|

|

市場調査レポート

商品コード

1375159

欧州のアンプとコンパレータ市場の2030年予測- 地域別分析- タイプ別、用途別Europe Amplifier and Comparator Market Forecast to 2030 - COVID-19 Impact and Regional Analysis - by Type and Application |

||||||

|

|||||||

| 欧州のアンプとコンパレータ市場の2030年予測- 地域別分析- タイプ別、用途別 |

|

出版日: 2023年08月29日

発行: The Insight Partners

ページ情報: 英文 135 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

欧州のアンプとコンパレータ市場は、2023年の36億4,911万米ドルから2030年には60億1,438万米ドルに成長すると予測され、2023年から2030年までのCAGRは7.4%と推定されます。

電子輸送の採用増加

交通手段の電子化は環境に役立ち、燃料消費量を削減すると認識されています。この地域の多くの政府は、国際エネルギー機関(IEA)が調整する複数の政府による政策フォーラムである電気自動車イニシアティブ(EVI)を受け入れ、世界中で電気自動車のイントロダクションと採用を加速させています。IEAによると、現在このプログラムに参加しているのは、フィンランド、フランス、ドイツ、オランダ、ノルウェー、ポーランド、ポルトガル、スウェーデン、英国の16カ国です。電気バッテリーは、電気移動手段の中核をなす部品です。これらのバッテリーでは、コンパレータの出力が、放電または低電力状態に関するマイクロコントローラへの警告に使用されます。また、アンプはEVバッテリ管理にも使用され、絶縁アンプのオフセットが電流センスの初期精度を決定します。このように、電子輸送に必要なバッテリーにアンプが大規模に応用されることで、アンプとコンパレータの消費は将来的に強化されると思われます。

欧州アンプとコンパレータ市場概要

欧州のアンプとコンパレータ市場は、フランス、ドイツ、イタリア、ロシア、英国、その他欧州に区分されます。西欧は高度に発展した地域であり、さまざまなタイプのビジネスで構成されています。欧州では、産業用モノのインターネット、モノのインターネット、インダストリー4.0などの最先端技術を利用した製造業が確立されています。欧州市場は非常に競争が激しく、国内外にプレーヤーが存在します。アンプとコンパレータの設計、製造、販売に携わる主要企業がこの地域でビジネスを展開しています。これらの企業は、技術的進歩の先駆者であり続け、進化する顧客の要求に応えるため、研究開発に投資することが多いです。アンプとコンパレータ市場の主要企業は、競争において優位性を保つために、技術革新、新製品の発売、パートナーシップ、提携に注力しています。2023年3月、大手アンプメーカーの1つであるマーシャル・アンプリフィケーションは、スウェーデンのオーディオ会社ザウンド・インダストリーズに買収されました。この買収により、両社はマーシャル・グループの立ち上げで手を組むことを決定しました。アンプは音質を改善し、ダイナミックレンジを提供し、リスニング体験を向上させる。オーディオ業界におけるこうした戦略的開拓は、アンプとコンパレータ市場の成長を後押しすると予想されます。

欧州アンプとコンパレータ市場の収益と2030年までの予測(US$Million)

欧州アンプとコンパレータ市場のセグメンテーション

欧州アンプとコンパレータ市場は、タイプ、用途、国別に区分されます。タイプ別では、欧州アンプとコンパレータ市場はアンプとコンパレータに二分されます。2023年の市場シェアはアンプセグメントが大きいです。

用途別では、欧州アンプとコンパレータ市場は、産業分野、通信分野、コンピューティングデバイス、家電デバイス、自動車、軍事・航空宇宙、その他に区分されます。2023年には、産業分野セグメントが最大の市場シェアを占めています。

国別では、欧州アンプとコンパレータ市場はドイツ、英国、フランス、イタリア、ロシア、その他欧州に区分されます。2023年の欧州アンプとコンパレータ市場シェアはドイツが独占。

ABLIC Inc、Analog Devices Inc、Broadcom Inc、Microchip Technology Inc、NXP Semiconductors、On Semiconductor、Renesas Electronics Corporation、Skyworks Solutions Inc、STMicroelectronics NV、Texas Instruments Incが欧州アンプとコンパレータ市場の主要企業です。

目次

第1章 イントロダクション

第2章 キーポイント

第3章 調査手法

- カバー範囲

- 2次調査

- 1次調査

第4章 欧州アンプとコンパレータ市場情勢

- 市場概要

- PEST分析

- 欧州

- エコシステム分析

- 専門家の見解

第5章 欧州アンプとコンパレータ市場-主要市場力学

- 市場促進要因

- 光アンプ需要の増加

- ADAS(先進運転支援システム)の採用

- 市場抑制要因

- オペアンプの物理的限界

- 市場機会

- 産業オートメーション重視の高まり

- 市場動向

- 電子輸送の採用増加

- 促進要因と抑制要因の影響分析

第6章 アンプとコンパレータ市場-欧州市場分析

- アンプとコンパレータの欧州市場概要

- 欧州のアンプとコンパレータ市場の予測と分析

第7章 アンプとコンパレータの欧州市場収益と2030年までの予測-タイプ別

- アンプとコンパレータ市場:タイプ別(2022年、2030年)

- アンプ

- コンパレータ

第8章 欧州アンプとコンパレータ市場の収益と2030年までの予測:アプリケーション

- アンプとコンパレータ市場:用途別(2022年、2030年)

- 産業分野

- 通信分野

- コンピューティングデバイス

- 民生用電子機器

- 自動車

- 軍事・航空宇宙

- その他

第9章 欧州アンプとコンパレータ市場:国別分析

- 欧州のアンプとコンパレータ市場

- 欧州のアンプとコンパレータの市場:主要国別

第10章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第11章 企業プロファイル

- Analog Devices Inc

- Broadcom Inc

- STMicroelectronics NV

- Microchip Technology Inc

- NXP Semiconductors NV

- On Semiconductor Corp

- Renesas Electronics Corp

- Skyworks Solutions Inc

- Texas Instruments Inc

- ABLIC Inc

第12章 付録

List Of Tables

- Table 1. Europe Amplifier and Comparator Market, Revenue and Forecast, 2020-2030 (US$ Million)

- Table 2. Germany: Amplifier and Comparator Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Germany: Amplifier and Comparator Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 4. France: Amplifier and Comparator Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 5. France: Amplifier and Comparator Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 6. Italy: Amplifier and Comparator Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 7. Italy: Amplifier and Comparator Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 8. UK: Amplifier and Comparator Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 9. UK: Amplifier and Comparator Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 10. Russia: Amplifier and Comparator Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 11. Russia: Amplifier and Comparator Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 12. Rest of Europe: Amplifier and Comparator Market, By Type - Revenue and Forecast to 2030 (US$ Million)

- Table 13. Rest of Europe: Amplifier and Comparator Market, By Application - Revenue and Forecast to 2030 (US$ Million)

- Table 14. List of Abbreviation

List Of Figures

- Figure 1. Europe Amplifier and Comparator Market Segmentation

- Figure 2. Europe Amplifier and Comparator Market Segmentation - by Country

- Figure 3. Europe Amplifier and Comparator Market Overview

- Figure 4. Europe Amplifier and Comparator Market, By Type

- Figure 5. Europe: PEST Analysis

- Figure 6. Europe Amplifier and Comparator Market Ecosystem Analysis

- Figure 7. Europe Expert Opinion

- Figure 8. Europe Amplifier and Comparator Market: Impact Analysis of Drivers and Restraints

- Figure 9. Europe Amplifier and Comparator Market, Forecast and Analysis (US$ Million)

- Figure 10. Europe Amplifier and Comparator Market, By Type (2022 and 2030)

- Figure 11. Amplifier: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Comparator: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

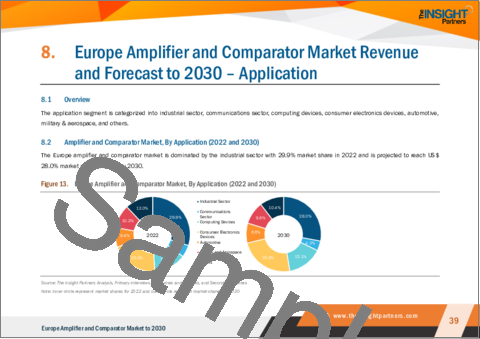

- Figure 13. Europe Amplifier and Comparator Market, By Application (2022 and 2030)

