|

|

市場調査レポート

商品コード

1510750

北米の教育用家具:2030年市場予測:地域別分析:材料別、製品タイプ別、最終用途別North America Educational Furniture Market Forecast to 2030 - Regional Analysis - by Material, Product Type, and End Use |

||||||

|

|||||||

| 北米の教育用家具:2030年市場予測:地域別分析:材料別、製品タイプ別、最終用途別 |

|

出版日: 2024年05月07日

発行: The Insight Partners

ページ情報: 英文 72 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の教育用家具市場は、2022年には34億9,399万米ドルとなり、2030年には52億550万米ドルに達すると予測され、2022~2030年のCAGRは5.1%で成長すると予測されています。

新設校における教育用家具需要の増加が北米の教育用家具市場を活性化

教育用家具の需要は、学校が生徒のニーズの変化に適応することで増加しています。都市部や農村部における教育意識の高まりによる生徒数の急増は、世界中でより多くの学校の建設と生徒数の増加をもたらしています。さらに、各国政府による義務初等教育制度が学校建設を促進しています。学校施設の老朽化、生徒数の急増、建築構造や安全基準の変更に伴い、多くの国の政府当局は新しいインフラに投資するか、既存のインフラをアップグレードしています。このように、学校建設の増加が北米の教育用家具市場の成長を牽引しています。

北米の教育用家具市場概要

北米の家具メーカーは、明確な顧客需要に対応するため、事業全般を継続的に強化しています。ほとんどの国内外企業は北米に強固な足場を築いています。北米の教育用家具市場は米国、カナダ、メキシコに区分されます。米国は同地域市場において主要な貢献国であり、カナダ、メキシコがこれに続く。北米の教育機関は既存のリソースをアップグレードし、革新的な家具を調達しています。効果的な製造・貿易政策も教育用家具市場の成長に寄与しています。さらに、人間工学に基づいて設計された学校用家具は、特に誤った姿勢から生じる幼児の健康問題を予防するため、この地域で大きな支持を集めています。

持ち運びが可能で、組み替えが容易な調節可能な家具の需要は、ブレンデッドラーニングや反転教室のような形で採用されている包括的、双方向的、ダイナミックな教育スタイルに起因しています。教育セクターの発展に伴い、北米では伝統的な学校用家具から革新的で審美的に魅力的な家具への移行が進んでいます。教育用家具は、木製、プラスチック製、金属製など、さまざまな材料から独特のデザイン、形態、色で製造されています。米国では、Fleetwood Furniture、Herman Miller Inc、Steelcaseといった大手教育用家具メーカーが存在感を示しています。さらに、Simplova、Educan School Furniture Ltd、RJH Solutions、CDI Spacesなどがカナダで事業展開している教育用家具メーカーサプライヤーです。米国土木学会が発表した2021年インフラ報告カードによると、米国には~8万4,000校の公立学校があり、約10万棟の建物があり、2026年には5,680万人が入学すると推定されています。

このように、学校数の増加、モダンで人間工学に基づいた家具への傾斜、教育用家具メーカーの存在が、北米の教育用家具市場を今後数年で押し上げると予想されます。

北米の教育用家具市場の収益と2030年までの予測(金額)

北米の教育用家具市場のセグメンテーション

北米の教育用家具市場は、材料、製品タイプ、最終用途、国別にセグメント化されています。

北米の教育用家具市場は、材料別に木材、プラスチック、金属、その他に区分されます。2022年の北米の教育用家具市場シェアは、木材セグメントが最大です。

製品タイプでは、北米の教育用家具市場はベンチと椅子、机とテーブル、収納ユニット、その他に分類されます。2022年の北米の教育用家具市場シェアは、ベンチと椅子に大別されます。

最終用途の観点から、北米の教育用家具市場は施設用と住宅用に二分されます。2022年の北米の教育用家具市場シェアは、施設用セグメントが大きいです。施設セグメントはさらに小学校、中学校、高等教育に拡大されます。

