|

|

市場調査レポート

商品コード

1372550

米国の椎弓根スクリュー市場規模・予測、地域シェア、動向、成長機会分析レポート対象範囲:製品タイプ別、用途別、手術タイプ別、エンドユーザー別、:国別分析US Pedicle Screw Market Size and Forecasts, Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type, Application, Surgery Type, End User, and Country Analysis |

||||||

|

|||||||

| 米国の椎弓根スクリュー市場規模・予測、地域シェア、動向、成長機会分析レポート対象範囲:製品タイプ別、用途別、手術タイプ別、エンドユーザー別、:国別分析 |

|

出版日: 2023年10月10日

発行: The Insight Partners

ページ情報: 英文 81 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

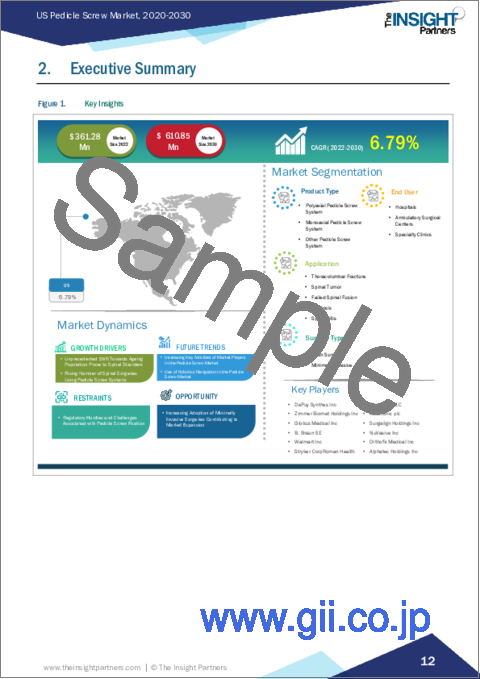

米国の椎弓根スクリュー市場規模は、2022年の3億6,100万米ドルから2030年には6億1,000万米ドルに成長すると予想され、2022年から2030年までのCAGRは6.79%と推定されます。

椎弓根スクリューシステムは、強度を高め、脊髄の損傷をサポートする上で重要な役割を果たしています。脊椎手術を専門とする医療従事者の増加は、椎弓根スクリューの市場成長を促進すると予想されます。Health Central LLCに掲載されたデータによると、2019年には米国で毎年約162万件の脊椎手術が実施され、年間約3億1,300万件の手術が行われ、米国では年間50万件の腰椎手術が実施されました。この種の手術では、費用も重要な要素です。例えば、2022年にHealth Trust-The Source Magazineに掲載されたデータによると、腰椎固定術の平均費用は8万米ドルで、約120万件の手術が行われています。

さらに、米国の椎弓根スクリューシステムは、脊椎手術件数の増加とともに大きく発展してきました。椎弓根スクリューシステムを設置する際にナビゲーションシステムを組み込むことは、椎弓根スクリューシステム市場において主要な発展です。さらに、ロボット工学は、精度を高め、外科的侵襲を最小限に抑えるために、椎弓根スクリューの設置に使用されています。高齢患者におけるロボット工学はまだ大規模に研究されていないが、このような患者は、手術時間を短縮し、出血を最小限に抑え、術後の痛みを軽減する低侵襲技術としてロボット工学を使用することで、近い将来、最終的に合併症を減少させるという大きな恩恵を受ける可能性があります。

さらに、変性脊椎疾患の治療において椎弓根スクリューシステムの採用が増加していることも、市場成長の促進要因となっています。スポーツ関連や脊髄損傷(SCI)、事故による骨折が急増した結果、外科手術が行われるようになり、それがさらに椎弓根スクリューの使用につながっています。National Spinal Cord Injury Statistical Centerが2022年に発表したデータによると、2021年の外傷性脊髄損傷(SCI)の年間発生率は米国で100万人当たり約54件でした。したがって、脊髄損傷の有病率の上昇は、椎弓根スクリュー市場の需要を押し上げ、市場全体の成長を促進すると予測されます。

市場拡大に寄与する低侵襲手術の採用増加

技術的に進歩したロボット手術や画像誘導(IG)手術と相まって、低侵襲手術の採用が増加しており、市場全体の成長を後押しすると予想され、新興市場参入企業に有利な機会を提供しています。過去何年にもわたり、低侵襲外科手術は脊椎疾患の管理に実行可能で、普及し、効率的になってきました。椎弓根スクリューを用いた脊椎手術は、低侵襲のパラダイムへと大きく変化しています。ナビゲーテッド椎弓根スクリューの挿入は、低侵襲脊椎手術の基本であることが証明されています。この種の手術は、軟部組織や筋肉への損傷が少なく、術後の痛みが少なく、入院期間が短く、回復が早いなど、開腹手術に比べてさまざまな利点があります。

さらに、椎弓根スクリュー市場の多くの企業が、外科手術全般を容易にするための新製品のイノベーションに取り組んでいます。例えば、2023年1月、Orthofix Medical社は、完全市販のマリナー奇形用椎弓根スクリューシステムを発売しました。この製品は、縮小矯正器具、特殊インプラント技術、より良い外科的介入のための骨切り工具を進歩させるために発売されました。同様に、2021年9月、アルファテック・ホールディングスは、InVictus OsseoScrewを発売し、脊椎固定のプラットフォームを拡大しました。InVictus OsseoScrewは、固定を最適化し、骨における固定不全という臨床的課題に対処するために設計された、市販されている最初の椎弓根スクリュー技術です。

米国の椎弓根スクリュー市場は、製品タイプ、用途、手術タイプ、エンドユーザーによって区分されます。製品タイプ別では、椎弓根スクリュー市場は多軸椎弓根スクリューシステム、単軸椎弓根スクリューシステム、その他の椎弓根スクリューシステムに分けられます。用途別では、胸腰椎骨折、脊椎腫瘍、脊柱側弯症、脊椎固定不全脊椎炎に区分されます。手術タイプ別では、椎弓根スクリュー市場は開腹手術と低侵襲手術に区分されます。エンドユーザー別では、椎弓根スクリュー市場は病院、外来手術センター、専門クリニックに分けられます。

また、他の先進国や新興諸国に比べ、技術的に確立された国です。椎弓根スクリューの技術的進歩により、さまざまな椎弓根スクリューや関連技術が開発されています。米国人口における腰椎骨折、脊椎変形、脊椎腫瘍の有病率の増加と椎弓根スクリューの技術進歩が、椎弓根スクリューの需要を促進しています。2022年のNational Health Servicesによると、米国における腰痛の生涯発症率は60%~90%で、年間発症率は5%と報告されています。同出典によると、毎年新規患者の14.3%がLBPを理由に医師を訪れ、慢性的なLBPを理由に1300万人以上が医師を訪れています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

- 対象範囲

- 2次調査

- 1次調査

第4章 米国の椎弓根スクリュー市場情勢

- イントロダクション

- PEST分析

- 米国のPEST分析

第5章 米国の椎弓根スクリュー市場:主要産業力学

- 主な市場促進要因

- 脊椎疾患にかかりやすい高齢化人口の感受性

- 椎弓根スクリューシステムを用いた脊椎手術件数の増加

- 主な市場抑制要因

- 規制と運用の複雑さ

- 主な市場機会

- 低侵襲手術の採用増加

- 今後の動向

- ロボットナビゲーションの使用

- 影響分析

第6章 米国の椎弓根スクリュー市場:市場分析

- 米国の椎弓根ねじ市場の売上高、2022年~2030年

第7章 米国の椎弓根スクリュー市場-製品タイプ別収益と2030年までの予測

- 製品タイプ別

- 米国椎弓根スクリュー市場:2022年・2030年製品タイプ別売上高シェア(%)

