|

|

市場調査レポート

商品コード

1394056

北米の男性用コンドーム市場の2028年までの予測- 地域別分析、素材別、製品タイプ別、流通チャネル別North America Male Condom Market Forecast to 2028 - Regional Analysis By Material, Product Type, and Distribution Channels |

||||||

|

|||||||

| 北米の男性用コンドーム市場の2028年までの予測- 地域別分析、素材別、製品タイプ別、流通チャネル別 |

|

出版日: 2023年10月11日

発行: The Insight Partners

ページ情報: 英文 100 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の男性用コンドーム市場は、2022年の19億7,953万米ドルから2028年には30億5,625万米ドルに成長すると予測されています。2022年から2028年までのCAGRは7.5%で成長すると推定されます。

北米の男性用コンドーム市場における性感染症事例の増加

性感染症(STI)は、世界の性と生殖の健康に大きな影響を与えています。世界保健機関(WHO)によると、地域では毎日100万人以上がSTIに感染しています。毎年、クラミジア、淋病、梅毒、トリコモナスへの新規感染が3億7,600万件報告されています。避妊法はSTIに感染するリスクを変化させる。コンドームは、細菌およびウイルス感染から一定レベルの保護を提供します。

米国で最も一般的なSTIはヒトパピローマウイルス(HPV)です。National Center for Biotechnology Information(NCBI)に掲載された記事によると、性的に活発な人の80%が感染しています。そのうちの42%は18歳から59歳の年齢層が含まれおり、7%の人が口腔HPVに感染しています。そして毎年約1,400万人の新規感染者が報告されています。 HPVは非常に一般的な感染症であるため、疾病管理センター(CDC)は、予防接種を受けていない性的に活発な人のほぼ全員が最終的に感染すると推定しています。HPVは、特に男性では無症状であることが多いが、性病や肛門性器疣贅の原因となることがあります。CDCは、2020年に米国で報告されたHPVに関連しないSTIは240万人であると決定しています。このうちクラミジアが最も多く160万件でした。さらに、2020年に報告された淋病は677,769例で、2016年から45%増加し、原発性および続発性の梅毒は133,945例で、同期間に52%増加しました。一般的に米国ではSTI全体の感染率が上昇しており、2022年には250万人以上のSTD患者が発生すると予想されています。このように、STIの症例数の増加と政府のイニシアティブによるSTDに対する意識の高まりが、予測期間中の男性用コンドーム市場を牽引し、北米の男性用コンドーム市場の成長を促しています。

北米の男性用コンドーム市場概要

北米では、米国が男性用コンドーム市場で大きなシェアを占めています。同国における市場の成長は、主に避妊に対する意識の高まりによってもたらされています。疾病対策予防センターの青少年リスク行動調査米国2019によると、最終性交時のコンドーム使用率は54.3%であり、コンドームは米国で最も普及している主要避妊具です。

性感染症の蔓延が拡大していることが、この地域における市場の主な促進要因です。米国疾病予防管理センター(CDC)によると、2018年には米国の5人に1人(6,800万人)がSTI(性感染症)に罹患しており、そのうち2,600万件が2018年の新規STIでした。また、家族計画に対する政府の取り組みも市場成長に有利に働く可能性が高いです。米国政府は50年以上にわたって常に家族計画/生殖医療(FP/RH)の取り組みを支援しており、世界的に家族計画/生殖医療への最大の貢献国です。また、米国は世界最大の避妊薬の流通・購入国のひとつです。米国政府が国連人口基金(UNFPA)に拠出するFP/RHのための資金は、2019年には6億800万米ドルでした。保健福祉省(HHS)は、リスクの高い10代の妊娠グループをターゲットにしたプログラムで構成される10代妊娠予防イニシアチブを導入しました。政府は、10代の妊娠率の高さと性行為に対処し、避妊の使用率を高め、性感染症(STI)を減らし、コンドームの使用を増やすために、10代妊娠予防プログラムに1億米ドルの助成金を投資しました。

米国における製品発売の増加は、予測期間中の市場成長を促進すると思われます。2022年、FDAはアナルセックスに特化した初のコンドームを承認しました。このコンドームは、アナルセックス時の性感染症を最小限に抑えるのに役立ちます。すべての年齢層における需要の急増が、この地域の市場成長を牽引しています。

北米の男性用コンドーム市場の2028年までの収益と予測(金額)

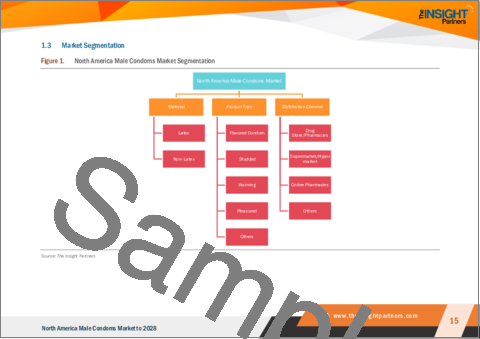

北米の男性用コンドーム市場セグメンテーション

北米の男性用コンドーム市場は、製品タイプ、素材、流通チャネル、国別に区分されます。

製品タイプに基づき、北米の男性用コンドーム市場はフレーバーコンドーム、スタッドコンドーム、ウォーミングコンドーム、プレジャーコンドーム、その他に区分されます。2022年の北米の男性用コンドーム市場では、フレーバーセグメントが最大のシェアを占めています。素材に基づいて、北米の男性用コンドーム市場はラテックスと非ラテックスに区分されます。ラテックスセグメントは2022年に北米の男性用コンドーム市場でより大きなシェアを占めました。流通チャネルに基づき、北米の男性用コンドーム市場はドラッグストア/薬局、スーパーマーケット/ハイパーマーケット、オンライン薬局、その他に区分されます。ドラッグストア/薬局セグメントが2022年の北米の男性用コンドーム市場で最大のシェアを占めました。国別では、北米の男性用コンドーム市場は米国、カナダ、メキシコに区分されます。2022年の北米の男性用コンドーム市場は米国が支配的でした。Reckitt Benckiser Group Plc、Okamoto Industries Inc、Karex Bhd、Church &Dwight Co Inc、Humanwell Healthcare Group Co Ltdなどが北米の男性用コンドーム市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 北米の男性用コンドーム市場- 主要なポイント

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の男性用コンドーム市場- 市場情勢

- 北米PEST分析

- 専門家の見解

第5章 北米の男性用コンドーム市場-主要市場力学

- 市場促進要因

- コンドームの使用を奨励する政府の取り組みの高まり

- 性感染症の増加

- 市場抑制要因

- 男性用コンドームに使用される材料の副作用

- 市場機会

- 製品発売の急増

- 今後の動向

- 男性用コンドームの技術革新

- 影響分析

第6章 北米の男性用コンドーム市場分析

- 北米の男性用コンドーム市場の収益と予測分析

第7章 北米の男性用コンドーム市場-2028年までの収益と予測:素材別

- 北米の男性用コンドーム市場:素材別、収益シェア、2022年・2028年

- ラテックス

- 非ラテックス

第8章 北米の男性用コンドーム市場、2028年までの分析と予測:製品タイプ別

- 北米の男性用コンドーム市場:製品タイプ別、2022年・2028年

- フレーバーコンドーム

- スタッド付き

- ウォーミング

- プレジャード

- その他

第9章 北米の男性用コンドーム市場:2028年までの収益と予測:流通チャネル別

- 北米の男性用コンドーム市場:流通チャネル別、収益シェア、2022年・2028年

- ドラッグストア/薬局

- スーパーマーケット/ハイパーマーケット

- オンライン薬局

- その他

第10章 男性用コンドーム市場:2028年までの収益と予測:国別分析

- 北米

第11章 北米の男性用コンドーム市場、業界情勢

- 北米の男性用コンドーム市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

第12章 企業プロファイル

- Reckitt Benckiser Group Plc

- Okamoto Industries Inc

- Karex Bhd

- Church & Dwight Co Inc

- Humanwell Healthcare Group Co Ltd

第13章 付録

List Of Tables

- Table 1. US Male Condoms Market, by Material - Revenue and Forecast to 20228 (US$ Million)

