|

|

市場調査レポート

商品コード

1216976

商用ヘリコプターの世界市場レポート 2023年Commercial Helicopters Global Market Opportunities And Strategies To 2032 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 商用ヘリコプターの世界市場レポート 2023年 |

|

出版日: 受注後更新

発行: The Business Research Company

ページ情報: 英文 175 Pages

納期: 2~10営業日

|

- 全表示

- 概要

- 目次

世界の商用ヘリコプター市場は、2022年の282億9000万米ドルから2023年には287億8000万米ドルへ、年平均成長率(CAGR)1.8%で成長する見込みです。ロシア・ウクライナ戦争は、少なくとも短期的には、COVID-19の大流行からの世界経済回復の可能性を混乱させました。この2国間の戦争は、複数の国に対する経済制裁、商品価格の高騰、サプライチェーンの混乱につながり、商品やサービス全体にインフレを引き起こし、世界中の多くの市場に影響を及ぼしています。商用ヘリコプター市場は、2027年にはCAGR7.9%で390億6000万米ドルに成長すると予測されます。

2022年の商用ヘリコプター市場では、北米が最大の地域となっています。北米は予測期間中、最も急速に成長する地域と予想されます。商業用ヘリコプター市場レポートの対象地域は、アジア太平洋、西欧、東欧、北米、南米、中東・アフリカです。

救急医療サービス(EMS)、捜索救助(SAR)、消防活動などにおけるヘリコプターの利用が増加していることが、民間ヘリコプター市場の成長を牽引すると予想されます。航空EMSは、一刻を争う緊急搬送や長距離の定期搬送のために、医療ネットワークを通じて患者、機器、物資、医療従事者の移動を支援する医療搬送システムの重要な部分を形成しています。MIT国際航空輸送センター(ICAT)によると、米国では毎年約40万人の患者が回転翼機で、15万人の患者が固定翼機で搬送されているのに対し、地上搬送は3600万人となっています。このように、EMSにおけるヘリコプターの利用が増え続けていることは、商用ヘリコプター市場の成長を促す要因の一つとなっています。

目次

第1章 エグゼクティブサマリー

第2章 商用ヘリコプター市場の特徴

第3章 商用ヘリコプター市場の動向と戦略

第4章 商用ヘリコプター市場- マクロ経済シナリオ

第5章 商用ヘリコプターの市場規模と成長

- 世界の商用ヘリコプター市場の実績、2017年から2022年

- 市場の促進要因

- 市場の抑制要因

- 世界の商用ヘリコプター市場の予測、2022-2027F、2032F

- 市場の促進要因

- 市場の抑制要因

第6章 商用ヘリコプター市場セグメンテーション

- 世界の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

- 軽量商用ヘリコプター

- 中型商用ヘリコプター

- 大型商用ヘリコプター

- 世界の商用ヘリコプター市場、エンジン数別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

- シングルエンジン

- マルチエンジン

- 世界の商用ヘリコプター市場、アプリケーション別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

- 石油・ガス

- 輸送

- 医療サービス

- 法執行機関と公安

- その他

第7章 商用ヘリコプター市場の地域および国別分析

- 世界の商用ヘリコプター市場、地域別、実績と予測、2017-2022、2022-2027F、2032F

- 世界の商用ヘリコプター市場、国別、実績と予測、2017-2022、2022-2027F、2032F

第8章 アジア太平洋の商用ヘリコプター市場

- アジア太平洋の商用ヘリコプター市場概要

- 地域情報, COVID-19の影響,市場情報,背景情報,政府のイニシアチブ,規制,規制機関,主要団体,課税される税,法人税構造,投資,主要企業

- アジア太平洋の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第9章 中国の商用ヘリコプター市場

- 中国の商用ヘリコプター市場概要

- 中国の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第10章 インドの商用ヘリコプター市場

- インドの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第11章 日本の商用ヘリコプター市場

- 日本の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第12章 オーストラリアの商用ヘリコプター市場

- オーストラリアの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第13章 インドネシアの商用ヘリコプター市場

- インドネシアの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第14章 韓国の商用ヘリコプター市場

- 韓国の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第15章 西欧の商用ヘリコプター市場

- 西欧の商用ヘリコプター市場概要

- 西欧の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第16章 英国の商用ヘリコプター市場

- 英国の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第17章 ドイツの商用ヘリコプター市場

- ドイツの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第18章 フランスの商用ヘリコプター市場

- フランスの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第19章 東欧の商用ヘリコプター市場

- 東欧の商用ヘリコプター市場概要

- 東欧の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第20章 ロシアの商用ヘリコプター市場

- ロシアの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第21章 北米の商用ヘリコプター市場

- 北米の商用ヘリコプター市場概要

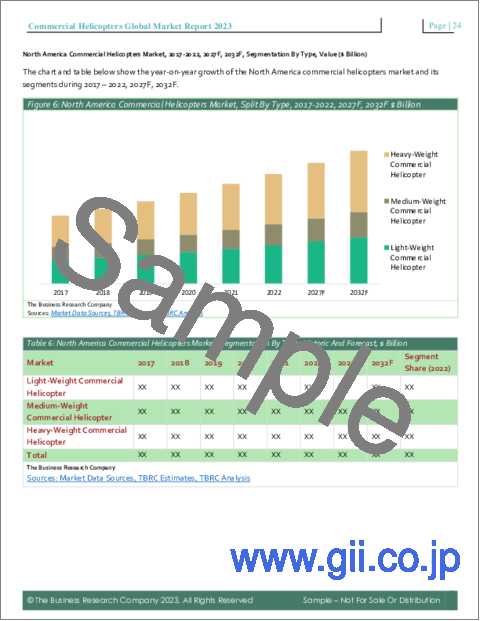

- 北米の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第22章 米国の商用ヘリコプター市場

- 米国の商用ヘリコプター市場概要

- 米国の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第23章 南米の商用ヘリコプター市場

- 南米の商用ヘリコプター市場概要

- 南米の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第24章 ブラジルの商用ヘリコプター市場

- ブラジルの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第25章 中東の商用ヘリコプター市場

- 中東の商用ヘリコプター市場概要

- 中東の商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第26章 アフリカの商用ヘリコプター市場

- アフリカの商用ヘリコプター市場概要

- アフリカの商用ヘリコプター市場、タイプ別セグメンテーション、実績と予測、2017-2022、2022-2027F、2032F

第27章 商用ヘリコプター市場の競合情勢と企業プロファイル

- 商用ヘリコプター市場の競合情勢

- 商用ヘリコプター市場の企業プロファイル

- Airbus Helicopter

- Bell Helicopter

- Leonardo

- Lockheed Martin Corporation

- Russian Helicopters

第29章 商用ヘリコプター市場における主要な合併と買収

第29章 商用ヘリコプター市場の将来の見通しと潜在的な分析

第30章 付録

“Commercial Helicopters Global Market Report 2023 ” from The Business Research Company provides strategists, marketers and senior management with the critical information they need to assess the market.

This report focuses on commercial helicopters market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war's impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you within 3-5 working days of order along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Where is the largest and fastest growing market for commercial helicopters ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? “The commercial helicopters market global report ” from The Business Research Company answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

Scope

Markets Covered:

1) By Type: Light-Weight Commercial Helicopter; Medium-Weight Commercial Helicopter; Heavy-Weight Commercial Helicopter

2) By Number Of Engines: Single-Engine; Multi-Engine

3) By Application: Oil And Gas; Transport; Medical Services; Law Enforcement And Public Safety; Others

Companies Mentioned: Airbus Helicopter; Bell Helicopter; Leonardo; Lockheed Martin Corporation; Russian Helicopters

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery format: PDF, Word and Excel Data Dashboard.

Executive Summary

Major players in the commercial helicopters market are: Airbus Helicopter, Bell Helicopter, Leonardo, Lockheed Martin Corporation, Russian Helicopters, MD Helicopters Inc., Robinson Helicopter Company, Kaman Corporation, Boeing, Korea Aerospace Industries Ltd, Sikorsky Aircraft Corporation, Textron Inc., Enstrom Helicopter Corp., and Kawasaki Heavy Industries Ltd.

The global commercial helicopters market will grow from $28.29 billion in 2022 to $28.78 billion in 2023 at a compound annual growth rate (CAGR) of 1.8%. The Russia-Ukraine war disrupted the chances of global economic recovery from the COVID-19 pandemic, at least in the short term. The war between these two countries has led to economic sanctions on multiple countries, surge in commodity prices, and supply chain disruptions, causing inflation across goods and services effecting many markets across the globe. The commercial helicopters market is expected to grow to $39.06 billion in 2027 at a CAGR of 7.9%.

The commercial helicopter market consists of sales of helicopters of various types for commercial purposes such as passenger transport, cargo, and utility tasks such as photo, patrol, forestry, and advertising. The market includes MRO (maintenance, repair, and overhaul) services provided by manufacturers during the commercial helicopter's warranty period. Values in this market are: 'factory gate' values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The commercial helicopter refers to any helicopters used for commercial purposes such as transportation of passengers, and cargo. The commercial helicopters can fly with one or two pilots and virtually land and take off everywhere such as airports, urban areas, helipad on buildings and other such places.

North America is the largest region in the commercial helicopters market in 2022. North America is expected to be the fastest growing region in the forecast period. The regions covered in commercial helicopters market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

The main types of commercial helicopters are light-weight commercial helicopters, medium-weight commercial helicopters, and heavy-weight commercial helicopters. By the number of engines, the helicopters are classified into single-engine and multi-engine types that are used in oil and gas, transport, medical services, law enforcement, public safety, and others.

Rising usage of helicopters in emergency medical services (EMS), search and rescue (SAR), and firefighting operations is expected to drive the growth of the commercial helicopter market. Air EMS creates a significant part of the medical transport system that assists in shuttling patients, equipment, supplies, and medical personnel throughout the medical network for time-critical emergency transport as well as long-distance scheduled transfers. According to the MIT International Center for Air Transportation (ICAT), air ambulances transport approximately 400,000 patients by rotary-wing and 150,000 by fixed-wing aircraft each year in the USA, compared to 36 million transported by ground. Thus, the ever-increasing number of helicopters in EMS is one of the key drivers for the growth of the commercial helicopter market.

Stringent regulatory norms for helicopter manufacturing and development are anticipated to limit the growth of the commercial helicopter market. Due to the stringent rules in the aerospace industry, the aerospace maintenance process is highly regulated. The authorities, including the European Aviation Safety Agency (EASA) and the Federal Aviation Administration (FAA), are responsible for standards of safety, certification, and control in the aerospace industry. For instance, USA-based Boeing, Sikorsky, and Bell Helicopters must comply with the FAA's Code of Federal Regulations (CFR) Title 14, Part 27 and Part 29, which closely mirror CS-27 and CS-29. Hence, it is a challenge for component manufacturers to adhere to stringent regulatory norms and deliver quality outcomes.

Major companies operating in the industry are focusing on introducing technological innovations to maintain their position in the competitive business environment, which is gaining significant popularity in the commercial helicopter market. For instance, Bell, part of Textron, is developing a new technology called electrically distributed anti-torque (EDAT) to decrease the sound problem. The new system ensures enhancements to safety and operating cost, as well as a decrease in sound compared to an aircraft with a conventional tail rotor. The 429, built with EDAT technology, features four fans, electrically driven, in the back of the helicopter instead of the conventional rotor setup. It provides key benefits to the traditional tail rotor.

In January 2020, Leonardo S.p.A., an Italian helicopter manufacturer, acquired Kopter Group AG, a Swiss helicopter company, for approximately $185 million. The acquisition will enable Kopter Group AG to finalize the development of the SH09, which is on its third prototype currently, and provide Leonardo S.p.A. with a new aircraft type that will add to its existing portfolio. Kopter Group AG is a Switzerland-based manufacturer of helicopters, which has designed the SH09, a new-generation single-turbine helicopter.

The countries covered in the commercial helicopters market are: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK and USA.

The market value is defined as the revenues that enterprises gain from goods and/or services sold within the specified market and geography through sales, grants, or donations in terms of currency (in USD ($) unless otherwise specified).

The revenues for a specified geography are consumption values - that is, they are revenues generated by organizations in the specified geography within the specified market, irrespective of where they are produced. It does not include revenues from resales either further along the supply chain or as part of other products.

The commercial helicopters market research report is one of a series of new reports from The Business Research Company that provides commercial helicopters market statistics, including global and regional shares, competitors with a commercial helicopters market share, detailed commercial helicopters market segments, market trends and opportunities, and any further data you may need to thrive in the commercial helicopters industry. This commercial helicopter market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

Table of Contents

1. Executive Summary

2. Commercial Helicopters Market Characteristics

3. Commercial Helicopters Market Trends And Strategies

4. Commercial Helicopters Market - Macro Economic Scenario

5. Commercial Helicopters Market Size And Growth

- 5.1. Global Commercial Helicopters Historic Market, 2017-2022, $ Billion

- 5.1.1. Drivers Of The Market

- 5.1.2. Restraints On The Market

- 5.2. Global Commercial Helicopters Forecast Market, 2022-2027F, 2032F, $ Billion

- 5.2.1. Drivers Of The Market

- 5.2.2. Restraints On the Market

6. Commercial Helicopters Market Segmentation

- 6.1. Global Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Light-Weight Commercial Helicopter

- Medium-Weight Commercial Helicopter

- Heavy-Weight Commercial Helicopter

- 6.2. Global Commercial Helicopters Market, Segmentation By Number Of Engines, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Single-Engine

- Multi-Engine

- 6.3. Global Commercial Helicopters Market, Segmentation By Application, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- Oil And Gas

- Transport

- Medical Services

- Law Enforcement And Public Safety

- Others

7. Commercial Helicopters Market Regional And Country Analysis

- 7.1. Global Commercial Helicopters Market, Split By Region, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

- 7.2. Global Commercial Helicopters Market, Split By Country, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

8. Asia-Pacific Commercial Helicopters Market

- 8.1. Asia-Pacific Commercial Helicopters Market Overview

- Region Information, Impact Of COVID-19, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

- 8.2. Asia-Pacific Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

9. China Commercial Helicopters Market

- 9.1. China Commercial Helicopters Market Overview

- 9.2. China Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F,$ Billion

10. India Commercial Helicopters Market

- 10.1. India Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

11. Japan Commercial Helicopters Market

- 11.1. Japan Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

12. Australia Commercial Helicopters Market

- 12.1. Australia Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

13. Indonesia Commercial Helicopters Market

- 13.1. Indonesia Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

14. South Korea Commercial Helicopters Market

- 14.1. South Korea Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

15. Western Europe Commercial Helicopters Market

- 15.1. Western Europe Commercial Helicopters Market Overview

- 15.2. Western Europe Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

16. UK Commercial Helicopters Market

- 16.1. UK Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

17. Germany Commercial Helicopters Market

- 17.1. Germany Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

18. France Commercial Helicopters Market

- 18.1. France Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

19. Eastern Europe Commercial Helicopters Market

- 19.1. Eastern Europe Commercial Helicopters Market Overview

- 19.2. Eastern Europe Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

20. Russia Commercial Helicopters Market

- 20.1. Russia Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

21. North America Commercial Helicopters Market

- 21.1. North America Commercial Helicopters Market Overview

- 21.2. North America Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

22. USA Commercial Helicopters Market

- 22.1. USA Commercial Helicopters Market Overview

- 22.2. USA Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

23. South America Commercial Helicopters Market

- 23.1. South America Commercial Helicopters Market Overview

- 23.2. South America Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

24. Brazil Commercial Helicopters Market

- 24.1. Brazil Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

25. Middle East Commercial Helicopters Market

- 25.1. Middle East Commercial Helicopters Market Overview

- 25.2. Middle East Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

26. Africa Commercial Helicopters Market

- 26.1. Africa Commercial Helicopters Market Overview

- 26.2. Africa Commercial Helicopters Market, Segmentation By Type, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

27. Commercial Helicopters Market Competitive Landscape And Company Profiles

- 27.1. Commercial Helicopters Market Competitive Landscape

- 27.2. Commercial Helicopters Market Company Profiles

- 27.2.1. Airbus Helicopter

- 27.2.1.1. Overview

- 27.2.1.2. Products and Services

- 27.2.1.3. Strategy

- 27.2.1.4. Financial Performance

- 27.2.2. Bell Helicopter

- 27.2.2.1. Overview

- 27.2.2.2. Products and Services

- 27.2.2.3. Strategy

- 27.2.2.4. Financial Performance

- 27.2.3. Leonardo

- 27.2.3.1. Overview

- 27.2.3.2. Products and Services

- 27.2.3.3. Strategy

- 27.2.3.4. Financial Performance

- 27.2.4. Lockheed Martin Corporation

- 27.2.4.1. Overview

- 27.2.4.2. Products and Services

- 27.2.4.3. Strategy

- 27.2.4.4. Financial Performance

- 27.2.5. Russian Helicopters

- 27.2.5.1. Overview

- 27.2.5.2. Products and Services

- 27.2.5.3. Strategy

- 27.2.5.4. Financial Performance

- 27.2.1. Airbus Helicopter

29. Key Mergers And Acquisitions In The Commercial Helicopters Market

29. Commercial Helicopters Market Future Outlook and Potential Analysis

30. Appendix

- 30.1. Abbreviations

- 30.2. Currencies

- 30.3. Historic And Forecast Inflation Rates

- 30.4. Research Inquiries

- 30.5. The Business Research Company

- 30.6. Copyright And Disclaimer