|

|

市場調査レポート

商品コード

1494743

バグフィルター市場の2030年までの予測:材料別、タイプ別、用途別、地域別の世界分析Bag Filter Market Forecasts to 2030 - Global Analysis By Material (Porous Polytetrafluoroethylene (PTFE) Film, Polypropylene, Polyester and Nylon), Type (Shaker, Pulse Jet, Reverse Air and Other Types), Application and By Geography |

||||||

カスタマイズ可能

|

|||||||

| バグフィルター市場の2030年までの予測:材料別、タイプ別、用途別、地域別の世界分析 |

|

出版日: 2024年06月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界のバグフィルター市場は2024年に144億5,000万米ドルを占め、予測期間中にCAGR 7.7%で成長し、2030年には225億6,000万米ドルに達する見込みです。

バグフィルターは、気体または液体の流れから粒子を除去するために使用される濾過システムです。フィルター媒体として機能する一連の布製バッグで構成されます。汚染された液体はこれらの袋を通過し、粒子は布の表面または繊維内に捕捉されます。バグフィルターの設計により、大きな粒子も小さな粒子も効率的に除去できるため、大気汚染防止、水処理、工業プロセスなど幅広い用途に適しています。

EIAの統計によると、米国における発電用天然ガスのシェアは、2010年の24%から2035年には27%に達すると予想されています。

健康と安全への関心の高まり

バグフィルターは大気汚染防止システムに不可欠な部品であり、工業プロセスから有害な微粒子や汚染物質を確実に除去します。規制が強化され、環境意識が高まるにつれて、産業界は排出を緩和し、労働者の健康を守るために高度なろ過ソリューションを採用せざるを得なくなっています。さらに、大気の質とそれが公衆衛生に及ぼす影響に関する懸念の高まりが、世界各国の政府に厳しい排出規制の施行を促し、バグフィルターの需要をさらに押し上げています。

初期投資コスト

バグフィルターはガス流から粒子状物質を除去する効率が高く、セメント、発電、製薬などの産業で不可欠となっています。しかし、これらのろ過システムを設置するために必要な初期資本は相当な額になることがあり、特に予算上の制約が多い中小企業や発展途上地域では、潜在的な購入者の足かせとなっています。しかし、フィルターバッグのメンテナンスと定期的な交換にかかるコストが経済的負担を増大させ、環境コンプライアンスと業務効率の面で長期的なメリットがあるにもかかわらず、バグフィルターの採用を思いとどまらせる産業もあります。

大気汚染に対する意識の高まり

粒子状物質や産業排出物に関連する健康リスクへの懸念が高まる中、産業界はますます厳しい大気質管理対策を採用するようになっています。バグフィルターは、発電、化学生産、製造などの様々な産業プロセスから排出される粒子状物質や汚染物質を捕捉するための効率的なソリューションを提供します。さらに、バグフィルターの需要は、排出規制基準を義務付ける政府規制によってさらに促進され、産業界に汚染軽減技術への投資を促しています。

規制遵守の課題

主に厳しい環境規制と排出ガス規制を管理する基準の進化が原因です。ますます厳しくなる排出規制を遵守する必要性から、バグフィルター業界では絶え間ない技術革新と適応が求められています。これらの基準を満たすには、より効率的なろ過技術と素材を開発するための研究開発に多額の投資を必要とすることが多いです。しかし、多様な地域の規制への適合を確保することは、複雑さを増し、メーカーのコストを増加させる。

COVID-19の影響:

COVID-19の流行は、様々な業界のバグフィルター市場に大きな影響を与えました。室内空気の質に対する意識が高まり、空気中に浮遊するウイルスの拡散を緩和する必要性が高まったため、バグフィルターのような効率的なろ過ソリューションに対する需要が急増しました。ヘルスケア、製薬、食品加工などの業界では、無菌環境を維持し、従業員の安全を確保するためにバグフィルターの需要が顕著に増加しました。しかし、パンデミックはサプライチェーンを混乱させ、バグフィルターの生産と流通に課題をもたらしました。

予測期間中はポリプロピレン・セグメントが最大になる見込み

ポリプロピレン・セグメントは、優れた濾過効率と耐久性を提供することで、予測期間中に最大になると予想されています。熱可塑性ポリマーであるポリプロピレンは、優れた耐薬品性と耐熱性を誇り、様々な産業におけるフィルター用途に最適です。ポリプロピレン固有の特性により、腐食、湿気、ほとんどの化学薬品に耐性があり、フィルター工程における寿命と信頼性を保証します。さらに、高温に耐えるポリプロピレンの特性は、工業環境や公害防止システムのような過酷な環境での有用性を拡大します。

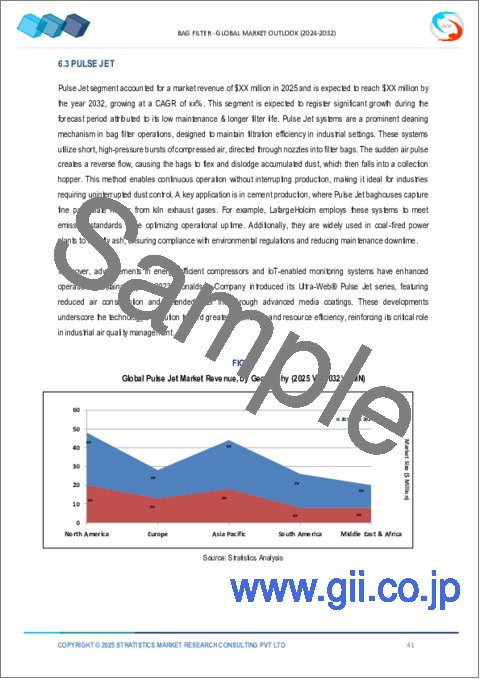

パルスジェットセグメントは予測期間中最も高いCAGRが見込まれる

パルスジェットセグメントは、予測期間中に最も高いCAGRが見込まれます。パルスジェットセグメントは、フィルターバッグから粒子状物質を取り除くために高圧空気のバーストを採用し、連続運転とフィルター寿命の延長を保証します。この技術革新により、メンテナンスのためのダウンタイムが最小限に抑えられ、製造、製薬、食品加工など、空気ろ過システムに依存している業界の生産性向上とコスト削減につながります。さらに、パルスジェット技術は優れた集塵能力を提供し、空気品質基準を規定する厳しい環境規制への準拠を保証します。

最大のシェアを占める地域

欧州地域は、推定期間を通じてバグフィルター市場で最大のシェアを占めています。バグフィルターは、粒子状物質や、水銀やその他の有害汚染物質を含む有害な排出物を捕捉することにより、大気汚染の抑制に役立っています。排出物に関する規制が強化される中、欧州全域の産業界では環境基準を遵守するためにバグフィルターシステムの採用が増加しています。このようなバグフィルター需要の急増が市場の成長を促し、技術革新を促進し、地域全体の空気の質を向上させています。さらに、持続可能な実践と企業の社会的責任を重視することが、バグフィルター市場の地域的な採用をさらに促進しています。

CAGRが最も高い地域:

北米地域は予測期間中に大幅な成長を維持する見込みです。政府の規制は、排出を抑制し、持続可能な慣行を促進することを目的としており、発電、化学、石油・ガスなどの産業におけるバグフィルターの地域的な採用を促進しています。例えば、米国の大気浄化法のような規制は汚染物質の削減を義務付けており、産業界はバグフィルターのような効率的なろ過システムへの投資を余儀なくされています。さらに、クリーン技術を採用する企業に対してインセンティブを提供する政府の取り組みが、この地域の市場成長をさらに後押ししています。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 用途分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界のバグフィルター市場:材質別

- 多孔質ポリテトラフルオロエチレン(PTFE)フィルム

- ポリプロピレン

- ポリエステル

- ナイロン

第6章 世界のバグフィルター市場:タイプ別

- シェーカー

- パルスジェット

- リバースエア

- その他のタイプ

第7章 世界のバグフィルター市場:用途別

- 自動車

- 発電

- セメント産業

- パルプ・紙

- その他の用途

第8章 世界のバグフィルター市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイリング

- BWF Envirotech

- Danaher

- Donaldson

- Eaton Corporation

- General Electric

- Mitsubishi Hitachi Power Systems

- Parker Hannifin

- Shanghai Filterbag Factory Co., Ltd

- Thermax

List of Tables

- Table 1 Global Bag Filter Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Bag Filter Market Outlook, By Material (2022-2030) ($MN)

- Table 3 Global Bag Filter Market Outlook, By Porous Polytetrafluoroethylene (PTFE) Film (2022-2030) ($MN)

- Table 4 Global Bag Filter Market Outlook, By Polypropylene (2022-2030) ($MN)

