.3.1 Overview

- 9.3.2 Power Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Automotive

- 9.4.1 Overview

- 9.4.2 Automotive Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Building and Construction

- 9.5.1 Overview

- 9.5.2 Building and Construction Market Revenue and Forecast to 2030 (US$ Million)

- 9.6 Aerospace and Defense

- 9.6.1 Overview

- 9.6.2 Aerospace and Defense Market Revenue and Forecast to 2030 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others Market Revenue and Forecast to 2030 (US$ Million)

10. Middle East Anticorrosion Coatings Market - Geographical Analysis

- 10.1 Middle East

- 10.1.1 Overview

- 10.1.2 Middle East Anticorrosion Coatings Market Revenue and Forecasts and Analysis - By Countries

- 10.1.2.1 Middle East Anticorrosion Coatings Market Breakdown by Country

- 10.1.2.2 Saudi Arabia Anticorrosion Coatings Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.3 Saudi Arabia Anticorrosion Coatings Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.2.3.1 Saudi Arabia Anticorrosion Coatings Market Breakdown by Resin Type

- 10.1.2.3.2 Saudi Arabia Anticorrosion Coatings Market Breakdown by Technology

- 10.1.2.3.3 Saudi Arabia Anticorrosion Coatings Market Breakdown by End Use

- 10.1.2.4 UAE Anticorrosion Coatings Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.5 UAE Anticorrosion Coatings Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.2.5.1 UAE Anticorrosion Coatings Market Breakdown by Resin Type

- 10.1.2.5.2 UAE Anticorrosion Coatings Market Breakdown by Technology

- 10.1.2.5.3 UAE Anticorrosion Coatings Market Breakdown by End Use

- 10.1.2.6 Iran Anticorrosion Coatings Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.7 Iran Anticorrosion Coatings Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.2.7.1 Iran Anticorrosion Coatings Market Breakdown by Resin Type

- 10.1.2.7.2 Iran Anticorrosion Coatings Market Breakdown by Technology

- 10.1.2.7.3 Iran Anticorrosion Coatings Market Breakdown by End Use

- 10.1.2.8 Qatar Anticorrosion Coatings Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.9 Qatar Anticorrosion Coatings Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.2.9.1 Qatar Anticorrosion Coatings Market Breakdown by Resin Type

- 10.1.2.9.2 Qatar Anticorrosion Coatings Market Breakdown by Technology

- 10.1.2.9.3 Qatar Anticorrosion Coatings Market Breakdown by End Use

- 10.1.2.10 Rest of Middle East Anticorrosion Coatings Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.11 Rest of Middle East Anticorrosion Coatings Market Volume and Forecasts to 2030 (Kilo Tons)

- 10.1.2.11.1 Rest of Middle East Anticorrosion Coatings Market Breakdown by Resin Type

- 10.1.2.11.2 Rest of Middle East Anticorrosion Coatings Market Breakdown by Technology

- 10.1.2.11.3 Rest of Middle East Anticorrosion Coatings Market Breakdown by End Use

11. Impact of COVID-19 Pandemic on Middle East Anticorrosion Coatings Market

- 11.1 Pre & Post Covid-19 Impact

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Merger and Acquisition

14. Company Profiles

- 14.1 RPM International Inc

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 The Sherwin-Williams Co

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Akzo Nobel NV

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Jotun AS

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 PPG Industries Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 3M Co

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 The Progressive Center Co for Construction Chemicals Ltd

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Nippon Paint Holdings Co Ltd

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 BASF SE

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 HB Fuller Co

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments