|

|

市場調査レポート

商品コード

1423669

産業用微生物検査サービス市場の2030年までの予測:検査タイプ別、エンドユーザー別、地域別の世界分析Industrial Microbiology Testing Services Market Forecasts to 2030 - Global Analysis By Test Type, By End User and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 産業用微生物検査サービス市場の2030年までの予測:検査タイプ別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年02月02日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の産業用微生物検査サービス市場は、2023年に33億米ドルを占め、予測期間中にCAGR 11.4%で成長し、2030年には71億米ドルに達する見込みです。

産業用微生物検査サービスには、微生物汚染物質の分析と評価、微生物の特定、工業環境における微生物活動の評価が含まれます。これらのサービスは、医薬品、飲食品、化粧品、環境分野など様々な産業において、製品の品質、安全性、規制基準の遵守を確保することを目的としています。微生物学的手法を用いることで、これらのサービスは、産業運営における汚染の防止、プロセス効率の確保、製品の完全性の維持を支援します。

フード・ナビゲーターによると、自然食品とオーガニック飲食品の売上は、米国市場において2024年までに3,000億米ドル、2030年までに4,000億米ドルを突破します。

食品の安全性と品質に対する需要の高まり

食品の安全性と品質に対する需要の高まりは、産業用微生物検査サービス市場の重要な促進要因となっています。消費者が安全で高品質な食品を優先する中、産業界は厳しい規制に準拠しなければならないです。微生物検査は、食品に有害な病原体、汚染物質、腐敗微生物が含まれていないことを保証し、規制基準を満たします。このような食品の安全性への関心の高まりは、食品加工、飲食品、農業などの業界を微生物検査サービスに従事させ、安全な消耗品の生産を保証し、検査サービス市場を強化しています。

高い検査コスト

総合的な微生物検査には、高度な技術、特殊な機器、熟練した専門家が必要であり、検査費用の高騰につながります。産業界は、厳格な検査プロトコール、特に日常的で広範な微生物学的分析にリソースを割り当てる上で、予算上の制約に直面することが多いです。特に中小企業にとっては、こうしたサービスのコスト高が障壁となり、定期的かつ徹底した微生物学的検査の実施が妨げられ、コンプライアンスに影響を与え、市場参入が制限される可能性があります。

製薬・バイオ医薬品産業の成長

製薬・バイオ医薬品産業の拡大は、産業用微生物検査サービス市場に大きなチャンスをもたらします。これらの産業が成長するにつれ、医薬品の安全性、品質、有効性を確保するための厳格な微生物検査の必要性が高まっています。さらに、これらの分野では、微生物同定、無菌試験、環境モニタリングにまたがる試験サービスへの需要が、微生物学試験サービスプロバイダーに大きな成長の見通しを生み出しています。

厳しい規制要件

絶え間なく進化する規制を遵守するためには、厳格な試験プロトコルと品質基準の遵守が要求され、産業界に経済的負担を強いています。これらの基準を満たすには、高度な検査手法と熟練した人材が必要となり、運用コストが増大します。さらに、規制状況の変化により、技術のアップグレードや手法のバリデーションに追加投資が必要となり、利益率に影響を与えることもあります。コンプライアンス遵守の複雑さとコストの高さは、中小企業の足かせとなり、市場へのアクセスを制限し、市場の成長を困難にする可能性があります。

COVID-19の影響:

COVID-19の大流行は、産業用微生物検査サービス市場に大きな影響を与えました。この危機は病原体検査の重要性を浮き彫りにし、特にヘルスケア、製薬、食品分野での微生物検査サービスの需要増加を促しました。しかし、サプライチェーンの混乱、産業運営の縮小、財政的制約により、一時的な後退を余儀なくされました。当初の課題にもかかわらず、パンデミックは微生物検査の重要性を強め、技術革新を促進し、市場を強化しました。

予測期間中、水質検査分野が最大になる見込み

産業活動や環境規制によって、水の安全性と品質に対する懸念が高まっていることから、予測期間中、産業用微生物検査サービス市場では水検査分野が最大になると予測されます。微生物汚染物質、病原体、水系感染症に対する厳しいモニタリングが、水質検査サービスの優位性を促進しています。さらに、安全な飲料水を確保するための規制の増加と水質汚染に対する意識の高まりが、このセグメントの持続的成長に寄与しています。

飲食品セグメントは予測期間中最も高いCAGRが見込まれる

飲食品分野は、食品の安全性に対する懸念の高まりにより、産業用微生物検査サービス市場で最も高い成長率を予測しています。厳しい規制と安全で高品質な食品に対する消費者の要求が、厳格な微生物検査の必要性を高めています。さらに、検査技術の進歩、食品の世界の取引の増加、品質保証の重視の高まりが需要を増大させ、このセグメントの急成長を促進しています。

最大シェアの地域:

欧州は、規制の枠組みが厳しく、品質基準がしっかりしているため、食品、医薬品、化粧品などの業界全体で微生物検査の需要を牽引しており、同市場で最大の市場シェアを確保する見通しです。さらに、環境安全への関心の高まりと水質に関する厳格な基準が、微生物検査サービスの必要性を後押ししています。強力なヘルスケア・インフラ、技術の進歩、コンプライアンスへの積極的な取り組みは、この市場における欧州の優位性をさらに強固なものにしています。

CAGRが最も高い地域:

アジア太平洋地域は、急速な工業化、都市化、人口増加により、市場の大幅な成長が見込まれています。食品の安全性に対する懸念の高まり、ヘルスケア基準に対する意識の高まり、厳格な規制措置が検査サービスの採用を後押ししています。さらに、新興国のヘルスケアインフラへの投資や、部門を超えた品質保証の重視の高まりも、この地域の微生物検査サービスの有望な成長見通しに寄与しています。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレイヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- エンドユーザー分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の産業用微生物検査サービス市場:検査タイプ別

- 空気モニタリング検査

- 生物負荷検査

- 微生物限界検査

- 無菌検査

- 水質検査

- その他の検査タイプ

第6章 世界の産業用微生物検査サービス市場:エンドユーザー別

- 農業

- 化粧品

- 環境試験

- 食品・飲料

- ヘルスケア施設

- 製薬およびバイオテクノロジー企業

- その他のエンドユーザー

第7章 世界の産業用微生物検査サービス市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第8章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第9章 企業プロファイル

- AsureQuality

- Becton, Dickinson and Company(BD)

- bioMerieux SA

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Eurofins Scientific

- Intertek Group plc

- LONZA

- Merck KGaA

- Merieux NutriSciences

- Microbac Laboratories, Inc.

- Neogen Corporation

- NSF International

- Pacific BioLabs

- Pall Corporation

- Qiagen

- Sartorius AG

- SGS SA

- Thermo Fisher Scientific, Inc.

List of Tables

- Table 1 Global Industrial Microbiology Testing Services Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Industrial Microbiology Testing Services Market Outlook, By Test Type (2021-2030) ($MN)

- Table 3 Global Industrial Microbiology Testing Services Market Outlook, By Air Monitoring Tests (2021-2030) ($MN)

- Table 4 Global Industrial Microbiology Testing Services Market Outlook, By Bio-burden Testing (2021-2030) ($MN)

- Table 5 Global Industrial Microbiology Testing Services Market Outlook, By Microbial Limits Testing (2021-2030) ($MN)

- Table 6 Global Industrial Microbiology Testing Services Market Outlook, By Sterility Testing (2021-2030) ($MN)

- Table 7 Global Industrial Microbiology Testing Services Market Outlook, By Water Testing (2021-2030) ($MN)

- Table 8 Global Industrial Microbiology Testing Services Market Outlook, By Other Test Types (2021-2030) ($MN)

- Table 9 Global Industrial Microbiology Testing Services Market Outlook, By End User (2021-2030) ($MN)

- Table 10 Global Industrial Microbiology Testing Services Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 11 Global Industrial Microbiology Testing Services Market Outlook, By Cosmetics (2021-2030) ($MN)

- Table 12 Global Industrial Microbiology Testing Services Market Outlook, By Environmental Testing (2021-2030) ($MN)

- Table 13 Global Industrial Microbiology Testing Services Market Outlook, By Food & Beverages (2021-2030) ($MN)

- Table 14 Global Industrial Microbiology Testing Services Market Outlook, By Healthcare Facilities (2021-2030) ($MN)

- Table 15 Global Industrial Microbiology Testing Services Market Outlook, By Pharmaceutical & Biotechnology Companies (2021-2030) ($MN)

- Table 16 Global Industrial Microbiology Testing Services Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 17 North America Industrial Microbiology Testing Services Market Outlook, By Country (2021-2030) ($MN)

- Table 18 North America Industrial Microbiology Testing Services Market Outlook, By Test Type (2021-2030) ($MN)

