|

|

市場調査レポート

商品コード

1420193

北米のホメオパシー市場の2030年予測-地域別分析:由来、タイプ、用途、流通チャネル別North America Homeopathy Market Forecast to 2030 - Regional Analysis - by Source, Type, Application, and Distribution Channel |

||||||

|

|||||||

| 北米のホメオパシー市場の2030年予測-地域別分析:由来、タイプ、用途、流通チャネル別 |

|

出版日: 2023年12月04日

発行: The Insight Partners

ページ情報: 英文 92 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米のホメオパシー市場は、2022年に16億4,842万米ドルと評価され、2030年には50億6,680万米ドルに達すると予測され、2022年から2030年までのCAGRは15.1%で成長すると予測されています。

ホメオパシー医学の採用増加が北米のホメオパシー市場を煽る

アロパシー医薬品や常用薬の潜在的な副作用に対する懸念が高まっています。2017年にScandinavian Journal of Public Healthに掲載された研究では、代替医療は主に補完的に、あるいは伝統医療と組み合わせて使用されていると述べられています。

副作用のない経口投与薬や医薬品への嗜好は以前から高まっており、今後も増え続けると思われます。アロパシーには強力な薬が含まれているが、万人に適しているわけではないです。さらに、アロパシー薬は高価で、病気に対して一過性の効果しかないです。さらに、処方された薬を服用したにもかかわらず、病気が再発することもあります。薬物乱用のケースはアロパシー薬でより一般的であり、これも自然療法に注目が集まる要因のひとつです。一方、ホメオパシー療法は安価で、副作用もないか、無視できる程度です。そのため、ホメオパシー薬の採用が増加しており、ホメオパシー市場の成長を後押ししています。

北米のホメオパシー市場の概要

北米のホメオパシー市場は米国、カナダ、メキシコに区分され、2022年には米国が最大の市場シェアを占めました。北米の市場成長は、ホメオパシー療法に対する消費者の認識と関心の高まりが市場成長に重要な役割を果たしたことに起因しており、消費者は代替ヘルスケアの選択肢を積極的に求めており、ホメオパシー治療の探求に意欲的であることが市場拡大に寄与しています。

北米のホメオパシー市場の収益と2030年までの予測(金額)

北米のホメオパシー市場セグメンテーション

北米のホメオパシー市場は、由来、タイプ、用途、流通チャネル、国に基づいて細分化されます。供給源に基づき、北米のホメオパシー市場は植物、動物、ミネラルに区分されます。2022年には植物セグメントが最大の市場シェアを占めました。

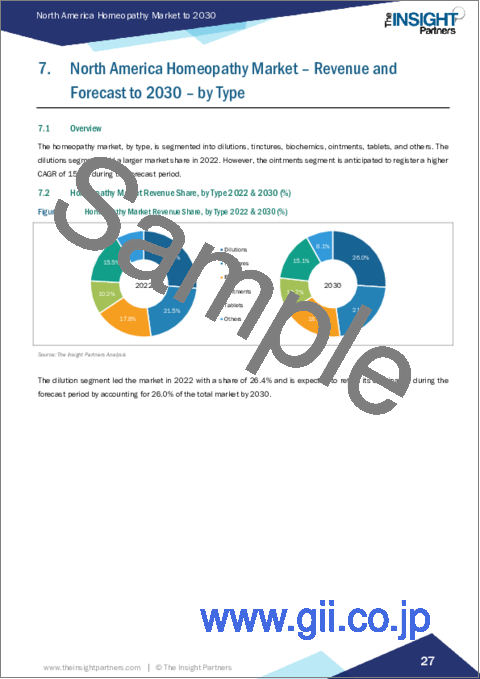

タイプ別では、北米のホメオパシー市場は希釈液、チンキ剤、生化学、軟膏、錠剤、その他に区分されます。希釈液セグメントが2022年に最大の市場シェアを占めました。

用途別では、北米のホメオパシー市場は鎮痛解熱、呼吸器、神経、免疫、消化器、皮膚、その他に区分されます。2022年には免疫学分野が最大の市場シェアを占めました。

流通チャネルに基づき、北米のホメオパシー市場はホメオパシークリニック、小売薬局、電子小売業者、その他に区分されます。ホメオパシークリニック部門が2022年に最大の市場シェアを占めました。