- 多軸性椎弓根スクリューシステム

- 単軸ペディキュラルスクリューシステム

第8章 米国の椎弓根スクリュー市場-手術タイプ別収益と2030年までの予測

- イントロダクション

- 米国椎弓根スクリュー市場:2022年・2030年手術タイプ別売上高シェア(%)

- 開腹手術タイプ

- 低侵襲脊椎手術タイプ

第9章 米国の椎弓根スクリュー市場-用途別収益と2030年までの予測

- イントロダクション

- 米国椎弓根スクリュー市場:2022年・2030年用途別売上高シェア(%)

- 胸腰椎骨折

- 脊椎腫瘍

- 脊柱側弯症

- 脊椎固定術の失敗

- 脊椎炎

第10章 米国の椎弓根スクリュー市場-エンドユーザー別収益と2030年までの予測

- イントロダクション

- 米国椎弓根スクリュー市場:2022年・2030年エンドユーザー別売上高シェア(%)

- 病院

- 外来手術センター(ASCs)

- 専門クリニック

第11章 業界情勢

- イントロダクション

- 椎弓根スクリュー市場における成長戦略

- 有機的成長戦略

- 概要

- 無機的成長戦略

- 概要

第12章 企業プロファイル

- DePuy Synthes Inc

- Zimmer Biomet Holdings Inc

- Globus Medical Inc

- B. Braun SE

- Stryker Corp

- Medtronic Plc

- Surgalign Holdings Inc

- NuVasive Inc

- Orthofix Medical Inc

- Alphatec Holdings Inc

第13章 付録

List Of Tables

- Table 1. US Pedicle Screw Market Segmentation

- Table 2. Companies Offering Monoaxial Pedicle Screw System

- Table 3. Recent Organic Growth Strategies in Pedicle Screw Market

- Table 4. Recent Inorganic Growth Strategies in the Pedicle Screw Market

- Table 5. Glossary of Terms, US Pedicle Screw Market

List Of Figures

- Figure 1. Key Insights

- Figure 2. US PEST Analysis

- Figure 3. US Pedicle Screw Market - Key Industry Dynamics

- Figure 4. Fig 1: Incidence of Subsequent Vertebral Fractures in Two Groups in Aging Population-Based Study

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. US Pedicle Screw Market Revenue (US$ Mn), 2022 - 2030

- Figure 7. US Pedicle Screw market Revenue Share, by Product Type 2022 & 2030 (%)

- Figure 8. Polyaxial Pedicle Screw System: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Monoaxial Pedicle Screw System: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Other Pedicle Screw System: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. US Pedicle Screw Market Revenue Share, by Type 2022 & 2030 (%)

- Figure 12. Open Surgery: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Minimally Invasive Surgery: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. US Pedicle Screw Market Revenue Share, by Application 2022 & 2030 (%)

- Figure 15. Thoracolumbar Fracture: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Spinal Tumor: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Scoliosis: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Failed Spinal Fusion: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Spondylitis: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. US Pedicle Screw Market Revenue Share, by End User 2022 & 2030 (%)

- Figure 21. Hospitals: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Ambulatory Surgical Centers: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Specialty Clinics: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Growth Strategies in Pedicle Screw Market

The US pedicle screw market size is expected to grow from US$ 0.361 billion in 2022 to US$ 0.610 billion by 2030; it is estimated to register a CAGR of 6.79% from 2022 to 2030.

The pedicle screw system plays an important role in increasing strength and providing support to damage the spinal cord. The escalating number of medical professionals specializing in spinal surgeries is expected to drive the market growth of pedicle screws. According to the data published in Health Central LLC, in 2019, approximately 1.62 million spinal procedures were performed every year in the United States and approximately 313 million surgeries were performed annually, with 500,000 lumbar spine surgeries carried out annually in the United States. Cost is also an important factor in these types of surgeries. For instance, according to the data published in Health Trust-The Source Magazine in 2022, approximately 1.2 million surgeries are performed with an average cost of US$ 80, 000 for lumbar spinal fusion surgery.