- Table 19 North America Industrial Microbiology Testing Services Market Outlook, By Air Monitoring Tests (2021-2030) ($MN)

- Table 20 North America Industrial Microbiology Testing Services Market Outlook, By Bio-burden Testing (2021-2030) ($MN)

- Table 21 North America Industrial Microbiology Testing Services Market Outlook, By Microbial Limits Testing (2021-2030) ($MN)

- Table 22 North America Industrial Microbiology Testing Services Market Outlook, By Sterility Testing (2021-2030) ($MN)

- Table 23 North America Industrial Microbiology Testing Services Market Outlook, By Water Testing (2021-2030) ($MN)

- Table 24 North America Industrial Microbiology Testing Services Market Outlook, By Other Test Types (2021-2030) ($MN)

- Table 25 North America Industrial Microbiology Testing Services Market Outlook, By End User (2021-2030) ($MN)

- Table 26 North America Industrial Microbiology Testing Services Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 27 North America Industrial Microbiology Testing Services Market Outlook, By Cosmetics (2021-2030) ($MN)

- Table 28 North America Industrial Microbiology Testing Services Market Outlook, By Environmental Testing (2021-2030) ($MN)

- Table 29 North America Industrial Microbiology Testing Services Market Outlook, By Food & Beverages (2021-2030) ($MN)

- Table 30 North America Industrial Microbiology Testing Services Market Outlook, By Healthcare Facilities (2021-2030) ($MN)

- Table 31 North America Industrial Microbiology Testing Services Market Outlook, By Pharmaceutical & Biotechnology Companies (2021-2030) ($MN)

- Table 32 North America Industrial Microbiology Testing Services Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 33 Europe Industrial Microbiology Testing Services Market Outlook, By Country (2021-2030) ($MN)

- Table 34 Europe Industrial Microbiology Testing Services Market Outlook, By Test Type (2021-2030) ($MN)

- Table 35 Europe Industrial Microbiology Testing Services Market Outlook, By Air Monitoring Tests (2021-2030) ($MN)

- Table 36 Europe Industrial Microbiology Testing Services Market Outlook, By Bio-burden Testing (2021-2030) ($MN)

- Table 37 Europe Industrial Microbiology Testing Services Market Outlook, By Microbial Limits Testing (2021-2030) ($MN)

- Table 38 Europe Industrial Microbiology Testing Services Market Outlook, By Sterility Testing (2021-2030) ($MN)

- Table 39 Europe Industrial Microbiology Testing Services Market Outlook, By Water Testing (2021-2030) ($MN)

- Table 40 Europe Industrial Microbiology Testing Services Market Outlook, By Other Test Types (2021-2030) ($MN)

- Table 41 Europe Industrial Microbiology Testing Services Market Outlook, By End User (2021-2030) ($MN)

- Table 42 Europe Industrial Microbiology Testing Services Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 43 Europe Industrial Microbiology Testing Services Market Outlook, By Cosmetics (2021-2030) ($MN)

- Table 44 Europe Industrial Microbiology Testing Services Market Outlook, By Environmental Testing (2021-2030) ($MN)

- Table 45 Europe Industrial Microbiology Testing Services Market Outlook, By Food & Beverages (2021-2030) ($MN)

- Table 46 Europe Industrial Microbiology Testing Services Market Outlook, By Healthcare Facilities (2021-2030) ($MN)

- Table 47 Europe Industrial Microbiology Testing Services Market Outlook, By Pharmaceutical & Biotechnology Companies (2021-2030) ($MN)

- Table 48 Europe Industrial Microbiology Testing Services Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 49 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Country (2021-2030) ($MN)

- Table 50 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Test Type (2021-2030) ($MN)

- Table 51 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Air Monitoring Tests (2021-2030) ($MN)

- Table 52 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Bio-burden Testing (2021-2030) ($MN)

- Table 53 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Microbial Limits Testing (2021-2030) ($MN)

- Table 54 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Sterility Testing (2021-2030) ($MN)

- Table 55 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Water Testing (2021-2030) ($MN)

- Table 56 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Other Test Types (2021-2030) ($MN)

- Table 57 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By End User (2021-2030) ($MN)

- Table 58 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 59 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Cosmetics (2021-2030) ($MN)

- Table 60 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Environmental Testing (2021-2030) ($MN)

- Table 61 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Food & Beverages (2021-2030) ($MN)

- Table 62 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Healthcare Facilities (2021-2030) ($MN)

