|

|

市場調査レポート

商品コード

1126263

医薬品用リーファーコンテナの2028年までの市場予測-アプリケーションタイプおよびコンテナサイズによる世界分析Reefer Container for Pharmaceutical Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Application Type and Container Size |

||||||

| 医薬品用リーファーコンテナの2028年までの市場予測-アプリケーションタイプおよびコンテナサイズによる世界分析 |

|

出版日: 2022年09月02日

発行: The Insight Partners

ページ情報: 英文 192 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

医薬品用リーファーコンテナ市場は、2021年の28億4670万米ドルから2028年には63億9180万米ドルに達すると予測されます。2022年から2028年の間にCAGR12.5%で成長すると推定されます。

北米の医薬品用リーファーコンテナ市場の成長は、国際貿易を奨励する政府の政策とともに、冷蔵医薬品、ワクチン、血漿の需要が増加していることが主な要因です。経済分析局によると、2021年の米国の物品・サービス輸出は2020年と比較して3941億米ドル(18.5%)増加し、輸入は5765億米ドル(20.5%)急増したとされています。米国は交渉による貿易自由化を進め、医薬品などの重要製品の輸送を促進することで経済成長を促す政策をとっています。ハイテク冷凍コンテナは、一般に温度変化を監視する最先端の装置を備えており、温度に敏感な製品の輸送に最適な状態を維持し、最終目的地に到着するまで、外部の脅威にもかかわらず損傷を受けないようにするために理想的なものです。また、わずかな温度変化や、医薬品の組成を変化させる可能性のある光の照射を検知するセンサーも搭載されています。

コールドチェーン業界は、COVID-19の流行により、2020年に急成長を遂げました。医薬品の輸送には、ほとんどの場合、購入品よりもレンタルリーファーコンテナが好まれるようになっています。2022年4月、カーディナルヘルスは、米国保健社会福祉省(HHS)内の準備・対応担当次官補室の一部である戦略的国家備蓄(SNS)を支援するために、個人防護具(PPE)8万パレットの保管と配布について5780万米ドル相当の契約を受注しました。最近の研究では、15のリーファー貿易ルートの調査に基づき、2021年の第3四半期に50%の増加が見られ、ドライコンテナの運賃は2021年に2倍以上に増加しました。また、2022年7月、FESCO Transportation Groupは、子会社Dalreftransの発展戦略のもと、2022年夏までにリーファーコンテナの保有台数を4,000台に拡大する予定でした。このように、医薬品の輸送・物流需要の急増がリーファーコンテナの採用に拍車をかけています。

アジア太平洋地域では、COVID-19の大流行が貿易制限によりヘルスケアのサプライチェーンとコールドチェーン産業に大きな影響を及ぼしています。中国、インド、シンガポール、韓国は、医薬品製造、臨床試験、病理学的検査のアウトソーシング先として台頭してきており、これがリーファーコンテナの必要性を後押ししています。アジア太平洋地域の医薬品用リーファーコンテナ市場の成長は、主にこの地域のいくつかの国の膨大な人口に起因するバイオ医薬品やワクチンの需要の増加に起因しています。中国の医薬品業界向けのリーファーコンテナメーカーには、Hapag-Lloyd AG、Tianjin LongTeng International Trade Co.

欧州委員会による規制と政策の策定への取り組みが活発化していることが、欧州の医薬品向け冷凍コンテナ市場の成長を後押ししています。欧州連合は、欧州企業により良い取引機会を提供することを目的とした特定の政策を通じて貿易・投資関係を管理しており、これがさらに医薬品輸送用リーファーコンテナの高い需要に寄与しています。2021年11月には、ドイツのMECOTECグループから、COVID-19ワクチンの深冷保存用コンテナ8基が納入されました。

BSL REFRIGERATED CONTAINERS、CMA CGM GROUP、KLINGE CORPORATION、DAIKIN INDUSTRIES, LTD、MAERSK CONTAINER INDUSTRY AS、EVERGREEN MARINE CORP.(TAIWAN)LTD、SEACO、TITAN CONTAINERS A/S、COSCO SHIPPING、W&K CONTAINERS, INC.などが医薬品用リーファー・コンテナの市場調査においてプロファイリングを行った主要プレイヤーに含まれます。市場レポートは詳細な市場洞察を提供し、主要企業が今後数年間の成長を戦略化するのに役立ちます。

医薬品業界のサプライチェーンで使用される技術は、意図した目的地に医療製品を安全に届けるための新しい方法で進化しています。医薬品業界のコールドチェーン施設は、コントロールタワー技術、パッケージングオートメーション、人工知能、その他の技術に高い依存度を示しています。近年、希少疾患や慢性疾患を治療する生物学的療法、COVID-19やその他の感染症を治療するワクチン、新しい腫瘍治療、細胞・遺伝子治療(CGT)など、温度に敏感な医薬品の普及に関する進歩が続いており、コールドチェーンの要件もより複雑になってきています。2022年8月のColliersによる最新レポートによると、インドの冷蔵倉庫容量は2023年までに4,070万トンに達し、2020年の報告から8.2%増加する見込みです。また、ジョーンズ・ラング・ラサールIP社の報告によると、コールドチェーン業界は世界的に、2025年までにCAGR20%以上で成長すると予想されており、これは従来の低温貯蔵から近代的な貯蔵スペースへの移行に起因しています。2022年8月、マースク・カンパニー(MCI)は、サウスカロライナ州リッジビルに温度管理された商品を扱う新しい冷蔵倉庫を計画し、2023年の第1四半期から稼働させる予定であることを発表しました。

リーファーコンテナの継続的な開発は、医薬品業界で使用されるコンテナの効率性と信頼性の増強に寄与しています。ほとんどの海運会社がモノのインターネット(IoTに接続された)デバイスの利用を増やしていることは、重要な動向の1つです。輸送プロセス全体で膨大な量のデータが収集・送信され、これを活用することで、問題の特定、ダウンタイムの軽減、手順の合理化など、海運業界の業務効率の向上につながる重要な知見が得られる可能性があります。2022年2月、CMA CGMは冷蔵品用の連結型コンテナ「SMART reefer container」を発表しました。SMART冷凍コンテナでは、冷蔵品の位置や状態を把握することができます。また、2022年3月には、IoTソリューションの世界プロバイダーであるORBCOMM Inc.が、冷凍コンテナのスマートマネジメントの次の進化を特徴とするIoTテレマティクス機器「CT 3500」の発売を発表しています。ORBCOMMのデータ駆動型冷凍コンテナソリューションは、機能性、接続性オプション、分析機能を強化したものです。特に、他社のテレマティクス機器との相互運用性を示し、荷主や輸送会社が冷凍コンテナ物流の効率化を図れるよう支援します。このように、スマート冷凍コンテナは冷凍コンテナメーカーの間で大きな支持を得ており、予測期間中に医薬品用リーファーコンテナ市場の成長を促進する可能性があります。

医薬品用リーファーコンテナ市場は、コンテナサイズと用途に基づいて二分化されています。コンテナサイズに基づき、市場は小型コンテナ、中型コンテナ、大型コンテナに区分されます。用途別では、医薬品製剤、注射剤、血液製剤、ワクチン・血清、その他に区分されます。

医薬品用リーファーコンテナ市場は、北米、欧州、アジア太平洋(APAC)、中東・アフリカ(MEA)、南米(SAM)の5つの主要地域に区分されます。2021年には、アジア太平洋が最大のシェアを獲得して市場をリードし、北米がそれに続きました。さらに、欧州は2022-2028年の間に市場で最も高いCAGRを記録すると予測されています。

医薬品用リーファーコンテナの市場規模は、一次情報および二次情報を用いて導き出されました。調査プロセスを開始するにあたり、市場に関する質的・量的情報を得るために、社内外の情報源を用いて徹底的な二次調査を実施しました。このプロセスは、すべての市場セグメントに関する概要と予測を得る目的も兼ねています。また、データを検証し、より分析的な洞察を得るために、業界関係者に一次インタビューを実施しました。このプロセスの参加者は、副社長、事業開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家、評価専門家、調査アナリスト、キーオピニオンリーダーなどの医薬品向けリーファーコンテナ市場を専門とする外部コンサルタントです。

