|

|

市場調査レポート

商品コード

1206513

中東・アフリカの統合エンドポイント管理市場の2028年までの予測- 地域別分析- コンポーネント別、展開タイプ別、プラットフォーム別、組織規模別、エンドユーザー別Middle East & Africa Unified Endpoint Management Market Forecast to 2028 - COVID-19 Impact and Regional Analysis- by Component, Deployment Type, Platform, Organization Size, and End-User |

||||||

| 中東・アフリカの統合エンドポイント管理市場の2028年までの予測- 地域別分析- コンポーネント別、展開タイプ別、プラットフォーム別、組織規模別、エンドユーザー別 |

|

出版日: 2023年01月19日

発行: The Insight Partners

ページ情報: 英文 150 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

中東・アフリカの統合エンドポイント管理市場は、2022年の2億7,061万米ドルから2028年には11億7,031万米ドルに成長すると予測されています。2022年から2028年までのCAGRは27.6%と推定されています。

中小規模企業(SME)セクターの高い成長性が中東・アフリカの統合エンドポイント管理市場を牽引する

大企業顧客は、さまざまな地域で統合エンドポイント管理市場を独占しています。複雑で大規模な業務、膨大な数のエンドポイントデバイス、リモートワークの動向、先進的なソリューションの迅速な導入などが、この地域の大企業における統合エンドポイント管理ソリューションおよびサービスの需要を促進する主な理由となっています。また、大企業は、業務の改善やプロセスセキュリティの強化を目的としたデジタル変革の最前線にも立っています。しかし、中小企業は、従来のエンドポイント管理ソリューションに代わって、統合エンドポイント管理などの先進技術ソリューションを採用する成長段階にあります。統合エンドポイント管理ソリューションがもたらす潜在的なコストや生産性の向上に関するリソースや意識の不足が、中小企業における採用に一定の影響を与えています。しかし、クラウドベースの統合エンドポイント管理の普及に伴い、中小企業はこうしたソリューションへの投資を増やしており、中東・アフリカの統合エンドポイント管理市場で活動する市場関係者に大きな成長機会を提供しています。シトリックス・システムズ、ヴイエムウェア、マイクロソフトなどの主要企業は、中小企業向けにクラウドベースのUEMソリューション/サブスクリプションを競争力のある価格で提供し、その収益と市場シェアを拡大しています。さらに、ビジネスプロセスの改善、生産性の向上、コスト削減を目的としたデジタル変革の動向は、中小企業における統合エンドポイント管理ソリューションおよびサービスの採用を後押しし、2022年から2028年の予測期間中、市場関係者に潜在的な成長機会を提供するものと思われます。このような取り組みが、予測期間中の中東・アフリカの統合エンドポイント管理市場の成長を促進すると考えられます。

