|

|

市場調査レポート

商品コード

1494817

定置用燃料電池の2030年までの市場予測: 容量別、技術別、用途別、エンドユーザー別、地域別の世界分析Stationary Fuel Cells Market Forecasts to 2030 - Global Analysis By Capacity, Technology (PAFC, MCFC and PEMFC ), Application, End User and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 定置用燃料電池の2030年までの市場予測: 容量別、技術別、用途別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年06月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、定置用燃料電池の世界市場は2024年に16億9,000万米ドルを占め、予測期間中のCAGRは14.2%で成長し、2030年には37億5,000万米ドルに達する見込みです。

定置用燃料電池は、燃料(通常は水素)からの化学エネルギーを電気化学反応によって電気エネルギーに変換する装置です。燃焼を利用した発電とは異なり、燃料電池は静かに作動し、低排出で高効率を実現します。建物のバックアップ電源、遠隔地への電力供給、再生可能エネルギーシステムとの統合による送電網の安定性向上など、さまざまな用途で使用されています。定置用燃料電池は、その信頼性、低メンテナンス、温室効果ガス排出削減の可能性から支持されており、よりクリーンなエネルギー源への移行における重要な技術となっています。

パロアルト研究所(PARC)の研究チームによると、改質水素燃料を使用することで、高エネルギー密度の燃料電池を実現しています。

エネルギー効率と信頼性

エネルギー効率と信頼性は、定置用燃料電池市場の重要な促進要因です。定置用燃料電池は、水素のような燃料からの化学エネルギーを、しばしば50%を超える高い効率で電気に変換し、従来の燃焼ベースの発電に比べてエネルギー損失を大幅に削減します。この高効率は運用コストの削減と二酸化炭素排出量の削減につながり、持続可能性を目指す企業や公益事業にとって魅力的な選択肢となります。さらに、燃料電池はダウンタイムを最小限に抑えた信頼性の高い発電を提供するため、病院、データセンター、産業施設などの重要な用途に不可欠です。また、モジュラー設計により、特定のエネルギー需要に合わせたスケーラブルなソリューションが可能となり、市場での魅力が高まっています。

インフラの不足

インフラの不足は、定置用燃料電池市場の大幅な抑制要因となっています。主な課題の一つは、燃料電池の運転に不可欠な水素の製造、貯蔵、流通のためのネットワークが不十分なことです。強固で広範な水素インフラがなければ、定置用燃料電池の展開と効率は制限されます。さらに、このインフラの構築と維持に伴う高いコストと技術的な複雑さが投資を抑制し、市場の成長を鈍化させています。

水素経済の成長

水素経済の成長は、定置用燃料電池市場に大きな機会をもたらします。産業界や政府が二酸化炭素排出量の削減にますます注力する中、水素を燃料とする燃料電池は、バックアップ電源、送電網の安定化、遠隔地での発電といった定置用途にクリーンで効率的なエネルギー・ソリューションを提供します。水素製造・貯蔵技術の進歩とコストの低下により、燃料電池は経済的に実行可能なものとなっています。さらに、水素インフラへの支援政策や投資が市場導入を加速しており、定置用燃料電池は持続可能なエネルギーシステムへの移行において極めて重要な要素となっています。

高い初期コスト

定置用燃料電池の初期コストの高さは、市場導入の大きな脅威となっています。これらのコストは、高価な材料、複雑な製造プロセス、特殊なインフラの必要性から生じています。従来のエネルギー源と比較すると、燃料電池システムの初期投資は法外であり、効率や低排出ガスといった長期的なメリットにもかかわらず、潜在的な顧客の足を引っ張る可能性があります。加えて、限られたスケールメリットと発展途上のサプライチェーンが、価格をさらに高騰させています。その結果、大幅な財政的インセンティブやコスト削減のための技術的ブレークスルーがなければ、市場浸透は依然として困難です。

COVID-19の影響:

COVID-19の流行は定置用燃料電池市場に大きな影響を与え、サプライチェーンとプロジェクトのスケジュールに混乱をもたらしました。操業停止や規制により、燃料電池システムの製造や設置に遅れが生じました。しかし、パンデミックの間にクリーン・エネルギーと回復力のある電力インフラが重視されるようになったことで、定置用燃料電池への関心が高まった。政府や企業は信頼性が高く持続可能なエネルギー・ソリューションを求めており、これが当初の挫折にもかかわらず需要を押し上げました。また、グリーン技術を支援する投資や政策も増加し、悪影響の一部を緩和し、長期的な成長を促進する一助となった。

予測期間中、SOFC(固体酸化物形燃料電池)分野が最大となる見込み

固体酸化物形燃料電池(SOFC)セグメントは、いくつかの重要な要因により、定置用燃料電池市場において顕著な成長を遂げています。SOFCは燃料を電気に変換する効率が高いため、定置型発電用途に魅力的です。さらに、天然ガス、バイオガス、水素を含むさまざまな燃料を利用できることが、その汎用性と市場アピールに拍車をかけています。さらに、材料と製造プロセスの進歩により、SOFCシステムの信頼性と耐久性が向上し、運用コストの削減と採用率の向上につながっています。クリーンエネルギー・ソリューションを推進する政府の取り組みや、信頼性の高い分散型発電の必要性も、定置用燃料電池市場におけるSOFCの成長に寄与しています。

無停電電源装置(UPS)分野は予測期間中に最も高いCAGRが見込まれる

定置用燃料電池市場における無停電電源装置(UPS)分野の成長は、いくつかの要因に起因しています。UPSシステムは、データセンター、病院、通信など、電源の連続性が重要な産業でますます不可欠になっています。定置用燃料電池は、従来のUPSバッテリーに代わる信頼性の高い選択肢を提供し、より長いランタイムとより速い充電時間を実現します。さらに、燃料電池技術の進歩により効率が向上し、運用コストが削減されたため、従来のUPSソリューションとの競争力が高まっています。さらに、化石燃料ベースの発電機に比べて排出量が少なく、エネルギー効率が高いため、環境の持続可能性に対する懸念の高まりが燃料電池の採用を後押ししています。

最大のシェアを占める地域

近年、北米では、クリーンエネルギー技術の促進を目的とした政府の取り組みにより、定置用燃料電池市場が大きく成長しています。さらに、同地域の堅調な産業部門と、信頼性が高く効率的な発電ソリューションに対する需要の高まりが、定置用燃料電池の展開を加速させています。特に燃料電池の効率とコスト削減における技術の進歩により、従来の電源との競合が激化しています。北米の良好な規制環境と再生可能エネルギーに対する支援政策も、市場の成長を促し、投資を誘致し、この分野の技術革新を促進する上で極めて重要な役割を果たしています。

CAGRが最も高い地域:

アジア太平洋地域は、クリーンで持続可能なエネルギー・ソリューションへの需要が高まっているため、定置用燃料電池市場が大きく成長しています。燃料電池技術の進歩はコストの低下と相まって、定置用燃料電池の競争力を高め、家庭用、商業用、産業用発電など様々な用途で魅力的なものとなっています。この地域の急速な都市化と工業化は、信頼性の高い分散型電源の必要性に拍車をかけ、定置用燃料電池の需要をさらに押し上げています。さらに、政府の支援政策やインセンティブ、インフラ開拓への投資が、市場成長のための環境を整えています。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 技術分析

- 用途分析

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の定置用燃料電池市場:容量別

- 3kW未満

- 3kW~10kW

- 10kW~50kW

- 50kW超

第6章 世界の定置用燃料電池市場:技術別

- PAFC(リン酸燃料電池)

- MCFC(溶融炭酸塩燃料電池)

- SOFC(固体酸化物形燃料電池)

- PEMFC(プロトン交換膜燃料電池)

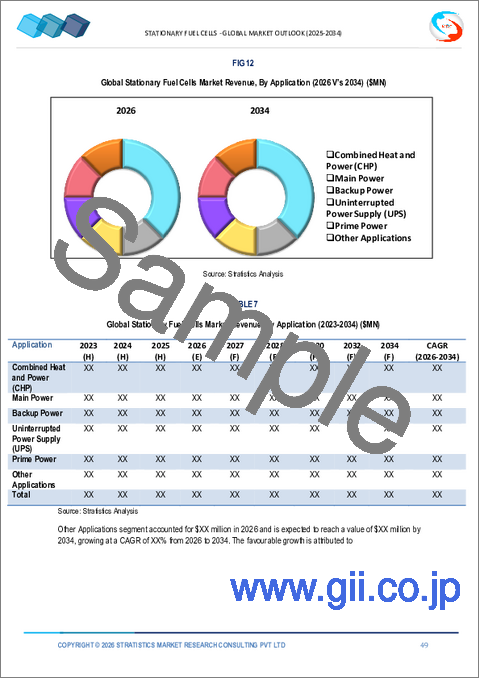

第7章 世界の定置用燃料電池市場:用途別

- 熱電併給発電(CHP)

- 主電源

- バックアップ電源

- 無停電電源装置(UPS)

- プライムパワー

- その他の用途

第8章 世界の定置用燃料電池市場:エンドユーザー別

- 商業

- 産業/ユーティリティ

- 住宅

- 輸送機関

- その他のエンドユーザー

第9章 世界の定置用燃料電池市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第10章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイリング

- AFC Energy PLC

- Altergy

- Ballard Power

- Bloom Energy

- Cummins Inc.

- Doosan PureCell America

- FuelCell Energy

- Fuji Electric Co., Ltd.

- GenCell Ltd.

- JX Nippon

- NUVERA FUEL CELLS, LLC.

- Panasonic

- Plug Power Inc.

- POSCO ENERGY

- SFC Energy AG

- Siemens Energy

- SOLIDpower

- Toshiba

List of Tables

- Table 1 Global Stationary Fuel Cells Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Stationary Fuel Cells Market Outlook, By Capacity (2022-2030) ($MN)

- Table 3 Global Stationary Fuel Cells Market Outlook, By <3 kW (2022-2030) ($MN)

- Table 4 Global Stationary Fuel Cells Market Outlook, By 3 kW - 10 kW (2022-2030) ($MN)

- Table 5 Global Stationary Fuel Cells Market Outlook, By 10 kW - 50 kW (2022-2030) ($MN)

- Table 6 Global Stationary Fuel Cells Market Outlook, By >50 kW (2022-2030) ($MN)

- Table 7 Global Stationary Fuel Cells Market Outlook, By Technology (2022-2030) ($MN)

- Table 8 Global Stationary Fuel Cells Market Outlook, By PAFC (Phosphoric Acid Fuel Cell) (2022-2030) ($MN)

- Table 9 Global Stationary Fuel Cells Market Outlook, By MCFC (Molten carbonate fuel cells) (2022-2030) ($MN)

- Table 10 Global Stationary Fuel Cells Market Outlook, By SOFC (Solid oxide fuel cell) (2022-2030) ($MN)

- Table 11 Global Stationary Fuel Cells Market Outlook, By PEMFC (Proton exchange membrane fuel cell) (2022-2030) ($MN)

- Table 12 Global Stationary Fuel Cells Market Outlook, By Application (2022-2030) ($MN)

- Table 13 Global Stationary Fuel Cells Market Outlook, By Combined Heat and Power (CHP) (2022-2030) ($MN)

- Table 14 Global Stationary Fuel Cells Market Outlook, By Main Power (2022-2030) ($MN)

- Table 15 Global Stationary Fuel Cells Market Outlook, By Backup Power (2022-2030) ($MN)

- Table 16 Global Stationary Fuel Cells Market Outlook, By Uninterrupted Power Supply (UPS) (2022-2030) ($MN)

- Table 17 Global Stationary Fuel Cells Market Outlook, By Prime Power (2022-2030) ($MN)

- Table 18 Global Stationary Fuel Cells Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 19 Global Stationary Fuel Cells Market Outlook, By End User (2022-2030) ($MN)

- Table 20 Global Stationary Fuel Cells Market Outlook, By Commercial (2022-2030) ($MN)

- Table 21 Global Stationary Fuel Cells Market Outlook, By Industrial/Utility (2022-2030) ($MN)

- Table 22 Global Stationary Fuel Cells Market Outlook, By Residential (2022-2030) ($MN)

- Table 23 Global Stationary Fuel Cells Market Outlook, By Transportation (2022-2030) ($MN)

- Table 24 Global Stationary Fuel Cells Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 25 North America Stationary Fuel Cells Market Outlook, By Country (2022-2030) ($MN)

- Table 26 North America Stationary Fuel Cells Market Outlook, By Capacity (2022-2030) ($MN)

- Table 27 North America Stationary Fuel Cells Market Outlook, By <3 kW (2022-2030) ($MN)

- Table 28 North America Stationary Fuel Cells Market Outlook, By 3 kW - 10 kW (2022-2030) ($MN)

- Table 29 North America Stationary Fuel Cells Market Outlook, By 10 kW - 50 kW (2022-2030) ($MN)

- Table 30 North America Stationary Fuel Cells Market Outlook, By >50 kW (2022-2030) ($MN)

- Table 31 North America Stationary Fuel Cells Market Outlook, By Technology (2022-2030) ($MN)

- Table 32 North America Stationary Fuel Cells Market Outlook, By PAFC (Phosphoric Acid Fuel Cell) (2022-2030) ($MN)

- Table 33 North America Stationary Fuel Cells Market Outlook, By MCFC (Molten carbonate fuel cells) (2022-2030) ($MN)

- Table 34 North America Stationary Fuel Cells Market Outlook, By SOFC (Solid oxide fuel cell) (2022-2030) ($MN)

- Table 35 North America Stationary Fuel Cells Market Outlook, By PEMFC (Proton exchange membrane fuel cell) (2022-2030) ($MN)