- Table 63 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Pharmaceutical & Biotechnology Companies (2021-2030) ($MN)

- Table 64 Asia Pacific Industrial Microbiology Testing Services Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 65 South America Industrial Microbiology Testing Services Market Outlook, By Country (2021-2030) ($MN)

- Table 66 South America Industrial Microbiology Testing Services Market Outlook, By Test Type (2021-2030) ($MN)

- Table 67 South America Industrial Microbiology Testing Services Market Outlook, By Air Monitoring Tests (2021-2030) ($MN)

- Table 68 South America Industrial Microbiology Testing Services Market Outlook, By Bio-burden Testing (2021-2030) ($MN)

- Table 69 South America Industrial Microbiology Testing Services Market Outlook, By Microbial Limits Testing (2021-2030) ($MN)

- Table 70 South America Industrial Microbiology Testing Services Market Outlook, By Sterility Testing (2021-2030) ($MN)

- Table 71 South America Industrial Microbiology Testing Services Market Outlook, By Water Testing (2021-2030) ($MN)

- Table 72 South America Industrial Microbiology Testing Services Market Outlook, By Other Test Types (2021-2030) ($MN)

- Table 73 South America Industrial Microbiology Testing Services Market Outlook, By End User (2021-2030) ($MN)

- Table 74 South America Industrial Microbiology Testing Services Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 75 South America Industrial Microbiology Testing Services Market Outlook, By Cosmetics (2021-2030) ($MN)

- Table 76 South America Industrial Microbiology Testing Services Market Outlook, By Environmental Testing (2021-2030) ($MN)

- Table 77 South America Industrial Microbiology Testing Services Market Outlook, By Food & Beverages (2021-2030) ($MN)

- Table 78 South America Industrial Microbiology Testing Services Market Outlook, By Healthcare Facilities (2021-2030) ($MN)

- Table 79 South America Industrial Microbiology Testing Services Market Outlook, By Pharmaceutical & Biotechnology Companies (2021-2030) ($MN)

- Table 80 South America Industrial Microbiology Testing Services Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 81 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Country (2021-2030) ($MN)

- Table 82 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Test Type (2021-2030) ($MN)

- Table 83 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Air Monitoring Tests (2021-2030) ($MN)

- Table 84 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Bio-burden Testing (2021-2030) ($MN)

- Table 85 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Microbial Limits Testing (2021-2030) ($MN)

- Table 86 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Sterility Testing (2021-2030) ($MN)

- Table 87 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Water Testing (2021-2030) ($MN)

- Table 88 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Other Test Types (2021-2030) ($MN)

- Table 89 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By End User (2021-2030) ($MN)

- Table 90 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Agriculture (2021-2030) ($MN)

- Table 91 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Cosmetics (2021-2030) ($MN)

- Table 92 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Environmental Testing (2021-2030) ($MN)

- Table 93 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Food & Beverages (2021-2030) ($MN)

- Table 94 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Healthcare Facilities (2021-2030) ($MN)

- Table 95 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Pharmaceutical & Biotechnology Companies (2021-2030) ($MN)

- Table 96 Middle East & Africa Industrial Microbiology Testing Services Market Outlook, By Other End Users (2021-2030) ($MN)

According to Stratistics MRC, the Global Industrial Microbiology Testing Services Market is accounted for $3.3 billion in 2023 and is expected to reach $7.1 billion by 2030 growing at a CAGR of 11.4% during the forecast period. Industrial microbiology testing services involve analysing and assessing microbial contaminants, identifying microorganisms, and evaluating microbial activities in industrial settings. These services aim to ensure product quality, safety and compliance with regulatory standards across various industries such as pharmaceuticals, food and beverages, cosmetics and environmental sectors. By employing microbiological techniques, these services aid in preventing contamination, ensuring process efficiency and maintaining product integrity in industrial operations.

According to food navigator, the sale of natural and organic food & beverages would surpass $300 billion by 2024 and $400 billion by 2030 in the U.S. market.

Market Dynamics:

Driver:

Increasing demand for food safety and quality

The rising demand for food safety and quality acts as a significant driver in the industrial microbiology testing services market. As consumers prioritise safe and high-quality food products, industries must comply with stringent regulations. Microbiological testing ensures food products are free from harmful pathogens, contaminants, and spoilage microorganisms, meeting regulatory standards. This increased focus on food safety drives industries like food processing, beverages, and agriculture to engage in microbiology testing services, ensuring the production of safe consumables, thereby bolstering the market for testing services.

