|

|

市場調査レポート

商品コード

1206448

北米の車載トランシーバー市場の2028年までの予測-地域別分析-プロトコル別、アプリケーション別、車種別North America Automotive Transceivers Market Forecast to 2028 - COVID-19 Impact and Regional Analysis - By Protocol, Application, and Vehicle Type |

||||||

| 北米の車載トランシーバー市場の2028年までの予測-地域別分析-プロトコル別、アプリケーション別、車種別 |

|

出版日: 2023年01月19日

発行: The Insight Partners

ページ情報: 英文 139 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の車載トランシーバー市場は、2022年の10億9,673万米ドルから2028年には14億8,262万米ドルに成長すると予測されています。2022年から2028年までのCAGRは5.2%と推定されています。

自動車における通信ニーズの高まりが北米の車載トランシーバー市場を牽引する

自動車メーカーは、自動車の乗員の快適性を高めるとともに、安全性と性能の向上、環境負荷の低減に絶えず取り組んでいます。このため、自動車の電子制御ユニット(ECU)間で生成・通信されるデータ量が増加し、ECUへの依存度も高まるため、車載トランシーバーの需要に拍車をかけています。現在、先進的な自動車では、次世代、組み込みネットワーク、高帯域幅の需要の高まりに対応するため、約5つのECUを使い分けています。帯域幅と組み込みネットワークに対する要求の高まりが、自動車へのトランシーバーの導入を後押ししています。

以前は、高級車だけが快適性やその他の優れた機能を備えていました。しかし、スケールメリットによるセンサーやECUの価格低下により、これらの機能は他の自動車セグメントでも徐々に一般的になってきています。現在では、ハッチバックやB・Cセグメントのセダンにも、これらの快適・安全機能が搭載されています。このため、自動車市場ではECUやセンサーの需要が大きく、すべてのECUやセンサーを1つのメッシュネットワークで接続するトランシーバーの需要が誘発されます。車載トランシーバー市場の主要企業の1つであるFlexRayは、主流のパワートレイン通信にCANを、低コストのボディエレクトロニクスにLocal Interconnect Networkを提供して、コストの最適化とハイエンドアプリケーションの移行課題の軽減を図っています。ミラー、パワーシート、アクセサリーなどのボディエレクトロニクスではLIN、エンジン、トランスミッション、ABSなどのパワートレイン部品ではCAN、高性能パワートレインおよび安全システムではFlexRayのアプリケーションが増加しており、トランシーバーの採用がさらに促進されています。このように、自動車における通信ニーズの高まりは、北米の車載トランシーバー市場の成長を後押ししています。

北米の車載トランシーバー市場の概要

北米の車載トランシーバー市場は、米国、カナダ、メキシコに区分されます。この地域には、STMicroelectronics、Infineon Technologies AG、Renesas Electronics America Inc.、Microchip Technology Inc.、Broadcom Inc.、Semiconductor Components Industries, LLC、 Texas Instruments Incorporated、NXP Semiconductors N.V., Analog Devices, Incなどの大手車載トランシーバーメーカーがあります。また、これらのプレイヤーによる車載トランシーバーの機能向上のための取り組みが活発化していることが、市場の成長を後押ししています。例えば、2022年11月、Infineon Technologies AGは、車載レーダーモジュール向けに高性能、拡張性、信頼性を備えた新しいCMOSトランシーバーMMIC CTRX8181を発表しました。この開拓は、コーナー、フロント、ショートレンジなどの異なるセンサーに対応するスケーラブルなプラットフォームアプローチを提供するとともに、新しいソフトウェア定義の車両アーキテクチャに対応する柔軟性を備えており、消費者の間で市場の需要を高めています。さらに、2022年11月には、ルネサスエレクトロニクス株式会社が、ADASやレベル3以上の自律走行アプリケーションの高まるニーズに応えるために設計された4x4チャネル、76-81GHzトランシーバを発表しました。また、2022年9月には、NXP Semiconductors N.V.がADASおよび自律走行向けの第2世代77GHz RFCMOSレーダー・トランシーバーの生産を発表しました。この開発により、アダプティブクルーズコントロール、自動緊急ブレーキ、ブラインドスポットモニタリング、クロストラフィックアラート、自動駐車などの重要な安全アプリケーションのための360°センシングが可能になります。このように、先進的な車載トランシーバーを開発するためのこのような成長著しい技術進歩により、プレーヤーは競合他社に対する競争力を獲得することができ、これが予測期間中の北米の車載トランシーバー市場の成長に寄与しています。

北米は、乗用車の継続的な生産により、自動車産業が発展しています。例えば、Organisation Internationale des Constructeurs d'Automobiles(OICA)2021年のレポートによると、米国は2021年に70,24,288台の乗用車を生産し、2020年には68,64,024台を生産しました。同様に、カナダは2021年に3,20,605台の乗用車を生産し、2020年には3,18,750台の乗用車を生産しました。OICAの統計によると、米国、カナダ、メキシコは、全世界で乗用車の生産をリードしています。このように、この地域では乗用車の継続的な生産に伴い、車載トランシーバーの需要も急速に伸びています。これは、コネクテッドカーの需要の増加や、乗客の安全とセキュリティを強化するためのADASやV2Xモジュールなど、車内の電子部品の統合が進んでいることに起因しており、これが北米の車載トランシーバー市場の成長をさらに促進しています。

北米の車載トランシーバー市場の収益と2028年までの予測(金額)

北米の車載トランシーバー市場のセグメンテーション

北米の車載トランシーバー市場は、プロトコル、アプリケーション、車種、国ごとに区分されます。

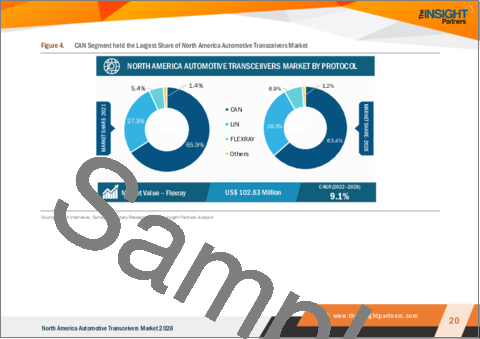

プロトコルに基づき、北米の車載トランシーバー市場は、CAN、LIN、FLEXRAY、その他に区分されます。2022年には、CANセグメントが最大の市場シェアを占めています。

アプリケーションに基づき、北米の車載トランシーバー市場は、安全、ボディコントロールモジュール、シャーシ、パワートレイン、ステアリングホイール、エンジン、ドア/シートに区分されます。2022年の市場シェアは、セーフティセグメントがより大きなシェアを占めています。

車両タイプに基づき、北米の車載トランシーバー市場は、乗用車と商用車に二分されます。2022年は乗用車がより大きなシェアを占めています。

国別では、北米の車載トランシーバー市場は米国、カナダ、メキシコに区分されます。2022年の市場シェアは米国が圧倒的に多いです。

Broadcom Inc、Cypress Semiconductor Corp、Maxim Integrated Products Inc、Microchip Technology Inc、NXP Semiconductors NV、Renesas Electronics Corp、Robert Bosch、STMicroelectronics NV、 Texas Instruments Inc、およびToshiba Corpは、北米の車載トランシーバー市場で活動している主要企業です。

目次

第1章 イントロダクション

第2章 重要なポイント

第3章 調査手法

- カバレッジ

- 2次調査

- 1次調査

第4章 北米の車載トランシーバー市場情勢

- 市場概要

- 北米-PEST分析

- エコシステム分析

- 専門家の見解

第5章 北米の車載トランシーバー市場- 主要な産業力学

- 市場促進要因

- 自動車における通信ニーズの高まり

- 電気自動車における高度な通信機能および安全機能の搭載

- 市場抑制要因

- 電子システムの複雑化

- 市場機会

- 自動運転車や自律走行車の採用が進む

- 動向

- ドライブ・バイ・ワイヤ、ステア・バイ・ワイヤ、ブレーキ・バイ・ワイヤ

- 促進要因と抑制要因の影響分析

第6章 北米の車載トランシーバー市場-市場分析

- 北米の車載トランシーバー市場の概要

- 北米の車載トランシーバー市場の予測・分析

第7章 北米の車載トランシーバー市場分析:プロトコル別

- 北米の車載トランシーバー市場:プロトコル別(2021年・2028年)

- CAN

- LIN

- FLEXRAY

- その他

第8章 北米の車載トランシーバー市場の収益と2028年までの予測:アプリケーション別

- 北米の車載トランシーバー市場:アプリケーション別(2021年・2028年)

- セーフティ

- ボディコントロールモジュール

- シャシー

- パワートレイン

- ステアリングホイール

- エンジン

- ドア/シート

第9章 北米の車載トランシーバー市場の収益と2028年までの予測:車種別

- 北米の車載トランシーバー市場:車種別(2021年・2028年)

- 乗用車

- 車種別

- 商用車

第10章 北米の車載トランシーバー市場:国別分析

- 米国

- カナダ

- メキシコ

第11章 業界情勢

- 市場の取り組み

- 新製品開発

- 合併・買収

第12章 企業プロファイル

- Broadcom Inc

- Cypress Semiconductor Corp

- Renesas Electronics Corp

- Maxim Integrated Products Inc

- Microchip Technology Inc

- NXP Semiconductors NV

- Robert Bosch

- Texas Instruments Inc

- Toshiba Corp

- STMicroelectronics NV

第13章 付録

List Of Tables

- Table 1. North America Automotive Transceivers Market - Revenue and Forecast to 2028 (US$ Million)

- Table 2. North America Automotive Transceivers Market, By Protocol - Revenue and Forecast to 2028 (US$ Million)

- Table 3. North America: North America Automotive Transceivers Market, By Application - Revenue and Forecast to 2028 (US$ Million)

- Table 4. North America: North America Automotive Transceivers Market, By Vehicle Type - Revenue and Forecast to 2028 (US$ Million)

- Table 5. US: Automotive Transceivers, By Protocol -Revenue and Forecast to 2028 (US$ Million)

- Table 6. US: Automotive Transceivers, By Application -Revenue and Forecast to 2028 (US$ Million)

- Table 7. US: Automotive Transceivers, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

- Table 8. Canada: Automotive Transceivers, By Protocol -Revenue and Forecast to 2028 (US$ Million)

- Table 9. Canada: Automotive Transceivers, By Application -Revenue and Forecast to 2028 (US$ Million)

- Table 10. Canada: Automotive Transceivers, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

- Table 11. Mexico: Automotive Transceivers, By Protocol -Revenue and Forecast to 2028 (US$ Million)

- Table 12. Mexico: Automotive Transceivers, By Application -Revenue and Forecast to 2028 (US$ Million)

- Table 13. Mexico: Automotive Transceivers, By Vehicle Type -Revenue and Forecast to 2028 (US$ Million)

- Table 14. List of Abbreviation

List Of Figures

- Figure 1. North America Automotive Transceivers Market Segmentation

- Figure 2. North America Automotive Transceivers Market Segmentation - By Country

- Figure 3. North America Automotive Transceivers Market Overview

- Figure 4. CAN Segment held the Largest Share of North America Automotive Transceivers Market

- Figure 5. US to Show Great Traction During Forecast Period

- Figure 6. North America- PEST Analysis

- Figure 7. Ecosystem Analysis: North America Automotive Transceivers Market

- Figure 8. Expert Opinion

- Figure 9. North America Automotive Transceivers Market: Impact Analysis of Drivers and Restraints

- Figure 10. North America Automotive Transceivers Market Forecast and Analysis (US$ Million)

- Figure 11. North America Automotive Transceivers Market Revenue Share, By Protocol (2021 & 2028)

- Figure 12. CAN: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 13. LIN: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 14. FLEXRAY: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 15. Others: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 16. North America Automotive Transceivers Market Revenue Share, By Application (2021 & 2028)

- Figure 17. Safety: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 18. Body Control Module: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 19. Chassis: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 20. Powertrain: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 21. Steering Wheel: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 22. Engine: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Door/Seat: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 24. North America Automotive Transceivers Market Revenue Share, By Vehicle Type (2021 & 2028)

- Figure 25. Passenger Vehicles: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 26. Commercial Vehicles: North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

- Figure 27. North America Automotive Transceivers, by Key Country - Revenue (2021) (US$ Million)

- Figure 28. North America Automotive Transceivers Market Revenue Share, by Key Country (2021 & 2028)

- Figure 29. US: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

- Figure 30. Canada: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

- Figure 31. Mexico: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

The North America automotive transceivers market is expected to grow from US$ 1,096.73 million in 2022 to US$ 1,482.62 million by 2028. It is estimated to grow at a CAGR of 5.2% from 2022 to 2028.

Increasing Need for Communications in Automobiles is Driving the North America Automotive Transceivers Market

Automobile manufacturers are continuously striving to improve safety and performance, and reduce the environmental impact of their products, along with enhancing comfort for vehicle occupants. This, in turn, increases the volume of data generated and communicated between electronic control units (ECUs) of vehicles, along with the reliance on the same, thereby contributing to the demand for automotive transceivers. Advanced vehicles, nowadays, utilize about five separate ECUs to address the elevating demand for next-generation, embedded networks, and high bandwidths. The growing requirement for bandwidth and embedded networks propels the deployment of transceivers in automobiles.

Earlier, only high-end cars had comfort and other prime features. However, these features are gradually becoming common in other car segments due to the declining prices of sensors and ECUs with economies of scale. Nowadays, hatchbacks, and B and C segment sedans are also equipped with these comfort and safety features. This has created a huge demand for ECUs and sensors in the automotive market, which triggers the demand for transceivers, as they connect all ECUs and sensors on a single mesh network. FlexRay, one of the key players in the automotive transceivers market, provides CAN for mainstream powertrain communications and Local Interconnect Network for low-cost body electronics to optimize cost and reduce transition challenges in high-end applications. The increasing applications of LIN in body electronics such as mirrors, power seats, and accessories; CAN in powertrain components such as engine, transmission, and ABS; and FlexRay in high-performance powertrain and safety systems further trigger the adoption of transceivers. Thus, increasing communications needs in automobiles propel the growth of the North America automotive transceivers market.

North America Automotive Transceivers Market Overview

The North America automotive transceivers market is segmented into the US, Canada, and Mexico. The region has leading automotive transceivers manufacturers such as STMicroelectronics; Infineon Technologies AG; Renesas Electronics America Inc.; Microchip Technology Inc.; Broadcom Inc.; Semiconductor Components Industries, LLC; Texas Instruments Incorporated; NXP Semiconductors N.V.; and Analog Devices, Inc. In addition, the growing initiatives for advancing features in automotive transceivers from these players are fueling the market growth. For instance, in November 2022, Infineon Technologies AG introduced a new CMOS transceiver MMIC CTRX8181 with high performance, scalability, and reliability for automotive radar modules. This development offers a scalable platform approach for different sensors, including corner, front, and short range, along with flexibility for new software-defined vehicle architectures, which is boosting the market demand among consumers. In addition, in November 2022, Renesas Electronics Corporation introduced a 4x4-channel, 76-81GHz transceiver designed to cater to the growing needs of ADAS and Level 3 and higher autonomous driving applications. Also, in September 2022, NXP Semiconductors N.V. announced the production of its 2nd Generation 77GHz RFCMOS radar transceivers for ADAS and autonomous driving. This development enables 360° sensing for critical safety applications, such as adaptive cruise control, automated emergency braking, blind-spot monitoring, cross-traffic alert, and automated parking. Thus, such growing technological advancements for developing advanced automotive transceivers enable the players to achieve a competitive edge over the competitors, which is contributing to the North America automotive transceivers market growth over the forecast period.

North America has a developed automotive industry due to the continuous production of passenger vehicles. For instance, as per the Organisation Internationale des Constructeurs d'Automobiles (OICA) 2021 report, the US produced 70,24,288 passenger vehicles in 2021 and 68,64,024 in 2020. Similarly, Canada produced 3,20,605 passenger vehicles in 2021 and 3,18,750 in 2020, as per the same report. As per OICA statistics, the US, Canada, and Mexico are leading in the production of passenger vehicles across the globe. Thus, with the continuous production of passenger vehicles across the region, the demand for automotive transceivers is also rapidly growing. This is owing to a rise in the demand for connected vehicles and the growing integration of electronic components in the vehicle such as ADAS and V2X module for enhancing passenger safety and security, which is further promoting the North America automotive transceivers market growth.

North America Automotive Transceivers Market Revenue and Forecast to 2028 (US$ Million)

North America Automotive Transceivers Market Segmentation

The North America automotive transceivers market is segmented into protocol, application, vehicle type, and country.

Based on protocol, the North America automotive transceivers market is segmented into CAN, LIN, FLEXRAY, and others. The CAN segment held the largest market share in 2022.

Based on application, the North America automotive transceivers market is segmented into safety, body control module, chassis, powertrain, steering wheel, engine, and door/seat. The safety segment held the larger market share in 2022.

Based on vehicle type, the North America automotive transceivers market is bifurcated into passenger vehicles, and commercial vehicles. The passenger vehicles segment held the larger market share in 2022.

Based on country, the North America automotive transceivers market is segmented into the US, Canada, and Mexico. The US dominated the market share in 2022.

Broadcom Inc; Cypress Semiconductor Corp; Maxim Integrated Products Inc; Microchip Technology Inc; NXP Semiconductors NV; Renesas Electronics Corp; Robert Bosch; STMicroelectronics NV; Texas Instruments Inc; and Toshiba Corp are the leading companies operating in the North America automotive transceivers market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America automotive transceivers market

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in North America automotive transceivers market , thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Automotive Transceivers Market Landscape

- 4.1 Market Overview

- 4.2 North America - PEST Analysis

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. North America Automotive Transceivers Market - Key Industry Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Communications in Automobiles

- 5.1.2 Equipment of Advanced Communication and Safety Features in Electric Vehicles

- 5.2 Market Restraints

- 5.2.1 Increasing Complexities in Electronic Systems

- 5.3 Market Opportunities

- 5.3.1 Growing Adoption of Self-Driving or Autonomous Vehicles

- 5.4 Trends

- 5.4.1 Drive-By-Wire, Steer-By-Wire, and Brake-By-Wire

- 5.5 Impact Analysis of Drivers and Restraints

6. North America Automotive Transceivers Market -Market Analysis

- 6.1 North America Automotive Transceivers Market Overview

- 6.2 North America Automotive Transceivers Market Forecast and Analysis

7. North America Automotive Transceivers Market Analysis - By Protocol

- 7.1 Overview

- 7.2 North America Automotive Transceivers Market, By Protocol (2021 & 2028)

- 7.3 CAN

- 7.3.1 Overview

- 7.3.2 CAN: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 7.4 LIN

- 7.4.1 Overview

- 7.4.2 LIN: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 7.5 FLEXRAY

- 7.5.1 Overview

- 7.5.2 FLEXRAY: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 7.6 OTHERS

- 7.6.1 Overview

- 7.6.2 Others: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

8. North America Automotive Transceivers Market Revenue and Forecast to 2028 - By Application

- 8.1 Overview

- 8.2 North America Automotive Transceivers Market, By Application (2021 & 2028)

- 8.3 Safety

- 8.3.1 Overview

- 8.3.2 Safety: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 8.4 Body Control Module

- 8.4.1 Overview

- 8.4.2 Body Control Module: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 8.5 Chassis

- 8.5.1 Overview

- 8.5.2 Chassis: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 8.6 Powertrain

- 8.6.1 Overview

- 8.6.2 Powertrain: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 8.7 Steering Wheel

- 8.7.1 Overview

- 8.7.2 Steering Wheel: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 8.8 Engine

- 8.8.1 Overview

- 8.8.2 Engine: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 8.9 Door/Seat

- 8.9.1 Overview

- 8.9.2 Door/Seat: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

9. North America Automotive Transceivers Market Revenue and Forecast to 2028 - Vehicle Type

- 9.1 Overview

- 9.2 North America Automotive Transceivers Market, By Vehicle Type (2021 & 2028)

- 9.3 Passenger Vehicles

- 9.3.1 Overview

- 9.3.2 Passenger Vehicles: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

- 9.4 Commercial Vehicles

- 9.4.1 Overview

- 9.4.2 Commercial Vehicles: North America Automotive Transceivers Market Revenue and Forecast To 2028 (US$ Million)

10. North America Automotive Transceivers Market - Country Analysis

- 10.1 Overview

- 10.1.1 North America Automotive Transceivers Market, by Key Country

- 10.1.1.1 US: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

- 10.1.1.1.1 US: Automotive Transceivers, By Protocol

- 10.1.1.1.2 US: Automotive Transceivers, By Application

- 10.1.1.1.3 US: Automotive Transceivers, By Vehicle Type

- 10.1.1.2 Canada: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

- 10.1.1.2.1 Canada: Automotive Transceivers, By Protocol

- 10.1.1.2.2 Canada: Automotive Transceivers, By Application

- 10.1.1.2.3 Canada: Automotive Transceivers, By Vehicle Type

- 10.1.1.3 Mexico: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

- 10.1.1.3.1 Mexico: Automotive Transceivers, By Protocol

- 10.1.1.3.2 Mexico: Automotive Transceivers, By Application

- 10.1.1.3.3 Mexico: Automotive Transceivers, By Vehicle Type

- 10.1.1.1 US: Automotive Transceivers - Revenue, and Forecast to 2028 (US$ Million)

- 10.1.1 North America Automotive Transceivers Market, by Key Country

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

- 11.4 Merger and Acquisition

12. Company Profiles

- 12.1 Broadcom Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Cypress Semiconductor Corp

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Renesas Electronics Corp

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Maxim Integrated Products Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Microchip Technology Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 NXP Semiconductors NV

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Robert Bosch

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Texas Instruments Inc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Toshiba Corp

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 STMicroelectronics NV

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Word Index