|

|

市場調査レポート

商品コード

1400915

航空機用貨物ライナーの世界市場:市場規模・シェア・動向・予測、競合分析、成長機会 (2023年~2028年)Aircraft Cargo Liner Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2023-2028 |

||||||

|

|||||||

| 航空機用貨物ライナーの世界市場:市場規模・シェア・動向・予測、競合分析、成長機会 (2023年~2028年) |

|

出版日: 2023年11月02日

発行: Stratview Research

ページ情報: 英文 135 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

世界の航空機用貨物ライナー市場は、今後5年間で10.3%の魅力的なCAGRで成長し、2028年には2億米ドルの規模に達する見込みです。

航空機用貨物ライナーは、貨物室を損傷から保護する、航空機の貨物室に不可欠な部品です。これらのライナーは、ガラス繊維強化フェノール/ポリエステル樹脂のような、耐久性と耐火性に優れた材料で作られており、航空移動の厳しさに耐えることができます。これらのライナーは、輸送中の貨物の安全性とセキュリティを確保し、飛行中のずれ、振動、衝撃による損傷を防ぐように設計されています。

COVID-19の衝撃

2020年の新型コロナウイルス感染症 (COVID-19) の出現により、航空宇宙産業は大混乱に陥り、航空宇宙コミュニティ全体に影響を及ぼしました。IATAによると、世界の航空貨物市場は2020年に10.6%の需要減 (貨物トンキロで計測) に遭遇しました。ライナーの需要も深刻な打撃を受け、2012年から2013年の水準にまで落ち込みました。全体として、航空機用貨物ライナーの需要は2020年に38%の大幅な落ち込みとなりました。さらに、2021年には、市場のサプライチェーンの混乱が主な原因となって、市場も10%以上の落ち込みを体験しました。

業界の回復は2022年以降に始まりましたが、これは主に航空機の生産率の回復や、新しい航空機計画の参入によるものでした。航空機用貨物ライナー市場は、2021年から2022年にかけて目覚ましい2桁成長を記録しました。また、市場は今後数年間、有望な成長パターンをたどり、最終的には2025年までに感染拡大前のレベルを超えるのに役立つ、と業界関係者は考えています。

当レポートでは、世界の航空機用貨物ライナーの市場について分析し、市場の基本構造や主な促進・抑制要因、全体的な市場規模の動向見通し、セグメント別・地域別の詳細動向、競合情勢、主要企業のプロファイルなどを調査しております。

目次

第1章 エグゼクティブサマリー:市場の鳥瞰図

第2章 市場環境分析:市場力学に影響を与える要因の検討

- サプライチェーン分析 (バリューチェーン全体の主要企業/材料の特定)

- PEST分析 (市場の需要に直接的・間接的に影響を与えるすべての要因のリスト)

- 業界のライフサイクル分析 (市場の現在・将来のライフサイクルの各段階)

- 主要な動向 (市場力学を形成する主要な業界・市場の動向)

- 市場促進要因 (促進要因とその短期的・長期的な影響の分析)

- 市場の課題 (普及・成長を阻害する要因の分析)

第3章 航空機用貨物ライナー市場の評価 (単位:100万米ドル、2017年~2028年)

- 航空機用内装品市場全体に占める貨物ライナーのシェア

- 航空機用貨物ライナー市場の動向と予測 (単位:100万米ドル)

- 市場シナリオ分析:さまざまな市場環境における成長軌道

- COVID-19の影響評価と、予想される回復曲線

第4章 航空機用貨物ライナー市場のセグメント分析 (単位:100万米ドル、2017年~2028年)

- 機種別の分析

- ナローボディ機:地域別の動向と予測 (単位:100万米ドル)

- ワイドボディ機:地域別の動向と予測 (単位:100万米ドル)

- リージョナル機:地域別の動向と予測 (単位:100万米ドル)

- ビジネスジェット:地域別の動向と予測 (単位:100万米ドル)

- 装置の種類別の分析

- バイヤー実装の装置:地域別の動向と予測 (単位:100万米ドル)

- サプライヤー実装の装置:地域別の動向と予測 (単位:100万米ドル)

- エンドユーザーの種類別の分析

- OE:地域別の動向と予測 (単位:100万米ドル)

- アフターマーケット:地域別の動向と予測 (単位:100万米ドル)

- 地域分析

- 北米の航空機用貨物ライナー市場:国別分析

- 欧州の航空機用貨物ライナー市場:国別分析

- アジア太平洋の航空機用貨物ライナー市場:国別分析

- その他の地域 (ROW) の航空機用貨物ライナー市場:国別分析

第5章 競合分析

- 競合の程度 (市場再編に基づく競合の現段階)

- 競合情勢 (重要指標に基づく主要企業のベンチマーク)

- 市場シェア分析 (主要企業と各社のシェア)

- 製品ポートフォリオのマッピング (各種の市場カテゴリーにおける製品の存在感のマッピング)

- 各地域でのプレゼンス (マッピング)

- 製品開発の主要ターゲット領域 (開発中の業界の焦点への理解)

- ポーターのファイブフォース分析 (競合情勢全体の鳥瞰図)

第6章 戦略的成長機会

- 市場の求心力の分析

- 市場の求心力:機種別

- 市場の求心力:装置の種類別

- 市場の求心力:エンドユーザーの種類別

- 市場の求心力:地域別

- 市場の求心力:国別

- 新たな動向 (将来の市場力学を形成する可能性のある主要な動向)

- 重要な戦略的影響 (変化する市場力学とその重要な影響)

- 主要成功要因 (KSF) (企業のビジネス獲得に役立つ可能性のある、一部の要因の特定)

第7章 主要企業のプロファイル (アルファベット順)

- Elbe Flugzeugwerke GmbH (EFW GmbH)

- FACC AG

- Safran S.A.

- The Gill Corporation

- Vaupell, Inc.

第8章 付録

The Aircraft Cargo Liner Market is set to grow at an attractive CAGR of 10.3% over the next five years to reach US$ 0.2 Billion in 2028.

Aircraft cargo liner is an essential component of an aircraft's cargo compartment that protects the cargo compartment from damage. These liners are made from durable and fire-resistant materials, such as fiberglass-reinforced phenolic/polyester resin, that can withstand the rigors of air travel. These liners are designed to ensure the safety and security of the cargo during transportation, preventing damage from shifting, vibration, or impact during flight.

COVID-19 Impact

The emergence of the COVID pandemic in 2020 left the aerospace industry in shambles, affecting the entire aerospace community. According to IATA, the global air freight market witnessed a drop in demand by 10.6% (measured in cargo tonne kilometers) in 2020. The demand for cargo liners also got severely hit, taking the demand to about 2012-2013 levels. Overall, the demand for aircraft cargo liners witnessed a massive decline of 38% in 2020. Moreover, the market also witnessed a drop of over 10% in 2021, majorly due to the disruption in the supply chain of the market.

The industry's recovery commenced from 2022 onwards, primarily driven by rebounding aircraft production rates and the entry of new aircraft programs. The aircraft cargo liner market recorded an impressive double-digit growth during 2021-2022. It is also estimated that the market will follow a promising growth pattern in the years to come, ultimately helping industry stakeholders to cross their pre-pandemic levels by 2025.

Segment Analysis

By Aircraft Type

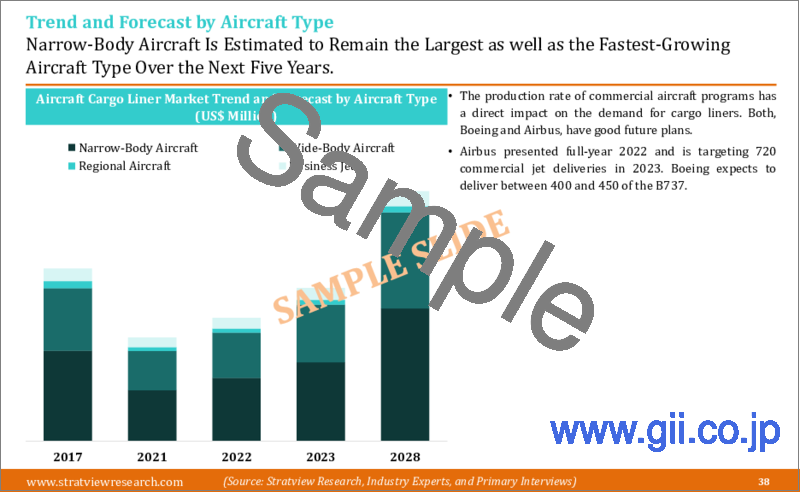

The market is segmented into narrow-body aircraft, wide-body aircraft, regional aircraft, and business jet. Among these aircraft types, narrow-body aircraft, mainly Boeing 737Max and Airbus A320neo families, significantly influence the market and is likely to remain the biggest demand generator for cargo liners due to their high operational volumes. Faster recovery of narrow-body aircraft in the post-pandemic market environment than wide-body aircraft is likely to drive the segment's demand for cargo liners. Furthermore, Airbus A220 and COMAC C919 are projected to add sizeable volume and create new revenue pockets in the market.

By Equipment Type

the market is segmented into buyer-furnished equipment (BFE) and supplier-furnished equipment (SFE). Between these equipment types, BFE is expected to maintain its dominance as well as witness faster growth in the market during the forecast period, as it offers flexibility to adapt to changing cargo needs. BFE allows airline customers to replace or upgrade equipment as cargo requirements evolve, without the need for major modifications or changes to the entire aircraft.

By End-User Type

The market is segmented into OE and aftermarket. Between these end-user types, OE is expected to remain the dominant end-user type in the market during the forecast period. The aerospace giants, such as Both, Airbus and Boeing, are expected to increase their aircraft production rates in the coming years. During 2023-28, it is expected that about 11,000 commercial aircraft and 1,300 regional aircraft will be developed, creating a huge demand for cargo liners in the coming years.

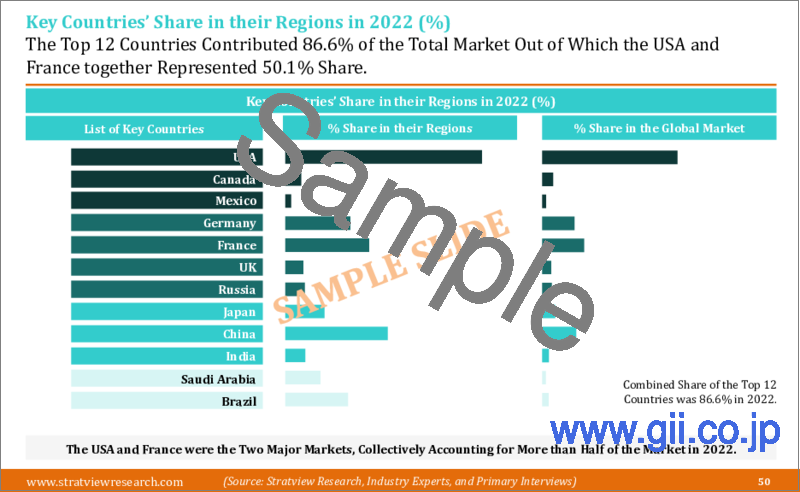

Regional Analysis

In terms of regions, North America is expected to remain the largest market for aircraft cargo liners during the forecast period, with the presence of several large- to small-sized aircraft OEMs, tier players, distributors, and material suppliers. The USA is likely to remain the leading market, both in North America and globally, during the forecast period. Concurrently, Asia-Pacific is likely to be the fastest-growing region during 2023-2028, with China, India, and Japan being the major contributors. The entry of COMAC C919 is also estimated to add momentum to regional market growth.

Key Players

The market is highly consolidated with the presence of a limited number of global players. These players are engaged in the development of lightweight cargo liners, along with features, such as fire resistance, smoke resistance, and an impressive strength-to-weight ratio. These players are holding their respective market positions, owing to their excellent product development capabilities and established customer relationships. The following are the key players in the aircraft cargo liner market:

- The Gill Corporation

- Elbe Flugzeugwerke GmbH (EFW GmbH)

- Safran S.A.

- FACC AG

- Vaupell, Inc.

- Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today's aircraft cargo liner market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research's internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 10 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Table of Contents

- Report Scope

- Report Objectives

- Research Methodology

- Market Segmentation

- Secondary Research

- Key Information Gathered from Secondary Research

- Primary Research

- Key Information Gathered from Primary Research

- Breakdown of Primary Interviews by Region, Designation, and Value Chain Node

- Data Analysis and Triangulation

1. Executive Summary: A Bird's Eye View of the Market

2. Market Environment Analysis: Study of Factors Affecting the Market Dynamics

- 2.1. Supply Chain Analysis (Identification of Key Players/Materials across the Value Chain)

- 2.2. PEST Analysis (List of All Factors Directly or Indirectly Affecting the Market Demand)

- 2.3. Industry Life Cycle Analysis (Current and Future Lifecycle Stage of the Market)

- 2.4. Market Drivers (Study of Drivers and their Short- and Long-Term Impacts)

- 2.5. Market Challenges (Study of Factors Hindrance the Adoption/Growth)

3. Aircraft Cargo Liner Market Assessment (2017-2028) (US$ Million)

- 3.1. Share of Cargo Liners in the Total Aircraft Interiors Market

- 3.2. Aircraft Cargo Liner Market Trend and Forecast (US$ Million)

- 3.3. Market Scenario Analysis: Growth Trajectories in Different Market Conditions

- 3.4. COVID-19 Impact Assessment and Expected Recovery Curve

4. Aircraft Cargo Liner Market Segments' Analysis (2017-2028) (US$ Million)

- 4.1. Aircraft-Type Analysis

- 4.1.1. Narrow-Body Aircraft: Regional Trend and Forecast (US$ Million)

- 4.1.2. Wide-Body Aircraft: Regional Trend and Forecast (US$ Million)

- 4.1.3. Regional Aircraft: Regional Trend and Forecast (US$ Million)

- 4.1.4. Business Jet: Regional Trend and Forecast (US$ Million)

- 4.2. Equipment-Type Analysis

- 4.2.1. Buyer-Furnished Equipment: Regional Trend and Forecast (US$ Million)

- 4.2.2. Supplier-Furnished Equipment: Regional Trend and Forecast (US$ Million)

- 4.3. End-User-Type Analysis

- 4.3.1. OE: Regional Trend and Forecast (US$ Million)

- 4.3.2. Aftermarket: Regional Trend and Forecast (US$ Million)

- 4.4. Regional Analysis

- 4.4.1. North American Aircraft Cargo Liner Market: Country Analysis

- 4.4.1.1. The USA's Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.1.2. Canadian Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.1.3. Mexican Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.2. European Aircraft Cargo Liner Market: Country Analysis

- 4.4.2.1. German Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.2.2. French Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.2.3. The UK's Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.2.4. Russian Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.2.5. Rest of the European Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.3. Asia-Pacific's Aircraft Cargo Liner Market: Country Analysis

- 4.4.3.1. Chinese Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.3.2. Indian Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.3.3. Japanese Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.3.4. Rest of the Asia-Pacific's Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.4. Rest of the World's (RoW) Aircraft Cargo Liner Market: Country Analysis

- 4.4.4.1. Saudi Arabian Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.4.2. Brazilian Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.4.3. Others Aircraft Cargo Liner Market T&F (US$ Million)

- 4.4.1. North American Aircraft Cargo Liner Market: Country Analysis

5. Competitive Analysis

- 5.1. Degree of Competition (Current Stage of Competition based on Market Consolidation)

- 5.2. Competitive Landscape (Benchmarking of Key Players in Crucial Parameters)

- 5.3. Market Share Analysis (Key Players and their Respective Shares)

- 5.4. Product Portfolio Mapping (Map their Presence in Different Market Categories)

- 5.5. Geographical Presence (Map their Geographical Presence)

- 5.6. Key Target Areas for Product Development (Understand the Industry Focus while Development)

- 5.7. Porter's Five Forces Analysis (A Bird's Eye View of the Overall Competitive Landscape)

6. Strategic Growth Opportunities

- 6.1. Market Attractiveness Analysis

- 6.1.1. Market Attractiveness by Aircraft Type

- 6.1.2. Market Attractiveness by Equipment Type

- 6.1.3. Market Attractiveness by End-User Type

- 6.1.4. Market Attractiveness by Region

- 6.1.5. Market Attractiveness by Country

- 6.2. Emerging Trends (Key Trends that May Shape the Market Dynamics in the Future)

- 6.3. Key Strategic Implications (Changing Market Dynamics and their Key Implications)

- 6.4. Key Success Factors (KSFs) (Identifying Some Factors that May Help Companies to Gain Business)

7. Company Profile of Key Players (Alphabetically Arranged)

- 7.1. Elbe Flugzeugwerke GmbH (EFW GmbH)

- 7.2. FACC AG

- 7.3. Safran S.A.

- 7.4. The Gill Corporation

- 7.5. Vaupell, Inc.

8. Appendix

- 8.1. Disclaimer

- 8.2. Copyright

- 8.3. Abbreviation

- 8.4. Currency Exchange

- 8.5. Market Numbers