- Figure 14. Industrial Sector: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Communications Sector: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Computing Devices: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Consumer Electronics Devices: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Automotive: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Military and Aerospace: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Others: Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Europe: Amplifier and Comparator Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 22. Europe: Amplifier and Comparator Revenue Share, by Key Country (2022 and 2030)

- Figure 23. Germany: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- Figure 24. France: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Italy: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- Figure 26. UK: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Russia: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- Figure 28. Rest of Europe: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

The Europe amplifier and comparator market is expected to grow from US$ 3,649.11 million in 2023 to US$ 6,014.38 million by 2030; it is estimated to grow at a CAGR of 7.4% from 2023 to 2030.

Rising Adoption of Electronic Transportation

The electronic mode of transportation is perceived to benefit the environment and reduce fuel consumption. Many governments across the region have embraced the Electric Vehicles Initiative (EVI), a multi-government policy forum coordinated by the International Energy Agency (IEA) to accelerate the introduction and adoption of electric vehicles worldwide. According to the IEA, 16 countries are the current participants of this program, including Finland, France, Germany, the Netherlands, Norway, Poland, Portugal, Sweden, and the UK. An electric battery is a core component of the electric mode of transportation. In these batteries, the output of the comparator is used to alert a microcontroller regarding their discharged or low power status. Also, the amplifier is used in EV battery management, and the isolated amplifier offset determines the initial precision of the current sense. Thus, the large-scale application of amplifiers in batteries required for electronic transportation would bolster the consumption of amplifiers and comparators in the future.

Europe Amplifier and Comparator Market Overview

The amplifier and comparator market in Europe is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Western Europe is a highly developed region and comprises different types of businesses. Europe has a well-established manufacturing industry using cutting-edge technologies, which include the Industrial Internet of Things, the Internet of Things, and Industry 4.0. The European market is extremely competitive, with the presence of both local and international players. Key companies involved in designing, manufacturing, and distributing amplifiers and comparators conduct business in the region. These companies often invest in research and development to remain the forerunners in technological advancements and meet evolving customer demands. Key players in the amplifier and comparator market focus on innovation, new product launches, partnerships, and collaborations to stay relevant in the competition. In March 2023, Marshall Amplification, one of the leading amp-makers, was acquired by the Swedish audio firm Zound Industries. With this acquisition, both companies decided to join forces with the launch of the Marshall Group. An amplifier improves audio quality, provides dynamic range, and enhances listening experiences. These strategic developments in the audio industry are expected to bolster the growth of the amplifier and comparator market.

Europe Amplifier and Comparator Market Revenue and Forecast to 2030 (US$ Million)

Europe Amplifier and Comparator Market Segmentation

The Europe amplifier and comparator market is segmented based on type, application, and country. Based on type, the Europe amplifier and comparator market is bifurcated into amplifier and comparator. The amplifier segment held a larger market share in 2023.

Based on application, the Europe amplifier and comparator market is segmented into industrial sector, communications sector, computing devices, consumer electronics devices, automotive, military & aerospace, and others. The industrial sector segment held the largest market share in 2023.

Based on country, the Europe amplifier and comparator market is segmented into Germany, the UK, France, Italy, Russia, and the Rest of Europe. Germany dominated the Europe amplifier and comparator market share in 2023.