中東・アフリカの統合エンドポイント管理市場の概要

中東・アフリカの統合エンドポイント管理市場は、南アフリカ、サウジアラビア、UAE、その他中東とアフリカに区分されます。湾岸諸国は経済的に進んでいるが、アフリカ諸国はまだ経済状況のバランスを取る必要があります。湾岸諸国協議会(GCC)は、協力の促進、技術革新の強化、複合一貫輸送の合理化、国家経済の改善など、さまざまな戦略を計画しています。EUが導入したGDPRは、この地域の企業、主に中小企業にとって問題を引き起こしています。政府当局は、石油・ガス生産に加え、雇用の促進やGDPの多様化を目的とした経済成長プログラムを推進する方向にあります。民間企業が成長するにつれ、中小企業は連邦政府の規制遵守のためのコストに大きな打撃を受けることになります。中東では、サイバーリスクを回避するために、企業がGDPRの規則を遵守することが義務付けられています。マイクロソフトの中東・アフリカの企業対外・法務担当のアシスタント・ジェネラル・カウンセルによると、企業が個人情報をどのように収集、保管、使用するかについてのGDPRの要件は160近くあり、個人情報漏洩の72時間以内の通知を義務付けています。中東・アフリカにおけるGDPR対応の実施は、データセキュリティを確保するための統合エンドポイント管理の活用に影響を与えると予測されます。Boldon James、Titus、および数社の企業が統合エンドポイント管理ツールを導入しています。2019年7月、Spire solutionsはTitusの販売代理店となり、同地域のデータ保護と統合エンドポイント管理の要件に対応します。同様に、2017年7月には、セキュリティ専門のVAD(Value-Added-Distributor)であるStarLinkが、Boldon Jamesと提携しました。この提携により、中東での販売を拡大しました。こうした取り組みが、予測期間中の中東・アフリカの統合エンドポイント管理市場の成長を促進すると思われます。BFSI、エネルギー、ヘルスケア、政府など、さまざまな業界別では、膨大な量の機密・秘密データを保有しているため、エンドポイント管理の導入が進んでいます。さらに、中東・アフリカでは、BYOD(Bring Your Own Device)やWFH(Work from Home)シナリオがCOVID-19の流行時に普及しているため、ネットワークセキュリティ産業が拡大しています。Aruba Networksのレポートによると、2021年には中東の組織の69%が何らかの形でBYODを採用しています。同様に、この地域のネットワークセキュリティ事業は、運用技術(OT)および監視制御・データ収集(SCADA)上のITセキュリティインフラを確立することが複雑化しているため、実装の難しさを目の当たりにします。中東の企業ネットワークは、COVID-19パンデミックの影響によるリモートワークの拡大によっても脅かされています。組織は、この状況にうまく対処するために、対策を講じ、セキュリティ業者と協力しています。したがって、この地域全体で拡大するBYODの習慣は、予測期間中、中東・アフリカの統合エンドポイント管理市場に有利な機会を生み出すと予想されます。

中東・アフリカの統合エンドポイント管理市場の収益と2028年までの予測

中東・アフリカの統合エンドポイント管理市場のセグメンテーション

中東・アフリカの統合エンドポイント管理市場は、コンポーネント、展開タイプ、プラットフォーム、組織規模、エンドユーザー、国ごとに区分されます。

コンポーネントに基づき、中東・アフリカの統合エンドポイント管理市場は、ソリューションとサービスに区分されます。2022年の市場シェアは、ソリューションセグメントがより大きなシェアを占めています。

展開タイプに基づき、中東・アフリカの統合エンドポイント管理市場は、クラウドベースとオンプレミスに区分されます。2022年にはクラウドベースセグメントがより大きな市場シェアを占めています。

プラットフォームに基づき、中東・アフリカの統合エンドポイント管理市場は、デスクトップとモバイルに区分されます。2022年の市場シェアは、デスクトップ型が圧倒的に多いです。

組織規模に基づき、中東・アフリカの統合エンドポイント管理市場は、中小企業と大企業に区分されます。2022年は大企業セグメントが市場シェアを独占しました。

エンドユーザーに基づき、中東・アフリカの統合エンドポイント管理市場は、BFSI、政府・防衛、ヘルスケア、IT・テレコム、自動車・輸送、小売、製造、その他に区分されます。2022年はIT・テレコム分野が市場シェアを独占しました。

国別に見ると、中東・アフリカの統合エンドポイント管理市場は、南アフリカ、サウジアラビア、UAE、その他中東・アフリカに区分されます。2022年の市場シェアはサウジアラビアセグメントが独占しています。

Citrix Systems, Inc.、IBM Corporation、Ivanti、MICROLAND LIMITED、Microsoft Corporation、STEFANINI、およびZoho Corporation Pvt. Ltd.は、中東・アフリカの統合エンドポイント管理市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 重要なポイント

第3章 調査手法

- カバレッジ

- 2次調査

- 1次調査

第4章 中東・アフリカの統合エンドポイント管理市場の展望

- 市場概要

- PEST分析

- 中東・アフリカ地域の

- エコシステム分析

- エキスパートオピニオン

第5章 中東・アフリカの統合エンドポイント管理市場力学

- 市場促進要因

- 各業界における単一エンドポイント管理ソリューションへの需要の高まり

- 組織全体におけるエンドポイント数の大幅な増加

- データ保護ルールの標準化

- 市場抑制要因

- 統合エンドポイント管理ソリューションの利点に関する認識不足と代替手段の利用可能性

- クラウドベースのセキュリティソリューションの導入に関する懸念

- 市場参入の可能性

- 中小企業(SME)分野における高い成長の可能性

- データ量の増加、BYOD(Bring Your Own Device)およびCYOD(Choose Your Own Device)動向の上昇

- 今後の動向

- 企業におけるクラウドベースのソリューションの導入の増加

- 人工知能(AI)の導入とマルチクラウド戦略

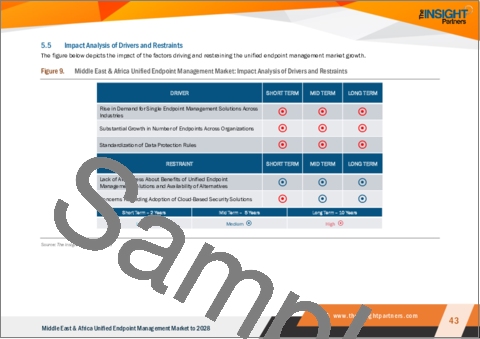

- 促進要因と抑制要因の影響分析

第6章 中東・アフリカの統合エンドポイント管理市場- 市場分析

- 中東・アフリカの統合エンドポイント管理市場の概要

第7章 中東・アフリカの統合エンドポイント管理市場分析- コンポーネント別

- 中東・アフリカの統合エンドポイント管理市場:コンポーネント別(2021年、2028年)

- ソリューション

- サービス

第8章 中東・アフリカの統合エンドポイント管理市場の分析- 展開タイプ別

- 中東・アフリカの統合エンドポイント管理市場:展開タイプ別(2021年、2028年)

- クラウドベース

- オンプレミス型

第9章 中東・アフリカの統合エンドポイント管理の市場分析- プラットフォーム別

- 中東・アフリカの統合エンドポイント管理市場:プラットフォーム別(2021年、2028年)

- デスクトップ

- モバイル

第10章 中東・アフリカの統合エンドポイント管理の市場分析- 組織規模別

- 中東・アフリカの統合エンドポイント管理市場内訳:組織規模別(2021年、2028年

- 中小企業

- 大企業

第11章 中東・アフリカの統合エンドポイント管理市場の分析- エンドユーザー別

- 中東・アフリカの統合エンドポイント管理市場:エンドユーザー別(2021年、2028年)

- BFSI

- 政府・防衛

- ヘルスケア

- IT・通信

- 自動車・運輸

- 小売業

- 製造業

- その他

第12章 中東・アフリカの統合エンドポイント管理市場- 国別分析

- 中東・アフリカ

- 南アフリカ共和国

- サウジアラビア

- アラブ首長国連邦

- 中東・アフリカのその他の地域

第13章 業界情勢

- 市場の取り組み

- 新製品開発

- 合併・買収

第14章 企業プロファイル

- Ivanti

- Citrix Systems, Inc.

- IBM Corporation

- Microsoft Corporation

- Zoho Corporation Pvt. Ltd.

- MICROLAND LIMITED

- STEFANINI

第15章 付録

List Of Tables

- Table 1. Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Table 2. Middle East & Africa Unified Endpoint Management Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 3. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, By Deployment Type (2021 and 2028)

- Table 4. MEA: Middle East & Africa Unified Endpoint Management Market, by Platform- Revenue and Forecast to 2028 (US$ Million)

- Table 5. MEA: Middle East & Africa Unified Endpoint Management Market, by Organization Size- Revenue and Forecast to 2028 (US$ Million)

- Table 6. MEA: Middle East & Africa Unified Endpoint Management Market, by End User- Revenue and Forecast to 2028 (US$ Million)

- Table 7. Middle East & Africa Unified Endpoint Management Market, by Country - Revenue and Forecast to 2028 (USD Million)

- Table 8. South Africa: Middle East & Africa Unified Endpoint Management Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 9. South Africa: Middle East & Africa Unified Endpoint Management Market, By Deployment Type - Revenue and Forecast to 2028 (US$ Million)

- Table 10. South Africa: Middle East & Africa Unified Endpoint Management Market, By Platform -Revenue and Forecast to 2028 (US$ Million)

- Table 11. South Africa: Middle East & Africa Unified Endpoint Management Market, by Organization Size - Revenue and Forecast to 2028 (US$ Million)

- Table 12. South Africa: Middle East & Africa Unified Endpoint Management Market, by End User - Revenue and Forecast to 2028 (US$ Million)

- Table 13. Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, by Component- Revenue and Forecast to 2028 (US$ Million)

- Table 14. Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, By Deployment Type - Revenue and Forecast to 2028 (US$ Million)

- Table 15. Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, By Platform -Revenue and Forecast to 2028 (US$ Million)

- Table 16. Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, by Organization Size - Revenue and Forecast to 2028 (US$ Million)

- Table 17. Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, by End User - Revenue and Forecast to 2028 (US$ Million)

- Table 18. UAE: Middle East & Africa Unified Endpoint Management Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 19. UAE: Middle East & Africa Unified Endpoint Management Market, By Deployment Type - Revenue and Forecast to 2028 (US$ Million)

- Table 20. UAE: Middle East & Africa Unified Endpoint Management Market, By Platform -Revenue and Forecast to 2028 (US$ Million)

- Table 21. UAE: Middle East & Africa Unified Endpoint Management Market, by Organization Size- Revenue and Forecast to 2028 (US$ Million)

- Table 22. UAE: Middle East & Africa Unified Endpoint Management Market, by End User - Revenue and Forecast to 2028 (US$ Million)

- Table 23. Rest of MEA: Middle East & Africa Unified Endpoint Management Market, by Component - Revenue and Forecast to 2028 (US$ Million)

- Table 24. Rest of MEA: Middle East & Africa Unified Endpoint Management Market, By Deployment Type - Revenue and Forecast to 2028 (US$ Million)

- Table 25. Rest of MEA: Middle East & Africa Unified Endpoint Management Market, By Platform -Revenue and Forecast to 2028 (US$ Million)

- Table 26. Rest of MEA: Middle East & Africa Unified Endpoint Management Market, by Organization Size - Revenue and Forecast to 2028 (US$ Million)

- Table 27. Rest of MEA: Middle East & Africa Unified Endpoint Management Market, by End User- Revenue and Forecast to 2028 (US$ Million)

- Table 28. List of Abbreviation

List Of Figures

- Figure 1. Middle East & Africa Unified Endpoint Management Market Segmentation

- Figure 2. Middle East & Africa Unified Endpoint Management Market Segmentation - By Country

- Figure 3. Middle East & Africa Unified Endpoint Management Market Overview

- Figure 4. Solutions Segment held the Largest Share of Middle East & Africa Unified Endpoint Management Market

- Figure 5. UAE to Show Great Traction During Forecast Period

- Figure 6. Middle East & Africa - PEST Analysis

- Figure 7. Middle East & Africa Unified Endpoint Management Market- Ecosystem Analysis

- Figure 8. Expert Opinion

- Figure 9. Middle East & Africa Unified Endpoint Management Market: Impact Analysis of Drivers and Restraints

- Figure 10. Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 11. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, by Component (2021 and 2028)

- Figure 12. Solutions: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 13. Services: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 14. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, By Deployment Type (2021 and 2028)

- Figure 15. Cloud Based: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 16. On-Premise: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 17. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, by Platform (2021 and 2028)

- Figure 18. Desktop: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 19. Mobile: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 20. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, by Organization Size (2021 and 2028)

- Figure 21. SMEs: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028(US$ Million)

- Figure 22. Large Enterprises: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028(US$ Million)

- Figure 23. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, by End User (2021 and 2028)

- Figure 24. BFSI: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 25. Government and Defense: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 26. Healthcare: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 27. IT and Telecom: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 28. Automotive and Transportation: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 29. Retail: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 30. Manufacturing: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 31. Others: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 32. MEA: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 33. MEA: Middle East & Africa Unified Endpoint Management Market Revenue Share, by Key Country (2021 and 2028)

- Figure 34. South Africa: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 35. Saudi Arabia: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 36. UAE: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 37. Rest of MEA: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

The Middle East & Africa unified endpoint management market is expected to grow from US$ 270.61 million in 2022 to US$ 1,170.31 million by 2028. It is estimated to grow at a CAGR of 27.6% from 2022 to 2028.

High Growth Potential in Small and Medium-Sized Enterprise (SME) Sector would drive the Middle East & Africa Unified Endpoint Management Market

Large enterprise customers dominate the unified endpoint management market across various geographies. The complex, large-scale operations, huge number of endpoint devices, prevailing trend of remote work, and fast adoption of advanced solutions are some of the key reasons driving the demand for unified endpoint management solutions and services across large enterprises regionally. In addition, large enterprises are also at the forefront of digital transformation to improve operations and enhance process security. However, small, and medium-sized enterprises (SMEs) are still in the growth stage of adopting advanced technology solutions such as unified endpoint management by replacing traditional endpoint management solutions. The lack of resources and awareness about the potential cost and productivity benefits of unified endpoint management solutions have impacted the adoption to some extent among SMEs. However, with the growing popularity of cloud-based unified endpoint management, SMEs are increasingly investing in such solutions, thus, offering a huge growth opportunity for the market players operating in the Middle East & Africa unified endpoint management market . Key companies such as Citrix Systems, Inc.; VMware, Inc.; and Microsoft Corporation are offering cloud-based UEM solutions/subscriptions at competitive prices for SMEs to increase their revenue and market share. Moreover, the rising trend of digital transformation among these enterprises to improve business processes, enhance productivity, and reduce costs will boost the adoption of unified endpoint management solutions and services among SMEs, thus, providing potential growth opportunities to the market players during the forecast period of 2022 to 2028. Such initiatives would drive the growth of Middle East & Africa unified endpoint management market during the forecast period.

Middle East & Africa Unified Endpoint Management Market Overview

The Middle East & Africa unified endpoint management market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Gulf countries are economically advanced, while the African countries still have to balance their economic conditions. The Gulf Countries Council (GCC) plans various strategies to encourage collaboration, enhance innovation, streamline intermodal transportation, and improve national economies. The EU's introduction of GDPR is creating issues for companies in the region, majorly for SMEs. The government authorities are on the path to pursue economic growth programs to accelerate employment and diversify GDP in addition to oil-and-gas production. As the private sector grows, SMEs are heavily hit by the cost of federal regulatory compliance. In Middle East, it is mandatory for businesses to comply with GDPR rules to avoid cyber risks. As per the assistant general counsel for corporate external and legal affairs for the Middle East & Africa at Microsoft, there are nearly 160 GDPR requirements for how business gathers, stores, and uses personal information to mandate a 72-hour notification of personal data breaches. The implementation of GDPR compliance in the Middle East & Africa is projected to affect the utilization of unified endpoint management to ensure data security. Boldon James, Titus, and a few companies have adopted unified endpoint management tools. In July 2019, Spire solutions became a distributor of Titus to cater to data protection and unified endpoint management requirements in the region. Similarly, in July 2017, StarLink, the security-specialized Value-Added-Distributor (VAD), partnered with Boldon James. The company has expanded its sales in Middle East through this partnership. Such initiatives would drive the growth of Middle East & Africa unified endpoint management market during the forecast period. Various verticals, including BFSI, energy, healthcare, and government, are adopting endpoint management as they possess an enormous amount of sensitive and secret data. Additionally, the network security industry in the Middle East & Africa is expanding because the Bring Your Own Device (BYOD) and Work from Home (WFH) scenarios are becoming prevalent during the COVID-19 pandemic. Based on the Aruba Networks report, in 2021, 69% of the organizations in Middle East adopted some form of BYOD. Similarly, the network security business in the region witnesses implementation difficulties because of the increasing complexity of establishing IT security infrastructure on operational technology (OT) and supervisory control and data acquisition (SCADA). The network of businesses in Middle East has also been threatened by the expansion of remote working practices due to the effects of COVID-19 pandemic. Organizations are implementing countermeasures and working with security suppliers to handle the situation successfully. Hence, the expanding BYOD practice across the region is anticipated to create lucrative opportunities for the Middle East & Africa unified endpoint management market over the forecast period.

Middle East & Africa Unified Endpoint Management Market Revenue and Forecast to 2028 (US$ Million)

Middle East & Africa Unified Endpoint Management Market Segmentation

The Middle East & Africa unified endpoint management market is segmented into component, deployment type, platform, organization size, end-user, and country.

Based on component, the Middle East & Africa unified endpoint management market is segmented into solutions and services. The solutions segment held the larger market share in 2022.

Based on deployment type, the Middle East & Africa unified endpoint management market is segmented into cloud based and on-premise. The cloud based segment held the larger market share in 2022.

Based on platform, the Middle East & Africa unified endpoint management market is segmented into desktop and mobile. The desktop segment dominated the market share in 2022.

Based on organization size, the Middle East & Africa unified endpoint management market is segmented into SMEs and large enterprises. The large enterprises segment dominated the market share in 2022.

Based on end-user, the Middle East & Africa unified endpoint management market is segmented into BFSI, government and defense, healthcare, IT and telecom, automotive and transportation, retail, manufacturing, and others. The IT and telecom segment dominated the market share in 2022.

Based on country, the Middle East & Africa unified endpoint management market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia segment dominated the market share in 2022.

Citrix Systems, Inc.; IBM Corporation; Ivanti; MICROLAND LIMITED; Microsoft Corporation; STEFANINI; and Zoho Corporation Pvt. Ltd. are the leading companies operating in the Middle East & Africa unified endpoint management market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa unified endpoint management market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in Middle East & Africa unified endpoint management market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 Middle East & Africa Unified Endpoint Management Market - By Component

- 1.3.2 Middle East & Africa Unified Endpoint Management Market - By Deployment Type

- 1.3.3 Middle East & Africa Unified Endpoint Management Market - By Platform

- 1.3.4 Middle East & Africa Unified Endpoint Management Market - By Organization Size

- 1.3.5 Middle East & Africa Unified Endpoint Management Market - By End User

- 1.3.6 Middle East & Africa Unified Endpoint Management Market- By Country

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Middle East & Africa Unified Endpoint Management Market Landscape

- 4.1 Market Overview

- 4.2 PEST Analysis

- 4.2.1 Middle East & Africa

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. Middle East & Africa Unified Endpoint Management -Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Single Endpoint Management Solutions Across Industries

- 5.1.2 Substantial Growth in Number of Endpoints Across Organizations

- 5.1.3 Standardization of Data Protection Rules

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness About Benefits of Unified Endpoint Management Solutions and Availability of Alternatives

- 5.2.2 Concerns Regarding Adoption of Cloud-Based Security Solutions

- 5.3 Market Opportunities

- 5.3.1 High Growth Potential in Small and Medium-Sized Enterprise (SME) Sector

- 5.3.2 Increase in Data Generation and Rise in Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD) Trends

- 5.4 Future Trends

- 5.4.1 Increase in Adoption of Cloud-Based Solutions Across Enterprises

- 5.4.2 Incorporation of Artificial Intelligence (AI) and Multi-Cloud Strategy

- 5.5 Impact Analysis of Drivers and Restraints

6. Middle East & Africa Unified Endpoint Management Market -Market Analysis

- 6.1 Middle East & Africa Unified Endpoint Management Market Overview

- 6.2 Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

7. Middle East & Africa Unified Endpoint Management Market Analysis - By Component

- 7.1 Overview

- 7.2 Middle East & Africa Unified Endpoint Management Market, by Component (2021 and 2028)

- 7.3 Solutions

- 7.3.1 Overview

- 7.3.2 Solutions: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 7.4 Services

- 7.4.1 Overview

- 7.4.2 Services: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

8. Middle East & Africa Unified Endpoint Management Market Analysis - By Deployment Type

- 8.1 Overview

- 8.2 Middle East & Africa Unified Endpoint Management Market, By Deployment Type (2021 and 2028)

- 8.3 Cloud Based

- 8.3.1 Overview

- 8.3.2 Cloud Based: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 8.4 On-Premise

- 8.4.1 Overview

- 8.4.2 On-Premise: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

9. Middle East & Africa Unified Endpoint Management Market Analysis - By Platform

- 9.1 Overview

- 9.2 Middle East & Africa Unified Endpoint Management Market, By Platform (2021 and 2028)

- 9.3 Desktop

- 9.3.1 Overview

- 9.3.2 Desktop: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 9.4 Mobile

- 9.4.1 Overview

- 9.4.2 Mobile: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

10. Middle East & Africa Unified Endpoint Management Market Analysis - By Organization Size

- 10.1 Overview

- 10.2 Middle East & Africa Unified Endpoint Management Market Breakdown, by Organization Size, 2021 and 2028

- 10.3 SMEs

- 10.3.1 Overview

- 10.3.2 SMEs: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 10.4 Large Enterprises

- 10.4.1 Overview

- 10.4.2 Large Enterprises: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million).

11. Middle East & Africa Unified Endpoint Management Market Analysis - By End User

- 11.1 Overview

- 11.2 Middle East & Africa Unified Endpoint Management Market, by End User (2021 and 2028)

- 11.3 BFSI

- 11.3.1 Overview

- 11.3.2 BFSI: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.4 Government and Defense

- 11.4.1 Overview

- 11.4.2 Government and Defense: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.5 Healthcare

- 11.5.1 Overview

- 11.5.2 Healthcare: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.6 IT and Telecom

- 11.6.1 Overview

- 11.6.2 IT and Telecom: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.7 Automotive and Transportation

- 11.7.1 Overview

- 11.7.2 Automotive and Transportation: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.8 Retail

- 11.8.1 Overview

- 11.8.2 Retail: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.9 Manufacturing

- 11.9.1 Overview

- 11.9.2 Manufacturing: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 11.10 Others

- 11.10.1 Overview

- 11.10.2 Others: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

12. Middle East & Africa Unified Endpoint Management Market - Country Analysis

- 12.1 MEA: Middle East & Africa Unified Endpoint Management Market

- 12.1.1 MEA: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 12.1.2 MEA: Middle East & Africa Unified Endpoint Management Market, by Key Country

- 12.1.2.1 South Africa: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 12.1.2.1.1 South Africa: Middle East & Africa Unified Endpoint Management Market, by Component

- 12.1.2.1.2 South Africa: Middle East & Africa Unified Endpoint Management Market, By Deployment Type

- 12.1.2.1.3 South Africa: Middle East & Africa Unified Endpoint Management Market, By Platform

- 12.1.2.1.4 South Africa: Middle East & Africa Unified Endpoint Management Market, by Organization Size

- 12.1.2.1.5 South Africa: Middle East & Africa Unified Endpoint Management Market, by End User

- 12.1.2.2 Saudi Arabia: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 12.1.2.2.1 Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, by Component

- 12.1.2.2.2 Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, By Deployment Type

- 12.1.2.2.3 Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, By Platform

- 12.1.2.2.4 Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, by Organization Size

- 12.1.2.2.5 Saudi Arabia: Middle East & Africa Unified Endpoint Management Market, by End User

- 12.1.2.3 UAE: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 12.1.2.3.1 UAE: Middle East & Africa Unified Endpoint Management Market, by Component

- 12.1.2.3.2 UAE: Middle East & Africa Unified Endpoint Management Market, By Deployment Type

- 12.1.2.3.3 UAE: Middle East & Africa Unified Endpoint Management Market, By Platform

- 12.1.2.3.4 UAE: Middle East & Africa Unified Endpoint Management Market, by Organization Size

- 12.1.2.3.5 UAE: Middle East & Africa Unified Endpoint Management Market, by End User

- 12.1.2.4 Rest of MEA: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

- 12.1.2.4.1 Rest of MEA: Middle East & Africa Unified Endpoint Management Market, by Component

- 12.1.2.4.2 Rest of MEA: Middle East & Africa Unified Endpoint Management Market, By Deployment Type

- 12.1.2.4.3 Rest of MEA: Middle East & Africa Unified Endpoint Management Market, By Platform

- 12.1.2.4.4 Rest of MEA: Middle East & Africa Unified Endpoint Management Market, by Organization Size

- 12.1.2.4.5 Rest of MEA: Middle East & Africa Unified Endpoint Management Market, by End User

- 12.1.2.1 South Africa: Middle East & Africa Unified Endpoint Management Market - Revenue and Forecast to 2028 (US$ Million)

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 New Product Development

- 13.4 Merger and Acquisition

14. COMPANY PROFILES

- 14.1 Ivanti

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Citrix Systems, Inc.

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 IBM Corporation

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Microsoft Corporation

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Zoho Corporation Pvt. Ltd.

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 MICROLAND LIMITED

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 STEFANINI

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Word Index