国別では、北米のホメオパシー市場は米国、カナダ、メキシコに区分されます。米国が2022年の北米のホメオパシー市場シェアを独占しました。

Fourrts、Hahnemann Laboratories, Inc、Boiron、Homeocan Inc、Hyland's, Inc、Biologische Heilmittel Heel GmbH、DHU-Arzneimittel GmbH &Co.KG、Dr Reckeweg &Co GmbH、Similasan Corpなどが北米のホメオパシー市場で活動する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のホメオパシー市場:主要産業力学

- 市場促進要因

- ホメオパシー製品に関連する安全性

- ホメオパシー医学の採用率上昇

- 市場抑制要因

- 規制当局による厳しいアプローチとホメオパシー施設・医師の不足

- 市場機会

- カナダにおけるホメオパシー利用に対する意識の高まり

- 今後の動向

- 植物性サプリメントへの需要の高まりと革新的なホメオパシー療法の発売

- 影響分析

第5章 ホメオパシー市場:北米市場分析

- ホメオパシー市場の売上高、2022年~2030年

第6章 北米のホメオパシー市場-収益と2030年までの予測:由来別

- ホメオパシー市場の2022年および2030年の収益シェア:由来別

- 植物

- 動物

- 鉱物

第7章 北米のホメオパシー市場-収益と2030年までの予測:タイプ別

- ホメオパシー市場の2022年および2030年の収益シェア:タイプ別

- 希釈剤

- チンキ剤

- 生化学

- 軟膏

- 錠剤

- その他

第8章 北米のホメオパシー市場-収益と2030年までの予測:用途別

- ホメオパシー市場の2022年および2030年の収益シェア:用途別

- 鎮痛解熱薬

- 呼吸器

- 神経学

- 免疫学

- 消化器病学

- 皮膚科

- その他

第9章 北米のホメオパシー市場-収益と2030年までの予測:流通チャネル別

- ホメオパシー市場の2022年および2030年の収益シェア:流通チャネル別

- ホメオパシークリニック

- 小売薬局

- e小売業者

- その他

第10章 北米のホメオパシー市場-収益と2030年までの予測:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 ホメオパシー市場-業界情勢

- 有機的開発

- 無機的展開

第12章 企業プロファイル

- Fourrts

- Hahnemann Laboratories, Inc

- Boiron

- Homeocan Inc

- Hyland's, Inc.

- Biologische Heilmittel Heel GmbH

- DHU-Arzneimittel GmbH & Co. KG

- Dr Reckeweg & Co GmbH

- Similasan Corporation

第13章 付録

List Of Tables

- Table 1. North America Homeopathy Market Segmentation

- Table 2. US Homeopathy Market, by Source - Revenue and Forecast to 2030 (US$ Million)

- Table 3. US Homeopathy Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 4. US Homeopathy Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 5. US Homeopathy Market, by Distribution Channel - Revenue and Forecast to 2030 (US$ Million)

- Table 6. Canada Homeopathy Market, by Source - Revenue and Forecast to 2030 (US$ Million)

- Table 7. Canada Homeopathy Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 8. Canada Homeopathy Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 9. Canada Homeopathy Market, by Distribution Channel - Revenue and Forecast to 2030 (US$ Million)

- Table 10. Mexico Homeopathy Market, by Source - Revenue and Forecast to 2030 (US$ Million)

- Table 11. Mexico Homeopathy Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 12. Mexico Homeopathy Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 13. Mexico Homeopathy Market, by Distribution Channel - Revenue and Forecast to 2030 (US$ Million)

- Table 14. Organic Developments Done by Companies

- Table 15. Inorganic Developments Done by Companies

- Table 16. Glossary of Terms

List Of Figures

- Figure 1. North America Homeopathy Market Segmentation, By Country

- Figure 2. North America Homeopathy Market: Key Industry Dynamics

- Figure 3. North America Homeopathy Market: Impact Analysis of Drivers and Restraints

- Figure 4. North America Homeopathy Market Revenue (US$ Mn), 2022 - 2030

- Figure 5. North America Homeopathy Market Revenue Share, by Source 2022 & 2030 (%)

- Figure 6. Plants: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Animals: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Minerals: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Homeopathy Market Revenue Share, by Type 2022 & 2030 (%)

- Figure 10. Dilutions: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Tinctures: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Biochemics: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Ointments: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Tablets: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Others: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Homeopathy Market Revenue Share, by Application 2022 & 2030 (%)

- Figure 17. Analgesic and Antipyretic: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Respiratory: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Neurology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Immunology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Gastroenterology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Dermatology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Others: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Homeopathy Market Revenue Share, by Distribution Channel 2022 & 2030 (%)

- Figure 25. Homeopathic Clinics: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Retail Pharmacies: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. e-Retailers: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 28. Others: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. North America: Homeopathy Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 30. North America: Homeopathy Market, by Country, 2022 & 2030 (%)

- Figure 31. US: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 32. Canada: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Mexico: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

The North America homeopathy market was valued at US$ 1,648.42 million in 2022 and is expected to reach US$ 5,066.80 million by 2030; it is estimated to grow at a CAGR of 15.1% from 2022 to 2030.

