|

|

市場調査レポート

商品コード

1069957

航空宇宙用プリント基板の世界市場規模:シェア、動向、予測、競合分析、成長機会(2022年~2027年)Aerospace Printed Circuit Board Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2022-2027 |

||||||

| 航空宇宙用プリント基板の世界市場規模:シェア、動向、予測、競合分析、成長機会(2022年~2027年) |

|

出版日: 2022年04月13日

発行: Stratview Research

ページ情報: 英文 146 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の航空宇宙用プリント基板の市場規模は、予測期間中に5.3%のCAGRで成長し、2027年には17億米ドルの規模に達すると推定されています。同市場の成長を後押しする主な要因には、主要な航空機プログラムの生産率上昇の予想、今後の航空機プログラムの市場参入、機内エンターテイメント(IFE)の使用増加、最新の航空機プログラムでの電子コンテンツの増加などが挙げられます。

当レポートでは、世界の航空宇宙用プリント基板市場を調査しており、市場の概要、市場の成長要因および抑制要因の分析、プラットフォームタイプ・製品タイプ・ラミネート材料タイプ・用途・地域別の分析、競合情勢、さらに主要企業のプロファイルなど、包括的な情報を提供しています。

目次

第1章 エグゼクティブサマリー

第2章 航空宇宙用プリント基板市場の環境分析

- サプライチェーン分析

- PEST分析

- 業界のライフサイクル分析

- 主な動向

- 市場促進要因

- 市場の課題

第3章 航空宇宙用プリント基板市場:COVID-19影響評価

- 航空宇宙用プリント基板の市場動向と予測

- COVID前とCOVID後の市場評価

- 市場シナリオ分析:悲観的シナリオ、最も可能性が高いシナリオ、楽観的シナリオ

- 実質GDP損失と航空宇宙用プリント基板損失(2019年~2020年)

第4章 航空宇宙用プリント基板市場評価(2016年~2027)

- プラットフォームタイプ分析

- 民間航空機:地域の動向と予測

- リージョナル航空機:地域の動向と予測

- 一般航空:地域の動向と予測

- 軍用機:地域の動向と予測

- ヘリコプター:地域の動向と予測

- 宇宙船:地域の動向と予測

- 無人航空機(UAV):地域の動向と予測

- 製品タイプ分析

- リジッド1,2側面:地域の動向と予測

- 標準マルチレイヤー:地域の動向と予測

- フレキシブル:地域の動向と予測

- リジッドフレックス:地域の動向と予測

- 高密度インターコネクト/マイクロビア/ビルドアップ/IC基板:地域の動向と予測

- その他:地域の動向と予測

- ラミネート材料タイプの分析

- FR4:地域の動向と予測

- ポリイミド:地域の動向と予測

- その他:地域の動向と予測

- 用途分析

- 電源:地域の動向と予測

- 電力変換器:地域の動向と予測

- 無線通信:地域の動向と予測

- エンジン制御システム:地域の動向と予測

- レーダー:地域の動向と予測

- 健康監視センサー:地域の動向と予測

- その他:地域の動向と予測

- 地域分析

- 北米の航空宇宙用プリント基板市場:国別分析

- 欧州の航空宇宙用プリント基板市場:国別分析

- アジア太平洋の航空宇宙用プリント基板市場:国別分析

- その他地域の航空宇宙用プリント基板市場:国別分析

第5章 競合分析

- 市場統合レベル

- 競合情勢

- 市場シェア分析

- 製品ポートフォリオ分析

- 地理的存在

- 新製品の発売

- 戦略的提携

- ポーターのファイブフォース分析

第6章 戦略的成長機会

- 市場の魅力分析

- プラットフォームタイプ別の市場の魅力

- 製品タイプ別の市場の魅力

- ラミネート材料タイプ別の市場の魅力

- 用途別の市場の魅力

- 地域別の市場の魅力

- 国別の市場の魅力

- 新た動向

- 戦略的意味

- 主成功要因(KSF)

第7章 主要企業の企業プロファイル

- Amphenol Corporation

- ACB

- Advanced Circuits, Inc.

- Amitron Corporation

- Aspocomp Group Plc

- AT&S

- Eltek Ltd.

