|

|

市場調査レポート

商品コード

1226890

中東・アフリカのバタフライニードル市場の2028年までの予測- 地域別分析- 用途別、エンドユーザー別Middle East & Africa Butterfly Needles Market Forecast to 2028 - COVID-19 Impact and Regional Analysis - by Application and End User |

||||||

| 中東・アフリカのバタフライニードル市場の2028年までの予測- 地域別分析- 用途別、エンドユーザー別 |

|

出版日: 2023年02月13日

発行: The Insight Partners

ページ情報: 英文 106 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

中東・アフリカのバタフライニードル市場は、2022年の949万米ドルから2028年には1,462万米ドルに成長すると予測されています。2022年から2028年までのCAGRは7.5%で成長すると推定されています。

がん研究の増加が予測期間中の中東・アフリカのバタフライニードル市場の成長を後押しする

静脈内注射針は、がん治療のための化学療法を行うために使用されます。上腕または手の静脈に挿入されたバタフライニードルを通じて、薬が血流に直接投与されます。がんは主要な健康問題であり、増加の一途をたどっているため、さまざまな国の政府がこの問題に対処するための努力を行っています。がん研究は主に、がんのリスクが高い集団の研究、冷蔵を必要としない医薬品やワクチンの開発、生物試料を管理するバイオバンクの設立など、さまざまな機会に焦点を当てています。臨床研究を進めるには、製薬企業、調査機関、政府、ヘルスケア関係者が連携したマルチレベルのアプローチが必要です。このように、この地域では、がん患者の増加やがん関連の調査活動が活発化しており、予測期間中に中東・アフリカのバタフライニードル市場に有利な成長機会をもたらすと期待されます。

中東・アフリカのバタフライニードル市場の概要

中東・アフリカのバタフライニードル市場は、UAE、サウジアラビア、南アフリカ、その他中東・アフリカに区分されます。中東・アフリカでは、サウジアラビアが最大の市場シェアを占め、予測期間中は緩やかに発展すると予測されています。ヘルスケアサービスを向上させるため、公的機関や政府は同国でバタフライニードルの使用を強化するプログラムを開始しました。ここ数年、サウジアラビアのヘルスケアシステムにおいて、民間企業が重要な役割を果たすようになっています。サウジアラビア政府は、石油への依存度を下げ、ヘルスケアを含む他のセクターの多様化を図るため、「サウジ・ビジョン2030」プログラムを開始しました。国立がん研究所の友の会(AFNCI)は、2020年に150のキャンペーンを開催し、3,764の血液バッグを集めました。さらに、高齢者層における慢性疾患の有病率の上昇や、子どもたちの遺伝的な血液疾患が、バタフライ針の需要を高めています。Saudi Medical Journalによると、サウジアラビアは鎌状赤血球貧血やサラセミアなどのヘモグロビン異常症の有病率が最も高くなっています。また、B-サラセミアは検査対象者の1.8%(29,006人)の有病率であることが確認されており、2021年にはサウジアラビアの人々におけるヘモグロビン異常症の有病率が高くなることが確認されています。これらの針は、神経損傷を最小限に抑え、汎用性が高いという様々な利点があるため、広く使用されています。したがって、慢性疾患の有病率の上昇は、中東・アフリカのバタフライニードル市場の成長を牽引しています。

中東・アフリカのバタフライニードル市場の収益と2028年までの予測

中東・アフリカのバタフライニードル市場のセグメンテーション

中東・アフリカのバタフライニードル市場は、アプリケーション、エンドユーザー、国に基づいてセグメント化されています。

用途に基づき、中東・アフリカのバタフライニードル市場は、採血、静脈内補水、薬剤の送達、静脈穿刺、輸血に区分されます。2022年の中東・アフリカのバタフライニードル市場シェアは、採血セグメントが最大でした。

エンドユーザーに基づいて、中東・アフリカのバタフライニードル市場は、病院、クリニック、血液銀行、およびその他に分割されます。2022年の中東・アフリカのバタフライニードル市場は、病院セグメントが最大のシェアを占めています。

国に基づき、中東・アフリカのバタフライニードル市場は、UAE、サウジアラビア、南アフリカ、その他中東とアフリカに分類されました。地域別分析では、その他中東・アフリカが2022年に中東・アフリカのバタフライニードル市場を独占したと述べています。

B.Braun SE、Becton Dickinson and Co、Cardinal Health Inc、ICU Medical Inc、Medline Industries Inc、Nipro Corp、Terumo Corpが中東・アフリカのバタフライニードル市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 中東・アフリカのバタフライニードル市場-主要な要点

第3章 調査手法

- カバレッジ

- 2次調査

- 1次調査

第4章 中東・アフリカのバタフライニードル市場- 市場情勢

- 中東・アフリカのPEST分析

- 専門家の見解

第5章 中東・アフリカのバタフライニードル市場- 主要市場力学

- 市場促進要因

- 慢性疾患の増加

- 直針に対するバタフライニードルの優位性

- 市場抑制要因

- バタフライニードル別傷害に関連するリスク

- 市場機会

- がん研究の増加

- 今後の動向

- 主要プレーヤー別有機的・無機的な戦略の増加

- インパクト分析

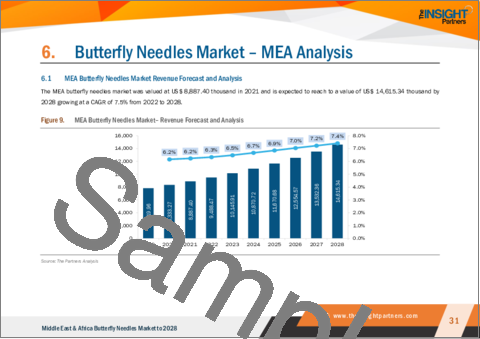

第6章 バタフライニードル市場- 中東・アフリカ分析

- 中東・アフリカのバタフライニードル市場収益と予測・分析

第7章 中東・アフリカのバタフライニードル市場分析- 用途別

- 中東・アフリカのバタフライニードル市場、用途別2021年・2028年(%)

- 血液採取

- 静脈内補水

- 薬物送達

- 静脈穿刺

- 血液の輸血

第8章 中東・アフリカのバタフライニードル市場の分析- エンドユーザー別

- 中東・アフリカのバタフライニードル市場、エンドユーザー別2021年・2028年売上高シェア(%)

- 病院

- 診療所

- 血液銀行

- その他

第9章 中東・アフリカのバタフライニードル市場- 国別分析

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- UAE

- 中東・アフリカの残りの地域

第10章 業界情勢

- 有機的開発

- 無機的展開

第11章 企業プロファイル

- B. Braun SE

- Becton Dickinson and Co

- Nipro Corp

- Cardinal Health Inc

- Medline Industries Inc

- Terumo Corp

- ICU Medical Inc

第12章 付録

List Of Tables

- Table 1. MEA Butterfly Needles Market, Revenue and Forecast, 2019-2028 (US$ Thousand)

- Table 2. South Africa Butterfly Needles Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 3. South Africa Butterfly Needles Market, by End User - Revenue and Forecast to 2028 (US$ Thousand)

- Table 4. Saudi Arabia Butterfly Needles Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 5. Saudi Arabia Butterfly Needles Market, by End User - Revenue and Forecast to 2028 (US$ Thousand)

- Table 6. UAE Butterfly Needles Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 7. UAE Butterfly Needles Market, by End User - Revenue and Forecast to 2028 (US$ Thousand)

- Table 8. Rest of MEA Butterfly Needles Market, by Application - Revenue and Forecast to 2028 (US$ Thousand)

- Table 9. Rest of MEA Butterfly Needles Market, by End User - Revenue and Forecast to 2028 (US$ Thousand)

- Table 10. Organic Developments

- Table 11. Inorganic Developments

- Table 12. Glossary of Terms

List Of Figures

- Figure 1. MEA Butterfly Needles Market Segmentation

- Figure 2. MEA Butterfly Needles Market, by Country

- Figure 3. MEA Butterfly Needles Market Overview

- Figure 4. MEA Butterfly Needles Market, By Application

- Figure 5. MEA Butterfly Needles Market, By Country

- Figure 6. MEA: PEST Analysis

- Figure 7. Experts' Opinion

- Figure 8. MEA Butterfly Needles Market: Impact Analysis of Drivers and Restraints

- Figure 9. MEA Butterfly Needles Market- Revenue Forecast and Analysis

- Figure 10. MEA Butterfly Needles Market, by Application 2021 & 2028 (%)

- Figure 11. Blood Collection: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 12. IV Rehydration: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 13. Delivery of Medications: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 14. Venipuncture: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 15. Blood Transfusion: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 16. MEA Butterfly Needles Market Revenue Share, by End User 2021 & 2028 (%)

- Figure 17. Hospitals: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 18. Clinics: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 19. Blood Banks: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 20. Others: MEA Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 21. MEA: Butterfly Needles Market, by Key Country - Revenue (2021) (US$ Thousand)

- Figure 22. South Africa: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 23. Saudi Arabia: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 24. UAE: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- Figure 25. Rest of MEA: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

The Middle East & Africa butterfly needles market is expected to grow from US$ 9.49 million in 2022 to US$ 14.62 million by 2028. It is estimated to record a CAGR of 7.5% from 2022 to 2028.

Increasing Cancer Research to Bolster Middle East & Africa Butterfly Needles Market Growth During Forecast Period

An intravenous (IV) needle is used to administer chemotherapy for cancer treatment. The medicine is administered directly into the bloodstream through a butterfly needle inserted into the upper arm or hand vein. Cancer is a major and increasing health problem, driving efforts of different national governments to address the problem. Cancer research primarily focuses on various opportunities, including studying populations that are at high risk of cancer, developing drugs and vaccines that do not require refrigeration, and establishing biobanks to manage biospecimens. A multi-level approach is required to advance clinical research, involving collaboration between the pharma industry, regulators, government, and healthcare professionals. Thus, increasing number of cancer cases and rising cancer-related research activities across the region are expected to provide lucrative Middle East & Africa butterfly needles market growth opportunities during the forecast period.

Middle East & Africa Butterfly Needles Market Overview

The Middle East & Africa butterfly needles market is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Saudi Arabia is expected to account for the largest market share and is expected to develop moderately in the Middle East & Africa during the forecast period. To improve healthcare services, public organizations and the government have initiated programs to enhance the use of butterfly needles in the country. In the last few years, the private sector has been playing an important role in the healthcare system in Saudi Arabia owing to the rising investments, which helps in the development of healthcare facilities and infrastructure in the country. The government of Saudi Arabia has launched the Saudi Vision 2030 program to reduce oil dependence and diversify other sectors, including healthcare. Association of friends of the National Cancer Institute (AFNCI) organized 150 campaigns and collected 3,764 blood bags in 2020. Furthermore, rising prevalence of chronic disorders among the elder population and genetic blood disorders among children has increased the demand for butterfly needles. As per the Saudi Medical Journal, Saudi Arabia has had the highest prevalence rate of hemoglobinopathies, including sickle cell anemia and thalassemia. Additionally, B-thalassemia was identified as having a prevalence of 1.8% (29,006 patients) among tested people, confirming a higher prevalence of hemoglobinopathies in the Saudi population in 2021. These needles are widely used owing of the various advantages offered by these needles make them versatile with minimal nerve injury. Therefore, the rising prevalence of chronic disorders is driving the growth of the Middle East & Africa butterfly needles market.

Middle East & Africa Butterfly Needles Market Revenue and Forecast to 2028 (US$ Million)

Middle East & Africa Butterfly Needles Market Segmentation

The Middle East & Africa butterfly needles market is segmented based on application, end user, and country.

Based on application, the Middle East & Africa butterfly needles market is segmented into blood collection, IV rehydration, delivery of medications, venipuncture, and blood transfusion. The blood collection segment held the largest Middle East & Africa butterfly needles market share in 2022.

Based on end user, the Middle East & Africa butterfly needles market is segmented into hospitals, clinics, blood banks, and others. The hospitals segment held the largest Middle East & Africa butterfly needles market share in 2022.

Based on country, the Middle East & Africa butterfly needles market has been categorized into the UAE, Saudi Arabia, South Africa, and the Rest of Middle East & Africa. Our regional analysis states that the Rest of Middle East & Africa dominated the Middle East & Africa butterfly needles market in 2022.

B. Braun SE, Becton Dickinson and Co, Cardinal Health Inc, ICU Medical Inc, Medline Industries Inc, Nipro Corp, and Terumo Corp are the leading companies operating in the Middle East & Africa butterfly needles market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa butterfly needles market.

- Highlights key business priorities to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa butterfly needles market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the butterfly needles market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Scope of the Study

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 MEA Butterfly Needles Market - by Application

- 1.3.2 MEA Butterfly Needles Market - by End User

- 1.3.3 MEA Butterfly Needles Market - by Country

2. MEA Butterfly Needles Market - Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. MEA Butterfly Needles Market - Market Landscape

- 4.1 Overview

- 4.2 MEA PEST Analysis

- 4.3 Expert's Opinion

5. MEA Butterfly Needles Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rise in Prevalence of Chronic Diseases

- 5.1.2 Advantages of Butterfly Needles over Straight Needles

- 5.2 Market Restraints

- 5.2.1 Risk Associated with Butterfly Needlestick Injuries

- 5.3 Market Opportunities

- 5.3.1 Increasing Cancer Research

- 5.4 Future Trends

- 5.4.1 Increasing Organic and Inorganic Strategies by Key Players

- 5.5 Impact Analysis

6. Butterfly Needles Market - MEA Analysis

- 6.1 MEA Butterfly Needles Market Revenue Forecast and Analysis

7. MEA Butterfly Needles Market Analysis - By Application

- 7.1 Overview

- 7.2 MEA Butterfly Needles Market, by Application 2021 & 2028 (%)

- 7.3 Blood Collection

- 7.3.1 Overview

- 7.3.2 Blood Collection: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.4 IV Rehydration

- 7.4.1 Overview

- 7.4.2 IV Rehydration: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.5 Delivery of Medications

- 7.5.1 Overview

- 7.5.2 Delivery of Medications: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.6 Venipuncture

- 7.6.1 Overview

- 7.6.2 Venipuncture: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 7.7 Blood Transfusion

- 7.7.1 Overview

- 7.7.2 Blood Transfusion: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

8. MEA Butterfly Needles Market Analysis - by End User

- 8.1 Overview

- 8.2 MEA Butterfly Needles Market Revenue Share, by End User 2021 & 2028 (%)

- 8.3 Hospitals

- 8.3.1 Overview

- 8.3.2 Hospitals: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.4 Clinics

- 8.4.1 Overview

- 8.4.2 Clinics: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.5 Blood Banks

- 8.5.1 Overview

- 8.5.2 Blood Banks: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

9. MEA Butterfly Needles Market - Country Analysis

- 9.1 Overview

- 9.1.1 MEA: Butterfly Needles Market, by Country, 2021 & 2028 (%)

- 9.1.1.1 South Africa: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.1.1 Overview

- 9.1.1.1.2 South Africa: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.1.3 South Africa: Butterfly Needles Market, by Application, 2019-2028 (US$ Thousand)

- 9.1.1.1.4 South Africa: Butterfly Needles Market, by End User, 2019-2028 (US$ Thousand)

- 9.1.1.2 Saudi Arabia: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.2.1 Saudi Arabia: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.2.2 Saudi Arabia: Butterfly Needles Market, by Application, 2019-2028 (US$ Thousand)

- 9.1.1.2.3 Saudi Arabia: Butterfly Needles Market, by End User, 2019-2028 (US$ Thousand)

- 9.1.1.3 UAE: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.3.1 UAE: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.3.2 UAE: Butterfly Needles Market, by Application, 2019-2028 (US$ Thousand)

- 9.1.1.3.3 UAE: Butterfly Needles Market, by End User, 2019-2028 (US$ Thousand)

- 9.1.1.4 Rest of MEA: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.4.1 Rest of MEA: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1.4.2 Rest of MEA: Butterfly Needles Market, by Application, 2019-2028 (US$ Thousand)

- 9.1.1.4.3 Rest of MEA: Butterfly Needles Market, by End User, 2019-2028 (US$ Thousand)

- 9.1.1.1 South Africa: Butterfly Needles Market - Revenue and Forecast to 2028 (US$ Thousand)

- 9.1.1 MEA: Butterfly Needles Market, by Country, 2021 & 2028 (%)

10. Industry Landscape

- 10.1 Overview

- 10.2 Organic Developments

- 10.2.1 Overview

- 10.3 Inorganic Developments

- 10.3.1 Overview

11. Company Profiles

- 11.1 B. Braun SE

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Becton Dickinson and Co

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Nipro Corp

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Cardinal Health Inc

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Medline Industries Inc

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Terumo Corp

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 ICU Medical Inc

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners

- 12.2 Glossary of Terms