目次

第1章 イントロダクション

- 調査範囲

- インサイトパートナーズの調査報告書ガイダンス

- 市場セグメンテーション

- 医薬品用リーファーコンテナの世界市場-アプリケーションタイプ別

- 医薬品用リーファーコンテナの世界市場-コンテナサイズ別

- 医薬品用リーファーコンテナの世界市場-地域別

第2章 主要なポイント

第3章 調査手法

- 対象範囲

- 2次調査

- 1次調査

第4章 医薬品用リーファーコンテナ市場情勢

- 市場概要

- PEST分析

- 北米

- 欧州

- APAC

- MEA

- SAM

- エコシステム分析

- 専門家の見解

第5章 医薬品用リーファーコンテナ市場- 主な市場力学

- 市場促進要因

- 航空輸送よりも海上輸送を好む傾向の高まり

- 医薬品需要の増加が市場成長を促進

- 主な市場抑制要因

- リーファーコンテナに関連する運用・財務上の課題

- 主な市場機会

- コールドチェーン分野での発展が有利な機会をもたらす

- 動向

- スマート冷凍コンテナの需要拡大

- 推進要因と抑制要因の影響度分析

第6章 医薬品用リーファーコンテナ市場- 世界市場分析

- 医薬品用リーファーコンテナ市場の世界概要

- 医薬品用リーファーコンテナの世界市場予測・分析

- 市場のポジショニング-トップ5企業

第7章:医薬品用リーファーコンテナの市場収益と2028年までの予測-アプリケーションタイプ

- 医薬品用リーファーコンテナ市場:アプリケーションタイプ別(2021年、2028年)

- 医薬品用リーファーコンテナ市場:アプリケーションタイプ別(2021年、2028年)

- 医薬品製剤

- 注射剤

- 血液製剤

- ワクチンと血清

- その他

第8章 医薬品用リーファーコンテナの世界市場分析- 容器サイズ別

- 医薬品用リーファーコンテナ市場、容器サイズ別(2021年、2028年)

- 小型コンテナ

- 中型コンテナ

- 大型容器

第9章 医薬品用リーファーコンテナ市場-地域別分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州

- APAC

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- APACのその他諸国

- MEA

- サウジアラビア

- UAE

- 南アフリカ

- MEAの残りの地域

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

第10章 COVID-19のパンデミック別医薬品用リーファーコンテナ市場への影響

- 北米

- 欧州

- APAC

- MEA

- SAM

第11章 業界の情勢

- 市場の取り組み

- 新規開発

第12章 企業プロファイル

- BSL REFRIGERATED CONTAINERS

- CMA CGM GROUP

- KLINGE CORPORATION.

- DAIKIN INDUSTRIES, LTD.

- MAERSK CONTAINER INDUSTRY AS.

- EVERGREEN MARINE CORP.(TAIWAN)LTD

- SEACO

- TITAN CONTAINERS A/S

- COSCO Shipping.

- W&K CONTAINERS, INC

第13章 企業情報付録

- The Insight Partners について

- 単語索引

List Of Tables

- Table 1. Global Reefer Container for Pharmaceutical Market, Revenue and Forecast, 2019-2028 (US$ Million)

- Table 2. North America Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Application Type (US$ million)

- Table 3. North America Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Container Size (US$ million)

- Table 4. North America Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 5. US Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 6. US Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 7. Canada Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 8. Canada Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 9. Mexico Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- Table 10. Mexico Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 11. Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Application Type (US$ million)

- Table 12. Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Container Size (US$ million)

- Table 13. Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 14. Germany Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 15. Germany Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 16. France Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 17. France Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 18. Italy Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 19. Italy Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 20. UK Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 21. UK Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 22. Russia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 23. Russia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 24. Rest of Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 25. Rest of Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 26. APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Application Type (US$ million)

- Table 27. APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Container Size (US$ million)

- Table 28. APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 29. Australia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 30. Australia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 31. China Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 32. China Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 33. India Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 34. India Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 35. Japan Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 36. Japan Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 37. South Korea Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 38. South Korea Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 39. Rest of APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 40. Rest of APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 41. MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Application Type (US$ million)

- Table 42. MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Container Size (US$ million)

- Table 43. MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Country (US$ million)

- Table 44. Saudi Arabia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 45. Saudi Arabia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 46. UAE Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 47. UAE Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 48. South Africa Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 49. South Africa Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 50. Rest of MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 51. Rest of MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 52. SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Application Type (US$ million)

- Table 53. SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Container Size (US$ million)

- Table 54. SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 - By Country (US$ million)

- Table 55. Brazil Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 56. Brazil Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 57. Argentina Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 58. Argentina Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 59. Rest of SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Application Type (US$ million)

- Table 60. Rest of SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 - By Container Size (US$ million)