Restraint:

High cost of testing

Comprehensive microbial testing involves sophisticated techniques, specialised equipment, and skilled professionals, leading to elevated testing expenses. Industries often face budgetary constraints in allocating resources for rigorous testing protocols, especially for routine and extensive microbiological analyses. The cost-intensive nature of these services creates barriers, particularly for smaller enterprises, hindering their ability to conduct regular and thorough microbiological testing, impacting compliance and potentially limiting market accessibility.

Opportunity:

Growing pharmaceutical and biopharmaceutical industries

The expansion of the pharmaceutical and biopharmaceutical industries presents a significant opportunity in the industrial microbiology testing services market. As these industries grow, there's an elevated need for rigorous microbiological testing to ensure the safety, quality and efficacy of pharmaceutical products. In addition, the demand for testing services spanning microbial identification, sterility testing and environmental monitoring within these sectors creates substantial growth prospects for microbiology testing service providers.

Threat:

Stringent regulatory requirements

Compliance with constantly evolving regulations demands rigorous testing protocols and adherence to quality standards, imposing financial burdens on industries. Meeting these standards necessitates sophisticated testing methodologies and skilled personnel, increasing operational costs. Furthermore, changes in regulatory landscapes can demand additional investments for technology upgrades or method validation, affecting profit margins. The complexity and costliness of compliance can deter smaller enterprises, potentially limiting market accessibility and challenging market growth.

Covid-19 Impact:

The COVID-19 pandemic significantly influenced the industrial microbiology testing services market. The crisis highlighted the criticality of testing for pathogens, prompting increased demand for microbial testing services, especially in the healthcare, pharmaceutical and food sectors. However, disruptions in supply chains, reduced industrial operations, and financial constraints led to temporary setbacks. Despite initial challenges, the pandemic reinforced the importance of microbiological testing, driving innovation, and strengthening the market.

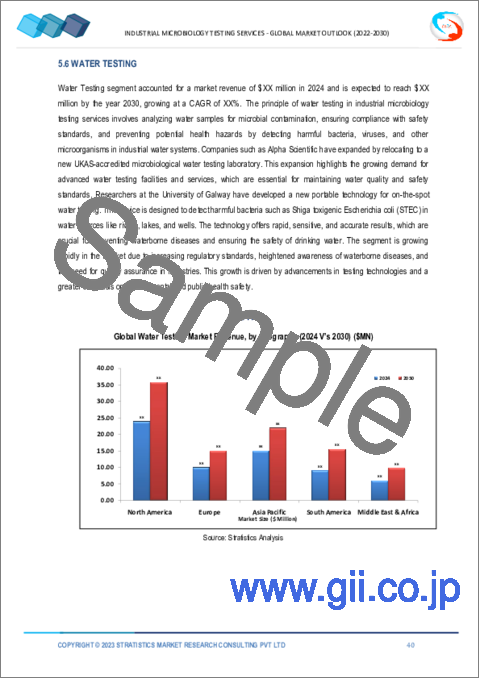

The water testing segment is expected to be the largest during the forecast period

The water testing segment is projected to be the largest in the industrial microbiology testing services market during the forecast period, owing to growing concerns about water safety and quality, driven by industrial activities and environmental regulations. Stringent monitoring for microbial contaminants, pathogens and waterborne diseases fosters the dominance of water testing services. Moreover, increasing regulations to ensure safe drinking water and heightened awareness about water pollution contribute to the sustained growth of this segment.

The food & beverages segment is expected to have the highest CAGR during the forecast period

The food and beverages segment anticipates the highest growth rate in the industrial microbiology testing services market due to escalating concerns about food safety. Stringent regulations and consumer demand for safe, high-quality food drive the need for rigorous microbiological testing. Additionally, advancements in testing technologies, increased global trade of food products and a heightened emphasis on quality assurance amplify the demand, fostering the segment's rapid growth.

Region with largest share:

Europe is poised to secure the largest market share in the market due to the region's stringent regulatory framework and robust quality standards, which drive the demand for microbiological testing across industries like food, pharmaceuticals and cosmetics. Additionally, a heightened focus on environmental safety and stringent norms for water quality propel the need for microbiology testing services. Strong healthcare infrastructure, technological advancements and a proactive approach to compliance further solidify Europe's dominance in this market.

