|

|

市場調査レポート

商品コード

1569756

先進鉛蓄電池市場の2030年までの予測:タイプ別、構築方法別、エンドユーザー別、地域別の世界分析Advanced Lead Acid Battery Market Forecasts to 2030 - Global Analysis By Type, Construction Method (Flooded Battery, VRLA, Absorbent Glass Mat Batteries, Gel Batteries and Other Construction Methods), End User and by Geography |

||||||

カスタマイズ可能

|

|||||||

| 先進鉛蓄電池市場の2030年までの予測:タイプ別、構築方法別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年10月10日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の先進鉛蓄電池市場は2024年に266億2,000万米ドルを占め、予測期間中のCAGRは8.3%で成長し、2030年には429億6,000万米ドルに達する見込みです。

先進的な鉛蓄電池の性能と寿命は、従来の鉛蓄電池よりも先進的な材料と改良された設計を組み合わせることで向上します。より高いエネルギー密度、より優れたサイクル寿命、より優れた充電受容性を可能にする技術革新は、これらの電池で一般的に見られます。さらに、新しい鉛蓄電池は、バックアップ電源、自動車システム、再生可能エネルギー貯蔵など、複数の用途で安定した電力供給が可能なため、据置型とモバイル用途の両方で人気の高い選択肢となっています。

Battery Council International(2023年1月)によると、北米の鉛電池の年間製造能力は206GWh以上です。

再生可能エネルギー貯蔵への要求の高まり

クリーンで再生可能なエネルギーに向けた世界の取り組みが拡大する中、太陽光や風力によって生産される断続的な電力を効率的に貯蔵・管理できるエネルギー貯蔵システムが決定的に必要とされています。先進鉛蓄電池は拡張性があり、価格も手頃で、短時間でも長時間でもエネルギーを貯蔵できるため、グリッド規模のエネルギー貯蔵プロジェクトでますます利用されるようになっています。高度な鉛蓄電池は、遠隔地や十分なサービスを受けていない地域でオフグリッド再生可能エネルギー設備やマイクログリッドが拡大するにつれて、ますます需要が高まっています。さらに、これらの設備は、余剰電力を貯蔵し、エネルギーの安定供給を保証するための信頼性が高く、費用対効果の高い方法を提供します。

代替品と比較して低いエネルギー密度

リチウムイオン・バッテリーやソリッド・ステート・バッテリーのような最新のバッテリー技術と比較して、現代の鉛蓄電池のエネルギー密度が低いことは、その主な欠点のひとつです。この制約は、現代の電気自動車や携帯電子機器のように、重量とスペースが不可欠な産業での使用を制限しています。さらに、鉛蓄電池はエネルギー密度が低いため、高密度のものと同じ量のエネルギーを貯蔵するためには、より高度なものが必要となり、軽量でコンパクトなソリューションが求められる用途での魅力が低下する可能性があります。

先進電池技術の進歩

現在進行中の先進鉛蓄電池技術の研究開発には、市場拡大のチャンスがたくさんあります。鉛蓄電池の性能と寿命は、より優れたグリッド材料、改良された電解液配合、改良された電池管理システムなどの技術革新によって絶えず改善されています。メーカーは、研究開発に投資してエネルギー密度を改善し、サイクル寿命を延ばし、効率を高めた新製品を開発することで、鉛蓄電池技術の現在の欠点のいくつかに対処することができます。さらに、リチウムイオンやスーパーキャパシタと鉛蓄電池を統合したハイブリッド電池の選択肢を検討することで、新たな用途や市場機会が生まれる可能性があります。

代替技術との激しい競争

先進的な鉛蓄電池の市場は、フロー電池、固体電池、リチウムイオン電池などの新しい電池技術との競争が激しいです。より優れた安全機能、より長いサイクル時間、より高いエネルギー密度は、これらの代替技術によって頻繁に提供されます。電気自動車や携帯電子機器など、高いエネルギー密度と長期的な信頼性が求められる用途では、例えばリチウムイオン電池が業界標準として台頭しています。さらに、先進鉛蓄電池の市場シェアと成長の可能性は、これらの技術がさらに発展し、より手頃な価格になるにつれて、直接脅かされています。

COVID-19の影響:

COVID-19の大流行は、生産を遅らせ、国際的なサプライ・チェーンを混乱させ、原材料のコストを変化させることによって、先進鉛蓄電池市場に大きな影響を与えました。パンデミックは産業活動の低下と生産施設の一時閉鎖を引き起こし、リードタイムを長引かせ、電池製造用部品の供給を遅らせた。さらに、エネルギーやインフラ・プロジェクトへの投資に影響を及ぼす個人消費の減少や景気の不透明感により、先進鉛蓄電池の需要は減少しました。この悪影響を部分的に相殺し、一部の産業で需要を押し上げるために、パンデミックはデジタル・ソリューションとリモート・ワークの採用を加速させ、その結果、信頼性の高いバックアップ電源システムの必要性が高まった。

予測期間中、VRLA(バルブ制御鉛蓄電池)分野が最大になる見込み

VRLA(バルブ制御鉛蓄電池)市場セグメントは、先進鉛蓄電池市場で最大のシェアを占めています。VRLAバッテリーは、信頼できる性能と最小限のメンテナンスの必要性で定評があるため、さまざまな用途で広く使用されています。VRLAバッテリーは密閉構造であるため、液漏れを最小限に抑え、頻繁に水を補充する必要がないため、バックアップ電源用途や重要なシステムでの使用に最適です。さらに、VRLAバッテリーの効率性、安全性、多用途性は、産業用と民生用アプリケーションの両方で最良の選択肢となっており、このセグメントの優位性を支えています。

自動車・輸送分野は予測期間中に最も高いCAGRが見込まれる

先進鉛蓄電池市場では、自動車・輸送分野が最もCAGRが高いです。電気自動車やハイブリッド車では、信頼性が高く手頃な価格のエネルギー貯蔵オプションを提供する先進鉛蓄電池の使用が増加しており、この産業の成長を後押ししています。先進鉛蓄電池は、従来の鉛蓄電池よりも耐久性が高く、エネルギー密度が高いため、コスト削減と車両性能および電池寿命の向上を目指す自動車メーカーにとって魅力的な選択肢となります。さらに、このセグメントの成長は、輸送技術の電動化への大きな動向を示しています。

最大のシェアを持つ地域:

北米は先進鉛蓄電池市場で圧倒的なシェアを占めています。この優位性は、同地域の自動車産業が先進的であることに起因しており、ハイブリッド車や電気自動車における高性能バッテリーの需要を大きく促進しています。さらに、先進鉛蓄電池は、北米の強力なインフラと技術進歩により、バックアップ電源システムや再生可能エネルギー貯蔵など、さまざまな用途で広く使用されています。同地域による多額の研究開発費は、同市場における支配的地位をより強固なものにしています。

CAGRが最も高い地域:

先進鉛蓄電池市場は、アジア太平洋地域で最も高いCAGRで成長しています。この地域の急速な工業化、エネルギー貯蔵技術に対するニーズの高まり、特に中国やインドのような国々で盛んな自動車産業が、このブームの主な原動力となっています。アジア太平洋地域では、電気自動車と再生可能エネルギー源への注目が高まっており、先進鉛蓄電池の利用を後押ししています。さらに、この地域のダイナミックな成長軌道は、インフラ整備への多額の投資と政府による支援政策によってさらに後押しされています。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の先進鉛蓄電池市場:タイプ別

- 据置型

- 動機

- その他のタイプ

第6章 世界の先進鉛蓄電池市場:構築方法別

- 液式バッテリー

- VRLA(制御弁式鉛蓄電池)

- 吸収ガラスマット(AGM)バッテリー

- ゲル電池

- その他の構築方法

第7章 世界の先進鉛蓄電池市場:エンドユーザー別

- ユーティリティ

- 自動車・輸送

- エネルギーと電力

- 産業

- コマーシャル

- 住宅

- その他のエンドユーザー

第8章 世界の先進鉛蓄電池市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイリング

- Exide Technologies

- Crown Battery Manufacturing Co.

- Gs Yuasa International Ltd

- Enersys

- Hitachi

- Amara Raja Batteries Ltd

- Narada Power Source Co. Ltd.

- Leoch International Technology Ltd.

- Midac Batteries S.P.A

- Panasonic Holdings Corporation

- Trojan Battery Company

- Clarios

- Furukawa Battery Co., Ltd

- East Penn Manufacturing Co. Inc.

- Chaowei Power Holdings Limited

List of Tables

- Table 1 Global Advanced Lead Acid Battery Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Advanced Lead Acid Battery Market Outlook, By Type (2022-2030) ($MN)

- Table 3 Global Advanced Lead Acid Battery Market Outlook, By Stationary (2022-2030) ($MN)

- Table 4 Global Advanced Lead Acid Battery Market Outlook, By Motive (2022-2030) ($MN)

- Table 5 Global Advanced Lead Acid Battery Market Outlook, By Other Types (2022-2030) ($MN)

- Table 6 Global Advanced Lead Acid Battery Market Outlook, By Construction Method (2022-2030) ($MN)

- Table 7 Global Advanced Lead Acid Battery Market Outlook, By Flooded Battery (2022-2030) ($MN)

- Table 8 Global Advanced Lead Acid Battery Market Outlook, By VRLA (Valve Regulated Lead Acid Battery) (2022-2030) ($MN)

- Table 9 Global Advanced Lead Acid Battery Market Outlook, By Absorbent Glass Mat (AGM) Batteries (2022-2030) ($MN)

- Table 10 Global Advanced Lead Acid Battery Market Outlook, By Gel Batteries (2022-2030) ($MN)

- Table 11 Global Advanced Lead Acid Battery Market Outlook, By Other Construction Methods (2022-2030) ($MN)

- Table 12 Global Advanced Lead Acid Battery Market Outlook, By End User (2022-2030) ($MN)

- Table 13 Global Advanced Lead Acid Battery Market Outlook, By Utility (2022-2030) ($MN)

- Table 14 Global Advanced Lead Acid Battery Market Outlook, By Automotive and Transportation (2022-2030) ($MN)

- Table 15 Global Advanced Lead Acid Battery Market Outlook, By Energy and Power (2022-2030) ($MN)

- Table 16 Global Advanced Lead Acid Battery Market Outlook, By Industrial (2022-2030) ($MN)

- Table 17 Global Advanced Lead Acid Battery Market Outlook, By Commercial (2022-2030) ($MN)

- Table 18 Global Advanced Lead Acid Battery Market Outlook, By Residential (2022-2030) ($MN)

- Table 19 Global Advanced Lead Acid Battery Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 20 North America Advanced Lead Acid Battery Market Outlook, By Country (2022-2030) ($MN)

- Table 21 North America Advanced Lead Acid Battery Market Outlook, By Type (2022-2030) ($MN)

- Table 22 North America Advanced Lead Acid Battery Market Outlook, By Stationary (2022-2030) ($MN)

- Table 23 North America Advanced Lead Acid Battery Market Outlook, By Motive (2022-2030) ($MN)

- Table 24 North America Advanced Lead Acid Battery Market Outlook, By Other Types (2022-2030) ($MN)

- Table 25 North America Advanced Lead Acid Battery Market Outlook, By Construction Method (2022-2030) ($MN)

- Table 26 North America Advanced Lead Acid Battery Market Outlook, By Flooded Battery (2022-2030) ($MN)

- Table 27 North America Advanced Lead Acid Battery Market Outlook, By VRLA (Valve Regulated Lead Acid Battery) (2022-2030) ($MN)

- Table 28 North America Advanced Lead Acid Battery Market Outlook, By Absorbent Glass Mat (AGM) Batteries (2022-2030) ($MN)

- Table 29 North America Advanced Lead Acid Battery Market Outlook, By Gel Batteries (2022-2030) ($MN)

- Table 30 North America Advanced Lead Acid Battery Market Outlook, By Other Construction Methods (2022-2030) ($MN)

- Table 31 North America Advanced Lead Acid Battery Market Outlook, By End User (2022-2030) ($MN)

- Table 32 North America Advanced Lead Acid Battery Market Outlook, By Utility (2022-2030) ($MN)

- Table 33 North America Advanced Lead Acid Battery Market Outlook, By Automotive and Transportation (2022-2030) ($MN)

- Table 34 North America Advanced Lead Acid Battery Market Outlook, By Energy and Power (2022-2030) ($MN)

- Table 35 North America Advanced Lead Acid Battery Market Outlook, By Industrial (2022-2030) ($MN)

- Table 36 North America Advanced Lead Acid Battery Market Outlook, By Commercial (2022-2030) ($MN)

- Table 37 North America Advanced Lead Acid Battery Market Outlook, By Residential (2022-2030) ($MN)

- Table 38 North America Advanced Lead Acid Battery Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 39 Europe Advanced Lead Acid Battery Market Outlook, By Country (2022-2030) ($MN)

- Table 40 Europe Advanced Lead Acid Battery Market Outlook, By Type (2022-2030) ($MN)

- Table 41 Europe Advanced Lead Acid Battery Market Outlook, By Stationary (2022-2030) ($MN)

- Table 42 Europe Advanced Lead Acid Battery Market Outlook, By Motive (2022-2030) ($MN)

- Table 43 Europe Advanced Lead Acid Battery Market Outlook, By Other Types (2022-2030) ($MN)

- Table 44 Europe Advanced Lead Acid Battery Market Outlook, By Construction Method (2022-2030) ($MN)

- Table 45 Europe Advanced Lead Acid Battery Market Outlook, By Flooded Battery (2022-2030) ($MN)

- Table 46 Europe Advanced Lead Acid Battery Market Outlook, By VRLA (Valve Regulated Lead Acid Battery) (2022-2030) ($MN)

- Table 47 Europe Advanced Lead Acid Battery Market Outlook, By Absorbent Glass Mat (AGM) Batteries (2022-2030) ($MN)

- Table 48 Europe Advanced Lead Acid Battery Market Outlook, By Gel Batteries (2022-2030) ($MN)

- Table 49 Europe Advanced Lead Acid Battery Market Outlook, By Other Construction Methods (2022-2030) ($MN)

- Table 50 Europe Advanced Lead Acid Battery Market Outlook, By End User (2022-2030) ($MN)

- Table 51 Europe Advanced Lead Acid Battery Market Outlook, By Utility (2022-2030) ($MN)

- Table 52 Europe Advanced Lead Acid Battery Market Outlook, By Automotive and Transportation (2022-2030) ($MN)

- Table 53 Europe Advanced Lead Acid Battery Market Outlook, By Energy and Power (2022-2030) ($MN)

- Table 54 Europe Advanced Lead Acid Battery Market Outlook, By Industrial (2022-2030) ($MN)

- Table 55 Europe Advanced Lead Acid Battery Market Outlook, By Commercial (2022-2030) ($MN)

- Table 56 Europe Advanced Lead Acid Battery Market Outlook, By Residential (2022-2030) ($MN)

- Table 57 Europe Advanced Lead Acid Battery Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 58 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Country (2022-2030) ($MN)

- Table 59 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Type (2022-2030) ($MN)

- Table 60 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Stationary (2022-2030) ($MN)

- Table 61 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Motive (2022-2030) ($MN)

- Table 62 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Other Types (2022-2030) ($MN)

- Table 63 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Construction Method (2022-2030) ($MN)

- Table 64 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Flooded Battery (2022-2030) ($MN)

- Table 65 Asia Pacific Advanced Lead Acid Battery Market Outlook, By VRLA (Valve Regulated Lead Acid Battery) (2022-2030) ($MN)

- Table 66 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Absorbent Glass Mat (AGM) Batteries (2022-2030) ($MN)

- Table 67 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Gel Batteries (2022-2030) ($MN)

- Table 68 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Other Construction Methods (2022-2030) ($MN)

- Table 69 Asia Pacific Advanced Lead Acid Battery Market Outlook, By End User (2022-2030) ($MN)

- Table 70 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Utility (2022-2030) ($MN)

- Table 71 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Automotive and Transportation (2022-2030) ($MN)

- Table 72 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Energy and Power (2022-2030) ($MN)

- Table 73 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Industrial (2022-2030) ($MN)

- Table 74 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Commercial (2022-2030) ($MN)

- Table 75 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Residential (2022-2030) ($MN)

- Table 76 Asia Pacific Advanced Lead Acid Battery Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 77 South America Advanced Lead Acid Battery Market Outlook, By Country (2022-2030) ($MN)

- Table 78 South America Advanced Lead Acid Battery Market Outlook, By Type (2022-2030) ($MN)

- Table 79 South America Advanced Lead Acid Battery Market Outlook, By Stationary (2022-2030) ($MN)

- Table 80 South America Advanced Lead Acid Battery Market Outlook, By Motive (2022-2030) ($MN)

- Table 81 South America Advanced Lead Acid Battery Market Outlook, By Other Types (2022-2030) ($MN)

- Table 82 South America Advanced Lead Acid Battery Market Outlook, By Construction Method (2022-2030) ($MN)

- Table 83 South America Advanced Lead Acid Battery Market Outlook, By Flooded Battery (2022-2030) ($MN)

- Table 84 South America Advanced Lead Acid Battery Market Outlook, By VRLA (Valve Regulated Lead Acid Battery) (2022-2030) ($MN)

- Table 85 South America Advanced Lead Acid Battery Market Outlook, By Absorbent Glass Mat (AGM) Batteries (2022-2030) ($MN)

- Table 86 South America Advanced Lead Acid Battery Market Outlook, By Gel Batteries (2022-2030) ($MN)

- Table 87 South America Advanced Lead Acid Battery Market Outlook, By Other Construction Methods (2022-2030) ($MN)

- Table 88 South America Advanced Lead Acid Battery Market Outlook, By End User (2022-2030) ($MN)

- Table 89 South America Advanced Lead Acid Battery Market Outlook, By Utility (2022-2030) ($MN)

- Table 90 South America Advanced Lead Acid Battery Market Outlook, By Automotive and Transportation (2022-2030) ($MN)

- Table 91 South America Advanced Lead Acid Battery Market Outlook, By Energy and Power (2022-2030) ($MN)

- Table 92 South America Advanced Lead Acid Battery Market Outlook, By Industrial (2022-2030) ($MN)

- Table 93 South America Advanced Lead Acid Battery Market Outlook, By Commercial (2022-2030) ($MN)

- Table 94 South America Advanced Lead Acid Battery Market Outlook, By Residential (2022-2030) ($MN)

- Table 95 South America Advanced Lead Acid Battery Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 96 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Country (2022-2030) ($MN)

- Table 97 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Type (2022-2030) ($MN)

- Table 98 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Stationary (2022-2030) ($MN)

- Table 99 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Motive (2022-2030) ($MN)

- Table 100 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Other Types (2022-2030) ($MN)

- Table 101 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Construction Method (2022-2030) ($MN)

- Table 102 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Flooded Battery (2022-2030) ($MN)

- Table 103 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By VRLA (Valve Regulated Lead Acid Battery) (2022-2030) ($MN)

- Table 104 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Absorbent Glass Mat (AGM) Batteries (2022-2030) ($MN)

- Table 105 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Gel Batteries (2022-2030) ($MN)

- Table 106 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Other Construction Methods (2022-2030) ($MN)

- Table 107 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By End User (2022-2030) ($MN)

- Table 108 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Utility (2022-2030) ($MN)

- Table 109 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Automotive and Transportation (2022-2030) ($MN)

- Table 110 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Energy and Power (2022-2030) ($MN)

- Table 111 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Industrial (2022-2030) ($MN)

- Table 112 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Commercial (2022-2030) ($MN)

- Table 113 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Residential (2022-2030) ($MN)

- Table 114 Middle East & Africa Advanced Lead Acid Battery Market Outlook, By Other End Users (2022-2030) ($MN)

According to Stratistics MRC, the Global Advanced Lead Acid Battery Market is accounted for $26.62 billion in 2024 and is expected to reach $42.96 billion by 2030 growing at a CAGR of 8.3% during the forecast period. The performance and longevity of advanced lead-acid batteries are increased by combining advanced materials and improved design over traditional lead-acid batteries. Innovations that enable higher energy density, better cycle life, and better charge acceptance are commonly found in these batteries. Moreover, newer lead-acid batteries are a popular option for both stationary and mobile applications because of their consistent power delivery in multiple applications, including backup power, automotive systems, and renewable energy storage.

According to Battery Council International (January 2023), the annual manufacturing capacity of lead batteries in North America is over 206 GWh.

Market Dynamics:

Driver:

Increasing requirement for storage of renewable energy

Energy storage systems that can efficiently store and manage intermittent power produced by solar and wind sources are critically needed as the world's push toward clean and renewable energy grows. Because they are scalable, affordable, and capable of storing energy for both short and long periods of time, advanced lead-acid batteries are being utilized more and more in grid-scale energy storage projects. Advanced lead-acid batteries are becoming more and more in demand as off-grid renewable energy installations and micro grids expand in remote or underserved areas. Additionally, these installations offer a dependable and cost-effective way to store excess power and guarantee a steady supply of energy.

Restraint:

Low energy density in relation to alternatives

The lower energy density of modern lead-acid batteries in comparison to more recent battery technologies, like lithium-ion and solid-state batteries is one of their main drawbacks. This constraint limits their use in industries where weight and space are essential, like in contemporary electric cars and portable electronics. Furthermore, more sophisticated lead-acid batteries are needed to store the same amount of energy as their higher-density counterparts due to the lower energy density, which may reduce their appeal in applications that call for lightweight and compact solutions.

Opportunity:

Advancement of advanced battery technologies

There are plenty of chances for market expansion in the ongoing research and development of advanced lead-acid battery technologies. The performance and lifespan of lead-acid batteries are constantly being improved by innovations like better grid materials, improved electrolyte formulations, and improved battery management systems. Manufacturers can address some of the present drawbacks of lead-acid technology by investing in R&D to create new products with improved energy density, extended cycle life, and increased efficiency. Moreover, investigating hybrid battery options that integrate lithium-ion or super capacitors with lead-acid could lead to new applications and market opportunities.

Threat:

Vigorous rivalry from alternative technologies

The market for advanced lead-acid batteries is highly competitive, with new battery technologies like flow, solid-state, and lithium-ion batteries. Better safety features, longer cycle times, and higher energy densities are frequently provided by these substitutes. In applications like electric vehicles and portable electronics that demand a high energy density and long-term dependability, lithium-ion batteries, for example, have emerged as the industry standard. Additionally, the market share and growth potential of advanced lead-acid batteries are directly threatened by these technologies as they develop further and become more affordable.

Covid-19 Impact:

The COVID-19 pandemic had a major effect on the market for advanced lead-acid batteries by delaying production, upsetting international supply chains, and altering the cost of raw materials. The pandemic caused a decrease in industrial activity and the temporary closure of production facilities, which prolonged lead times and slowed down the supply of parts for battery manufacturing. Furthermore, the demand for advanced lead-acid batteries declined as a result of reduced consumer spending and economic uncertainty affecting investments in energy and infrastructure projects. To partially offset the negative effects and boost demand in some industries, the pandemic also accelerated the adoption of digital solutions and remote work, which in turn increased the need for dependable backup power systems.

The VRLA (Valve Regulated Lead Acid Battery) segment is expected to be the largest during the forecast period

The VRLA (Valve Regulated Lead Acid) Batteries market segment has the largest share in the advanced lead acid battery market. VRLA batteries are widely used in many different applications because of their reputation for dependable performance and minimal maintenance needs. They are perfect for use in backup power applications and critical systems because of their sealed construction, which minimizes spills and lessens the need for frequent water refilling. Moreover, the efficiency, safety, and versatility of VRLA batteries, which make them a top option for both industrial and consumer applications, are what propel this segment's dominance.

The Automotive and Transportation segment is expected to have the highest CAGR during the forecast period

The Automotive and Transportation segment of the Advanced Lead Acid Battery Market has the highest CAGR. The increasing use of advanced lead-acid batteries in electric and hybrid vehicles, which provide dependable and affordable energy storage options, is fueling the growth of this industry. Because advanced lead-acid batteries are more durable and have a higher energy density than traditional lead-acid batteries, they present a compelling alternative for automakers looking to reduce costs and increase vehicle performance and battery life. Additionally, the growth of this segment is indicative of a larger trend in transportation technologies toward electrification.

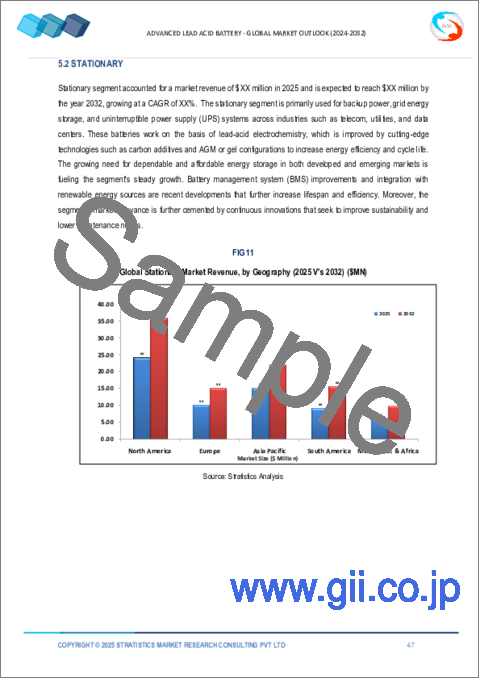

Region with largest share:

North America has a dominant market share in the advanced lead-acid battery market. This dominance is attributable to the advanced automotive industry in the region, which fuels a significant demand for high-performance batteries in hybrid and electric cars. Furthermore, advanced lead-acid batteries are widely used in many different applications, such as backup power systems and renewable energy storage, owing to North America's strong infrastructure and technological advancements. Significant R&D expenditures made by the area support its dominant position in the market even more.

Region with highest CAGR:

The market for advanced lead-acid batteries is growing at the highest CAGR in the Asia-Pacific region. The region's fast industrialization, rising need for energy storage technologies, and thriving automotive industry-particularly in nations like China and India-are the main drivers of this boom. The Asia-Pacific region's increasing focus on electric vehicles and renewable energy sources is propelling the use of advanced lead-acid batteries. Moreover, the region's dynamic growth trajectory is further bolstered by substantial investments in infrastructure development and supportive policies from the government.

Key players in the market

Some of the key players in Advanced Lead Acid Battery market include Exide Technologies, Crown Battery Manufacturing Co., Gs Yuasa International Ltd, Enersys, Hitachi, Amara Raja Batteries Ltd, Narada Power Source Co. Ltd., Leoch International Technology Ltd., Midac Batteries S.P.A, Panasonic Holdings Corporation, Trojan Battery Company, Clarios, Furukawa Battery Co., Ltd, East Penn Manufacturing Co. Inc. and Chaowei Power Holdings Limited.

Key Developments:

In June 2024, Amara Raja Advanced Cell Technologies Pvt Ltd on said it has signed a licensing agreement with GIB EnergyX Slovakia s.r.o., for lithium-ion cells technology. As part of the agreement, GIB EnergyX, a subsidiary of Gotion High-Tech Co Ltd, will license Gotion's 'LFP technology' for lithium-ion cells to Amara Raja Advanced Cell Technologies (ARACT), a wholly-owned arm of Amara Raja Energy & Mobility Ltd (ARE&M), the company said in a statement.

In May 2024, Stored energy technologies provider EnerSys has entered into a definitive agreement to acquire for $208 million Bren-Tronics, a manufacturer of portable power products for defense customers. EnerSys said it expects to close the all-cash transaction by the second quarter of 2024.

In May 2023, GS Yuasa International Ltd. (GS Yuasa) and Honda Motor Co., Ltd. (Honda) announced that they have signed a joint venture agreement toward the establishment of a new company. Honda and GS Yuasa Reach Basic Agreement Toward Collaboration for a High-capacity, High-output Lithium-ion Battery, the two companies have been discussing specifics for collaboration on high-capacity, high-output lithium-ion batteries, mainly for EVs.

Types Covered:

- Stationary

- Motive

- Other Types

Construction Methods Covered:

- Flooded Battery

- VRLA (Valve Regulated Lead Acid Battery)

- Absorbent Glass Mat (AGM) Batteries

- Gel Batteries

- Other Construction Methods

End Users Covered:

- Utility

- Automotive and Transportation

- Energy and Power

- Industrial

- Commercial

- Residential

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 End User Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Advanced Lead Acid Battery Market, By Type

- 5.1 Introduction

- 5.2 Stationary

- 5.3 Motive

- 5.4 Other Types

6 Global Advanced Lead Acid Battery Market, By Construction Method

- 6.1 Introduction

- 6.2 Flooded Battery

- 6.3 VRLA (Valve Regulated Lead Acid Battery)

- 6.4 Absorbent Glass Mat (AGM) Batteries

- 6.5 Gel Batteries

- 6.6 Other Construction Methods

7 Global Advanced Lead Acid Battery Market, By End User

- 7.1 Introduction

- 7.2 Utility

- 7.3 Automotive and Transportation

- 7.4 Energy and Power

- 7.5 Industrial

- 7.6 Commercial

- 7.7 Residential

- 7.8 Other End Users

8 Global Advanced Lead Acid Battery Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 Exide Technologies

- 10.2 Crown Battery Manufacturing Co.

- 10.3 Gs Yuasa International Ltd

- 10.4 Enersys

- 10.5 Hitachi

- 10.6 Amara Raja Batteries Ltd

- 10.7 Narada Power Source Co. Ltd.

- 10.8 Leoch International Technology Ltd.

- 10.9 Midac Batteries S.P.A

- 10.10 Panasonic Holdings Corporation

- 10.11 Trojan Battery Company

- 10.12 Clarios

- 10.13 Furukawa Battery Co., Ltd

- 10.14 East Penn Manufacturing Co. Inc.

- 10.15 Chaowei Power Holdings Limited