Rise in Adoption of Homeopathic Medicine fuel the North America Homeopathy Market

There are growing concerns about the potential side effects of allopathic pharmaceutical drugs or regular medication. A study published in the Scandinavian Journal of Public Health in 2017 stated that alternative practices are primarily used in a complementary manner or in combination with traditional medicine.

The preference for orally administered medications and drugs without any side effects has been on the rise for a long, and it would continue to grow in the coming years. Allopathy contains strong medications; however, they are not appropriate for everyone. Furthermore, allopathic drugs are expensive and only have a transient effect on illnesses. Moreover, despite the completion of the course of prescribed drugs, the illness can resurface. Cases of drug abuse are more common with allopathic medicines, which is another factor for the shifting focus toward natural medications. Homeopathy remedies, on the other hand, are inexpensive and exhibit no or negligible side effects. Thus, the increasing adoption of homeopathic medicine bolsters the homeopathy market growth.

North America Homeopathy Market Overview

The North America homeopathy market has been segmented into the US, Canada, and Mexico; the US held the largest market share in 2022. The market growth in North America is attributed to the increased consumer awareness and interest in homeopathic remedies have played a significant role in the market growth, consumers are actively seeking alternative healthcare options and are more willing to explorer homeopathic treatment contributing to the market's expansion.

North America Homeopathy Market Revenue and Forecast to 2030 (US$ Million)

North America Homeopathy Market Segmentation

The North America homeopathy market is segmented based on source, type, application, distribution channel, and country. Based on source, the North America homeopathy market is segmented into plants, animals, and minerals. The plants segment held the largest market share in 2022.

Based on type, the North America homeopathy market is segmented into dilutions, tinctures, biochemics, ointments, tablets, and others. The dilutions segment held the largest market share in 2022.

Based on application, the North America homeopathy market is segmented into analgesic and antipyretic, respiratory, neurology, immunology, gastroenterology, dermatology, and others. The immunology segment held the largest market share in 2022.

Based on distribution channel, the North America homeopathy market is segmented into homeopathic clinics, retail pharmacies, e-retailers, and others. The homeopathic clinics segment held the largest market share in 2022.

Based on country, the North America homeopathy market is segmented into the US, Canada, and Mexico. The US dominated the North America homeopathy market share in 2022.

Fourrts; Hahnemann Laboratories, Inc; Boiron; Homeocan Inc; Hyland's, Inc.; Biologische Heilmittel Heel GmbH; DHU-Arzneimittel GmbH & Co. KG; Dr Reckeweg & Co GmbH; and Similasan Corp are some of the leading players operating in the North America homeopathy market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America homeopathy market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America homeopathy market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America homeopathy market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Homeopathy Market - Key Industry Dynamics

- 4.1 Market Drivers

- 4.1.1 Safety Associated with Homeopathic Products

- 4.1.2 Rise in Adoption of Homeopathic Medicine

- 4.2 Market Restraints

- 4.2.1 Stringent Approach by Regulatory Authorities and Shortage of Homeopathic Facilities & Doctors

- 4.3 Market Opportunities

- 4.3.1 Rising awareness on Homeopathy Usage in Canada

- 4.4 Future Trends

- 4.4.1 Increasing Demand for Plant-Based Supplements and Launch of Innovative Homeopathic Remedies

- 4.5 Impact Analysis

5. Homeopathy Market - North America Market Analysis

- 5.1 Homeopathy Market Revenue (US$ Mn), 2022 - 2030

6. North America Homeopathy Market - Revenue and Forecast to 2030 - by Source

- 6.1 Overview

- 6.2 Homeopathy Market Revenue Share, by Source 2022 & 2030 (%)

- 6.3 Plants

- 6.3.1 Overview

- 6.3.2 Plants: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 6.4 Animals

- 6.4.1 Overview

- 6.4.2 Animals: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 6.5 Minerals

- 6.5.1 Overview

- 6.5.2 Minerals: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

7. North America Homeopathy Market - Revenue and Forecast to 2030 - by Type

- 7.1 Overview

- 7.2 Homeopathy Market Revenue Share, by Type 2022 & 2030 (%)

- 7.3 Dilutions

- 7.3.1 Overview

- 7.3.2 Dilutions: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Tinctures

- 7.4.1 Overview

- 7.4.2 Tinctures: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Biochemics

- 7.5.1 Overview

- 7.5.2 Biochemics: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 7.6 Ointments

- 7.6.1 Overview

- 7.6.2 Ointments: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 7.7 Tablets

- 7.7.1 Overview

- 7.7.2 Tablets: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 7.8 Others

- 7.8.1 Overview

- 7.8.2 Others: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Homeopathy Market - Revenue and Forecast to 2030 - by Application.

