|

|

市場調査レポート

商品コード

1402026

医療美容市場の2030年までの予測:製品別、施術別、用途別、エンドユーザー別、地域別の世界分析Medical Aesthetics Market Forecasts to 2030 - Global Analysis By Product, Procedure, Application, End User and by Geography |

||||||

カスタマイズ可能

|

|||||||

| 医療美容市場の2030年までの予測:製品別、施術別、用途別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2023年12月01日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の医療美容市場は2023年に234億6,000万米ドルを占め、予測期間中にCAGR 14.2%で成長し、2030年には594億2,000万米ドルに達すると予測されています。

医療美容は、低侵襲的・非侵襲的な美容施術を駆使して患者の外見を改善することに重点を置く医療分野です。しわ、小じわ、皮膚のたるみ、余分な脂肪などの問題を治療する目的で、これらの処置は顔や体の見た目を向上させることを目的としています。さらに、ボトックスや皮膚充填剤のような注射は、老化の兆候を軽減し、皮膚の若返りや脱毛のためのレーザー治療、非外科的ボディ輪郭技術は、一般的な医療美容治療の例です。

2021年2月に発表されたBAAPSの調査によると、2021年には英国で15,405件の美容外科手術が行われました。美容施術の増加に伴い、医療美容機器が必要とされています。これが医療美容機器のニーズを生み出し、市場の成長を促進しています。

高齢化の進展

医療美容機器市場は、世界の高齢化人口の増加が大きな原動力となっています。しわ、小じわ、肌の弾力低下は、加齢に伴って自然に進行する老化現象の一例です。加えて、若々しく見られたいという願望や美容施術の進歩により、加齢に関連した美容上の懸念に対する治療も高い需要があります。

好ましくない状況や問題の危険性

潜在的な患者は、医療&美容処置による好ましくない結果や合併症の固有のリスクのために躊躇するかもしれないです。安全基準はずいぶん進歩したが、合併症の発生は、現実のものであれ、想像のものであれ、社会的信頼を損ないかねないです。さらに、この制約を緩和するために、業界の利害関係者は、公開性、包括的な患者教育、継続的な安全プロトコルの改善に高い優先順位を置く必要があります。

革新と技術の進歩

絶え間ない技術革新と技術の進歩は、医療美容市場に大きなチャンスをもたらします。治療計画とシミュレーションは、機械学習(ML)、拡張現実(AR)、人工知能(AI)を取り入れることで、より正確で個別化されたものとなります。さらに、エネルギーベースのプラットフォームや高度なレーザーのような革新的な機器の開発により、低侵襲・非侵襲の処置のための新たな道が開かれます。

景気後退と個人消費の減少

医療&美容のような必需品以外のサービスに対する消費者の支出は、景気後退、不況、世界の金融危機によって影響を受ける可能性があります。可処分所得の変化に敏感であるため、この業界は不況時の需要減少の影響を受けやすいです。さらに、この脅威を乗り切るためには、景気の不透明な時期に回復力を高める戦略を立て、マーケティング・アプローチを修正することが不可欠です。

COVID-19の影響:

医療美容市場は、COVID-19の大流行によって大きな影響を受けています。パンデミックの初期には、政府による封鎖、選択的施術の制限、安全性への懸念の高まりにより、患者の受診や施術件数が著しく減少しました。業界はクリニックの閉鎖、サプライチェーンの混乱、基本的ヘルスケアに対する消費者の優先順位の変化を経験しました。とはいえ、制限の緩和とともに、美容サービスに対する需要は徐々に回復していった。さらに、パンデミックはバーチャル診察や遠隔医療の普及を早め、患者との交流に変化をもたらしました。

予測期間中、豊胸手術分野が最大となる見込み

美容市場では、豊胸手術分野が最大のシェアを占めています。豊胸術は、インプラントや脂肪移植を用いてバストの大きさや形を大きくする外科的プロセスです。豊胸手術の魅力は、美容上の問題を緩和し、自己肯定感を高めることができることです。さらに、美容業界におけるこの手術の持続的な人気は、美の基準の進化、ボディポジティブの上昇、手術技術の向上など、多くの要因に起因しています。