- Table 61. List of Abbreviation

List Of Figures

- Figure 1. Reefer Container for Pharmaceutical Market Segmentation

- Figure 2. Reefer Container for Pharmaceutical Market Segmentation - Geography

- Figure 3. Reefer Container for Pharmaceutical Market Overview

- Figure 4. Reefer Container for Pharmaceutical Market, By Application Type

- Figure 5. Reefer Container for Pharmaceutical Market, By Container Size

- Figure 6. Reefer Container for Pharmaceutical Market, By Region

- Figure 7. North America: PEST Analysis

- Figure 8. Europe: PEST Analysis

- Figure 9. APAC: PEST Analysis

- Figure 10. MEA: PEST Analysis

- Figure 11. SAM: PEST Analysis

- Figure 12. Reefer Container for Pharmaceutical Market Ecosystem Analysis

- Figure 13. Expert Opinion

- Figure 14. Reefer Container for Pharmaceutical Market: Impact Analysis of Drivers and Restraints

- Figure 15. Geographic Overview of Reefer Container for Pharmaceutical Market

- Figure 16. Global Reefer Container for Pharmaceutical Market, Forecast and Analysis (US$ Million)

- Figure 17. Market Positioning- Top Five Players

- Figure 18. Reefer Container for Pharmaceutical Market, By Application Type (2021 and 2028)

- Figure 19. Reefer Container for Pharmaceutical Market, By Application Type (2021 and 2028)

- Figure 20. Pharmaceutical Preparations: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 21. Injectables: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 22. Blood Derivatives: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Vaccine and Serum: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 24. Others: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 25. Reefer Container for Pharmaceutical Market, By Container Size (2021 and 2028)

- Figure 26. Small: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 27. Medium: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 28. Large: Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ Million)

- Figure 29. Global Reefer Container for Pharmaceutical Market Revenue Share, By Region (2021 & 2028)

- Figure 30. North America Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 31. North America Reefer Container for Pharmaceutical Market Breakdown, By Application Type, 2021 & 2028 (%)

- Figure 32. North America Reefer Container for Pharmaceutical Market Breakdown, By Container Size, 2021 & 2028 (%)

- Figure 33. North America Reefer Container for Pharmaceutical Market Breakdown, by Country, 2021 & 2028 (%)

- Figure 34. US Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 35. Canada Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 36. Mexico Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 37. Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 38. Europe Reefer Container for Pharmaceutical Market Breakdown, By Application Type, 2021 & 2028 (%)

- Figure 39. Europe Reefer Container for Pharmaceutical Market Breakdown, By Container Size, 2021 & 2028 (%)

- Figure 40. Europe Reefer Container for Pharmaceutical Market Breakdown, by Country, 2018 & 2027(%)

- Figure 41. Germany Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 42. France Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 43. Italy Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 44. UK Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 45. Russia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 46. Rest of Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 47. APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 48. APAC Reefer Container for Pharmaceutical Market Breakdown, By Application Type, 2021 & 2028 (%)

- Figure 49. APAC Reefer Container for Pharmaceutical Market Breakdown, By Container Size, 2021 & 2028 (%)

- Figure 50. APAC Reefer Container for Pharmaceutical Market Breakdown, by Country, 2021 & 2028 (%)

- Figure 51. Australia Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 52. China Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 53. India Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 54. Japan Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 55. South Korea Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 56. Rest of APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 57. MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 58. MEA Reefer Container for Pharmaceutical Market Breakdown, By Application Type, 2021 & 2028 (%)

- Figure 59. MEA Reefer Container for Pharmaceutical Market Breakdown, By Container Size, 2021 & 2028 (%)

- Figure 60. MEA Reefer Container for Pharmaceutical Market Breakdown, By Country, 2021 & 2028 (%)

- Figure 61. Saudi Arabia Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 62. UAE Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 63. South Africa Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 64. Rest of MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast To 2028 (US$ million)

- Figure 65. SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 66. SAM Reefer Container for Pharmaceutical Market Breakdown, By Application Type, 2021 & 2028 (%)

- Figure 67. SAM Reefer Container for Pharmaceutical Market Breakdown, By Container Size, 2021 & 2028 (%)

- Figure 68. SAM Reefer Container for Pharmaceutical Market Breakdown, by Country, 2021 & 2028 (%)

- Figure 69. Brazil Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 70. Argentina Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 71. Rest of SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- Figure 72. Impact of COVID-19 Pandemic on North American Country Markets

- Figure 73. Impact of COVID-19 Pandemic on European Country Markets

- Figure 74. Impact of COVID-19 Pandemic on APAC Country Markets

- Figure 75. Impact of COVID-19 Pandemic on MEA Country Markets

- Figure 76. Impact of COVID-19 Pandemic on SAM Country Markets

The reefer container for pharmaceutical market is expected to reach US$ 6,391.8 million by 2028 from US$ 2,846.7 million in 2021. It is estimated to grow at a CAGR of 12.5% during 2022-2028.

