|

|

市場調査レポート

商品コード

1438197

ソホロリピッドとラムノリピッド市場の2030年までの予測: タイプ別、用途別、地域別の世界分析Sophorolipid and Rhamnolipid Market Forecasts to 2030 - Global Analysis By Type, Application and by Geography |

||||||

カスタマイズ可能

|

|||||||

| ソホロリピッドとラムノリピッド市場の2030年までの予測: タイプ別、用途別、地域別の世界分析 |

|

出版日: 2024年02月02日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、ソホロリピッドとラムノリピッドの世界市場は、2023年に3億6,234万米ドルを占め、予測期間中に8.2%のCAGRで成長し、2030年までに6億2,908万米ドルに達すると予想されています。

バイオサーファクタントは、幅広い用途を持つ環境に優しい物質の一種で、ソホロリピッドとラムノリピッドが含まれます。酵母(通常はキャンディダ・ボンビコーラ)はソホロリピッドを生産するが、これは優れた界面活性を有し、石油増進回収やバイオレメディエーションなど、さまざまな産業・環境用途に使用できます。さらに、ラムノリピッドは、食品や化粧品産業における乳化剤としての利用や、疎水性汚染物質の生分解の可能性から注目を集めています。

アメリカ化学会によると、ソホロリピッドやラムノリピッドのようなバイオ界面活性剤は、バイオレメディエーションから石油増進回収に至るまで、様々な産業への応用が可能な、環境に優しい代替物質として脚光を浴びています。

環境に優しい治療薬へのニーズの高まり

ソホロリピッドとラムノリピッドの需要は、環境に優しく持続可能なソリューションへの世界のシフトの結果として高まっています。環境への影響が少ない代替品を求める産業や消費者が増えています。ソホロリピッドとラムノリピッドは微生物由来であるため、再生可能な性質と持続可能な慣行での使用に適していることが認められています。さらに、バイオベースの界面活性剤に対するニーズの高まりは、石油化学由来の製品への依存を減らすという大きな目標と一致しており、さまざまな用途でこれらのバイオ界面活性剤の開発を後押ししています。

生産コストと規模拡大の問題

ソホロリピッドとラムノリピッドの市場は、スケーラビリティと生産コストの問題によって一部阻害されています。これらのバイオ界面活性剤は環境に優しい代替品を提供するが、特に大規模に製造する場合、従来の化学界面活性剤よりも製造コストが高くなる可能性があります。しかし、生産プロセスの高度化、品質の一貫性の保証、コスト競合の実現が困難なため、普及はまだ妨げられています。

拡大する農薬・農業用途

ソホロリピッドやラムノリピッドは、農業や農薬の分野で有望視されています。植物表面での広がりや付着性を向上させることで、その界面活性剤の性質は農薬製剤の効力を向上させることができます。さらに、これらのバイオサーファクタントが土壌伝染性病害を軽減し、植物の成長を促進する可能性があることも示唆されています。さらに、ソホロリピッドとラムノリピッドは、環境に優しく持続可能な農業への需要が高まる中、バイオベースの農薬ソリューションの開発において重要な役割を果たす可能性があります。

合成代替品の競合

ソホロリピッドとラムノリピッドの市場は、有名な合成界面活性剤との激しい競争によって常に脅かされています。従来の化学界面活性剤は、性能プロファイルが確立されており、市場での存在感が大きく、製造コストが安いです。さらに、よく知られた合成界面活性剤からバイオベースの界面活性剤に切り替えるよう業界を説得するのは、バイオベースの界面活性剤の有効性、一貫性、手頃な価格に対する疑念があるため、難しい課題です。

COVID-19の影響:

ソホロリピッドとラムノリピッドの市場は、COVID-19の大流行によってさまざまな影響を受けています。ロックダウン、経済の不確実性、世界のサプライチェーンの混乱により、これらのバイオベースの界面活性剤の生産と流通が困難となり、入手可能性にも影響を及ぼしています。持続可能性と衛生面が重視されるようになったため、環境に優しいソリューションへのニーズが高まっているが、景気低迷と各業界の慎重な支出が市場全体の成長を抑制しています。とはいえ、パンデミック後の環境では、バイオテクノロジー業界の粘り強さと持続可能な慣行への継続的な移行により、回復と将来の拡大の見通しが示されています。

