|

市場調査レポート

商品コード

1498832

誘電体前駆体の世界市場(重要材料):2024~2025年 (Critical Materials Report)Dielectric Precursors Market Report 2024-2025 (Critical Materials Report) |

||||||

|

|||||||

| 誘電体前駆体の世界市場(重要材料):2024~2025年 (Critical Materials Report) |

|

出版日: 2024年06月01日

発行: TECHCET

ページ情報: 英文 134 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

概要

当レポートでは、半導体デバイス製造に使用される前駆体の市場動向とサプライチェーンを網羅しています。主要サプライヤーの情報、材料サプライチェーンの課題と動向、サプライヤーの市場シェアの推計・予測、材料セグメントの予測などを掲載しています。

サンプルビュー

目次

第1章 エグゼクティブサマリー

第2章 調査範囲・目的・手法

第3章 半導体産業:市場の現状と展望

- 世界経済と見通し

- 半導体産業と世界経済のつながり

- 半導体売上高の成長

- 台湾のアウトソーシングメーカーの月間売上動向

- チップ売上高:電子製品のセグメント別

- エレクトロニクスの展望

- 自動車産業の展望

- スマートフォンの展望

- PCの展望

- サーバー/IT市場

- 半導体製造の成長と拡大

- チップ拡張への巨額投資の真っ只中

- 米国の新しい工場

- 世界各地での製造工場拡大が成長を牽引

- 設備投資の動向

- 高度ロジック技術のロードマップ

- 製造工場への投資の評価

- 政策・貿易の動向と影響

- 半導体材料の概要

- ウエハー投入枚数の予測 (~2028年)

- 材料市場の予測 (~2028年)

第4章 材料市場の動向

- CVD・ALD・金属:High-Kおよび先進誘電体前駆体の市場動向

- 2023年の前駆体市場:2024年へのつながり

- 先駆的市場の展望

- 誘電体前駆体の出荷量の予測:セグメント別 (今後5年間分)

- 上位サプライヤーの誘電体の生産量

- 誘電体の生産量:地域別

- ALD/CVD材料の生産能力の拡大

- 投資発表の概要

- 価格動向

- 技術動向/技術促進要因- 概要

- 前駆体の全般的な技術概要:技術動向

- 顧客主導型テクノロジー

- NANDのロードマップと課題:スタック/ティア付き3D NANDレベル

- 3D NANDプロセスの進歩が必要

- Micronが画期的なNVDRAMを発表:DRAMに匹敵する性能を持つ、デュアルレイヤー32ギガビット不揮発性強誘電体メモリ

- 高度ロジックのロードマップと課題:ロジックトランジスタEST.ロードマップ

- 高度ロジック (ファウンドリ) ノードHVMの見積

- 高度ロジック:将来の技術的課題

- フォトリソグラフィーにおける技術進歩の影響

- CFETアーキテクチャ:CFETスケーリングの利点

- 無機EUVレジスト:スピンオンデポジション

- SADP (セルフアラインマルチパターニング)

- EUV・マルチパターニング・地政学

- エリア選択沈着 (ASD)

- 特殊/新興誘電体と活用領域

- 地域的な考慮事項:誘電体

- 地域的側面と促進要因

- EHSと貿易/物流の問題 - 金属、High-K、誘電体

- 誘電体市場動向に関するアナリストの評価

第5章 供給サイドの市場情勢

- 前駆体材料の市場シェア

- 現在の四半期の活動 - MERCK

- 現在の四半期の活動 - AIR LIQUIDE

- 現在の四半期の活動 - ENTEGRIS

- ADEKA

- M&A活動とパートナーシップ

- 工場閉鎖

- 新規参入企業

- MSPがTURBO II (TM) 気化器を発売:半導体製造の次世代効率

- 製造中止の恐れがあるサプライヤーまたは部品/製品ライン

- アナリストによる先行サプライヤーの評価

第6章 サブティア (下層) サプライチェーン・前駆体

- サブティアサプライチェーン:供給元と市場の概要

- サブティアサプライチェーン:供給元と市場概要 - ティア 2の事例 (NOURYON・GELEST)