クリニック、病院、メディカルスパ部門は予測期間中最も高いCAGRが見込まれる

予測期間を通じて、メディカルスパセグメントが最も高いCAGRを示すと予想されます。メディカル・スパは、伝統的なスパの特徴と認定ヘルスケア専門家が管理する医療サービスを組み合わせることで、美容ケアへの包括的なアプローチを提供します。その魅力は、リラクゼーションやウェルネス・サービスとともに最先端のエステティック・トリートメントを提供し、顧客に唯一無二の包括的な体験を与えることにあります。さらに、メディカル・スパ・モデルは、スパのような環境で非侵襲的な施術を求める多様な顧客を頻繁に惹きつけるため、高い成長を遂げる可能性を秘めています。

最大のシェアを持つ地域:

世界のエステティック業界では、北米が最大のシェアを占めると予測されています。特に米国では、様々な美容施術に対する強い需要があり、市場は大きく成長しています。医療制度が整備されていること、美容施術に対する意識が高いこと、外見や美しさを重視することなどが、この地域の隆盛を支えています。さらに、レーザー治療、肌の若返り、体の輪郭形成、顔への注射、その他の施術はすべて、北米で提供されている幅広い美容施術の一部です。

CAGRが最も高い地域:

CAGRが最も高いアジア太平洋地域は、世界の美容市場においてダイナミックな力となっています。中産階級の増加、美の基準の変化、可処分所得の増加はすべて、中国、日本、韓国などの国々における美容施術の需要急増に寄与しています。さらに、この地域は、非侵襲的施術の迅速な取り込みと美容強化の文化的受容により、業界の最前線に進んでいます。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 製品分析

- アプリケーション分析

- エンドユーザー分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の医療美容市場:製品別

- フェイシャルエステ用品

- 化粧品インプラント

- 肌エステ機器

- 身体輪郭矯正装置

- 医師が調剤する化粧品および美白剤

- 脱毛装置

- タトゥー除去装置

- スレッドリフト製品

- 医師が調剤したまつげ製品

- 爪治療用レーザー装置

- その他の製品

第6章 世界の医療美容市場:施術別

- 豊胸

- 鼻整形

- フェイスリフトとボディリフト

- アンチエイジングと肌の若返り

- タトゥーと傷跡の除去

- 脱毛

- 脂肪分解

- その他の施術

第7章 世界の医療美容市場:用途別

- アンチエイジングとシワ

- 顔と肌の若返り

- 胸の強化

- ボディシェイプとセルライト

- タトゥー除去

- 血管病変

- シアーズ、色素性病変の再建

- 乾癬と白斑

- その他の用途

第8章 世界の医療美容市場:エンドユーザー別

- クリニック、病院、医療スパ

- ビューティーセンター

- ホームケア設定

- 化粧品センター

- 皮膚科クリニック

- その他のエンドユーザー

第9章 世界の医療美容市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第10章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイル

- Mentor Worldwide LLC

- Lumenis

- Bausch Health Companies Inc.

- Johnson & Johnson Services, Inc.

- Galderma Laboratories L.P

- AbbVie Inc.

- Merz Pharmaceuticals GmbH

- El.En. S.p.A.(Asclepion Laser Technologies)

- Syneron Medical, Ltd

- Deka Laser Technologies

- Solta Medical, Inc

- Allergan plc

- Sientra, Inc.

- Cynosure Inc.

- Sharplight Technologies Inc

- Alma Lasers

- Sciton Inc.

List of Tables

- Table 1 Global Medical Aesthetics Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Medical Aesthetics Market Outlook, By Product (2021-2030) ($MN)

- Table 3 Global Medical Aesthetics Market Outlook, By Facial Aesthetic Products (2021-2030) ($MN)

- Table 4 Global Medical Aesthetics Market Outlook, By Cosmetics Implant (2021-2030) ($MN)

- Table 5 Global Medical Aesthetics Market Outlook, By Skin Aesthetic Devices (2021-2030) ($MN)

- Table 6 Global Medical Aesthetics Market Outlook, By Body Contouring Devices (2021-2030) ($MN)

- Table 7 Global Medical Aesthetics Market Outlook, By Physician-dispensed Cosmeceuticals And Skin Lighteners (2021-2030) ($MN)

- Table 8 Global Medical Aesthetics Market Outlook, By Hair Removal Devices (2021-2030) ($MN)

- Table 9 Global Medical Aesthetics Market Outlook, By Tattoo Removal Devices (2021-2030) ($MN)

- Table 10 Global Medical Aesthetics Market Outlook, By Thread Lift Products (2021-2030) ($MN)

- Table 11 Global Medical Aesthetics Market Outlook, By Physician- Dispensed Eyelash Products (2021-2030) ($MN)

- Table 12 Global Medical Aesthetics Market Outlook, By Nail Treatment Laser Devices (2021-2030) ($MN)

- Table 13 Global Medical Aesthetics Market Outlook, By Other Products (2021-2030) ($MN)

- Table 14 Global Medical Aesthetics Market Outlook, By Procedure (2021-2030) ($MN)

- Table 15 Global Medical Aesthetics Market Outlook, By Breast Augmentation (2021-2030) ($MN)

- Table 16 Global Medical Aesthetics Market Outlook, By Rhinoplasty (2021-2030) ($MN)

- Table 17 Global Medical Aesthetics Market Outlook, By Facelift And Body Lift (2021-2030) ($MN)

- Table 18 Global Medical Aesthetics Market Outlook, By Anti-Aging And Skin Rejuvenation (2021-2030) ($MN)

- Table 19 Global Medical Aesthetics Market Outlook, By Tattoo And Scar Removal (2021-2030) ($MN)

- Table 20 Global Medical Aesthetics Market Outlook, By Hair Removal (2021-2030) ($MN)

- Table 21 Global Medical Aesthetics Market Outlook, By Lipolysis (2021-2030) ($MN)

- Table 22 Global Medical Aesthetics Market Outlook, By Other Procedures (2021-2030) ($MN)

- Table 23 Global Medical Aesthetics Market Outlook, By Application (2021-2030) ($MN)

- Table 24 Global Medical Aesthetics Market Outlook, By Anti-Aging and Wrinkles (2021-2030) ($MN)

- Table 25 Global Medical Aesthetics Market Outlook, By Facial and Skin Rejuvenation (2021-2030) ($MN)

- Table 26 Global Medical Aesthetics Market Outlook, By Breast Enhancement (2021-2030) ($MN)

- Table 27 Global Medical Aesthetics Market Outlook, By Body Shaping and Cellulite (2021-2030) ($MN)

- Table 28 Global Medical Aesthetics Market Outlook, By Tattoo Removal (2021-2030) ($MN)

- Table 29 Global Medical Aesthetics Market Outlook, By Vascular Lesions (2021-2030) ($MN)

- Table 30 Global Medical Aesthetics Market Outlook, By Sears, Pigment Lesions Reconstructive (2021-2030) ($MN)

- Table 31 Global Medical Aesthetics Market Outlook, By Psoriasis and Vitiligo (2021-2030) ($MN)

- Table 32 Global Medical Aesthetics Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 33 Global Medical Aesthetics Market Outlook, By End User (2021-2030) ($MN)

- Table 34 Global Medical Aesthetics Market Outlook, By Clinics, Hospitals, And Medicals Spas (2021-2030) ($MN)

- Table 35 Global Medical Aesthetics Market Outlook, By Beauty Centers (2021-2030) ($MN)

- Table 36 Global Medical Aesthetics Market Outlook, By Home Care Settings (2021-2030) ($MN)

- Table 37 Global Medical Aesthetics Market Outlook, By Cosmetic Centers (2021-2030) ($MN)

- Table 38 Global Medical Aesthetics Market Outlook, By Dermatology Clinics (2021-2030) ($MN)

- Table 39 Global Medical Aesthetics Market Outlook, By Other End Users (2021-2030) ($MN)

Note: Tables for North America, Europe, APAC, South America, and Middle East & Africa Regions are also represented in the same manner as above.

According to Stratistics MRC, the Global Medical Aesthetics Market is accounted for $23.46 billion in 2023 and is expected to reach $59.42 billion by 2030 growing at a CAGR of 14.2% during the forecast period. Medical aesthetics is a field of medicine that focuses on improving a patient's appearance using a range of minimally invasive and non-invasive cosmetic procedures. With the aim of treating issues like wrinkles, fine lines, sagging skin, and extra fat, these procedures aim to enhance the appearance of the face and body. Moreover, injectables like Botox and dermal fillers, which lessen signs of aging, laser therapy for skin rejuvenation and hair removal, and non-surgical body contouring techniques are examples of common medical aesthetic treatments.

According to the BAAPS survey released in February 2021, 15,405 cosmetic surgical procedures were performed in the United Kingdom in 2021. The increasing number of aesthetic procedures requires medical aesthetic devices. This is creating the need for medical aesthetic devices and driving the market's growth.

Market Dynamics:

Driver:

Increasingly aging population

The market for medical aesthetics is largely driven by the global increase in the aging population. Wrinkles, fine lines, and a decrease in skin elasticity are examples of the natural progression of signs of aging that occur as people age. Additionally, treatments for age-related cosmetic concerns are in high demand due to the desire to look youthful and the advancements in aesthetic procedures.

Restraint:

Hazard of unfavorable circumstances and issues

Potential patients may hesitate due to the inherent risk of unfavorable outcomes or complications from medical aesthetic procedures. Safety standards have come a long way, but incidents of complications-real or imagined-can undermine public confidence. Furthermore, in order to alleviate this constraint, industry stakeholders need to place a high priority on openness, comprehensive patient education, and ongoing safety protocol improvement.

Opportunity:

Innovation and technological advancements

Continuous innovations and advancements in technology offer the medical aesthetics market a sizable opportunity. Treatment planning and simulations are made more accurate and individualized by incorporating machine learning (ML), augmented reality (AR), and artificial intelligence (AI). Additionally, new paths for minimally invasive and non-invasive procedures are opened by the development of innovative devices like energy-based platforms and sophisticated lasers.

Threat:

Economic downturns and declines in consumer spending

Consumer expenditure on non-essential services, such as medical aesthetics, can be impacted by economic downturns, recessions, or global financial crises. Due to its sensitivity to changes in disposable income, the industry is susceptible to a decline in demand during recessions. Moreover, to navigate this threat, it is imperative to develop resilience strategies and modify marketing approaches during periods of economic uncertainty.

COVID-19 Impact:

The market for medical aesthetics has been significantly impacted by the COVID-19 pandemic. Early in the pandemic, there was a marked decline in patient visits and procedural volumes due to government-imposed lockdowns, limitations on elective procedures, and increased safety concerns. The industry experienced clinic closures, supply chain disruptions, and changes in consumer priorities toward basic healthcare. Pent-up demand for aesthetic services drove a gradual recovery, nevertheless, as restrictions eased. Additionally, the pandemic hastened the uptake of virtual consultations and telemedicine, which has altered patient interactions.

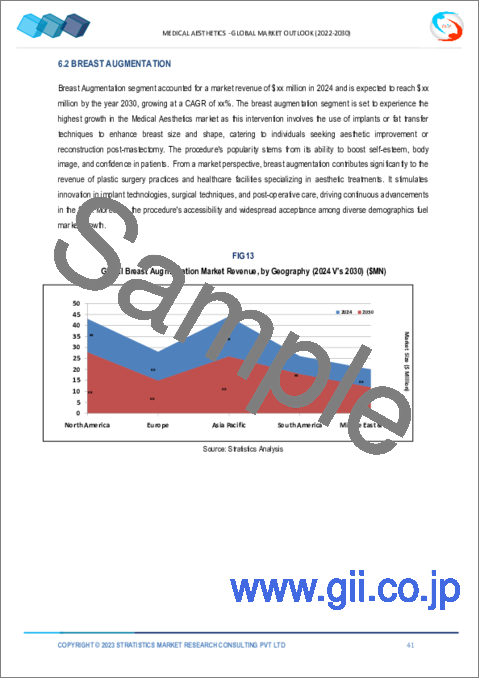

The Breast Augmentation segment is expected to be the largest during the forecast period

In the aesthetic market, the breast augmentation segment has the largest share. Breast augmentation is the surgical process of using implants or fat transfer to increase the size and shape of the breasts. The allure of breast augmentation is its capacity to alleviate cosmetic issues and enhance self-assurance. Moreover, the sustained popularity of this procedure in the aesthetic industry can be attributed to a number of factors, including evolving standards of beauty, a rise in body positivity, and improvements in surgical techniques.

The Clinics, Hospitals, And Medicals Spas segment is expected to have the highest CAGR during the forecast period

Throughout the forecast period, the medical spa segment is expected to have the highest CAGR. Medical spas provide a comprehensive approach to aesthetic care by combining the features of a traditional spa with medical services managed by certified healthcare professionals. Their appeal lies in offering cutting-edge aesthetic treatments along with relaxation and wellness services, giving customers a one-of-a-kind and all-inclusive experience. Furthermore, the medical spa model has the potential to have high growth because it frequently draws a diverse clientele looking for non-invasive procedures in a spa-like setting.

Region with largest share:

It is predicted that in the global aesthetic industry, North America will hold the largest share. Particularly in the United States, where there is a strong demand for a variety of aesthetic procedures, the market has grown significantly. A well-established healthcare system, a high degree of awareness regarding cosmetic procedures, and a strong emphasis on appearance and beauty are some of the factors that contribute to the region's prominence. Moreover, laser treatments, skin rejuvenation, body contouring, facial injectables, and other procedures are all part of the wide range of aesthetic procedures offered in North America.

Region with highest CAGR:

With the highest CAGR, the Asia-Pacific region has become a dynamic force in the global aesthetic market. A growing middle class, changing beauty standards, and rising disposable incomes have all contributed to a boom in the demand for aesthetic procedures in nations like China, Japan, and South Korea. Additionally, the region has advanced to the forefront of the industry due to its quick uptake of non-invasive procedures and cultural acceptance of cosmetic enhancements.

Key players in the market:

Some of the key players in Medical Aesthetics market include Mentor Worldwide LLC, Lumenis, Bausch Health Companies Inc., Johnson & Johnson Services, Inc., Galderma Laboratories L.P, AbbVie Inc., Merz Pharmaceuticals GmbH, El.En. S.p.A. (Asclepion Laser Technologies), Syneron Medical, Ltd, Deka Laser Technologies, Solta Medical, Inc, Allergan plc, Sientra, Inc., Cynosure Inc., Sharplight Technologies Inc, Alma Lasers and Sciton Inc.

Key Developments:

In June 2023, Bausch + Lomb Corporation, a subsidiary of Bausch Health Companies Inc., announced that it has entered into a definitive agreement with Novartis to acquire XIIDRA® 5%, a non-steroid eye drop specifically approved to treat the signs and symptoms of dry eye disease (DED) focusing on inflammation associated with dry eye.

In March 2023, Galderma announced today the launch of FACE by Galderma™, an innovative aesthetic visualization tool powered by augmented reality (AR) that allows aesthetic professionals and patients to visualize injectable treatment results* at the planning stage before treatment begins. This innovative solution gives patients a simulated real-time "before and after" visual of what may be possible from an individualized treatment plan and may help alleviate patient concerns about injectable results.

In January 2023, Pharmaceutical companies AbbVie (ABBV.N) and Eli Lilly have withdrawn from Britain's voluntary medicines pricing agreement, an industry body said on Monday. Companies are increasingly arguing that it is no longer possible to justify the UK's "voluntary scheme" to global boardrooms and investors as repayment rates in 2023 have surged to 26.5% of revenue, the Association of the British Pharmaceutical Industry (ABPI) said in a statement.

Product Types Covered:

- Facial Aesthetic Products

- Cosmetics Implant

- Skin Aesthetic Devices

- Body Contouring Devices

- Physician-dispensed Cosmeceuticals And Skin Lighteners

- Hair Removal Devices

- Tattoo Removal Devices

- Thread Lift Products

- Physician- Dispensed Eyelash Products

- Nail Treatment Laser Devices

- Other Products

Procedures Covered:

- Breast Augmentation

- Rhinoplasty

- Facelift And Body Lift

- Anti-Aging And Skin Rejuvenation

- Tattoo And Scar Removal

- Hair Removal

- Lipolysis

- Other Procedures

Applications Covered:

- Anti-Aging and Wrinkles

- Facial and Skin Rejuvenation

- Breast Enhancement

- Body Shaping and Cellulite

- Tattoo Removal

- Vascular Lesions

- Sears, Pigment Lesions Reconstructive

- Psoriasis and Vitiligo

- Other Applications

End Users Covered:

- Clinics, Hospitals, And Medicals Spas

- Beauty Centers

- Home Care Settings

- Cosmetic Centers

- Dermatology Clinics

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 Application Analysis

- 3.8 End User Analysis

- 3.9 Emerging Markets

- 3.10 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Medical Aesthetics Market, By Product

- 5.1 Introduction

- 5.2 Facial Aesthetic Products

- 5.3 Cosmetics Implant

- 5.4 Skin Aesthetic Devices

- 5.5 Body Contouring Devices

- 5.6 Physician-dispensed Cosmeceuticals And Skin Lighteners

- 5.7 Hair Removal Devices

- 5.8 Tattoo Removal Devices

- 5.9 Thread Lift Products

- 5.10 Physician- Dispensed Eyelash Products

- 5.11 Nail Treatment Laser Devices

- 5.12 Other Products

6 Global Medical Aesthetics Market, By Procedure

- 6.1 Introduction

- 6.2 Breast Augmentation

- 6.3 Rhinoplasty

- 6.4 Facelift And Body Lift

- 6.5 Anti-Aging And Skin Rejuvenation

- 6.6 Tattoo And Scar Removal

- 6.7 Hair Removal

- 6.8 Lipolysis

- 6.9 Other Procedures

7 Global Medical Aesthetics Market, By Application

- 7.1 Introduction

- 7.2 Anti-Aging and Wrinkles

- 7.3 Facial and Skin Rejuvenation

- 7.4 Breast Enhancement

- 7.5 Body Shaping and Cellulite

- 7.6 Tattoo Removal

- 7.7 Vascular Lesions

- 7.8 Sears, Pigment Lesions Reconstructive

- 7.9 Psoriasis and Vitiligo

- 7.10 Other Applications

8 Global Medical Aesthetics Market, By End User

- 8.1 Introduction

- 8.2 Clinics, Hospitals, And Medicals Spas

- 8.3 Beauty Centers

- 8.4 Home Care Settings

- 8.5 Cosmetic Centers

- 8.6 Dermatology Clinics

- 8.7 Other End Users

9 Global Medical Aesthetics Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 Mentor Worldwide LLC

- 11.2 Lumenis

- 11.3 Bausch Health Companies Inc.

- 11.4 Johnson & Johnson Services, Inc.

- 11.5 Galderma Laboratories L.P

- 11.6 AbbVie Inc.

- 11.7 Merz Pharmaceuticals GmbH

- 11.8 El.En. S.p.A. (Asclepion Laser Technologies)

- 11.9 Syneron Medical, Ltd

- 11.10 Deka Laser Technologies

- 11.11 Solta Medical, Inc

- 11.12 Allergan plc

- 11.13 Sientra, Inc.

- 11.14 Cynosure Inc.

- 11.15 Sharplight Technologies Inc

- 11.16 Alma Lasers

- 11.17 Sciton Inc.