- Table 5 Global Bag Filter Market Outlook, By Polyester (2022-2030) ($MN)

- Table 6 Global Bag Filter Market Outlook, By Nylon (2022-2030) ($MN)

- Table 7 Global Bag Filter Market Outlook, By Type (2022-2030) ($MN)

- Table 8 Global Bag Filter Market Outlook, By Shaker (2022-2030) ($MN)

- Table 9 Global Bag Filter Market Outlook, By Pulse Jet (2022-2030) ($MN)

- Table 10 Global Bag Filter Market Outlook, By Reverse Air (2022-2030) ($MN)

- Table 11 Global Bag Filter Market Outlook, By Other Types (2022-2030) ($MN)

- Table 12 Global Bag Filter Market Outlook, By Application (2022-2030) ($MN)

- Table 13 Global Bag Filter Market Outlook, By Automotive (2022-2030) ($MN)

- Table 14 Global Bag Filter Market Outlook, By Power Generation (2022-2030) ($MN)

- Table 15 Global Bag Filter Market Outlook, By Cement Industries (2022-2030) ($MN)

- Table 16 Global Bag Filter Market Outlook, By Pulp & Paper (2022-2030) ($MN)

- Table 17 Global Bag Filter Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 18 North America Bag Filter Market Outlook, By Country (2022-2030) ($MN)

- Table 19 North America Bag Filter Market Outlook, By Material (2022-2030) ($MN)

- Table 20 North America Bag Filter Market Outlook, By Porous Polytetrafluoroethylene (PTFE) Film (2022-2030) ($MN)

- Table 21 North America Bag Filter Market Outlook, By Polypropylene (2022-2030) ($MN)

- Table 22 North America Bag Filter Market Outlook, By Polyester (2022-2030) ($MN)

- Table 23 North America Bag Filter Market Outlook, By Nylon (2022-2030) ($MN)

- Table 24 North America Bag Filter Market Outlook, By Type (2022-2030) ($MN)

- Table 25 North America Bag Filter Market Outlook, By Shaker (2022-2030) ($MN)

- Table 26 North America Bag Filter Market Outlook, By Pulse Jet (2022-2030) ($MN)

- Table 27 North America Bag Filter Market Outlook, By Reverse Air (2022-2030) ($MN)

- Table 28 North America Bag Filter Market Outlook, By Other Types (2022-2030) ($MN)

- Table 29 North America Bag Filter Market Outlook, By Application (2022-2030) ($MN)

- Table 30 North America Bag Filter Market Outlook, By Automotive (2022-2030) ($MN)

- Table 31 North America Bag Filter Market Outlook, By Power Generation (2022-2030) ($MN)

- Table 32 North America Bag Filter Market Outlook, By Cement Industries (2022-2030) ($MN)

- Table 33 North America Bag Filter Market Outlook, By Pulp & Paper (2022-2030) ($MN)

- Table 34 North America Bag Filter Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 35 Europe Bag Filter Market Outlook, By Country (2022-2030) ($MN)

- Table 36 Europe Bag Filter Market Outlook, By Material (2022-2030) ($MN)

- Table 37 Europe Bag Filter Market Outlook, By Porous Polytetrafluoroethylene (PTFE) Film (2022-2030) ($MN)

- Table 38 Europe Bag Filter Market Outlook, By Polypropylene (2022-2030) ($MN)

- Table 39 Europe Bag Filter Market Outlook, By Polyester (2022-2030) ($MN)

- Table 40 Europe Bag Filter Market Outlook, By Nylon (2022-2030) ($MN)

- Table 41 Europe Bag Filter Market Outlook, By Type (2022-2030) ($MN)

- Table 42 Europe Bag Filter Market Outlook, By Shaker (2022-2030) ($MN)

- Table 43 Europe Bag Filter Market Outlook, By Pulse Jet (2022-2030) ($MN)

- Table 44 Europe Bag Filter Market Outlook, By Reverse Air (2022-2030) ($MN)

- Table 45 Europe Bag Filter Market Outlook, By Other Types (2022-2030) ($MN)

- Table 46 Europe Bag Filter Market Outlook, By Application (2022-2030) ($MN)

- Table 47 Europe Bag Filter Market Outlook, By Automotive (2022-2030) ($MN)

- Table 48 Europe Bag Filter Market Outlook, By Power Generation (2022-2030) ($MN)

- Table 49 Europe Bag Filter Market Outlook, By Cement Industries (2022-2030) ($MN)

- Table 50 Europe Bag Filter Market Outlook, By Pulp & Paper (2022-2030) ($MN)

- Table 51 Europe Bag Filter Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 52 Asia Pacific Bag Filter Market Outlook, By Country (2022-2030) ($MN)

- Table 53 Asia Pacific Bag Filter Market Outlook, By Material (2022-2030) ($MN)

- Table 54 Asia Pacific Bag Filter Market Outlook, By Porous Polytetrafluoroethylene (PTFE) Film (2022-2030) ($MN)

- Table 55 Asia Pacific Bag Filter Market Outlook, By Polypropylene (2022-2030) ($MN)

- Table 56 Asia Pacific Bag Filter Market Outlook, By Polyester (2022-2030) ($MN)

- Table 57 Asia Pacific Bag Filter Market Outlook, By Nylon (2022-2030) ($MN)

- Table 58 Asia Pacific Bag Filter Market Outlook, By Type (2022-2030) ($MN)

- Table 59 Asia Pacific Bag Filter Market Outlook, By Shaker (2022-2030) ($MN)

- Table 60 Asia Pacific Bag Filter Market Outlook, By Pulse Jet (2022-2030) ($MN)

- Table 61 Asia Pacific Bag Filter Market Outlook, By Reverse Air (2022-2030) ($MN)

- Table 62 Asia Pacific Bag Filter Market Outlook, By Other Types (2022-2030) ($MN)

- Table 63 Asia Pacific Bag Filter Market Outlook, By Application (2022-2030) ($MN)

- Table 64 Asia Pacific Bag Filter Market Outlook, By Automotive (2022-2030) ($MN)

- Table 65 Asia Pacific Bag Filter Market Outlook, By Power Generation (2022-2030) ($MN)

- Table 66 Asia Pacific Bag Filter Market Outlook, By Cement Industries (2022-2030) ($MN)

- Table 67 Asia Pacific Bag Filter Market Outlook, By Pulp & Paper (2022-2030) ($MN)

- Table 68 Asia Pacific Bag Filter Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 69 South America Bag Filter Market Outlook, By Country (2022-2030) ($MN)

- Table 70 South America Bag Filter Market Outlook, By Material (2022-2030) ($MN)

- Table 71 South America Bag Filter Market Outlook, By Porous Polytetrafluoroethylene (PTFE) Film (2022-2030) ($MN)

- Table 72 South America Bag Filter Market Outlook, By Polypropylene (2022-2030) ($MN)

- Table 73 South America Bag Filter Market Outlook, By Polyester (2022-2030) ($MN)

- Table 74 South America Bag Filter Market Outlook, By Nylon (2022-2030) ($MN)

- Table 75 South America Bag Filter Market Outlook, By Type (2022-2030) ($MN)

- Table 76 South America Bag Filter Market Outlook, By Shaker (2022-2030) ($MN)

- Table 77 South America Bag Filter Market Outlook, By Pulse Jet (2022-2030) ($MN)

- Table 78 South America Bag Filter Market Outlook, By Reverse Air (2022-2030) ($MN)

- Table 79 South America Bag Filter Market Outlook, By Other Types (2022-2030) ($MN)

- Table 80 South America Bag Filter Market Outlook, By Application (2022-2030) ($MN)

- Table 81 South America Bag Filter Market Outlook, By Automotive (2022-2030) ($MN)

- Table 82 South America Bag Filter Market Outlook, By Power Generation (2022-2030) ($MN)

- Table 83 South America Bag Filter Market Outlook, By Cement Industries (2022-2030) ($MN)

- Table 84 South America Bag Filter Market Outlook, By Pulp & Paper (2022-2030) ($MN)

- Table 85 South America Bag Filter Market Outlook, By Other Applications (2022-2030) ($MN)

- Table 86 Middle East & Africa Bag Filter Market Outlook, By Country (2022-2030) ($MN)

- Table 87 Middle East & Africa Bag Filter Market Outlook, By Material (2022-2030) ($MN)

- Table 88 Middle East & Africa Bag Filter Market Outlook, By Porous Polytetrafluoroethylene (PTFE) Film (2022-2030) ($MN)

- Table 89 Middle East & Africa Bag Filter Market Outlook, By Polypropylene (2022-2030) ($MN)

- Table 90 Middle East & Africa Bag Filter Market Outlook, By Polyester (2022-2030) ($MN)

- Table 91 Middle East & Africa Bag Filter Market Outlook, By Nylon (2022-2030) ($MN)

- Table 92 Middle East & Africa Bag Filter Market Outlook, By Type (2022-2030) ($MN)

- Table 93 Middle East & Africa Bag Filter Market Outlook, By Shaker (2022-2030) ($MN)

- Table 94 Middle East & Africa Bag Filter Market Outlook, By Pulse Jet (2022-2030) ($MN)

- Table 95 Middle East & Africa Bag Filter Market Outlook, By Reverse Air (2022-2030) ($MN)

- Table 96 Middle East & Africa Bag Filter Market Outlook, By Other Types (2022-2030) ($MN)

- Table 97 Middle East & Africa Bag Filter Market Outlook, By Application (2022-2030) ($MN)

- Table 98 Middle East & Africa Bag Filter Market Outlook, By Automotive (2022-2030) ($MN)

- Table 99 Middle East & Africa Bag Filter Market Outlook, By Power Generation (2022-2030) ($MN)

- Table 100 Middle East & Africa Bag Filter Market Outlook, By Cement Industries (2022-2030) ($MN)

- Table 101 Middle East & Africa Bag Filter Market Outlook, By Pulp & Paper (2022-2030) ($MN)

- Table 102 Middle East & Africa Bag Filter Market Outlook, By Other Applications (2022-2030) ($MN)

According to Stratistics MRC, the Global Bag Filter Market is accounted for $14.45 billion in 2024 and is expected to reach $22.56 billion by 2030 growing at a CAGR of 7.7% during the forecast period. A bag filter is a filtration system used to remove particles from a gas or liquid stream. It consists of a series of fabric bags that act as a filter medium. The contaminated fluid is passed through these bags, and the particles are trapped on the surface or within the fibers of the fabric. The design of the bag filter allows for efficient removal of both large and small particles, making it suitable for a wide range of applications, including air pollution control, water treatment, and industrial processes.

According to EIA statistics, the share of natural gas for power generation in the US is expected to reach 27% in 2035 from 24% in 2010.

Market Dynamics:

Driver:

Rising focus on health and safety

Bag filters are integral components in air pollution control systems, ensuring the removal of harmful particulates and pollutants from industrial processes. As regulations tighten and environmental consciousness rises, industries are compelled to adopt advanced filtration solutions to mitigate emissions and safeguard worker health. Moreover, the escalating concerns regarding air quality and its impact on public health have prompted governments worldwide to enforce stringent emissions regulations, further propelling the demand for bag filters.

Restraint:

Initial investment costs

Bag filters are highly efficient in removing particulate matter from gas streams, making them essential in industries like cement, power generation, and pharmaceuticals. However, the initial capital required for installing these filtration systems can be substantial, deterring potential buyers, especially in smaller enterprises or developing regions where budget constraints are prevalent. However, the cost of maintenance and periodic replacement of filter bags adds to the financial burden, dissuading some industries from adopting bag filters despite their long-term benefits in terms of environmental compliance and operational efficiency.

Opportunity:

Increased awareness of air pollution

With growing concerns over health risks associated with particulate matter and industrial emissions, industries are increasingly adopting stringent air quality control measures. Bag filters offer an efficient solution for capturing particulate matter and pollutants from various industrial processes, including power generation, chemical production, and manufacturing. Furthermore, the demand for bag filters is further propelled by government regulations mandating emission control standards, encouraging industries to invest in pollution abatement technologies.

Threat:

Regulatory compliance challenges

Regulatory compliance poses a significant challenge to the bag filter market, primarily due to stringent environmental regulations and evolving standards governing emissions control. The need to comply with increasingly stringent emission norms necessitates constant innovation and adaptation within the bag filter industry. Meeting these standards often requires substantial investments in research and development to develop more efficient filtration technologies and materials. However, ensuring compliance with diverse regional regulations adds complexity and increases costs for manufacturers.

Covid-19 Impact:

The Covid-19 pandemic significantly impacted the bag filter market across various industries. With heightened awareness of indoor air quality and the need to mitigate the spread of airborne viruses, demand surged for efficient filtration solutions like bag filters. Industries such as healthcare, pharmaceuticals, and food processing witnessed a notable increase in demand for bag filters to maintain sterile environments and ensure employee safety. However, the pandemic also disrupted supply chains, leading to challenges in the production and distribution of bag filters.

The Polypropylene segment is expected to be the largest during the forecast period

Polypropylene segment is expected to be the largest during the forecast period by offering superior filtration efficiency and durability. Polypropylene, a thermoplastic polymer, boasts remarkable chemical and thermal resistance, making it ideal for filtering applications in various industries. Its inherent properties make it resistant to corrosion, moisture, and most chemicals, ensuring longevity and reliability in filtering processes. Moreover, Polypropylene's ability to withstand high temperatures expands its utility in demanding environments, such as industrial settings or pollution control systems.

The Pulse Jet segment is expected to have the highest CAGR during the forecast period

Pulse Jet segment is expected to have the highest CAGR during the forecast period. Pulse Jet segments employ high-pressure bursts of air to dislodge particulate matter from filter bags, ensuring continuous operation and prolonged filter lifespan. This innovation minimizes downtime for maintenance, resulting in increased productivity and cost savings for industries reliant on air filtration systems, such as manufacturing, pharmaceuticals, and food processing. Furthermore, Pulse Jet technology offers superior dust collection capabilities, ensuring compliance with stringent environmental regulations governing air quality standards.

Region with largest share:

Europe region commanded the largest share in the Bag Filter Market throughout the extrapolated period. Bag filters are instrumental in controlling air pollution by capturing particulate matter and harmful emissions, including mercury and other toxic pollutants. With stricter regulations on emissions, industries across Europe are increasingly adopting bag filter systems to comply with environmental standards. This surge in demand for bag filters is driving market growth, fostering innovation and improving air quality across the region. Moreover, the emphasis on sustainable practices and corporate social responsibility further propels the regional adoption of bag filter market.

Region with highest CAGR:

North America region is poised to hold substantial growth during the projection period. Government regulations aim to curb emissions and promote sustainable practices, driving the regional adoption of bag filters in industries such as power generation, chemicals, and oil & gas. For instance, regulations like the Clean Air Act in the United States mandate the reduction of pollutants, compelling industries to invest in efficient filtration systems like bag filters. Moreover, government initiatives offering incentives for companies adopting clean technologies further bolster market growth across the region.

Key players in the market

Some of the key players in Bag Filter market include BWF Envirotech, Danaher, Donaldson, Eaton Corporation, General Electric, Mitsubishi Hitachi Power Systems, Parker Hannifin, Shanghai Filterbag Factory Co., Ltd and Thermax.

Key Developments:

In February 2022, Babcock and Wilcox Enterprises, Inc. announced that it had acquired Fossil Power Systems, Inc., a renowned manufacturer of natural gas, hydrogen, and renewable pulp and paper combustion equipment.

In January 2022, Pall Corporation, a leader in filtration, separation and purification technology and a Danaher operating company, launched the new SupralonTM hydraulic and lube oil filter element range, a direct upgrade for Pall's Coralon(R), Ultipor(R) and Red1000 series filters. Supralon filter elements incorporate a new pack construction with filter media utilizing stress-resistant technology (SRT) and showcasing anti-static properties, which ultimately help protect and prolong the life of equipment in hydraulic and lube oil applications.

Materials Covered:

- Porous Polytetrafluoroethylene (PTFE) Film

- Polypropylene

- Polyester

- Nylon

Types Covered:

- Shaker

- Pulse Jet

- Reverse Air

- Other Types

Applications Covered:

- Automotive

- Power Generation

- Cement Industries

- Pulp & Paper

- Other Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Application Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Bag Filter Market, By Material

- 5.1 Introduction

- 5.2 Porous Polytetrafluoroethylene (PTFE) Film

- 5.3 Polypropylene

- 5.4 Polyester

- 5.5 Nylon

6 Global Bag Filter Market, By Type

- 6.1 Introduction

- 6.2 Shaker

- 6.3 Pulse Jet

- 6.4 Reverse Air

- 6.5 Other Types

7 Global Bag Filter Market, By Application

- 7.1 Introduction

- 7.2 Automotive

- 7.3 Power Generation

- 7.4 Cement Industries

- 7.5 Pulp & Paper

- 7.6 Other Applications

8 Global Bag Filter Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 BWF Envirotech

- 10.2 Danaher

- 10.3 Donaldson

- 10.4 Eaton Corporation

- 10.5 General Electric

- 10.6 Mitsubishi Hitachi Power Systems

- 10.7 Parker Hannifin

- 10.8 Shanghai Filterbag Factory Co., Ltd

- 10.9 Thermax