|

|

市場調査レポート

商品コード

1226968

北米のFBO(運航支援事業者)市場の2028年までの予測 - 提供サービス別、用途別の地域分析North America Fixed-Base Operator Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Services Offered and Application |

||||||

| 北米のFBO(運航支援事業者)市場の2028年までの予測 - 提供サービス別、用途別の地域分析 |

|

出版日: 2023年02月20日

発行: The Insight Partners

ページ情報: 英文 112 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米のFBO(運航支援事業者)市場は、2022年の88億9,706万米ドルから2028年には126億3,833万米ドルに成長すると予測されています。2022年から2028年までのCAGRは6.0%と推定されています。

燃料補給サービスがFBOのサービス事業に大きく貢献し、北米のFBO市場を牽引する

FBOは、ハンガリング、燃料補給、飛行指導、航空機メンテナンス、航空機レンタルなど、多様なサービスを提供しています。このうち、燃料補給は最も高い収益を生む分野です。世界中のFBOは、ピストンエンジン機にはAVGAS、タービンエンジン機にはジェット燃料の燃料補給サービスを提供しています。燃料補給サービスでは、飛行機の所有者に燃料を販売したり、飛行機を停める場所を提供したりしています。過去数年間(COVID以前)、ビジネス航空セクターは力強く成長してきたため、燃料供給サービスプロバイダーの需要も急増しています。さらに、現在のシナリオでは、いくつかのFBOが、一般的な航空ジェット機オペレーターの二酸化炭素排出量削減を支援する戦略として、持続可能な航空燃料(SAF)の提供を行っています。SAFの配布は、FBOのサービス向上と顧客誘致を目的としています。シグネチャー・アビエーションとアトランティック・アビエーションは、SAFを顧客に提供している主要なFBOの一つです。FBOの間でSAFへの関心が高まっていることは、市場の将来シナリオを理解するための分析であり、北米のFBO市場の重要な促進要因の1つと考えられています。さらに、いくつかの空港当局は、一般航空を利用する旅行者にさまざまなサービスを提供し、旅行体験を向上させるために、FBOの配備に継続的に投資しています。例えば、2021年2月、本土の航空機サービスは、カラエア空港に豪華な「運航支援事業」と燃料ファームのために1,200万米ドルを投資し、提携を発表しました。フリーマン・ホールディングス・グループ(カンザス州)とミリオン・エア(テキサス州)は、共に米国でFBOとして運営し、燃料補給、修理、パイロットラウンジなどのサービスを提供しています。-北米です。したがって、空港でのFBO運営へのこうした投資は、航空機所有者の間で燃料補給サービスの成長を支えています。

北米のFBO市場の概要

北米は、世界最大の一般航空機保有国として知られており、これらの航空機は運航のために定期的なFBOサービスを必要としています。これらの経済は、可処分所得の高さ、生活水準の高さ、一般航空分野や一般航空空港のインフラにおける急速な技術的進歩を特徴としています。北米は、ビジネスジェット機とパーソナルジェット機の保有台数が世界で最も多い地域です。国内外を問わず、大量のビジネスジェット機やパーソナルジェット機が運航されており、同地域に存在するFBOの数の増加と相まって、北米のFBO市場を牽引しています。この地域の一般航空産業は成熟しており、複数の航空機OEMが存在します。また、研究開発への政府投資の増加や、地域の一般航空サービス事業者による先進的なヘリコプター、プライベートジェット機、練習機の調達が進んでいます。また、民間空港のインフラ強化に注力する動きが活発化していることや、規制が好転していることも、北米のFBO市場を支えています。さらに、Pentastar Aviation、Xjet、AirFlite、JA Air Center、Tampa International Jet Center、Wilson Air Center、Global Select、Jet Aviation Palm Beach、Meridian Teterboro、Banyan Air Serviceなどの多数のFBOがこの地域に存在し、市場の成長にプラスの影響を及ぼしています。この地域のFBOは、保管、給油、ケータリング、コンシェルジュサービス、会議室、メンテナンスサービスなど、多様な一般航空サービスを提供しています。この地域には、空港に1つまたは複数のFBOが存在する公共利用および民間利用の空港が多数存在します。

さらに、北米のFBO市場全体の最近の動向には、以下のようなものがあります:

2022年6月、ウィルミントン国際空港に航空サービスを提供する新しい固定基地事業者(FBO)が正式にオープンしました。

2022年11月、テキサス州のペロ・フィールド・フォートワース・アライアンス空港は、空港敷地内に新しいFBOターミナルを開設することを発表しました。

2022年9月、Modern Aviation社はElliott Aviation社からデモイン国際空港のFBO資産と事業の買収を完了し、拠点数が13になったことを発表しました。

しかし、COVID-19のパンデミックは、政府による渡航制限、企業の操業停止、監禁などの様々な封じ込め措置により、この地域の航空セクターに大きな影響を与えました。この地域の経済が再開され、旅行産業が活発化するにつれて、安全性を高めた旅行用のプライベートジェット機の需要も拡大しつつあります。このため、固定式オペレーターサービスの需要が増加し、固定式オペレーター市場を後押ししています。また、Signature Aviation、Jet Aviation(General Dynamics Corporationの子会社)、Universal Aviationなどの主要な市場プレーヤーがこの地域で事業を展開しており、これが北米のFBO市場の主要な促進要因となっています。

北米FBO市場の収益と2028年までの予測(金額)

北米のFBO市場のセグメンテーション

北米のFBO市場は、サービス、用途、国別に区分されます。

提供されるサービスに基づき、北米のFBO市場は、ハンガリング、燃料補給、飛行訓練、航空機メンテナンス、航空機レンタルに区分されます。2022年、燃料補給セグメントは北米のFBO市場で最大のシェアを記録しました。

用途に基づき、北米のFBO市場はビジネス航空とレジャー航空に二分されます。2022年、北米のFBO市場では、ビジネス航空セグメントがより大きなシェアを記録しました。

国別では、北米のFBO市場は、米国、カナダ、メキシコに区分されます。2022年、北米のFBO市場では、米国セグメントが最大のシェアを記録しました。

Abilene Aero;Atlantic Aviation FBO Inc.;Avemex SA De CV;DEER JET CO.LTD.、dnata Corporation、ExecuJet Aviation Group AG、General Dynamics Corporation、Jetex、Luxaviation、Signature Aviation、Swissport、およびUniversal Weather and Aviation, Inc.は、北米のFBO市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 重要なポイント

第3章 調査手法

- カバレッジ

- 2次調査

- 1次調査

第4章 北米のFBO市場の情勢

- 市場概要

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- エコシステム分析

第5章 北米のFBO市場力学

- 市場促進要因

- ビジネス航空セクターの成長

- 燃料補給サービスはFBOサービス事業に大きく寄与する

- 市場抑制要因

- 人手不足と高い運用コスト

- 動向

- 大型機のハンガリングサービスの需要拡大

- 促進要因と抑制要因の影響分析

第6章 FBO市場- 北米市場分析

- 北米のFBO市場の概要

- 北米のFBO市場の収益予測と分析

第7章 北米のFBO市場分析- 提供サービス別

- 北米のFBO市場:提供サービス別(2021年、2028年)

- ハンガリング

- 燃料補給

- 飛行指導

- 航空機メンテナンス

- 航空機レンタル

第8章 北米のFBO市場-用途別

- 北米のFBO市場:用途別(2021年、2028年)

- ビジネス航空

- レジャー航空

第9章 北米のFBO市場- 国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 業界情勢

- マーケットイニシアティブ

- 合併・買収

- 新規開発

第11章 企業プロファイル

- Avemex SA De CV

- DEER JET CO. LTD.

- dnata Corporation

- General Dynamics Corporation

- Jetex

- Luxaviation

- Signature Aviation

- Swissport

- Abilene Aero

- Atlantic Aviation FBO Inc.

- ExecuJet Aviation Group AG

- Universal Weather and Aviation, Inc.

第12章 付録

List Of Tables

- Table 1. North America Fixed-Base Operator Market Revenue and Forecast to 2028 (US$ Million)

- Table 2. US: Fixed-Base Operator Market - by Services Offered -Revenue and Forecast to 2028 (US$ Million)

- Table 3. US: Fixed-Base Operator Market - by Application -Revenue and Forecast to 2028 (US$ Million)

- Table 4. Canada: Fixed-Base Operator Market - by Services Offered -Revenue and Forecast to 2028 (US$ Million)

- Table 5. Canada: Fixed-Base Operator Market - by Application -Revenue and Forecast to 2028 (US$ Million)

- Table 6. Mexico: Fixed-Base Operator Market - by Services Offered -Revenue and Forecast to 2028 (US$ Million)

- Table 7. Mexico: Fixed-Base Operator Market - by Application -Revenue and Forecast to 2028 (US$ Million)

- Table 8. List of Abbreviation

List Of Figures

- Figure 1. North America Fixed-Base Operator Market Segmentation

- Figure 2. North America Fixed-Base Operator Market Segmentation - By Country

- Figure 3. North America Fixed-Base Operator Market Overview

- Figure 4. North America Fixed-Base Operator Market, by Services Offered

- Figure 5. North America Fixed-Base Operator Market, by Application

- Figure 6. North America Fixed-Base Operator Market, By Country

- Figure 7. North America Fixed-Base Operator Market - Porter's Five Forces Analysis

- Figure 8. North America Fixed-Base Operator Market: Ecosystem Analysis

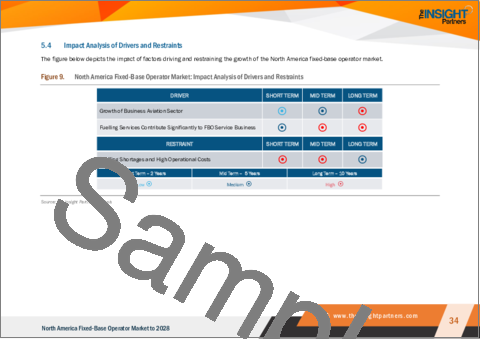

- Figure 9. North America Fixed-Base Operator Market: Impact Analysis of Drivers and Restraints

- Figure 10. North America Fixed-Base Operator Market Revenue Forecast and Analysis (US$ Million)

- Figure 11. North America Fixed-Base Operator Market Revenue Share, by Services Offered (2021 and 2028)

- Figure 12. Hangaring: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 13. Fuelling: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 14. Flight Instructions: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 15. Aircraft Maintenance: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 16. Aircraft Rental: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 17. North America Fixed-Base Operator Market Revenue Share, by Application (2021 and 2028)

- Figure 18. Business Aviation: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 19. Leisure Aviation: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 20. North America: Fixed-Base Operator Market, by Key Country - Revenue (2021) (US$ Million)

- Figure 21. North America: Fixed-Base Operator Market Revenue Share, by Key Country (2021 and 2028)

- Figure 22. US: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Canada: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 24. Mexico: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

The North America fixed-base operator market is expected to grow from US$ 8,897.06 million in 2022 to US$ 12,638.33 million by 2028. It is estimated to grow at a CAGR of 6.0% from 2022 to 2028.

Fuelling Services Contribute Significantly to Fixed-Base Operator Service Business is Driving the North America Fixed-Base Operator Market

The fixed-base operators offer a diversified range of services such as hangaring, fuelling, flight instructions, aircraft maintenance, and aircraft rental. Of these, fuelling is the highest revenue generating segments. FBOs across the world offer fuelling services of AVGAS to the piston engine aircraft and/or Jet Fuel to the turbine-powered aircraft. The fuelling services involve selling fuel to plane owners as well as offering them places to park their planes. Since, the business aviation sector has been growing strongly over the past few years (pre-COVID), the demand for fuelling service provider also surged. In addition, several FBOs in the current scenario are offering Sustainable Aviation Fuel (SAF) as a strategy to help the general aviation jet operators to reduce carbon footprint. The distribution of SAF among the FBOs is also aimed at improving their services and attract customers. Signature Aviation and Atlantic Aviation are among the leading FBOs offering SAF to their customers. The growing attraction towards SAF among the FBOs is analyzed to understand the future scenario of the market and has been considered to be one of the crucial driving parameters for the North America fixed-base operator market . Moreover, several airport authorities are continuously investing in the deployment of fixed-based operators to provide different services to travelers availing general aviation for enhancing their travelling experience. For instance, in February 2021, a mainland aircraft services announced its partnership by investing ~US$ 12 million for a luxury "fixed-base operation" and fuel farm at Kalaeloa Airport. The Freeman Holdings Group (Kansas) and Million Air (Texas) together operate as an FBO in the US and offer services such as fuelling, repair, and pilot lounges. -North America. Therefore, such investments in FBO operation in the airport supports the growth of fuelling services among the aircraft owners.

North America Fixed-Base Operator Market Overview

North America is known to have the largest fleet of general aviation aircraft globally, and these aircraft require regular FBO services for operational availability. These economies are characterized by high disposable individual incomes, higher standards of living, and rapid technological advancements in the arena of general aviation and general aviation airport infrastructure. North America comprises the largest fleet of business and personal jets aircraft in the world. Huge volumes of business and personal fleets in operations in the domestic as well as international arena, coupled with the rise in number of FBOs present in the region, propel the North America fixed-base operator market. The general aviation industry in the region is matured and has the presence of several aircraft OEMs. Also, there is an increase in government investments in R&D and the procurement of advanced helicopters, private jets, and trainer aircraft from the regional general aviation service players. The growing focus on enhancing the infrastructure of private airports, along with favorable changes in regulations, is also supporting the North America fixed-base operator market in North America. Furthermore, the presence of large number of FBOs in the region such as Pentastar Aviation, Xjet, AirFlite, JA Air Center, Tampa International Jet Center, Wilson Air Center, Global Select, Jet Aviation Palm Beach, Meridian Teterboro, and Banyan Air Service, is positively influencing the growth of the market. The FBOs in the region offer diversified general aviation services such as storage, fueling, catering, concierge services, meeting rooms, and maintenance services. The region consists of maximum number of public use and private use airports with one or more than one FBOs present at the airports.

Moreover, some of the recent developments across the North America FBO market include:

In June 2022, a new fixed-base operator (FBO) providing aeronautical services officially opened at the Wilmington International Airport.

In November 2022, Texas's Perot Field Fort Worth Alliance Airport announced the opening of a new FBO terminal across its airport premises.

In September 2022, Modern Aviation announced that it has closed the acquisition of the FBO assets and operations at Des Moines International Airport from Elliott Aviation, bringing its total number of locations to 13.

However, the COVID-19 pandemic has significantly affected the aviation sector in this region due to various containment measures imposed by the governments such as travel restrictions, shutdowns of businesses, and lockdowns. With the economies reopening in this region and travel industry pacing up, the demand for private jets for traveling with enhanced safety is also upscaling. This is showcasing a rise in demand for fixed-based operator services, thereby boosting the fixed-based operator market. Also, key market players such as Signature Aviation, Jet Aviation (a subsidiary of General Dynamics Corporation), and Universal Aviation among others, operate in the region, which is a key driving factor for the North America fixed-based operator market.

North America Fixed-Base Operator Market Revenue and Forecast to 2028 (US$ Million)

North America Fixed-Base Operator Market Segmentation

The North America fixed-base operator market is segmented into services offered, application, and country.

Based on services offered, the North America fixed-base operator market is segmented into hangaring, fuelling, flight training, aircraft maintenance, aircraft rental. In 2022, the fuelling segment registered a largest share in the North America fixed-base operator market.

Based on application, the North America fixed-base operator market is bifurcated into Business aviation and leisure aviation. In 2022, the Business aviation segment registered a larger share in the North America fixed-base operator market.

Based on country, the North America fixed-base operator market is segmented into the US, Canada, and Mexico. In 2022, the US segment registered a largest share in the North America fixed-base operator market.

Abilene Aero; Atlantic Aviation FBO Inc.; Avemex SA De CV; DEER JET CO. LTD.; dnata Corporation; ExecuJet Aviation Group AG; General Dynamics Corporation; Jetex; Luxaviation; Signature Aviation; Swissport; and Universal Weather and Aviation, Inc. are the leading companies operating in the North America fixed-base operator market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America fixed-base operator market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America fixed-base operator market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the fixed-base operator market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Fixed-Base Operator Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threats to New Entrants

- 4.2.4 Threats to Substitute

- 4.2.5 Competitive Rivalry

- 4.3 Ecosystem Analysis

5. North America Fixed-Base Operator - Market Dynamics

- 5.1 Market Driver

- 5.1.1 Growth of Business Aviation Sector

- 5.1.2 Fuelling Services Contribute Significantly to FBO Service Business

- 5.2 Market Restraint

- 5.2.1 Staffing Shortages and High Operational Costs

- 5.3 Trends

- 5.3.1 Escalating Demand for Hangaring Services for Large Aircraft

- 5.4 Impact Analysis of Drivers and Restraints

6. Fixed-Base Operator Market - North America Market Analysis

- 6.1 North America Fixed-Base Operator Market Overview

- 6.2 North America Fixed-Base Operator Market Revenue Forecast and Analysis

7. North America Fixed-Base Operator Market Analysis - by Services Offered

- 7.1 Overview

- 7.2 North America Fixed-Base Operator Market, by Services Offered (2021 and 2028)

- 7.3 Hangaring

- 7.3.1 Overview

- 7.3.2 Hangaring: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 7.4 Fuelling

- 7.4.1 Overview

- 7.4.2 Fuelling: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 7.5 Flight Instructions

- 7.5.1 Overview

- 7.5.2 Flight Instructions: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 7.6 Aircraft Maintenance

- 7.6.1 Overview

- 7.6.2 Aircraft Maintenance: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 7.7 Aircraft Rental

- 7.7.1 Overview

- 7.7.2 Aircraft Rental: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

8. North America Fixed-Base Operator Market - by Application

- 8.1 Overview

- 8.2 North America Fixed-Base Operator Market, by Application (2021 and 2028)

- 8.3 Business Aviation

- 8.3.1 Overview

- 8.3.2 Business Aviation: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 8.4 Leisure Aviation

- 8.4.1 Overview

- 8.4.2 Leisure Aviation: North America Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

9. North America Fixed-Base Operator Market - Country Analysis

- 9.1 Overview

- 9.1.1 North America: Fixed-Base Operator Market - by Key Country

- 9.1.1.1 US: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 9.1.1.1.1 US: Fixed-Base Operator Market - by Services Offered

- 9.1.1.1.2 US: Fixed-Base Operator Market - by Application

- 9.1.1.2 Canada: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 9.1.1.2.1 Canada: Fixed-Base Operator Market - by Services Offered

- 9.1.1.2.2 Canada: Fixed-Base Operator Market - by Application

- 9.1.1.3 Mexico: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 9.1.1.3.1 Mexico: Fixed-Base Operator Market - by Services Offered

- 9.1.1.3.2 Mexico: Fixed-Base Operator Market - by Application

- 9.1.1.1 US: Fixed-Base Operator Market - Revenue and Forecast to 2028 (US$ Million)

- 9.1.1 North America: Fixed-Base Operator Market - by Key Country

10. Industry Landscape

- 10.1 Overview

- 10.2 Market Initiative

- 10.3 Merger and Acquisition

- 10.4 New Development

11. Company Profiles

- 11.1 Avemex SA De CV

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 DEER JET CO. LTD.

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 dnata Corporation

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 General Dynamics Corporation

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Jetex

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Luxaviation

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 Signature Aviation

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 Swissport

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Abilene Aero

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 Atlantic Aviation FBO Inc.

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments

- 11.11 ExecuJet Aviation Group AG

- 11.11.1 Key Facts

- 11.11.2 Business Description

- 11.11.3 Products and Services

- 11.11.4 Financial Overview

- 11.11.5 SWOT Analysis

- 11.11.6 Key Developments

- 11.12 Universal Weather and Aviation, Inc.

- 11.12.1 Key Facts

- 11.12.2 Business Description

- 11.12.3 Products and Services

- 11.12.4 Financial Overview

- 11.12.5 SWOT Analysis

- 11.12.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners

- 12.2 Word Index