The growth of the reefer container for pharmaceutical market in North America is primarily attributed to the increasing demand for refrigerated medicines, vaccines, and blood plasma along with the government policies encouraging international trade. According to the Bureau of Economic Analysis, the goods and service exports in the US increased by US$ 394.1 billion or 18.5% and imports surged by US$ 576.5 billion or 20.5% in 2021, compared to 2020. The US is pursuing trade liberalization through negotiations and policies that stimulate economic growth by boosting the transportation of pharmaceutical and other important products. The high-tech reefer containers, generally equipped with cutting-edge devices to monitor temperature variations, are ideal for maintaining optimal conditions for shipping temperature-sensitive products, keeping them undamaged despite external threats until they reach their final destination. These containers are also equipped with sensors to detect small temperature variations and determine if the products are exposed to light, which could trigger alterations in the compositions of certain pharmaceuticals.

The cold chain industry experienced rapid growth in 2020 owing to the COVID-19 pandemic. Rental reefer containers are being preferred over purchased ones for the transportation of pharmaceuticals in most cases. In April 2022, Cardinal Health received a contract worth US$ 57.8 million for the storage and distribution of 80,000 pallets of personal protective equipment (PPE) to support the Strategic National Stockpile (SNS), a part of the Office of the Assistant Secretary for Preparedness and Response within US Department of Health and Human Services (HHS). As per recent studies, based on the examination of 15 reefer trade routes, there was a 50% increase in the third quarter of 2021, while dry container freight rates more than doubled in 2021. Also, in July 2022, FESCO Transportation Group planned to expand its fleet of reefer containers to 4,000 units by the end of summer 2022, under the company's strategy for the development of its Dalreftrans subsidiary. Thus, a surge in the demand for transportation and logistics of pharmaceutical products is fueling the adoption of reefer containers.

In Asia Pacific, the COVID-19 pandemic has significantly impacted healthcare supply chains and cold chain industry due to restrictions on trade. China, India, Singapore, and South Korea are emerging as major destinations for outsourcing drug manufacturing, clinical trials, and pathology testing, which, in turn, propels the need for reefer containers. The growth of the reefer container for pharmaceutical market in Asia Pacific is primarily attributed to the growing demand for biopharmaceuticals and vaccines due to the huge populations of several countries in the region; most of these are temperature-sensitive products, and cold storage facilities are required for their efficient handling. Reefer container manufacturers catering to the pharmaceuticals industry in China include Hapag-Lloyd AG, Tianjin LongTeng International Trade Co., Ltd., and Shanghai Metal Corporation.

The growing initiatives from the European Commission for designing regulations and policies drive the growth of the reefer container for the pharmaceutical market in Europe. The European Union manages its trade and investment relations through a specific policy that aims to provide better trading opportunities to European companies, which further contributes to the high demand for reefer containers for the transportation of pharmaceutical products. In November 2021, the MECOTEC Group, Germany, delivered 8 containers for the deep-freeze storage of COVID-19 Vaccines.

BSL REFRIGERATED CONTAINERS; CMA CGM GROUP; KLINGE CORPORATION; DAIKIN INDUSTRIES, LTD.; MAERSK CONTAINER INDUSTRY AS; EVERGREEN MARINE CORP. (TAIWAN) LTD.; SEACO; TITAN CONTAINERS A/S; COSCO SHIPPING; and W&K CONTAINERS, INC. are among the key players profiled in the reefer container for pharmaceutical market study. The market report provides detailed market insights, which helps the key players strategize the growth in the coming years.

Technologies used in the supply chains of pharmaceuticals industries are evolving with new ways to ensure the safe delivery of medical products to their intended destinations. Cold chain facilities for the pharmaceuticals industry highly rely on control tower technology, packaging automation, artificial intelligence, and other technologies. In recent years, ongoing advancements related to the dissemination of temperature-sensitive pharmaceutical products-ranging from biological therapies to treat rare and chronic diseases; vaccines to treat COVID-19 and other infectious diseases; and novel oncology treatments, and cell and gene (CGT) therapies-have presented more complex cold-chain requirements. Per the latest report by Colliers in August 2022, cold storage capacity in India is likely to reach 40.7 million metric tonnes by 2023, rising by 8.2% from that reported in 2020. Also, as per Jones Lang LaSalle IP, Inc., the cold chain industry globally, is expected to grow at more than 20% CAGR by 2025, which is attributed to the shift from conventional cold storage to modern storage spaces. In August 2022, Maersk Company (MCI) announced a new cold storage facility planned for Ridgeville, South Carolina, to serve temperature-controlled goods, which is expected to begin operations from the first quarter of 2023.

Ongoing developments in reefer containers are contributing to the augmentation of the efficiency and reliability of containers used in the pharmaceuticals industry. The increasing use of Internet of Things (IoT-connected) devices by most of the shipping companies is one of the crucial trends. A huge volume of data is collected and transmitted during the entire transportation process, which can be utilized to derive important insights that may pinpoint issues, mitigate downtime, and streamline procedures, thereby improving operational efficiencies in the maritime industry. In February 2022, CMA CGM introduced its SMART reefer container, which is a connected container for refrigerated goods. With the SMART reefer containers, the position and status of the refrigerated goods can be tracked. Also, in March 2022, ORBCOMM Inc., a global provider of IoT solutions, announced the launch of its CT 3500 IoT telematics device, which features the next evolution in the smart management of refrigerated containers. The ORBCOMM's data-driven refrigerated container solution featured enhanced functionality, connectivity options, and analytics capabilities. Notably, it exhibits interoperability with third-party telematics devices to help shippers and carriers drive efficiencies in reefer container logistics. Thus, smart reefer containers are gaining significant acceptance among the reefer container manufacturers, which is likely to fuel the reefer container for pharmaceutical market growth during the projected period.

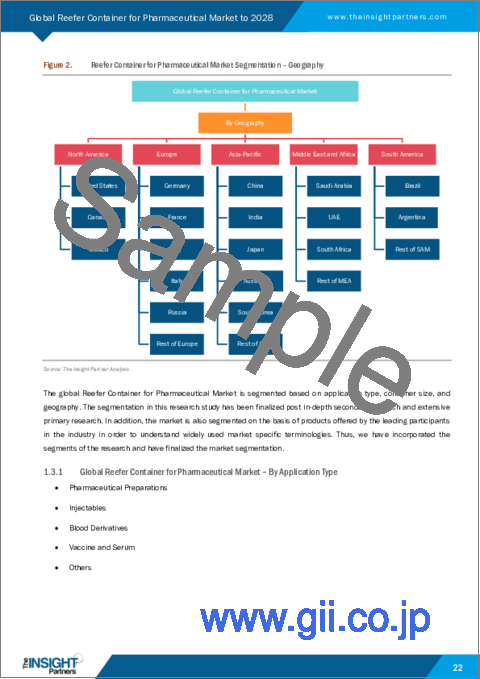

The reefer container for pharmaceutical market is bifurcated on the basis of container size and application. Based on container size, the market is segmented into small containers, medium containers, and large containers. By application, the market is segmented into pharmaceutical preparations, injectables, blood derivatives, vaccine & serum, and others.

The reefer container for pharmaceutical market is segmented into five major regions-North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM). In 2021, Asia Pacific led the market with the largest share, followed by North America. Further, Europe is expected to register the highest CAGR in the market during 2022-2028.

The Reefer Container for Pharmaceutical Market size has been derived using primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information about the market. The process also serves the purpose of obtaining an overview and forecast concerning all the market segments. Also, primary interviews were conducted with industry participants to validate data and gain more analytical insights into the topic. Participants in this process are industry experts such as VPs, business development managers, market intelligence managers, national sales managers, and external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Reefer Container for Pharmaceutical market

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global reefer container for pharmaceutical market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations such as specific regional and segmental insight highlights crucial progressive industry trends in the global reefer container for pharmaceutical market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

- 1.3.1 Global Reefer Container for Pharmaceutical Market - By Application Type

- 1.3.2 Global Reefer Container for Pharmaceutical Market - By Container Size

- 1.3.3 Global Reefer Container for Pharmaceutical Market - By Geography

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Reefer Container for Pharmaceutical Market Landscape