- Table 2. US Male Condoms Market, by Product Type - Revenue and Forecast to 2028 (US$ Million)

- Table 3. US Male Condoms Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 4. Canada Male Condoms Market, by Material - Revenue and Forecast to 20228 (US$ Million)

- Table 5. Canada Male Condoms Market, by Product Type - Revenue and Forecast to 2028 (US$ Million)

- Table 6. Canada Male Condoms Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 7. Mexico Male Condoms Market, by Material - Revenue and Forecast to 20228 (US$ Million)

- Table 8. Mexico Male Condoms Market, by Product Type - Revenue and Forecast to 2028 (US$ Million)

- Table 9. Mexico Male Condoms Market, by Distribution Channel - Revenue and Forecast to 2028 (US$ Million)

- Table 10. Recent Organic Growth Strategies in North America Male Condoms Market

- Table 11. Recent Inorganic Growth Strategies in the Male Condoms Market

- Table 12. Glossary of Terms

List Of Figures

- Figure 1. North America Male Condoms Market Segmentation

- Figure 2. North America Male Condoms Market, by Country

- Figure 3. North America Male Condoms Market Overview

- Figure 4. Latex Segment Held Larger Share of Material Segment in North America Male Condoms Market

- Figure 5. US Expected to Show Remarkable Growth During Forecast Period

- Figure 6. PEST Analysis

- Figure 7. Experts' Opinion

- Figure 8. North America Male Condoms Market Impact Analysis of Driver and Restraints

- Figure 9. North America Male Condoms Market - Revenue Forecast and Analysis - 2018-2028

- Figure 10. North America Male Condoms Market Revenue Share, by Material 2022 & 2028 (%)

- Figure 11. Latex: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 12. Non-Latex: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 13. North America Male Condoms Market, by Product Type 2022 & 2028 (%)

- Figure 14. Flavored Condom: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 15. Studded: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 16. Warming: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 17. Pleasured: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 18. Others: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 19. North America Male Condoms Market Revenue Share, by Distribution Channel 2022 & 2028 (%)

- Figure 20. Drug Store/Pharmacies: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 21. Supermarkets/Hypermarkets: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 22. Online Pharmacies: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Others: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 24. North America: Male Condoms Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 25. North America: Male Condoms Market, by Country, 2022 & 2028 (%)

- Figure 26. US: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 27. Canada: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 28. Mexico: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 29. Growth Strategies in North America Male Condoms Market

The North America male condom market is expected to grow from US$ 1,979.53 million in 2022 to US$ 3,056.25 million by 2028. It is estimated to grow at a CAGR of 7.5% from 2022 to 2028.

Rising Cases of Sexually Transmitted Infections in North America Male Condom Market

Sexually transmitted infections (STIs) have a major impact on sexual and reproductive health worldwide. As per the World Health Organization (WHO), more than 1 million people acquire STIs every day regionally. Each year, ~376 million new infections with chlamydia, gonorrhea, syphilis, and trichomoniasis are reported. Contraceptive methods alter the risk of acquiring STIs. Condoms provide a certain level of protection from bacterial and viral infections.

The most common STI in the US is the human papillomavirus or HPV. As per an article published in National Center for Biotechnology Information (NCBI), 80% of sexually active people are infected, including 42% of people in the 18-59 age group; 7% of people have oral HPV; and approximately 14 million new cases are reported yearly. It is so common that the Centers for Disease Control (CDC) estimates that virtually all sexually active persons who are not vaccinated will eventually become infected. HPV is often asymptomatic, especially in men, but it may cause venereal and anogenital warts. The CDC has determined that ~2.4 million non-HPV-related STIs were reported in the US in 2020. Chlamydia was the most common of these at 1.6 million cases. Moreover, 677,769 cases of gonorrhea were reported in 2020, up 45% from 2016, and 133,945 cases of primary and secondary syphilis, up 52% over the same period. In general, the overall rate of STIs is increasing in the US, with 2.5 million STD cases or more expected to occur in 2022. Thus, rising cases of STI's and growing awareness about STDs through government initiatives will drive the market for male condoms in forecast period is driving the growth of the North America Male Condom Market.

North America Male Condom Market Overview

In North America, the US holds a significant share of the male condoms market. The growth of the market in the country is primarily driven by the increasing awareness of birth control. As per the Centers for Diseases Control and Prevention youth risk behavior survey US 2019, the condom use at last sexual intercourse was 54.3%, and condoms were the most prevalent primary contraceptive used in the United States.

The growing prevalence of sexually transmitted diseases is the major driving factor for the market in the region. According to the Centers for Disease Control and Prevention (CDC), in 2018, one in five (68 million) people in the US had an STI (sexually transmitted infection), of which 26 million cases were new STIs in 2018. Also, government efforts for family planning are likely to favor market growth. The government of the US has always supported family planning/reproductive health (FP/RH) efforts for more than 50 years and is the largest contributor to family planning/reproductive health globally. It is one of the largest distributors and buyers of contraceptives worldwide. The US government funds for FP/RH to the United Nations Population Fund (UNFPA) was US$ 608 million in 2019. The Department of Health and Human Services (HHS) introduced a Teen Pregnancy Prevention Initiative comprising programs targeting high-risk teen pregnancy groups. The government invested USD 100 million in grant funding for the Teen Pregnancy Prevention Program to address high rates of teen pregnancy and sexual activity, increase the usage of contraception, reduce sexually transmitted infections (STIs), and increase the use of condoms.

An increasing number of product launches in the US is likely to propel market growth during the forecast period. In 2022, FDA approved the first condom specifically intended for anal sex. This condom will help users to minimize sexually transmitted infections during anal sex. An upsurge in demand among all age groups drives the market growth in this region.

North America Male Condom Market Revenue and Forecast to 2028 (US$ Million)

North America Male Condom Market Segmentation

The North America male condom market is segmented into product type, material, and distribution channels, and country.

Based on product type, the North America male condom market is segmented into flavored condom, studded, warming, pleasured, and others. The flavored segment held the largest share of the North America male condom market in 2022. Based on material, the North America male condom market is segmented into latex and non-latex. The latex segment held a larger share of the North America male condom market in 2022. Based on distribution channel, the North America male condom market is segmented into drug stores/ pharmacies, supermarkets/ hypermarkets, online pharmacies, and others. The drug stores/ pharmacies segment held the largest share of the North America male condom market in 2022. Based on country, the North America male condom market is segmented into the US, Canada, and Mexico. The US dominated the North America male condom market in 2022. Reckitt Benckiser Group Plc, Okamoto Industries Inc, Karex Bhd, Church & Dwight Co Inc, and Humanwell Healthcare Group Co Ltd are some of the leading companies operating in the North America male condom market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America male condom market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America male condom market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 North America Male Condoms Market - by Material

- 1.3.2 North America Male Condoms Market - by Product Type

- 1.3.3 North America Male Condoms Market - by Distribution Channel

- 1.3.4 North America Male Condoms Market - by Country

2. North America Male Condoms Market - Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Male Condoms Market - Market Landscape

- 4.1 North America PEST Analysis

- 4.2 Expert's Opinion

5. North America Male Condoms Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Government Efforts to Encourage Use of Condoms

- 5.1.2 Rising Cases of Sexually Transmitted Infections

- 5.2 Market Restraints

- 5.2.1 Side Effects of Materials Used in Male Condoms

- 5.3 Market Opportunities

- 5.3.1 Surge in Product Launches

- 5.4 Future Trends

- 5.4.1 Innovations in Male Condoms

- 5.5 Impact analysis

6. North America Male Condoms Market - Analysis

- 6.1 North America Male Condoms Market Revenue Forecast and Analysis

7. North America Male Condoms Market - Revenue and Forecast to 2028 - By Material

- 7.1 Overview

- 7.2 North America Male Condoms Market Revenue Share, by Material 2022 & 2028 (%)

- 7.3 Latex

- 7.3.1 Overview

- 7.3.2 Latex: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 7.4 Non-Latex

- 7.4.1 Overview

- 7.4.2 Non-Latex: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

8. North America Male Condoms Market Analysis and Forecasts to 2028 - by Product Type

- 8.1 Overview

- 8.2 North America Male Condoms Market, by Product Type 2022 & 2028 (%)

- 8.3 Flavored Condom

- 8.3.1 Overview

- 8.3.2 Flavored Condom: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 8.4 Studded

- 8.4.1 Overview

- 8.4.2 Studded: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 8.5 Warming

- 8.5.1 Overview

- 8.5.2 Warming: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 8.6 Pleasured

- 8.6.1 Overview

- 8.6.2 Pleasured: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

9. North America Male Condoms Market - Revenue and Forecast to 2028 - by Distribution Channel

- 9.1 Overview

- 9.2 North America Male Condoms Market Revenue Share, by Distribution Channel 2022 & 2028 (%)

- 9.3 Drug Stores/Pharmacies

- 9.3.1 Overview

- 9.3.2 Drug Stores/Pharmacies: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 9.4 Supermarket/Hypermarkets

- 9.4.1 Overview

- 9.4.2 Supermarkets/Hypermarkets: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 9.5 Online Pharmacies

- 9.5.1 Overview

- 9.5.2 Online Pharmacies: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: North America Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

10. Male Condoms Market - Revenue and Forecast to 2028 - Country Analysis

- 10.1 North America: Overview

- 10.1.1 US: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.1.1 US: Male Condoms Market, by Material, 2018-2028 (US$ Million)

- 10.1.1.2 US: Male Condoms Market, by Product Type - Revenue and Forecast to 2028 (US$ Million)

- 10.1.1.3 US: Male Condoms Market, by Distribution Channel, 2018-2028 (US$ Million)

- 10.1.2 Canada: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.1 Canada: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.2 Canada: Male Condoms Market, by Material, 2018-2028 (US$ Million)

- 10.1.2.3 Canada: Male Condoms Market, by Product Type - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.4 Canada: Male Condoms Market, by Distribution Channel, 2018-2028 (US$ Million)

- 10.1.3 Mexico: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.3.1 Mexico: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.3.2 Mexico: Male Condoms Market, by Material, 2018-2028 (US$ Million)

- 10.1.3.3 Mexico: Male Condoms Market, by Product Type - Revenue and Forecast to 2028 (US$ Million)

- 10.1.3.4 Mexico: Male Condoms Market, by Distribution Channel, 2018-2028 (US$ Million)

- 10.1.1 US: Male Condoms Market - Revenue and Forecast to 2028 (US$ Million)

11. North America Male Condoms Market-Industry Landscape

- 11.1 Overview

- 11.2 Growth Strategies in North America Male Condoms Market

- 11.3 Organic Growth Strategies

- 11.3.1 Overview

- 11.4 Inorganic Growth Strategies

- 11.4.1 Overview

12. Company Profiles

- 12.1 Reckitt Benckiser Group Plc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Okamoto Industries Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Karex Bhd

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Church & Dwight Co Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Humanwell Healthcare Group Co Ltd

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms