|

|

市場調査レポート

商品コード

1834001

スクーターの世界市場:2034年までの機会と戦略Scooter Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| スクーターの世界市場:2034年までの機会と戦略 |

|

出版日: 2025年10月06日

発行: The Business Research Company

ページ情報: 英文 287 Pages

納期: 2~3営業日

|

概要

世界のスクーターの市場規模は、2019年に545億2,137万米ドルと評価され、2024年まで5.00%以上の複合年間成長率(CAGR)で成長しました。

スクーターは、小型内燃エンジンまたは電気モーターを動力源とする二輪車です。スクーターは通常、ステップスルーフレームとライダーの足のためのプラットフォームを持っており、取り付けや操作が簡単です。スクーターは、その軽量設計、使いやすさ、燃費の良さが広く評価され、都市部では一般的な交通手段となっています。特に、交通渋滞や限られた駐車場が懸念される人口密集都市では、短距離の通勤によく使われています。

スクーター市場は、主に短距離移動に使用されるスクーターの事業体(組織、個人事業主、パートナーシップ)による販売で構成されます。スクーターは、ステップスルーフレームが特徴の軽量車両で、一般的に二輪車に比べて車輪が小さいため、都市部での通勤に便利です。

電動スクーター用充電インフラの拡大

電動スクーター用充電インフラの拡大は、過去期間におけるスクーター市場の成長を支えました。充電ステーションの広範なネットワークは、ユーザーにとってのアクセシビリティと利便性を向上させ、航続距離への不安に対処し、電動スクーターに対する消費者の信頼を高めました。このインフラ投資によって操作上の制約が軽減され、電動スクーターが従来の燃料モデルに代わるより現実的で魅力的な選択肢となったため、市場の普及が促進され、業界の成長が加速しました。例えば、2024年11月、米国を拠点とする政府機関である米国エネルギー省傘下の研究機関である国立再生可能エネルギー研究所(National Renewable Energy Laboratory)によると、2024年第2四半期(Q2)には、ステーションロケーター(Station Locator)に1万2,485のEV充電ポートが追加され、6.3%増を記録し、合計で21万1,382ポートになったと報告しました。大半を占める公共充電ポートは6.5%増、民間充電ポートは同期間に4.4%増となりました。したがって、電動スクーターの充電インフラの拡大が、過去期間におけるスクーター市場の成長を牽引しました。

高性能、スマート、持続可能な技術でEモビリティを推進

スクーター市場で事業を展開する主要企業は、高度な接続性、安全機能、持続可能なバッテリー技術を備えた高性能電動モデルの開発に注力し、ユーザーエクスペリエンスの向上、レアアース材料への依存度の低減、世界市場での普及拡大を図っています。例えば、インドを拠点とする電気自動車製造会社Ola Electric Mobility Limitedは2025年8月、最もスポーティーな電動スクーター「S1 Pro Sport」を発売しました。このモデルは、デザインを一新したエプロン、カーボンファイバー製エレメント、エアロ・ウィンドシールド、14インチホイールを備えています。フロントカメラによる衝突検知などのADAS(先進運転支援システム)機能も搭載しています。自社開発のフェライト製電気モーターを搭載し、ピーク出力16kW、トルク71Nmを発揮し、レアアースへの依存度を低減。先進の4680セルを使用した5.2kWhのバッテリーを搭載し、充電効率の向上とともに、インド・ドライビング・サイクル(IDC)航続距離320km、最高時速152km、0~40km/h加速2秒を実現しています。

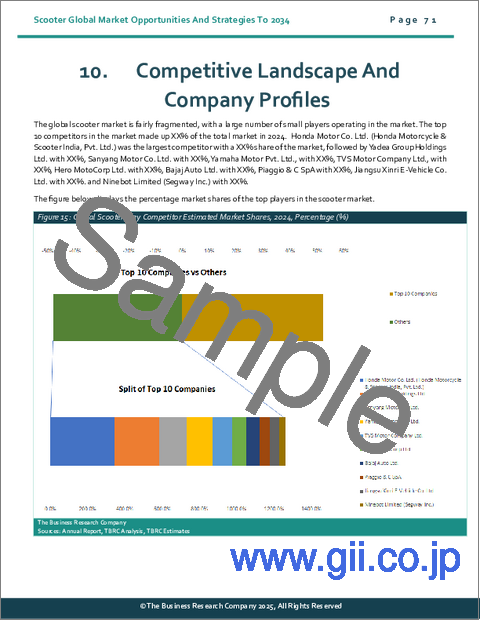

世界のスクーター市場はかなり断片化されており、多数の小規模企業が市場で事業を展開しています。同市場における競合上位10社のシェアは11.31%です。

よくあるご質問

目次

第1章 エグゼクティブサマリー

- スクーター:市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- スクーター市場の定義とセグメンテーション