- Elvia PCB Group

- Epec Engineered Technologies

- FTG Group

- IEC Electronics

- Sanmina Corporation

- SMTC Corporation

- Summit Interconnect

- TTM Technologies, Inc.

第8章 付録

- 免責事項

- 著作権

- 略語

- 為替

- 市場番号

- 民間航空機:地域の動向と予測

- リージョナル航空機:地域の動向と予測

- 一般航空:地域の動向と予測

- 軍用機:地域の動向と予測

- ヘリコプター:地域の動向と予測

- 宇宙船:地域の動向と予測

- 無人航空機(UAV):地域の動向と予測

- リジッド1,2側面:地域の動向と予測

- 標準マルチレイヤー:地域の動向と予測

- フレキシブル:地域の動向と予測

- リジッドフレックス:地域の動向と予測

- 高密度インターコネクト/マイクロビア/ビルドアップ/IC基板:地域の動向と予測

- その他:地域の動向と予測

- FR4:地域の動向と予測

- ポリイミド:地域の動向と予測

- その他:地域の動向と予測

- 電源:地域の動向と予測

- 電力変換器:地域の動向と予測

- 無線通信:地域の動向と予測

- エンジン制御システム:地域の動向と予測

- レーダー:地域の動向と予測

- 健康監視センサー:地域の動向と予測

- その他:地域の動向と予測

- 北米の航空宇宙用プリント基板市場:国別分析

- 欧州の航空宇宙用プリント基板市場:国別分析

- アジア太平洋の航空宇宙用プリント基板市場:国別分析

- その他地域の航空宇宙用プリント基板市場:国別分析

- 市場統合レベル

- 競合情勢

- 市場シェア分析

- 製品ポートフォリオ分析

- 地理的存在

- 新製品の発売

- 戦略的提携

- ポーターのファイブフォース分析

- プラットフォームタイプ別の市場の魅力

- 製品タイプ別の市場の魅力

- ラミネート材料タイプ別の市場の魅力

- 用途別の市場の魅力

- 地域別の市場の魅力

- 国別の市場の魅力

Market Highlights

Printed Circuit Boards or PCBs are boards that have lines, paths, and traces to mechanically support and electrically connect different components and are used as a base in electrical components. The board may act as a support and be used as a wiring area for the components that are surface-mounted and socketed.

In the aerospace industry, a wide range of PCBs are used, such as rigid 1,2-sided, standard multilayer, flexible, rigid-flex, and HDI/Microvia/Build-up/ IC Substrate, depending upon the applications, like power supplies, power converters, radio communication, engine control systems, radars, health monitoring sensors, etc.

The aerospace industry is shifting focus towards the usage of advanced materials in order to make the aircraft lightweight yet durable with an ultimate aim to enhance fuel efficiency. PCBs used nowadays are experiencing miniaturization of components in order to establish weight and space savings. The aerospace industry requires sturdier PCBs so as to withstand harsh conditions. Some of the key properties of PCBs targeting aerospace applications include high-temperature resistance, shock absorption, high durability, and reliability.

The outbreak of the COVID-19 pandemic shook the aerospace industry due to cancellations of orders, a drop in revenue passenger kilometers, and supply chain disruptions. As a result, the industry recorded a massive decline in the year 2020 across regions. However, PCBs are among few products that recorded a minimal decline in the aerospace industry in 2020, credit goes to the shortage of PCB supplies, which triggered tier players to procure PCBs in large quantities in the uncertain supply scenario. The global aerospace printed circuit board market witnessed a decline of -4.3% in 2020 amid the pandemic.

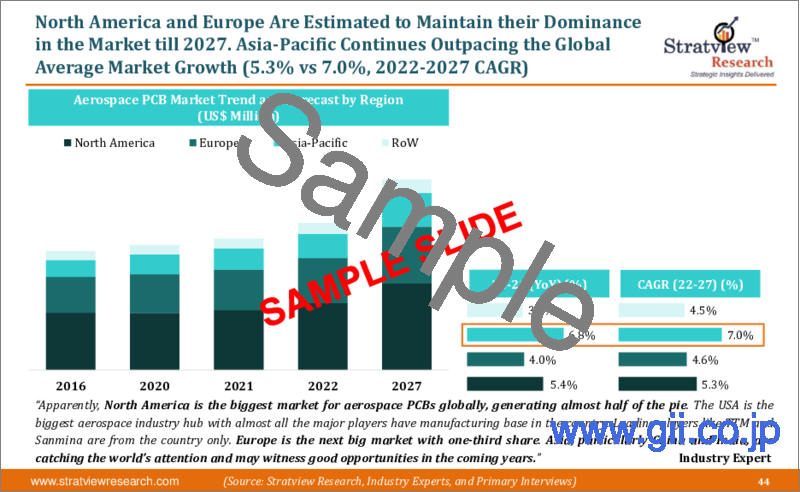

The market got recovered from the disruption brought by the COVID pandemic in the year 2021 due to economic recovery, gradual increase in RPKs, and regain of normalcy in major cities with the end of lockdowns. The aerospace printed circuit board market is estimated to grow at a healthy CAGR of 5.3% during the forecast period to reach a value of US$ 1.7 Billion in 2027. Major factors, such as the expected rise in the production rate of key aircraft programs, market entry of upcoming aircraft programs, increasing use of in-flight entertainment (IFE), and increasing electronic content in the latest aircraft programs, are likely to drive the growth of the aerospace PCB market.

Segments' Analysis

Based on the platform type, the market is segmented as commercial aircraft, regional aircraft, general aviation, military aircraft, helicopter, spacecraft, and Unmanned Aerial vehicles (UAV). Commercial aircraft is expected to remain the largest and the fastest-growing segment of the market during the forecast period. Increasing miniaturization of components, demand for lightweight yet durable components and parts; strong industry fundamentals; expected market entry of new players, such as COMAC and Irkut; introduction of variants of existing best-selling aircraft programs, such as A320neo and B777X; and rebounding commercial and regional aircraft deliveries across regions, are the key factors propelling the demand for circuit boards in the commercial aircraft segment.

Based on the product type, the market is segmented into rigid 1,2-sided, standard multilayer, flexible, rigid-flex, High-Density Interconnect (HDI)/Microvia/build-up/IC substrate, and others. Standard multilayer held the largest share of the market as it offers various advantages (space and weight savings, high reliability and efficiency, and high assembly density) over other PCB types, making it the preferred choice for multiple applications. HDI/Microvia/build-up/IC substrate is expected to grow with the highest growth during the forecast period due to increasing demand for weight-reduction through miniaturization of components used in various applications. In addition to that, HDI/Microvia/build-up/IC substrate offers various advantages such as higher performance and space-saving.

Based on the laminate material type, the market is segmented as FR4, polyimide, and others. FR4 is expected to remain the most preferred laminate type in the market during the forecast period. FR4 offers various advantages, such as high strength, excellent moisture resistance, weight savings, lower cost, and fire resistance, which make them the preferred material for a wide array of applications in the aerospace industry such as aerospace probes, navigation systems, radar systems, satellite tracking system, and airplane autopilot.

In terms of regions, North America is expected to remain the largest market for aerospace printed circuit boards over the forecast period. Major factors, such as the presence of major aircraft OEMs, tier players, raw material suppliers, and part fabricators, are driving the growth of the region's market. In addition to that, most of the printed circuit board manufacturers have their presence in the region, such as TTM Technologies, Sanmina Corporation, and Amphenol Corporation, to address the emergent needs of OEMs in order to be the partner for their upcoming aircraft programs or upcoming fuel-efficient variants of existing aircraft programs.

Asia-Pacific is expected to witness the highest growth during the same period propelled by factors such as increasing demand for commercial aircraft to support rising passenger traffic, the opening of assembly plants of Boeing and Airbus in China, the expected launch of COMAC C919, and rising aircraft fleet size.

Key Players

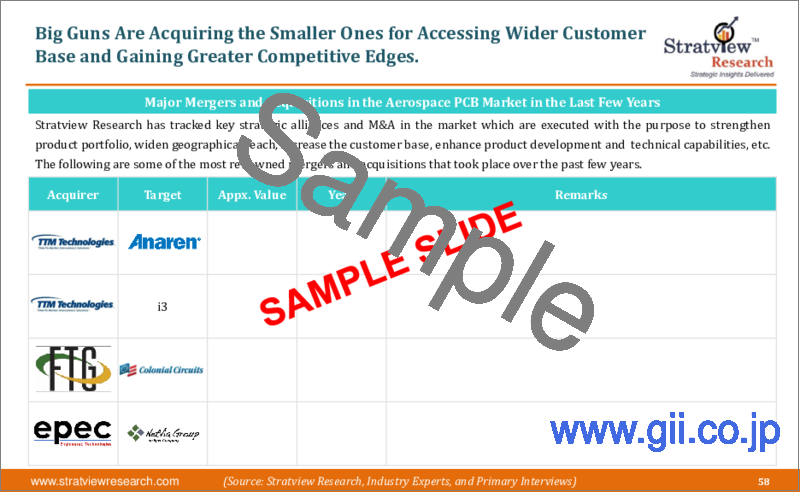

The aerospace PCB Market is highly consolidated with the top five players securing a mammoth share in 2021. All the major printed circuit board manufacturers have different growth strategies based on their synergies, product portfolio, market reach, geographical presence, and market positioning. However, some of the most common strategies adopted by them include new product development, development of a vast product portfolio, and execution of M&As to quickly gain market share. For instance, TTM Technologies acquired i3 Electronic, Inc. and Anaren Inc. in the year 2019 and 2018 respectively. The following are some of the key players in the aerospace printed circuit board market:

- TTM Technologies, Inc.

- Sanmina Corporation

- Amphenol Corporation

- AT&S

- Advanced Circuits, Inc.

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today's aerospace printed circuit board market realities and future market possibilities for the forecast period of 2022 to 2027. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research's internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 12 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter's five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Product portfolio, New Product Launches, etc.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The aerospace printed circuit board market is segmented into the following categories:

Aerospace Printed Circuit Board Market, by Platform Type

- Commercial Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- General Aviation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Helicopter (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Spacecraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Unmanned Aerial Vehicle (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aerospace Printed Circuit Board Market, by Product Type

- Rigid 1,2-Sided (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Standard Multilayer (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Flexible (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Rigid-Flex (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- High-Density Interconnect/Microvia/Build-Up/IC Substrate (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aerospace Printed Circuit Board Market, by Laminate Material Type

- FR4 (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Polyimide (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aerospace Printed Circuit Board Market, by Application Type

- Power Supplies (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Power Converters (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Radio Communication (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Engine Control Systems (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Radars (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Health Monitoring Sensors (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aerospace Printed Circuit Board Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Table of Contents

- Report Scope

- Report Objectives

- Market Segmentation

- Research Methodology

- Secondary Research

- Key Information Gathered from Secondary Research

- Primary Research

- Key Information Gathered from Primary Research

- Breakdown of Primary Interviews by Region, Designation, and Value Chain Node

- Data Analysis and Triangulation

1. Executive Summary

2. Aerospace Printed Circuit Board Market Environment Analysis

- 2.1. Supply Chain Analysis

- 2.2. PEST Analysis

- 2.3. Industry Life Cycle Analysis

- 2.4. Key Trends

- 2.5. Market Drivers

- 2.6. Market Challenges

3. Aerospace Printed Circuit Board Market - The COVID-19 Impact Assessment

- 3.1. Aerospace Printed Circuit Board Market Trend and Forecast (US$ Million)

- 3.2. Pre-COVID vs Post-COVID Market Assessment

- 3.3. Market Scenario Analysis: Pessimistic, Most Likely, and Optimistic Scenarios

- 3.4. Real GDP Loss vs Aerospace Printed Circuit Board Loss (2019-2020)

4. Aerospace Printed Circuit Board Market Assessment (2016-2027)

- 4.1. Platform-Type Analysis

- 4.1.1. Commercial Aircraft: Regional Trend and Forecast (US$ Million)

- 4.1.2. Regional Aircraft: Regional Trend and Forecast (US$ Million)

- 4.1.3. General Aviation: Regional Trend and Forecast (US$ Million)

- 4.1.4. Military Aircraft: Regional Trend and Forecast (US$ Million)

- 4.1.5. Helicopter: Regional Trend and Forecast (US$ Million)

- 4.1.6. Spacecraft: Regional Trend and Forecast (US$ Million)

- 4.1.7. Unmanned Aerial Vehicle (UAV): Regional Trend and Forecast (US$ Million)

- 4.2. Product-Type Analysis

- 4.2.1. Rigid 1,2-Sided: Regional Trend and Forecast (US$ Million)

- 4.2.2. Standard Multilayer: Regional Trend and Forecast (US$ Million)

- 4.2.3. Flexible: Regional Trend and Forecast (US$ Million)

- 4.2.4. Rigid-Flex: Regional Trend and Forecast (US$ Million)

- 4.2.5. High-Density Interconnect/Microvia/Build-Up/IC Substrate: Regional Trend and Forecast (US$ Million)

- 4.2.6. Others: Regional Trend and Forecast (US$ Million)

- 4.3. Laminate-Material-Type Analysis

- 4.3.1. FR4: Regional Trend and Forecast (US$ Million)

- 4.3.2. Polyimide: Regional Trend and Forecast (US$ Million)

- 4.3.3. Others: Regional Trend and Forecast (US$ Million)

- 4.4. Application-Type Analysis

- 4.4.1. Power Supplies: Regional Trend and Forecast (US$ Million)

- 4.4.2. Power Converters: Regional Trend and Forecast (US$ Million)

- 4.4.3. Radio Communication: Regional Trend and Forecast (US$ Million)

- 4.4.4. Engine Control Systems: Regional Trend and Forecast (US$ Million)

- 4.4.5. Radars: Regional Trend and Forecast (US$ Million)

- 4.4.6. Health Monitoring Sensors: Regional Trend and Forecast (US$ Million)

- 4.4.7. Others: Regional Trend and Forecast (US$ Million)

- 4.5. Regional Analysis

- 4.5.1. North American Aerospace Printed Circuit Board Market: Country Analysis

- 4.5.1.1. The USA's Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.1.2. Canadian Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.1.3. Mexican Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.2. European Aerospace Printed Circuit Board Market: Country Analysis

- 4.5.2.1. German Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.2.2. French Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.2.3. The UK's Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.2.4. Russian Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.2.5. RoE's Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.3. Asia-Pacific's Aerospace Printed Circuit Board Market: Country Analysis

- 4.5.3.1. Chinese Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.3.2. Japanese Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.3.3. Indian Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.3.4. RoAP's Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.4. Rest of the World's (RoW) Aerospace Printed Circuit Board Market: Country Analysis

- 4.5.4.1. Brazilian Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.4.2. Saudi Arabian Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.4.3. Other Aerospace Printed Circuit Board Market T&F (US$ Million)

- 4.5.1. North American Aerospace Printed Circuit Board Market: Country Analysis

5. Competitive Analysis

- 5.1.1. Market Consolidation Level

- 5.1.2. Competitive Landscape

- 5.1.3. Market Share Analysis

- 5.1.4. Product Portfolio Analysis

- 5.1.5. Geographical Presence

- 5.1.6. New Product Launches

- 5.1.7. Strategic Alliances

- 5.1.8. Porter's Five Forces Analysis

6. Strategic Growth Opportunities

- 6.1. Market Attractiveness Analysis

- 6.1.1. Market Attractiveness by Platform Type

- 6.1.2. Market Attractiveness by Product Type

- 6.1.3. Market Attractiveness by Laminate Material Type

- 6.1.4. Market Attractiveness by Application Type

- 6.1.5. Market Attractiveness by Region

- 6.1.6. Market Attractiveness by Country

- 6.2. Emerging Trends

- 6.3. Strategic Implications

- 6.4. Key Success Factors (KSFs)

7. Company Profile of Key Players (Alphabetically Arranged)

- 7.1. Amphenol Corporation

- 7.2. ACB

- 7.3. Advanced Circuits, Inc.

- 7.4. Amitron Corporation

- 7.5. Aspocomp Group Plc

- 7.6. AT&S

- 7.7. Eltek Ltd.

- 7.8. Elvia PCB Group

- 7.9. Epec Engineered Technologies

- 7.10. FTG Group

- 7.11. IEC Electronics

- 7.12. Sanmina Corporation

- 7.13. SMTC Corporation

- 7.14. Summit Interconnect

- 7.15. TTM Technologies, Inc.

8. Appendix

- 8.1. Disclaimer

- 8.2. Copyright

- 8.3. Abbreviation

- 8.4. Currency Exchange

- 8.5. Market Numbers