国別では、北米の教育用家具市場は米国、カナダ、メキシコに区分されます。2022年の北米の教育用家具市場は米国が独占しています。

C Fleetwood Group Inc、Haworth Inc、Knoll Inc、Scholar Craft Products Inc、Smith Systems Manufacturing Co、Virco Manufacturing Corp、Vitra International AGなどが北米の教育用家具市場で事業を展開する大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブ概要

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

- 限界と前提条件

第4章 北米の教育用家具市場情勢

- イントロダクション

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- エコシステム分析

- 原材料

- 製造業

- 最終消費者

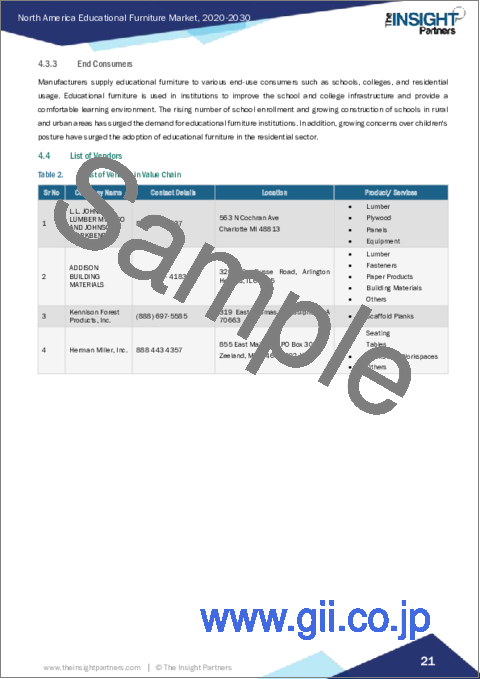

- ベンダー一覧

第5章 北米の教育用家具市場:主要市場力学

- 市場促進要因

- 新設校における教育用家具需要の増加

- モダンで軟質な学習空間への需要の高まり

- 市場抑制要因

- 木材価格の変動

- 市場機会

- 持続可能性への注目の高まり

- 今後の動向

- 人間工学に基づいた家具の人気の高まり

- 促進要因と抑制要因の影響分析

第6章 教育用家具市場:北米市場分析

- 北米の教育用家具市場収益

- 北米の教育用家具市場の予測・分析(2020~2030年)

第7章 北米の教育用家具市場分析:材料別

- 木材

- プラスチック

- 金属

- その他

第8章 北米の教育用家具市場の収益分析:製品タイプ別

- イントロダクション

- ベンチと椅子

- 机とテーブル

- 収納ユニット

- その他

第9章 北米の教育用家具市場の収益分析:最終用途別

- イントロダクション

- 教育機関

- 住宅

第10章 北米の教育用家具市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 業界情勢

- 合併と買収

- 企業ニュース

第12章 企業プロファイル

- Fleetwood Group Inc

- Scholar Craft Products Inc

- Smith Systems Manufacturing Co

- Knoll Inc

- Haworth Inc

- Vitra International AG

- Virco Manufacturing Corp

第13章 企業概要付録

List Of Tables

- Table 1. North America Educational Furniture Market Segmentation

- Table 2. List of Vendors in Value Chain

- Table 3. North America Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

- Table 4. North America Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Material

- Table 5. North America Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Product Type

- Table 6. North America Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By End Use

- Table 7. US Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Material

- Table 8. US Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Product Type

- Table 9. US Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By End Use

- Table 10. Canada Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Material

- Table 11. Canada Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Product Type

- Table 12. Canada Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By End Use

- Table 13. Mexico Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Material

- Table 14. Mexico Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By Product Type

- Table 15. Mexico Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million) - By End Use

List Of Figures

- Figure 1. North America Educational Furniture Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis: North America Educational Furniture Market

- Figure 3. Ecosystem Analysis: North America Educational Furniture Market

- Figure 4. North America Educational Furniture Market - Key Industry Dynamics

- Figure 5. North America Educational Furniture Market Impact Analysis of Drivers and Restraints

- Figure 6. North America Educational Furniture Market Revenue (US$ Million), 2020 - 2030