- サブティアサプライチェーン:供給元と市場概要 - 化学物質・ガス管理システム

- サブティアサプライチェーン:供給元と市場概要 - 化学物質配送キャビネット

- サブティアサプライチェーン:供給元と市場概要 - バルブマニホールドボックス (VMB)

- サブティアサプライチェーン:供給元と市場概要 - バルクスペックガスシステム

- サブティアサプライチェーン:供給元と市場概要 - ガスキャビネット

- サブティアサプライチェーン:供給元と市場概要 - フォーミングガス・ドーパントガスのブレンダー

- サブティアサプライチェーン:供給元と市場概要 - 化学物質の監視・分析システム

- サブティア材料:CVD-ALD前駆体の動向

- サブティア材料:工業用 vs 半導体グレード

- 半導体グレードのサブティア材料サプライヤーの国際的ネットワーク:Merck

- 半導体グレードのサブティア材料サプライヤーの国際的ネットワーク:Air Liquide

- 半導体グレードのサブティア材料サプライヤーの最新情報

- サブティアサプライチェーンの破壊者

- サブティアサプライチェーンT:アナリストの評価

第7章 サプライヤープロファイル

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- その他20社以上

図表

LIST OF FIGURES

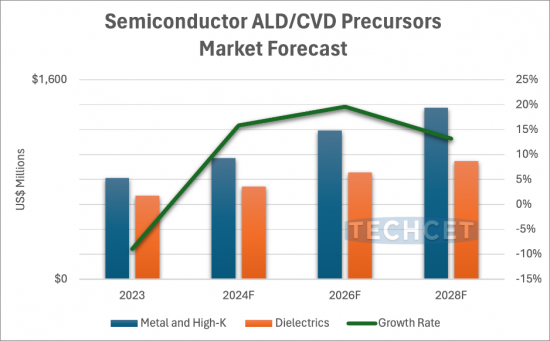

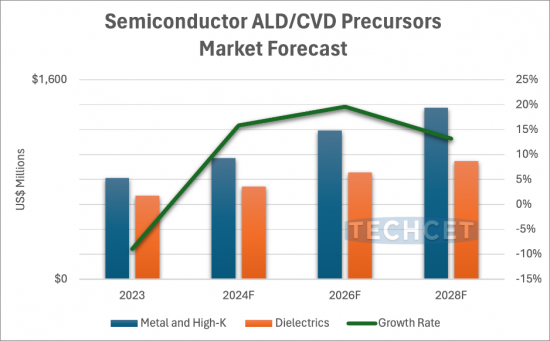

- FIGURE 1.1: DIELECTRIC PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 1.2: WW MARKET SHARE - DIELECTRIC PRECURSORS 2023

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: DIELECTRIC PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 4.2: WW MARKET SHARE - DIELECTRIC PRECURSORS 2023

- FIGURE 4.3: DIELECTRIC PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- FIGURE 4.4: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 4.5: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 4.6: 3D NAND PROGRESSION

- FIGURE 4.7: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 4.8: GATE STRUCTURE ROADMAP

- FIGURE 4.9: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 4.10: RIBBON FET

- FIGURE 4.11: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 4.12: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 4.13: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 4.14: DIRECTED SELF-ASSEMBLY

- FIGURE 4.15: DSA PATENT FILING BY COMPANY

- FIGURE 4.16: DSA PATEN FILING SINCE 2023

- FIGURE 4.17: WHAT IS PATTERN SHAPING?

- FIGURE 4.18: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 4.19: COMPLEMENTARY FET (CFET)

- FIGURE 4.20: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 4.21: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 4.22: MCFET NEW FEATURE: MIDDLE DIELECTRIC ISOLATION

- FIGURE 4.23: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 4.24: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 4.25: BSPDN ADVANTAGE: IR DROP REDUCTION

- FIGURE 4.26: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 4.27: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 4.28: INPRIA EUV MOR

- FIGURE 4.29: INPRIA SPIN ON INORGANIC RESIST IS MUCH THINNER THAN STANDARD STACKS OF PHOTO RESIST

- FIGURE 4.30: PATENT FILING FOR MLD DEPOSITED EUV RESIST SEARCH PERFORMED IN PATBASE

- FIGURE 4.31: SADP PROCESS FLOW USING ALD SPACER

- FIGURE 4.32: ONE OF MANY FLAVORS OF SAQP PROCESS FLOW

- FIGURE 4.33: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 4.34: SPECIALTY/EMERGING DIELECTRIC APPLICATIONS FOR HETEROGENOUS INTEGRATIONS (APPLIED MATERIALS)

- FIGURE 4.35: 2023 DIELECTRIC REVENUE SHARE BY REGION

- FIGURE 5.1: 2023 PRECURSOR MATERIAL SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.2: MERCK ELECTRONICS REVENUE 2022-2023 (M EUR), LEFT - SEMICONDUCTOR SOLUTIONS ANNUAL REVENUE FORECAST (M EUR), RIGHT

- FIGURE 5.3: AIR LIQUIDE ELECTRONICS REVENUE FORECAST (M EUR)

- FIGURE 5.4: THE MS (MATERIAL SOLUTIONS) DIVISION OF ENTEGRIS REVENUE FORECAST

- FIGURE 5.5: ADEKA REVENUE ELECTRONICS REVENUE FORECAST (100M JPY)

- FIGURE 6.1: FORMING GAS BLENDER CONFIGURATION

- FIGURE 6.2: TOP COUNTRIES/REGIONS THAT SUPPLY VERSUM MATERIALS US LLC (PANJIVA APRIL 2024)

- FIGURE 6.3: TOP COUNTRIES/REGIONS THAT SUPPLY AIR LIQUIDE AMERICA CORP. (PANJEIVA APRIL 2024)

- FIGURE 6.4: TOP COUNTRIES/REGIONS THAT SUPPLY H.C. STARCK INC. (USA)

LIST OF TABLES

- TABLE 1.1: DIELECTRIC PRECURSOR REVENUES AND GROWTH RATES

- TABLE 1.2: ESTIMATED DIELECTRIC PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: PRECURSORS REVENUE AND GROWTH RATES

- TABLE 4.2: DIELECTRIC PRECURSOR REVENUES AND GROWTH RATES

- TABLE 4.3: ESTIMATED DIELECTRIC PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 4.4: DIELECTRIC PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- TABLE 4.5: OVERVIEW OF ANNOUNCED 2023/2024 MATERIAL SUPPLIER INVESTMENTS

- TABLE 4.6: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 4.7: MULTIPATTERNING AT 7NM BY TSMC

- TABLE 4.8: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS

- TABLE 4.9: REGIONAL PRECURSOR MATERIAL MARKETS

- TABLE 4.10: REGIONAL PRECURSOR MATERIAL MARKETS, CONTINUED

- TABLE 5.1: MERCK QUARTER FINANCIALS

- TABLE 5.2: AIR LIQUIDE CURRENT QUARTER FINANCIALS

- TABLE 5.3: ENTEGRIS SUPPLIER CURRENT QUARTER FINANCIALS

- TABLE 6.1: CVD AND ALD PRECURSOR

目次

This report covers the market landscape and supply-chain for Precursors used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

Table of Contents

1 Executive Summary

- 1.1 PRECURSORS BUSINESS - MARKET OVERVIEW

- 1.2 PRECURSORS MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT: DIELECTRIC PRECURSORS

- 1.4 PRECURSOR TRENDS

- 1.5 PRECURSOR TECHNOLOGY TRENDS

- 1.6 COMPETITIVE LANDSCAPE DIELECTRIC PRECURSORS

- 1.7 ANALYST ASSESSMENT OF DIELECTRIC PRECURSORS

2 Scope, Purpose, and Methodology

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 Semiconductor Industry Market Status & Outlook

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH - EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 Material Market Trends

- 4.1 CVD, ALD METAL - HIGH-K AND ADVANCED DIELECTRIC PRECURSORS MARKET TRENDS

- 4.1.1 2023 PRECURSOR MARKET LEADING INTO 2024

- 4.1.2 PRECURSOR MARKET OUTLOOK

- 4.1.3 DIELECTRIC PRECURSORS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.1.4 DIELECTRIC PRODUCTION OF TOP SUPPLIERS

- 4.1.5 DIELECTRIC PRODUCTION BY REGION

- 4.1.6 ALD/CVD MATERIAL PRODUCTION CAPACITY EXPANSIONS

- 4.1.7 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2 PRICING TRENDS

- 4.3 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.3.1 PRECURSOR GENERAL TECHNOLOGY OVERVIEW - TECHNOLOGY TRENDS

- 4.3.2 CUSTOMER DRIVEN TECHNOLOGIES

- 4.3.3 NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 4.3.4 3D NAND PROCESS ADVANCES REQUIRED

- 4.3.5 MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILEFERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 4.3.6 ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 4.3.7 ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 4.3.7.1 THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 4.3.8 ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 4.3.9 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 4.3.9.1 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 4.3.9.2 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 4.3.9.3 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 4.3.10 CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 4.3.10.1 CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 4.3.10.2 CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 4.3.11 INORGANIC EUV RESIST - SPIN ON DEPOSITION

- 4.3.11.1 INORGANIC EUV RESIST - ALD DEPOSITED

- 4.3.12 SELF ALIGNED MULTI PATTERNING - SADP

- 4.3.12.1 SELF ALIGNED MULTI PATTERNING - SAQP

- 4.3.12.2 SELF ALIGNED MULTI PATTERNING - PEALD EQUIPMENT

- 4.3.12.3 SELF ALIGNED MULTI PATTERNING - CAN SAQP BYPASS EUV BEYOND 7 NM?

- 4.3.13 EUV, MULTI PATTERNING AND GEOPOLITICS

- 4.3.14 AREA SELECTIVE DEPOSITION (ASD)

- 4.3.14.1 AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 4.3.15 SPECIALTY/EMERGING DIELECTRIC AND APPLICATIONS

- 4.3.16 REGIONAL CONSIDERATIONS - DIELECTRICS

- 4.3.17 REGIONAL ASPECTS AND DRIVERS

- 4.4 EHS AND TRADE/LOGISTIC ISSUES - METALS, HIGH-K AND DIELECTRICS

- 4.5 ANALYST ASSESSMENT OF DIELECTRIC MARKET TRENDS

5 Supply-Side Market Landscape

- 5.1 PRECURSOR MATERIAL MARKET SHARE

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.1.1.1 MERCK

- 5.1.2 CURRENT QUARTER ACTIVITY - AIR LIQUIDE

- 5.1.2.1 AIR LIQUIDE

- 5.1.3 CURRENT QUARTER ACTIVITY -ENTEGRIS

- 5.1.3.1 ENTEGRIS

- 5.1.4 ADEKA

- 5.1.4.1 ADEKA

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.2 M-A ACTIVITY AND PARTNERSHIPS

- 5.3 PLANT CLOSURES

- 5.4 NEW ENTRANTS

- 5.4.1 MSP LAUNCHES TURBO II(TM) VAPORIZERS: NEXT-GEN EFFICIENCY FOR SEMICONDUCTOR FABRICATION

- 5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 Sub Tier Supply Chain, Precursors

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - TIER 2 EXAMPLES NOURYON AND GELEST

- 6.1.2 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL & GAS MANAGEMENT SYSTEMS

- 6.1.3 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL DELIVERY CABINETS

- 6.1.4 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - VALVE MANIFOLD BOXES (VMB)

- 6.1.5 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - BULK SPEC GAS SYSTEMS

- 6.1.6 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - GAS CABINETS

- 6.1.7 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - FORMING GAS & DOPANT GAS BLENDERS

- 6.1.8 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW CHEMICAL - MONITORING AND ANALYTICAL SYSTEMS

- 6.2 SUB-TIER MATERIAL CVD - ALD PRECURSOR TRENDS

- 6.3 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR-GRADE

- 6.4 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK MERCK

- 6.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK AIR LIQUIDE

- 6.6 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.7 SUB-TIER SUPPLY-CHAIN DISRUPTORS

- 6.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 Supplier profiles

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- ...and 20+ more