- 市場セグメンテーション:製品タイプ別

- 電動スクーター

- ガススクーター

- キックスクーター

- 市場セグメンテーション:用途別

- 商業

- 個人

第7章 主要な市場動向

- 高性能、スマート、そして持続可能な技術でEモビリティを進化させる

- 軽量、スマート、耐久性に優れた電動スクーターソリューションで都市のモビリティを拡大

- 革新的なデュアル燃料スクーターが都市交通の持続可能性と効率性を推進

- 革新的なデュアルサスペンション設計が都市通勤に快適さと携帯性をもたらす

- 自動バランス調整機能と接続機能を備えた先駆的なスマートモビリティ

第8章 世界のスクーターの成長分析と戦略分析フレームワーク

- 世界のスクーターのPESTEL分析

- 政治

- 経済

- 社会

- 技術

- 環境

- 法律

- エンドユーザー分析(B2C市場)

- 個人通勤者

- 学生と若者

- 配送および宅配サービス

- シェアードモビリティオペレーター

- その他のエンドユーザー

- 世界の市場規模と成長

- 市場成長実績(2019年~2024年)

- 市場促進要因(2019年~2024年)

- 市場抑制要因(2019年~2024年)

- 市場成長予測(2024年~2029年、2034年)

- 予測成長寄与要因

- 定量的な成長寄与要因

- 促進要因

- 抑制要因

- 世界のスクーター:総潜在市場規模(TAM)

第9章 世界のスクーター市場:セグメンテーション

- 世界のスクーター市場:製品タイプ別、実績と予測(2019年~2024年、2029年、2034年)

- 世界のスクーター市場:用途別、実績と予測(2019年~2024年、2029年、2034年)

- 世界のスクーター市場:サブセグメンテーション、電動スクーター(製品タイプ別)、実績と予測(2019年~2024年、2024年~2029年、2034年)

- 世界のスクーター市場:サブセグメンテーション、ガススクーター(製品タイプ別)、実績と予測(2019年~2024年、2024年~2029年、2034年)

- 世界のスクーター市場:サブセグメンテーション、キックスクーター(製品タイプ別)、実績と予測(2019年~2024年、2024年~2029年、2034年)

第10章 スクーター市場:地域・国別分析

- 世界のスクーター市場:地域別、実績と予測(2019年~2024年、2029年、2034年)

- 世界のスクーター市場:国別、実績と予測(2019年~2024年、2029年、2034年)

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Honda Motor Co. Ltd.(Honda Motorcycle & Scooter India, Pvt. Ltd.)

- Yadea Group Holdings Ltd

- Sanyang Motor Co. Ltd

- Yamaha Motor Co Ltd

- TVS Motor Company Limited

第19章 その他の大手企業と革新的企業

- Hero MotoCorp Ltd.

- Bajaj Auto Ltd.

- Piaggio & C. SpA

- Jiangsu Xinri E-Vehicle Co. Ltd.(SUNRA)

- Ninebot Limited(Segway Inc.)

- Ather Energy Pvt. Ltd.

- Suzuki Motor Corporation

- Ola Electric Mobility Pvt. Ltd.

- Niu Technologies

- Mahindra & Mahindra Ltd.(Mahindra Two Wheelers)

- Gogoro Inc.

- OKAI Inc.

- Ampere Electric Vehicles Pvt Ltd.(Greaves Electric Mobility)

- Razor USA LLC

- Okinawa Autotech Pvt. Ltd.

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Lohia E-Mobility Strengthens Global Portfolio With Kumpan Electric Acquisition

- Tier Mobility Strengthens Global Footprint With Spin Acquisition

第23章 最近の開発:スクーター市場

第24章 機会と戦略

- 世界のスクーター市場、2029年:新たな機会を提供する国

- 世界のスクーター市場、2029年:新たな機会を提供するセグメント

- 世界のスクーター市場、2029年:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 スクーター市場:結論と提言

- 結論

- 提言

- 製品

- 流通

- 価格

- 販売促進

- 人