|

|

市場調査レポート

商品コード

1477067

2035年までの動物実験と動物実験代替法の世界市場機会と戦略Animal Testing And Non-Animal Alternative Testing Global Market Opportunities And Strategies To 2035 |

||||||

カスタマイズ可能

|

|||||||

| 2035年までの動物実験と動物実験代替法の世界市場機会と戦略 |

|

出版日: 2024年05月09日

発行: The Business Research Company

ページ情報: 英文 259 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の動物実験市場は2023年に121億9,000万米ドルに成長し、CAGR(複合年間成長率)は2.0%を超えます。

製薬会社による研究開発投資の増加

製薬企業によるR&D(研究開発)投資の増加は、動物実験市場の成長につながります。投資率は年々増加しており、製薬会社は研究開発への投資額トップです。研究開発型の製薬企業がR&D投資を増やす主要要因は、アンメット・メディカル・ニーズに応える新薬の発見と開発です。20~21年度のインドの製薬企業の平均研究開発費は総収益の7.2%で、Lupin、Alembic Pharma、Dr.Reddy'sが他より多く支出しています。世界の製薬企業上位20社の2022年の研究開発費は合計1,390億米ドルとなっています。スイスの医療企業であるRocheは、2022年に140億5,000万スイスフラン(151億5,000万米ドル)を研究開発に費やしました。例えば、世界の製薬企業は2022年に研究開発に総額1,390億米ドルを費やしました。また、連邦政府の統計によれば、2019年、世界の製薬企業は、売上のおよそ25%を研究開発に平均して費やしています。したがって、動物モデルへの投資の増加は、医薬品研究に広く採用されることになります。これが動物実験市場を牽引すると予想されます。

目次

第1章 エグゼクティブサマリー

第2章 目次

第3章 目次

第4章 テーブル一覧

第5章 レポートの構造

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- 動物実験と動物実験代替法市場定義とセグメンテーション

- 動物実験

- 動物実験代替法

- 研究における動物に関する事実-動物と人間の体の機能的類似点

- 市場セグメンテーション:最終用途産業別

- 医薬品

- 学術研究

- 医療機器

- 化学物質と農薬

- 化粧品

- その他

第7章 バリューチェーン分析

- 動物飼育者と供給者

- 動物実験代替法技術開発者

- 規制当局

- 代替テストサービスプロバイダー

- 最終用途産業

- 臨床試験

第8章 動物実験代替法市場の動向

- 倫理的な代替手段で創薬技術を加速するAI

- 薬剤の有効性を試験するためのin silico試験の採用

- 試験におけるモデル生物の使用

- 試験用OOC(Organ-On-Chip)の開発

- 試験用の3Dプリント臓器に注目

- 動物実験を減らすための協力とパートナーシップの拡大

- 動物実験を推進する取り組みと助成金の増加

第9章 動物実験と代替技術のコスト分析

- 実験動物の平均費用

- 動物実験代替法法の平均コスト

- 動物実験と代替法のコスト比較分析

- 動物実験にかかる費用, 2021

第10章 動物実験と動物実験代替法市場セグメント

- 最終用途別産業用途

- 重要な使用セグメント

- 基礎調査

- 応用調査

- 規制テスト

- 新しい診断方法の開発

- 遺伝子組み換え動物の繁殖

- 動物のクローン

- エンドユーザー用途

- 動物実験市場:動物タイプ別

- マウス

- ねずみ

- カエル

- 魚

- 鳥類

- モルモット

- ハムスター

- ウサギ

- 羊

- 犬

- 猫

- サル研究

- 豚

- その他

第11章 研究に使用された動物の数:国別

- USA

- 欧州

- 英国

- ドイツ

- フランス

- オーストラリア

- カナダ

- 中国

第12章 動物実験代替法技術タイプと最終用途別

- イントロダクション

- 動物実験代替法技術タイプ

- 細胞または組織培養(インビトロ)

- 世界の主要な細胞培養開発業者

- 臓器オンチップ(OOC)

- 世界のOOC市場の規模と成長

- OOC市場の促進要因と抑制要因

- 市場促進要因

- 市場抑制要因

- インシリコ(コンピュータベースのモデル)

- 人工皮膚モデル(皮膚代替品)

- その他

第13章 エンドユーザー産業における動物実験代替法技術の採用

- 業界別の代替試験技術の採用

- 化粧品業界

- 製薬業界

- 医療機器業界

- その他

- 米国における3Rの導入

- 中国における3Rの導入

- 欧州における3Rの導入

第14章 世界の動物実験と動物実験代替法市場

第15章 動物実験と動物実験代替法市場、地域と国別分析

第16章 米国の動物実験と動物実験代替法市場

第17章 日本の動物実験と動物実験代替法市場

第18章 中国の動物実験と動物実験代替法市場

第19章 オーストラリアの動物実験と動物実験代替法市場

第20章 欧州の動物実験と動物実験代替法市場

第21章 フランスの動物実験と動物実験代替法市場

第22章 ドイツの動物実験と動物実験代替法市場

第23章 英国の動物実験と動物実験代替法市場

第24章 カナダの動物実験と動物実験代替法市場

第25章 その他の動物実験と動物実験代替法市場

第26章 動物実験代替法の競合情勢と企業プロファイル

- 企業プロファイル

- Bio-Rad Laboratories, Inc.

- SGS SA

- Abbott Laboratories

- Evotec SE

- Emulate, Inc

- 米国の動物実験代替法市場の競合情勢

- 企業プロファイル

- Charles River Laboratories

- Cyprotex

- Emulate, Inc

- BioIVT

- EMD Millipore

- 日本の動物実験代替法市場の競合情勢

- 企業プロファイル

- Japan Tissue Engineering Co., Ltd. (J-TEC)

- ReproCell Inc

- Organ Technologies Co, Ltd

- 欧州の動物実験代替法市場の競合情勢

- 企業プロファイル

- CN Bio Innovations, Ltd

- Cyprotex

- Certest Biotec

- XCellR8

- Gentronix Ltd

第27章 動物実験と動物実験代替法の世界市場の機会と戦略

- 2035年の世界の動物実験市場-最も新しい機会を提供する地域

- 2035年の世界の動物実験代替法市場-最も新しい機会を提供する地域

- 世界の動物実験と動物実験代替法市場、2035年-最も新しい機会を提供するセグメント

- 世界の動物実験と動物実験代替法市場2025年-成長戦略

- 動物実験代替法市場の動向別の戦略

- 競合の戦略

第28章 動物実験と動物実験代替法市場:結論と提言

- 結論

- 推奨事項

- 製品

- 場所

- 価格

- プロモーション

- 人材

第29章 付録

- 通貨

- ビジネス調査カンパニー

- 著作権と免責事項

Animal testing or in-vivo testing is the use of living animals in scientific experiments to assess the safety and effectiveness of new products developed in the biopharma, medical devices, chemicals, food and other industries. Animal testing allows scientists to understand how the human body might react to specific substances. The study on animals is a vital part of the research because the basic cell process and physiology of animals is similar to that of humans.

The animal testing market consists of the total expenses incurred by end-use entities that use animals for testing their products. End-use entities include academic research institutions and various industries (such as pharmaceuticals, medical devices, chemicals & pesticides and cosmetics,) that conduct animal testing during product development. Pharmaceutical and medical device companies also use animal testing to understand basic disease mechanisms. End-use entities may also outsource these tests to clinical research organizations (CROs). The animal testing market covered in this report includes sales of animal testing services by CROs to end use industries.

The Global animal testing market grew to $12.19 billion in 2023 at a compound annual growth rate (CAGR) of more than 2.0%.

Increasing Investment In R&D By The Pharmaceutical Companies

The rise in investment in R&D (research and development) by the pharma companies leads to the growth of the animal testing market. The rate of investment has been increasing over the years and pharmaceutical companies are the top investors in R&D. The key factor for research-based pharmaceutical companies investing more in R&D is the discovery and development of new drugs serving unmet medical needs. For FY20-21, the average R&D expenses of pharma companies in India were 7.2% of total revenues, with Lupin, Alembic Pharma and Dr. Reddy's spending more than others. The top 20 global pharmaceutical companies collectively spent $139 billion on R&D in 2022. Roche, a Swiss healthcare company, spent 14.05 billion Swiss francs ($15.15 billion) on R&D in 2022. For example, the global pharmaceutical companies collectively spent $139 billion on research and development in 2022. Also in 2019, globally pharmaceutical companies spent an average of roughly 25% of their revenue on R&D, according to federal government statistics. Therefore, the increasing investment in animal models will be widely employed in pharmaceutical research. This is expected to drive the animal testing market.

AI To Accelerate Drug Discovery Technologies With Ethical Alternatives

Major non-animal testing technologies companies are focusing on AI (artificial intelligence) to accelerate drug discovery technologies with ethical alternatives to expand their businesses. AI plays a crucial role in enhancing the capabilities of both animal testing and non-animal alternative testing methods, ultimately advancing biomedical research while reducing the ethical concerns and limitations associated with animal experimentation. For example, in June 2023, Quantiphi, a US-based AI-driven digital engineering company, launched Digital Animal Replacement Technology (DART), which is a solution that offers a humane and accurate alternative to traditional animal testing for drug discovery, manufacturing and pre-clinical trials. DART combines human biology with advanced digital technologies to predict drug safety and efficacy accurately, eliminating the need for animal testing in many scenarios. The technology uses ethically sourced human stem cells, a Digital Workstation and AI to accelerate drug discovery while ensuring safety and efficacy. DART's launch represents a significant step towards more ethical, efficient and effective alternatives to animal testing in the pharmaceutical industry.

The global non-animal alternatives testing market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 10.95% of the total market in 2022.

Animal Testing And Non-Animal Alternative Testing Global Market Opportunities And Strategies To 2035 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global animal testing and non-animal alternative testing market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 8 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for animal testing and non-animal alternative testing? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The animal testing and non-animal alternative testing market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider animal testing and non-animal alternative testing market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics- Brief introduction to the segmentations covered in the market, definitions, and explanations about the animal testing and non-animal alternative testing market.

- Market Value Chain Analysis- This section gives information on value chain analysis for the animal testing and non-animal alternative testing markets.

Non-Animal Alternative Testing Trends- This chapter describes the major trends shaping the global non-animal alternative testing market.

- Cost Analysis For Animal Testing and Alternative Technologies- This section describes the comparative cost analysis for animal testing and alternative methods to understand the cost-effectiveness and time efficiency of alternative methods. It includes the average cost of animal species and the cost of alternatives to conventional animal testing methods.

- Animal Testing And Non-Animal Alternative Testing By Type And End Use- This section describes the overview of the types of non-animal alternative testing technologies. It also highlights the major developers and end-use industries in non-animal alternative testing technologies in the major geographies.

- End-User Industries Adoption to Alternative Technologies- This section details information on the adoption of alternative technologies by top end-use industries in the USA, Germany, France, UK, and Japan. This section also includes the adoption of 3R principles by each of the top industries in the USA, China, and Europe.

- Global Market Size This section provides information on the global animal testing and non-animal alternative testing market by value and volume for the current and forecast period (2019-2035) and the drivers and restraints that support the growth of the market during this period.

- Regional And Country Analysis- This section contains the animal testing market by value and volume, and non-animal alternative testing market by value for the major geographies for the current and forecast period (2019-2035). This section also provides end-use industries segmentation in animal alternative testing in the major geographies.

- Animal Testing Regulatory Landscape- This section describes the regulatory landscape for animal testing and its alternatives in major geographies. It includes information on regulatory agencies and policies governing animal testing. This section also includes the proposed regulations and guidelines that are driving the non-animal alternative testing technologies market in major geographies.

- Competitive Landscape For Alternative Technologies- This section briefs information on major companies involved in the alternative technology market in the USA, China, and Europe. This section includes the profiles of the major alternative technology developers with information on their product portfolio, financial analysis, and strategies implemented by these companies.

- Market Opportunities And Strategies- This section includes market opportunities and strategies based on findings of the research. This section also gives information on growth opportunities across countries, segments and strategies to be followed in those markets. It gives an understanding of where there is significant business to be gained by competitors in the next five years.

- Conclusions And Recommendations- This section includes recommendations for animal testing and non-animal alternative testing providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By End Use Industrial Application: Basic Research; Applied Research; Regulatory Testing; Development Of New Diagnostic Methods; Breeding Of Genetically Altered Animals; Animal Cloning

- 2) By End-Use Industry: Pharmaceutical; Academic Research; Medical Devices; Chemicals And Pesticides; Cosmetics; Other End Users

- 3) By Animal Type: Mice; Rats; Frogs; Fish; Birds; Guinea Pigs; Hamsters; Rabbits; Sheep; Dogs; Cats; Monkeys; Pigs; Others

- Companies Mentioned: Bio-Rad Laboratories, Inc.; SGS SA; Abbott; Evotec SE; Emulate, Inc

- Countries: Australia; China; Japan; USA; Canada; France; Germany; UK

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; animal testing and non-animal alternative testing indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Animal Testing And Non-Animal Alternative Testing Market Definition And Segmentations

- 6.3.1 Animal Testing

- 6.3.2 Non-Animal Alternative Testing

- 6.3.3 Facts About Animals In Research - Functional Resemblances Of Animals To Human Body

- 6.4 Market Segmentation By End-Use Industry

- 6.4.1 Pharmaceuticals

- 6.4.2 Academic Research

- 6.4.3 Medical Devices

- 6.4.4 Chemicals And Pesticides

- 6.4.5 Cosmetics

- 6.4.6 Other End Users

7 Value Chain Analysis

- 7.1 Animal Breeders and Suppliers

- 7.2 Non-Animal Alternative Testing Technology Developers

- 7.3 Regulatory Authorities

- 7.4 Alternative Testing Service Providers

- 7.5 End-Use Industries

- 7.6 Clinical Trials

8 Non-Animal Alternative Testing Market Trends

- 8.1 AI To Accelerate Drug Discovery Technologies With Ethical Alternatives

- 8.2 Adoption Of In Silico Trials To Test Efficacy Of Drugs

- 8.3 Use Of Model Organisms In Testing

- 8.4 Developments In OOC (Organ-On-Chip) For Testing

- 8.5 Focus On 3D-Printed Organs For Testing

- 8.6 Increasing Collaborations And Partnerships To Reduce Animal Testing

- 8.7 Rising Initiatives And Grants To Promote Animal-Free Testing

9 Cost Analysis For Animal Testing And Alternative Technologies

- 9.1 Average Cost Of Laboratory Animals

- 9.2 Average Cost Of Non-Animal Alternative Testing Methods

- 9.3 Comparative Cost Analysis For Animal Testing And Alternative Methods

- 9.4 Costs Involved In Animal Testing, 2021

10 Animal Testing And Non-Animal Alternative Testing Market Segments

- 10.1 By End Use Industrial Application

- 10.1.1 Important Areas of Use

- 10.1.2 Basic Research

- 10.1.3 Applied Research

- 10.1.4 Regulatory Testing

- 10.1.5 Development Of New Diagnostic Methods

- 10.1.6 Breeding Of Genetically Altered Animals

- 10.1.7 Animal Cloning

- 10.2 End-User Applications

- 10.3 Animal Testing Market By Animal Type

- 10.3.1 Mice

- 10.3.2 Rat

- 10.3.3 Frogs

- 10.3.4 Fish

- 10.3.5 Birds

- 10.3.6 Guinea pig

- 10.3.7 Hamster

- 10.3.8 Rabbits

- 10.3.9 Sheep

- 10.3.10 Dogs

- 10.3.11 Cats

- 10.3.12 Monkeys

- 10.3.13 Pigs

- 10.3.14 Others

11 Number Of Animals Used In Research, By Country

- 11.1 USA

- 11.2 Europe

- 11.3 United Kingdom (UK)

- 11.4 Germany

- 11.5 France

- 11.6 Australia

- 11.7 Canada

- 11.8 China

12 Non-Animal Alternative Testing Technologies By Type And End Use

- 12.1 Introduction

- 12.2 Types Of Non-Animal Alternative Testing Technologies

- 12.2.1 Cell Or Tissue Culture (In-Vitro)

- 12.2.2 Major Cell Culture Developers Worldwide

- 12.2.3 Organ-On-Chip (OOC)

- 12.2.4 Global OOC Market Size And Growth

- 12.2.5 OOC Market Drivers And Restraints

- 12.2.6 Market Drivers

- 12.2.7 Market Restraints

- 12.2.8 In-silico (Computer-Based Models)

- 12.2.9 Artificial Skin Models (Skin Substitutes)

- 12.2.10 Other Technologies

13 End-User Industries Adoption Of Alternative Testing Technologies

- 13.1 Adoption of Alternative Testing Technologies By Type of Industry

- 13.1.1 Cosmetics Industry

- 13.1.2 Pharmaceutical Industry

- 13.1.3 Medical Device Industry

- 13.1.4 Others

- 13.2 Adoption of 3R's In USA

- 13.2.1 3R Adoption In The Cosmetics Industry

- 13.2.2 3R Adoption In The Pharmaceutical Industry

- 13.2.3 3R Adoption In The Medical Device Industry

- 13.3 Adoption of 3R's In China

- 13.3.1 3R Adoption In The Cosmetics Industry

- 13.3.2 3R Adoption In The Pharmaceutical Industry

- 13.3.3 3R Adoption In The Medical Device Industry

- 13.4 Adoption of 3R's In Europe

- 13.4.1 3R Adoption In The Cosmetics Industry

- 13.4.2 3R Adoption In The Pharmaceutical Industry

- 13.4.3 3R Adoption In The Medical Device Industry

14 Global Animal Testing And Non-Animal Testing Market

- 14.1 Global Animal Testing Market Size And Growth

- 14.1.1 Global Animal Testing Market Value ($ Billion)

- 14.1.2 Global Animal Testing Market, By Volume (Million Units)

- 14.1.3 Animal Testing Market Drivers

- 14.1.4 Animal Testing Market Restraints

- 14.2 Global Non-Animal Alternative Testing Market Size And Growth

- 14.2.1 Global Non-Animal Alternative Testing Market Value ($ Billion)

- 14.2.2 Non-Animal Alternative Testing Market Drivers

- 14.2.3 Non-Animal Alternative Testing Market Restraints

15 Animal Testing And Non-Animal Testing Market, Regional And Country Analysis

16 USA Animal Testing And Non-Animal Alternative Testing Market

- 16.1 USA Animal Testing Market

- 16.1.1 USA Animal Testing Market Value ($ Billion)

- 16.1.2 USA Animal Testing Market, By Volume (Million Units)

- 16.2 USA Non-Animal Alternative Testing Market

- 16.2.1 USA Non-Animal Alternative Testing Market Value ($ Billion)

- 16.3 USA Animal Testing Market By End Use Industrial Application

- 16.3.1 Market By Value And Volume

- 16.3.2 122

- 16.3.3 Share Of Top 5 Companies, By Revenue (In Each Industrial Application)

- 16.4 Regulatory Landscape In The USA

- 16.4.1 Regulatory Bodies & Policies

- 16.4.2 Proposed Regulations & Guidelines Driving The Animal Testing Alternatives Market

- 16.4.3 USDA & Animal Welfare Act

- 16.4.4 ICCVAM

- 16.4.5 FDA

- 16.4.6 NIH

- 16.4.7 Animal Welfare Act (AWA)

17 Japan Animal Testing And Non-Animal Alternative Testing Market

- 17.1 Japan Animal Testing Market

- 17.1.1 Japan Animal Testing Market Value ($ Billion)

- 17.1.2 Japan Animal Testing Market, By Volume (Million Units)

- 17.2 Japan Non-Animal Alternative Testing Market

- 17.2.1 Japan Non-Animal Alternative Testing Market Value ($ Billion)

- 17.3 Japan Animal Testing Market By End Use Industrial Application

- 17.3.1 Share Of Top 5 Companies, By Revenue (In Each Industrial Application)

- 17.4 Regulatory Landscape In Japan

- 17.4.1 Regulatory Bodies & Policies

- 17.4.2 Proposed Regulations & Guidelines Driving Animal Testing Alternatives Market

- 17.4.3 Law for the Humane Treatment and Management of Animals

- 17.4.4 MHLW, MEXT, PMDA And MAFF

18 China Animal Testing And Non-Animal Alternative Testing Market

- 18.1 China Animal Testing Market

- 18.1.1 China Animal Testing Market Value ($ Billion)

- 18.1.2 China Animal Testing Market, By Volume (Million Units)

- 18.2 Regulatory Landscape In China

- 18.2.1 Regulatory Bodies & Policies

- 18.2.2 Proposed Regulations & Guidelines Driving Animal Testing Alternatives Market

19 Australia Animal Testing And Non-Animal Alternative Testing Market

- 19.1 Australia Animal Testing Market

- 19.1.1 Australia Animal Testing Market Value ($ Billion)

- 19.1.2 Australia Animal Testing Market, By Volume (Million Units)

- 19.2 Regulatory Landscape In Australia

- 19.2.1 Regulatory Bodies & Policies

- 19.2.2 Proposed Regulations & Guidelines Driving The Animal Testing Alternatives Market

20 Europe Animal Testing And Non-Animal Alternative Testing Market

- 20.1 Regulatory Landscape In Europe

- 20.1.1 EU Directive 2010/63

- 20.2 Europe Non-Animal Alternative Testing Market

- 20.2.1 Europe Non-Animal Alternative Testing Market Value ($ Billion)

21 France Animal Testing And Non-Animal Alternative Testing Market

- 21.1 France Animal Testing Market

- 21.1.1 France Animal Testing Market Value ($ Billion)

- 21.1.2 France Animal Testing Market, By Volume (Million Units)

- 21.2 France Animal Testing Market By End Use Industrial Application

- 21.2.1 Market By Value

- 21.2.2 160

- 21.3 Regulatory Landscape In France

- 21.3.1 Regulatory Bodies & Policies

- 21.3.2 Proposed Regulations & Guidelines Driving The Animal Testing Alternatives Market

22 Germany Animal Testing And Non-Animal Alternative Testing Market

- 22.1 Germany Animal Testing Market

- 22.1.1 Germany Animal Testing Market Value ($ Billion)

- 22.1.2 Germany Animal Testing Market, By Volume (Million Units)

- 22.2 Germany Animal Testing Market By End Use Industrial Application

- 22.2.1 Market By Value

- 22.2.2 168

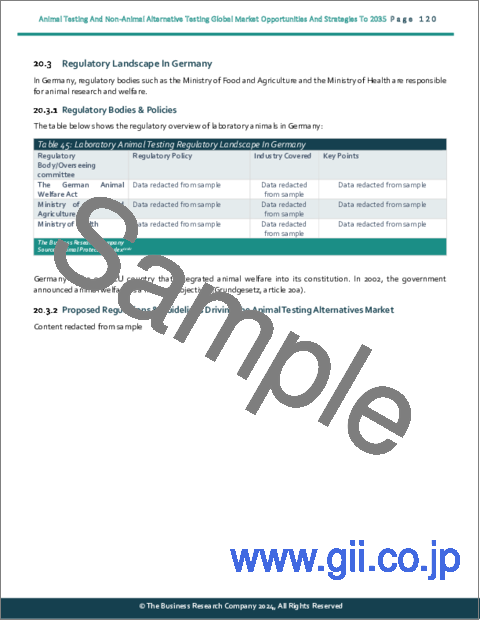

- 22.3 Regulatory Landscape In Germany

- 22.3.1 Regulatory Bodies & Policies

- 22.3.2 Proposed Regulations & Guidelines Driving the Animal Testing Alternatives Market

23 UK Animal Testing And Non-Animal Alternative Testing Market

- 23.1 UK Animal Testing Market

- 23.1.1 UK Animal Testing Market Value ($ Billion)

- 23.1.2 UK Animal Testing Market, By Volume (Million Units)

- 23.2 UK Animal Testing Market By End Use Industrial Application

- 23.2.1 Market By Value

- 23.2.2 176

- 23.3 Regulatory Landscape in United Kingdom (UK)

- 23.3.1 Regulatory Bodies & Policies

- 23.3.2 Proposed Regulations & Guidelines Driving the Animal Testing Alternatives Market

24 Canada Animal Testing And Non-Animal Alternative Testing Market

- 24.1 Canada Animal Testing Market

- 24.1.1 Canada Animal Testing Market Value ($ Billion)

- 24.1.2 Canada Animal Testing Market, By Volume (Million Units)

- 24.2 Regulatory Landscape In Canada

- 24.2.1 Regulatory Bodies & Policies

- 24.2.2 Proposed Regulations & Guidelines Driving Animal Testing Alternatives Market

25 Rest of the World (RoW) Animal Testing And Non-Animal Alternative Testing Market

- 25.1 Rest of the World (RoW) Animal Testing Market

- 25.1.1 Rest of the World (RoW) Animal Testing Market Value ($ Billion)

- 25.1.2 Rest of the World (RoW) Animal Testing Market, By Volume (Million Units)

- 25.2 Regulatory Landscape In Rest of the World (RoW)

- 25.2.1 Regulatory Bodies & Policies

- 25.2.2 Proposed Regulations & Guidelines Driving Animal Testing Alternatives Market

26 Non-Animal Alternatives Testing Competitive Landscape And Company Profiles

- 26.1 Company Profiles

- 26.2 Bio-Rad Laboratories, Inc.

- 26.2.1 Company Overview

- 26.2.2 Products And Services

- 26.2.3 Business Strategy

- 26.2.4 Financial Overview

- 26.3 SGS SA

- 26.3.1 Company Overview

- 26.3.2 Products And Services

- 26.3.3 Business Strategy

- 26.3.4 Financial Overview

- 26.4 Abbott Laboratories

- 26.4.1 Company Overview

- 26.4.2 Products And Services

- 26.4.3 Financial Overview

- 26.5 Evotec SE

- 26.5.1 Company Overview

- 26.5.2 Products And Services

- 26.5.3 Business Strategy

- 26.5.4 Financial Overview

- 26.6 Emulate, Inc

- 26.6.1 Company Overview

- 26.6.2 Products And Services

- 26.6.3 Business Strategy

- 26.6.4 Financial Overview

- 26.7 USA Non-Animal Alternative Testing Market Competitive Landscape

- 26.8 Company Profiles

- 26.9 Charles River Laboratories

- 26.9.1 Company Overview

- 26.9.2 Products And Services

- 26.9.3 Business Strategy

- 26.9.4 Financial Overview

- 26.10 Cyprotex

- 26.10.1 Company Overview

- 26.10.2 Products And Services

- 26.10.3 Business Strategy

- 26.10.4 Financial Overview

- 26.11 Emulate, Inc

- 26.11.1 Company Overview

- 26.11.2 Products And Services

- 26.11.3 Business Strategy

- 26.11.4 Financial Overview

- 26.12 BioIVT

- 26.12.1 Company Overview

- 26.12.2 Products And Services

- 26.12.3 Business Strategy

- 26.12.4 Financial Overview

- 26.13 EMD Millipore

- 26.13.1 Company Overview

- 26.13.2 Products And Services

- 26.13.3 Business Strategy

- 26.13.4 Financial Overview

- 26.14 Japan Non-Animal Alternative Testing Market Competitive Landscape

- 26.15 Company Profiles

- 26.16 Japan Tissue Engineering Co., Ltd. (J-TEC)

- 26.16.1 Company Overview

- 26.16.2 Products And Services

- 26.16.3 Business Strategy

- 26.16.4 Financial Overview

- 26.17 ReproCell Inc

- 26.17.1 Company Overview

- 26.17.2 Products And Services

- 26.17.3 Financial Overview

- 26.18 Organ Technologies Co, Ltd

- 26.18.1 Company Overview

- 26.18.2 Products And Services

- 26.19 Europe Non-Animal Alternative Testing Market Competitive Landscape

- 26.20 Company Profiles

- 26.21 CN Bio Innovations, Ltd

- 26.21.1 Company Overview

- 26.21.2 Products And Services

- 26.21.3 Business Strategy

- 26.21.4 Financial Overview

- 26.22 Cyprotex

- 26.22.1 Company Overview

- 26.22.2 Products And Services

- 26.22.3 Business Strategy

- 26.22.4 Financial Overview

- 26.23 Certest Biotec

- 26.23.1 Company Overview

- 26.23.2 Products And Services

- 26.23.3 Financial Overview

- 26.24 XCellR8

- 26.24.1 Company Overview

- 26.24.2 Products And Services

- 26.24.3 Financial Overview

- 26.25 Gentronix Ltd

- 26.25.1 Company Overview

- 26.25.2 Products And Services

- 26.25.3 Financial Overview

27 Animal Testing And Non-Animal Alternative Testing Global Market Opportunities And Strategies

- 27.1 Global Animal Testing Market In 2035 - Geographies Offering Most New Opportunities

- 27.2 Global Non-Animal Alternative Testing Market In 2035 - Geographies Offering Most New Opportunities

- 27.3 Global Animal Testing And Non-Animal Alternative Testing Market In 2035 - Segments Offering Most New Opportunities

- 27.4 Global Animal Testing And Non-Animal Alternative Testing Market In 2025 - Growth Strategies

- 27.4.1 Non-Animal Alternative Testing Market Trend Based Strategies

- 27.4.2 Competitor Strategies

28 Animal Testing And Non-Animal Alternative Testing Market, Conclusions And Recommendations

- 28.1 Conclusions

- 28.2 Recommendations

- 28.2.1 Product

- 28.2.2 Place

- 28.2.3 Price

- 28.2.4 Promotion

- 28.2.5 People

29 Appendix

- 29.1 Geographies Covered

- 29.2 Glossary

- 29.3 Market Data Sources

- 29.4 Research Methodology

- 29.4.1 OCED Accepted In Vito Tests

- 29.5 Currencies

- 29.6 The Business Research Company

- 29.7 Copyright and Disclaimer