ABLIC Inc; Analog Devices Inc; Broadcom Inc; Microchip Technology Inc; NXP Semiconductors; On Semiconductor; Renesas Electronics Corporation; Skyworks Solutions Inc; STMicroelectronics NV; and Texas Instruments Inc are the leading companies operating in the Europe amplifier and comparator market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe amplifier and comparator market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Europe amplifier and comparator market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe amplifier and comparator market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Amplifier and Comparator Market Landscape

- 4.1 Market Overview

- 4.2 PEST Analysis

- 4.2.1 Europe

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. Europe Amplifier and Comparator Market- Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Optical Amplifiers

- 5.1.2 Adoption of Advanced Driver-Assistance Systems

- 5.2 Market Restraint

- 5.2.1 Physical Limitations of Operational Amplifiers

- 5.3 Market Opportunities

- 5.3.1 Growing Emphasis on Industrial Automation

- 5.4 Market Trends

- 5.4.1 Rising Adoption of Electronic Transportation

- 5.5 Impact Analysis of Drivers and Restraints

6. Amplifier and Comparator Market- Europe Market Analysis

- 6.1 Amplifier and Comparator Market Europe Overview

- 6.2 Europe Amplifier and Comparator Market Forecast and Analysis

7. Europe Amplifier and Comparator Market Revenue and Forecast to 2030 - Type.

- 7.1 Overview

- 7.2 Amplifier and Comparator Market, By Type (2022 and 2030)

- 7.3 Amplifier

- 7.3.1 Overview

- 7.3.2 Amplifier: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 7.4 Comparator

- 7.4.1 Overview

- 7.4.2 Comparator: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

8. Europe Amplifier and Comparator Market Revenue and Forecast to 2030 - Application

- 8.1 Overview

- 8.2 Amplifier and Comparator Market, By Application (2022 and 2030)

- 8.3 Industrial Sector

- 8.3.1 Overview

- 8.3.2 Industrial Sector: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 8.4 Communications Sector

- 8.4.1 Overview

- 8.4.2 Communications Sector: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 8.5 Computing Devices

- 8.5.1 Overview

- 8.5.2 Computing Devices: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 8.6 Consumer Electronics Devices

- 8.6.1 Overview

- 8.6.2 Consumer Electronics Devices: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 8.7 Automotive

- 8.7.1 Overview

- 8.7.2 Automotive: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 8.8 Military and Aerospace

- 8.8.1 Overview

- 8.8.2 Military and Aerospace: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

- 8.9 Others

- 8.9.1 Overview

- 8.9.2 Others: Amplifier and Comparator Market Revenue and Forecast To 2030 (US$ Million)

9. Europe Amplifier and Comparator Market- by Country Analysis

- 9.1 Europe: Amplifier and Comparator Market

- 9.1.1 Europe: Amplifier and Comparator Market, by Key Country

- 9.1.1.1 Germany: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.1.1 Germany: Amplifier and Comparator Market, By Type

- 9.1.1.1.2 Germany: Amplifier and Comparator Market, By Application

- 9.1.1.2 France: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.2.1 France: Amplifier and Comparator Market, By Type

- 9.1.1.2.2 France: Amplifier and Comparator Market, By Application

- 9.1.1.3 Italy: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.3.1 Italy: Amplifier and Comparator Market, By Type

- 9.1.1.3.2 Italy: Amplifier and Comparator Market, By Application

- 9.1.1.4 UK: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.4.1 UK: Amplifier and Comparator Market, By Type

- 9.1.1.4.2 UK: Amplifier and Comparator Market, By Application

- 9.1.1.5 Russia: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.5.1 Russia: Amplifier and Comparator Market, By Type

- 9.1.1.5.2 Russia: Amplifier and Comparator Market, By Application

- 9.1.1.6 Rest of Europe: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.6.1 Rest of Europe: Amplifier and Comparator Market, By Type

- 9.1.1.6.2 Rest of Europe: Amplifier and Comparator Market, By Application

- 9.1.1.1 Germany: Amplifier and Comparator Market- Revenue and Forecast to 2030 (US$ Million)

- 9.1.1 Europe: Amplifier and Comparator Market, by Key Country

10. Industry Landscape

- 10.1 Overview

- 10.2 Market Initiative

- 10.3 Product Development

- 10.4 Mergers & Acquisitions

11. Company Profiles

- 11.1 Analog Devices Inc

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Broadcom Inc

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 STMicroelectronics NV

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Microchip Technology Inc

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 NXP Semiconductors NV

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 On Semiconductor Corp

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 Renesas Electronics Corp

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 Skyworks Solutions Inc

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Texas Instruments Inc

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 ABLIC Inc

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners

- 12.2 Word Index