Furthermore, the US pedicle screw system has significantly developed with the rising number of spinal surgeries. Incorporating a navigation system while placing the pedicle screw system is a major development in the pedicle screw system market space. Moreover, robotics is used for pedicle screw placement to augment accuracy and minimize surgical invasiveness. Although robotics in elderly patients has not been studied at a larger scale, this population may benefit significantly from using robotics as a minimally invasive technique to decrease operative time, minimize blood loss, and reduce postoperative pain, ultimately decreasing complications in the near future.

Additionally, the rising adoption of pedicle screw systems in treating degenerative spinal disorders is another driving factor for the market growth. A steep rise in sports-related and spinal cord injury (SCI) injuries and accidental fractures results in surgical procedures, which further results in the usage of pedicle screws. According to the data published by the National Spinal Cord Injury Statistical Center in 2022, the traumatic spinal cord injury (SCI) annual incidence in 2021 was approximately 54 cases per one million people in the United States. Thus, the rising prevalence of spinal cord injury is projected to boost the demand for the pedicle screw market, propelling overall market growth.

Increasing Adoption of Minimally Invasive Surgeries Contributing to Market Expansion

The rising adoption of minimally invasive surgeries, coupled with technologically advanced robotic and image-guided (IG) surgeries, is anticipated to boost overall market growth, thereby providing lucrative opportunities for emerging market players. Over the past many years, minimally invasive surgical procedures have become feasible, popular, and efficient for managing spinal disorders. Spinal surgeries using pedicle screw are transforming significantly towards a minimally invasive paradigm. Navigated pedicle screw insertion has been proven fundamental in minimally invasive spinal surgeries. These types of surgeries provide various advantages over open surgeries, such as less damage to soft tissue and muscle, less pain post-surgery, shorter hospital stay, and quicker recovery.

Additionally, many companies in the pedicle screw market are involved in new product innovations to ease the overall surgical procedures. For instance, in January 2023, Orthofix Medical launched a fully commercial mariner deformity pedicle screw system. The product was launched to advance reduction and correct instrumentation, specialized implant technologies, and for osteotomy tools for better surgical intervention. Similarly, in September 2021, Alphatec Holdings, Inc. expanded the platform spinal fixation with the launch of InVictus OsseoScrew. InVictus OsseScrew was the first commercially available pedicle screw technology designed to optimize fixation and address the clinical challenge of fixation failure in bone.

US pedicle screw market is segmented on the basis of product type, application, surgery type, and end user. By product type, the pedicle screw market is divided into polyaxial pedicle screw systems, monoaxial pedicle screw systems, and other pedicle screw systems. Based on application, the market is segmented into thoracolumbar fracture, spinal tumor, scoliosis, and failed spine fusion spondylitis. On the basis of surgery type, the pedicle screw market is segmented into open surgery and minimally invasive surgery. On the basis of end user, the pedicle screw market is divided into hospitals, ambulatory surgical centers, and specialty clinics.

Moreover, the nation is well-established in terms of technology compared to other developed and emerging countries. Technological advancements in the pedicle screw have resulted in the development of a variety of pedicle screw and associated technologies. The increase in the prevalence of lumbar fracture, spinal deformities, and spinal tumor among the U.S. population and technological advancements in the pedicle screw is fueling the demand for pedicle screws. According to National Health Services in 2022, the lifetime incidence of LBP in the US is reported to be 60%-90% with annual incidence of 5%. Per the same source, 14.3% of new patients visit physicians because of LBP every year and ~13 million people visit physicians due to chronic LBP.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the smart hospital beds market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the global pedicle screws, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global pedicle screws market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. US Pedicle Screw Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.2.1 US PEST Analysis

5. US Pedicle Screw Market - Key Industry Dynamics

- 5.1 Key Market Drivers:

- 5.1.1 Susceptibility of Aging Population Prone to Spinal Disorders

- 5.1.2 Rising Number of Spinal Surgeries Using Pedicle Screw System

- 5.3 Key Market Restraints:

- 5.3.1 Regulatory and Operational Complexities

- 5.4 Key Market Opportunities:

- 5.4.1 Increasing Adoption of Minimally Invasive Surgeries

- 5.5 Future Trends

- 5.5.1 Use of Robotics Navigation in the Pedicle Screw Market

- 5.6 Impact Analysis:

6. US Pedicle Screw Market - Market Analysis

- 6.1 US Pedicle Screw Market Revenue (US$ Mn), 2022 - 2030

7. US Pedicle Screw Market - Revenue and Forecast to 2030 - by Product Type

- 7.1 Overview

- 7.2 US Pedicle Screw market Revenue Share, by Product Type 2022 & 2030 (%)

- 7.3 Polyaxial Pedicle Screw System

- 7.3.1 Overview

- 7.3.2 Table 1: Companies Offering Polyaxial Pedicle Screw Systems

- 7.3.3 Polyaxial Pedicle Screw System: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Monoaxial Pedicle Screw System

- 7.4.1 Overview

- 7.4.2 Monoaxial Pedicle Screw System: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4.3 Other Pedicle Screw System

- 7.4.4 Other Pedicle Screw System: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

8. US Pedicle Screw market - Revenue and Forecast to 2030 - by Surgery Type

- 8.1 Overview

- 8.2 US Pedicle Screw Market Revenue Share, by Type 2022 & 2030 (%)

- 8.3 Open Surgery Type

- 8.3.1 Overview

- 8.3.2 Open Surgery: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Minimally Invasive Spine Surgery Type

- 8.4.1 Overview

- 8.4.2 Minimally Invasive Surgery: US Pedicle Screw market - Revenue and Forecast to 2030 (US$ Million)

9. US Pedicle Screw market - Revenue and Forecast to 2030 - by Application

- 9.1 Overview

- 9.2 US Pedicle Screw Market Revenue Share, by Application 2022 & 2030 (%)

- 9.3 Thoracolumbar Fracture

- 9.3.1 Overview

- 9.3.2 Thoracolumbar Fracture: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Spinal Tumor

- 9.4.1 Overview

- 9.4.2 Spinal Tumor: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Scoliosis

- 9.5.1 Overview

- 9.5.2 Scoliosis: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Failed Spinal Fusion

- 9.6.1 Overview

- 9.6.2 Failed Spinal Fusion: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 9.7 Spondylitis

- 9.7.1 Overview

- 9.7.2 Spondylitis: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

10. US Pedicle Screw Market - Revenue and Forecast to 2030 - by End User

- 10.1 Overview

- 10.2 US Pedicle Screw Market Revenue Share, by End User 2022 & 2030 (%)

- 10.3 Hospitals

- 10.3.1 Overview

- 10.3.2 Hospitals: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 10.4 Ambulatory Surgical Centres (ASCs)

- 10.4.1 Overview

- 10.4.2 Ambulatory Surgical Centers: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

- 10.5 Specialty Clinics

- 10.5.1 Overview

- 10.5.2 Specialty Clinics: US Pedicle Screw Market - Revenue and Forecast to 2030 (US$ Million)

11. Industry Landscape

- 11.1 Overview

- 11.2 Growth Strategies in Pedicle Screw Market

- 11.3 Organic Growth Strategies

- 11.3.1 Overview

- 11.4 Inorganic Growth Strategies

- 11.4.1 Overview

12. Company Profiles

- 12.1 DePuy Synthes Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Zimmer Biomet Holdings Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Globus Medical Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 B. Braun SE

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Stryker Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Medtronic Plc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Surgalign Holdings Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 NuVasive Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Orthofix Medical Inc

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Alphatec Holdings Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About Us

- 13.2 Glossary of Terms