|

|

市場調査レポート

商品コード

1562363

北米の冷却水処理薬品:2030年までの市場予測 - 地域分析 - タイプ別、最終用途別North America Cooling Water Treatment Chemicals Market Forecast to 2030 - Regional Analysis - by Type and End Use |

||||||

|

|||||||

| 北米の冷却水処理薬品:2030年までの市場予測 - 地域分析 - タイプ別、最終用途別 |

|

出版日: 2024年07月04日

発行: The Insight Partners

ページ情報: 英文 96 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の冷却水処理薬品市場は、2022年に29億7,897万米ドルと評価され、2030年には46億8,458万米ドルに達すると予測され、2022年から2030年までのCAGRは5.8%と推定されます。

電力産業からの需要拡大が北米の冷却水処理薬品市場を後押し

人口増加と都市化に伴い、電力産業は急速に成長しています。World Energy outlook 2022によると、世界の電力需要は2030年までに25~30%増加します。また、主要な最終用途産業の電化により、2050年までに電力需要は倍増すると予想されています。さまざまな非公開会社や政府によるエネルギー・インフラの建設・維持への投資の増加も、この産業を後押ししています。火力発電所や原子力発電所を含む電力産業は、大量の水を必要とします。これらの産業では、熱交換装置の冷却に海水や湖水を使用することが多いです。水は何度も再利用され、水源に戻されます。~水源から回収された水の99%は戻され、放散に浪費される水は1%未満です。この業界では、淡水資源への依存度を下げるため、冷却水処理薬品が広く使用されています。これらの化学薬品は、熱交換機器の伝熱効率を高めるため、特に開放循環、閉ループ、貫流冷却の枠組みで注目を集めています。世界中で原子力発電所の数が増加していることに加え、既存の発電所を維持するための取り組みが行われているため、冷却水処理薬品の使用は今後さらに増加すると考えられます。

北米の冷却水処理薬品市場概要

北米の冷却水処理市場は、米国、カナダ、メキシコに区分されます。北米諸国には国内外の企業が進出しています。米国は冷却水処理薬品の主要市場であり、カナダとメキシコがそれぞれこれに続く。北米の冷却水処理市場を牽引する主な要因には、工業排水源からの廃水処理を管理するための厳しい規制要件や、電力産業からのこれらの化学薬品に対する需要の増大が含まれます。きれいな水は発電に不可欠な要素です。急速な人口増加と都市化は、ライフスタイルの変化と相まって、一人当たりの電力消費を増加させています。このため、発電産業が急増し、水の再利用を図るため、冷却水処理薬品に対する需要が高まっています。さらに、処理された廃水の品質を監視する規制の強化が、今後数年間の同地域の市場成長を支えると思われます。北米の冷却水処理薬品市場の主要企業には、Accepta Ltd、Albemarle Corp、Buckman Laboratories lnternational Inc.などがあります。

北米の冷却水処理薬品市場の収益と2030年までの予測(億米ドル)

北米の冷却水処理薬品市場セグメンテーション

北米の冷却水処理薬品市場は、タイプ、最終用途、国に分類されます。

タイプ別では、北米の冷却水処理薬品市場は、スケール抑制剤、腐食抑制剤、殺生物剤、その他に区分されます。2022年には、スケール抑制剤セグメントが最大の市場シェアを占めています。

最終用途別では、北米の冷却水処理薬品市場は電力、鉄鋼・鉱業・冶金、石油化学・石油・ガス、食品・飲料、繊維、その他に区分されます。2022年には電力セグメントが最大の市場シェアを占めています。

国別では、北米の冷却水処理薬品市場は米国、カナダ、メキシコに区分されます。2022年の北米の冷却水処理薬品市場シェアは米国が独占しました。

Albemarle Corp、Buckman Laboratories lnternational Inc、ChemTreat Inc、DuBois Chemicals Inc、Ecolab Inc、Kemira Oyj、Kurita Water Industries Ltd、Veolia Water Solutions &Technologies SAは、北米の冷却水処理薬品市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の冷却水処理薬品市場情勢

- ポーターのファイブフォース分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の冷却水処理薬品市場:主要市場力学

- 冷却水処理薬品市場- 主要市場力学

- 市場促進要因

- 電力産業からの需要拡大

- 水のリサイクルと再利用重視の高まり

- 市場抑制要因

- 塩素代替薬品への嗜好の高まり

- 市場機会

- ゼロ液体排出の人気の高まり

- 今後の動向

- グリーンケミカルへのシフト

- 促進要因と抑制要因の影響

第6章 冷却水処理薬品市場:北米市場分析

- 北米の冷却水処理薬品市場収益、2022年~2030年

- 北米の冷却水処理薬品市場予測分析

第7章 北米の冷却水処理薬品市場分析:タイプ別

- スケール抑制剤

- 腐食抑制剤

- 殺生物剤

- その他

第8章 北米の冷却水処理薬品市場分析:最終用途別

- 電力

- 鉄鋼、鉱業、冶金

- 石油化学・石油・ガス

- 飲食品

- 繊維

- その他

第9章 北米の冷却水処理薬品市場:国別分析

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 製品発表

第12章 企業プロファイル

- ChemTreat Inc

- DuBois Chemicals Inc

- Kurita Water Industries Ltd

- Kemira Oyj

- Ecolab Inc

- Buckman Laboratories lnternational Inc

- Albemarle Corp

- Veolia Water Solutions & Technologies SA

第13章 付録

List Of Tables

- Table 1. North America Cooling Water Treatment Chemicals Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. North America Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 5. North America Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 6. North America Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 7. United States: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 8. United States: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 9. Canada: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 10. Canada: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 11. Mexico: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 12. Mexico: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million) - by End Use

- Table 13. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. North America Cooling Water Treatment Chemicals Market Segmentation, by Country

- Figure 2. Cooling Water Treatment Chemicals Market - Porter's Analysis

- Figure 3. Ecosystem: Cooling Water Treatment Chemicals Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Cooling Water Treatment Chemicals Market Revenue (US$ Million), 2022-2030

- Figure 6. North America Cooling Water Treatment Chemicals Market Share (%) - by Type (2022 and 2030)

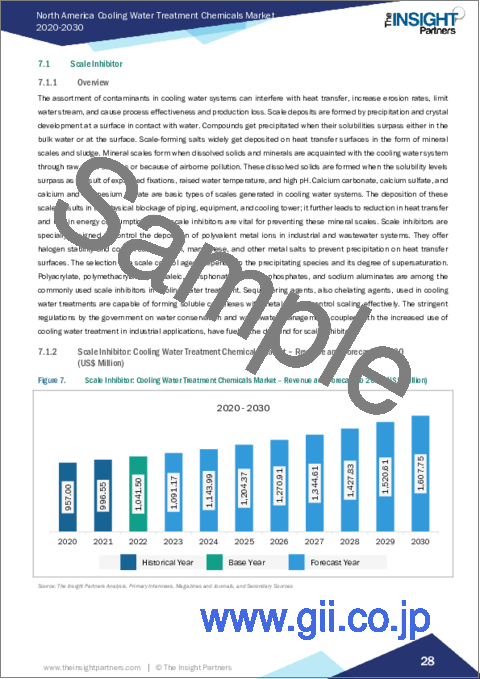

- Figure 7. Scale Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Corrosion Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Biocide: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. North America Cooling Water Treatment Chemicals Market Share (%) - by End Use (2022 and 2030)

- Figure 12. Power: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Steel, Mining, and Metallurgy: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Petrochemicals, Oil, and Gas: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Food and Beverages: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Textile: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. North America Cooling Water Treatment Chemicals Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 19. North America Cooling Water Treatment Chemicals Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 20. United States: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 21. Canada: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 22. Mexico: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. Company Positioning & Concentration

The North America cooling water treatment chemicals market was valued at US$ 2,978.97 million in 2022 and is expected to reach US$ 4,684.58 million by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030.

Growing Demand from Power Industry Fuels North America Cooling Water Treatment Chemicals Market

The power industry is growing rapidly with population growth and urbanization. According to the world energy outlook 2022, global electricity demand electricity demand rises by 25-30% to 2030. Also, electrification across major end-use industries is expected to double the electricity demand by 2050. Increasing investment by various private companies and governments in the building and maintenance of energy infrastructure is also bolstering this industry. The power industry, including thermal and atomic plants, requires water in huge quantities. These industries frequently use seawater or lake water for cooling the heat exchange equipment. The water is reused several times and returned to its source. ~99% of the water retrieved from the source is returned, and less than 1% of the water is squandered in dissipation. Cooling water treatment chemicals are widely used in this industry to lower the dependency on freshwater resources. These chemicals are gaining attention, especially in open-recirculating, closed-loop, and once-through cooling frameworks, as they boost the heat transfer efficiency in heat-exchange equipment. The growing number of atomic energy plants across the world, combined with efforts being made to maintain existing plants, would further boost the use of cooling water treatment chemicals in the coming years.

North America Cooling Water Treatment Chemicals Market Overview

The cooling water treatment market in North America is segmented into the US, Canada, and Mexico. Several domestic and international enterprises have a strong foothold in North American countries. The US is a major market for cooling water treatment chemicals, followed by Canada and Mexico, respectively. The major factors driving the cooling water treatment market in North America include the stringent regulatory requirements to control wastewater disposal from industrial sources and the growing demand for these chemicals from the power industry. Clean water is an essential component for electricity generation. The rapidly growing population and urbanization, coupled with changing lifestyles, have triggered the per capita power consumption. This has driven the proliferation of the power generation industries, in turn, propelling the demand for cooling water treatment chemicals in this industry, in efforts to reuse water. Further, tighter restrictions monitoring the quality of treated wastewater would support the market growth in the region in the coming years. Major companies in the cooling water treatment chemicals market in North America include Accepta Ltd, Albemarle Corp, and Buckman Laboratories lnternational Inc.

North America Cooling Water Treatment Chemicals Market Revenue and Forecast to 2030 (US$ Billion)

North America Cooling Water Treatment Chemicals Market Segmentation

The North America cooling water treatment chemicals market is categorized into type, end use, and country.

Based on type, the North America cooling water treatment chemicals market is segmented into scale inhibitor, corrosion inhibitor, biocide, and others. The scale inhibitor segment held the largest market share in 2022.

In terms of end use, the North America cooling water treatment chemicals market is segmented into power; steel, mining, and metallurgy; petrochemicals, oil, and gas; food and beverages; textile; and others. The power segment held the largest market share in 2022.

By country, the North America cooling water treatment chemicals market is segmented into the US, Canada, and Mexico. The US dominated the North America cooling water treatment chemicals market share in 2022.

Albemarle Corp, Buckman Laboratories lnternational Inc, ChemTreat Inc, DuBois Chemicals Inc, Ecolab Inc, Kemira Oyj, Kurita Water Industries Ltd, and Veolia Water Solutions & Technologies SA are some of the leading companies operating in the North America cooling water treatment chemicals market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Cooling Water Treatment Chemicals Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Cooling Water Treatment Chemicals Market - Key Market Dynamics

- 5.1 Cooling Water Treatment Chemicals Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Demand from Power Industry

- 5.2.2 Growing Emphasis on Water Recycling and Reuse

- 5.3 Market Restraints

- 5.3.1 Surging Preference for Chlorine Alternatives

- 5.4 Market Opportunities

- 5.4.1 Increasing Popularity of Zero Liquid Discharge

- 5.5 Future Trends

- 5.5.1 Shifting Focus Toward Green Chemicals

- 5.6 Impact of Drivers and Restraints:

6. Cooling Water Treatment Chemicals Market - North America Market Analysis

- 6.1 North America Cooling Water Treatment Chemicals Market Revenue (US$ Million), 2022-2030

- 6.2 North America Cooling Water Treatment Chemicals Market Forecast Analysis

7. North America Cooling Water Treatment Chemicals Market Analysis - by Type

- 7.1 Scale Inhibitor

- 7.1.1 Overview

- 7.1.2 Scale Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Corrosion Inhibitor

- 7.2.1 Overview

- 7.2.2 Corrosion Inhibitor: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Biocide

- 7.3.1 Overview

- 7.3.2 Biocide: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Cooling Water Treatment Chemicals Market Analysis - by End Use

- 8.1 Power

- 8.1.1 Overview

- 8.1.2 Power: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Steel, Mining, and Metallurgy

- 8.2.1 Overview

- 8.2.2 Steel, Mining, and Metallurgy: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Petrochemicals, Oil, and Gas

- 8.3.1 Overview

- 8.3.2 Petrochemicals, Oil, and Gas: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Food and Beverages

- 8.4.1 Overview

- 8.4.2 Food and Beverages: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Textile

- 8.5.1 Overview

- 8.5.2 Textile: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Cooling Water Treatment Chemicals Market - Country Analysis

- 9.1 North America Cooling Water Treatment Chemicals Market Overview

- 9.1.1 North America Cooling Water Treatment Chemicals Market - Revenue and Forecast Analysis - by Country

- 9.1.1.1 North America Cooling Water Treatment Chemicals Market - Revenue and Forecast Analysis - by Country

- 9.1.1.2 United States: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.2.1 United States: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.2.2 United States: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.3 Canada: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.3.1 Canada: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.3.2 Canada: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1.4 Mexico: Cooling Water Treatment Chemicals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.4.1 Mexico: Cooling Water Treatment Chemicals Market Breakdown, by Type

- 9.1.1.4.2 Mexico: Cooling Water Treatment Chemicals Market Breakdown, by End Use

- 9.1.1 North America Cooling Water Treatment Chemicals Market - Revenue and Forecast Analysis - by Country

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Launch

12. Company Profiles

- 12.1 ChemTreat Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 DuBois Chemicals Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Kurita Water Industries Ltd

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Kemira Oyj

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Ecolab Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Buckman Laboratories lnternational Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Albemarle Corp

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Veolia Water Solutions & Technologies SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners