|

|

市場調査レポート

商品コード

1833959

真空コーティング装置の世界市場機会と2034年までの戦略Vacuum Coating Equipment Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| 真空コーティング装置の世界市場機会と2034年までの戦略 |

|

出版日: 2025年09月18日

発行: The Business Research Company

ページ情報: 英文 376 Pages

納期: 2~3営業日

|

概要

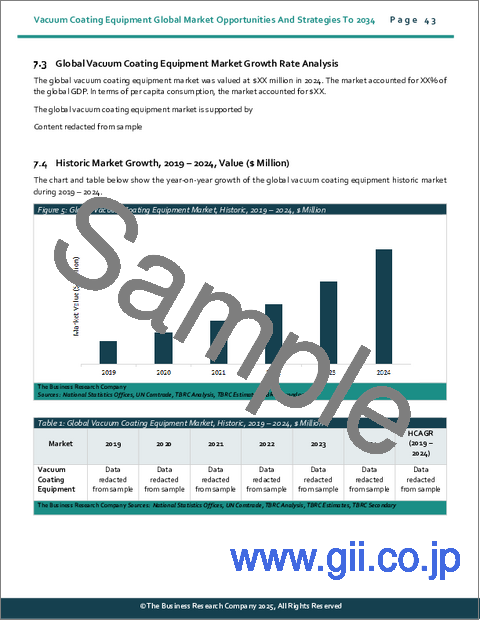

世界の真空コーティング装置市場は、2019年に181億1,557万米ドルと評価され、2024年まで5.00%以上の複合年間成長率(CAGR)で成長しました。

真空コーティング装置とは、真空チャンバー内で材料の表面に薄膜やコーティングを蒸着するために使用される機械を指します。このプロセスでは、空気やその他のガスを除去して低圧環境を作り出し、物理蒸着法(PVD)、化学蒸着法(CVD)、その他の真空ベースの技術によるコーティングの精密な塗布を可能にします。これらのシステムは、硬度、導電性、反射率、耐食性などの表面特性を向上させるために不可欠であり、エレクトロニクス、光学、自動車、航空宇宙、パッケージングなどの産業で広く使用されています。

電気自動車の普及拡大

電気自動車の普及拡大が、実績期間における真空コーティング装置市場の成長を牽引しました。コーティングは、電気自動車とその部品の基板を錆や損傷から保護する上で重要な役割を果たしています。電気自動車メーカーは、バッテリー、パワーエレクトロニクス、軽量素材などの重要なコンポーネントの性能、耐久性、エネルギー効率を高めるために、高度なコーティングへの依存度を高めています。真空コーティング技術は、バッテリー電極、熱障壁、センサー用光学層に使用される高性能薄膜の製造を可能にし、バッテリー寿命、安全性、車両全体の効率向上に貢献しました。例えば、パリに本部を置く自治政府間組織である国際エネルギー機関(IEA)によると、2023年の電気自動車販売台数は350万台と顕著な伸びを示し、前年比35%の堅調な伸びを反映しています。したがって、電気自動車の普及が真空コーティング装置市場の成長を支えています。

太陽電池製造を加速する次世代薄膜コーティングプラットフォーム

真空コーティング装置市場で事業を展開する主要企業は、進化する業界の需要に対応するため、効率、精度、自動化を強化した革新的な成膜装置プラットフォームの開発に注力しています。これらの進歩は、メーカーのコスト削減、持続可能性の向上、競争力の獲得に役立っています。例えば、2024年9月、ドイツのハイテクコーティング装置メーカーであるVON ARDENNEは、新しいGIGA|novaコーティング装置プラットフォームを米国の太陽光発電(ソーラー)市場に初めて投入しました。これは、マグネトロンスパッタリングや熱蒸着などの真空プロセスを含む物理蒸着(PVD)技術に基づく真空コーティング装置システムです。このプラットフォームにはGIGA|nova SCXとGIGA|nova DCXの2つのバージョンがあり、太陽電池製造における効率とスケーラビリティを高めるように設計されています。この戦略的な発売は、米国の再生可能エネルギー分野での事業を拡大する同社の努力を示すものです。GIGA|novaプラットフォームは先進的な薄膜コーティング技術を統合し、次世代の太陽電池製造をサポートします。

世界の真空コーティング装置市場はかなり細分化されており、多数の小規模企業が活動しています。同市場における上位10社の競合企業は、2024年には市場全体の21.20%を占めています。

よくあるご質問

目次

第1章 エグゼクティブサマリー

- 真空コーティング装置-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- 真空コーティング装置市場定義とセグメンテーション

- 市場セグメンテーション:製品別

- 物理蒸着法(PVD)

- マグネトロンスパッタリング

- 化学蒸着法(CVD)

- 市場セグメンテーション:用途別

- 透明導電体

- 光学フィルム

- パッケージ

- 硬質・耐摩耗コーティング

- エネルギー(水素および電池の用途を含む)

- 医療機器

- 耐摩耗工具

- 電子部品およびデバイス

- その他

- 市場セグメンテーション:産業別

- エレクトロニクス

- 自動車

- ヘルスケア

- 航空宇宙

- オプトエレクトロニクス

- 防衛

- その他

第7章 主要な市場動向

- 次世代薄膜コーティングプラットフォームが太陽電池製造を加速

- 先進的な次世代PVDシステムが真空コーティングの新たな基準を確立

- 戦略的パートナーシップが真空コーティング技術の革新を推進

- コーティング技術センターが航空宇宙およびタービン製造におけるイノベーションを加速

- 高度な真空コーティングラインが研究開発と産業生産を繋ぐ

- 先進のスパッタリングマシンがコーティングの精度と効率性を再定義

第8章 各用途に必要なコーティング材料に関する定性情報

- 透明導電体

- 光学フィルム

- パッケージ

- 硬質・耐摩耗コーティング

- エネルギー

- 医療機器

- 耐摩耗工具

- 電子部品およびデバイス

- その他

第9章 世界の真空コーティング装置市場:成長分析と戦略分析フレームワーク

- 世界の真空コーティング装置:PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- エンドユーザー(B2B)の分析

- エレクトロニクス

- 自動車

- ヘルスケア

- 航空宇宙

- オプトエレクトロニクス

- 防衛

- その他

- 世界の真空コーティング装置市場:成長率分析

- 市場成長実績、2019~2024年

- 市場促進要因、2019~2024年

- 市場抑制要因、2019~2024年

- 市場成長予測、2024~2029年、2034年

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 世界の真空コーティング装置:総潜在市場規模(TAM)

第10章 世界の真空コーティング装置市場:セグメンテーション

- 世界の真空コーティング装置市場:製品別、実績と予測、2019~2024年、2029年、2034年

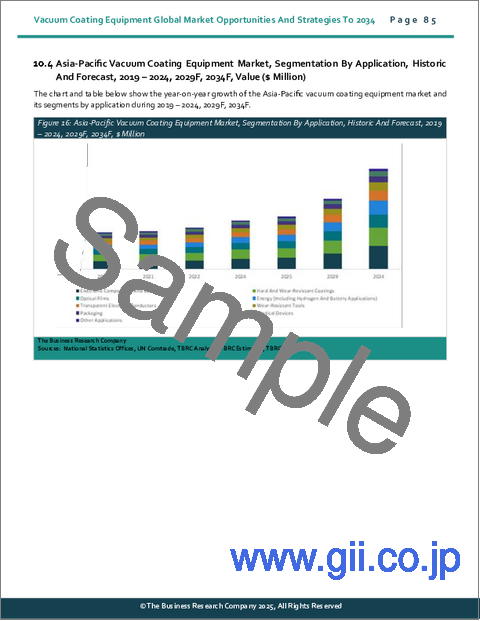

- 世界の真空コーティング装置市場:用途別、実績と予測、2019~2024年、2029年、2034年

- 世界の真空コーティング装置市場:産業別、実績と予測、2019~2024年、2029年、2034年

- 世界の真空コーティング装置市場:物理蒸着法(PVD)のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界の真空コーティング装置市場:マグネトロンスパッタリングのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界の真空コーティング装置市場:化学蒸着法(CVD)のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

第11章 真空コーティング装置市場:地域・国別分析

- 世界の真空コーティング装置市場:地域別、実績と予測、2019~2024年、2029年、2034年

- 世界の真空コーティング装置市場:国別、実績と予測、2019~2024年、2029年、2034年

第12章 アジア太平洋市場

第13章 西欧市場

第14章 東欧市場

第15章 北米市場

第16章 南米市場

第17章 中東市場

第18章 アフリカ市場

第19章 競合情勢と企業プロファイル

- 企業プロファイル

- 19.3 IHI Corporation(Hauzer Techno Coating)

- 19.4 Buhler Group

- 19.5 Applied Materials Inc

- 19.6 Ferrotec Holdings Corporation

第20章 その他の大手企業と革新的企業

- ULVAC Inc.

- Veeco Instruments Inc.

- Pfeiffer Vacuum Technology AG

- ShinMaywa Industries Ltd.

- Leybold GmbH

- Bobst Group SA

- HEF Groupe

- Kashiyama Industries Ltd.

- Optorun Inc.

- Kurt J. Lesker Company

- Singulus Technologies AG

- Anest Iwata Corporation

- Osaka Vacuum Ltd.

- CVD Equipment Corporation

- Evatec AG

第21章 競合ベンチマーキング

第22章 競合ダッシュボード

第23章 主要な合併と買収

- HEF Groupe Acquired Vergason Technology

- Nanofilm Technologies International Limited Acquired AxynTeC Dunnschichttechnik

- Spartek Acquired Marca Coating Technologies

第24章 真空コーティング装置の最近の動向

第25章 市場機会と戦略

- 世界の真空コーティング装置市場2029:新たな機会を提供する国

- 世界の真空コーティング装置市場2029:新たな機会を提供するセグメント

- 世界の真空コーティング装置市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第26章 真空コーティング装置市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々