|

|

市場調査レポート

商品コード

1367867

シェアード&アンライセンススペクトラムのLTE/5Gネットワークエコシステム:2023年~2030年- 機会、課題、戦略、予測The Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2023 - 2030 - Opportunities, Challenges, Strategies & Forecasts |

||||||

|

|||||||

| シェアード&アンライセンススペクトラムのLTE/5Gネットワークエコシステム:2023年~2030年- 機会、課題、戦略、予測 |

|

出版日: 2023年10月23日

発行: SNS Telecom & IT

ページ情報: 英文 845 Pages; 96 Tables & Figures

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

5G時代の進展に伴い、携帯電話通信業界は、技術革新、自由な規制政策、破壊的なビジネスモデルによって、革命的なパラダイムシフトを迎えています。この急激な変革の重要な側面の1つは、シェアード周波数帯や免許不要周波数帯(1つの携帯電話事業者に独占的に免許されていない周波数帯)の採用が拡大していることです。

世界中の通信規制当局は、免許を受けた周波数帯の協調的シェアードを促進する革新的な枠組みを発表しているか、または発表している最中です。例えば、米国の3段階CBRS(市民ブロードバンド無線サービス)周波数シェアード方式、ドイツの5Gキャンパスネットワーク用3.7~3.8GHzおよび28GHz免許、英国のシェアードおよびローカルアクセス免許モデル、フランスの垂直周波数帯およびサブリース取り決め、オランダの地理的に制限されたミッドバンド周波数割り当て、スイスの3.4~3.5GHz帯のNPN(Non-Public Networks)用、フィンランドのローカル4G/5Gネットワーク用2.3GHzおよび26GHz免許、スウェーデンの3.7GHzおよび26GHz許可、ノルウェーの3.8~4.2GHz帯のローカルネットワーク規制。8~4.2GHz帯、ポーランドの地方自治体および企業向け周波数割り当て、バーレーンの民間5Gネットワーク・ライセンス、日本の4.6~4.9GHzおよび28GHzのローカル5Gネットワーク・ライセンス、韓国の4.7GHzおよび28GHz帯のe-Um 5G割り当て、台湾の4.8~4.9GHz帯のプライベート5Gネットワーク用周波数帯、香港のLWBS(ローカライズドワイヤレスブロードバンド・システム)ライセンス、オーストラリアの装置ライセンス方式、カナダが計画しているNCL(非競争的ローカル)ライセンスの枠組み、ブラジルのSLP(プライベート・リミテッド・サービス)ライセンスなどです。

米国の3.5GHz帯CBRSのGAA(General Authorized Access)階層や日本の1.9GHz帯sXGP(Shared Extended Global Platform)など、国によって指定された免許免除周波数帯を活用することで、免許不要の周波数帯のみで運用される独立携帯電話ネットワークへのアクセスが拡大していることも重要な進展です。さらに、600 MHzのTVWS(TVホワイトスペース)、5 GHz、6 GHz、60 GHz帯など、世界的・地域的にハーモナイズされた免許免除周波数帯の広大な範囲も世界中で利用可能であり、国内規制に従って、免許不要のLTEおよび5G NR-U(NR in Unlicensed Spectrum)機器の運用に使用することができます。

モバイルネットワークの高密度化、地方におけるFWA(固定無線アクセス)、MVNO(仮想移動体通信事業者)のオフロードから、農業、教育、ヘルスケア、製造、軍事、鉱業、石油・ガス、公共部門、小売・接客業、スポーツ、運輸、公益事業などの企業や垂直産業向けの中立的なホストインフラやプライベートセルラーネットワークに至るまで、さまざまな使用事例があります。

当レポートでは、シェアード&アンライセンススペクトルLTE/5Gネットワークエコシステムについて調査し、市場の概要とともに、バリューチェーン、市場促進要因、導入障壁、実現技術、主要動向、将来ロードマップ、ビジネスモデル、使用事例、用途、標準化、周波数帯の利用可能性と割り当て、規制状況、ケーススタディ、エコシステムにおける参入企業のプロファイル、戦略など、詳細な評価を掲載しています。

目次

第1章 イントロダクション

第2章 シェアード&アンライセンススペクトラムLTE/5Gネットワークの概要

第3章 シェアード&アンライセンススペクトラム技術

- 調整されたシェアードスペクトル技術

- アンライセンススペクトルでのLTEおよび5G NR

第4章 ビジネスモデル、使用事例、用途

- ビジネスモデルと使用事例

- 用途

第5章 スペクトルの可用性、割り当て、および使用法

- 調整された(ライセンスを取得した)シェアードスペクトル

- ライセンスのない(ライセンス免除)スペクトル

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 中南米

第6章 標準化、規制および共同イニシアチブ

- 3GPP(第3世代パートナーシッププロジェクト)

- 5Gキャンパスネットワークアライアンス

- 5GMF(第5世代移動通信推進フォーラム、日本)

- AGURRE(フランス運用無線ネットワークの主要ユーザー協会)

- ATIS(電気通信産業ソリューションのためのアライアンス)

- BTG(オランダ大規模ICTおよび電気通信ユーザー協会)

- CEPT(欧州郵政電気通信行政会議)

- CTIA

- DSA(ダイナミックスペクトラムアライアンス)

- ETSI(欧州電気通信標準化協会)

- EUWENA(欧州エンタープライズワイヤレスネットワークユーザー協会)

- EWA(エンタープライズワイヤレスアライアンス)

- IETF(インターネットエンジニアリングタスクフォース)

- ITU(国際電気通信連合)

- LTE-Uフォーラム(廃止)

- MFA(マルチファイアアライアンス)

- NGMN(次世代モバイルネットワーク)アライアンス

- NSC(国家スペクトルコンソーシアム)

- ONF(オープンネットワーキング財団)

- OnGoアライアンス

- スモールセルフォーラム

- 未来へのスペクトル

- ホワイトスペースアライアンス

- WINnForum(ワイヤレスイノベーションフォーラム)

- XGP(eXtended Global Platform)フォーラム

- その他

第7章 導入のケーススタディ

第8章 市場規模と予測

- シェアード&アンライセンススペクトラムLTE/5Gネットワークの世界の見通し

- エアインターフェイス技術別セグメンテーション

- 細胞タイプ別セグメンテーション

- スペクトルライセンシングモデル別セグメント化

- 周波数帯域別セグメンテーション

- 使用事例別セグメンテーション

- 地域別見通し

第9章 生態系の主要参入企業

- 4RF

- 6Harmonics/6WiLInk

- 7P (Seven Principles)

- ABiT Corporation

- Accelleran

- Accuver (InnoWireless)

- ADRF (Advanced RF Technologies)

- Affirmed Networks (Microsoft Corporation)

- AI-LINK

- Airgain

- Airspan Networks

- Airtower Networks

- Airwavz Solutions

- Akoustis Technologies

- albis-elcon (UET - United Electronic Technology)

- Alcadis

- Alef (Alef Edge)

- Allen Vanguard Wireless

- Alpha Wireless

- Alsatis R?seaux

- Amazon/AWS (Amazon Web Services)

- Ambra Solutions-ECOTEL

- Amdocs

- American Tower Corporation

- AMIT Wireless

- Anritsu

- ANS - Advanced Network Services (Charge Enterprises)

- Antenna Company

- Anterix

- Apple

- aql

- Aquila (Suzhou Aquila Solutions)

- Aqura Technologies (Telstra Purple)

- Arctic Semiconductor (Formerly SiTune Corporation)

- Arete M

- Artemis Networks

- Askey Computer Corporation (ASUS - ASUSTeK Computer)

- ASOCS

- ASTRI (Hong Kong Applied Science and Technology Research Institute)

- ASUS (ASUSTeK Computer)

- ATDI

- ATEL (Asiatelco Technologies)

- Athonet (HPE - Hewlett Packard Enterprise)

- ATN International

- AttoCore

- Aviat Networks

- Axians (VINCI Energies)

- Azcom Technology

- Baicells

- Ballast Networks

- BAYFU (Bayerische Funknetz)

- BBB (BB Backbone Corporation)

- BBK Electronics

- BearCom

- BEC Technologies (Billion Electric)

- becon

- Benetel

- Betacom

- BinnenBereik (NOVEC)

- Black Box

- Blackned

- BLiNQ Networks (CCI - Communication Components Inc.)

- Blu Wireless

- Blue Arcus Technologies

- Boingo Wireless (DigitalBridge Group)

- Boldyn Networks (Formerly BAI Communications)

- Branch Communications

- BTI Wireless

- Bureau Veritas/7Layers

- BVSystems (Berkeley Varitronics Systems)

- C3Spectra

- CableFree (Wireless Excellence)

- CableLabs

- CalChip Connect

- Cambium Networks

- Cambridge Consultants (Capgemini Invent)

- CampusGenius

- Capgemini Engineering

- CapX Nederland

- Casa Systems

- CCI (Communication Components Inc.)

- CCN (Cirrus Core Networks)

- Cegeka

- CellAntenna Corporation

- Cellnex Telecom

- cellXica

- Celona

- Centerline Communications

- Challenge Networks (Vocus)

- CICT - China Information and Communication Technology Group (China Xinke Group)

- Cisco Systems

- Citymesh (Cegeka/DIGI Communications)

- COCUS

- Codium Networks

- Comba Telecom

- CommAgility (E-Space)

- Commnet Wireless (ATN International)

- CommScope

- Compal Electronics

- COMSovereign

- CONEXIO Corporation

- CONGIV (ROBUR Industry Service Group)

- Connectivity Wireless Solutions (M/C Partners)

- Contela

- coreNOC

- Corning

- Council Rock

- Cradlepoint (Ericsson)

- Crown Castle International Corporation

- CTL

- CTS (Communication Technology Services)

- Cumucore

- DAEL Group

- dbSpectra

- DeepSig

- Dejero Labs

- DEKRA

- Dell Technologies

- Dense Air (SIP - Sidewalk Infrastructure Partners)

- DGS (Digital Global Systems)

- Digi International

- Digicert

- Digita (DigitalBridge Group)

- DigitalBridge Group

- DKK (Denki Kogyo)

- D-Link Corporation

- Doodle Labs

- Druid Software

- e-BO Enterprises

- EDX Wireless

- Edzcom (Cellnex Telecom)

- EION Wireless

- Element Materials Technology

- EMS (Electronic Media Services)

- Encore Networks

- Ericsson

- ETRI (Electronics & Telecommunications Research Institute, South Korea)

- EUCAST

- EXFO

- ExteNet Systems (DigitalBridge Group)

- EZcon Network

- Fairspectrum

- Federated Wireless

- Fenix Group

- Fibocom

- Fibrolan

- Firecell

- Flash Private Mobile Networks

- floLIVE

- FMBE (FMB Engineering)

- Fortress Solutions

- Foxconn (Hon Hai Technology Group)

- Fraunhofer FOKUS (Institute for Open Communication Systems)

- Fraunhofer HHI (Heinrich Hertz Institute)

- Fraunhofer IIS (Institute for Integrated Circuits)

- Fraunhofer IPT (Institute for Production Technology)

- FreedomFi

- Freshwave Group (DigitalBridge Group)

- FRTek

- FSG (Field Solutions Group)

- Fujitsu

- Future Technologies Venture

- G REIGNS (HTC Corporation)

- G+D (Giesecke+Devrient)

- GCT Semiconductor

- GE (General Electric)

- Gemtek Technology

- Getac Technology Corporation

- GigSky

- Global Telecom

- Globalgig

- Goodman Telecom Services

- Google (Alphabet)

- Granite Telecommunications

- Grape One (Sumitomo Corporation)

- Green Packet

- Greenet (Netherlands)

- GS Lab (Great Software Laboratory)

- GXC (Formerly GenXComm)

- Hawk Networks (Althea)

- HCL Technologies

- HFR Networks

- Hitachi

- HMF (Hytera Mobilfunk)

- Horizon Powered

- HP

- HPE (Hewlett Packard Enterprise)

- HSC (Hughes Systique Corporation)

- HTC Corporation

- Huawei

- HUBER+SUHNER

- Hughes Network Systems (EchoStar Corporation)

- iBwave Solutions

- Iconec

- InfiniG

- Infinite Electronics

- Infomark Corporation

- Infosys

- Infovista

- Innonet

- Inseego Corporation

- Insta Group

- Intel Corporation

- Intelsat

- Intenna Systems

- InterDigital

- INTERLEV

- IoT4Net

- IPLOOK Networks

- iPosi

- Itron

- JACS Solutions

- JATONTEC (Jaton Technology)

- JCI (Japan Communications Inc.)

- JIT (JI Technology)

- JMA Wireless

- JRC (Japan Radio Company)

- Juniper Networks

- Kajeet

- Key Bridge Wireless

- Keysight Technologies

- Kisan Telecom

- KLA Laboratories

- Kleos

- KMW

- KORE Wireless

- Kumu Networks

- Kyndryl

- Kyocera Corporation

- Kyrio (CableLabs)

- Landmark Dividend (DigitalBridge Group)

- Lekha Wireless Solutions

- Lemko Corporation

- Lenovo

- LG Corporation

- Lime Microsystems

- Lindsay Broadband

- Linkem

- Linx Technologies

- LIONS Technology

- Logicalis (Datatec)

- LS telcom

- m3connect

- MarchNet

- Marubun Corporation

- MatSing

- Maven Wireless

- Mavenir

- MCS Benelux

- Media Broadcast (freenet Group)

- Meta

- Metaswitch Networks (Microsoft Corporation)

- MiCOM Labs

- Microlab (RF Industries)

- Microsoft Corporation

- Miliwave

- MitraStar Technology (Unizyx Holding Corporation)

- MKI (Mitsui Knowledge Industry)

- Mobile Mark

- MobileComm Professionals (UST)

- Monogoto

- MosoLabs (Sercomm Corporation)

- Motorola Mobility (Lenovo)

- Motorola Solutions

- MRK Media

- MRT Technology (Suzhou)

- MSB (M S Benbow & Associates)

- MTI (Microelectronics Technology, Inc.)

- MTI Wireless Edge

- MUGLER

- Multi-Tech Systems

- MVI Group

- NEC Corporation

- Nemko

- Netgear

- Netmore Group

- Netvision Telecom

- Neutral Wireless

- Neutroon Technologies

- NewEdge Signal Solutions

- Nextivity

- Node-H

- Nokia

- Nova Labs (Helium)

- NRB (Network Research Belgium)

- NS Solutions Corporation

- Nsight

- NTT Group

- NuRAN Wireless

- Oceus Networks

- Octasic

- OneLayer

- Ontix

- OPTAGE

- Opticoms

- Oracle Communications

- Panasonic Connect

- Panorama Antennas

- Parallel Wireless

- Parsec Technologies

- Pavlov Media

- PBE Axell (Formerly Axell Wireless)

- PCS Technologies

- PCTEL

- PCTEST Lab (PCTEST Engineering Laboratory)

- Pente Networks

- Pierson Wireless

- Pivot Technology Services

- Pivotal Commware

- Pivotel Group

- Polaris Networks (Motorola Solutions)

- Pollen Mobile

- Potevio (CETC - China Electronics Technology Group Corporation)

- Proptivity

- QCT (Quanta Cloud Technology)

- QuadGen Wireless Solutions

- Qualcomm

- Quantum Wireless

- Qucell Networks (InnoWireless)

- Quectel Wireless Solutions

- Qulsar (VIAVI Solutions)

- Radisys (Reliance Industries)

- RADTONICS

- Rakuten Symphony

- Ranger Systems

- Ranplan Wireless

- Raycap

- RCS Telecommunications

- RED Technologies

- RF Connect

- RFS (Radio Frequency Systems)

- Rivada Networks

- RKTPL (RK Telesystem Private Limited)

- Rohde & Schwarz

- RSConnect

- RugGear

- RuggON Corporation

- Saankhya Labs (Tejas Networks)

- SAC Wireless (Nokia)

- Samsung

- Sanjole

- SBA Communications

- Select Spectrum

- Seowon Intech

- Sequans Communications

- Sercomm Corporation

- SETUP Protokolltester

- SGS

- Shared Access

- Sharp Corporation (Foxconn - Hon Hai Technology Group)

- Siemens

- Sierra Wireless (Semtech Corporation)

- Sigma Wireless

- Silicom Connectivity Solutions

- Sinclair Technologies (Norsat International/Hytera Communications)

- siticom (Logicalis)

- Sivers Semiconductors

- Skyworks Solutions

- Smart Mobile Labs

- SMAWave (Shanghai SMAWave Technology)

- Socionext

- SOLiD

- Sonim Technologies

- Sony Group Corporation

- Spectrum Effect

- SPIE Group

- Spirent Communications

- Sporton International

- SQUAN

- SSC (Shared Spectrum Company)

- Star Solutions

- STEP CG

- Sunwave Communications

- Supermicro (Super Micro Computer)

- SureSite Consulting Group

- Syniverse

- System Innovation Group

- T&W (Shenzhen Gongjin Electronics)

- Tait Communications

- Tango Networks

- Taoglas

- Tarana Wireless

- TE Connectivity

- Teal Communications

- Techbros

- Tecore Networks

- Telent

- Telet Research

- Televate

- Telewave

- TeleWorld Solutions (Samsung)

- Telit Cinterion

- Telrad Networks

- Telsasoft

- TeraGo

- Tessares

- TESSCO Technologies/Ventev

- ThinkRF

- Three Group Solutions (CK Hutchison)

- Tibco Telecoms

- Tillman Global Holdings

- Tilson

- TIL-TEK Antennae

- Titan ICT

- Titan.ium Platform

- TLC Solutions

- TRIOPT

- T-Systems International

- T?V S?D

- Ubicquia

- Ubiik

- UCtel

- UL

- URSYS

- V&M (Venus & Mercury) Telecom

- Valid8

- Vapor IO

- Vertical Bridge (DigitalBridge Group)

- Verveba Telecom

- Viasat

- VIAVI Solutions

- VITES

- VMware

- VVDN Technologies

- Wave-In Communication

- Wavelabs

- Wavesight

- Weaccess Group

- Westell Technologies

- Widelity

- WiFrost

- Wilson Electronics

- Wilus

- WIN Connectivity (Wireless Information Networks)

- Winncom Technologies

- WNC (Wistron NeWeb Corporation)

- WorldCell Solutions

- Wytec International

- Xantaro

- XCOM Labs

- Zebra Technologies

- Zinwave (Wilson Electronics)

- Zmtel (Shanghai Zhongmi Communication Technology)

- ZTE

- Zyxel

第10章 結論および戦略的提言

Synopsis

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum - frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have either launched or are in the process of releasing innovative frameworks to facilitate the coordinated sharing of licensed spectrum. Examples include but are not limited to the three-tiered CBRS (Citizens Broadband Radio Service) spectrum sharing scheme in the United States, Germany's 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks, United Kingdom's shared and local access licensing model, France's vertical spectrum and sub-letting arrangements, Netherlands' geographically restricted mid-band spectrum assignments, Switzerland's 3.4 - 3.5 GHz band for NPNs (Non-Public Networks), Finland's 2.3 GHz and 26 GHz licenses for local 4G/5G networks, Sweden's 3.7 GHz and 26 GHz permits, Norway's regulation of local networks in the 3.8-4.2 GHz band, Poland's spectrum assignment for local government units and enterprises, Bahrain's private 5G network licenses, Japan's 4.6-4.9 GHz and 28 GHz local 5G network licenses, South Korea's e-Um 5G allocations in the 4.7 GHz and 28 GHz bands, Taiwan's provision of 4.8-4.9 GHz spectrum for private 5G networks, Hong Kong's LWBS (Localized Wireless Broadband System) licenses, Australia's apparatus licensing approach, Canada's planned NCL (Non-Competitive Local) licensing framework and Brazil's SLP (Private Limited Service) licenses.

Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA (General Authorized Access) tier of the 3.5 GHz CBRS band in the United States and Japan's 1.9 GHz sXGP (Shared Extended Global Platform) band. In addition, vast swaths of globally and regionally harmonized license-exempt spectrum - most notably, the 600 MHz TVWS (TV White Space), 5 GHz, 6 GHz and 60 GHz bands - are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled 5G NR and LTE networks for a diverse array of use cases - ranging from mobile network densification, FWA (Fixed Wireless Access) in rural communities and MVNO (Mobile Virtual Network Operator) offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

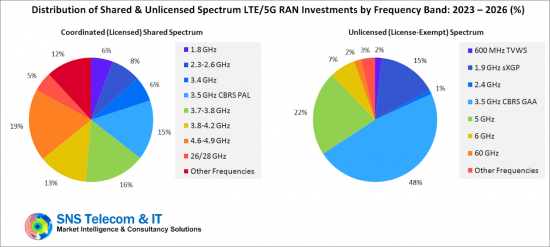

SNS Telecom & IT estimates that global investments in 5G NR and LTE-based RAN (Radio Access Network) infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

The "Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2023 - 2030 - Opportunities, Challenges, Strategies & Forecasts" report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2023 to 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 15 frequency bands, seven use cases and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

Key Findings

The report has the following key findings:

- SNS Telecom & IT estimates that global investments in LTE and 5G NR-based RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.4 Billion by the end of 2023. The market is expected to continue its upward trajectory beyond 2023, growing at a CAGR of approximately 27% between 2023 and 2026 to reach nearly $3 Billion in annual spending by 2026.

- Breaking away from traditional practices of spectrum assignment for mobile services that predominantly focused on exclusive-use national licenses, telecommunications regulatory authorities across the globe have either launched or are in the process of releasing innovative frameworks to facilitate the coordinated sharing of licensed spectrum. Examples include but are not limited to:

- The three-tiered CBRS spectrum sharing scheme in the United States

- Germany's 3.7-3.8 GHz and 28 GHz licenses for 5G campus networks

- United Kingdom's shared and local access licensing model

- France's vertical spectrum and sub-letting arrangements

- Netherlands' geographically restricted mid-band spectrum assignments

- Switzerland's 3.4 - 3.5 GHz band for NPNs (Non-Public Networks)

- Finland's 2.3 GHz and 26 GHz licenses for local 4G/5G networks

- Sweden's 3.7 GHz and 26 GHz permits, Norway's regulation of local networks in the 3.8-4.2 GHz band

- Poland's spectrum assignment for local government units and enterprises

- Bahrain's private 5G network licenses

- Japan's 4.6-4.9 GHz and 28 GHz local 5G network licenses

- South Korea's e-Um 5G allocations in the 4.7 GHz and 28 GHz bands

- Taiwan's provision of 4.8-4.9 GHz spectrum for private 5G networks

- Hong Kong's LWBS (Localized Wireless Broadband System) licenses

- Australia's apparatus licensing approach

- Canada's planned NCL (Non-Competitive Local) licensing framework

- Brazil's SLP (Private Limited Service) licenses

- Another important development is the growing accessibility of independent cellular networks that operate solely in unlicensed spectrum by leveraging nationally designated license-exempt frequencies such as the GAA tier of the 3.5 GHz CBRS band in the United States and Japan's 1.9 GHz sXGP band. In addition, vast swaths of globally and regionally harmonized license-exempt spectrum - most notably, the 600 MHz TVWS, 5 GHz, 6 GHz and 60 GHz bands - are also available worldwide, which can be used for the operation of unlicensed LTE and 5G NR-U (NR in Unlicensed Spectrum) equipment subject to domestic regulations.

- Collectively, ground-breaking spectrum liberalization initiatives are catalyzing the rollout of shared and unlicensed spectrum-enabled LTE and 5G NR networks for a diverse array of use cases - ranging from mobile network densification, FWA in rural communities and MVNO offload to neutral host infrastructure and private cellular networks for enterprises and vertical industries such as agriculture, education, healthcare, manufacturing, military, mining, oil and gas, public sector, retail and hospitality, sports, transportation and utilities.

- In particular, private LTE and 5G networks operating in shared spectrum are becoming an increasingly common theme. Hundreds of local and priority access licenses - predominantly in mid-band spectrum - have been issued in the United States, Germany, United Kingdom, France, Finland, Sweden, Japan, South Korea, Taiwan and other pioneering markets to facilitate the operation of purpose-built wireless networks based on 3GPP standards.

- Airbus, ArcelorMittal, Bayer, BBC (British Broadcasting Corporation), BMW, Bosch, Dow, EDF, Ferrovial, Groupe ADP, Holmen Iggesund, Hoban Construction, Hsinchu City Fire Department, Inventec, John Deere, KEPCO (Korea Electric Power Corporation), Lufthansa, Mercedes-Benz, Mitsubishi, NAVER, NFL (National Football League), Osaka Gas, Ricoh, SDG&E (San Diego Gas & Electric), Siemens, SVT (Sveriges Television), Tesla, Toyota, Volkswagen, X Shore and the U.S. military are just a few of the many end user organizations investing in shared spectrum-enabled private cellular networks.

- In some national markets, neutral host solutions based on shared spectrum small cells are being employed as a cost-effective means of coverage enhancement inside office spaces, public venues and other indoor environments. One prominent example is social media and technology giant Meta's in-building wireless network that uses small cells operating in the GAA tier of CBRS spectrum and MOCN (Multi-Operator Core Network) technology to provide multi-operator cellular coverage at its properties in the United States.

- Although the uptake of 5G NR equipment operating in high-band mmWave (Millimeter Wave) frequencies has been slower than initially anticipated, practical cases of 5G networks based on locally licensed 26/28 GHz spectrum are steadily piling up in multiple national markets - examples range from private 5G installations at HKIA (Hong Kong International Airport), SMC (Samsung Medical Center) and various manufacturing facilities to Japanese cable TV operator-led deployments of 28 GHz local 5G networks.

- The very first deployments of 5G NR-U technology are also beginning to emerge. For example, the SGCC (State Grid Corporation of China) has deployed a private NR-U network - operating in license-exempt Band n46 (5.8 GHz) spectrum - to support video surveillance, mobile inspection robots and other 5G-connected applications at its Lanzhou East and Mogao substations in China's Gansu province. In the coming years, with the technology's commercial maturity, we also anticipate seeing NR-U deployments in Band n96 (6 GHz) and Band n263 (60 GHz) for both licensed assisted and standalone modes of operation.

Topics Covered

The report covers the following topics:

- Introduction to shared and unlicensed spectrum LTE/5G networks

- Value chain and ecosystem structure

- Market drivers and challenges

- Enabling technologies and concepts, including CBRS, LSA/eLSA, local area licensing, AFC, 5G NR-U, LTE-U, LAA/eLAA/FeLAA, sXGP and MulteFire

- Key trends such as the growing prevalence of private cellular networks in industrial and enterprise settings, neutral host small cells, fixed wireless broadband rollouts, MVNO offload and mobile network densification

- Business models, use cases and application scenarios

- Future roadmap of shared and unlicensed spectrum LTE/5G networks

- Spectrum availability, allocation and usage across the global, regional and national domains

- Standardization, regulatory and collaborative initiatives

- 100 case studies of 5G NR and LTE deployments in shared and unlicensed spectrum

- Profiles and strategies of more than 400 ecosystem players

- Strategic recommendations for 5G NR and LTE equipment suppliers, system integrators, service providers, enterprises and vertical industries

- Market analysis and forecasts from 2023 to 2030

Forecast Segmentation

Market forecasts for LTE and 5G NR-based RAN equipment operating in shared and unlicensed spectrum are provided for each of the following submarkets and their subcategories:

- Air Interface Technologies

- LTE

- 5G NR

- Cell Types

- Indoor Small Cells

- Outdoor Small Cells

- Spectrum Licensing Models

- Coordinated (Licensed) Shared Spectrum

- Unlicensed (License-Exempt) Spectrum

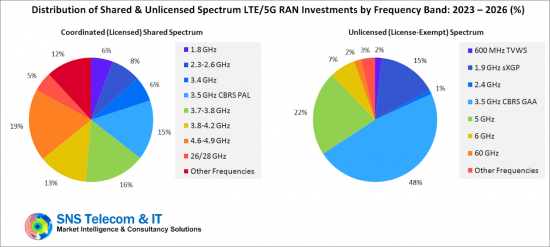

- Frequency Bands

- Coordinated (Licensed) Shared Spectrum

- 1.8 GHz

- 2.3-2.6 GHz

- 3.4 GHz

- 3.5 GHz CBRS PAL

- 3.7-3.8 GHz

- 3.8-4.2 GHz

- 4.6-4.9 GHz

- 26/28 GHz

- Other Frequencies

- Unlicensed (License-Exempt) Spectrum

- 600 MHz TVWS

- 1.9 GHz sXGP

- 2.4 GHz

- 3.5 GHz CBRS GAA

- 5 GHz

- 6 GHz

- 60 GHz

- Other Frequencies

- Coordinated (Licensed) Shared Spectrum

- Use Cases

- Mobile Network Densification

- FWA (Fixed Wireless Access)

- Cable Operators & New Entrants

- Neutral Hosts

- Private Cellular Networks

- Offices, Buildings & Corporate Campuses

- Vertical Industries

- Regional Markets

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- Latin & Central America

Key Questions Answered:

The report provides answers to the following key questions:

- How big is the opportunity for 5G NR and LTE networks operating in shared and unlicensed spectrum?

- What trends, drivers and challenges are influencing its growth?

- What will the market size be in 2026, and at what rate will it grow?

- Which submarkets and regions will see the highest percentage of growth?

- What are the existing and candidate shared/unlicensed spectrum bands for the operation of 5G NR and LTE, and what is the status of their adoption worldwide?

- What are the business models, use cases and application scenarios for shared and unlicensed spectrum?

- How are CBRS and other coordinated shared spectrum frameworks accelerating the uptake of private cellular networks for enterprises and vertical industries?

- How does the integration of shared and unlicensed spectrum relieve capacity constraints faced by traditional mobile operators?

- What opportunities exist for cable operators, neutral hosts, niche service providers and other new entrants?

- How is the commercial availability of 5G NR-based shared and unlicensed spectrum network equipment setting the stage for Industry 4.0 and advanced applications?

- Who are the key ecosystem players, and what are their strategies?

- What strategies should 5G NR and LTE equipment suppliers, system integrators, service providers and other stakeholders adopt to remain competitive?

Table of Contents

Chapter 1: Introduction

- 1.1. Executive Summary

- 1.2. Topics Covered

- 1.3. Forecast Segmentation

- 1.4. Key Questions Answered

- 1.5. Key Findings

- 1.6. Methodology

- 1.7. Target Audience

- 1.8. Companies & Organizations Mentioned

Chapter 2: An Overview of Shared & Unlicensed Spectrum LTE/5G Networks

- 2.1. Spectrum: The Lifeblood of the Wireless Communications Industry

- 2.1.1. Traditional Exclusive-Use Licensed Spectrum

- 2.1.2. Shared & Unlicensed Spectrum

- 2.2. Why Utilize Shared & Unlicensed Spectrum for LTE/5G Networks?

- 2.2.1. Alleviating Capacity Constraints on Mobile Operator Spectrum

- 2.2.2. New Business Models: Neutral Host, Enterprise & Private Cellular Networks

- 2.2.3. Resurgence of FWA (Fixed Wireless Access) Services

- 2.3. How Shared & Unlicensed Spectrum Differs From Traditional Licensed Frequencies

- 2.3.1. Exclusive vs. Shared Use

- 2.3.2. License Fees & Validity

- 2.3.3. Network Buildout & Service Obligations

- 2.3.4. Power Limits & Other Restrictions

- 2.4. Common Approaches to the Utilization of Shared & Unlicensed Spectrum

- 2.4.1. Coordinated Sharing of Licensed Spectrum

- 2.4.1.1. Authorized Sharing of Licensed Spectrum

- 2.4.1.2. Sub-Leasing of Unused Mobile Operator Frequencies

- 2.4.1.3. Light Licensing

- 2.4.1.4. Local Area Licenses

- 2.4.1.5. Concurrent Shared Access

- 2.4.2. License-Exempt (Unlicensed) Operation

- 2.4.2.1. Dedicated Unlicensed Bands

- 2.4.2.2. Opportunistic Unlicensed Access

- 2.4.3. Database-Assisted Spectrum Coordination

- 2.4.3.1. Manual Coordination

- 2.4.3.2. Semi-Automated Coordination

- 2.4.3.3. Automated Coordination

- 2.4.3.4. DSA (Dynamic Spectrum Access)

- 2.4.1. Coordinated Sharing of Licensed Spectrum

- 2.5. The Value Chain of Shared & Unlicensed Spectrum LTE/5G Networks

- 2.5.1. Semiconductor & Enabling Technology Specialists

- 2.5.2. Terminal OEMs (Original Equipment Manufacturers)

- 2.5.3. 5G NR & LTE Infrastructure Suppliers

- 2.5.4. Service Providers

- 2.5.4.1. Public Mobile Operators

- 2.5.4.2. MVNOs (Mobile Virtual Network Operators)

- 2.5.4.3. Fixed-Line Service Providers

- 2.5.4.4. Neutral Hosts

- 2.5.4.5. Private 5G/4G Network Operators

- 2.5.4.6. Towercos (Tower Companies)

- 2.5.4.7. Cloud & Edge Platform Providers

- 2.5.5. End Users

- 2.5.5.1. Consumers

- 2.5.5.2. Enterprises & Vertical Industries

- 2.5.6. Other Ecosystem Players

- 2.6. Market Drivers

- 2.6.1. Continued Growth of Mobile Data Traffic

- 2.6.2. New Revenue Streams: FWA, IoT & Vertical-Focused Services

- 2.6.3. Private & Neutral Host Network Deployments

- 2.6.4. Shared & Unlicensed Spectrum Availability

- 2.6.5. Lower Cost Network Equipment & Installation

- 2.6.6. Expanding Ecosystem of Compatible Devices

- 2.7. Market Barriers

- 2.7.1. Cell Site & Network Deployment Challenges

- 2.7.2. Restricted Coverage Due to Transmit Power Limits

- 2.7.3. Interference & Congestion Concerns in Unlicensed Bands

- 2.7.4. Resistance From Other Spectrum Users

- 2.7.5. Competition From Non-3GPP Technologies

- 2.7.6. Economic & Supply Chain-Related Factors

Chapter 3: Shared & Unlicensed Spectrum Technologies

- 3.1. Coordinated Shared Spectrum Technologies

- 3.1.1. CBRS (Citizens Broadband Radio Service): Three-Tiered Sharing

- 3.1.1.1. Dynamic Access to the 3.5 GHz Band in the United States

- 3.1.1.2. Tiers of Authorization

- 3.1.1.2.1. Tier 1 - Incumbent Access

- 3.1.1.2.2. Tier 2 - PALs (Priority Access Licenses)

- 3.1.1.2.3. Tier 3 - GAA (General Authorized Access)

- 3.1.1.3. CBRS System Architecture & Functional Elements

- 3.1.2. LSA (Licensed Shared Access): Two-Tiered Sharing

- 3.1.2.1. Database-Assisted Sharing of the 2.3 - 2.4 GHz Band in Europe

- 3.1.2.2. Functional Architecture of LSA Systems

- 3.1.2.3. eLSA (Evolved LSA): Frequency-Agnostic Sharing for Local Wireless Networks

- 3.1.3. AFC (Automated Frequency Coordination): License-Exempt Sharing

- 3.1.3.1. SP (Standard Power) Operation in the Unlicensed 6 GHz Band

- 3.1.3.2. AFC System Implementation Model & Architecture

- 3.1.4. Local Area Licensing of Shared Spectrum

- 3.1.4.1. Germany's 3.7 - 3.8 GHz & 26 GHz Licenses for 5G Campus Networks

- 3.1.4.2. United Kingdom's Shared & Local Access Licensing Model

- 3.1.4.3. France's Vertical Spectrum & Sub-Letting Arrangements

- 3.1.4.4. Netherlands' Geographically Restricted Mid-Band Spectrum Assignments

- 3.1.4.5. Switzerland's 3.4 - 3.5 GHz Band for NPNs (Non-Public Networks)

- 3.1.4.6. Finland's 2.3 GHz & 26 GHz Licenses for Local 4G/5G Networks

- 3.1.4.7. Sweden's 3.7 GHz & 26 GHz Local Permits for Mobile Services

- 3.1.4.8. Norway's Regulation of Local Networks in the 3.8 - 4.2 GHz Band

- 3.1.4.9. Poland's Spectrum Assignment for Local Government Units & Enterprises

- 3.1.4.10. Bahrain's 3.8 - 4.2 GHz Private 5G Network Licenses

- 3.1.4.11. Japan's 4.6 - 4.9 GHz & 28 GHz Local 5G Network Licenses

- 3.1.4.12. South Korea's e-Um 5G Allocations in the 4.7 GHz & 28 GHz Bands

- 3.1.4.13. Taiwan's Provision of 4.8 - 4.9 GHz Spectrum for Private 5G Networks

- 3.1.4.14. Hong Kong's LWBS (Localized Wireless Broadband System) Licenses

- 3.1.4.15. Australia's PTS (Public Telecommunications Service) & Area-Wide Apparatus Licenses

- 3.1.4.16. Canada's Planned NCL (Non-Competitive Local) Licensing Framework

- 3.1.4.17. Brazil's SLP (Private Limited Service) Licenses

- 3.1.4.18. Local Licensing Schemes in Other National Markets

- 3.1.5. Other Coordinated Shared Spectrum Technologies

- 3.1.1. CBRS (Citizens Broadband Radio Service): Three-Tiered Sharing

- 3.2. LTE & 5G NR in Unlicensed Spectrum

- 3.2.1. LTE-U

- 3.2.1.1. Channel Selection

- 3.2.1.2. CSAT (Carrier Sensing Adaptive Transmission)

- 3.2.1.3. Opportunistic On-Off Switching

- 3.2.2. LAA (Licensed Assisted Access)

- 3.2.2.1. LBT (Listen Before Talk): Category 4 & Category 2 LBT

- 3.2.2.2. FS3 (Frame Structure Type 3) for Unlicensed Carriers

- 3.2.2.3. Other LAA Design & Operational Aspects

- 3.2.3. eLAA (Enhanced LAA)

- 3.2.4. FeLAA (Further Enhanced LAA)

- 3.2.5. MulteFire

- 3.2.5.1. Supported Unlicensed Bands

- 3.2.5.2. Building on 3GPP-Specified LAA & eLAA Functionality

- 3.2.5.3. Modifications for Standalone Operation Without Licensed Anchor

- 3.2.5.4. Neutral Host Access, Cellular IoT Optimizations & Additional Capabilities

- 3.2.6. Japan's sXGP (Shared Extended Global Platform)

- 3.2.6.1. License-Exempt Operation of 1.9 GHz Private LTE Networks

- 3.2.6.2. LBT for Coexistence With PHS & Other sXGP Networks

- 3.2.6.3. Possible Use of 1.9 GHz as an Anchor Band for Local 5G Networks

- 3.2.7. 5G NR-U (NR in Unlicensed Spectrum)

- 3.2.7.1. Modes of Operation

- 3.2.7.1.1. Anchored NR-U

- 3.2.7.1.2. Standalone NR-U

- 3.2.7.2. LBT-Based Channel Access

- 3.2.7.3. Air Interface Refinements for NR-U

- 3.2.7.4. Time-Synchronized NR-U & Future Developments

- 3.2.7.1. Modes of Operation

- 3.2.1. LTE-U

Chapter 4: Business Models, Use Cases & Applications

- 4.1. Business Models & Use Cases

- 4.1.1. Service Provider Networks

- 4.1.1.1. Mobile Network Densification & Buildouts

- 4.1.1.2. FWA (Fixed Wireless Access) Broadband

- 4.1.1.3. Mobile Networks for Cable Operators & New Entrants

- 4.1.2. Neutral Host Networks

- 4.1.2.1. Indoor Spaces

- 4.1.2.2. Large Public Venues

- 4.1.2.3. Transport Hubs & Corridors

- 4.1.2.4. High-Density Urban Settings

- 4.1.2.5. Remote & Rural Coverage

- 4.1.3. Private Cellular Networks/NPNs (Non-Public Networks)

- 4.1.3.1. Offices, Buildings & Corporate Campuses

- 4.1.3.2. Vertical Industries

- 4.1.3.2.1. Education

- 4.1.3.2.2. Governments & Municipalities

- 4.1.3.2.3. Healthcare

- 4.1.3.2.4. Manufacturing

- 4.1.3.2.5. Military

- 4.1.3.2.6. Mining

- 4.1.3.2.7. Oil & Gas

- 4.1.3.2.8. Retail & Hospitality

- 4.1.3.2.9. Sports

- 4.1.3.2.10. Transportation

- 4.1.3.2.11. Utilities

- 4.1.3.2.12. Other Verticals

- 4.1.1. Service Provider Networks

- 4.2. Applications

- 4.2.1. Mobile Broadband

- 4.2.2. Home & Business Broadband

- 4.2.3. Voice & Messaging Services

- 4.2.4. High-Definition Video Transmission

- 4.2.5. Telepresence & Video Conferencing

- 4.2.6. Multimedia Broadcasting & Multicasting

- 4.2.7. IoT (Internet of Things) Networking

- 4.2.8. Wireless Connectivity for Wearables

- 4.2.9. Untethered AR/VR/MR (Augmented, Virtual & Mixed Reality)

- 4.2.10. Real-Time Holographic Projections

- 4.2.11. Tactile Internet & Haptic Feedback

- 4.2.12. High-Precision Positioning & Tracking

- 4.2.13. Industrial Automation

- 4.2.14. Remote Control of Machines

- 4.2.15. Connected Mobile Robotics

- 4.2.16. Unmanned & Autonomous Vehicles

- 4.2.17. BVLOS (Beyond Visual Line-of-Sight) Operation of Drones

- 4.2.18. Data-Driven Analytics & Insights

- 4.2.19. Sensor-Equipped Digital Twins

- 4.2.20. Predictive Maintenance of Equipment

Chapter 5: Spectrum Availability, Allocation & Usage

- 5.1. Coordinated (Licensed) Shared Spectrum

- 5.1.1. 1.8 GHz (1,710 - 1,880 MHz)

- 5.1.2. 2.3 GHz (2,300 - 2,400 MHz)

- 5.1.3. 2.6 GHz (2,570 - 2,620 MHz)

- 5.1.4. 3.4 GHz (3,300 - 3,500 MHz)

- 5.1.5. 3.5 GHz CBRS PAL Tier (3,550 - 3,650 MHz)

- 5.1.6. 3.7 - 3.8 GHz (3,700 - 3,800 MHz)

- 5.1.7. 3.8 - 4.2 GHz (3,800 - 4,200 MHz)

- 5.1.8. 4.6 - 4.9 GHz (4,600 - 4,900 MHz)

- 5.1.9. 26 GHz (24.25 - 27.5 GHz)

- 5.1.10. 28 GHz (26.5 - 29.5 GHz)

- 5.1.11. 37 GHz (37 - 37.6 GHz)

- 5.1.12. Other Bands

- 5.2. Unlicensed (License-Exempt) Spectrum

- 5.2.1. 600 MHz TVWS & Sub-1 GHz Bands (470 - 790/800/900 MHz)

- 5.2.2. 1.8 GHz DECT Guard Band (1,780 - 1,785 MHz / 1,875 - 1,880 MHz)

- 5.2.3. 1.9 GHz sXGP Band (1,880 - 1,920 MHz)

- 5.2.4. 2.4 GHz (2,400 - 2,483.5 MHz)

- 5.2.5. 3.5 GHz CBRS GAA Tier (3,550 - 3,700 MHz)

- 5.2.6. 5 GHz (5,150 - 5,925 MHz)

- 5.2.7. 6 GHz (5,925 - 7,125 MHz)

- 5.2.8. 60 GHz (57 - 71 GHz)

- 5.2.9. Other Bands

- 5.3. North America

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Asia Pacific

- 5.4.1. Australia

- 5.4.2. New Zealand

- 5.4.3. China

- 5.4.4. Hong Kong

- 5.4.5. Taiwan

- 5.4.6. Japan

- 5.4.7. South Korea

- 5.4.8. Singapore

- 5.4.9. Malaysia

- 5.4.10. Indonesia

- 5.4.11. Philippines

- 5.4.12. Thailand

- 5.4.13. Vietnam

- 5.4.14. Myanmar

- 5.4.15. India

- 5.4.16. Pakistan

- 5.4.17. Rest of Asia Pacific

- 5.5. Europe

- 5.5.1. United Kingdom

- 5.5.2. Ireland

- 5.5.3. France

- 5.5.4. Germany

- 5.5.5. Belgium

- 5.5.6. Netherlands

- 5.5.7. Switzerland

- 5.5.8. Austria

- 5.5.9. Italy

- 5.5.10. Spain

- 5.5.11. Portugal

- 5.5.12. Sweden

- 5.5.13. Norway

- 5.5.14. Denmark

- 5.5.15. Finland

- 5.5.16. Iceland

- 5.5.17. Estonia

- 5.5.18. Czech Republic

- 5.5.19. Poland

- 5.5.20. Ukraine

- 5.5.21. Türkiye

- 5.5.22. Greece

- 5.5.23. Bulgaria

- 5.5.24. Romania

- 5.5.25. Hungary

- 5.5.26. Slovenia

- 5.5.27. Croatia

- 5.5.28. Serbia

- 5.5.29. Russia

- 5.5.30. Belarus

- 5.5.31. Rest of Europe

- 5.6. Middle East & Africa

- 5.6.1. Saudi Arabia

- 5.6.2. United Arab Emirates

- 5.6.3. Qatar

- 5.6.4. Oman

- 5.6.5. Bahrain

- 5.6.6. Kuwait

- 5.6.7. Jordan

- 5.6.8. Israel

- 5.6.9. Egypt

- 5.6.10. Algeria

- 5.6.11. Morocco

- 5.6.12. Tunisia

- 5.6.13. South Africa

- 5.6.14. Kenya

- 5.6.15. Mauritius

- 5.6.16. Rest of the Middle East & Africa

- 5.7. Latin & Central America

- 5.7.1. Brazil

- 5.7.2. Mexico

- 5.7.3. Argentina

- 5.7.4. Colombia

- 5.7.5. Chile

- 5.7.6. Peru

- 5.7.7. Dominican Republic

- 5.7.8. Guatemala

- 5.7.9. El Salvador

- 5.7.10. Honduras

- 5.7.11. Costa Rica

- 5.7.12. Rest of Latin & Central America

Chapter 6: Standardization, Regulatory & Collaborative Initiatives

- 6.1. 3GPP (Third Generation Partnership Project)

- 6.1.1. Release 13: LAA for Downlink Operation

- 6.1.2. Release 14: eLAA, CBRS & LSA OAM

- 6.1.3. Release 15: FeLAA & 5G NR Air Interface

- 6.1.4. Release 16: 3GPP Support for 5G NR-U & NPNs

- 6.1.5. Release 17: NPN Refinements & Extension of Operation to 71 GHz

- 6.1.6. Release 18: Further Evolution of 5G NR in Shared & Unlicensed Spectrum

- 6.2. 5G Campus Network Alliance

- 6.2.1. Supporting the Market Development of 5G Campus Networks in Germany

- 6.3. 5GMF (Fifth Generation Mobile Communication Promotion Forum, Japan)

- 6.3.1. Initiatives Related to Local 5G Networks in Japan

- 6.4. AGURRE (Association of Major Users of Operational Radio Networks, France)

- 6.4.1. Spectrum Access, Regulatory Framework & Industrial Ecosystem for Private Mobile Networks

- 6.5. ATIS (Alliance for Telecommunications Industry Solutions)

- 6.5.1. Deployment & Operational Requirements of 5G-Based NPNs

- 6.5.2. IMSI Assignment & Management for CBRS Networks

- 6.5.3. Additional Shared Spectrum-Related Efforts

- 6.6. BTG (Dutch Association of Large-Scale ICT & Telecommunications Users)

- 6.6.1. KMBG (Dutch Critical Mobile Broadband Users) Expert Group

- 6.7. CEPT (European Conference of Postal and Telecommunications Administrations)

- 6.7.1. ECC (Electronic Communications Committee): Operational Guidelines for Spectrum Sharing in Europe

- 6.8. CTIA

- 6.8.1. Involvement in OnGo Alliance's CBRS Product Certification Program

- 6.9. DSA (Dynamic Spectrum Alliance)

- 6.9.1. Advocacy Efforts for Unlicensed & Dynamic Access to Spectrum

- 6.10. ETSI (European Telecommunications Standards Institute)

- 6.10.1. RRS (Reconfigurable Radio Systems) Technical Committee: Technical Specifications for LSA & eLSA

- 6.10.1.1. LSA in the 2.3 GHz (2,300 - 2,400 MHz) Band

- 6.10.1.2. Frequency Agnostic eLSA for Local Wireless Networks

- 6.10.1.3. Other Work Related to Temporary & Flexible Spectrum Access

- 6.10.2. BRAN (Broadband Radio Access Networks) Technical Committee: Harmonized Standards for Wireless Access Systems

- 6.10.2.1. TVWSD (TV White Space Devices) in the 470 - 694 MHz Band

- 6.10.2.2. RLANs (Radio Local Area Networks) in the 5 GHz & 6 GHz Bands

- 6.10.2.3. Multi-Gigabit Wireless Systems in the 60 GHz (57 - 71 GHz) Band

- 6.10.1. RRS (Reconfigurable Radio Systems) Technical Committee: Technical Specifications for LSA & eLSA

- 6.11. EUWENA (European Users of Enterprise Wireless Networks Association)

- 6.11.1. Catalyzing the Wider Adoption of 3GPP-Based Private Networks

- 6.12. EWA (Enterprise Wireless Alliance)

- 6.12.1. Supporting the Private Wireless Industry in the United States

- 6.13. IETF (Internet Engineering Task Force)

- 6.13.1. Standards & Protocols for Interworking Between 3GPP & Unlicensed Technologies

- 6.14. ITU (International Telecommunication Union)

- 6.14.1. International Regulation of Shared & Unlicensed Spectrum

- 6.15. LTE-U Forum (Defunct)

- 6.15.1. Technical Specifications for LTE-U in Unlicensed 5 GHz Spectrum

- 6.16. MFA (MulteFire Alliance)

- 6.16.1. Uni5G Technology Blueprints for Private 5G Networks

- 6.16.2. Network Identifier Program Supporting Private & Neutral Host Networks

- 6.16.3. MulteFire Specifications: LTE Operation in Unlicensed Spectrum

- 6.16.4. Certification Program for MulteFire Equipment

- 6.16.5. MulteFire OSU (Online Sign-Up) System

- 6.17. NGMN (Next-Generation Mobile Networks) Alliance

- 6.17.1. Shared & Unlicensed Spectrum-Related Activates

- 6.18. NSC (National Spectrum Consortium)

- 6.18.1. Increasing Confidence in Spectrum Sharing Approaches

- 6.19. ONF (Open Networking Foundation)

- 6.19.1. Shared & Unlicensed Spectrum Support in the Aether Private 5G Connected Edge Platform

- 6.20. OnGo Alliance

- 6.20.1. Promoting 4G & 5G OnGo Wireless Network Technology

- 6.20.2. Technical Specifications & Guidelines for 4G/5G-Based CBRS Networks

- 6.20.3. Certification Program Supporting Multi-Vendor Interoperability

- 6.21. Small Cell Forum

- 6.21.1. Work Related to License-Exempt & Shared Spectrum Small Cells

- 6.22. Spectrum for the Future

- 6.22.1. Advocating for Wireless Spectrum Sharing in the United States

- 6.23. WhiteSpace Alliance

- 6.23.1. Promoting the Use of 3GPP, IEEE & IETF Standards for TVWS Spectrum

- 6.24. WInnForum (Wireless Innovation Forum)

- 6.24.1. CBRS Standards for the Implementation of FCC Rulemaking

- 6.24.2. Specification of Sharing Arrangements in the 6 GHz Band

- 6.24.3. Other Shared & Unlicensed Spectrum-Related Efforts

- 6.25. XGP (eXtended Global Platform) Forum

- 6.25.1. Development & Promotion of the sXGP Unlicensed LTE Service

- 6.26. Others

- 6.26.1. National Government Agencies & Regulators

- 6.26.2. Vertical Industry-Specific Associations

- 6.26.3. Non-3GPP Technology Alliances

Chapter 7: Case Studies of Shared & Unlicensed Spectrum LTE/5G Deployments

- 7.1. ABP (Associated British Ports): Shared Access License-Enabled Private 5G Network for Port of Southampton

- 7.1.1. Spectrum Type

- 7.1.2. Integrators & Suppliers

- 7.1.3. Deployment Summary

- 7.2. AccessParks: Capitalizing on CBRS Shared Spectrum for Wireless Access in National & State Parks

- 7.2.1. Spectrum Type

- 7.2.2. Integrators & Suppliers

- 7.2.3. Deployment Summary

- 7.3. Airbus: Multi-Campus Private 4G/5G Network for Aircraft Manufacturing Facilities Across Europe

- 7.3.1. Spectrum Type

- 7.3.2. Integrators & Suppliers

- 7.3.3. Deployment Summary

- 7.4. Airport Authority Hong Kong: 28 GHz HKIA Public-Private 5G Infrastructure Project

- 7.4.1. Spectrum Type

- 7.4.2. Integrators & Suppliers

- 7.4.3. Deployment Summary

- 7.5. ANA (All Nippon Airways): Local 5G-Powered Digital Transformation of Aviation Training

- 7.5.1. Spectrum Type

- 7.5.2. Integrators & Suppliers

- 7.5.3. Deployment Summary

- 7.6. ArcelorMittal: 5G Steel Project for Industrial Digitization & Automation

- 7.6.1. Spectrum Type

- 7.6.2. Integrators & Suppliers

- 7.6.3. Deployment Summary

- 7.7. AT&T: Tapping Shared & Unlicensed Spectrum for FWA & Private Cellular Networks

- 7.7.1. Spectrum Type

- 7.7.2. Integrators & Suppliers

- 7.7.3. Deployment Summary

- 7.8. BAM Nuttall: Accelerating Innovation at Construction Sites With Private 5G Networks

- 7.8.1. Spectrum Type

- 7.8.2. Integrators & Suppliers

- 7.8.3. Deployment Summary

- 7.9. BBB (BB Backbone Corporation): 1.9 GHz sXGP Private LTE Network Service

- 7.9.1. Spectrum Type

- 7.9.2. Integrators & Suppliers

- 7.9.3. Deployment Summary

- 7.10. BMW Group: 5G NR-Based CBRS Network for Autonomous Logistics in Spartanburg Plant

- 7.10.1. Spectrum Type

- 7.10.2. Integrators & Suppliers

- 7.10.3. Deployment Summary

- 7.11. BT Media & Broadcast: Portable Private 5G Networks for Live Sports Broadcasting

- 7.11.1. Spectrum Type

- 7.11.2. Integrators & Suppliers

- 7.11.3. Deployment Summary

- 7.12. BYD SkyRail: Unlicensed 5 GHz Wireless System for Railway Communications

- 7.12.1. Spectrum Type

- 7.12.2. Integrators & Suppliers

- 7.12.3. Deployment Summary

- 7.13. Cal Poly (California Polytechnic State University): Converged Public-Private 5G Network

- 7.13.1. Spectrum Type

- 7.13.2. Integrators & Suppliers

- 7.13.3. Deployment Summary

- 7.14. CDA (Chicago Department of Aviation): Private Network for Chicago O'Hare International Airport

- 7.14.1. Spectrum Type

- 7.14.2. Integrators & Suppliers

- 7.14.3. Deployment Summary

- 7.15. Charter Communications: Transforming MVNO & FWA Service Offerings With CBRS Shared Spectrum

- 7.15.1. Spectrum Type

- 7.15.2. Integrators & Suppliers

- 7.15.3. Deployment Summary

- 7.16. Chunghwa Telecom: Utilizing Unlicensed 5 GHz Spectrum to Enhance Mobile Broadband Experience

- 7.16.1. Spectrum Type

- 7.16.2. Integrators & Suppliers

- 7.16.3. Deployment Summary

- 7.17. City of Las Vegas: Municipal Private Wireless Network for Businesses, Government & Educational Institutions

- 7.17.1. Spectrum Type

- 7.17.2. Integrators & Suppliers

- 7.17.3. Deployment Summary

- 7.18. Cologne Bonn Airport: Revolutionizing Internal Operations With Private 5G Campus Network

- 7.18.1. Spectrum Type

- 7.18.2. Integrators & Suppliers

- 7.18.3. Deployment Summary

- 7.19. COMAC (Commercial Aircraft Corporation of China): 5G-Connected Intelligent Aircraft Manufacturing Factories

- 7.19.1. Spectrum Type

- 7.19.2. Integrators & Suppliers

- 7.19.3. Deployment Summary

- 7.20. Del Conca USA: Automating & Streamlining Production Processes With Private Wireless Network

- 7.20.1. Spectrum Type

- 7.20.2. Integrators & Suppliers

- 7.20.3. Deployment Summary

- 7.21. DFW (Dallas Fort Worth) International Airport: Private 5G Network for IoT & Digitization Use Cases

- 7.21.1. Spectrum Type

- 7.21.2. Integrators & Suppliers

- 7.21.3. Deployment Summary

- 7.22. Dow: Modernizing Chemical Plant Maintenance With Private Cellular Networks

- 7.22.1. Spectrum Type

- 7.22.2. Integrators & Suppliers

- 7.22.3. Deployment Summary

- 7.23. EDF: Private Mobile Networks for Enhanced Connectivity at Nuclear Power Plants & Wind Farms

- 7.23.1. Spectrum Type

- 7.23.2. Integrators & Suppliers

- 7.23.3. Deployment Summary

- 7.24. EHIME CATV: Gigabit-Grade FWA Service Using 28 GHz Local 5G Network

- 7.24.1. Spectrum Type

- 7.24.2. Integrators & Suppliers

- 7.24.3. Deployment Summary

- 7.25. Ferrovial: Standalone Private 5G Network for Silvertown Tunnel Project

- 7.25.1. Spectrum Type

- 7.25.2. Integrators & Suppliers

- 7.25.3. Deployment Summary

- 7.26. Fiskarheden: Local 3.7 GHz License-Based Private 5G Network for Transtrand Sawmill

- 7.26.1. Spectrum Type

- 7.26.2. Integrators & Suppliers

- 7.26.3. Deployment Summary

- 7.27. FOX Sports: Private Wireless Network for Live Broadcast Operations

- 7.27.1. Spectrum Type

- 7.27.2. Integrators & Suppliers

- 7.27.3. Deployment Summary

- 7.28. Fraport: Private 5G Campus Network for Future-Oriented Operations at Frankfurt Airport

- 7.28.1. Spectrum Type

- 7.28.2. Integrators & Suppliers

- 7.28.3. Deployment Summary

- 7.29. Frontier Communications: Leveraging CBRS Shared Spectrum for Rural Broadband

- 7.29.1. Spectrum Type

- 7.29.2. Integrators & Suppliers

- 7.29.3. Deployment Summary

- 7.30. Fujitsu: Japan's First 5G Network Installation Based on 28 GHz Local 5G Spectrum

- 7.30.1. Spectrum Type

- 7.30.2. Integrators & Suppliers

- 7.30.3. Deployment Summary

- 7.31. Gale South Beach Hotel: CBRS Network for Guest Engagement & Hotel Operations

- 7.31.1. Spectrum Type

- 7.31.2. Integrators & Suppliers

- 7.31.3. Deployment Summary

- 7.32. Geisinger (Kaiser Permanente): Private LTE Network for Telemedicine in Rural Pennsylvania

- 7.32.1. Spectrum Type

- 7.32.2. Integrators & Suppliers

- 7.32.3. Deployment Summary

- 7.33. Gogo Business Aviation: Leveraging Unlicensed 2.4 GHz spectrum for 5G-Based A2G (Air-to-Ground) Connectivity

- 7.33.1. Spectrum Type

- 7.33.2. Integrators & Suppliers

- 7.33.3. Deployment Summary

- 7.34. Groupe ADP: 3GPP-Based Private Mobile Network for Paris Airports

- 7.34.1. Spectrum Type

- 7.34.2. Integrators & Suppliers

- 7.34.3. Deployment Summary

- 7.35. Guident: Private 5G Testbed for Autonomous Vehicles & Smart City Use Cases

- 7.35.1. Spectrum Type

- 7.35.2. Integrators & Suppliers

- 7.35.3. Deployment Summary

- 7.36. Helios Park Hospital: Enhancing Medical System Efficiency With Standalone 5G Campus Network

- 7.36.1. Spectrum Type

- 7.36.2. Integrators & Suppliers

- 7.36.3. Deployment Summary

- 7.37. Hiroshima Gas: Local 5G-Powered Safety Operations at Hatsukaichi LNG Terminal

- 7.37.1. Spectrum Type

- 7.37.2. Integrators & Suppliers

- 7.37.3. Deployment Summary

- 7.38. Hoban Construction: 4.7 GHz Private 5G Network for Apartment Complex Worksite

- 7.38.1. Spectrum Type

- 7.38.2. Integrators & Suppliers

- 7.38.3. Deployment Summary

- 7.39. Howard University: Delivering Secure & Enhanced Campus Connectivity With CBRS Network

- 7.39.1. Spectrum Type

- 7.39.2. Integrators & Suppliers

- 7.39.3. Deployment Summary

- 7.40. HSG (Haslam Sports Group): 3GPP-Based Private Wireless Infrastructure for Stadium Operations

- 7.40.1. Spectrum Type

- 7.40.2. Integrators & Suppliers

- 7.40.3. Deployment Summary

- 7.41. Hsinchu City Fire Department: Satellite-Backhauled Private 5G Network for PPDR Communications

- 7.41.1. Spectrum Type

- 7.41.2. Integrators & Suppliers

- 7.41.3. Deployment Summary

- 7.42. Inventec Corporation: Standalone Private 5G Network for Taoyuan Guishan Plant

- 7.42.1. Spectrum Type

- 7.42.2. Integrators & Suppliers

- 7.42.3. Deployment Summary

- 7.43. JBG SMITH Properties: National Landing Private 5G Infrastructure Platform

- 7.43.1. Spectrum Type

- 7.43.2. Integrators & Suppliers

- 7.43.3. Deployment Summary

- 7.44. John Deere: Private Cellular Connectivity for Manufacturing Processes

- 7.44.1. Spectrum Type

- 7.44.2. Integrators & Suppliers

- 7.44.3. Deployment Summary

- 7.45. Kansai Electric Power: Enhancing Power Station & Wind Farm Maintenance Using Local 5G Networks

- 7.45.1. Spectrum Type

- 7.45.2. Integrators & Suppliers

- 7.45.3. Deployment Summary

- 7.46. Kawasaki Heavy Industries: Connecting Smart Factory Robotics With Local 5G

- 7.46.1. Spectrum Type

- 7.46.2. Integrators & Suppliers

- 7.46.3. Deployment Summary

- 7.47. KEPCO (Korea Electric Power Corporation): Private 5G Networks for Substation Management

- 7.47.1. Spectrum Type

- 7.47.2. Integrators & Suppliers

- 7.47.3. Deployment Summary

- 7.48. Kumagai Gumi: Unleashing the Potential of Unmanned Construction Using Local 5G Networks

- 7.48.1. Spectrum Type

- 7.48.2. Integrators & Suppliers

- 7.48.3. Deployment Summary

- 7.49. Logan Aluminum: Enhancing Plant Safety & Efficiency Using Private Broadband Network

- 7.49.1. Spectrum Type

- 7.49.2. Integrators & Suppliers

- 7.49.3. Deployment Summary

- 7.50. Lufthansa Technik: Industrial-Grade 5G Campus Network for Hamburg Engine Shops

- 7.50.1. Spectrum Type

- 7.50.2. Integrators & Suppliers

- 7.50.3. Deployment Summary

- 7.51. Mediacom Communications: Harnessing CBRS Spectrum for FWA Services in Rural America

- 7.51.1. Spectrum Type

- 7.51.2. Integrators & Suppliers

- 7.51.3. Deployment Summary

- 7.52. Memorial Health System: Temporary Private Cellular Network to Support COVID-19 Response Efforts

- 7.52.1. Spectrum Type

- 7.52.2. Integrators & Suppliers

- 7.52.3. Deployment Summary

- 7.53. Mercedes-Benz Group: World's First 5G Campus Network for Automotive Production

- 7.53.1. Spectrum Type

- 7.53.2. Integrators & Suppliers

- 7.53.3. Deployment Summary

- 7.54. Mercury Broadband: CBRS Network for Broadband Expansion in the Midwestern United States

- 7.54.1. Spectrum Type

- 7.54.2. Integrators & Suppliers

- 7.54.3. Deployment Summary

- 7.55. Meta: CBRS-Powered Neutral Host Wireless Network for Indoor Coverage in Office Buildings

- 7.55.1. Spectrum Type

- 7.55.2. Integrators & Suppliers

- 7.55.3. Deployment Summary

- 7.56. Midco (Midcontinent Communications): Shared & Unlicensed Spectrum for Rural Broadband Connectivity

- 7.56.1. Spectrum Type

- 7.56.2. Integrators & Suppliers

- 7.56.3. Deployment Summary

- 7.57. Mitsubishi Electric: Local 5G-Based Industrial Wireless System for Factory Automation

- 7.57.1. Spectrum Type

- 7.57.2. Integrators & Suppliers

- 7.57.3. Deployment Summary

- 7.58. Mori Building Company: 5G Core-Enabled 1.9 GHz sXGP Network for Building Management & Tenant Services

- 7.58.1. Spectrum Type

- 7.58.2. Integrators & Suppliers

- 7.58.3. Deployment Summary

- 7.59. MTS (Mobile TeleSystems): Delivering Gigabit-Grade LTE Services Using LAA Technology

- 7.59.1. Spectrum Type

- 7.59.2. Integrators & Suppliers

- 7.59.3. Deployment Summary

- 7.60. NetCity (GEOS Telecom): Unlicensed Sub-1 GHz LTE Network for AMI (Advanced Metering Infrastructure)

- 7.60.1. Spectrum Type

- 7.60.2. Integrators & Suppliers

- 7.60.3. Deployment Summary

- 7.61. NFL (National Football League): Private Wireless Technology for Coach-to-Coach & Sideline Communications

- 7.61.1. Spectrum Type

- 7.61.2. Integrators & Suppliers

- 7.61.3. Deployment Summary

- 7.62. Norfolk Southern Corporation: LTE-Based CBRS Network for Rail Yard Staff

- 7.62.1. Spectrum Type

- 7.62.2. Integrators & Suppliers

- 7.62.3. Deployment Summary

- 7.63. NYPL (New York Public Library): Shrinking the Digital Divide With CBRS Technology

- 7.63.1. Spectrum Type

- 7.63.2. Integrators & Suppliers

- 7.63.3. Deployment Summary

- 7.64. Ocado: 4G-Based Unlicensed 5 GHz Wireless Control System for Warehouse Automation

- 7.64.1. Spectrum Type

- 7.64.2. Integrators & Suppliers

- 7.64.3. Deployment Summary

- 7.65. OhioTT (Ohio Transparent Telecom): CBRS-Enabled Fixed Wireless Network for Rural Ohio

- 7.65.1. Spectrum Type

- 7.65.2. Integrators & Suppliers

- 7.65.3. Deployment Summary

- 7.66. Port Authority of New York and New Jersey: Private LTE Network for Newark Liberty International Airport

- 7.66.1. Spectrum Type

- 7.66.2. Integrators & Suppliers

- 7.66.3. Deployment Summary

- 7.67. Port of Rotterdam: Locally Licensed 3.7 GHz LTE Network for Business-Critical Applications

- 7.67.1. Spectrum Type

- 7.67.2. Integrators & Suppliers

- 7.67.3. Deployment Summary

- 7.68. Port of Tyne: Advancing Smart Port Transformation With Private 5G Network

- 7.68.1. Spectrum Type

- 7.68.2. Integrators & Suppliers

- 7.68.3. Deployment Summary

- 7.69. Pronto: Private Cellular-Enabled Driverless Trucks for Autonomous Haulage in Remote Mining Sites

- 7.69.1. Spectrum Type

- 7.69.2. Integrators & Suppliers

- 7.69.3. Deployment Summary

- 7.70. Purdue University: Private Wireless Networks for Smart City & Aviation Applications

- 7.70.1. Spectrum Type

- 7.70.2. Integrators & Suppliers

- 7.70.3. Deployment Summary

- 7.71. RCI (Rural Cloud Initiative): Building the Farm of the Future With CBRS Shared Spectrum

- 7.71.1. Spectrum Type

- 7.71.2. Integrators & Suppliers

- 7.71.3. Deployment Summary

- 7.72. Ricoh: Accelerating Digital Transformation of Production Operations With Local 5G Networks

- 7.72.1. Spectrum Type

- 7.72.2. Integrators & Suppliers

- 7.72.3. Deployment Summary

- 7.73. Robert Bosch: Automating & Digitizing Manufacturing Facilities With Private 5G Networks

- 7.73.1. Spectrum Type

- 7.73.2. Integrators & Suppliers

- 7.73.3. Deployment Summary

- 7.74. Rudin Management Company: Neutral Host CBRS Network for Multi-Tenant Office Building

- 7.74.1. Spectrum Type

- 7.74.2. Integrators & Suppliers

- 7.74.3. Deployment Summary

- 7.75. SDG&E (San Diego Gas & Electric): pLTE (Private LTE) Network for Advanced Safety & Protection Technologies

- 7.75.1. Spectrum Type

- 7.75.2. Integrators & Suppliers

- 7.75.3. Deployment Summary

- 7.76. SGCC (State Grid Corporation of China): 5.8 GHz Private NR-U Network for Lanzhou East & Mogao Substations

- 7.76.1. Spectrum Type

- 7.76.2. Integrators & Suppliers

- 7.76.3. Deployment Summary

- 7.77. SGP (Société du Grand Paris): 2.6 GHz Private LTE Network for Grand Paris Express Rapid Transit System

- 7.77.1. Spectrum Type

- 7.77.2. Integrators & Suppliers

- 7.77.3. Deployment Summary

- 7.78. Siemens: Independently Developed Private 5G Infrastructure for Industry 4.0 Applications

- 7.78.1. Spectrum Type

- 7.78.2. Integrators & Suppliers

- 7.78.3. Deployment Summary

- 7.79. SmarTone: Effectively Managing Traffic Surges With Strategically Located LAA Small Cells

- 7.79.1. Spectrum Type

- 7.79.2. Integrators & Suppliers

- 7.79.3. Deployment Summary

- 7.80. SMC (Samsung Medical Center): On-Premise Private 5G Network for Medical Education

- 7.80.1. Spectrum Type

- 7.80.2. Integrators & Suppliers

- 7.80.3. Deployment Summary

- 7.81. Southern Linc: Expanding LTE Network Capacity for Utility Communications With CBRS Shared Spectrum

- 7.81.1. Spectrum Type

- 7.81.2. Integrators & Suppliers

- 7.81.3. Deployment Summary

- 7.82. SSA Marine (Carrix): 3GPP-Based Private Wireless Network for Port of Seattle's Terminal 5

- 7.82.1. Spectrum Type

- 7.82.2. Integrators & Suppliers

- 7.82.3. Deployment Summary

- 7.83. St. Vrain Valley School District: Private LTE Network for Connecting Low-Income Students

- 7.83.1. Spectrum Type

- 7.83.2. Integrators & Suppliers

- 7.83.3. Deployment Summary

- 7.84. Teltech Group: Private 4G/5G-Enabled Warehouse Automation & Industry 4.0 Capabilities

- 7.84.1. Spectrum Type

- 7.84.2. Integrators & Suppliers

- 7.84.3. Deployment Summary

- 7.85. The Sound Hotel: Enhancing Guest Experience & Internal Operations With Private Wireless Technology

- 7.85.1. Spectrum Type

- 7.85.2. Integrators & Suppliers

- 7.85.3. Deployment Summary

- 7.86. Tokyo Metropolitan University: L5G (Local 5G) Project in Support of "Future Tokyo" Strategy

- 7.86.1. Spectrum Type

- 7.86.2. Integrators & Suppliers

- 7.86.3. Deployment Summary

- 7.87. TotalEnergies: 3GPP-Based PMR (Professional Mobile Radio) Network for Critical Communications

- 7.87.1. Spectrum Type

- 7.87.2. Integrators & Suppliers

- 7.87.3. Deployment Summary

- 7.88. TOUA (Tohono O'odham Utility Authority): Bringing Advanced Broadband Connectivity to Tribal Residents

- 7.88.1. Spectrum Type

- 7.88.2. Integrators & Suppliers

- 7.88.3. Deployment Summary

- 7.89. Toyota Motor Corporation: Private LTE & Local 5G Networks for Industrial Use Cases

- 7.89.1. Spectrum Type

- 7.89.2. Integrators & Suppliers

- 7.89.3. Deployment Summary

- 7.90. U.S. Marine Corps: Private 5G for Smart Warehousing & Expeditionary Base Operations

- 7.90.1. Spectrum Type

- 7.90.2. Integrators & Suppliers

- 7.90.3. Deployment Summary

- 7.91. UCSB (University of California, Santa Barbara): Outdoor CBRS Network for On-Campus IoT Services

- 7.91.1. Spectrum Type

- 7.91.2. Integrators & Suppliers

- 7.91.3. Deployment Summary

- 7.92. UIPA (Utah Inland Port Authority): CBRS-Enabled ICN (Intelligent Crossroads Network) for Utah's Supply Chain

- 7.92.1. Spectrum Type

- 7.92.2. Integrators & Suppliers

- 7.92.3. Deployment Summary

- 7.93. URSYS: Bringing Cellular Connectivity to Rural Areas and Outlying Regions With Unlicensed Spectrum

- 7.93.1. Spectrum Type

- 7.93.2. Integrators & Suppliers

- 7.93.3. Deployment Summary

- 7.94. Verizon Communications: Exploiting 3.5 GHz CBRS & 5 GHz Spectrum to Address Capacity Demands

- 7.94.1. Spectrum Type

- 7.94.2. Integrators & Suppliers

- 7.94.3. Deployment Summary

- 7.95. Vodacom Group: Employing Unlicensed 5 GHz Spectrum to Improve LTE Network Capacity & Performance

- 7.95.1. Spectrum Type

- 7.95.2. Integrators & Suppliers

- 7.95.3. Deployment Summary

- 7.96. Wells Fargo Center: Improving Critical Operations & Fan Experience With Private 4G/5G Connectivity

- 7.96.1. Spectrum Type

- 7.96.2. Integrators & Suppliers

- 7.96.3. Deployment Summary

- 7.97. WiFrost: 4G/5G-Based Unlicensed TVWS System for FWA & Precision Agriculture

- 7.97.1. Spectrum Type

- 7.97.2. Integrators & Suppliers

- 7.97.3. Deployment Summary

- 7.98. X Shore: Empowering Electric Boat Manufacturing With Private 5G Network

- 7.98.1. Spectrum Type

- 7.98.2. Integrators & Suppliers

- 7.98.3. Deployment Summary

- 7.99. Yangshan Port: Unlicensed 5.8 GHz Wireless Network for Automated Container Terminal Operations

- 7.99.1. Spectrum Type

- 7.99.2. Integrators & Suppliers

- 7.99.3. Deployment Summary

- 7.100. Yumeshima Container Terminal: Local 5G Network for Digital Transformation of Port Facilities

- 7.100.1. Spectrum Type

- 7.100.2. Integrators & Suppliers

- 7.100.3. Deployment Summary

Chapter 8: Market Sizing & Forecasts

- 8.1. Global Outlook for Shared & Unlicensed Spectrum LTE/5G Networks

- 8.2. Segmentation by Air Interface Technology

- 8.2.1. LTE

- 8.2.2. 5G NR

- 8.3. Segmentation by Cell Type

- 8.3.1. Indoor Small Cells

- 8.3.2. Outdoor Small Cells

- 8.4. Segmentation by Spectrum Licensing Model

- 8.4.1. Coordinated (Licensed) Shared Spectrum

- 8.4.2. Unlicensed (License-Exempt) Spectrum

- 8.5. Segmentation by Frequency Band

- 8.5.1. Coordinated Shared Spectrum

- 8.5.1.1. 1.8 GHz

- 8.5.1.2. 2.3 - 2.6 GHz

- 8.5.1.3. 3.4 GHz

- 8.5.1.4. 3.5 GHz CBRS PAL

- 8.5.1.5. 3.7-3.8 GHz

- 8.5.1.6. 3.8-4.2 GHz

- 8.5.1.7. 4.6-4.9 GHz

- 8.5.1.8. 26/28 GHz

- 8.5.1.9. Other Frequencies

- 8.5.2. Unlicensed Spectrum

- 8.5.2.1. 600 MHz TVWS

- 8.5.2.2. 1.9 GHz sXGP Band

- 8.5.2.3. 2.4 GHz

- 8.5.2.4. 3.5 GHz CBRS GAA

- 8.5.2.5. 5 GHz

- 8.5.2.6. 6 GHz

- 8.5.2.7. 60 GHz

- 8.5.2.8. Other Frequencies

- 8.5.1. Coordinated Shared Spectrum

- 8.6. Segmentation by Use Case

- 8.6.1. Mobile Network Densification

- 8.6.2. FWA (Fixed Wireless Access)

- 8.6.3. Cable Operators & New Entrants

- 8.6.4. Neutral Hosts

- 8.6.5. Private Cellular Networks

- 8.6.5.1. Offices, Buildings & Corporate Campuses

- 8.6.5.2. Vertical Industries

- 8.7. Regional Outlook

- 8.7.1. North America

- 8.7.2. Asia Pacific

- 8.7.3. Europe

- 8.7.4. Middle East & Africa

- 8.7.5. Latin & Central America

Chapter 9: Key Ecosystem Players

- 9.1. 4RF

- 9.2. 6Harmonics/6WiLInk

- 9.3. 7P (Seven Principles)

- 9.4. ABiT Corporation

- 9.5. Accelleran

- 9.6. Accuver (InnoWireless)

- 9.7. ADRF (Advanced RF Technologies)

- 9.8. Affirmed Networks (Microsoft Corporation)

- 9.9. AI-LINK

- 9.10. Airgain

- 9.11. Airspan Networks

- 9.12. Airtower Networks

- 9.13. Airwavz Solutions

- 9.14. Akoustis Technologies

- 9.15. albis-elcon (UET - United Electronic Technology)

- 9.16. Alcadis

- 9.17. Alef (Alef Edge)

- 9.18. Allen Vanguard Wireless

- 9.19. Alpha Wireless

- 9.20. Alsatis Réseaux

- 9.21. Amazon/AWS (Amazon Web Services)

- 9.22. Ambra Solutions-ECOTEL

- 9.23. Amdocs

- 9.24. American Tower Corporation

- 9.25. AMIT Wireless

- 9.26. Anritsu

- 9.27. ANS - Advanced Network Services (Charge Enterprises)

- 9.28. Antenna Company

- 9.29. Anterix

- 9.30. Apple

- 9.31. aql

- 9.32. Aquila (Suzhou Aquila Solutions)

- 9.33. Aqura Technologies (Telstra Purple)

- 9.34. Arctic Semiconductor (Formerly SiTune Corporation)

- 9.35. Arete M

- 9.36. Artemis Networks

- 9.37. Askey Computer Corporation (ASUS - ASUSTeK Computer)

- 9.38. ASOCS

- 9.39. ASTRI (Hong Kong Applied Science and Technology Research Institute)

- 9.40. ASUS (ASUSTeK Computer)

- 9.41. ATDI

- 9.42. ATEL (Asiatelco Technologies)

- 9.43. Athonet (HPE - Hewlett Packard Enterprise)

- 9.44. ATN International

- 9.45. AttoCore

- 9.46. Aviat Networks

- 9.47. Axians (VINCI Energies)

- 9.48. Azcom Technology

- 9.49. Baicells

- 9.50. Ballast Networks

- 9.51. BAYFU (Bayerische Funknetz)

- 9.52. BBB (BB Backbone Corporation)

- 9.53. BBK Electronics

- 9.54. BearCom

- 9.55. BEC Technologies (Billion Electric)

- 9.56. becon

- 9.57. Benetel

- 9.58. Betacom

- 9.59. BinnenBereik (NOVEC)

- 9.60. Black Box

- 9.61. Blackned

- 9.62. BLiNQ Networks (CCI - Communication Components Inc.)

- 9.63. Blu Wireless

- 9.64. Blue Arcus Technologies

- 9.65. Boingo Wireless (DigitalBridge Group)

- 9.66. Boldyn Networks (Formerly BAI Communications)

- 9.67. Branch Communications

- 9.68. BTI Wireless

- 9.69. Bureau Veritas/7Layers

- 9.70. BVSystems (Berkeley Varitronics Systems)

- 9.71. C3Spectra

- 9.72. CableFree (Wireless Excellence)

- 9.73. CableLabs

- 9.74. CalChip Connect

- 9.75. Cambium Networks

- 9.76. Cambridge Consultants (Capgemini Invent)

- 9.77. CampusGenius

- 9.78. Capgemini Engineering

- 9.79. CapX Nederland

- 9.80. Casa Systems

- 9.81. CCI (Communication Components Inc.)

- 9.82. CCN (Cirrus Core Networks)

- 9.83. Cegeka

- 9.84. CellAntenna Corporation

- 9.85. Cellnex Telecom

- 9.86. cellXica

- 9.87. Celona

- 9.88. Centerline Communications

- 9.89. Challenge Networks (Vocus)

- 9.90. CICT - China Information and Communication Technology Group (China Xinke Group)

- 9.91. Cisco Systems

- 9.92. Citymesh (Cegeka/DIGI Communications)

- 9.93. COCUS

- 9.94. Codium Networks

- 9.95. Comba Telecom

- 9.96. CommAgility (E-Space)

- 9.97. Commnet Wireless (ATN International)

- 9.98. CommScope

- 9.99. Compal Electronics

- 9.100. COMSovereign

- 9.101. CONEXIO Corporation

- 9.102. CONGIV (ROBUR Industry Service Group)

- 9.103. Connectivity Wireless Solutions (M/C Partners)

- 9.104. Contela

- 9.105. coreNOC

- 9.106. Corning

- 9.107. Council Rock

- 9.108. Cradlepoint (Ericsson)

- 9.109. Crown Castle International Corporation

- 9.110. CTL

- 9.111. CTS (Communication Technology Services)

- 9.112. Cumucore

- 9.113. DAEL Group

- 9.114. dbSpectra

- 9.115. DeepSig

- 9.116. Dejero Labs

- 9.117. DEKRA

- 9.118. Dell Technologies

- 9.119. Dense Air (SIP - Sidewalk Infrastructure Partners)

- 9.120. DGS (Digital Global Systems)

- 9.121. Digi International

- 9.122. Digicert

- 9.123. Digita (DigitalBridge Group)

- 9.124. DigitalBridge Group

- 9.125. DKK (Denki Kogyo)

- 9.126. D-Link Corporation

- 9.127. Doodle Labs

- 9.128. Druid Software

- 9.129. e-BO Enterprises

- 9.130. EDX Wireless

- 9.131. Edzcom (Cellnex Telecom)

- 9.132. EION Wireless

- 9.133. Element Materials Technology

- 9.134. EMS (Electronic Media Services)

- 9.135. Encore Networks

- 9.136. Ericsson

- 9.137. ETRI (Electronics & Telecommunications Research Institute, South Korea)

- 9.138. EUCAST

- 9.139. EXFO

- 9.140. ExteNet Systems (DigitalBridge Group)

- 9.141. EZcon Network

- 9.142. Fairspectrum

- 9.143. Federated Wireless

- 9.144. Fenix Group

- 9.145. Fibocom

- 9.146. Fibrolan

- 9.147. Firecell

- 9.148. Flash Private Mobile Networks

- 9.149. floLIVE

- 9.150. FMBE (FMB Engineering)

- 9.151. Fortress Solutions

- 9.152. Foxconn (Hon Hai Technology Group)

- 9.153. Fraunhofer FOKUS (Institute for Open Communication Systems)

- 9.154. Fraunhofer HHI (Heinrich Hertz Institute)

- 9.155. Fraunhofer IIS (Institute for Integrated Circuits)

- 9.156. Fraunhofer IPT (Institute for Production Technology)

- 9.157. FreedomFi

- 9.158. Freshwave Group (DigitalBridge Group)

- 9.159. FRTek

- 9.160. FSG (Field Solutions Group)

- 9.161. Fujitsu

- 9.162. Future Technologies Venture

- 9.163. G REIGNS (HTC Corporation)

- 9.164. G+D (Giesecke+Devrient)

- 9.165. GCT Semiconductor

- 9.166. GE (General Electric)

- 9.167. Gemtek Technology

- 9.168. Getac Technology Corporation

- 9.169. GigSky

- 9.170. Global Telecom

- 9.171. Globalgig

- 9.172. Goodman Telecom Services

- 9.173. Google (Alphabet)

- 9.174. Granite Telecommunications

- 9.175. Grape One (Sumitomo Corporation)

- 9.176. Green Packet

- 9.177. Greenet (Netherlands)

- 9.178. GS Lab (Great Software Laboratory)

- 9.179. GXC (Formerly GenXComm)

- 9.180. Hawk Networks (Althea)

- 9.181. HCL Technologies

- 9.182. HFR Networks

- 9.183. Hitachi

- 9.184. HMF (Hytera Mobilfunk)

- 9.185. Horizon Powered

- 9.186. HP

- 9.187. HPE (Hewlett Packard Enterprise)

- 9.188. HSC (Hughes Systique Corporation)

- 9.189. HTC Corporation

- 9.190. Huawei

- 9.191. HUBER+SUHNER

- 9.192. Hughes Network Systems (EchoStar Corporation)

- 9.193. iBwave Solutions

- 9.194. Iconec

- 9.195. InfiniG

- 9.196. Infinite Electronics

- 9.197. Infomark Corporation

- 9.198. Infosys

- 9.199. Infovista

- 9.200. Innonet

- 9.201. Inseego Corporation

- 9.202. Insta Group

- 9.203. Intel Corporation

- 9.204. Intelsat

- 9.205. Intenna Systems

- 9.206. InterDigital

- 9.207. INTERLEV

- 9.208. IoT4Net

- 9.209. IPLOOK Networks

- 9.210. iPosi

- 9.211. Itron

- 9.212. JACS Solutions

- 9.213. JATONTEC (Jaton Technology)

- 9.214. JCI (Japan Communications Inc.)

- 9.215. JIT (JI Technology)

- 9.216. JMA Wireless

- 9.217. JRC (Japan Radio Company)

- 9.218. Juniper Networks

- 9.219. Kajeet

- 9.220. Key Bridge Wireless

- 9.221. Keysight Technologies

- 9.222. Kisan Telecom

- 9.223. KLA Laboratories

- 9.224. Kleos

- 9.225. KMW

- 9.226. KORE Wireless

- 9.227. Kumu Networks

- 9.228. Kyndryl

- 9.229. Kyocera Corporation

- 9.230. Kyrio (CableLabs)

- 9.231. Landmark Dividend (DigitalBridge Group)

- 9.232. Lekha Wireless Solutions

- 9.233. Lemko Corporation

- 9.234. Lenovo

- 9.235. LG Corporation

- 9.236. Lime Microsystems

- 9.237. Lindsay Broadband

- 9.238. Linkem

- 9.239. Linx Technologies

- 9.240. LIONS Technology

- 9.241. Logicalis (Datatec)

- 9.242. LS telcom

- 9.243. m3connect