|

|

市場調査レポート

商品コード

1700099

マイクロセグメンテーションソリューション市場の2032年までの予測: コンポーネント別、セキュリティタイプ別、展開形態別、組織規模別、エンドユーザー別、地域別の世界分析Microsegmentation Solution Market Forecasts to 2032 - Global Analysis by Component (Services and Software), Security Type, Deployment Mode, Organization Size, End User and By Geography |

||||||

カスタマイズ可能

|

|||||||

| マイクロセグメンテーションソリューション市場の2032年までの予測: コンポーネント別、セキュリティタイプ別、展開形態別、組織規模別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2025年04月03日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、マイクロセグメンテーションソリューションの世界市場は2025年に216億米ドルを占め、2032年には1,336億米ドルに達すると予測され、予測期間中のCAGRは29.7%です。

マイクロセグメンテーションソリューションは、セキュリティを向上させ、不正アクセスを防止するために、ネットワークをより小さく分離するサイバーセキュリティ戦略です。ワークロードやアプリケーションレベルできめ細かなセキュリティポリシーが適用されるため、攻撃対象範囲が狭まり、脅威がネットワーク内で横方向に移動するのを阻止できます。マイクロセグメンテーションは、従来の境界ベースのセキュリティとは対照的に、適応性のあるコントロールとリアルタイムのモニタリングを提供し、企業がオンライン攻撃から重要な資産を保護することを可能にします。データセンター、クラウド環境、ハイブリッドインフラで幅広く活用され、コンプライアンスを保証し、セキュリティ侵害を減らし、ネットワークセキュリティ全般を強化します。効率化のため、先進的なソリューションでは自動化、AI、ゼロトラストのコンセプトが使用されています。

高まるサイバーセキュリティの脅威

サイバーセキュリティの脅威の高まりが、マイクロセグメンテーションソリューション市場の大きな成長を促しています。サイバー攻撃が高度化するにつれ、企業はネットワークセキュリティの強化、攻撃対象の最小化、脅威の横移動の防止を目的に、マイクロセグメンテーションを採用するケースが増えています。規制コンプライアンスとゼロトラストセキュリティモデルの必要性が需要をさらに促進しています。このような採用の急増は技術革新を促進し、AIを活用した高度なソリューションや脅威検出の改善につながります。その結果、市場は急速に拡大し、進化するサイバー脅威に対する保護と回復力が強化されます。

高い導入コスト

高い導入コストがマイクロセグメンテーションソリューション市場の成長を大きく阻害しています。ソフトウェアの導入、インフラの変更、有資格者の必要性など、これらのコストは中小企業(SME)にとって導入を困難にしています。法外な出費はスケーラビリティを妨げ、市場への浸透を遅らせ、意思決定を先送りします。その結果、企業はよりコストの低い選択肢を選ぶことになり、この分野全体の成長とイノベーションを阻害することになります。

クラウドとハイブリッド環境の成長

クラウドとハイブリッド環境の成長は、高度なセキュリティフレームワークに対する需要を高め、市場の拡大を促進しています。企業がマルチクラウドやハイブリッドインフラに移行するにつれ、脅威の横の動きを防ぐためのきめ細かなセキュリティ管理の必要性が急増しています。マイクロセグメンテーションはネットワークの可視性を高め、攻撃対象領域を減らし、厳格なサイバーセキュリティ規制への準拠を保証します。このようなクラウド主導のアーキテクチャの急速な採用が、マイクロセグメンテーションソリューションの技術革新に拍車をかけており、マイクロセグメンテーションソリューションは最新のサイバーセキュリティ戦略にとって極めて重要な要素となっています。

複雑な展開と管理

マイクロセグメンテーションソリューションの複雑な導入と管理は、導入コストの増加、熟練したIT人材の必要性、導入期間の長期化によって、市場の成長を妨げます。レガシーシステムや動的なクラウド環境との統合の課題は、導入をさらに複雑にしています。さらに、継続的なメンテナンスの必要性やポリシー管理の複雑さは、運用の非効率性につながる可能性があります。これらの要因により、企業はマイクロセグメンテーションの導入を敬遠し、市場の拡大を遅らせ、その普及を制限しています。

COVID-19の影響:

COVID-19の大流行は、リモートワークやクラウドの導入が進む中、企業がサイバーセキュリティを優先したため、マイクロセグメンテーションソリューションへの需要を加速させました。サイバー脅威やランサムウェア攻撃の増加はネットワークセキュリティへの投資を促進し、市場の成長を押し上げました。しかし、一部の分野では予算の制約があり、一時的に導入が遅れました。全体として、パンデミックは、重要なデータを保護するマイクロセグメンテーションの役割に対する認識を高め、各業界における長期的な市場拡大に拍車をかけた。

予測期間中はネットワークセキュリティ分野が最大になる見込み

増加するサイバー脅威に対抗するため、企業は強固なサイバーセキュリティ対策を優先するため、予測期間中、ネットワークセキュリティ分野が最大の市場シェアを占めると予想されます。クラウドコンピューティングやハイブリッドIT環境の導入が進む中、企業は機密データを保護し、横移動攻撃を軽減するための高度なセキュリティソリューションを求めています。マイクロセグメンテーションは、トラフィックフローのきめ細かな制御を可能にし、攻撃対象領域を減らし、厳しい規制へのコンプライアンスを確保することで、ネットワークセキュリティを強化します。このようなセキュリティ強化のニーズの高まりが、市場の拡大と技術革新の原動力となっています。

予測期間中、ヘルスケア分野のCAGRが最も高くなる見込み

予測期間中、ヘルスケア分野は、デジタルヘルスシステム、遠隔医療、IoT対応医療機器の導入が増加していることから、最も高い成長率を示すと予測され、高度なサイバーセキュリティソリューションに対する需要が高まっています。マイクロセグメンテーションは、サイバー脅威の防止、不正アクセスの制限、ネットワークインフラの強化に役立ちます。このプロアクティブなアプローチにより、データ漏洩を最小限に抑え、シームレスな運用と患者の機密性を確保できるため、市場の拡大が加速し、ヘルスケアサイバーセキュリティソリューションのイノベーションが促進されます。

最大のシェアを占める地域

予測期間中、北米地域が最大の市場シェアを占めると予想されます。これは、ゼロトラストセキュリティフレームワークの採用が増加しているためです。企業はマイクロセグメンテーションを活用して、ネットワークセキュリティの強化、攻撃サーフェスの最小化、規制遵守の徹底を図っています。クラウドベースのサービス、IoTの拡大、デジタルトランスフォーメーションに対する需要の高まりが、市場の拡大をさらに後押ししています。業界の主要企業がAIを活用した先進的なセキュリティソリューションに投資していることから、北米は依然として技術革新の重要な拠点となっており、よりレジリエントでセキュアなデジタルインフラストラクチャを育成しています。

CAGRが最も高い地域:

予測期間中、アジア太平洋地域は、厳格なデータプライバシー法とデジタル移行により、最も高いCAGRを示すと予測されます。IT、ヘルスケア、BFSIなどさまざまな分野の企業が、ネットワークセキュリティの向上、サイバー脅威の低減、コンプライアンスの保証を目的にマイクロセグメンテーションを導入しています。また、クラウドコンピューティングやIoTの利用拡大も需要を後押ししています。マイクロセグメンテーションは、機密データの保護、攻撃対象の最小化、サイバーセキュリティインフラへの投資の増加による地域のサイバー耐性の強化に不可欠です。

無料のカスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査資料

- 1次調査資料

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界のマイクロセグメンテーションソリューション市場:コンポーネント別

- サービス

- ソフトウェア

第6章 世界のマイクロセグメンテーションソリューション市場:セキュリティタイプ別

- ネットワークセキュリティ

- アプリケーションセキュリティ

- ワークロードセキュリティ

- クラウドセキュリティ

第7章 世界のマイクロセグメンテーションソリューション市場:展開形態別

- オンプレミス

- クラウドベース

第8章 世界のマイクロセグメンテーションソリューション市場:組織規模別

- 大企業

- 中小企業

第9章 世界のマイクロセグメンテーションソリューション市場:エンドユーザー別

- 銀行、金融サービス、保険(BFSI)

- ヘルスケア

- IT・通信

- 小売り

- 政府・防衛

- 製造業

- エネルギー・公益事業

第10章 世界のマイクロセグメンテーションソリューション市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第11章 主な発展

- 契約、パートナーシップ、コラボレーション、ジョイントベンチャー

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第12章 企業プロファイリング

- Akamai Technologies, Inc.

- Broadcom, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cloudflare, Inc.

- Dell Inc.

- Ericom Software Ltd.

- ExtraHop Networks, Inc.

- Fortinet, Inc.

- GigaSpaces Technologies Inc.

- Google LLC

- Hewlett Packard Enterprise Development LP

- Hillstone Networks

- Illumio, Inc.

- Intel Corporation

- International Business Machines Corporation(IBM)

- JumpCloud Inc.

- Microsoft Corporation

- Nutanix, Inc.

List of Tables

- Table 1 Global Microsegmentation Solution Market Outlook, By Region (2024-2032) ($MN)

- Table 2 Global Microsegmentation Solution Market Outlook, By Component (2024-2032) ($MN)

- Table 3 Global Microsegmentation Solution Market Outlook, By Services (2024-2032) ($MN)

- Table 4 Global Microsegmentation Solution Market Outlook, By Software (2024-2032) ($MN)

- Table 5 Global Microsegmentation Solution Market Outlook, By Security Type (2024-2032) ($MN)

- Table 6 Global Microsegmentation Solution Market Outlook, By Network Security (2024-2032) ($MN)

- Table 7 Global Microsegmentation Solution Market Outlook, By Application Security (2024-2032) ($MN)

- Table 8 Global Microsegmentation Solution Market Outlook, By Workload Security (2024-2032) ($MN)

- Table 9 Global Microsegmentation Solution Market Outlook, By Cloud Security (2024-2032) ($MN)

- Table 10 Global Microsegmentation Solution Market Outlook, By Deployment Mode (2024-2032) ($MN)

- Table 11 Global Microsegmentation Solution Market Outlook, By On-Premises (2024-2032) ($MN)

- Table 12 Global Microsegmentation Solution Market Outlook, By Cloud-Based (2024-2032) ($MN)

- Table 13 Global Microsegmentation Solution Market Outlook, By Organization Size (2024-2032) ($MN)

- Table 14 Global Microsegmentation Solution Market Outlook, By Large Enterprises (2024-2032) ($MN)

- Table 15 Global Microsegmentation Solution Market Outlook, By Small and Medium-Sized Enterprises (SMEs) (2024-2032) ($MN)

- Table 16 Global Microsegmentation Solution Market Outlook, By End User (2024-2032) ($MN)

- Table 17 Global Microsegmentation Solution Market Outlook, By Banking, Financial Services, and Insurance (BFSI) (2024-2032) ($MN)

- Table 18 Global Microsegmentation Solution Market Outlook, By Healthcare (2024-2032) ($MN)

- Table 19 Global Microsegmentation Solution Market Outlook, By IT and Telecommunications (2024-2032) ($MN)

- Table 20 Global Microsegmentation Solution Market Outlook, By Retail (2024-2032) ($MN)

- Table 21 Global Microsegmentation Solution Market Outlook, By Government and Defense (2024-2032) ($MN)

- Table 22 Global Microsegmentation Solution Market Outlook, By Manufacturing (2024-2032) ($MN)

- Table 23 Global Microsegmentation Solution Market Outlook, By Energy and Utilities (2024-2032) ($MN)

- Table 24 North America Microsegmentation Solution Market Outlook, By Country (2024-2032) ($MN)

- Table 25 North America Microsegmentation Solution Market Outlook, By Component (2024-2032) ($MN)

- Table 26 North America Microsegmentation Solution Market Outlook, By Services (2024-2032) ($MN)

- Table 27 North America Microsegmentation Solution Market Outlook, By Software (2024-2032) ($MN)

- Table 28 North America Microsegmentation Solution Market Outlook, By Security Type (2024-2032) ($MN)

- Table 29 North America Microsegmentation Solution Market Outlook, By Network Security (2024-2032) ($MN)

- Table 30 North America Microsegmentation Solution Market Outlook, By Application Security (2024-2032) ($MN)

- Table 31 North America Microsegmentation Solution Market Outlook, By Workload Security (2024-2032) ($MN)

- Table 32 North America Microsegmentation Solution Market Outlook, By Cloud Security (2024-2032) ($MN)

- Table 33 North America Microsegmentation Solution Market Outlook, By Deployment Mode (2024-2032) ($MN)

- Table 34 North America Microsegmentation Solution Market Outlook, By On-Premises (2024-2032) ($MN)

- Table 35 North America Microsegmentation Solution Market Outlook, By Cloud-Based (2024-2032) ($MN)

- Table 36 North America Microsegmentation Solution Market Outlook, By Organization Size (2024-2032) ($MN)

- Table 37 North America Microsegmentation Solution Market Outlook, By Large Enterprises (2024-2032) ($MN)

- Table 38 North America Microsegmentation Solution Market Outlook, By Small and Medium-Sized Enterprises (SMEs) (2024-2032) ($MN)

- Table 39 North America Microsegmentation Solution Market Outlook, By End User (2024-2032) ($MN)

- Table 40 North America Microsegmentation Solution Market Outlook, By Banking, Financial Services, and Insurance (BFSI) (2024-2032) ($MN)

- Table 41 North America Microsegmentation Solution Market Outlook, By Healthcare (2024-2032) ($MN)

- Table 42 North America Microsegmentation Solution Market Outlook, By IT and Telecommunications (2024-2032) ($MN)

- Table 43 North America Microsegmentation Solution Market Outlook, By Retail (2024-2032) ($MN)

- Table 44 North America Microsegmentation Solution Market Outlook, By Government and Defense (2024-2032) ($MN)

- Table 45 North America Microsegmentation Solution Market Outlook, By Manufacturing (2024-2032) ($MN)

- Table 46 North America Microsegmentation Solution Market Outlook, By Energy and Utilities (2024-2032) ($MN)

- Table 47 Europe Microsegmentation Solution Market Outlook, By Country (2024-2032) ($MN)

- Table 48 Europe Microsegmentation Solution Market Outlook, By Component (2024-2032) ($MN)

- Table 49 Europe Microsegmentation Solution Market Outlook, By Services (2024-2032) ($MN)

- Table 50 Europe Microsegmentation Solution Market Outlook, By Software (2024-2032) ($MN)

- Table 51 Europe Microsegmentation Solution Market Outlook, By Security Type (2024-2032) ($MN)

- Table 52 Europe Microsegmentation Solution Market Outlook, By Network Security (2024-2032) ($MN)

- Table 53 Europe Microsegmentation Solution Market Outlook, By Application Security (2024-2032) ($MN)

- Table 54 Europe Microsegmentation Solution Market Outlook, By Workload Security (2024-2032) ($MN)

- Table 55 Europe Microsegmentation Solution Market Outlook, By Cloud Security (2024-2032) ($MN)

- Table 56 Europe Microsegmentation Solution Market Outlook, By Deployment Mode (2024-2032) ($MN)

- Table 57 Europe Microsegmentation Solution Market Outlook, By On-Premises (2024-2032) ($MN)

- Table 58 Europe Microsegmentation Solution Market Outlook, By Cloud-Based (2024-2032) ($MN)

- Table 59 Europe Microsegmentation Solution Market Outlook, By Organization Size (2024-2032) ($MN)

- Table 60 Europe Microsegmentation Solution Market Outlook, By Large Enterprises (2024-2032) ($MN)

- Table 61 Europe Microsegmentation Solution Market Outlook, By Small and Medium-Sized Enterprises (SMEs) (2024-2032) ($MN)

- Table 62 Europe Microsegmentation Solution Market Outlook, By End User (2024-2032) ($MN)

- Table 63 Europe Microsegmentation Solution Market Outlook, By Banking, Financial Services, and Insurance (BFSI) (2024-2032) ($MN)

- Table 64 Europe Microsegmentation Solution Market Outlook, By Healthcare (2024-2032) ($MN)

- Table 65 Europe Microsegmentation Solution Market Outlook, By IT and Telecommunications (2024-2032) ($MN)

- Table 66 Europe Microsegmentation Solution Market Outlook, By Retail (2024-2032) ($MN)

- Table 67 Europe Microsegmentation Solution Market Outlook, By Government and Defense (2024-2032) ($MN)

- Table 68 Europe Microsegmentation Solution Market Outlook, By Manufacturing (2024-2032) ($MN)

- Table 69 Europe Microsegmentation Solution Market Outlook, By Energy and Utilities (2024-2032) ($MN)

- Table 70 Asia Pacific Microsegmentation Solution Market Outlook, By Country (2024-2032) ($MN)

- Table 71 Asia Pacific Microsegmentation Solution Market Outlook, By Component (2024-2032) ($MN)

- Table 72 Asia Pacific Microsegmentation Solution Market Outlook, By Services (2024-2032) ($MN)

- Table 73 Asia Pacific Microsegmentation Solution Market Outlook, By Software (2024-2032) ($MN)

- Table 74 Asia Pacific Microsegmentation Solution Market Outlook, By Security Type (2024-2032) ($MN)

- Table 75 Asia Pacific Microsegmentation Solution Market Outlook, By Network Security (2024-2032) ($MN)

- Table 76 Asia Pacific Microsegmentation Solution Market Outlook, By Application Security (2024-2032) ($MN)

- Table 77 Asia Pacific Microsegmentation Solution Market Outlook, By Workload Security (2024-2032) ($MN)

- Table 78 Asia Pacific Microsegmentation Solution Market Outlook, By Cloud Security (2024-2032) ($MN)

- Table 79 Asia Pacific Microsegmentation Solution Market Outlook, By Deployment Mode (2024-2032) ($MN)

- Table 80 Asia Pacific Microsegmentation Solution Market Outlook, By On-Premises (2024-2032) ($MN)

- Table 81 Asia Pacific Microsegmentation Solution Market Outlook, By Cloud-Based (2024-2032) ($MN)

- Table 82 Asia Pacific Microsegmentation Solution Market Outlook, By Organization Size (2024-2032) ($MN)

- Table 83 Asia Pacific Microsegmentation Solution Market Outlook, By Large Enterprises (2024-2032) ($MN)

- Table 84 Asia Pacific Microsegmentation Solution Market Outlook, By Small and Medium-Sized Enterprises (SMEs) (2024-2032) ($MN)

- Table 85 Asia Pacific Microsegmentation Solution Market Outlook, By End User (2024-2032) ($MN)

- Table 86 Asia Pacific Microsegmentation Solution Market Outlook, By Banking, Financial Services, and Insurance (BFSI) (2024-2032) ($MN)

- Table 87 Asia Pacific Microsegmentation Solution Market Outlook, By Healthcare (2024-2032) ($MN)

- Table 88 Asia Pacific Microsegmentation Solution Market Outlook, By IT and Telecommunications (2024-2032) ($MN)

- Table 89 Asia Pacific Microsegmentation Solution Market Outlook, By Retail (2024-2032) ($MN)

- Table 90 Asia Pacific Microsegmentation Solution Market Outlook, By Government and Defense (2024-2032) ($MN)

- Table 91 Asia Pacific Microsegmentation Solution Market Outlook, By Manufacturing (2024-2032) ($MN)

- Table 92 Asia Pacific Microsegmentation Solution Market Outlook, By Energy and Utilities (2024-2032) ($MN)

- Table 93 South America Microsegmentation Solution Market Outlook, By Country (2024-2032) ($MN)

- Table 94 South America Microsegmentation Solution Market Outlook, By Component (2024-2032) ($MN)

- Table 95 South America Microsegmentation Solution Market Outlook, By Services (2024-2032) ($MN)

- Table 96 South America Microsegmentation Solution Market Outlook, By Software (2024-2032) ($MN)

- Table 97 South America Microsegmentation Solution Market Outlook, By Security Type (2024-2032) ($MN)

- Table 98 South America Microsegmentation Solution Market Outlook, By Network Security (2024-2032) ($MN)

- Table 99 South America Microsegmentation Solution Market Outlook, By Application Security (2024-2032) ($MN)

- Table 100 South America Microsegmentation Solution Market Outlook, By Workload Security (2024-2032) ($MN)

- Table 101 South America Microsegmentation Solution Market Outlook, By Cloud Security (2024-2032) ($MN)

- Table 102 South America Microsegmentation Solution Market Outlook, By Deployment Mode (2024-2032) ($MN)

- Table 103 South America Microsegmentation Solution Market Outlook, By On-Premises (2024-2032) ($MN)

- Table 104 South America Microsegmentation Solution Market Outlook, By Cloud-Based (2024-2032) ($MN)

- Table 105 South America Microsegmentation Solution Market Outlook, By Organization Size (2024-2032) ($MN)

- Table 106 South America Microsegmentation Solution Market Outlook, By Large Enterprises (2024-2032) ($MN)

- Table 107 South America Microsegmentation Solution Market Outlook, By Small and Medium-Sized Enterprises (SMEs) (2024-2032) ($MN)

- Table 108 South America Microsegmentation Solution Market Outlook, By End User (2024-2032) ($MN)

- Table 109 South America Microsegmentation Solution Market Outlook, By Banking, Financial Services, and Insurance (BFSI) (2024-2032) ($MN)

- Table 110 South America Microsegmentation Solution Market Outlook, By Healthcare (2024-2032) ($MN)

- Table 111 South America Microsegmentation Solution Market Outlook, By IT and Telecommunications (2024-2032) ($MN)

- Table 112 South America Microsegmentation Solution Market Outlook, By Retail (2024-2032) ($MN)

- Table 113 South America Microsegmentation Solution Market Outlook, By Government and Defense (2024-2032) ($MN)

- Table 114 South America Microsegmentation Solution Market Outlook, By Manufacturing (2024-2032) ($MN)

- Table 115 South America Microsegmentation Solution Market Outlook, By Energy and Utilities (2024-2032) ($MN)

- Table 116 Middle East & Africa Microsegmentation Solution Market Outlook, By Country (2024-2032) ($MN)

- Table 117 Middle East & Africa Microsegmentation Solution Market Outlook, By Component (2024-2032) ($MN)

- Table 118 Middle East & Africa Microsegmentation Solution Market Outlook, By Services (2024-2032) ($MN)

- Table 119 Middle East & Africa Microsegmentation Solution Market Outlook, By Software (2024-2032) ($MN)

- Table 120 Middle East & Africa Microsegmentation Solution Market Outlook, By Security Type (2024-2032) ($MN)

- Table 121 Middle East & Africa Microsegmentation Solution Market Outlook, By Network Security (2024-2032) ($MN)

- Table 122 Middle East & Africa Microsegmentation Solution Market Outlook, By Application Security (2024-2032) ($MN)

- Table 123 Middle East & Africa Microsegmentation Solution Market Outlook, By Workload Security (2024-2032) ($MN)

- Table 124 Middle East & Africa Microsegmentation Solution Market Outlook, By Cloud Security (2024-2032) ($MN)

- Table 125 Middle East & Africa Microsegmentation Solution Market Outlook, By Deployment Mode (2024-2032) ($MN)

- Table 126 Middle East & Africa Microsegmentation Solution Market Outlook, By On-Premises (2024-2032) ($MN)

- Table 127 Middle East & Africa Microsegmentation Solution Market Outlook, By Cloud-Based (2024-2032) ($MN)

- Table 128 Middle East & Africa Microsegmentation Solution Market Outlook, By Organization Size (2024-2032) ($MN)

- Table 129 Middle East & Africa Microsegmentation Solution Market Outlook, By Large Enterprises (2024-2032) ($MN)

- Table 130 Middle East & Africa Microsegmentation Solution Market Outlook, By Small and Medium-Sized Enterprises (SMEs) (2024-2032) ($MN)

- Table 131 Middle East & Africa Microsegmentation Solution Market Outlook, By End User (2024-2032) ($MN)

- Table 132 Middle East & Africa Microsegmentation Solution Market Outlook, By Banking, Financial Services, and Insurance (BFSI) (2024-2032) ($MN)

- Table 133 Middle East & Africa Microsegmentation Solution Market Outlook, By Healthcare (2024-2032) ($MN)

- Table 134 Middle East & Africa Microsegmentation Solution Market Outlook, By IT and Telecommunications (2024-2032) ($MN)

- Table 135 Middle East & Africa Microsegmentation Solution Market Outlook, By Retail (2024-2032) ($MN)

- Table 136 Middle East & Africa Microsegmentation Solution Market Outlook, By Government and Defense (2024-2032) ($MN)

- Table 137 Middle East & Africa Microsegmentation Solution Market Outlook, By Manufacturing (2024-2032) ($MN)

- Table 138 Middle East & Africa Microsegmentation Solution Market Outlook, By Energy and Utilities (2024-2032) ($MN)

According to Stratistics MRC, the Global Microsegmentation Solution Market is accounted for $21.6 billion in 2025 and is expected to reach $133.6 billion by 2032 growing at a CAGR of 29.7% during the forecast period. A Microsegmentation Solution is a cybersecurity strategy that divides a network into smaller, isolated pieces in order to improve security and prevent unauthorized access. Granular security policies are enforced at the workload or application level, which lowers the attack surface and stops threats from moving laterally within a network. Microsegmentation, in contrast to conventional perimeter-based security, offers adaptive controls and real-time monitoring, enabling enterprises to protect vital assets from online attacks. It is extensively utilized in data centers, cloud environments, and hybrid infrastructures to guarantee compliance, reduce security breaches, and enhance network security in general. For efficiency, advanced solutions use automation, AI, and zero-trust concepts.

Market Dynamics:

Driver:

Rising Cybersecurity Threats

The rising cybersecurity threats are driving significant growth in the microsegmentation solution market. As cyberattacks become more sophisticated, organizations increasingly adopt microsegmentation to enhance network security, minimize attack surfaces, and prevent lateral movement of threats. Regulatory compliance and the need for Zero Trust security models further fuel demand. This surge in adoption fosters innovation, leading to advanced AI-driven solutions and improved threat detection. Consequently, the market experiences rapid expansion, offering enhanced protection and resilience against evolving cyber threats.

Restraint:

High Implementation Costs

High installation costs significantly impede the growth of the microsegmentation solution market. These costs, which include software deployment, infrastructure changes, and the need for qualified personnel, make adoption difficult for small and medium-sized businesses (SMEs). The exorbitant expenses may hinder scalability, slow market penetration, and postpone decision-making. As a result, companies might choose less costly options, which would impede the sector's overall growth and innovation.

Opportunity:

Growth of Cloud and Hybrid Environments

The growth of cloud and hybrid environments is driving the expansion of the market by increasing the demand for advanced security frameworks. As businesses migrate to multi-cloud and hybrid infrastructures, the need for granular security controls to prevent lateral movement of threats has surged. Microsegmentation enhances network visibility, reduces attack surfaces, and ensures compliance with stringent cybersecurity regulations. This rapid adoption of cloud-driven architectures is fueling innovation in microsegmentation solutions, making them a crucial component of modern cybersecurity strategies.

Threat:

Complex Deployment and Management

The complex deployment and management of microsegmentation solutions hinder market growth by increasing implementation costs, requiring skilled IT personnel, and extending deployment timelines. Integration challenges with legacy systems and dynamic cloud environments further complicate adoption. Additionally, ongoing maintenance demands and policy management complexities can lead to operational inefficiencies. These factors discourage enterprises from adopting microsegmentation, slowing market expansion and limiting its widespread implementation.

Covid-19 Impact:

The COVID-19 pandemic accelerated the demand for microsegmentation solutions as businesses prioritized cybersecurity amid remote work and cloud adoption. Increased cyber threats and ransomware attacks drove investments in network security, boosting market growth. However, budget constraints in some sectors temporarily slowed adoption. Overall, the pandemic heightened awareness of microsegmentation's role in protecting critical data, fueling long-term market expansion across industries.

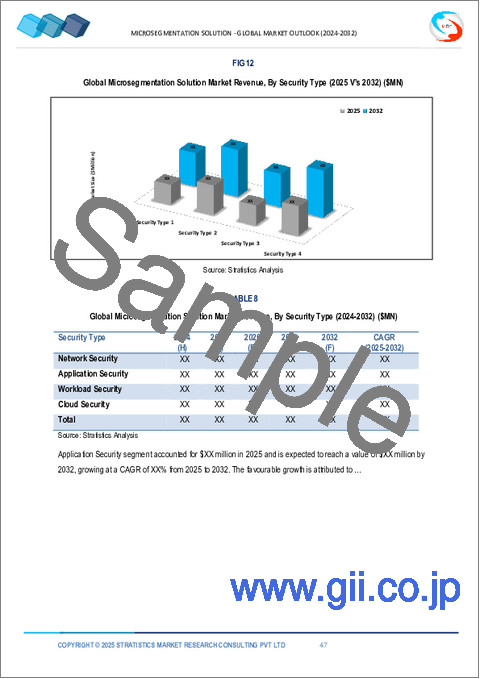

The network security segment is expected to be the largest during the forecast period

The network security segment is expected to account for the largest market share during the forecast period as organizations prioritize robust cybersecurity measures to combat rising cyber threats. With the increasing adoption of cloud computing and hybrid IT environments, businesses demand advanced security solutions to protect sensitive data and mitigate lateral movement attacks. Microsegmentation enhances network security by enabling granular control over traffic flows, reducing attack surfaces, and ensuring compliance with stringent regulations. This growing need for enhanced security fuels market expansion and innovation.

The healthcare segment is expected to have the highest CAGR during the forecast period

Over the forecast period, the healthcare segment is predicted to witness the highest growth rate owing to rising adoption of digital health systems, telemedicine, and IoT-enabled medical devices; the demand for advanced cybersecurity solutions is escalating. Microsegmentation helps prevent cyber threats, restricts unauthorized access, and fortifies network infrastructure. This proactive approach minimizes data breaches, ensuring seamless operations and patient confidentiality, thereby accelerating market expansion and fostering innovation in healthcare cybersecurity solutions.

Region with largest share:

During the forecast period, the North America region is expected to hold the largest market share because rising adoption of zero-trust security frameworks. Businesses are leveraging microsegmentation to enhance network security, minimize attack surfaces, and ensure regulatory compliance. The growing demand for cloud-based services, IoT expansion, and digital transformation further fuels market expansion. With major industry players investing in advanced AI-driven security solutions, North America remains a key hub for innovation, fostering a more resilient and secure digital infrastructure.

Region with highest CAGR:

Over the forecast period, the Asia Pacific region is anticipated to exhibit the highest CAGR because of strict data privacy laws and the digital transition. Companies in a variety of sectors, such as IT, healthcare, and BFSI, is implementing microsegmentation to improve network security, reduce cyberthreats, and guarantee compliance. Demand is also fueled by the growing use of cloud computing and IoT. Microsegmentation is essential for protecting sensitive data, minimizing attack surfaces, and enhancing regional cyber resilience as a result of rising investments in cybersecurity infrastructure.

Key players in the market

Some of the key players in Microsegmentation Solution Market include Akamai Technologies, Inc., Broadcom, Inc., Check Point Software Technologies Ltd., Cisco Systems, Inc., Cloudflare, Inc., Dell Inc., Ericom Software Ltd., ExtraHop Networks, Inc., Fortinet, Inc., GigaSpaces Technologies Inc., Google LLC, Hewlett Packard Enterprise Development LP, Hillstone Networks, Illumio, Inc., Intel Corporation, International Business Machines Corporation (IBM), JumpCloud Inc., Microsoft Corporation and Nutanix, Inc.

Key Developments:

In February 2025, Intel launched new Intel(R) Xeon(R) 6 processors with Performance-cores, offering industry-leading performance across data center workloads and up to 2x higher performance in AI processing.

In October 2024, Intel Corp. and AMD announced the creation of an x86 ecosystem advisory group bringing together technology leaders to shape the future of the world's most widely used computing architecture.

In September 2024, Intel Unveiled Next-Generation AI Solutions with the Launch of Xeon 6 and Gaudi 3, to deliver powerful AI systems with optimal performance per watt and lower total cost of ownership (TCO).

Components Covered:

- Services

- Software

Security Types Covered:

- Network Security

- Application Security

- Workload Security

- Cloud Security

Deployment Modes Covered:

- On-Premises

- Cloud-Based

Organization Sizes Covered:

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

End Users Covered:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- IT and Telecommunications

- Retail

- Government and Defense

- Manufacturing

- Energy and Utilities

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2024, 2025, 2026, 2028, and 2032

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 End User Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Microsegmentation Solution Market, By Component

- 5.1 Introduction

- 5.2 Services

- 5.3 Software

6 Global Microsegmentation Solution Market, By Security Type

- 6.1 Introduction

- 6.2 Network Security

- 6.3 Application Security

- 6.4 Workload Security

- 6.5 Cloud Security

7 Global Microsegmentation Solution Market, By Deployment Mode

- 7.1 Introduction

- 7.2 On-Premises

- 7.3 Cloud-Based

8 Global Microsegmentation Solution Market, By Organization Size

- 8.1 Introduction

- 8.2 Large Enterprises

- 8.3 Small and Medium-Sized Enterprises (SMEs)

9 Global Microsegmentation Solution Market, By End User

- 9.1 Introduction

- 9.2 Banking, Financial Services, and Insurance (BFSI)

- 9.3 Healthcare

- 9.4 IT and Telecommunications

- 9.5 Retail

- 9.6 Government and Defense

- 9.7 Manufacturing

- 9.8 Energy and Utilities

10 Global Microsegmentation Solution Market, By Geography

- 10.1 Introduction

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 Italy

- 10.3.4 France

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 New Zealand

- 10.4.6 South Korea

- 10.4.7 Rest of Asia Pacific

- 10.5 South America

- 10.5.1 Argentina

- 10.5.2 Brazil

- 10.5.3 Chile

- 10.5.4 Rest of South America

- 10.6 Middle East & Africa

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 Qatar

- 10.6.4 South Africa

- 10.6.5 Rest of Middle East & Africa

11 Key Developments

- 11.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 11.2 Acquisitions & Mergers

- 11.3 New Product Launch

- 11.4 Expansions

- 11.5 Other Key Strategies

12 Company Profiling

- 12.1 Akamai Technologies, Inc.

- 12.2 Broadcom, Inc.

- 12.3 Check Point Software Technologies Ltd.

- 12.4 Cisco Systems, Inc.

- 12.5 Cloudflare, Inc.

- 12.6 Dell Inc.

- 12.7 Ericom Software Ltd.

- 12.8 ExtraHop Networks, Inc.

- 12.9 Fortinet, Inc.

- 12.10 GigaSpaces Technologies Inc.

- 12.11 Google LLC

- 12.12 Hewlett Packard Enterprise Development LP

- 12.12 Hillstone Networks

- 12.14 Illumio, Inc.

- 12.15 Intel Corporation

- 12.16 International Business Machines Corporation (IBM)

- 12.17 JumpCloud Inc.

- 12.18 Microsoft Corporation

- 12.19 Nutanix, Inc.