- 8.1 Overview

- 8.2 Homeopathy Market Revenue Share, by Application 2022 & 2030 (%)

- 8.3 Analgesic and Antipyretic

- 8.3.1 Overview

- 8.3.2 Analgesic and Antipyretic: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Respiratory

- 8.4.1 Overview

- 8.4.2 Respiratory: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Neurology

- 8.5.1 Overview

- 8.5.2 Neurology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Immunology

- 8.6.1 Overview

- 8.6.2 Immunology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.7 Gastroenterology

- 8.7.1 Overview

- 8.7.2 Gastroenterology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.8 Dermatology

- 8.8.1 Overview

- 8.8.2 Dermatology: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 8.9 Others

- 8.9.1 Overview

- 8.9.2 Others: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Homeopathy Market - Revenue and Forecast to 2030 - by Distribution Channel

- 9.1 Overview

- 9.2 Homeopathy Market Revenue Share, by Distribution Channel 2022 & 2030 (%)

- 9.3 Homeopathic Clinics

- 9.3.1 Overview

- 9.3.2 Homeopathic Clinics: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Retail Pharmacies

- 9.4.1 Overview

- 9.4.2 Retail Pharmacies: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 e-Retailers

- 9.5.1 Overview

- 9.5.2 e-Retailers: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Homeopathy Market - Revenue and Forecast to 2030 - Country Analysis

- 10.1 North America: Homeopathy Market

- 10.1.1 Overview

- 10.1.2 North America: Homeopathy Market, by Country

- 10.1.2.1 US: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.1.1 Overview

- 10.1.2.1.2 US: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.1.3 US: Homeopathy Market, by Source, 2020-2030 (US$ Million)

- 10.1.2.1.4 US: Homeopathy Market, by Type, 2020-2030 (US$ Million)

- 10.1.2.1.5 US: Homeopathy Market, by Application, 2020-2030 (US$ Million)

- 10.1.2.1.6 US: Homeopathy Market, by Distribution Channel, 2020-2030 (US$ Million)

- 10.1.2.2 Canada: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.2.1 Overview

- 10.1.2.2.2 Canada: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.2.3 Canada: Homeopathy Market, by Source, 2020-2030 (US$ Million)

- 10.1.2.2.4 Canada: Homeopathy Market, by Type, 2020-2030 (US$ Million)

- 10.1.2.2.5 Canada: Homeopathy Market, by Application, 2020-2030 (US$ Million)

- 10.1.2.2.6 Canada: Homeopathy Market, by Distribution Channel, 2020-2030 (US$ Million)

- 10.1.2.3 Mexico: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.3.1 Overview

- 10.1.2.3.2 Mexico: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.3.3 Mexico: Homeopathy Market, by Source, 2020-2030 (US$ Million)

- 10.1.2.3.4 Mexico: Homeopathy Market, by Type, 2020-2030 (US$ Million)

- 10.1.2.3.5 Mexico: Homeopathy Market, by Application, 2020-2030 (US$ Million)

- 10.1.2.3.6 Mexico: Homeopathy Market, by Distribution Channel, 2020-2030 (US$ Million)

- 10.1.2.1 US: Homeopathy Market - Revenue and Forecast to 2030 (US$ Million)

11. Homeopathy Market-Industry Landscape

- 11.1 Overview

- 11.2 Organic Developments

- 11.2.1 Overview

- 11.3 Inorganic Developments

- 11.3.1 Overview

12. Company Profiles

- 12.1 Fourrts

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Hahnemann Laboratories, Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Boiron

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Homeocan Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Hyland's, Inc.

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Biologische Heilmittel Heel GmbH

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 DHU-Arzneimittel GmbH & Co. KG

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Dr Reckeweg & Co GmbH

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Similasan Corporation

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 Appendix

- 13.2 Appendix

- 13.3 Appendix

- 13.4 Glossary of Terms