|

|

市場調査レポート

商品コード

1226782

北米のECMO市場の2028年までの予測- 地域別分析- モダリティ、アプリケーション、年齢層別North America ECMO Market Forecast to 2028 - COVID-19 Impact and Regional Analysis - by Modality (Venoarterial ECMO, Venovenous ECMO, and Arteriovenous ECMO), Application (Respiratory and Cardiology), and Age Group (Adults, Pediatrics, and Neonates) |

||||||

| 北米のECMO市場の2028年までの予測- 地域別分析- モダリティ、アプリケーション、年齢層別 |

|

出版日: 2023年01月24日

発行: The Insight Partners

ページ情報: 英文 115 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

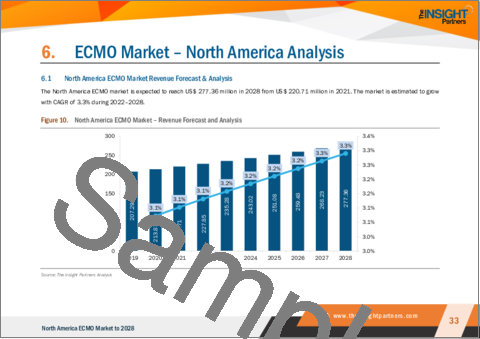

北米のECMO市場は、2022年の2億2,785万米ドルから2028年には2億7,736万米ドルに成長すると予測されています。2022年から2028年までのCAGRは3.3%を記録すると推定されています。

製品開拓と承認の急増が今後の北米のECMO市場の成長を促進する

医療技術の進歩やイノベーション、メーカーによる研究開発投資の増加により、ECMOをはじめとするさまざまな医療機器が発売されています。市場関係者は様々な製品開発活動に取り組んでいます。2020年10月、FDAはAbiomedのECMOシステム「Abiomed Breethe OXY-1 System」に510(k)クリアランスを与えました。COVID-19や心原性ショックを患っている患者の治療に使用することができます。このシステムは、肺が十分な末端臓器酸素化を提供できない患者に心肺バイパスサポートを提供します。同様に、2020年4月、Getingeは米国でECMO療法に使用されるデバイスの利用可能期間の一時的な拡張を受けた。この延長により、CardiohelpおよびHLS Advanced Setは、呼吸/心肺をサポートするCOVID-19患者に対して6時間以上使用することができます。さらに、2020年2月、FDAは、急性呼吸不全および心肺不全の治療に使用される心肺補助装置であるNovalungを承認しました。Novalungは、体外生命維持装置として6時間以上の使用が許可された最初の体外膜酸素化システムです。ECMO市場における多くの製品承認と開発により、ヘルスケア専門家がより良いサービスを提供できるようになっています。これらの開発により、システムメーカーは、心不全や呼吸不全の状態に苦しむ患者を効率的に治療できる技術的に高度なシステムに対する需要の高まりに応えることができます。このように、ECMO製品の開発および承認の拡大は、予測期間中、北米のECMO市場の成長を促進すると予想されます。

北米のECMO市場の概要

北米は、ECMOの最大市場です。米国、カナダ、メキシコがこの地域市場の主な貢献者です。2022年の北米のECMO市場は米国が支配しました。米国メディケア&メディケイドサービスセンターによると、米国の国民医療費は2019年に9.7%増加し、2020年には4兆1,000億米ドルに達します。さらに、国民医療費は2019年から2028年にかけて年率5.4%で増加し、2028年には6兆2,000億米ドルに達すると予測されています。ヘルスケア支出の増加は、患者ケアのための様々な機器の採用を増加させると推定され、予測期間中、同国におけるECMOの需要を促進すると思われます。米国における心血管疾患の有病率は非常に高く、人口の50%以上がさまざまなタイプの心血管疾患に苦しんでいます。米国疾病管理予防センター(CDC)によると、毎年60万人以上が心血管疾患により死亡しており、これはほぼ4人に1人の死亡を占めています。心血管疾患の主な原因は、高血圧症、肥満、糖尿病です。米国心臓協会によると、2019年1月、2035年までに1億3000万人以上、45.1%の人々が何らかの形で心血管疾患にかかる可能性があると報告されました。したがって、心血管疾患の有病率の増加は、今後数年間、ECMOの需要を促進すると予想されます。

北米のECMO市場の収益と2028年までの予測(金額)

北米のECMO市場のセグメント化

北米のECMO市場は、モダリティ、アプリケーション、年齢層、国によってセグメント化されています。

モダリティに基づき、北米のECMO市場は静脈動脈性ECMO、静脈性ECMO、動静脈性ECMOに区分されます。2022年には、静脈動脈ECMOセグメントが最大の市場シェアを占めています。

アプリケーションに基づき、北米のECMO市場は呼吸器と心臓病学に二分されます。2022年には呼吸器分野がより大きな市場シェアを占めました。

年齢層に基づき、北米のECMO市場は成人、小児科、新生児に区分されます。2022年には成人セグメントが最も大きな市場シェアを占めました。

国に基づき、北米のECMO市場は米国、カナダ、メキシコに区分されます。2022年には米国が市場を独占しました。

ABIOMED Inc、Braile Biomedica、Eurosets S.R.L.、Fresenius Medical Care AG &Co KGaA、Getinge AB、LivaNova Plc、Medtronic Plc、MicroPort Scientific Corporation、Nipro Medical Corporation、およびTerumo Groupは、北米のECMO市場で事業展開している主要企業の1つです。

目次

第1章 イントロダクション

第2章 重要なポイント

第3章 調査手法

- カバレッジ

- 2次調査

- 1次調査

第4章 北米のECMO市場-市場情勢

- 北米のPEST分析

- 専門家の見解

第5章 北米のECMO市場-主要市場力学

- 市場促進要因

- 心血管疾患と呼吸不全の有病率の上昇

- 肺移植手術におけるECMOの採用拡大

- 市場抑制要因

- ECMOに関連する合併症

- 市場機会

- ECMO別生存率の向上

- 今後の動向

- 製品開発および承認の急増

- 影響分析

第6章 ECMO市場-北米の分析

- 北米のECMO市場収益と予測・分析

第7章 北米のECMO市場の分析:モダリティ別

- 北米のECMO市場:モダリティ別シェア 2021年・2028年(%)

- 静脈ECMO

- 動静脈ECMO

- 動静脈ECMO

第8章 北米のECMO市場の分析:アプリケーション別

- 北米のECMO市場:アプリケーション別2021年・2028年(%)

- 心臓病学

- 呼吸器

第9章 北米のECMO市場の分析:年齢層別

- 北米のECMO市場:年齢層別2021年・2028年(%)

- 新生児

- 小児

- 成人

第10章 北米のECMO市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 業界情勢

- 無機的成長戦略

- 有機的な成長戦略

第12章 企業プロファイル

- Terumo Group

- Medtronic Plc

- MicroPort Scientific Corporation

- LivaNova Plc

- Nipro Medical Corporation

- Eurosets S.R.L.

- Getinge AB

- Braile Biomedica

- Fresenius Medical Care AG & Co KGaA

- ABIOMED Inc

第13章 付録

List Of Tables

- Table 1. North America ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- Table 2. US ECMO Market, by Modality - Revenue and Forecast to 2028 (US$ Million)

- Table 3. US ECMO Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 4. US ECMO Market, by Age Group- Revenue and Forecast to 2028 (US$ Million)

- Table 5. Canada ECMO Market, by Modality - Revenue and Forecast to 2028 (US$ Million)

- Table 6. Canada ECMO Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 7. Canada ECMO Market, by Age Group- Revenue and Forecast to 2028 (US$ Million)

- Table 8. Mexico ECMO Market, by Modality - Revenue and Forecast to 2028 (US$ Million)

- Table 9. Mexico ECMO Market, by Application- Revenue and Forecast to 2028 (US$ Million)

- Table 10. Mexico ECMO Market, by Age Group- Revenue and Forecast to 2028 (US$ Million)

- Table 11. Recent Inorganic Growth Strategies

- Table 12. Recent Organic Growth Strategies

- Table 13. Glossary of Terms

List Of Figures

- Figure 1. North America ECMO Market Segmentation

- Figure 2. North America ECMO Market, By Country

- Figure 3. North America ECMO Market Overview

- Figure 4. North America ECMO Market, By Modality

- Figure 5. North America ECMO Market, By Country

- Figure 7. North America: PEST Analysis

- Figure 8. Experts Opinion

- Figure 9. Impact Analysis: North America ECMO Market

- Figure 10. North America ECMO Market - Revenue Forecast and Analysis

- Figure 11. North America ECMO Market Share by Modality 2021 & 2028 (%)

- Figure 12. Venoarterial ECMO: North America ECMO Market Revenue and Forecast To 2028 (US$ Million)

- Figure 13. Venovenous ECMO: North America ECMO Market Revenue and Forecast To 2028 (US$ Million)

- Figure 14. Arteriovenous ECMO: North America ECMO Market Revenue and Forecast To 2028 (US$ Million)

- Figure 15. North America ECMO Market, by Application 2021 & 2028 (%)

- Figure 16. Cardiology : North America ECMO Market Revenue and Forecasts to 2028 (US$ Mn)

- Figure 17. Respiratory : North America ECMO Market Revenue and Forecasts To 2028 (US$ MN)

- Figure 18. North America ECMO Market, by Age Group 2021 & 2028 (%)

- Figure 19. Neonates : North America ECMO Market Revenue and Forecasts to 2028 (US$ Mn)

- Figure 20. Pediatrics : North America ECMO Market Revenue and Forecasts to 2028 (US$ Mn)

- Figure 21. Adults : North America ECMO Market Revenue and Forecasts to 2028 (US$ Mn)

- Figure 22. North America: ECMO Market, by Key Country - Revenue (2021) (US$ Million)

- Figure 23. North America: ECMO Market, by Country, 2021 & 2028 (%)

- Figure 24. US: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 25. Canada: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 26. Mexico: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

The North America ECMO market is expected to grow from US$ 227.85 million in 2022 to US$ 277.36 million by 2028. It is estimated to record a CAGR of 3.3% from 2022 to 2028.

Surging Product Developments and Approvals to Drive North America ECMO Market Growth in Future

Advancements in medical technology and innovations and an increase in investments in R&D by manufacturers have resulted in the launch of various medical devices, including ECMO. Market players are involved in various product development activities. In October 2020, FDA granted 510(k) clearance to Abiomed's ECMO system called Abiomed Breethe OXY-1 System. It can be used for treating patients suffering from COVID-19 and cardiogenic shock. The system provides cardiopulmonary bypass support for patients whose lungs cannot provide sufficient end organ oxygenation. Similarly, in April 2020, Getinge received a temporary expansion of the availability of devices used for ECMO therapy in the US. As per this extension, Cardiohelp and HLS Advanced Sets can be used for >6 hours for COVID-19 patients with respiratory/cardiopulmonary support. Further, in February 2020, FDA cleared Novalung, a heart and lung support system used to treat acute respiratory and cardiopulmonary failure. Novalung is the first extracorporeal membrane oxygenation system to be cleared for more than six hours of use as extracorporeal life support. Many product approvals and developments in the ECMO market are enabling healthcare professionals to provide improved services. These developments help system manufacturers meet the rising demand for technically advanced systems that can efficiently treat patients suffering from cardiac and respiratory failure conditions. Thus, growing product development and approvals of ECMO products are expected to drive the growth of the North America ECMO market during the forecast period.

North America ECMO Market Overview

The North America is the largest market for ECMO. The US, Canada, and Mexico are main contributors to the regional market. The US dominated the North America ECMO market in 2022. According to the US Centers for Medicare & Medicaid Services, the national healthcare expenditure in the US increased by 9.7% in 2019 to reach US$ 4.1 trillion in 2020. Furthermore, national health spending is expected to grow at a 5.4% annual rate from 2019 to 2028, and it is expected to reach US$ 6.2 trillion by 2028. The rising healthcare expenditure is estimated to increase the adoption of various equipment for patient care, which would fuel the demand for ECMO in the country during the forecast period. The prevalence of cardiovascular diseases in the US is much higher, as more than 50% population is suffering from different types of cardiovascular disease. According to the Centers for Disease Control and Prevention (CDC), every year, more than 0.6 million people die due to cardiovascular disease; this nearly accounts for one in every four deaths. The primary cause of cardiovascular disease among people is hypertension, obesity, and diabetes. According to the American Heart Association, in January 2019, it was reported that over 130 million or 45.1% of people are likely to have some form of cardiovascular disease by 2035. Thus, the growing prevalence of cardiovascular diseases is expected to propel the demand for ECMO in the coming years.

North America ECMO Market Revenue and Forecast to 2028 (US$ Million)

North America ECMO Market Segmentation

The North America ECMO market is segmented on the basis of modality, application, age group, and country.

Based on modality, the North America ECMO market is segmented into venoarterial ECMO, venovenous ECMO, and arteriovenous ECMO. The venoarterial ECMO segment held the largest market share in 2022.

Based on application, the North America ECMO market is bifurcated into respiratory and cardiology. The respiratory segment held a larger market share in 2022.

Based on age group, the North America ECMO market is segmented into adults, pediatrics, and neonates. The adults segment held the largest market share in 2022.

Based on country, the North America ECMO market is segmented into the US, Canada, and Mexico. The US dominated the market in 2022.

ABIOMED Inc, Braile Biomedica, Eurosets S.R.L., Fresenius Medical Care AG & Co KGaA, Getinge AB, LivaNova Plc, Medtronic Plc, MicroPort Scientific Corporation, Nipro Medical Corporation, and Terumo Group are among the leading companies operating in the North America ECMO market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America ECMO market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America ECMO market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the ECMO market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Scope of the Study

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 North America ECMO Market - By Modality

- 1.3.2 North America ECMO Market - By Application

- 1.3.3 North America ECMO Market - By Age Group

- 1.3.4 North America ECMO Market - By Country

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America ECMO Market - Market Landscape

- 4.1 Overview

- 4.2 North America PEST Analysis

- 4.3 Experts Opinion

5. North America ECMO Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Prevalence of Cardiovascular Diseases and Respiratory Failures

- 5.1.2 Growing Adoption of ECMO in Lung Transplantation Procedures

- 5.2 Market Restraints

- 5.2.1 Complications Associated with ECMO

- 5.3 Market Opportunities

- 5.3.1 Increasing Survival Rates with ECMO

- 5.4 Future Trends

- 5.4.1 Surging Product Developments and Approvals

- 5.5 Impact Analysis

6. ECMO Market - North America Analysis

- 6.1 North America ECMO Market Revenue Forecast & Analysis

7. North America ECMO Market Analysis - By Modality

- 7.1 Overview

- 7.2 North America ECMO Market Share by Modality 2021 & 2028 (%)

- 7.3 Venoarterial ECMO

- 7.3.1 Overview

- 7.3.2 Venoarterial ECMO: ECMO Market Revenue and Forecast to 2028 (US$ Million)

- 7.4 Venovenous ECMO

- 7.4.1 Overview

- 7.4.2 Venovenous ECMO: ECMO Market Revenue and Forecast to 2028 (US$ Million)

- 7.5 Arteriovenous ECMO

- 7.5.1 Overview

- 7.5.2 Arteriovenous ECMO: ECMO Market Revenue and Forecast to 2028 (US$ Million)

8. North America ECMO Market Analysis - By Application

- 8.1 Overview

- 8.2 North America ECMO Market, By Application 2021 & 2028 (%)

- 8.3 Cardiology

- 8.3.1 Overview

- 8.3.2 Cardiology Market Revenue and Forecast to 2028 (US$ Mn)

- 8.4 Respiratory

- 8.4.1 Overview

- 8.4.2 Respiratory Market Revenue and Forecast to 2028 (US$ Mn)

9. North America ECMO Market Analysis - By Age Group

- 9.1 Overview

- 9.2 North America ECMO Market, By Age Group 2021 & 2028 (%)

- 9.3 Neonates

- 9.3.1 Overview

- 9.3.2 Neonates Market Revenue and Forecast to 2028 (US$ Mn)

- 9.4 Pediatrics

- 9.4.1 Overview

- 9.4.2 Pediatrics Market Revenue and Forecast to 2028 (US$ Mn)

- 9.5 Adults

- 9.5.1 Overview

- 9.5.2 Adults Market Revenue and Forecast to 2028 (US$ Mn)

10. North America ECMO Market - Country Analysis

- 10.1 Overview

- 10.1.2 North America: ECMO Market, by Country, 2021 & 2028 (%)

- 10.1.2.1 US: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.1.1 Overview

- 10.1.2.1.2 US: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.1.3 US: ECMO Market, by Modality, 2020-2028 (US$ Million)

- 10.1.2.1.4 US: ECMO Market, by Application, 2020-2028 (US$ Million)

- 10.1.2.1.5 US: ECMO Market, by Age Group, 2020-2028 (US$ Million)

- 10.1.2.2 Canada: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.2.1 Overview

- 10.1.2.2.2 Canada: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.2.3 Canada: ECMO Market, by Modality, 2020-2028 (US$ Million)

- 10.1.2.2.4 Canada: ECMO Market, by Application, 2020-2028 (US$ Million)

- 10.1.2.2.5 Canada: ECMO Market, by Age Group, 2020-2028 (US$ Million)

- 10.1.2.3 Mexico: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.3.1 Overview

- 10.1.2.3.2 Mexico: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2.3.3 Mexico: ECMO Market, by Modality, 2020-2028 (US$ Million)

- 10.1.2.3.4 Mexico: ECMO Market, by Application, 2020-2028 (US$ Million)

- 10.1.2.3.5 Mexico: ECMO Market, by Age Group, 2020-2028 (US$ Million)

- 10.1.2.1 US: ECMO Market - Revenue and Forecast to 2028 (US$ Million)

- 10.1.2 North America: ECMO Market, by Country, 2021 & 2028 (%)

11. Industry Landscape

- 11.1 Overview

- 11.2 Inorganic Growth Strategies

- 11.2.1 Overview

- 11.3 Organic Growth Strategies

- 11.3.1 Overview

12. Company Profiles

- 12.1 Terumo Group

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Medtronic Plc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 MicroPort Scientific Corporation

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 LivaNova Plc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Nipro Medical Corporation

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Eurosets S.R.L.

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Getinge AB

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Braile Biomedica

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Fresenius Medical Care AG & Co KGaA

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 ABIOMED Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms