|

|

市場調査レポート

商品コード

1551233

低分子医薬品原薬市場の2030年までの予測:生産量、治療領域、地域別の世界分析Small Molecule Active Pharmaceutical Ingredient Market Forecasts to 2030 - Global Analysis By Production, Therapeutic Area and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 低分子医薬品原薬市場の2030年までの予測:生産量、治療領域、地域別の世界分析 |

|

出版日: 2024年09月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の低分子医薬品原薬(API)市場は2024年に1,695億米ドルを占め、予測期間中にCAGR 9.4%で成長し、2030年には2,906億米ドルに達すると予測されています。

低分子医薬品原薬(API)とは、薬理学的に活性で医薬品の製剤化に使用される低分子化合物を指します。これらの化合物は通常、分子量が900ダルトン未満であり、特定の生物学的標的と相互作用して治療効果を引き出す能力を特徴としています。低分子医薬品原薬は多くの場合、化学的工程を経て合成され、経口、局所、あるいはその他の経路で投与されます。

Drug, Chemical &Associated Technologies Association(DCAT)によると、2021年には50の新規分子医薬品(NME)が承認され、そのうち36製品が低分子医薬品でした。

慢性疾患の増加

糖尿病、心血管疾患、がんなどの慢性疾患の増加は、低分子医薬品原薬(API)市場の成長を大きく促進しています。慢性疾患は長期的な管理と一貫した投薬が必要であるため、効果的な低分子医薬品原薬の需要が高まっています。医薬品の開発において極めて重要なこれらのAPIは、生物製剤と比較して標的を絞った、しばしばより管理しやすい治療を提供します。さらに、細胞に浸透し、特定の生物学的経路を調節する能力により、慢性疾患の治療には欠かせないものとなっています。

環境と安全性への懸念

環境と安全性への懸念は、低分子医薬品原薬(API)の生産と開発に大きな影響を与えます。これらの分子の合成には、多くの場合、有害な化学物質やプロセスが関与しており、潜在的な環境汚染や安全性のリスクにつながります。製造から排出される廃棄物や排出物は土壌や水を汚染し、長期的な生態学的・健康的危険をもたらす可能性があります。規制上の圧力により、こうした影響を最小限に抑えるための厳格な対策が必要となり、原薬製造におけるコストと複雑さの増大につながります。しかし、企業は環境フットプリントを削減し、労働者の安全を確保するために先進的な技術や慣行に投資しなければならず、これは経済的負担となりうる。

ジェネリック医薬品の需要増加

ジェネリック医薬品の需要の高まりは、低分子医薬品原薬(API)市場を大幅に押し上げています。先発医薬品の特許が切れると、ジェネリック医薬品メーカーはこれらの医薬品のコピーを低コストで製造・販売できるようになり、ヘルスケアがより身近になります。この変化によって、ジェネリック医薬品の基礎成分である低分子医薬品原薬のニーズが高まっています。さらに、安定性と確立された製造工程で知られる低分子医薬品原薬は、費用対効果の高いジェネリック医薬品の製造に不可欠です。

知的財産の問題

知的財産(IP)の問題は、技術革新や市場参入の障壁となることで、低分子医薬品原薬の開発や生産を大きく妨げています。製薬会社は新しい低分子医薬品原薬を発見し開発するために研究開発に多額の投資をしていますが、特許紛争や重複するクレームなどの知的財産権紛争が進展を妨げることがあります。しかし、重なり合う特許の網の目のように張り巡らされた特許藪は、企業にとってライセンス契約をうまく進めることを困難にし、新しいAPIの導入を遅らせる可能性があります。

COVID-19の影響:

COVID-19の大流行は、世界なサプライチェーンと製造工程を混乱させることで、低分子の原薬(API)業界に大きな影響を与えました。厳格なロックダウン、渡航制限、工場の操業停止により、原薬の生産と流通は深刻な遅延と不足に直面しました。様々な治療や医薬品に不可欠な低分子医薬品原薬の多くは、主にアジアにある少数の主要製造拠点に依存していたため、不足が発生しました。この混乱は、必要不可欠な医薬品の生産に支障をきたすだけでなく、コスト増と価格変動にもつながった。

予測期間中、アウトソーシングセグメントが最大となる見込み

予測期間中、アウトソーシングセグメントが最大となる見込み。医薬製剤に不可欠な低分子医薬品原薬は、有効性、安全性、費用対効果を確保するために精密な開発が必要です。この分野をアウトソーシングすることで、製薬会社は専門的な知識、高度な技術、専門的な開発・製造受託機関(CDMO)のリソースを活用し、これらの分子を強化することができます。このプロセスには、合成方法の改善、収率の向上、精製技術の改良、製造プロセス全体の最適化などが含まれます。

予測期間中、心血管疾患分野のCAGRが最も高くなると予想される

心血管疾患分野は、予測期間中に最も高いCAGRが見込まれます。低分子は、特定の生物学的標的と相互作用し、その活性を調節して高血圧、心不全、冠動脈疾患などの疾患を管理する能力があるため、心血管治療の要となっています。これらの原薬を強化するには、バイオアベイラビリティを高め副作用を軽減するために化学的特性を最適化し、薬剤の安定性と溶解性を改善し、標的作用のための高度なデリバリーシステムを開発する必要があります。このプロセスには、構造ベースの薬物設計やハイスループットスクリーニングのような最先端技術の使用がしばしば含まれます。

最大のシェアを占める地域

推定期間中、北米地域が市場で最大のシェアを占めています。人口動態が高齢化へとシフトする中、同地域では、心血管疾患、糖尿病、神経疾患などの慢性疾患や加齢に伴う健康問題を管理するための医薬品に対する需要が増加しています。このような需要の高まりはAPI市場の成長の原動力となっており、製薬会社は地域全体でこれらの健康問題に対処できる低分子の市場開発と製造に力を注いでいます。加齢に関連した疾患に対する効果的な治療に対する地域のニーズは、APIの研究開発における技術革新と投資を促進し、医薬品の有効性と安全性の向上に寄与しています。

CAGRが最も高い地域:

欧州地域は予測期間中、収益性の高い成長を維持すると予測されています。欧州医薬品庁(EMA)と各国の規制機関は、厳格な試験、文書化、製造慣行を促進する厳しいガイドラインを実施しています。これらの規制は、技術革新と信頼性のための強固な環境を育み、原薬が市場に出回る前に最高水準を満たすことを保証します。さらに、この規制の枠組みは公衆衛生を守るだけでなく、投資家の信頼を高め、製薬会社の市場参入を促進します。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の低分子医薬品原薬(API)市場:生産量別

- アウトソーシング

- キャプティブ/社内

第6章 世界の低分子医薬品原薬(API)市場:治療領域別

- 呼吸器疾患

- 代謝障害

- 感染症

- 心血管疾患

- その他の治療領域

第7章 世界の低分子医薬品原薬(API)市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第8章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第9章 企業プロファイリング

- Aurobindo Pharma

- Boehringer Ingelheim GmbH

- Cambrex Corporation

- Dr. Reddy's Laboratories Ltd

- Gilead Sciences, Inc

- GlaxoSmithKline PLC

- Novartis AG

- Pfizer Inc

- Sanofi S.A

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

List of Tables

- Table 1 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Production (2022-2030) ($MN)

- Table 3 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Outsourced (2022-2030) ($MN)

- Table 4 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Captive/In-House (2022-2030) ($MN)

- Table 5 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Therapeutic Area (2022-2030) ($MN)

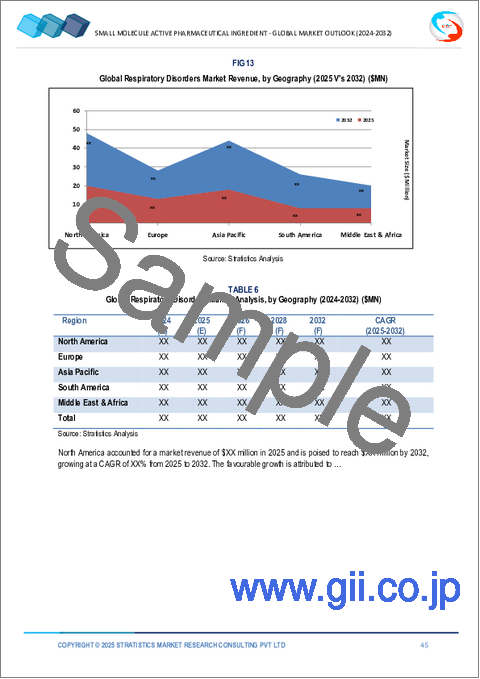

- Table 6 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Respiratory Disorders (2022-2030) ($MN)

- Table 7 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Metabolic Disorders (2022-2030) ($MN)

- Table 8 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Infectious Diseases (2022-2030) ($MN)

- Table 9 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Cardiovascular Diseases (2022-2030) ($MN)

- Table 10 Global Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Other Therapeutic Areas (2022-2030) ($MN)

- Table 11 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Country (2022-2030) ($MN)

- Table 12 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Production (2022-2030) ($MN)

- Table 13 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Outsourced (2022-2030) ($MN)

- Table 14 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Captive/In-House (2022-2030) ($MN)

- Table 15 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Therapeutic Area (2022-2030) ($MN)

- Table 16 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Respiratory Disorders (2022-2030) ($MN)

- Table 17 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Metabolic Disorders (2022-2030) ($MN)

- Table 18 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Infectious Diseases (2022-2030) ($MN)

- Table 19 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Cardiovascular Diseases (2022-2030) ($MN)

- Table 20 North America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Other Therapeutic Areas (2022-2030) ($MN)

- Table 21 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Country (2022-2030) ($MN)

- Table 22 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Production (2022-2030) ($MN)

- Table 23 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Outsourced (2022-2030) ($MN)

- Table 24 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Captive/In-House (2022-2030) ($MN)

- Table 25 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Therapeutic Area (2022-2030) ($MN)

- Table 26 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Respiratory Disorders (2022-2030) ($MN)

- Table 27 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Metabolic Disorders (2022-2030) ($MN)

- Table 28 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Infectious Diseases (2022-2030) ($MN)

- Table 29 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Cardiovascular Diseases (2022-2030) ($MN)

- Table 30 Europe Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Other Therapeutic Areas (2022-2030) ($MN)

- Table 31 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Country (2022-2030) ($MN)

- Table 32 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Production (2022-2030) ($MN)

- Table 33 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Outsourced (2022-2030) ($MN)

- Table 34 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Captive/In-House (2022-2030) ($MN)

- Table 35 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Therapeutic Area (2022-2030) ($MN)

- Table 36 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Respiratory Disorders (2022-2030) ($MN)

- Table 37 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Metabolic Disorders (2022-2030) ($MN)

- Table 38 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Infectious Diseases (2022-2030) ($MN)

- Table 39 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Cardiovascular Diseases (2022-2030) ($MN)

- Table 40 Asia Pacific Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Other Therapeutic Areas (2022-2030) ($MN)

- Table 41 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Country (2022-2030) ($MN)

- Table 42 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Production (2022-2030) ($MN)

- Table 43 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Outsourced (2022-2030) ($MN)

- Table 44 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Captive/In-House (2022-2030) ($MN)

- Table 45 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Therapeutic Area (2022-2030) ($MN)

- Table 46 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Respiratory Disorders (2022-2030) ($MN)

- Table 47 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Metabolic Disorders (2022-2030) ($MN)

- Table 48 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Infectious Diseases (2022-2030) ($MN)

- Table 49 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Cardiovascular Diseases (2022-2030) ($MN)

- Table 50 South America Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Other Therapeutic Areas (2022-2030) ($MN)

- Table 51 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Country (2022-2030) ($MN)

- Table 52 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Production (2022-2030) ($MN)

- Table 53 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Outsourced (2022-2030) ($MN)

- Table 54 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Captive/In-House (2022-2030) ($MN)

- Table 55 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Therapeutic Area (2022-2030) ($MN)

- Table 56 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Respiratory Disorders (2022-2030) ($MN)

- Table 57 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Metabolic Disorders (2022-2030) ($MN)

- Table 58 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Infectious Diseases (2022-2030) ($MN)

- Table 59 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Cardiovascular Diseases (2022-2030) ($MN)

- Table 60 Middle East & Africa Small Molecule Active Pharmaceutical Ingredient (API) Market Outlook, By Other Therapeutic Areas (2022-2030) ($MN)

According to Stratistics MRC, the Global Small Molecule Active Pharmaceutical Ingredient (API) Market is accounted for $169.5 billion in 2024 and is expected to reach $290.6 billion by 2030 growing at a CAGR of 9.4% during the forecast period. A Small Molecule Active Pharmaceutical Ingredient (API) refers to a low molecular weight compound that is pharmacologically active and used in the formulation of medications. These compounds typically have a molecular weight less than 900 Daltons and are characterized by their ability to interact with specific biological targets to elicit a therapeutic effect. Small molecule APIs are often synthesized through chemical processes and can be administered orally, topically, or through other routes.

According to the Drug, Chemical & Associated Technologies Association (DCAT), in 2021, 50 New Molecular Entities (NME) were approved, of which 36 products were small molecule entities.

Market Dynamics:

Driver:

Rising prevalence of chronic diseases

The increasing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer is significantly driving the growth of the Small Molecule Active Pharmaceutical Ingredient (API) market. Chronic diseases require long-term management and consistent medication, leading to a heightened demand for effective small molecule drugs. These APIs, which are crucial in the development of pharmaceuticals, offer targeted and often more manageable treatments compared to biologics. Furthermore, their ability to penetrate cells and modulate specific biological pathways makes them indispensable for treating chronic conditions.

Restraint:

Environmental and safety concerns

Environmental and safety concerns significantly impact the production and development of Small Molecule Active Pharmaceutical Ingredients (APIs). The synthesis of these molecules often involves hazardous chemicals and processes, leading to potential environmental pollution and safety risks. Waste products and emissions from manufacturing can contaminate soil and water, posing long-term ecological and health hazards. Regulatory pressures require stringent measures to minimize these impacts, leading to increased costs and complexities in API production. However, companies must invest in advanced technologies and practices to reduce their environmental footprint and ensure worker safety, which can be financially burdensome.

Opportunity:

Increasing demand for generic drugs

The rising demand for generic drugs is substantially boosting the market for Small Molecule Active Pharmaceutical Ingredients (APIs). As patents for branded pharmaceuticals expire, generic drug manufacturers can produce and market copies of these medications at lower costs, making healthcare more accessible. This shift drives up the need for small molecule APIs, which are the foundational ingredients in these generic drugs. Additionally, small molecule APIs, known for their stability and well-established production processes, are crucial for creating cost-effective generic medications.

Threat:

Intellectual property issues

Intellectual property (IP) issues significantly hinder the development and production of Small Molecule Active Pharmaceutical Ingredients (APIs) by creating barriers to innovation and market access. Pharmaceutical companies invest heavily in research and development to discover and develop new small molecule APIs, but IP conflicts, such as patent disputes and overlapping claims, can stall progress. However, patent thickets dense webs of overlapping patents can make it challenging for companies to navigate licensing agreements and may delay the introduction of new APIs.

Covid-19 Impact:

The COVID-19 pandemic significantly impacted the small molecule Active Pharmaceutical Ingredient (API) industry by disrupting global supply chains and manufacturing processes. With stringent lockdowns, travel restrictions, and factory shutdowns, the production and distribution of APIs faced severe delays and shortages. Many small molecule APIs, critical for various treatments and medications, experienced shortages due to the dependency on a few key manufacturing hubs, primarily in Asia. This disruption not only hindered the production of essential drugs but also led to increased costs and price volatility.

The Outsourced segment is expected to be the largest during the forecast period

Outsourced segment is expected to be the largest during the forecast period. Small molecule APIs, essential for pharmaceutical formulations, require precise development to ensure efficacy, safety, and cost-effectiveness. By outsourcing this segment, pharmaceutical companies can leverage the expertise, advanced technologies, and resources of specialized contract development and manufacturing organizations (CDMOs) to enhance these molecules. This process may include improving synthesis methods, increasing yield, refining purification techniques, or optimizing the overall production process.

The Cardiovascular Diseases segment is expected to have the highest CAGR during the forecast period

Cardiovascular Diseases segment is expected to have the highest CAGR during the forecast period. Small molecules are a cornerstone in cardiovascular therapy due to their ability to interact with specific biological targets, modulating their activity to manage diseases such as hypertension, heart failure, and coronary artery disease. Enhancing these APIs involves optimizing their chemical properties to increase bioavailability and reduce side effects, improving the drug's stability and solubility, and developing advanced delivery systems for targeted action. This process often includes the use of cutting-edge technologies like structure-based drug design and high-throughput screening.

Region with largest share:

North America region commanded the largest share of the market over the extrapolated period. As the demographic shifts towards an older population, there is an increased demand for pharmaceuticals to manage chronic diseases and age-related health issues, such as cardiovascular conditions, diabetes, and neurological disorders across the region. This rising demand is driving growth in the API market, as pharmaceutical companies intensify their focus on developing and manufacturing small molecules that can address these health concerns throughout the region. The regional need for effective treatments for age-related conditions fuels innovation and investment in API research and development, contributing to advancements in drug efficacy and safety.

Region with highest CAGR:

Europe region is projected to hold profitable growth during the forecast period. European Medicines Agency (EMA) and national regulatory bodies enforce stringent guidelines that promote rigorous testing, documentation, and manufacturing practices. These regulations foster a robust environment for innovation and reliability, ensuring that APIs meet the highest standards before reaching the market. Furthermore, this regulatory framework not only protects public health but also boosts investor confidence and facilitates market access for pharmaceutical companies.

Key players in the market

Some of the key players in Small Molecule Active Pharmaceutical Ingredient (API) market include Aurobindo Pharma, Boehringer Ingelheim GmbH, Cambrex Corporation, Dr. Reddy's Laboratories Ltd, Gilead Sciences, Inc, GlaxoSmithKline PLC, Novartis AG, Pfizer Inc, Sanofi S.A, Sun Pharmaceutical Industries Ltd and Teva Pharmaceutical Industries Ltd.

Key Developments:

In October 2023, Axplora announced the cGMP (current Good Manufacturing Practices) approval from Agenzia Italiana Del Farmaco (AIFA) for the expansion of the manufacturing capacities for HPAPIs and steroids in to meet the growing demand.

In March 2023, medicine developer CatSci announced a distribution agreement with small molecule developer AGC Pharma Chemicals (CDMO). For the development of new therapeutics, AGC says CatSci has the expertise to develop chemicals and analytical methods, crystallization and solids, pre-formulation, and high-potency active pharmaceutical ingredients (API), along with chemical manufacturing and control (CMC).

Productions Covered:

- Outsourced

- Captive/In-House

Therapeutic Areas Covered:

- Respiratory Disorders

- Metabolic Disorders

- Infectious Diseases

- Cardiovascular Diseases

- Other Therapeutic Areas

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Emerging Markets

- 3.7 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Small Molecule Active Pharmaceutical Ingredient (API) Market, By Production

- 5.1 Introduction

- 5.2 Outsourced

- 5.3 Captive/In-House

6 Global Small Molecule Active Pharmaceutical Ingredient (API) Market, By Therapeutic Area

- 6.1 Introduction

- 6.2 Respiratory Disorders

- 6.3 Metabolic Disorders

- 6.4 Infectious Diseases

- 6.5 Cardiovascular Diseases

- 6.6 Other Therapeutic Areas

7 Global Small Molecule Active Pharmaceutical Ingredient (API) Market, By Geography

- 7.1 Introduction

- 7.2 North America

- 7.2.1 US

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 New Zealand

- 7.4.6 South Korea

- 7.4.7 Rest of Asia Pacific

- 7.5 South America

- 7.5.1 Argentina

- 7.5.2 Brazil

- 7.5.3 Chile

- 7.5.4 Rest of South America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 Qatar

- 7.6.4 South Africa

- 7.6.5 Rest of Middle East & Africa

8 Key Developments

- 8.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 8.2 Acquisitions & Mergers

- 8.3 New Product Launch

- 8.4 Expansions

- 8.5 Other Key Strategies

9 Company Profiling

- 9.1 Aurobindo Pharma

- 9.2 Boehringer Ingelheim GmbH

- 9.3 Cambrex Corporation

- 9.4 Dr. Reddy's Laboratories Ltd

- 9.5 Gilead Sciences, Inc

- 9.6 GlaxoSmithKline PLC

- 9.7 Novartis AG

- 9.8 Pfizer Inc

- 9.9 Sanofi S.A

- 9.10 Sun Pharmaceutical Industries Ltd

- 9.11 Teva Pharmaceutical Industries Ltd