- Table 36 North America Stationary Fuel Cells Market Outlook, By Application (2022-2030) ($MN)

- Table 37 North America Stationary Fuel Cells Market Outlook, By Combined Heat and Power (CHP) (2022-2030) ($MN)

- Table 38 North America Stationary Fuel Cells Market Outlook, By Main Power (2022-2030) ($MN)

- Table 39 North America Stationary Fuel Cells Market Outlook, By Backup Power (2022-2030) ($MN)

- Table 40 North America Stationary Fuel Cells Market Outlook, By Uninterrupted Power Supply (UPS) (2022-2030) ($MN)

- Table 41 North America Stationary Fuel Cells Market Outlook, By Prime Power (2022-2030) ($MN)

- Table 42 North America Stationary Fuel Cells Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 43 North America Stationary Fuel Cells Market Outlook, By End User (2022-2030) ($MN)

- Table 44 North America Stationary Fuel Cells Market Outlook, By Commercial (2022-2030) ($MN)

- Table 45 North America Stationary Fuel Cells Market Outlook, By Industrial/Utility (2022-2030) ($MN)

- Table 46 North America Stationary Fuel Cells Market Outlook, By Residential (2022-2030) ($MN)

- Table 47 North America Stationary Fuel Cells Market Outlook, By Transportation (2022-2030) ($MN)

- Table 48 North America Stationary Fuel Cells Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 49 Europe Stationary Fuel Cells Market Outlook, By Country (2022-2030) ($MN)

- Table 50 Europe Stationary Fuel Cells Market Outlook, By Capacity (2022-2030) ($MN)

- Table 51 Europe Stationary Fuel Cells Market Outlook, By <3 kW (2022-2030) ($MN)

- Table 52 Europe Stationary Fuel Cells Market Outlook, By 3 kW - 10 kW (2022-2030) ($MN)

- Table 53 Europe Stationary Fuel Cells Market Outlook, By 10 kW - 50 kW (2022-2030) ($MN)

- Table 54 Europe Stationary Fuel Cells Market Outlook, By >50 kW (2022-2030) ($MN)

- Table 55 Europe Stationary Fuel Cells Market Outlook, By Technology (2022-2030) ($MN)

- Table 56 Europe Stationary Fuel Cells Market Outlook, By PAFC (Phosphoric Acid Fuel Cell) (2022-2030) ($MN)

- Table 57 Europe Stationary Fuel Cells Market Outlook, By MCFC (Molten carbonate fuel cells) (2022-2030) ($MN)

- Table 58 Europe Stationary Fuel Cells Market Outlook, By SOFC (Solid oxide fuel cell) (2022-2030) ($MN)

- Table 59 Europe Stationary Fuel Cells Market Outlook, By PEMFC (Proton exchange membrane fuel cell) (2022-2030) ($MN)

- Table 60 Europe Stationary Fuel Cells Market Outlook, By Application (2022-2030) ($MN)

- Table 61 Europe Stationary Fuel Cells Market Outlook, By Combined Heat and Power (CHP) (2022-2030) ($MN)

- Table 62 Europe Stationary Fuel Cells Market Outlook, By Main Power (2022-2030) ($MN)

- Table 63 Europe Stationary Fuel Cells Market Outlook, By Backup Power (2022-2030) ($MN)

- Table 64 Europe Stationary Fuel Cells Market Outlook, By Uninterrupted Power Supply (UPS) (2022-2030) ($MN)

- Table 65 Europe Stationary Fuel Cells Market Outlook, By Prime Power (2022-2030) ($MN)

- Table 66 Europe Stationary Fuel Cells Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 67 Europe Stationary Fuel Cells Market Outlook, By End User (2022-2030) ($MN)

- Table 68 Europe Stationary Fuel Cells Market Outlook, By Commercial (2022-2030) ($MN)

- Table 69 Europe Stationary Fuel Cells Market Outlook, By Industrial/Utility (2022-2030) ($MN)

- Table 70 Europe Stationary Fuel Cells Market Outlook, By Residential (2022-2030) ($MN)

- Table 71 Europe Stationary Fuel Cells Market Outlook, By Transportation (2022-2030) ($MN)

- Table 72 Europe Stationary Fuel Cells Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 73 Asia Pacific Stationary Fuel Cells Market Outlook, By Country (2022-2030) ($MN)

- Table 74 Asia Pacific Stationary Fuel Cells Market Outlook, By Capacity (2022-2030) ($MN)

- Table 75 Asia Pacific Stationary Fuel Cells Market Outlook, By <3 kW (2022-2030) ($MN)

- Table 76 Asia Pacific Stationary Fuel Cells Market Outlook, By 3 kW - 10 kW (2022-2030) ($MN)

- Table 77 Asia Pacific Stationary Fuel Cells Market Outlook, By 10 kW - 50 kW (2022-2030) ($MN)

- Table 78 Asia Pacific Stationary Fuel Cells Market Outlook, By >50 kW (2022-2030) ($MN)

- Table 79 Asia Pacific Stationary Fuel Cells Market Outlook, By Technology (2022-2030) ($MN)

- Table 80 Asia Pacific Stationary Fuel Cells Market Outlook, By PAFC (Phosphoric Acid Fuel Cell) (2022-2030) ($MN)

- Table 81 Asia Pacific Stationary Fuel Cells Market Outlook, By MCFC (Molten carbonate fuel cells) (2022-2030) ($MN)

- Table 82 Asia Pacific Stationary Fuel Cells Market Outlook, By SOFC (Solid oxide fuel cell) (2022-2030) ($MN)

- Table 83 Asia Pacific Stationary Fuel Cells Market Outlook, By PEMFC (Proton exchange membrane fuel cell) (2022-2030) ($MN)

- Table 84 Asia Pacific Stationary Fuel Cells Market Outlook, By Application (2022-2030) ($MN)

- Table 85 Asia Pacific Stationary Fuel Cells Market Outlook, By Combined Heat and Power (CHP) (2022-2030) ($MN)

- Table 86 Asia Pacific Stationary Fuel Cells Market Outlook, By Main Power (2022-2030) ($MN)

- Table 87 Asia Pacific Stationary Fuel Cells Market Outlook, By Backup Power (2022-2030) ($MN)

- Table 88 Asia Pacific Stationary Fuel Cells Market Outlook, By Uninterrupted Power Supply (UPS) (2022-2030) ($MN)

- Table 89 Asia Pacific Stationary Fuel Cells Market Outlook, By Prime Power (2022-2030) ($MN)

- Table 90 Asia Pacific Stationary Fuel Cells Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 91 Asia Pacific Stationary Fuel Cells Market Outlook, By End User (2022-2030) ($MN)

- Table 92 Asia Pacific Stationary Fuel Cells Market Outlook, By Commercial (2022-2030) ($MN)

- Table 93 Asia Pacific Stationary Fuel Cells Market Outlook, By Industrial/Utility (2022-2030) ($MN)

- Table 94 Asia Pacific Stationary Fuel Cells Market Outlook, By Residential (2022-2030) ($MN)

- Table 95 Asia Pacific Stationary Fuel Cells Market Outlook, By Transportation (2022-2030) ($MN)

- Table 96 Asia Pacific Stationary Fuel Cells Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 97 South America Stationary Fuel Cells Market Outlook, By Country (2022-2030) ($MN)

- Table 98 South America Stationary Fuel Cells Market Outlook, By Capacity (2022-2030) ($MN)

- Table 99 South America Stationary Fuel Cells Market Outlook, By <3 kW (2022-2030) ($MN)

- Table 100 South America Stationary Fuel Cells Market Outlook, By 3 kW - 10 kW (2022-2030) ($MN)

- Table 101 South America Stationary Fuel Cells Market Outlook, By 10 kW - 50 kW (2022-2030) ($MN)

- Table 102 South America Stationary Fuel Cells Market Outlook, By >50 kW (2022-2030) ($MN)

- Table 103 South America Stationary Fuel Cells Market Outlook, By Technology (2022-2030) ($MN)

- Table 104 South America Stationary Fuel Cells Market Outlook, By PAFC (Phosphoric Acid Fuel Cell) (2022-2030) ($MN)

- Table 105 South America Stationary Fuel Cells Market Outlook, By MCFC (Molten carbonate fuel cells) (2022-2030) ($MN)

- Table 106 South America Stationary Fuel Cells Market Outlook, By SOFC (Solid oxide fuel cell) (2022-2030) ($MN)

- Table 107 South America Stationary Fuel Cells Market Outlook, By PEMFC (Proton exchange membrane fuel cell) (2022-2030) ($MN)

- Table 108 South America Stationary Fuel Cells Market Outlook, By Application (2022-2030) ($MN)

- Table 109 South America Stationary Fuel Cells Market Outlook, By Combined Heat and Power (CHP) (2022-2030) ($MN)

- Table 110 South America Stationary Fuel Cells Market Outlook, By Main Power (2022-2030) ($MN)

- Table 111 South America Stationary Fuel Cells Market Outlook, By Backup Power (2022-2030) ($MN)

- Table 112 South America Stationary Fuel Cells Market Outlook, By Uninterrupted Power Supply (UPS) (2022-2030) ($MN)

- Table 113 South America Stationary Fuel Cells Market Outlook, By Prime Power (2022-2030) ($MN)

- Table 114 South America Stationary Fuel Cells Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 115 South America Stationary Fuel Cells Market Outlook, By End User (2022-2030) ($MN)

- Table 116 South America Stationary Fuel Cells Market Outlook, By Commercial (2022-2030) ($MN)

- Table 117 South America Stationary Fuel Cells Market Outlook, By Industrial/Utility (2022-2030) ($MN)

- Table 118 South America Stationary Fuel Cells Market Outlook, By Residential (2022-2030) ($MN)

- Table 119 South America Stationary Fuel Cells Market Outlook, By Transportation (2022-2030) ($MN)

- Table 120 South America Stationary Fuel Cells Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 121 Middle East & Africa Stationary Fuel Cells Market Outlook, By Country (2022-2030) ($MN)

- Table 122 Middle East & Africa Stationary Fuel Cells Market Outlook, By Capacity (2022-2030) ($MN)

- Table 123 Middle East & Africa Stationary Fuel Cells Market Outlook, By <3 kW (2022-2030) ($MN)

- Table 124 Middle East & Africa Stationary Fuel Cells Market Outlook, By 3 kW - 10 kW (2022-2030) ($MN)

- Table 125 Middle East & Africa Stationary Fuel Cells Market Outlook, By 10 kW - 50 kW (2022-2030) ($MN)

- Table 126 Middle East & Africa Stationary Fuel Cells Market Outlook, By >50 kW (2022-2030) ($MN)

- Table 127 Middle East & Africa Stationary Fuel Cells Market Outlook, By Technology (2022-2030) ($MN)

- Table 128 Middle East & Africa Stationary Fuel Cells Market Outlook, By PAFC (Phosphoric Acid Fuel Cell) (2022-2030) ($MN)

- Table 129 Middle East & Africa Stationary Fuel Cells Market Outlook, By MCFC (Molten carbonate fuel cells) (2022-2030) ($MN)

- Table 130 Middle East & Africa Stationary Fuel Cells Market Outlook, By SOFC (Solid oxide fuel cell) (2022-2030) ($MN)

- Table 131 Middle East & Africa Stationary Fuel Cells Market Outlook, By PEMFC (Proton exchange membrane fuel cell) (2022-2030) ($MN)

- Table 132 Middle East & Africa Stationary Fuel Cells Market Outlook, By Application (2022-2030) ($MN)

- Table 133 Middle East & Africa Stationary Fuel Cells Market Outlook, By Combined Heat and Power (CHP) (2022-2030) ($MN)

- Table 134 Middle East & Africa Stationary Fuel Cells Market Outlook, By Main Power (2022-2030) ($MN)

- Table 135 Middle East & Africa Stationary Fuel Cells Market Outlook, By Backup Power (2022-2030) ($MN)

- Table 136 Middle East & Africa Stationary Fuel Cells Market Outlook, By Uninterrupted Power Supply (UPS) (2022-2030) ($MN)

- Table 137 Middle East & Africa Stationary Fuel Cells Market Outlook, By Prime Power (2022-2030) ($MN)

- Table 138 Middle East & Africa Stationary Fuel Cells Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 139 Middle East & Africa Stationary Fuel Cells Market Outlook, By End User (2022-2030) ($MN)

- Table 140 Middle East & Africa Stationary Fuel Cells Market Outlook, By Commercial (2022-2030) ($MN)

- Table 141 Middle East & Africa Stationary Fuel Cells Market Outlook, By Industrial/Utility (2022-2030) ($MN)

- Table 142 Middle East & Africa Stationary Fuel Cells Market Outlook, By Residential (2022-2030) ($MN)

- Table 143 Middle East & Africa Stationary Fuel Cells Market Outlook, By Transportation (2022-2030) ($MN)

- Table 144 Middle East & Africa Stationary Fuel Cells Market Outlook, By Other End Users (2022-2030) ($MN)

According to Stratistics MRC, the Global Stationary Fuel Cells Market is accounted for $1.69 billion in 2024 and is expected to reach $3.75 billion by 2030 growing at a CAGR of 14.2% during the forecast period. Stationary fuel cells are devices that convert chemical energy from a fuel, typically hydrogen, into electrical energy through an electrochemical reaction. Unlike combustion-based power generation, fuel cells operate quietly, produce low emissions, and offer high efficiency. They are used in a variety of applications, including providing backup power for buildings, powering remote locations, and integrating with renewable energy systems to enhance grid stability. Stationary fuel cells are favored for their reliability, low maintenance, and potential to reduce greenhouse gas emissions, making them a key technology in the transition to cleaner energy sources.

According to a team of researchers at the Palo Alto Research Center (PARC), usage of reformed hydrogen fuel is responsible for the delivery of high-energy density fuel cells.

Market Dynamics:

Driver:

Energy efficiency and reliability

Energy efficiency and reliability are crucial drivers of the stationary fuel cell market. Stationary fuel cells convert chemical energy from fuels like hydrogen into electricity with high efficiency, often exceeding 50%, significantly reducing energy losses compared to traditional combustion-based power generation. This high efficiency translates to lower operational costs and reduced carbon emissions, making them an attractive option for businesses and utilities aiming for sustainability. Additionally, fuel cells offer reliable power generation with minimal downtime, which is crucial for critical applications such as hospitals, data centers, and industrial facilities. Their modular design also allows for scalable solutions tailored to specific energy demands, enhancing their appeal in the market.

Restraint:

Lack of infrastructure

The lack of infrastructure significantly restrains the stationary fuel cell market. One of the primary challenges is the insufficient network for hydrogen production, storage, and distribution, which is critical for fuel cell operation. Without a robust and widespread hydrogen infrastructure, the deployment and efficiency of stationary fuel cells are limited. Additionally, the high costs and technical complexities associated with building and maintaining this infrastructure deter investments and slow down market growth.

Opportunity:

Growth of the hydrogen economy

The growth of the hydrogen economy presents significant opportunities for the stationary fuel cell market. As industries and governments increasingly focus on reducing carbon emissions, hydrogen-powered fuel cells offer a clean and efficient energy solution for stationary applications such as backup power, grid stabilization, and remote power generation. Advancements in hydrogen production and storage technologies, along with declining costs, are making fuel cells more economically viable. Additionally, supportive policies and investments in hydrogen infrastructure are accelerating market adoption, positioning stationary fuel cells as a crucial component in the transition to sustainable energy systems.

Threat:

High initial costs

The high initial costs of stationary fuel cells pose a significant threat to their market adoption. These costs stem from expensive materials, complex manufacturing processes, and the need for specialized infrastructure. Compared to traditional energy sources, the upfront investment for fuel cell systems can be prohibitive, deterring potential customers despite long-term benefits like efficiency and low emissions. Additionally, limited economies of scale and nascent supply chains further inflate prices. As a result, without substantial financial incentives or technological breakthroughs to reduce costs, market penetration remains challenging.

Covid-19 Impact:

The COVID-19 pandemic significantly impacted the stationary fuel cell market, causing disruptions in supply chains and project timelines. Lockdowns and restrictions led to delays in the manufacturing and installation of fuel cell systems. However, the increased emphasis on clean energy and resilient power infrastructure during the pandemic boosted the interest in stationary fuel cells. Governments and businesses sought reliable and sustainable energy solutions, which fuelled demand despite initial setbacks. The market also saw increased investments and policies supporting green technologies, helping to mitigate some of the negative effects and promoting long-term growth.

The SOFC (Solid oxide fuel cell) segment is expected to be the largest during the forecast period

The solid oxide fuel cell (SOFC) segment is experiencing notable growth within the stationary fuel cell market due to several key factors. SOFCs offer high efficiency in converting fuel into electricity, making them attractive for stationary power generation applications. Additionally, their ability to utilize a variety of fuels, including natural gas, biogas, and hydrogen, adds to their versatility and market appeal. Furthermore, advancements in materials and manufacturing processes have improved the reliability and durability of SOFC systems, reducing operational costs and increasing adoption rates. Government initiatives promoting clean energy solutions and the need for reliable distributed power generation also contribute to the growth of SOFCs in the stationary fuel cell market.

The uninterrupted power supply (UPS) segment is expected to have the highest CAGR during the forecast period

The growth of the Uninterrupted Power Supply (UPS) segment in the stationary fuel cell market can be attributed to several factors. UPS systems are becoming increasingly essential in industries where power continuity is critical, such as data centers, hospitals, and telecommunications. Stationary fuel cells offer a reliable alternative to traditional UPS batteries, providing longer runtimes and faster recharge times. Moreover, advancements in fuel cell technology have improved efficiency and reduced operating costs, making them more competitive with conventional UPS solutions. Additionally, growing concerns about environmental sustainability drive the adoption of fuel cells due to their lower emissions and higher energy efficiency compared to fossil fuel-based generators.

Region with largest share:

In recent years, North America has witnessed significant growth in the stationary fuel cell market due to government initiatives aimed at promoting clean energy technologies spurring adoption. Additionally, the region's robust industrial sector, coupled with increasing demand for reliable and efficient power generation solutions, has accelerated the deployment of stationary fuel cells. Technological advancements, particularly in fuel cell efficiency and cost reduction, have made them increasingly competitive with traditional power sources. North America's favorable regulatory environment and supportive policies for renewable energy have also played a pivotal role in driving market growth, attracting investments, and fostering innovation in the sector.

Region with highest CAGR:

The Asia-Pacific region has experienced significant growth in the stationary fuel cell market because of an increasing demand for clean and sustainable energy solutions, driven by environmental concerns and government initiatives promoting green technology adoption. Advancements in fuel cell technology, coupled with declining costs, have made stationary fuel cells more competitive and attractive for various applications, such as residential, commercial, and industrial power generation. The region's rapid urbanization and industrialization have spurred the need for reliable and decentralized power sources, further boosting the demand for stationary fuel cells. Additionally, supportive government policies and incentives, along with investments in infrastructure development, have created a conducive environment for market growth.

Key players in the market

Some of the key players in Stationary Fuel Cells market include AFC Energy PLC, Altergy, Ballard Power, Bloom Energy, Cummins Inc., Doosan PureCell America, FuelCell Energy, Fuji Electric Co., Ltd., GenCell Ltd., JX Nippon, NUVERA FUEL CELLS, LLC., Panasonic, Plug Power Inc., POSCO ENERGY, SFC Energy AG, Siemens Energy, SOLIDpower and Toshiba.

Key Developments:

In May 2024, Cummins began production of its latest hydrogen internal combustion engines (H2-ICE) for Tata Motors at a new manufacturing facility in Jamshedpur, India. The first B6.7H hydrogen internal combustion engines rolled off the production line in March and will now be integrated into Tata Motors' trucks, the company said. The B6.7H engine shares many components with current diesel and natural gas engines, fits where a standard engine fits and can be refueled in minutes.

In May 2024, AFC Energy PLC, the hydrogen power generation specialist, has inked a strategic partnership deal with Illuming Power to scale up the production of fuel cell plates and stacks for the former's S Series air-cooled platform. A first of its kind for Illuminig, the multi-year agreement will utilise the North American group's international network to deliver fully commissioned S Series fuel cell plates and stacks, integral components of AFC's H-Power generator modules.

Capacities Covered:

- <3 kW

- 3 kW - 10 kW

- 10 kW - 50 kW

- >50 kW

Technologies Covered:

- PAFC (Phosphoric Acid Fuel Cell)

- MCFC (Molten carbonate fuel cells)

- SOFC (Solid oxide fuel cell)

- PEMFC (Proton exchange membrane fuel cell)

Applications Covered:

- Combined Heat and Power (CHP)

- Main Power

- Backup Power

- Uninterrupted Power Supply (UPS)

- Prime Power

- Other Applications

End Users Covered:

- Commercial

- Industrial/Utility

- Residential

- Transportation

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Technology Analysis

- 3.7 Application Analysis

- 3.8 End User Analysis

- 3.9 Emerging Markets

- 3.10 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Stationary Fuel Cells Market, By Capacity

- 5.1 Introduction

- 5.2 <3 kW

- 5.3 3 kW - 10 kW

- 5.4 10 kW - 50 kW

- 5.5 >50 kW

6 Global Stationary Fuel Cells Market, By Technology

- 6.1 Introduction

- 6.2 PAFC (Phosphoric Acid Fuel Cell)

- 6.3 MCFC (Molten carbonate fuel cells)

- 6.4 SOFC (Solid oxide fuel cell)

- 6.5 PEMFC (Proton exchange membrane fuel cell)

7 Global Stationary Fuel Cells Market, By Application

- 7.1 Introduction

- 7.2 Combined Heat and Power (CHP)

- 7.3 Main Power

- 7.4 Backup Power

- 7.5 Uninterrupted Power Supply (UPS)

- 7.6 Prime Power

- 7.7 Other Applications

8 Global Stationary Fuel Cells Market, By End User

- 8.1 Introduction

- 8.2 Commercial

- 8.3 Industrial/Utility

- 8.4 Residential

- 8.5 Transportation

- 8.6 Other End Users

9 Global Stationary Fuel Cells Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 AFC Energy PLC

- 11.2 Altergy

- 11.3 Ballard Power

- 11.4 Bloom Energy

- 11.5 Cummins Inc.

- 11.6 Doosan PureCell America

- 11.7 FuelCell Energy

- 11.8 Fuji Electric Co., Ltd.

- 11.9 GenCell Ltd.

- 11.10 JX Nippon

- 11.11 NUVERA FUEL CELLS, LLC.

- 11.12 Panasonic

- 11.13 Plug Power Inc.

- 11.14 POSCO ENERGY

- 11.15 SFC Energy AG

- 11.16 Siemens Energy

- 11.17 SOLIDpower

- 11.18 Toshiba