- 4.1 Market Overview

- 4.2 PEST Analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 APAC

- 4.2.4 MEA

- 4.2.5 SAM

- 4.3 Ecosystem Analysis

- 4.4 Expert Opinion

5. Reefer Container for Pharmaceutical Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Preference for Maritime Trade over Airborne Trade

- 5.1.2 Increasing Demand for Pharmaceutical Products Drives the Market Growth

- 5.2 Key Market Restraints

- 5.2.1 Operational and Financial Challenges Associated with Reefer Containers

- 5.3 Key Market Opportunities

- 5.3.1 Developments in cold chain sector present lucrative opportunities

- 5.4 Trends

- 5.4.1 Smart reefer containers gain demand

- 5.5 Impact analysis of Drivers and Restraints

6. Reefer Container for Pharmaceutical Market - Global Market Analysis

- 6.1 Reefer Container for Pharmaceutical Market Global Overview

- 6.2 Global Reefer Container for Pharmaceutical Market Forecast and Analysis

- 6.3 Market Positioning- Top Five Players

7. Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 - Application Type

- 7.1 Overview

- 7.2 Reefer Container for Pharmaceutical Market, By Application Type (2021 And 2028)

- 7.3 Reefer Container for Pharmaceutical Market, By Application Type (2021 And 2028)

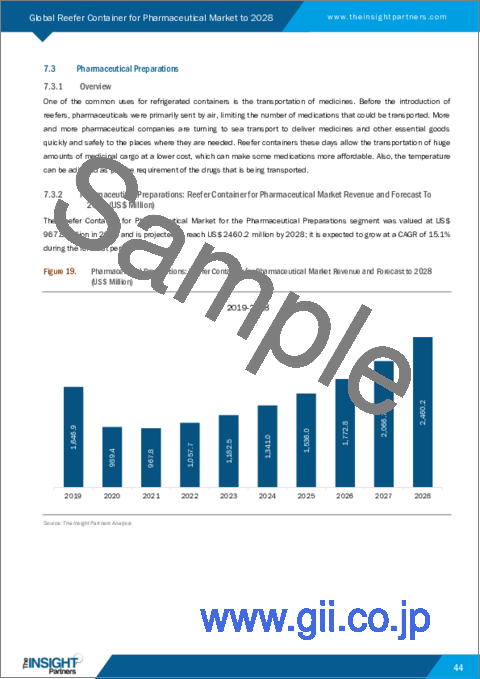

- 7.4 Pharmaceutical Preparations. 41

- 7.4.1 Overview

- 7.4.2 Pharmaceutical Preparations: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 42

- 7.5 Injectables. 43

- 7.5.1 Overview

- 7.5.2 Injectables: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 43

- 7.6 Blood Derivatives. 44

- 7.6.1 Overview

- 7.6.2 Blood Derivatives: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 44

- 7.7 Vaccine and Serum

- 7.7.1 Overview

- 7.7.2 Vaccine and Serum: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 45

- 7.8 Others. 46

- 7.8.1 Overview

- 7.8.2 Others: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 46

8. Global Reefer Container for Pharmaceutical Market Analysis - By Container Size

- 8.1 Overview

- 8.2 Reefer Container for Pharmaceutical Market, By Container Size (2021 And 2028)

- 8.3 Small Containers. 48

- 8.3.1 Overview

- 8.3.2 Small Containers: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 48

- 8.4 Medium Containers. 49

- 8.4.1 Overview

- 8.4.2 Medium Containers: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 49

- 8.5 Large Containers. 50

- 8.5.1 Overview

- 8.5.2 Large Containers: Reefer Container for Pharmaceutical Market Revenue and Forecast To 2028 (US$ Million) 50

9. Reefer Container for Pharmaceutical Market - Geographic Analysis

- 9.1 Overview

- 9.2 North America: Reefer Container for Pharmaceutical

- 9.2.1 North America: Reefer Container for Pharmaceutical - Revenue, and Forecast to 2028 (US$ Million)

- 9.2.2 North America Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.2.3 North America Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.2.4 North America Reefer Container for Pharmaceutical Market Breakdown, by Country

- 9.2.4.1 US Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.2.4.1.1 US Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.2.4.1.2 US Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.2.4.2 Canada Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.2.4.2.1 Canada Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.2.4.2.2 Canada Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.2.4.3 Mexico Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.2.4.3.1 Mexico Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.2.4.3.2 Mexico Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.2.4.1 US Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3 Europe: Reefer Container for Pharmaceutical Market