ソホロリピッド分野は予測期間中最大になる見込み

ソホロリピッドセグメントが最大のシェアを占めると予測されています。ソホロリピッドは、製薬、化粧品、農業産業で多くの用途があるため、高い需要があります。バイオベースの界面活性剤としての有効性と、持続可能な代替物に対する社会的・政府的支援の高まりから、ソホロリピッドは現在、市場の主要プレーヤーとなっています。さらに、低毒性や生分解性といったソホロリピッドの特徴的な特性が、環境意識の高い産業での人気に拍車をかけています。

ヘルスケア・医薬品分野が予測期間中最も高いCAGRが見込まれる

ヘルスケアおよび医薬品分野は、最も高いCAGRで成長しています。この市場の成長を牽引しているのは、ドラッグデリバリーシステム、医薬製剤、医療用途でこれらのバイオベース界面活性剤の使用が拡大していることです。ソホロリピッドとラムノリピッドは、その低毒性、生体適合性、抗菌性により、医薬品やヘルスケア製品に使用される優れた選択肢となっています。さらに、この分野の高成長は、創傷治療や医療機器コーティングへの応用の可能性や、特定の薬物の溶解性やバイオアベイラビリティを向上させる能力に起因しています。

最大のシェアを持つ地域:

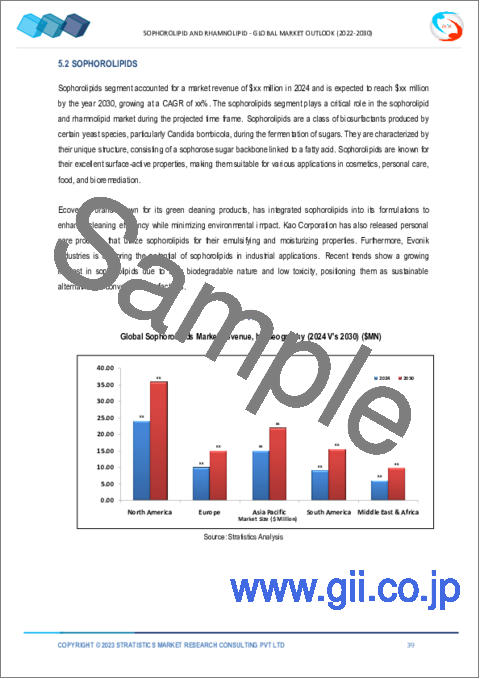

市場の最大シェアは北米と予測されます。同地域の優位性は、確立された産業部門、豊富な研究開発努力、持続可能性の重視など、さまざまな要因によるものです。特に米国では、家庭用洗剤、化粧品、医薬品など、さまざまな産業でバイオベースのソリューションが採用されています。さらに、北米はソホロリピッドとラムノリピッドの両市場で世界をリードしているが、その一因は、環境に優しい代替品に対する規制上の支援と、業界における重要なプレイヤーの存在にあります。

CAGRが最も高い地域:

アジア太平洋地域のCAGRが最も高いと予測されます。同地域の経済環境の変化と産業部門の急成長により、環境に優しく持続可能なソリューションへのニーズが高まっています。バイオベースの界面活性剤は、中国やインドで化粧品、医薬品、農業などさまざまな用途に使用されるようになっています。さらに、環境意識の高まりとグリーンテクノロジーへの動きは、アジア太平洋地域にとって有利です。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- アプリケーション分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競合企業間の敵対関係

第5章 世界のソホロリピッドとラムノリピッド市場:タイプ別

- ソホロリピッド

- 高純度ソホロリピッド

- 低純度ソホロリピッド

- ラムノリピド

- モノラムノリピド

- ジラムノリピド

- その他のタイプ

第6章 世界のソホロリピッドとラムノリピッド市場:用途別

- 石油・ガス

- 農業

- ヘルスケアと医薬品

- 食品および飲料

- 家庭用洗剤

- 産業用および施設用クリーナー

- 化粧品とパーソナルケア

- その他の用途

第7章 世界のソホロリピッドとラムノリピッド市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第8章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第9章 企業プロファイル

- Givaudan SA

- Dow Inc

- Allied Carbon Solutions Co Ltd

- Holiferm Ltd

- Evonik Industries AG

- Godrej Industries Ltd

- Jeneil Bioproducts GmbH

- Saraya Co. Ltd

- Deguan Biosurfactant Supplier

- Stepan Co

List of Tables

- Table 1 Global Sophorolipid and Rhamnolipid Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Sophorolipid and Rhamnolipid Market Outlook, By Type (2021-2030) ($MN)

- Table 3 Global Sophorolipid and Rhamnolipid Market Outlook, By Sophorolipids (2021-2030) ($MN)

- Table 4 Global Sophorolipid and Rhamnolipid Market Outlook, By High-purity Sophorolipids (2021-2030) ($MN)

- Table 5 Global Sophorolipid and Rhamnolipid Market Outlook, By Low-purity Sophorolipids (2021-2030) ($MN)

- Table 6 Global Sophorolipid and Rhamnolipid Market Outlook, By Rhamnolipids (2021-2030) ($MN)

- Table 7 Global Sophorolipid and Rhamnolipid Market Outlook, By Mono-Rhamnolipids (2021-2030) ($MN)

- Table 8 Global Sophorolipid and Rhamnolipid Market Outlook, By Di-Rhamnolipids (2021-2030) ($MN)

- Table 9 Global Sophorolipid and Rhamnolipid Market Outlook, By Other Types (2021-2030) ($MN)

- Table 10 Global Sophorolipid and Rhamnolipid Market Outlook, By Application (2021-2030) ($MN)

- Table 11 Global Sophorolipid and Rhamnolipid Market Outlook, By Oil and Gas (2021-2030) ($MN)

- Table 12 Global Sophorolipid and Rhamnolipid Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 13 Global Sophorolipid and Rhamnolipid Market Outlook, By Healthcare and Pharmaceuticals (2021-2030) ($MN)

- Table 14 Global Sophorolipid and Rhamnolipid Market Outlook, By Food and Beverage (2021-2030) ($MN)

- Table 15 Global Sophorolipid and Rhamnolipid Market Outlook, By Household Detergents (2021-2030) ($MN)

- Table 16 Global Sophorolipid and Rhamnolipid Market Outlook, By Industrial and Institutional Cleaners (2021-2030) ($MN)

- Table 17 Global Sophorolipid and Rhamnolipid Market Outlook, By Cosmetics and Personal Care (2021-2030) ($MN)

- Table 18 Global Sophorolipid and Rhamnolipid Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 19 North America Sophorolipid and Rhamnolipid Market Outlook, By Country (2021-2030) ($MN)

- Table 20 North America Sophorolipid and Rhamnolipid Market Outlook, By Type (2021-2030) ($MN)

- Table 21 North America Sophorolipid and Rhamnolipid Market Outlook, By Sophorolipids (2021-2030) ($MN)

- Table 22 North America Sophorolipid and Rhamnolipid Market Outlook, By High-purity Sophorolipids (2021-2030) ($MN)

- Table 23 North America Sophorolipid and Rhamnolipid Market Outlook, By Low-purity Sophorolipids (2021-2030) ($MN)

- Table 24 North America Sophorolipid and Rhamnolipid Market Outlook, By Rhamnolipids (2021-2030) ($MN)

- Table 25 North America Sophorolipid and Rhamnolipid Market Outlook, By Mono-Rhamnolipids (2021-2030) ($MN)

- Table 26 North America Sophorolipid and Rhamnolipid Market Outlook, By Di-Rhamnolipids (2021-2030) ($MN)

- Table 27 North America Sophorolipid and Rhamnolipid Market Outlook, By Other Types (2021-2030) ($MN)

- Table 28 North America Sophorolipid and Rhamnolipid Market Outlook, By Application (2021-2030) ($MN)

- Table 29 North America Sophorolipid and Rhamnolipid Market Outlook, By Oil and Gas (2021-2030) ($MN)

- Table 30 North America Sophorolipid and Rhamnolipid Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 31 North America Sophorolipid and Rhamnolipid Market Outlook, By Healthcare and Pharmaceuticals (2021-2030) ($MN)

- Table 32 North America Sophorolipid and Rhamnolipid Market Outlook, By Food and Beverage (2021-2030) ($MN)

- Table 33 North America Sophorolipid and Rhamnolipid Market Outlook, By Household Detergents (2021-2030) ($MN)

- Table 34 North America Sophorolipid and Rhamnolipid Market Outlook, By Industrial and Institutional Cleaners (2021-2030) ($MN)

- Table 35 North America Sophorolipid and Rhamnolipid Market Outlook, By Cosmetics and Personal Care (2021-2030) ($MN)

- Table 36 North America Sophorolipid and Rhamnolipid Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 37 Europe Sophorolipid and Rhamnolipid Market Outlook, By Country (2021-2030) ($MN)

- Table 38 Europe Sophorolipid and Rhamnolipid Market Outlook, By Type (2021-2030) ($MN)

- Table 39 Europe Sophorolipid and Rhamnolipid Market Outlook, By Sophorolipids (2021-2030) ($MN)

- Table 40 Europe Sophorolipid and Rhamnolipid Market Outlook, By High-purity Sophorolipids (2021-2030) ($MN)

- Table 41 Europe Sophorolipid and Rhamnolipid Market Outlook, By Low-purity Sophorolipids (2021-2030) ($MN)

- Table 42 Europe Sophorolipid and Rhamnolipid Market Outlook, By Rhamnolipids (2021-2030) ($MN)

- Table 43 Europe Sophorolipid and Rhamnolipid Market Outlook, By Mono-Rhamnolipids (2021-2030) ($MN)

- Table 44 Europe Sophorolipid and Rhamnolipid Market Outlook, By Di-Rhamnolipids (2021-2030) ($MN)

- Table 45 Europe Sophorolipid and Rhamnolipid Market Outlook, By Other Types (2021-2030) ($MN)

- Table 46 Europe Sophorolipid and Rhamnolipid Market Outlook, By Application (2021-2030) ($MN)

- Table 47 Europe Sophorolipid and Rhamnolipid Market Outlook, By Oil and Gas (2021-2030) ($MN)

- Table 48 Europe Sophorolipid and Rhamnolipid Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 49 Europe Sophorolipid and Rhamnolipid Market Outlook, By Healthcare and Pharmaceuticals (2021-2030) ($MN)

- Table 50 Europe Sophorolipid and Rhamnolipid Market Outlook, By Food and Beverage (2021-2030) ($MN)

- Table 51 Europe Sophorolipid and Rhamnolipid Market Outlook, By Household Detergents (2021-2030) ($MN)

- Table 52 Europe Sophorolipid and Rhamnolipid Market Outlook, By Industrial and Institutional Cleaners (2021-2030) ($MN)

- Table 53 Europe Sophorolipid and Rhamnolipid Market Outlook, By Cosmetics and Personal Care (2021-2030) ($MN)

- Table 54 Europe Sophorolipid and Rhamnolipid Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 55 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Country (2021-2030) ($MN)

- Table 56 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Type (2021-2030) ($MN)

- Table 57 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Sophorolipids (2021-2030) ($MN)

- Table 58 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By High-purity Sophorolipids (2021-2030) ($MN)

- Table 59 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Low-purity Sophorolipids (2021-2030) ($MN)

- Table 60 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Rhamnolipids (2021-2030) ($MN)

- Table 61 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Mono-Rhamnolipids (2021-2030) ($MN)

- Table 62 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Di-Rhamnolipids (2021-2030) ($MN)

- Table 63 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Other Types (2021-2030) ($MN)

- Table 64 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Application (2021-2030) ($MN)

- Table 65 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Oil and Gas (2021-2030) ($MN)

- Table 66 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 67 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Healthcare and Pharmaceuticals (2021-2030) ($MN)

- Table 68 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Food and Beverage (2021-2030) ($MN)

- Table 69 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Household Detergents (2021-2030) ($MN)

- Table 70 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Industrial and Institutional Cleaners (2021-2030) ($MN)

- Table 71 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Cosmetics and Personal Care (2021-2030) ($MN)

- Table 72 Asia Pacific Sophorolipid and Rhamnolipid Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 73 South America Sophorolipid and Rhamnolipid Market Outlook, By Country (2021-2030) ($MN)

- Table 74 South America Sophorolipid and Rhamnolipid Market Outlook, By Type (2021-2030) ($MN)

- Table 75 South America Sophorolipid and Rhamnolipid Market Outlook, By Sophorolipids (2021-2030) ($MN)

- Table 76 South America Sophorolipid and Rhamnolipid Market Outlook, By High-purity Sophorolipids (2021-2030) ($MN)

- Table 77 South America Sophorolipid and Rhamnolipid Market Outlook, By Low-purity Sophorolipids (2021-2030) ($MN)

- Table 78 South America Sophorolipid and Rhamnolipid Market Outlook, By Rhamnolipids (2021-2030) ($MN)

- Table 79 South America Sophorolipid and Rhamnolipid Market Outlook, By Mono-Rhamnolipids (2021-2030) ($MN)

- Table 80 South America Sophorolipid and Rhamnolipid Market Outlook, By Di-Rhamnolipids (2021-2030) ($MN)

- Table 81 South America Sophorolipid and Rhamnolipid Market Outlook, By Other Types (2021-2030) ($MN)

- Table 82 South America Sophorolipid and Rhamnolipid Market Outlook, By Application (2021-2030) ($MN)

- Table 83 South America Sophorolipid and Rhamnolipid Market Outlook, By Oil and Gas (2021-2030) ($MN)

- Table 84 South America Sophorolipid and Rhamnolipid Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 85 South America Sophorolipid and Rhamnolipid Market Outlook, By Healthcare and Pharmaceuticals (2021-2030) ($MN)

- Table 86 South America Sophorolipid and Rhamnolipid Market Outlook, By Food and Beverage (2021-2030) ($MN)

- Table 87 South America Sophorolipid and Rhamnolipid Market Outlook, By Household Detergents (2021-2030) ($MN)

- Table 88 South America Sophorolipid and Rhamnolipid Market Outlook, By Industrial and Institutional Cleaners (2021-2030) ($MN)

- Table 89 South America Sophorolipid and Rhamnolipid Market Outlook, By Cosmetics and Personal Care (2021-2030) ($MN)

- Table 90 South America Sophorolipid and Rhamnolipid Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 91 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Country (2021-2030) ($MN)

- Table 92 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Type (2021-2030) ($MN)

- Table 93 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Sophorolipids (2021-2030) ($MN)

- Table 94 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By High-purity Sophorolipids (2021-2030) ($MN)

- Table 95 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Low-purity Sophorolipids (2021-2030) ($MN)

- Table 96 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Rhamnolipids (2021-2030) ($MN)

- Table 97 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Mono-Rhamnolipids (2021-2030) ($MN)

- Table 98 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Di-Rhamnolipids (2021-2030) ($MN)

- Table 99 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Other Types (2021-2030) ($MN)

- Table 100 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Application (2021-2030) ($MN)

- Table 101 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Oil and Gas (2021-2030) ($MN)

- Table 102 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 103 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Healthcare and Pharmaceuticals (2021-2030) ($MN)

- Table 104 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Food and Beverage (2021-2030) ($MN)

- Table 105 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Household Detergents (2021-2030) ($MN)

- Table 106 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Industrial and Institutional Cleaners (2021-2030) ($MN)

- Table 107 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Cosmetics and Personal Care (2021-2030) ($MN)

- Table 108 Middle East & Africa Sophorolipid and Rhamnolipid Market Outlook, By Other Applications (2021-2030) ($MN)

According to Stratistics MRC, the Global Sophorolipid and Rhamnolipid Market is accounted for $362.34 million in 2023 and is expected to reach $629.08 million by 2030 growing at a CAGR of 8.2% during the forecast period. Biosurfactants, a class of environmentally benign substances with a wide range of uses, include sophorolipids and rhamnolipids. Yeast, usually Candida bombicola, produces sophorolipids, which have good surface-active qualities and can be used in a variety of industrial and environmental applications, including enhanced oil recovery and bioremediation. Moreover, rhamnolipids have drawn interest because of their potential for use as emulsifiers in the food and cosmetics industries, as well as for the biodegradation of hydrophobic pollutants.

According to the American Chemical Society, biosurfactants such as sophorolipids and rhamnolipids are gaining prominence as environmentally friendly alternatives with diverse applications in industries ranging from bioremediation to enhanced oil recovery.

Market Dynamics:

Driver:

Growing need for eco-friendly remedies

The demand for sophorolipid and rhamnolipid is rising as a result of the global shift towards environmentally friendly and sustainable solutions. A growing number of industries and consumers are looking for alternatives with less of an impact on the environment. Because they come from microbial sources, sophorolipids and rhamnolipids are acknowledged for their renewable nature and suitability for use in sustainable practices. Additionally, the growing need for bio-based surfactants is in line with the larger goal of reducing dependency on products derived from petrochemicals, which is encouraging the development of these biosurfactants in a range of applications.

Restraint:

Production expenses and scaling issues

The market for sophorolipids and rhamnolipids is hampered, in part, by issues with scalability and production costs. Although these biosurfactants provide environmentally friendly substitutes, they can be more expensive to produce than conventional chemical surfactants, especially when manufactured on a large scale. However, widespread adoption is still hampered by difficulties in boosting production processes, guaranteeing consistency in quality, and achieving cost competitiveness.

Opportunity:

Expanding uses for agrochemicals and agriculture

The fields of agriculture and agrochemicals present bright prospects for sophorolipids and rhamnolipids. By improving their spreading and adherence on plant surfaces, their surfactant qualities can improve the efficacy of agrochemical formulations. Further evidence suggests that these biosurfactants may help to mitigate soil-borne diseases and encourage plant growth. Moreover, sophorolipids and rhamnolipids may be important in the development of bio-based agrochemical solutions as the demand for environmentally friendly and sustainable agricultural practices rises.

Threat:

Synthetic Alternatives Competition

The market for sophorolipids and rhamnolipids is constantly threatened by fierce competition from well-known synthetic surfactants. Conventional chemical surfactants have a well-established performance profile, a large market presence, and cheaper production costs. Furthermore, persuading industries to switch from well-known synthetic surfactants to bio-based ones is a difficult task because there may be doubts about the bio-based surfactants' efficacy, consistency, and affordability.

Covid-19 Impact:

The sophorolipid and rhamnolipid markets have been impacted by the COVID-19 pandemic in many ways. Lockdowns, economic uncertainty, and disruptions in global supply chains have made it difficult to produce and distribute these bio-based surfactants, which has an impact on their availability. The need for eco-friendly solutions has grown due to the growing emphasis on sustainability and hygiene, but economic downturns and cautious spending across industries have restrained the market's overall growth. Nonetheless, in the post-pandemic environment, prospects for recovery and future expansion are presented by the biotechnology industry's tenacity and the continuous transition to sustainable practices.

The Sophorolipids segment is expected to be the largest during the forecast period

It is projected that the sophorolipids segment will have the largest share. Sophorolipids are in high demand because of their many uses in the pharmaceutical, cosmetic, and agricultural industries. Because of their effectiveness as bio-based surfactants and the increasing public and governmental support for sustainable alternatives, sophorolipids are now a major player in the market. Moreover, the distinctive characteristics of sophorolipids, such as their low toxicity and biodegradability, add to their popularity in environmentally conscious industries.

The Healthcare and Pharmaceuticals segment is expected to have the highest CAGR during the forecast period

The healthcare and pharmaceuticals segment is growing at the highest CAGR. The growth of this market has been driven by the growing use of these bio-based surfactants in drug delivery systems, pharmaceutical formulations, and medical applications. Due to their low toxicity, biocompatibility, and antimicrobial qualities, sophorolipids and rhamnolipids are excellent choices for usage in pharmaceutical and healthcare products. Furthermore, the high growth of the sector can be attributed to their potential applications in wound care and medical device coatings, as well as their capacity to improve the solubility and bioavailability of specific drugs.

Region with largest share:

The market's largest share is predicted to belong to North America. The dominance of the region is ascribed to various factors, including a firmly established industrial sector, abundant research and development endeavors, and a pronounced focus on sustainability. The adoption of bio-based solutions in a variety of industries, such as household detergents, cosmetics, and pharmaceuticals, has been spearheaded by the United States in particular. Moreover, North America leads the world in both the sophorolipid and rhamnolipid markets, partly due to regulatory support for eco-friendly alternatives and the presence of important players in the industry.

