|

|

市場調査レポート

商品コード

1702840

自動車エンジニアリングサービスプロバイダーの世界市場レポート 2025年Automotive Engineering Service Provider Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 自動車エンジニアリングサービスプロバイダーの世界市場レポート 2025年 |

|

出版日: 2025年04月01日

発行: The Business Research Company

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

全表示

- 概要

- 目次

自動車エンジニアリングサービスプロバイダー市場規模は、今後数年間で力強い成長が見込まれます。2029年にはCAGR8.2%で2,408億米ドルに成長します。予測期間の成長は、排ガス規制と安全規制の強化、効率性とリーン生産方式の重視、インダストリー4.0の原則の採用、環境への影響に対する意識の高まり、電気自動車の台頭などに起因すると考えられます。予測期間における主な動向としては、技術の進歩、IoTやAIなどのデジタル技術の統合、軽量素材の開発、自動運転車の開発、3Dプリンティングの採用などが挙げられます。

ADAS(先進運転支援システム)の需要の増加は、自動車エンジニアリングサービスプロバイダー市場の成長を促進すると予想されます。ADAS技術は、センサーやカメラなどの自動化システムを利用して、ドライバーの安全運転、障害物やエラーの検知、適切な対応を支援します。この需要は、安全機能強化のための規制要件、事故防止技術に対する消費者の関心、自律走行機能を促進するADASの可能性によってもたらされます。自動車エンジニアリング・サービス・プロバイダーは、自動車の安全性と自動化を強化するための専門知識と技術的ソリューションを提供することで、ADASの開発において重要な役割を果たしています。例えば、Highway Loss Data Instituteによると、2026年までにリアカメラとリアパーキングセンサーはそれぞれ登録車の71%と60%に搭載されると予測されています。ほとんどの安全装備は大幅な普及拡大が見込まれており、前部自動緊急ブレーキ(AEB)は、2022年までにAEBを搭載するよう車両に義務付ける自主的な合意もあって、2021年の18%から2026年には43%に上昇すると予測されています。このように、ADASに対する需要の高まりが自動車エンジニアリングサービスプロバイダー市場の成長を後押ししています。

自動車エンジニアリングサービスプロバイダー市場の主要企業は、顧客により良いサービスを提供するため、コネクテッド・サービス技術の進歩に注力しています。コネクテッドサービス技術により、車両はインターネットやクラウドベースのサービスに接続できるようになり、モバイルアプリやデジタルプラットフォームを介して、遠隔監視、制御、車両データや機能へのアクセスが容易になります。例えば、2024年6月、タタ・エルクシーはレッドハット社と提携し、5Gコネクテッドカー向けのマルチクラウドネットワークにおけるアプリケーションモビリティを促進しました。この提携は、TETHERと名付けられたタタ・エルクシーのコネクテッド・ビークル・プラットフォーム(CVP)とレッドハットの車載OSを使って、5Gコネクテッド・ビークルのアプリケーションを加速させることを目的としています。マルチクラウド環境にまたがる統合コンテナ・アズ・ア・サービス(CaaS)レイヤーとしてのRed Hat OpenShiftと、クラウドの自動化と5Gアプリケーションの近代化のためのTata ElxsiのNeuronプラットフォームを活用することで、このパートナーシップは、通信事業者とモバイル仮想ネットワーク事業者(MVNO)がネットワークを効果的に収益化できるようにすることを目指しています。

目次

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場- 金利、インフレ、地政学、新型コロナウイルス感染症、そして景気回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界自動車エンジニアリングサービスプロバイダーPESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界の自動車エンジニアリングサービスプロバイダー市場:成長率分析

- 世界の自動車エンジニアリングサービスプロバイダー市場の実績:規模と成長, 2019-2024

- 世界の自動車エンジニアリングサービスプロバイダー市場の予測:規模と成長, 2024-2029, 2034F

- 世界自動車エンジニアリングサービスプロバイダー総アドレス可能市場(TAM)

第6章 市場セグメンテーション

- 世界の自動車エンジニアリングサービスプロバイダー市場:サービス別、実績と予測, 2019-2024, 2024-2029F, 2034F

- エンジン

- シャーシ

- トランスミッション

- 車とホワイトボディ(BIW)

- 座席システム

- 冷房、暖房、換気、空調(HVAC)

- 内装と外装のトリム

- その他のサービス

- 世界の自動車エンジニアリングサービスプロバイダー市場モジュールタイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- インテリジェントパワーモジュール(IPM)

- 電源統合モジュール(PIM)

- 世界の自動車エンジニアリングサービスプロバイダー市場:車両タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 乗用車

- 商用車

- 二輪車

- 世界の自動車エンジニアリングサービスプロバイダー市場:用途別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 機械

- 電気・電子工学

- ソフトウェア

- 安全性

- 世界の自動車エンジニアリングサービスプロバイダー市場:エンドユーザー別、実績と予測, 2019-2024, 2024-2029F, 2034F

- オリジナル機器メーカー(OEM)

- 自動車部品サプライヤー

- その他のエンドユーザー

- 世界の自動車エンジニアリングサービスプロバイダー市場、エンジンのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- エンジン設計と開発

- エンジンテストとキャリブレーション

- エンジンパフォーマンスの最適化

- 世界の自動車エンジニアリングサービスプロバイダー市場、シャーシのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- シャーシ設計開発

- シャーシのテストと検証

- サスペンションおよびステアリングシステムエンジニアリング

- 世界の自動車エンジニアリングサービスプロバイダー市場、トランスミッションのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- トランスミッション設計・開発

- トランスミッションテストとキャリブレーション

- トランスミッション効率の最適化

- 世界の自動車エンジニアリングサービスプロバイダー市場、車とホワイトボディ(BIW)のサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- BIW設計とプロトタイピング

- BIW製造プロセス最適化

- BIWテストと検証

- 世界の自動車エンジニアリングサービスプロバイダー市場、座席システムのタイプ別サブセグメンテーション、実績と予測, 2019-2024, 2024-2029F, 2034F

- 座席の設計と開発

- 座席の安全性と快適性のテスト

- シートベルトとエアバッグの統合

- 世界の自動車エンジニアリングサービスプロバイダー市場、冷房と暖房、換気、空調(HVAC)のサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- HVACシステムの設計と開発

- 熱管理テストと最適化

- HVACシステムの統合と性能評価

- 世界の自動車エンジニアリングサービスプロバイダー市場、内外装トリムのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- インテリアデザインと開発

- 外装デザインと開発

- 材料と仕上げの最適化

- 世界の自動車エンジニアリングサービスプロバイダー市場その他のサービスのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 車両軽量化エンジニアリング

- 自動運転車エンジニアリング

- 電気自動車(EV)システムの統合と設計

第7章 地域別・国別分析

- 世界の自動車エンジニアリングサービスプロバイダー市場:地域別、実績と予測, 2019-2024, 2024-2029F, 2034F

- 世界の自動車エンジニアリングサービスプロバイダー市場:国別、実績と予測, 2019-2024, 2024-2029F, 2034F

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- 自動車エンジニアリングサービスプロバイダー市場:競合情勢

- 自動車エンジニアリングサービスプロバイダー市場:企業プロファイル

- Robert Bosch GmbH Overview, Products and Services, Strategy and Financial Analysis

- Magna International Inc. Overview, Products and Services, Strategy and Financial Analysis

- Capgemini Technology Services Limited Overview, Products and Services, Strategy and Financial Analysis

- HCL Technologies Limited Overview, Products and Services, Strategy and Financial Analysis

- Harman International Industries Inc. Overview, Products and Services, Strategy and Financial Analysis

第31章 その他の大手企業と革新的企業

- Tech Mahindra Limited

- Alten Group

- Intertek Group plc

- AVL LIST GmbH

- FEV GmbH

- HORIBA Ltd.

- Bertrandt AG

- ARRK Product Development Group

- EDAG Engineering GmbH

- IAV GmBH

- Altair Engineering Inc.

- Ricardo Plc

- Semcon

- Continental Engineering Services Ltd.

- P3 Automotive GmbH

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、セグメント、戦略

- 自動車エンジニアリングサービスプロバイダー市場2029:新たな機会を提供する国

- 自動車エンジニアリングサービスプロバイダー市場2029:新たな機会を提供するセグメント

- 自動車エンジニアリングサービスプロバイダー市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第36章 付録

Automotive engineering service providers are companies that offer comprehensive services across powertrain development, vehicle safety, emissions testing, and more to support original equipment manufacturers (OEMs) and component manufacturers in conceptualizing, designing, and producing advanced vehicles. These service providers play a crucial role in driving innovation, optimizing costs, and ensuring regulatory compliance within the automotive industry.

The main service types offered by automotive engineering service providers include engine development, chassis design, transmission systems, car and body in white (BIW) development, seating systems, cooling and heating systems, ventilation and air conditioning (HVAC), interior and exterior trims, and others. Engines are machines designed to convert various forms of energy into mechanical energy. They include modules such as intelligent power modules (IPM) and power integrated modules (PIM). These services cater to a range of vehicle types, including passenger cars, commercial vehicles, and two-wheelers, and cover applications in mechanical, electrical, electronics, software, and safety domains. They are utilized by various end-users such as OEMs and automotive component suppliers.

The automotive engineering service provider market research report is one of a series of new reports from The Business Research Company that provides automotive engineering service provider market statistics, including automotive engineering service provider industry global market size, regional shares, competitors with a automotive engineering service provider market share, detailed automotive engineering service provider market segments, market trends and opportunities, and any further data you may need to thrive in the automotive engineering service provider industry. This automotive engineering service provider market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The automotive engineering service provider market size has grown strongly in recent years. It will grow from $162.22 billion in 2024 to $175.96 billion in 2025 at a compound annual growth rate (CAGR) of 8.5%. The growth in the historic period can be attributed to the expansion of automotive markets, globalization of industries, changing consumer preferences towards sustainability, growth of urban areas, and growing emphasis on vehicle safety features.

The automotive engineering service provider market size is expected to see strong growth in the next few years. It will grow to $240.8 billion in 2029 at a compound annual growth rate (CAGR) of 8.2%. The growth in the forecast period can be attributed to stricter emission norms and safety regulations, focus on efficiency and lean manufacturing practices, adoption of industry 4.0 principles, increasing awareness of environmental impact, and rise of electric vehicles. Major trends in the forecast period include technological advancements, integration of digital technologies like IoT and AI, development of lightweight materials, development of self-driving cars, and adoption of 3D printing.

The increasing demand for advanced driver assistance systems (ADAS) is expected to fuel growth in the automotive engineering service provider market. ADAS technologies utilize automated systems such as sensors and cameras to assist drivers in operating vehicles safely, detecting obstacles and errors, and responding accordingly. This demand is driven by regulatory requirements for enhanced safety features, consumer interest in accident-prevention technologies, and the potential of ADAS to facilitate autonomous driving capabilities. Automotive engineering service providers play a crucial role in developing ADAS by offering specialized expertise and technological solutions to enhance vehicle safety and automation. For example, by 2026, rear cameras and rear parking sensors are projected to be installed on 71% and 60% of registered vehicles, respectively, according to the Highway Loss Data Institute. Most safety features are expected to see significant adoption increases, with front automatic emergency braking (AEB) forecasted to rise from 18% in 2021 to 43% in 2026, driven in part by voluntary agreements to equip vehicles with AEB by 2022. Thus, the growing demand for ADAS is propelling growth in the automotive engineering service provider market.

Major companies in the automotive engineering service provider market are concentrating on advancing connected service technology to better serve their customers. Connected service technology enables vehicles to connect to the internet and cloud-based services, facilitating remote monitoring, control, and access to vehicle data and functions via mobile apps and digital platforms. For instance, in June 2024, Tata Elxsi partnered with Red Hat, Inc. to expedite application mobility in a multi-cloud network for 5G-connected vehicles. This collaboration aims to accelerate 5G connected vehicle applications using Tata Elxsi's Connected Vehicle Platform (CVP) named TETHER and Red Hat In-Vehicle OS. By leveraging Red Hat OpenShift as a unified container-as-a-service (CaaS) layer across multi-cloud environments and Tata Elxsi's Neuron platform for cloud automation and 5G application modernization, the partnership seeks to enable telecom operators and mobile virtual network operators (MVNOs) to monetize their networks effectively.

In July 2023, HCL Technologies Limited acquired ASAP Group for $271.10 million as part of its strategic expansion in the automotive engineering services market, particularly in Europe. ASAP Group, based in the UK, specializes in providing automotive engineering services.

Major companies operating in the automotive engineering service provider market are Robert Bosch GmbH, Magna International Inc., Capgemini Technology Services Limited, HCL Technologies Limited, Harman International Industries Inc., Tech Mahindra Limited, Alten Group, Intertek Group plc, AVL LIST GmbH, FEV GmbH, HORIBA Ltd., Bertrandt AG, ARRK Product Development Group, EDAG Engineering GmbH, IAV GmBH, Altair Engineering Inc., Ricardo Plc, Semcon, Continental Engineering Services Ltd., P3 Automotive GmbH, Link Engineering Company, Kistler Holding AG, Magneti Marelli S.p.A

North America was the largest region in the automotive engineering service provider market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the automotive engineering service provider market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the automotive engineering service provider market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The automotive engineering service provider market includes revenues earned by entities by providing services such as manufacturing engineering, autonomous driving technology, vehicle safety engineering, and emissions testing and compliance. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

Automotive Engineering Service Provider Global Market Report 2025 from The Business Research Company provides strategists, marketers and senior management with the critical information they need to assess the market.

This report focuses on automotive engineering service provider market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you within 2-3 working days of order along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Where is the largest and fastest growing market for automotive engineering service provider ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The automotive engineering service provider market global report from the Business Research Company answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

- Markets Covered:1) By Service: Engine; Chassis; Transmission; Car And Body In White (BIW); Seating Systems; Cooling And Heating, Ventilation, And Air Conditioning (HVAC); Interior And Exterior Trims; Other Services

- 2) By Module Type: Intelligent Power Module (IPM); Power Integrated Module (PIM)

- 3) By Vehicle Type: Passenger Car; Commercial Vehicle; Two-Wheeler

- 4) By Application: Mechanical; Electrical And Electronics; Software; Safety

- 5) By End User: Original Equipment Manufacturers (OEMs); Automotive Component Suppliers; Other End Users

- Subsegments:

Here is the list following the requested format:

- 1) By Engine: Engine Design and Development; Engine Testing and Calibration; Powertrain Optimization

- 2) By Chassis: Chassis Design and Prototyping; Suspension System Design; Chassis Testing and Validation

- 3) By Transmission: Transmission Design and Development; Gearbox System Design; Transmission Efficiency and Performance Testing

- 4) By Car and Body in White (BIW): BIW Design and Engineering; BIW Manufacturing Process Optimization; BIW Assembly and Structural Integrity Testing

- 5) By Seating Systems: Seating Design and Prototyping; Safety Testing for Seating; Seat Comfort and Ergonomics Engineering

- 6) By Cooling and Heating, Ventilation, and Air Conditioning (HVAC): HVAC System Design and Optimization; Thermal Management Solutions; Cabin Comfort and Climate Control Testing

- 7) By Interior and Exterior Trims: Interior and Exterior Styling and Design; Trim Materials Engineering; Interior Comfort and Functionality Testing

- 8) By Other Services: Vehicle Lightweighting; Autonomous Vehicle Engineering; Electric Vehicle System Integration and Design

- Subsegments:

Here is the list following the requested format:

- 1) By Engine: Engine Design and Development; Engine Testing and Calibration; Engine Performance Optimization

- 2) By Chassis: Chassis Design and Development; Chassis Testing and Validation; Suspension and Steering System Engineering

- 3) By Transmission: Transmission Design and Development; Transmission Testing and Calibration; Transmission Efficiency Optimization

- 4) By Car and Body in White (BIW): BIW Design and Prototyping; BIW Manufacturing Process Optimization; BIW Testing and Validation

- 5) By Seating Systems: Seating Design and Development; Seating Safety and Comfort Testing; Seatbelt and Airbag Integration

- 6) By Cooling and Heating, Ventilation, and Air Conditioning (HVAC): HVAC System Design and Development; Thermal Management Testing and Optimization; HVAC System Integration and Performance Evaluation

- 7) By Interior and Exterior Trims: Interior Design and Development; Exterior Design and Development; Materials and Finishing Optimization

- 8) By Other Services: Vehicle Lightweighting Engineering; Autonomous Vehicle Engineering; Electric Vehicle (EV) System Integration and Design

- Companies Mentioned: Robert Bosch GmbH; Magna International Inc.; Capgemini Technology Services Limited; HCL Technologies Limited; Harman International Industries Inc.

- Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

- Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

- Delivery format: PDF, Word and Excel Data Dashboard.

Table of Contents

1. Executive Summary

2. Automotive Engineering Service Provider Market Characteristics

3. Automotive Engineering Service Provider Market Trends And Strategies

4. Automotive Engineering Service Provider Market - Macro Economic Scenario Including The Impact Of Interest Rates, Inflation, Geopolitics, Covid And Recovery On The Market

5. Global Automotive Engineering Service Provider Growth Analysis And Strategic Analysis Framework

- 5.1. Global Automotive Engineering Service Provider PESTEL Analysis (Political, Social, Technological, Environmental and Legal Factors, Drivers and Restraints)

- 5.2. Analysis Of End Use Industries

- 5.3. Global Automotive Engineering Service Provider Market Growth Rate Analysis

- 5.4. Global Automotive Engineering Service Provider Historic Market Size and Growth, 2019 - 2024, Value ($ Billion)

- 5.5. Global Automotive Engineering Service Provider Forecast Market Size and Growth, 2024 - 2029, 2034F, Value ($ Billion)

- 5.6. Global Automotive Engineering Service Provider Total Addressable Market (TAM)

6. Automotive Engineering Service Provider Market Segmentation

- 6.1. Global Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Engine

- Chassis

- Transmission

- Car And Body In White (BIW)

- Seating Systems

- Cooling And Heating, Ventilation, And Air Conditioning (HVAC)

- Interior And Exterior Trims

- Other Services

- 6.2. Global Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Intelligent Power Module (IPM)

- Power Integrated Module (PIM)

- 6.3. Global Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Passenger Car

- Commercial Vehicle

- Two-Wheeler

- 6.4. Global Automotive Engineering Service Provider Market, Segmentation By Application, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Mechanical

- Electrical And Electronics

- Software

- Safety

- 6.5. Global Automotive Engineering Service Provider Market, Segmentation By End User, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Original Equipment Manufacturers (OEMs)

- Automotive Component Suppliers

- Other End Users

- 6.6. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Engine, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Engine Design and Development

- Engine Testing and Calibration

- Engine Performance Optimization

- 6.7. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Chassis, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Chassis Design and Development

- Chassis Testing and Validation

- Suspension and Steering System Engineering

- 6.8. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Transmission, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Transmission Design and Development

- Transmission Testing and Calibration

- Transmission Efficiency Optimization

- 6.9. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Car and Body in White (BIW), By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- BIW Design and Prototyping

- BIW Manufacturing Process Optimization

- BIW Testing and Validation

- 6.10. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Seating Systems, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Seating Design and Development

- Seating Safety and Comfort Testing

- Seatbelt and Airbag Integration

- 6.11. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Cooling and Heating, Ventilation, and Air Conditioning (HVAC), By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- HVAC System Design and Development

- Thermal Management Testing and Optimization

- HVAC System Integration and Performance Evaluation

- 6.12. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Interior and Exterior Trims, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Interior Design and Development

- Exterior Design and Development

- Materials and Finishing Optimization

- 6.13. Global Automotive Engineering Service Provider Market, Sub-Segmentation Of Other Services, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Vehicle Lightweighting Engineering

- Autonomous Vehicle Engineering

- Electric Vehicle (EV) System Integration and Design

7. Automotive Engineering Service Provider Market Regional And Country Analysis

- 7.1. Global Automotive Engineering Service Provider Market, Split By Region, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 7.2. Global Automotive Engineering Service Provider Market, Split By Country, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

8. Asia-Pacific Automotive Engineering Service Provider Market

- 8.1. Asia-Pacific Automotive Engineering Service Provider Market Overview

- Region Information, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

- 8.2. Asia-Pacific Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 8.3. Asia-Pacific Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 8.4. Asia-Pacific Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

9. China Automotive Engineering Service Provider Market

- 9.1. China Automotive Engineering Service Provider Market Overview

- 9.2. China Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

- 9.3. China Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

- 9.4. China Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

10. India Automotive Engineering Service Provider Market

- 10.1. India Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.2. India Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.3. India Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

11. Japan Automotive Engineering Service Provider Market

- 11.1. Japan Automotive Engineering Service Provider Market Overview

- 11.2. Japan Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 11.3. Japan Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 11.4. Japan Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

12. Australia Automotive Engineering Service Provider Market

- 12.1. Australia Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 12.2. Australia Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 12.3. Australia Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

13. Indonesia Automotive Engineering Service Provider Market

- 13.1. Indonesia Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 13.2. Indonesia Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 13.3. Indonesia Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

14. South Korea Automotive Engineering Service Provider Market

- 14.1. South Korea Automotive Engineering Service Provider Market Overview

- 14.2. South Korea Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 14.3. South Korea Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 14.4. South Korea Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

15. Western Europe Automotive Engineering Service Provider Market

- 15.1. Western Europe Automotive Engineering Service Provider Market Overview

- 15.2. Western Europe Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 15.3. Western Europe Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 15.4. Western Europe Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

16. UK Automotive Engineering Service Provider Market

- 16.1. UK Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 16.2. UK Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 16.3. UK Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

17. Germany Automotive Engineering Service Provider Market

- 17.1. Germany Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 17.2. Germany Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 17.3. Germany Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

18. France Automotive Engineering Service Provider Market

- 18.1. France Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 18.2. France Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 18.3. France Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

19. Italy Automotive Engineering Service Provider Market

- 19.1. Italy Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 19.2. Italy Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 19.3. Italy Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

20. Spain Automotive Engineering Service Provider Market

- 20.1. Spain Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 20.2. Spain Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 20.3. Spain Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

21. Eastern Europe Automotive Engineering Service Provider Market

- 21.1. Eastern Europe Automotive Engineering Service Provider Market Overview

- 21.2. Eastern Europe Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 21.3. Eastern Europe Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 21.4. Eastern Europe Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

22. Russia Automotive Engineering Service Provider Market

- 22.1. Russia Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 22.2. Russia Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 22.3. Russia Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

23. North America Automotive Engineering Service Provider Market

- 23.1. North America Automotive Engineering Service Provider Market Overview

- 23.2. North America Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 23.3. North America Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 23.4. North America Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

24. USA Automotive Engineering Service Provider Market

- 24.1. USA Automotive Engineering Service Provider Market Overview

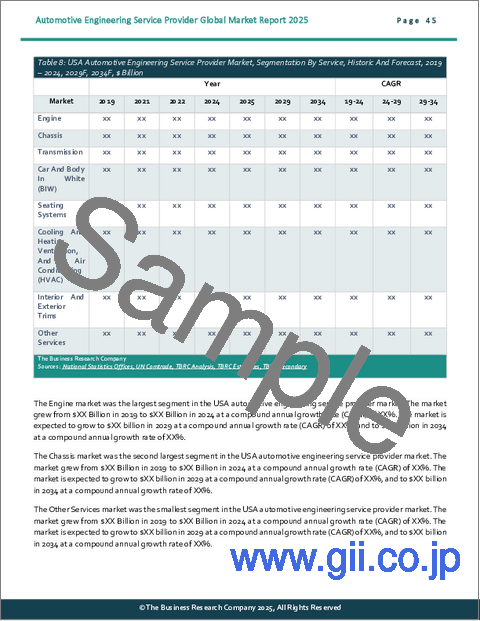

- 24.2. USA Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 24.3. USA Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 24.4. USA Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

25. Canada Automotive Engineering Service Provider Market

- 25.1. Canada Automotive Engineering Service Provider Market Overview

- 25.2. Canada Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 25.3. Canada Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 25.4. Canada Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

26. South America Automotive Engineering Service Provider Market

- 26.1. South America Automotive Engineering Service Provider Market Overview

- 26.2. South America Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 26.3. South America Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 26.4. South America Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

27. Brazil Automotive Engineering Service Provider Market

- 27.1. Brazil Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 27.2. Brazil Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 27.3. Brazil Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

28. Middle East Automotive Engineering Service Provider Market

- 28.1. Middle East Automotive Engineering Service Provider Market Overview

- 28.2. Middle East Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 28.3. Middle East Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 28.4. Middle East Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

29. Africa Automotive Engineering Service Provider Market

- 29.1. Africa Automotive Engineering Service Provider Market Overview

- 29.2. Africa Automotive Engineering Service Provider Market, Segmentation By Service, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 29.3. Africa Automotive Engineering Service Provider Market, Segmentation By Module Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 29.4. Africa Automotive Engineering Service Provider Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

30. Automotive Engineering Service Provider Market Competitive Landscape And Company Profiles

- 30.1. Automotive Engineering Service Provider Market Competitive Landscape

- 30.2. Automotive Engineering Service Provider Market Company Profiles

- 30.2.1. Robert Bosch GmbH Overview, Products and Services, Strategy and Financial Analysis

- 30.2.2. Magna International Inc. Overview, Products and Services, Strategy and Financial Analysis

- 30.2.3. Capgemini Technology Services Limited Overview, Products and Services, Strategy and Financial Analysis

- 30.2.4. HCL Technologies Limited Overview, Products and Services, Strategy and Financial Analysis

- 30.2.5. Harman International Industries Inc. Overview, Products and Services, Strategy and Financial Analysis

31. Automotive Engineering Service Provider Market Other Major And Innovative Companies

- 31.1. Tech Mahindra Limited

- 31.2. Alten Group

- 31.3. Intertek Group plc

- 31.4. AVL LIST GmbH

- 31.5. FEV GmbH

- 31.6. HORIBA Ltd.

- 31.7. Bertrandt AG

- 31.8. ARRK Product Development Group

- 31.9. EDAG Engineering GmbH

- 31.10. IAV GmBH

- 31.11. Altair Engineering Inc.

- 31.12. Ricardo Plc

- 31.13. Semcon

- 31.14. Continental Engineering Services Ltd.

- 31.15. P3 Automotive GmbH

32. Global Automotive Engineering Service Provider Market Competitive Benchmarking And Dashboard

33. Key Mergers And Acquisitions In The Automotive Engineering Service Provider Market

34. Recent Developments In The Automotive Engineering Service Provider Market

35. Automotive Engineering Service Provider Market High Potential Countries, Segments and Strategies

- 35.1 Automotive Engineering Service Provider Market In 2029 - Countries Offering Most New Opportunities

- 35.2 Automotive Engineering Service Provider Market In 2029 - Segments Offering Most New Opportunities

- 35.3 Automotive Engineering Service Provider Market In 2029 - Growth Strategies

- 35.3.1 Market Trend Based Strategies

- 35.3.2 Competitor Strategies

36. Appendix

- 36.1. Abbreviations

- 36.2. Currencies

- 36.3. Historic And Forecast Inflation Rates

- 36.4. Research Inquiries

- 36.5. The Business Research Company

- 36.6. Copyright And Disclaimer