|

|

市場調査レポート

商品コード

1849293

光ファイバーの世界市場レポート 2025年Fiber Optics Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 光ファイバーの世界市場レポート 2025年 |

|

出版日: 2025年09月12日

発行: The Business Research Company

ページ情報: 英文 250 Pages

納期: 2~10営業日

|

概要

光ファイバー市場規模は近年力強く成長しています。2024年の79億3,000万米ドルから2025年には86億4,000万米ドルへと、CAGR8.9%で拡大します。実績期間の成長は、エネルギー効率、人口の集中、家庭への光ファイバー供給、インターネットの成長、オンライン取引の増加に起因しています。

光ファイバー市場規模は、今後数年間で力強い成長が見込まれます。2029年の年間平均成長率(CAGR)は9.0%で、122億1,000万米ドルに成長します。予測期間の成長は、光ファイバ部品のコスト削減、バイオメディカルアプリケーションでの光ファイバーの使用、宇宙探査や衛星通信への関心の高まり、オンライン教育や遠隔学習の継続的な成長に起因しています。予測期間における主な動向としては、環境に優しい技術への注目、電気自動車の拡大、遠隔医療、産業オートメーション、デジタルツインをサポートする光ファイバーなどがあります。

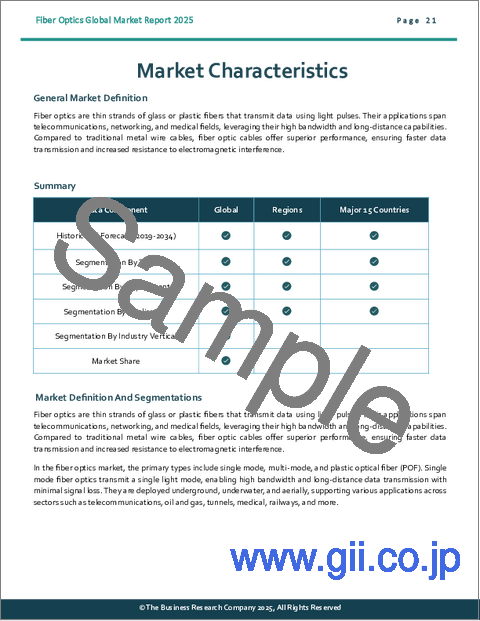

光ファイバーは、光パルスを使ってデータを伝送するガラスやプラスチックの細いファイバーです。高帯域幅と長距離伝送が可能であることから、通信、ネットワーク、医療などの分野で利用されています。光ファイバー・ケーブルは、従来の金属ワイヤー・ケーブルと比較して、より高速なデータ伝送と電磁干渉への耐性を備えた優れた性能を備えています。

光ファイバー市場では、主にシングルモード、マルチモード、プラスチック光ファイバー(POF)などがあります。シングルモードの光ファイバーは、単一の光モードを伝送するため、信号損失を最小限に抑え、高帯域幅で長距離のデータ伝送が可能です。通信、石油・ガス、トンネル、医療、鉄道など、さまざまな分野の地下、水中、空中に敷設され、さまざまなアプリケーションを支えています。

2025年春の米国関税の急上昇とそれに伴う貿易摩擦は、情報技術分野、特にハードウェア製造、データインフラ、ソフトウェア展開に大きな影響を及ぼしています。輸入半導体、回路基板、ネットワーク機器に対する関税の引き上げは、ハイテク企業、クラウド・サービス・プロバイダー、データセンターの生産・運営コストを押し上げています。ノートパソコン、サーバー、家電製品をグローバルに調達している企業は、リードタイムの延長と価格圧力に直面しています。同時に、特殊なソフトウェアに対する関税と主要国際市場の報復措置により、グローバルなITサプライチェーンが混乱し、米国製テクノロジーに対する海外からの需要が減退しています。これに対応するため、このセクターは国内チップ生産への投資を強化し、サプライヤー・ネットワークを拡大し、AIを活用した自動化によって回復力を高め、コスト管理を効率化しています。

光ファイバー市場調査レポートは、光ファイバー産業の世界市場規模、地域シェア、光ファイバー市場シェアを持つ競合企業、詳細な光ファイバー市場セグメント、市場動向、機会など、光ファイバー市場統計を提供し、光ファイバー産業で成功するために必要なデータを提供するビジネスリサーチ会社の最新レポートシリーズです。これらの光ファイバー市場調査レポートは、業界の現在と将来のシナリオを詳細に分析し、必要とされるあらゆるもの完全な展望をお届けします。

今後5年間の成長率9.0%という予測は、前回予測から0.1%の微減を反映しています。この減少は主に米国と他国との間の関税の影響によるものです。関税の賦課により、光ファイバーケーブル材料、特にアジアの主要サプライヤーから輸入される石英ガラス製プリフォームや光ファイバーのコストが上昇し、ブロードバンド拡張のプロジェクト・コストが増加する可能性が高いです。また、相互関税や、貿易の緊張と制限の高まりによる世界経済と貿易への悪影響により、その影響はより広範囲に及ぶと思われます。

光ファイバー市場は、広帯域通信に対する需要の高まりによって成長する態勢にあります。この需要とは、効率的な情報交換を促進し、ネットワーク上で大容量のデータを迅速に伝送することを指します。光ファイバーは、ガラスやプラスチック製の細いファイバーを通して光パルスとしてデータを伝送することで広帯域通信を実現し、信号損失を最小限に抑えた長距離伝送を可能にします。例えば、2023年1月現在、英国の72%の世帯がギガビット対応ブロードバンドにアクセスしており、2022年の64%、2021年の36%から増加しています。

光ファイバー市場の大手企業は、超低損失(ULL)海底光ファイバーでネットワークの信頼性と性能を高める技術革新を進めています。これらの先進的なファイバーは、広大な海洋距離にわたる海底通信システム用に調整されています。住友電工が2023年10月に発売した「2C Z-PLUS Fiber ULL」は、標準的な1芯ファイバーと同じ外径の2芯を採用し、伝送容量を2倍に高めました。1550 nmでの伝送損失は0.158 dB/kmで、コア間のクロストークが少ないため、海底ネットワークシステムに最適で、地域や大洋横断のアプリケーションをサポートします。

2023年7月、米国を拠点とする通信製品製造の専門会社であるテンポ・コミュニケーションズは、キングフィッシャー・インターナショナルを非公開の金額で買収しました。この買収は、テンポ・コミュニケーションズの製品ラインナップを強化し、光ファイバー・ネットワークの敷設、試験、測定のための最先端ソリューションを顧客に幅広く提供することを目的としています。オーストラリアに本社を置くキングフィッシャーインターナショナルは、光ファイバーシステムの試験・測定用機器の製造における専門知識で知られています。

光ファイバー市場は、光ファイバーケーブル、コネクター、トランシーバー、アンプ、スプリッター、エンクロージャーの売上で構成されています。この市場の価値は「ファクトリーゲート」の価値であり、他の事業体(川下の製造業者、卸売業者、流通業者、小売業者を含む)であれ、直接最終顧客であれ、商品の製造業者または製造者によって販売された商品の価値です。この市場における商品の価値には、商品の作り手によって販売される関連サービスも含まれます。

よくあるご質問

目次

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場:金利、インフレ、地政学、貿易戦争と関税、そしてコロナ禍と回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界の光ファイバー:PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界の光ファイバー市場:成長率分析

- 世界の光ファイバー市場の実績:規模と成長, 2019-2024

- 世界の光ファイバー市場の予測:規模と成長, 2024-2029, 2034F

- 世界の光ファイバー:総潜在市場規模(TAM)

第6章 市場セグメンテーション

- 世界の光ファイバー市場:タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- シングルモード

- マルチモード

- プラスチック光ファイバー(POF)

- 世界の光ファイバー市場:展開別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 地下

- 水中

- 空中

- 世界の光ファイバー市場:用途別、実績と予測, 2019-2024, 2024-2029F, 2034F

- コミュニケーション

- 非コミュニケーション

- 世界の光ファイバー市場:業界別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 通信

- 石油とガス

- トンネル

- 医学

- 鉄道

- その他の業種

- 世界の光ファイバー市場:サブセグメンテーション シングルモード、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- OS1(光シングルモード1)

- OS2(光シングルモード2)

- G.652ファイバー

- G.657ファイバー

- 世界の光ファイバー市場:サブセグメンテーション マルチモード、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- OM1(光マルチモード1)

- OM2(光マルチモード2)

- OM3(光マルチモード3)

- OM4(光マルチモード4)

- OM5(光マルチモード5)

- 世界の光ファイバー市場:サブセグメンテーション プラスチック光ファイバー(POF)、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- ステップインデックスPOF

- グレーデッドインデックスPOF

- パーフルオロPOF

第7章 地域別・国別分析

- 世界の光ファイバー市場:地域別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 世界の光ファイバー市場:国別、実績と予測, 2019-2024, 2024-2029F, 2034F

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- 光ファイバー市場:競合情勢

- 光ファイバー市場:企業プロファイル

- 3M Company Overview, Products and Services, Strategy and Financial Analysis

- Sumitomo Electric Industries Ltd. Overview, Products and Services, Strategy and Financial Analysis

- Prysmian S.p.A. Overview, Products and Services, Strategy and Financial Analysis

- TE Connectivity Ltd. Overview, Products and Services, Strategy and Financial Analysis

- Corning Incorporated Overview, Products and Services, Strategy and Financial Analysis

第31章 その他の大手企業と革新的企業

- Molex LLC

- Amphenol Corporation

- Yangtze Optical Fibre and Cable Joint Stock Limited Company(YOFC)

- Nexans S.A.

- Furukawa Electric Co. Ltd.

- CommScope Holding Company Inc.

- Fujikura Ltd.

- FiberHome Technologies Group

- RS Components Pte Ltd

- Lumentum Holdings Inc.

- Infinera Corporation

- Viavi Solutions Inc.

- Hirose Electric Co. Ltd.

- Sterlite Technologies Limited

- Glenair Inc.

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、セグメント、戦略

- 光ファイバー市場2029:新たな機会を提供する国

- 光ファイバー市場2029:新たな機会を提供するセグメント

- 光ファイバー市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略