Region with highest CAGR:

The Asia-Pacific region is projected to have the highest CAGR. The need for environmentally friendly and sustainable solutions has grown as a result of the region's changing economic environment and quickly growing industrial sector. Bio-based surfactants are being used more often in China and India for a variety of applications, including cosmetics, pharmaceuticals, and agriculture. Additionally, growing environmental consciousness and a move toward green technologies are advantageous to the Asia-Pacific region.

Key players in the market

Some of the key players in Sophorolipid and Rhamnolipid market include Givaudan SA, Dow Inc, Allied Carbon Solutions Co Ltd, Holiferm Ltd, Evonik Industries AG, Godrej Industries Ltd, Jeneil Bioproducts GmbH, Saraya Co. Ltd, Deguan Biosurfactant Supplier and Stepan Co.

Key Developments:

In May 2023, Dow and New Energy Blue announced a long-term supply agreement in North America in which New Energy Blue will create bio-based ethylene from renewable agricultural residues. Dow expects to purchase this bio-based ethylene, reducing carbon emissions from plastic production, and using it in recyclable applications across transportation, footwear, and packaging.

In April 2023, Givaudan, the global leader in Fragrance & Beauty, today announces that it has completed the acquisition of major cosmetic ingredients portfolio from Amyris, Inc. Givaudan had announced that it had reached an agreement for this transaction. Amyris is a leading biotechnology company accelerating the world's transition to sustainable consumption through its Lab-to-Market™ technology platform in beauty, health & wellness and flavours & fragrances markets.

In November 2022, Evonik has entered into an agreement to supply blueSulfate, a liquid ammonium sulfate (8-0-0-9) solution from its site in Mobile, AL, to Interoceanic Corporation (IOC). This agreement supports Evonik's strategy to focus on its core business in Animal Nutrition by marketing one of the co-products of its methionine production network via IOC.

Types Covered:

- Sophorolipids

- Rhamnolipids

- Other Types

Applications Covered:

- Oil and Gas

- Agriculture

- Healthcare and Pharmaceuticals

- Food and Beverage

- Household Detergents

- Industrial and Institutional Cleaners

- Cosmetics and Personal Care

- Other Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Application Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Sophorolipid and Rhamnolipid Market, By Type

- 5.1 Introduction

- 5.2 Sophorolipids

- 5.2.1 High-purity Sophorolipids

- 5.2.2 Low-purity Sophorolipids

- 5.3 Rhamnolipids

- 5.3.1 Mono-Rhamnolipids

- 5.3.2 Di-Rhamnolipids

- 5.4 Other Types

6 Global Sophorolipid and Rhamnolipid Market, By Application

- 6.1 Introduction

- 6.2 Oil and Gas

- 6.3 Agriculture

- 6.4 Healthcare and Pharmaceuticals

- 6.5 Food and Beverage

- 6.6 Household Detergents

- 6.7 Industrial and Institutional Cleaners

- 6.8 Cosmetics and Personal Care

- 6.9 Other Applications

7 Global Sophorolipid and Rhamnolipid Market, By Geography

- 7.1 Introduction

- 7.2 North America

- 7.2.1 US

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 New Zealand

- 7.4.6 South Korea

- 7.4.7 Rest of Asia Pacific

- 7.5 South America

- 7.5.1 Argentina

- 7.5.2 Brazil

- 7.5.3 Chile

- 7.5.4 Rest of South America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 Qatar

- 7.6.4 South Africa

- 7.6.5 Rest of Middle East & Africa

8 Key Developments

- 8.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 8.2 Acquisitions & Mergers

- 8.3 New Product Launch

- 8.4 Expansions

- 8.5 Other Key Strategies

9 Company Profiling

- 9.1 Givaudan SA

- 9.2 Dow Inc

- 9.3 Allied Carbon Solutions Co Ltd

- 9.4 Holiferm Ltd

- 9.5 Evonik Industries AG

- 9.6 Godrej Industries Ltd

- 9.7 Jeneil Bioproducts GmbH

- 9.8 Saraya Co. Ltd

- 9.9 Deguan Biosurfactant Supplier

- 9.10 Stepan Co