|

|

市場調査レポート

商品コード

1833923

リースの世界市場機会と2034年までの戦略Leasing Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| リースの世界市場機会と2034年までの戦略 |

|

出版日: 2025年09月19日

発行: The Business Research Company

ページ情報: 英文 942 Pages

納期: 2~3営業日

|

概要

世界のリース市場は2019年に1兆2,771億9,000万米ドルと評価され、2024年までCAGR8.25%以上で成長しました。

リースとは、一方の当事者(貸手)が他方の当事者(借手)に対し、定期的な支払いと引き換えに資産を使用する一時的な権利を付与する契約上の取り決めを指します。設備、車両、ソフトウェア、その他の資産を利用したい企業や個人が利用します。リースは通常、ユーザーが柔軟性、資本支出の削減、資産管理のサポートを必要とする場合に利用されます。このサービスは、自動車、製造業、メディアなどの業界をはじめ、個人資産の利用を目的とする消費者にも広く利用されています。

リース市場は、消費財、産業用機械・設備、自動車など多種多様な有形財を使用目的で提供し、定期的なレンタル料やリース料と引き換えに商標などの無形資産を顧客に譲渡する事業体(組織、個人事業主、パートナーシップ)によるリースサービスの販売で構成されます。

インフラプロジェクトの増加

インフラプロジェクトの増加が、実績期間におけるリース市場の成長を牽引しました。インフラプロジェクトの増加により、建設機械や車両などのリース機器の需要が高まっています。企業は、初期資本コストを削減し、柔軟性を維持するためにリースを好みます。プロジェクトベースのスケジュールにより、所有権よりも短期リースの方が現実的です。官民パートナーシップや政府投資は、リース需要をさらに刺激します。この動向は、建設、車両、設備リース分野全体の着実な成長を牽引しています。例えば、2020年11月、英国政府は国のインフラをアップグレードするために1,000億英ポンド(1,335億米ドル)のインフラ計画を発表し、今後4年間で政府はインフラへの支出を6,000億英ポンド(8,010億米ドル)に増やす計画です。このインフラ開発プロジェクトには、86万戸の新築住宅の建設、新しい道路、自転車専用道路、コミュニティ施設の建設、2025年までに英国全土の95%で4Gブロードバンドを整備することなどが含まれています。したがって、インフラ整備プロジェクトの増加がリース市場の成長を支えています。

中古車リースモデルは企業に費用対効果が高く持続可能なフリートソリューションを提供

リース市場で事業を展開する大手企業は、革新的なリースモデルを通じて、費用対効果が高く持続可能なソリューションの提供を拡大しています。費用対効果の高いリースモデルとは、総所有コストを最小限に抑えながら、必要な資産や設備、財産へのアクセスを提供するリース戦略や仕組みを指します。例えば、ルーマニアを拠点とする自動車リースサービスのArval Romaniaは2025年5月、ルーマニア市場で中古車専用の新しいオペレーショナルリースサービスであるArval Re-Leaseを導入しました。このプログラムは、費用対効果の高い車両管理ソリューションを求める企業を対象としており、オペレーショナルリースの主なメリットである月額固定費、車両メンテナンス、保険、ロードサイドアシスタンス、季節タイヤなどを、新車リースに比べて低価格で提供します。過去にオペレーショナルリース契約を完了した車両のみが対象となります。これらの車両は車齢4年未満で、走行距離は最大12万kmであり、高水準の性能と安全性を確保しています。

世界のリース市場は断片化されており、多数の小規模企業が市場に進出しています。同市場における競合企業上位10社は、2024年時点で市場全体の6.39%を占めています。

よくあるご質問

目次

第1章 エグゼクティブサマリー

- リース-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- リース市場定義とセグメンテーション

- 市場セグメンテーション:タイプ別

- 自動車機器リース

- 消費財・一般レンタルセンター

- 機械リース

- 非金融無形資産のリース会社

- 市場セグメンテーション:モード別

- オンライン

- オフライン

- 市場セグメンテーション:リースタイプ別

- クローズドエンドリース

- リース購入オプション

- サブベントリース

- その他

第7章 主要な市場動向

- 中古車リースモデルは、企業に費用対効果が高く持続可能なフリートソリューションを提供

- デジタルで柔軟な「Fit-Out-As-A-Service」ソリューションによるワークスペースリースの変革

- 保険代理店プラットフォームを通じたシームレスなデジタル車両リース

- 革新的なバッテリーリースモデルが電動リキシャ運転手の電動モビリティを手頃な価格に

- パートナーシップが持続可能なソリューションのためのリースサービスのイノベーションを推進

- 車両リースにおける顧客体験を向上させる新製品の発売

- 新しいデジタルプラットフォームが統合ソリューションで航空機リースと取引に革命をもたらす

- リースにおける技術革新、効率性の向上、顧客アクセスの向上

- 新興宇宙経済の成長を加速させる宇宙資産リースの先駆者

第8章 世界のリース市場:成長分析と戦略分析フレームワーク

- 世界のリース市場:PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- エンドユーザー分析(B2C)

- 企業

- 中小企業

- 政府・公共部門の機関

- 個人消費者

- 物流・運輸会社

- その他

- 世界のリース市場:成長率分析

- 市場成長実績、2019~2024年

- 市場促進要因、2019~2024年

- 市場抑制要因、2019~2024年

- 市場成長予測、2024~2029年、2034年

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 世界のリース:総潜在市場規模(TAM)

第9章 世界のリース市場:セグメンテーション

- 世界のリース市場:タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:モード別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:リースタイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:自動車機器リースのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:消費財・一般レンタルセンターのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:機械リースのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:非金融無形資産のリース会社のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2029年、2034年

第10章 世界のリース市場:地域・国別分析

- 世界のリース市場:地域別、実績と予測、2019~2024年、2029年、2034年

- 世界のリース市場:国別、実績と予測、2019~2024年、2029年、2034年

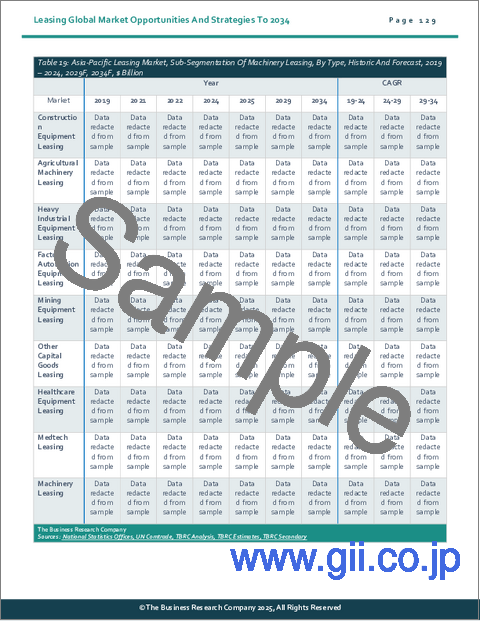

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Volkswagen Leasing GmbH

- Mercedes-Benz AG.

- United Rentals Inc.

- Ayvens(ALD Automotive)

- Ashtead Group

第19章 その他の主要企業

- Deutsche Leasing AG

- 会社概要

- 製品・サービス

- Hertz Global Holdings Inc

- 会社概要

- 製品・サービス

- AerCap Holdings N.V.

- 会社概要

- 製品・サービス

- Localiza Rent a Car S.A.

- 会社概要

- 製品・サービス

- Toyota Financial Services Corporation

- 会社概要

- 製品・サービス

- Avis Budget Group Inc.

- 会社概要

- 製品・サービス

- Orix Corp.

- 会社概要

- 製品・サービス

- Sixt SE

- 会社概要

- 製品・サービス

- Herc Holdings Inc.

- 会社概要

- 製品・サービス

- Avolon Aerospace Leasing Limited

- 会社概要

- 製品・サービス

- Air Lease Corporation

- 会社概要

- 製品・サービス

- BOC Aviation Limited

- 会社概要

- 製品・サービス

- Triton International Limited

- 会社概要

- 製品・サービス

- Dubai Aerospace Enterprise (DAE) Ltd (Nordic Aviation Capital)

- 会社概要

- 製品・サービス

- Element Fleet Management Corp

- 会社概要

- 製品・サービス

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- CHG-MERIDIAN Acquired Meridian Leasing Corporation

- CoStar Group Closes Deal to Acquire Visual Lease

- De Lage Landen International B.V. Acquired ELF Leasing GmbH

- Penske Truck Leasing Expands Through Acquisition Of Star Truck Rentals And Kris-Way Truck Leasing

- Mizuho Leasing Acquired Rent Alpha

- ALD Automotive Acquired LeasePlan

- LeaseAccelerator Acquired LeaseController Software-As-A-Service From Deloitte

第23章 リースの最近の動向

- 自動車リースの進歩

- 特別リースプログラムの立ち上げに注力

第24章 機会と戦略

- 世界のリース市場2029:新たな機会を提供する国

- 世界のリース市場2029:新たな機会を提供するセグメント

- 世界のリース市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 リース市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々