- 9.3.1 Overview

- 9.3.2 Europe Reefer Container for Pharmaceutical Market Revenue and Forecast to 2028 (US$ million)

- 9.3.3 Europe Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.4 Europe Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5 Europe Reefer Container for Pharmaceutical Market Breakdown, by Country

- 9.3.5.1 Germany Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3.5.1.1 Germany Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.5.1.2 Germany Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5.2 France Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3.5.2.1 France Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.5.2.2 France Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5.3 Italy Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3.5.3.1 Italy Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.5.3.2 Italy Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5.4 UK Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3.5.4.1 UK Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.5.4.2 UK Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5.5 Russia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3.5.5.1 Russia Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.5.5.2 Russia Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5.6 Rest of Europe Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.3.5.6.1 Rest of Europe Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.3.5.6.2 Rest of Europe Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.3.5.1 Germany Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.4 APAC: Reefer Container for Pharmaceutical Market

- 9.4.1 Overview

- 9.4.2 APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.3 APAC Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.4 APAC Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5 APAC Reefer Container for Pharmaceutical Market Breakdown, by Country

- 9.4.5.1 Australia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.5.1.1 Australia Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.5.1.2 Australia Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5.2 China Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.5.2.1 China Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.5.2.2 China Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5.3 India Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.5.3.1 India Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.5.3.2 India Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5.4 Japan Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.5.4.1 Japan Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.5.4.2 Japan Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5.5 South Korea Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.5.5.1 South Korea Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.5.5.2 South Korea Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5.6 Rest of APAC Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.4.5.6.1 Rest of APAC Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.4.5.6.2 Rest of APAC Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.4.5.1 Australia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.5 MEA: Reefer Container for Pharmaceutical Market

- 9.5.1 Overview

- 9.5.2 MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.5.3 MEA Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.5.4 MEA Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.5.5 MEA Reefer Container for Pharmaceutical Market Breakdown, By Country

- 9.5.5.1 Saudi Arabia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.5.5.1.1 Saudi Arabia Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.5.5.1.2 Saudi Arabia Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.5.5.2 UAE Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.5.5.2.1 UAE Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.5.5.2.2 UAE Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.5.5.3 South Africa Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.5.5.3.1 South Africa Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.5.5.3.2 South Africa Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.5.5.4 Rest of MEA Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.5.5.4.1 Rest of MEA Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.5.5.4.2 Rest of MEA Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.5.5.1 Saudi Arabia Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.6 SAM: Reefer Container for Pharmaceutical Market

- 9.6.1 Overview

- 9.6.2 SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028 (US$ million)

- 9.6.3 SAM Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.6.4 SAM Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.6.5 SAM Reefer Container for Pharmaceutical Market Breakdown, by Country

- 9.6.5.1 Brazil Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.6.5.1.1 Brazil Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.6.5.1.2 Brazil Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.6.5.2 Argentina Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.6.5.2.1 Argentina Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.6.5.2.2 Argentina Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.6.5.3 Rest of SAM Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

- 9.6.5.3.1 Rest of SAM Reefer Container for Pharmaceutical Market Breakdown, By Application Type

- 9.6.5.3.2 Rest of SAM Reefer Container for Pharmaceutical Market Breakdown, By Container Size

- 9.6.5.1 Brazil Reefer Container for Pharmaceutical Market, Revenue and Forecast to 2028

10. Impact of COVID-19 Pandemic on Reefer Container for Pharmaceutical Market

- 10.1 Overview

- 10.2 North America: Impact Assessment of COVID-19 Pandemic

- 10.3 Europe: Impact Assessment of COVID-19 Pandemic

- 10.4 APAC: Impact Assessment of COVID-19 Pandemic

- 10.5 MEA: Impact Assessment of COVID-19 Pandemic

- 10.6 SAM: Impact Assessment of COVID-19 Pandemic

11. Industry Landscape

- 11.1 Market Initiative

- 11.2 New Development

12. Company Profiles

- 12.1 BSL REFRIGERATED CONTAINERS

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 CMA CGM GROUP

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 KLINGE CORPORATION.

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 DAIKIN INDUSTRIES, LTD.

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 MAERSK CONTAINER INDUSTRY AS.

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 EVERGREEN MARINE CORP. (TAIWAN) LTD

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 SEACO

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 TITAN CONTAINERS A/S

- 12.8.1 Business Description

- 12.8.2 Products and Services

- 12.8.3 Financial Overview

- 12.8.4 SWOT Analysis

- 12.8.5 Key Developments

- 12.9 COSCO Shipping.

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 W&K CONTAINERS, INC

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Word Index