- Figure 7. North America Educational Furniture Market Share (%) - By Material, 2022 and 2030

- Figure 8. Wood: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Plastic: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Metal: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Others: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 12. North America Educational Furniture Market Revenue Share, By Product Type (2022 and 2030)

- Figure 13. Benches and Chairs: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Desks and Tables: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Storage Units: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Others: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 17. North America Educational Furniture Market Revenue Share, By End Use (2022 and 2030)

- Figure 18. Institutional: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Elementary School: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Secondary School: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Higher Education: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Residential: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- Figure 23. North America Educational Furniture Market Revenue, by Key Countries, (2022)(US$ Mn)

- Figure 24. North America Educational Furniture Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 25. US Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. Canada Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 27. Mexico Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

The North America educational furniture market was valued at US$ 3,493.99 million in 2022 and is expected to reach US$ 5,205.50 million by 2030; it is estimated to grow at a CAGR of 5.1% from 2022 to 2030.

Increase in Demand for Educational Furniture in Newly Constructed Schools Fuels North America Educational Furniture Market

The demand for educational furniture is increasing with schools adapting to the changing needs of students. An upsurge in student population due to increased education awareness in urban and rural areas has led to the construction of more schools and increased student enrollment around the world. Further, mandatory primary education systems by national governments promote school construction. With the aging school facilities, a surge in the number of students, and changes in building construction and safety codes, the government authorities of many countries are either investing in new infrastructure or upgrading existing ones. Thus, the growing construction of schools is driving the growth of the North America educational furniture market.

North America Educational Furniture Market Overview

Furniture manufacturers in North America continuously enhance their overall business operations to meet distinct customer demands. Most domestic and international companies have a strong foothold in North America. The educational furniture market in North America is segmented into the US, Canada, and Mexico. The US is a major contributor to the regional market, followed by Canada and Mexico, respectively. Educational institutions in North America are upgrading their existing resources and procuring innovative furniture. Effective manufacturing and trade policies are also contributing to the growth of the educational furniture market. In addition, ergonomically designed school furniture to prevent health issues in children, especially arising from incorrect posture, is gaining significant traction in this region.

The demand for portable and adjustable furniture with easy reconfiguration can be attributed to comprehensive, interactive, and dynamic teaching styles adopted in the form of blended learning and flipped classrooms. With the progress of the education sector, North America is transitioning from traditional school furniture to innovative and aesthetically appealing furniture. Educational furniture is manufactured in distinct designs, shapes, and colors from different materials, such as wood, plastic, or metal. The US marks the presence of major educational furniture manufacturers, namely Fleetwood Furniture, Herman Miller Inc, and Steelcase Inc. Further, Simplova, Educan School Furniture Ltd, RJH Solutions, and CDI Spaces are among the educational furniture manufacturers and suppliers operating in Canada, among others. According to the 2021 Infrastructure Report Card published by the American Society of Civil Engineers, there are ~84,000 public schools with ~100,000 buildings in the US, with an estimated enrollment of 56.8 million by 2026.

Thus, an increase in the number of schools, an inclination towards modern and ergonomic furniture, and the presence of educational furniture manufacturers are expected to boost the educational furniture market in North America in the coming years.

North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

North America Educational Furniture Market Segmentation

The North America educational furniture market is segmented based on material, product type, end use, and country.

Based on material, the North America educational furniture market is segmented into wood, plastic, metal, and others. The wood segment held the largest North America educational furniture market share in 2022.

In terms of product type, the North America educational furniture market is categorized into benches and chairs, desks and tables, storage units, and others. The benches and chairs segment the largest North America educational furniture market share in 2022.

In terms of end use, the North America educational furniture market is bifurcated into institutional and residential. The institutional segment held a larger North America educational furniture market share in 2022. The institutional segment is further expanded into elementary school, secondary school, and higher education.

Based on country, the North America educational furniture market is segmented into the US, Canada, and Mexico. The US dominated the North America educational furniture market in 2022.