Region with highest CAGR:

The Asia-Pacific region is poised for substantial growth in the market due to rapid industrialization, urbanisation and an expanding population. Heightened concerns about food safety, increasing awareness of healthcare standards and stringent regulatory measures encourage the adoption of testing services. Moreover, emerging economies' investments in healthcare infrastructure and a growing emphasis on quality assurance across sectors contribute to the region's promising growth prospects in microbiology testing services.

Key players in the market

Some of the key players in Industrial Microbiology Testing Services market AsureQuality, Becton, Dickinson and Company (BD), BioMerieux SA, Bio-Rad Laboratories, Inc., Charles River Laboratories, Eurofins Scientific, Intertek Group plc, LONZA, Merck KGaA, Merieux NutriSciences, Microbac Laboratories, Inc., Neogen Corporation, NSF International, Pacific BioLabs, Pall Corporation, Qiagen, Sartorius AG, SGS SA and Thermo Fisher Scientific, Inc.

Key Developments:

In September 2023, Eurofins, a leading global testing company with a presence in 61 countries, is thrilled to unveil its latest addition to the network of laboratories: a cutting-edge microbiology laboratory in Columbia, Missouri. This facility is set to revolutionize the field of microbiological testing, catering to the diverse needs of the food, feed, and ingredient industries, as well as providing essential environmental monitoring services.

In May 2023, Charles River Laboratories International, Inc. announced the launch of Accugenix® Next Generation Sequencing for Bacterial Identification and Fungal Identification (Accugenix® NGS). Accugenix NGS simultaneously sequences millions of individual DNA fragments from a sample and provides key information to pharmaceutical and personal care manufacturers regarding microbial control.

In June 2022, SGS Launches New Microbiology Laboratory in Phoenix, Arizona. The launch of a dedicated Biosafety Level-2 microbiology lab within testing facility in Phoenix, Arizona. Comprising around 4,000 square feet of the 12,000 square feet facility, the new lab will be focused on efficacy testing for hand sanitizers and antibacterial hand soaps. This adds significant additional capacity to our testing capabilities, with studies expected to start in the new lab from June 2022 onwards.

Test Types Covered:

- Air Monitoring Tests

- Bio-burden Testing

- Microbial Limits Testing

- Sterility Testing

- Water Testing

- Other Test Types

End Users Covered:

- Agriculture

- Cosmetics

- Environmental Testing

- Food & Beverages

- Healthcare Facilities

- Pharmaceutical & Biotechnology Companies

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 End User Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Industrial Microbiology Testing Services Market, By Test Type

- 5.1 Introduction

- 5.2 Air Monitoring Tests

- 5.3 Bio-burden Testing

- 5.4 Microbial Limits Testing

- 5.5 Sterility Testing

- 5.6 Water Testing

- 5.7 Other Test Types

6 Global Industrial Microbiology Testing Services Market, By End User

- 6.1 Introduction

- 6.2 Agriculture

- 6.3 Cosmetics

- 6.4 Environmental Testing

- 6.5 Food & Beverages

- 6.6 Healthcare Facilities

- 6.7 Pharmaceutical & Biotechnology Companies

- 6.8 Other End Users

7 Global Industrial Microbiology Testing Services Market, By Geography

- 7.1 Introduction

- 7.2 North America

- 7.2.1 US

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 New Zealand

- 7.4.6 South Korea

- 7.4.7 Rest of Asia Pacific

- 7.5 South America

- 7.5.1 Argentina

- 7.5.2 Brazil

- 7.5.3 Chile

- 7.5.4 Rest of South America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 Qatar

- 7.6.4 South Africa

- 7.6.5 Rest of Middle East & Africa

8 Key Developments

- 8.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 8.2 Acquisitions & Mergers

- 8.3 New Product Launch

- 8.4 Expansions

- 8.5 Other Key Strategies

9 Company Profiling

- 9.1 AsureQuality

- 9.2 Becton, Dickinson and Company (BD)

- 9.3 bioMerieux SA

- 9.4 Bio-Rad Laboratories, Inc.

- 9.5 Charles River Laboratories

- 9.6 Eurofins Scientific

- 9.7 Intertek Group plc

- 9.8 LONZA

- 9.9 Merck KGaA

- 9.10 Merieux NutriSciences

- 9.11 Microbac Laboratories, Inc.

- 9.12 Neogen Corporation

- 9.13 NSF International

- 9.14 Pacific BioLabs

- 9.15 Pall Corporation

- 9.16 Qiagen

- 9.17 Sartorius AG

- 9.18 SGS SA

- 9.19 Thermo Fisher Scientific, Inc.