|

市場調査レポート

商品コード

1374456

単結晶(単粒子)正極の技術動向と市場見通し<2023> Single Crystal (Single Particle) Cathode Technology Development Trend and Market Outlook |

||||||

|

|||||||

| 単結晶(単粒子)正極の技術動向と市場見通し |

|

出版日: 2023年10月10日

発行: SNE Research

ページ情報: 英文 338 Pages

納期: お問合せ

|

- 全表示

- 概要

- 目次

電気自動車用バッテリーの性能を大幅に向上させる単結晶正極の量産が間近に迫っており、中国企業と韓国企業の競合の激化が予測されます。

市販の電気自動車用バッテリーで現在使用されている正極材は、複数の金属化合物結晶からなる多結晶構造です。しかし、均一な厚みを得るための圧延工程や充放電の際に、これらの粒子間にクラックが発生することが多いです。このようなクラックが繰り返し発生すると、材料が劣化し、バッテリー内のガス発生が増加し、充放電サイクルが低下してバッテリー寿命が低下します。

単結晶は多結晶とは異なり、粒子が無傷のままであるため、この問題とは無縁です。さらに、容量を増やすためにニッケル含有量が増えると、構造の安定性が低下し、発火の危険性が高まります。したがって、単結晶正極の開発は、この課題に対するソリューションとして浮上してきました。

単結晶正極は、残留物質を排除することでコスト削減と歩留まり向上を実現し、欠陥確率を下げ、洗浄工程の必要性をなくします。正極製造において不純物の除去に重要なこの工程は、単結晶技術では不要となります。

単結晶正極の実用化により、高ニッケル正極の利用範囲が広がります。ガス発生が減少するため、バッテリー寿命が延びると同時に、より多くの活物質を収容できるようになり、エネルギー密度が向上します。これを電気自動車のバッテリーパックに導入すれば、より少ないセル数で1回の充電で500km超の走行が可能になり、より長距離走行が可能な車両モデルが誕生する可能性があります。このゲームチェンジャーの可能性は、コスト削減と性能向上を同時に約束するものです。

しかし、単結晶正極には欠点もあります。多結晶とは異なり、大型の単結晶材料は初期抵抗が高く、所望の電圧を印加するのに課題があります。その結果、出力は低いままとなり、バッテリー性能の向上を妨げます。

しかし、単結晶正極は追加の工程を必要とし、より高い電圧で動作するため、バッテリーの温度を上昇させる可能性があります。さらに、単結晶粒子は、電極製造の重要な部分であるカレンダー加工で損傷を受けやすいです。

そのため、大量生産の初期段階では、単結晶は純粋な形で生産されるのではなく、多結晶とブレンドされる可能性が高いです。

中国の企業はすでにNCM523、622向けの単結晶正極を生産しており、LG Chem、Ecopro BEM、L&F、POSCO FutureMなどの国内企業も開発を完了し、顧客と品質テストを行っています。ターゲットは単結晶のNCAとNCMで、量産に向け準備が整っていると見られます。

産業の専門家は、単結晶正極の性能と品質は、耐久性を確保するためのコーティング技術と単結晶の製造工程にかかっていると予測しています。基本的には、表面処理を効果的に行い、同時に粒子径を大きくすることが焦点となります。

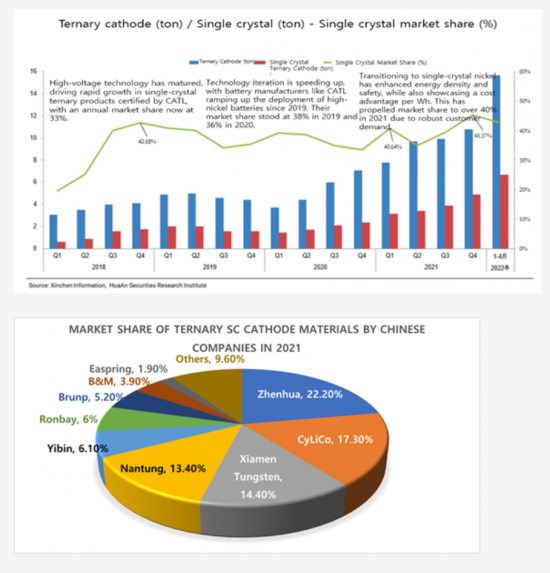

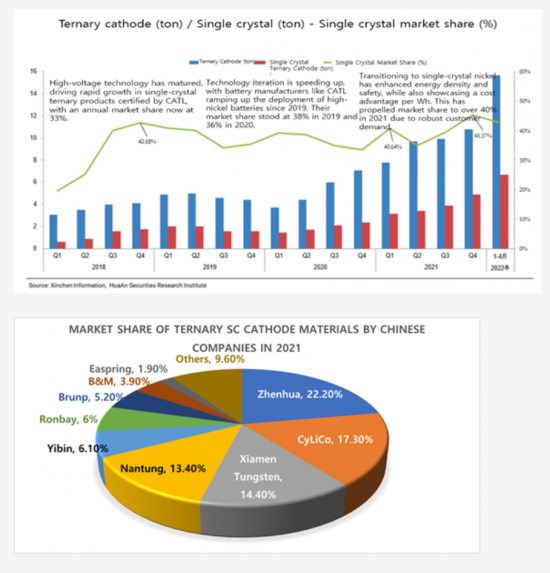

現在、量産型単結晶正極市場は、中国上位5社で全体の約75%を占めています。

韓国の正極材企業の発表から、SNE Researchは彼らが今年(2023)からサンプル供給を開始し、2025年に12万トン超を生産すると予測しています。現在、中国産三元系単結晶正極の場合、NCM523のような5系単結晶の割合が60~70%ともっとも高いです。NCM622のような6系単結晶の割合は18~25%です。Ni含有量80%以上の8系の場合、2021年以降生産比率が上昇し、現在は約15%です。この比率は今後も上昇すると予測されます。

SNE Researchによると、韓国についてはNi含有量ごとの生産データがないため、現時点で市場を予測することは困難です。しかし、中国の場合、2025年にHi-Niが約42億米ドル、Mid-Niが92億米ドルになると予測されます。2030年にはHi-Niが約240億米ドル、Mid-Niが238億米ドルと予測されており、Hi-Niの市場規模が大きくなる見込みです。

当レポートでは、中国と韓国の単結晶(単粒子)正極市場について調査分析し、研究動向、将来の見通し、主な合成法の比較、特許の分析などを提供しています。

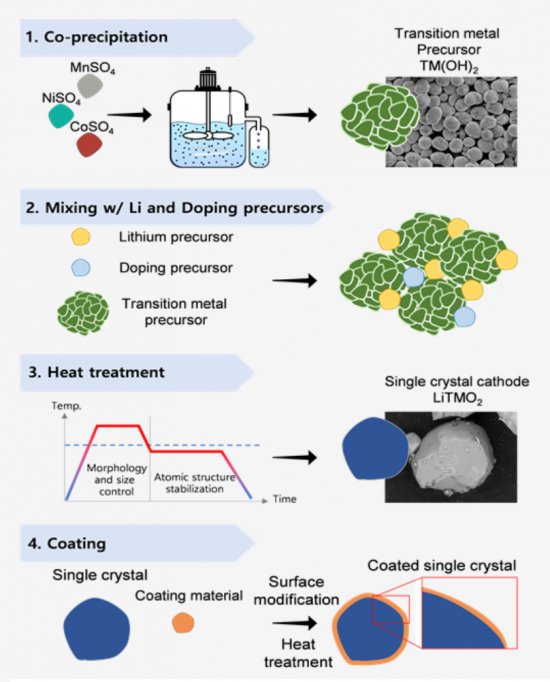

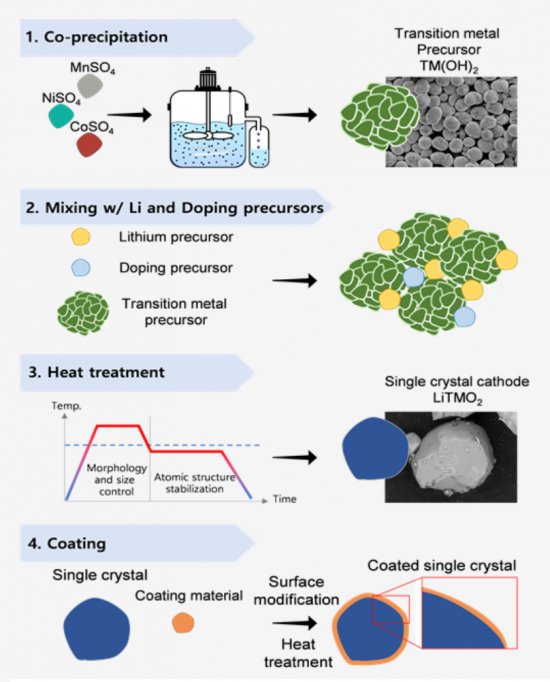

一般的な単結晶Niリッチ層状正極材の合成と追加改質プロセスの模式図

目次

第1章 正極材の概要

- 正極材開発の歴史

- 正極材の最新動向

- 正極材の開発状況:タイプ別

第2章 単結晶Niリッチ層状正極の研究動向と将来の見通し

- 単結晶Niリッチ層状材料の研究の必要性

- 単結晶正極材の定義

- 単結晶正極材技術の開発状況

- 材料の単粒子形成による改善

- 現在の超電導正極材技術開発の限界とその克服に向けた研究

第3章 単結晶Ni系正極材:基礎と進歩

- 概要

- Ni系正極材

- Ni系層状酸化物の課題

- 単結晶Ni系層状酸化物の起源

- 単結晶Ni系層状酸化物の合成

- 単結晶・多結晶材料の比較研究

- 単結晶Ni系正極材の近年の進歩

- 結果と結論

第4章 単結晶NiリッチNCM正極の容量低下メカニズムの研究

- 概要

- Niリッチ単結晶・多結晶正極の基礎特性の評価

第5章 Niリッチ単結晶正極材の粒子制御(焼結プロセスの応用)

- 概要

- 実験の説明

- 実験の結果

- 焼結処理の応用結果

第6章 単結晶NMC正極材の全乾式合成

- 概要

- 乾式合成

- 乾式合成の結果と考察

第7章 単結晶NCM523正極材のワンスポット合成

- 概要

- NCM523の合成

- 材料の特性の評価

- 電気化学的性質

- 実験結果と考察

第8章 単結晶NCM正極材の合成と改質:成長メカニズム

- 概要

- NCM正極の成長メカニズム

- 固体反応

- 固液レオロジー反応

- 溶融塩フラックス中の結晶成長

- 形態の改変

第9章 単結晶正極の開発:DOEプログラム

第10章 単結晶正極材企業の特許分析

- Tesla

- LG Chem

- SM Lab

- Nano One Materials

- POSCO Future M

- COSMO Advanced Materials & Technology

- L&F

- Easpring

- BASF Shan Shan

- GEM

- XTC (Xiamen Tungsten)

- Henan Kelong

- Hyundai Motor Company/Kia Corporation

- 6K Inc.

- Dynanonic

- Suzhou Long Power

- Fengchao Energy

- Ecopro BM

- Umicore

第11章 単結晶正極材産業の動向

- LG Chem

- POSCO FutureM

- EcoPro BM

- Zhenhua E-Chem (ZEC)

- Chanyuan Lico

- Ronbay

- XTC (Xiamen Tungsten)

- Tianjin B&M

- Easpring

- Reshane

- Yibin Libode

- Wanxing 123

- GEM

第12章 単結晶正極市場の見通し

- 中国の単結晶生産(2017年~2022年)

- 中国の単結晶正極材の生産とシェア(2019年~2022年4月)

- 中国のSC三元系正極材の生産の分布(2019年~2022年第1四半期)

- 中国の三元系SC正極材の生産シェア(2019年~2022年第1四半期)

- 中国の三元系SC正極材の市場浸透(2019年~2022年第1四半期)

- 中国の三元系SC正極材の市場シェア:企業別(2021年)

- 中国の三元系SC正極材企業の生産と市場シェア(2021年)

- 韓国と中国の三元系単結晶生産の予測

- 韓国の三元系SC正極材の生産と市場見通し

- 中国の三元系正極材に占める単結晶正極の割合

- 生産数比率の予測:中国の三元系単結晶正極材別

- 中国市場の予測:三元系単結晶正極材別

参考文献

The mass production of single-crystal cathodes, poised to significantly enhance electric vehicle battery performance, is imminent, heralding an anticipated escalation in competition between Chinese and Korean companies.

In commercial electric vehicle batteries, the cathode materials currently employed consist of polycrystalline structures comprising multiple metal compound crystals. However, cracks often develop between these particles during the rolling process to achieve uniform thickness, as well as during charging and discharging. With repeated cycles, these cracks expand, resulting in material deterioration, increased gas generation within the battery, and a decline in charging/discharging cycles, ultimately diminishing battery longevity.

Single crystals, unlike their polycrystalline counterparts, are immune to this issue as their particles remain intact. Moreover, as nickel content rises to boost capacity, structural stability decreases, heightening the risk of fire. Hence, the development of single crystal cathodes emerges as a solution to this challenge.

Single crystal cathodes offer cost savings and enhanced yields by eliminating residual materials, thereby lowering defect probability and obviating the need for a washing process. This step, crucial in cathode manufacturing for impurity removal, becomes unnecessary with single crystal technology.

The commercialization of single-crystal cathodes is poised to broaden the utilization of high-nickel cathodes. With reduced gas generation, battery lifespan extends while accommodating more active material, boosting energy density. Implementing this in electric vehicle battery packs could enable over 500 km of driving range on a single charge with fewer cells, facilitating longer-range vehicle models. This potential game-changer promises both cost reduction and performance enhancement simultaneously.

Yet, single crystal cathodes also pose drawbacks. Unlike polycrystalline counterparts, large single crystal materials exhibit high initial resistance, challenging the application of desired voltage. Consequently, output remains low, impeding battery performance enhancement.

However, single crystal cathodes entail extra processing steps and operate at higher voltages, potentially raising battery temperatures. Moreover, single crystal particles are susceptible to damage during the calendering process, a crucial part of electrode manufacturing.

Consequently, in the initial stages of mass production, single crystals are likely to be blended with polycrystals rather than being produced in their pure form.

Chinese companies are already producing single crystal cathodes for NCM523 and 622, and domestic companies such as LG Chem, Ecopro BEM, L&F, and POSCO FutureM have also completed development and are conducting quality tests with clients. The targets are single crystal NCA and NCM, and it can be seen that they are ready for mass production.

Industry experts anticipate that the performance and quality of single crystal cathodes will hinge on coating technology to ensure durability and the manufacturing process of single crystals. Essentially, the focus lies in effectively conducting surface treatment while simultaneously augmenting particle size.

Currently, the market for mass-produced single crystal cathodes is dominated by the top 5 Chinese companies, which account for about 75% of the total market.

According to announcements by Korean cathode material companies, SNE Research predicts that they will start supplying samples this year (2023) and produce more than 120,000 tons in 2025. Currently, in the case of Chinese ternary single crystal cathodes, the proportion of 5 series single crystals, such as NCM 523, is the highest at 60% to 70%. The proportion of 6 series single crystals, such as NCM622, is 18 to 25%. In the case of 8 series with a Ni content of 80% or higher, the production ratio has increased since 2021 and currently accounts for about 15%. This proportion is expected to continue to increase.

According to SNE Research, it is difficult to predict the market for Korea at this time because there is no data on production volume by Ni content. However, in the case of China, Hi-Ni is expected to be about $4.2 billion and Mid-Ni is expected to be $9.2 billion in 2025. In 2030, Hi-Ni is expected to be about $24 billion and Mid-Ni is expected to be $23.8 billion, so the market for Hi-Ni is expected to be larger.

Strong Points of this report:

- 1. Cover fundamental and advances in the development of single-crystal Ni-rich cathode materials

- 2. Include a very detailed study of research trends and future prospects for single-crystal Ni-rich cathode materials.

- 3. Include content on research regarding the capacity degradation mechanism of single-crystal Ni-rich cathodes.

- 4. Compare major synthesis methods for single-crystal NCM cathode materials

- 5. Detailed recent developments and patent analysis of single-crystal cathode material manufacturers

- 6. Market outlook for single-crystal cathode materials

[Schematic diagram of general single-crystal Ni-rich layered cathode material synthesis and additional modification process]

Table of Contents

1. Overview of Cathode Materials

- 1.1. History of Cathode Material Development

- 1.2. Recent Trends in Cathode Materials

- 1.2.1. Layered Oxide Cathode Materials

- 1.2.2. Spinel Oxide Cathode Material

- 1.2.3. Polyanionic Oxide (PAO) Cathode Materials

- 1.3. Development Status of Cathode Materials by Type

- 1.3.1. Microstructure Modification

- 1.3.2. Removal of Cathode Cracks

- 1.3.3. Application of the One-Pot process

- 1.3.4. Microwave Processing

2. Research Trends and Future Prospects of Single Crystal Ni-rich Layered Cathodes

- 2.1. Need for Research on Single Crystal Ni-rich Layered Materials

- 2.1.1. The Need for Ni-rich Layered Materials (Advantages)

- 2.1.2. Degradation Mechanisms of Ni-rich Layered Cathode Materials

- 2.1.3. Need for Single Crystallization (Monoparticulation) of Ni-rich Layered Cathode Materials

- 2.2. Definition of Single-crystal Cathode Material

- 2.3. Development Status of Single-crystal Cathode Material Technology

- 2.3.1. Single-particle Ni-rich Layered Material Synthesis Research

- 2.3.2. Research on Sintering Methods for Synthesis of Single-particle Ni-rich Layered Materials

- 2.3.3. Study on Modifying Materials to Enhance Performance of Single-particle Ni-rich Layered Materials

- 2.3.3.1. Surface Coating Research

- 2.3.3.2. Elemental Substitution Study (Doping)

- 2.3.3.2.1. Single Doping

- 2.3.3.2.2. Dual Doping

- 2.3.3.3. Electrolyte Optimization

- 2.3.4. Utilization Strategies for Single-Crystal Ni-Based Layered Materials

- 2.3.4.1. Advantages of Single-Crystallization in Ni-Based Layered Cathodes for Electrode Design

- 2.3.4.2. Disadvantages of Single-Crystallization in Ni-Based Layered Cathodes for Electrode Design

- 2.3.4.3. Research on Addressing Challenges in Single-Crystallization of Ni-Based Layered Materials

- 2.4. Improvement Through Material Single-Particle Formation

- 2.4.1. Mitigation of Particle Breakage Characteristics

- 2.4.4.1. Pressing Stage in Electrode Manufacturing

- 2.4.2. Particle Breakage During Charge-Discharge Processes

- 2.4.3. Quantitative Reduction of Surface Degradation through Reduced Specific Surface Area

- 2.4.4. Energy Density Increase

- 2.4.5. Washing Process Omission

- 2.4.1. Mitigation of Particle Breakage Characteristics

- 2.5. Limitations of Current SC Cathode Material Technology Development and Research for Overcoming Them

- 2.5.1. Degradation of Material Crystal Structure Due to Difficulties in Optimizing Synthesis Conditions

- 2.5.2. Particle Size Limit

3. Single-Crystal Ni-Based Cathode Materials: Fundamentals and Advances

- 3.1. Overview

- 3.2. Ni-based Cathode Materials

- 3.2.1. Chemical Structure

- 3.2.2. Electronic Structure

- 3.3. Challenges of Ni-based Layered Oxides

- 3.3.1. Synthesis Difficulties

- 3.3.2. Structural Instability

- 3.3.3. Chemical Instability

- 3.3.4. Mechanical Performance Degradation

- 3.3.5. Safety Issues

- 3.4. Origin of Single-Crystal Ni-Based Layered Oxides

- 3.5. Synthesis of Single-Crystal Ni-based Layered Oxides

- 3.5.1. Synthesis Methods

- 3.6. Comparative Study of Single-Crystal and Polycrystalline Materials

- 3.7. Recent Advances in Single-Crystal Ni-Based Cathode Materials

- 3.7.1. Doping and Surface Coating

- 3.7.2. Mechanical Research

- 3.8. Results and Conclusion

4. Study of Capacity Fading Mechanism of Single-crystal Ni-rich NCM Cathode

- 4.1. Overview

- 4.2. Assessment of Fundamental Properties in Ni-rich Single-crystal and Polycrystalline Cathodes

- 4.2.1. Single-crystal and Polycrystalline Cathode Synthesis

- 4.2.2. Composition and Analysis of Single-crystal and Polycrystalline Cathodes

- 4.2.3. Electrochemical Properties of Single-crystal and Polycrystalline Cathodes

- 4.2.4. Structural Stress Analysis of Single-crystal and Polycrystalline Cathode Materials

- 4.2.5. In-situ XRD Analysis of Single-crystal and Polycrystalline Cathodes

- 4.2.6. TEM Analysis of Single-crystal and Polycrystalline Cathode Materials

- 4.2.7. Results and Conclusions

5. Particle Control of Ni-rich Monocrystalline Cathode Materials (Application of Sintering Process)

- 5.1. Overview

- 5.2. Experiment Description

- 5.3. Experimental Results

- 5.3.1. Optimization of Sintering Additives for Promoting Crystal Growth

- 5.3.2. Crystal Growth Mechanism

- 5.3.3. Ni-rich Structure of a Single Crystal Cathode

- 5.3.4. Performance of Ni-rich Single Crystal Cathodes

- 5.4. Application Results of Sintering Treatment

6. All-Dry Synthesis of Single-Crystal NMC Cathode Materials

- 6.1. Overview

- 6.2. Dry Synthesis

- 6.3. Dry Synthesis Results and Discussion

- 6.3.1. Precursor Structure and Morphology

- 6.3.2. Effect of Sintering Conditions on NMC Formation

- 6.3.3. Single-crystal NCM from Ball-milled Precursors

- 6.3.4. Conclusion

7. One-Spot Synthesis of Single Crystal NCM523 Cathode Material

- 7.1. Overview

- 7.2. Synthesis of NCM523

- 7.3. Characterization of Materials

- 7.4. Electrochemical Properties

- 7.5. Experiment Results and Discussion

- 7.5.1. Cathode Material Synthesis Product Analysis

- 7.5.2. Electrochemical Properties of Cathode Materials

- 7.5.3. Conclusion

8. Synthesis and Modification of Single-Crystal NCM Cathode Materials:Growth Mechanism

- 8.1. Overview

- 8.2. Growth Mechanism for NCM Cathodes

- 8.3. Solid State Reaction

- 8.4. Solid-Liquid Rheological Reaction

- 8.5. Crystal Growth in Molten Salt Flux

- 8.6. Modification of morphology

- 8.6.1. Control of Shape

- 8.6.2. Facet Control

- 8.6.3. Conclusion

9. Development of Single-Crystal Cathodes: DOE Program

- 9.1. Ultrafast Hydrothermal Synthesis of Ni-rich Single-Crystal Cathodes

- 9.2. Scaling up of High Performance Single Crystalline Ni-rich Cathode Materials with Advanced Lithium

- 9.3. Single-Crystal Cathodes for High-Performance All-Solid-State LIBs

10. Patent Analysis of Single Crystal Cathode Material Companies

- 10.1. Tesla

- 10.2. LG Chem

- 10.3. SM Lab

- 10.4. Nano One Materials

- 10.5. POSCO Future M

- 10.6. COSMO Advanced Materials & Technology

- 10.7. L&F

- 10.8. Easpring

- 10.9. BASF Shan Shan

- 10.10. GEM

- 10.11. XTC (Xiamen Tungsten)

- 10.12. Henan Kelong

- 10.13. Hyundai Motor Company / Kia Corporation

- 10.14. 6K Inc.

- 10.15. Dynanonic

- 10.16. Suzhou Long Power

- 10.17. Fengchao Energy

- 10.18. Ecopro BM

- 10.19. Umicore

11. Single-Crystal Cathode Material Industry Trends

- 11.1. LG Chem

- 11.2. POSCO FutureM

- 11.3. EcoPro BM

- 11.4. Zhenhua E-Chem(ZEC)

- 11.5. Chanyuan Lico

- 11.6. Ronbay

- 11.7. XTC (Xiamen Tungsten)

- 11.8. Tianjin B&M

- 11.9. Easpring

- 11.10. Reshane

- 11.11. Yibin Libode

- 11.12. Wanxing 123

- 11.13. GEM

12. Single Crystal Cathode Market Outlook

- 12-1. 2017~2022H1 China Single Crystal Production Volume

- 12-2. 2019~2022.04 Production Volume and Share of Single Crystal Cathode Materials in China

- 12-3. 2019~2022Q1 Distribution of production volume by SC ternary cathode materials in China

- 12-4. 2019~2022Q1 Share of production by ternary SC cathode material in China

- 12-5. 2019~2022Q1 Market Penetration by Ternary SC Cathode Materials in China

- 12-6. Market Share of Ternary SC Cathode Materials by Chinese Companies in 2021

- 12-7. Production Volume and Market Share of Ternary SC cathode Material Companies in China in 2021

- 12-8. Korea-China Ternary Single Crystal Production Forecast

- 12-9. Korean Ternary SC Cathode Material Mroduction Volume and Market Outlook

- 12-10. Percentage of Single-crystal Cathodes among Ternary Cathode Materials in China

- 12-11. Forecast of Production Volume Ratio by Chinese Ternary Single Crystal Cathode Material

- 12-12. China Market Forecast by Ternary Single Crystal Cathode Material