C Fleetwood Group Inc, Haworth Inc, Knoll Inc, Scholar Craft Products Inc, Smith Systems Manufacturing Co, Virco Manufacturing Corp, and Vitra International AG are some of the leading companies operating in the North America educational furniture market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

- 3.4 Limitations and Assumptions

4. North America Educational Furniture Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers:

- 4.2.2 Bargaining Power of Suppliers:

- 4.2.3 Threat of Substitutes:

- 4.2.4 Threat of New Entrants:

- 4.2.5 Competitive Rivalry:

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Materials

- 4.3.2 Manufacturing

- 4.3.3 End Consumers

- 4.4 List of Vendors

5. North America Educational Furniture Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Educational Furniture in Newly Constructed Schools

- 5.1.2 Growing Demand for Modern and Flexible Learning Spaces

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Prices of Wood

- 5.3 Market Opportunities

- 5.3.1 Increasing Focus on Sustainability

- 5.4 Future Trends

- 5.4.1 Growing Popularity of Ergonomic Furniture

- 5.5 Impact Analysis of Drivers and Restraint

6. Educational Furniture Market - North America Market Analysis

- 6.1 North America Educational Furniture Market Revenue (US$ Million)

- 6.2 North America Educational Furniture Market Forecast and Analysis (2020-2030)

7. North America Educational Furniture Market Analysis - By Material

- 7.1 Wood

- 7.1.1 Overview

- 7.1.2 Wood: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 Plastic

- 7.2.1 Overview

- 7.2.2 Plastic: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 7.3 Metal

- 7.3.1 Overview

- 7.3.2 Metal: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

8. North America Educational Furniture Market Revenue Analysis - By Product Type

- 8.1 Overview

- 8.2 Benches and Chairs

- 8.2.1 Overview

- 8.2.2 Benches and Chairs: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 8.3 Desks and Tables

- 8.3.1 Overview

- 8.3.2 Desks and Tables: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Storage Units

- 8.4.1 Overview

- 8.4.2 Storage Units: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

9. North America Educational Furniture Market Revenue Analysis - By End Use

- 9.1 Overview

- 9.2 Institutional

- 9.2.1 Overview

- 9.2.2 Institutional: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 9.2.3 Elementary School

- 9.2.3.1 Overview

- 9.2.3.2 Elementary School: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 9.2.4 Secondary School

- 9.2.4.1 Overview

- 9.2.4.2 Secondary School: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 9.2.5 Higher Education

- 9.2.5.1 Overview

- 9.2.5.2 Higher Education: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Residential

- 9.3.1 Overview

- 9.3.2 Residential: North America Educational Furniture Market Revenue and Forecast to 2030 (US$ Million)

10. North America Educational Furniture Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Educational Furniture Market Revenue and Forecasts and Analysis - By Countries

- 10.1.1.1 North America Educational Furniture Market Breakdown by Country

- 10.1.1.2 US Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.2.1 US Educational Furniture Market Breakdown by Material

- 10.1.1.2.2 US Educational Furniture Market Breakdown by Product Type

- 10.1.1.2.3 US Educational Furniture Market Breakdown by End Use

- 10.1.1.3 Canada Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.3.1 Canada Educational Furniture Market Breakdown by Material

- 10.1.1.3.2 Canada Educational Furniture Market Breakdown by Product Type

- 10.1.1.3.3 Canada Educational Furniture Market Breakdown by End Use

- 10.1.1.4 Mexico Educational Furniture Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.4.1 Mexico Educational Furniture Market Breakdown by Material

- 10.1.1.4.2 Mexico Educational Furniture Market Breakdown by Product Type

- 10.1.1.4.3 Mexico Educational Furniture Market Breakdown by End Use

- 10.1.1 North America Educational Furniture Market Revenue and Forecasts and Analysis - By Countries

11. Industry Landscape

- 11.1 Merger & Acquisitions

- 11.2 Company News

12. Company Profiles

- 12.1 Fleetwood Group Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Scholar Craft Products Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Smith Systems Manufacturing Co

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Knoll Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Haworth Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Vitra International AG

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Virco Manufacturing Corp

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments