|

|

市場調査レポート

商品コード

1130891

バイオ医薬品受託製造の世界市場:提供されるサービスの種類別、製造される生物学的製剤の種類別、使用される発現系の種類別、事業規模別、企業規模別、主要地域別 - 業界動向と予測(2022年~2035年)Biopharmaceutical Contract Manufacturing Market by Type of Service Offered, Type of Biologic Manufactured, Type of Expression System Used, Scale of Operation, Company Size, and Key Geographical Regions : Industry Trends and Global Forecasts, 2022 - 2035 |

||||||

カスタマイズ可能

|

|||||||

| バイオ医薬品受託製造の世界市場:提供されるサービスの種類別、製造される生物学的製剤の種類別、使用される発現系の種類別、事業規模別、企業規模別、主要地域別 - 業界動向と予測(2022年~2035年) |

|

出版日: 2023年08月01日

発行: Roots Analysis

ページ情報: 英文 799 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

当レポートでは、バイオ医薬品受託製造市場について調査分析し、現在の市場情勢と今後10年間の将来の可能性のほか、主要促進要因や動向、主要企業などについて、最新の情報を提供しています。

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

第4章 市場情勢

- 章の概要

- バイオ医薬品受託製造業者:全体の市場情勢

第5章 地域の生産能力分析

- 章の概要

- 主な前提条件と手法

- 医薬品受託製造施設全体の情勢

- 地域の生産能力分析:北米のバイオ医薬品受託製造施設

- 地域の生産能力分析:欧州のバイオ医薬品受託製造施設

- 地域の生産能力分析:アジア太平洋地域・その他の地域のバイオ医薬品受託製造施設

第6章 北米のバイオ医薬品受託製造

- 章の概要

- 米国のバイオ医薬品受託製造の規制シナリオ

- 北米の主要なバイオ医薬品CMO

第7章 欧州のバイオ医薬品受託製造

- 章の概要

- 欧州のバイオ医薬品受託製造:規制シナリオ

- 欧州の主要なバイオ医薬品CMO

第8章 アジア太平洋地域・その他の地域のバイオ医薬品受託製造

- 章の概要

- 中国のバイオ医薬品受託製造

- 中国の主要なバイオ医薬品CMO

- インドのバイオ医薬品受託製造

- インドの主要なバイオ医薬品CMO

- 日本のバイオ医薬品受託製造

- 日本の主要なバイオ医薬品CMO

- 韓国のバイオ医薬品受託製造

- 韓国の主要なバイオ医薬品CMO

- オーストラリアのバイオ医薬品受託製造

- オーストラリアの主要なバイオ医薬品CMO

第9章 ニッチなバイオ医薬品部門

- 章の概要

- 二重特異性抗体

- 抗体薬物複合体(ADC)

- 細胞治療

- 遺伝子治療

- プラスミドDNA

第10章 ケーススタディ:バイオシミラーのアウトソーシング

- 章の概要

- バイオシミラー:イントロダクション

- バイオシミラー:開発段階

- バイオシミラーのライセンシングに関する規制要件

- バイオシミラーの開発と製造をアウトソーシングする必要性

- 世界の受託製造市場に対するバイオシミラーの影響

- バイオシミラー受託製造サービスプロバイダー

- バイオシミラー製造業務のアウトソーシングに関連する課題

第11章 ケーススタディ:低分子・高分子の医薬品/治療の比較

- 章の概要

- 低分子・高分子医薬品/治療

第12章 ケーススタディ:社内製造

- 章の概要

- 社内製造

- バイオ医薬品業界のアウトソーシングの動向

- 承認された生物学的製剤に使用される製造アプローチ

- 適切な戦略の選択:社内製造 vs. アウトソーシング

第13章 製造 vs. 購入の意思決定の枠組み

第14章 大手製薬会社のイニシアティブ

第15章 パートナーシップとコラボレーション

第16章 M&A

第17章 最近の拡張

第18章 最近の発展

第19章 生産能力分析

第20章 需要分析

第21章 バイオ医薬品受託製造組織の総所有コスト

第22章 市場予測と機会分析

- 章の概要

- 主な前提条件と手法

- 世界のバイオ医薬品受託製造市場(2022年~2035年)

- バイオ医薬品受託製造市場 - 分析:提供されるサービスの種類別

- バイオ医薬品受託製造市場 - 分析:製造される生物学的製剤の種類別

- バイオ医薬品受託製造市場 - 分析:使用される発現系の種類別

- バイオ医薬品受託製造市場 - 分析:事業規模別

- バイオ医薬品受託製造市場 - 分析:企業規模別(2022年~2035年)

- バイオ医薬品受託製造市場 - 分析:地域別

第23章 ケーススタディ:バーチャル製薬企業

第24章 SWOT分析

第25章 バイオ医薬品CMO市場の将来

第26章 調査分析

第27章 結論

第28章 インタビュー記録

第29章 付録I:表形式のデータ

第30章 付録II:企業/組織のリスト

LIST OF TABLES

- Table 3.1 Mammalian versus Microbial Expression Systems

- Table 4.1 List of Biopharmaceutical Contract Manufacturers

- Table 4.2 Biopharmaceutical Contract Manufacturers: Information on Type of Service(s) Offered

- Table 4.3 Biopharmaceutical Contract Manufacturers: Information on Type of Biologic Manufactured

- Table 4.4 Biopharmaceutical CMOs: Information on Scale of Operation

- Table 4.5 Biopharmaceutical Contract Manufacturers: Information on Type of Expression System Used

- Table 4.6 Biopharmaceutical Contract Manufacturers: Information on Type of Bioreactor Used

- Table 4.7 Biopharmaceutical Contract Manufacturers: Information on Mode of Operation of Bioreactor

- Table 5.1 List of Biopharmaceutical Contract Manufacturing Facilities in North America

- Table 5.2 List of Biopharmaceutical Contract Manufacturing Facilities in Europe

- Table 5.3 List of Biopharmaceutical Contract Manufacturing Facilities in Asia-Pacific and Rest of the World

- Table 6.1 AGC Biologics: Company Overview

- Table 6.2 AGC Biologics: Biologics Manufacturing Facilities

- Table 6.3 AGC Biologics: Recent Developments and Future Outlook

- Table 6.4 Catalent: Company Overview

- Table 6.5 Catalent: Biologics Manufacturing Facilities

- Table 6.6 Catalent: Recent Developments and Future Outlook

- Table 6.7 Cytiva: Company Overview

- Table 6.8 Cytiva: Manufacturing Facilities

- Table 6.9 FUJIFILM Diosynth Biotechnologies: Company Overview

- Table 6.10 FUJIFILM Diosynth Biotechnologies: Biopharmaceutical Facilities

- Table 6.11 FUJIFILM Diosynth Biotechnologies: Recent Developments and Future Outlook

- Table 6.12 KBI Biopharma: Company Overview,

- Table 6.13 KBI Biopharma: Overview of Manufacturing Capabilities

- Table 6.14 KBI Biopharma: Recent Developments and Future Outlook

- Table 6.15 Patheon: Company Overview

- Table 6.16 Patheon: Biopharmaceutical Manufacturing and Development Facilities

- Table 6.17 Patheon: Future Outlook

- Table 6.18 Piramal Pharma Solutions: Company Overview

- Table 6.19 Piramal Pharma Solutions: Facilities

- Table 6.20 Piramal Pharma Solutions: Recent Developments and Future Outlook

- Table 7.1 FDA Quality Agreement and EMA cGMP Regulations: A Comparative Analysis

- Table 7.2 Boehringer Ingelheim: Company Overview

- Table 7.3 Boehringer Ingelheim: Biopharmaceutical Facilities

- Table 7.4 Boehringer Ingelheim: Recent Developments and Future Outlook

- Table 7.5 Lonza: Company Overview

- Table 7.6 Lonza: Biopharmaceutical Facilities

- Table 7.7 Lonza: Recent Developments and Future Outlook

- Table 7.8 Novasep: Company Overview

- Table 7.9 Novasep: Biologics Manufacturing Facilities

- Table 7.10 Novasep: Recent Developments and Future Outlook

- Table 7.11 Olon: Company Overview

- Table 7.12 Olon: Biopharmaceutical Facilities

- Table 7.13 Olon: Recent Developments and Future Outlook

- Table 7.14 Rentschler Biopharma: Company Overview

- Table 7.15 Rentschler Biopharma: Recent Developments and Future Outlook

- Table 7.16 Sandoz: Company Overview

- Table 8.1 WuXi Biologics: Company Overview

- Table 8.2 WuXi Biologics: Recent Developments and Future Outlook

- Table 8.3 Kemwell Biopharma: Company Overview

- Table 8.4 Kemwell Biopharma: Recent Developments and Future Outlook

- Table 8.5 Minaris Regenerative Medicine: Company Overview

- Table 8.6 Minaris Regenerative Medicine: Manufacturing Facilities

- Table 8.7 Minaris Regenerative Medicine: Recent Developments and Future Outlook

- Table 8.8 Takara Bio: Company Overview

- Table 8.9 Takara Bio: Biologics Manufacturing Facilities

- Table 8.10 Takara Bio: Recent Developments and Future Outlook

- Table 8.11 Celltrion: Company Overview

- Table 8.12 Celltrion: Biologics Manufacturing Facilities

- Table 8.13 Celltrion: Recent Developments and Future Outlook

- Table 8.14 Samsung BioLogics: Company Overview

- Table 8.15 Samsung BioLogics: Biopharmaceutical Facilities

- Table 8.16 Samsung BioLogics: Recent Developments and Future Outlook

- Table 8.17 Cell Therapies: Company Overview

- Table 8.18 Cell Therapies: Recent Developments and Future Outlook

- Table 8.19 Luina Bio: Company Overview

- Table 8.20 Luina Bio: Recent Developments and Future Outlook

- Table 9.1 Bispecific Antibody Therapeutics: Information on Developer(s), Platform / Technology Used, Phase of Development, Target Antigens and Antibody Format

- Table 9.2 Bispecific Antibody Therapeutics: Information on Developer(s), Technology Used, Phase of Development, Target Antigens, Mechanism of Action, Disease Indication, Therapeutic Area and Broader Disease Segment

- Table 9.3 List of Other Emerging Multivalent Drug Candidates

- Table 9.4 Bispecific Antibody Therapeutics: List of Technology Platforms

- Table 9.5 Bispecific Antibody Contract Manufacturers: List of Companies

- Table 9.6 Commonly Used Cytotoxins for ADC Therapeutics

- Table 9.7 Occupational Exposure Limit Bands, Safebridge Consultants

- Table 9.8 Antibody Drug Conjugates: Drug Pipeline

- Table 9.9 Novel Drug Conjugates: List of Developers

- Table 9.10 ADC Contract Manufacturers: List of Companies

- Table 9.11 Applications of Cell-based Therapies

- Table 9.12 Cell-based Therapies: Commercialized Products,

- Table 9.13 Assessments for Key Cell Therapy Manufacturing Steps

- Table 9.14 Advantages and Disadvantages of Centralized and Decentralized Manufacturing Models

- Table 9.15 Cell Therapy Manufacturing (Industry Players): Information on Type of Cell Manufactured

- Table 9.16 Cell Therapy Contract Manufacturers: List of Cell Therapy Contract Manufacturers

- Table 9.17 Cell Therapy Contract Manufacturers: List of Non-Industry Players

- Table 9.18 Viral Vectors Manufacturers: Information on Type of Viral Vector Used

- Table 9.19 Viral Vectors Contract Manufacturers: List of Companies,

- Table 9.20 Plasmid DNA Contract Manufacturers: List of Companies

- Table 10.1 List of Biosimilars Contract Manufacturing Service Providers

- Table 11.1 Small Molecules and Large Molecules: Strengths and Weaknesses

- Table 11.2 Small Molecules and Large Molecules: Comparison of Key Characteristics

- Table 11.3 Small Molecules and Large Molecules: Comparison of Development Characteristics

- Table 12.1 List of FDA Approved Biologics (2016-2022)

- Table 14.1 Big Pharma Players: List of Biopharmaceutical Manufacturing Initiatives

- Table 15.1 Biopharmaceutical Contract Manufacturing: List of Partnerships and Collaborations, 2015-2022

- Table 15.2 Partnerships and Collaborations: Information on Type of Biologic Manufactured

- Table 16.1 Biopharmaceutical Contract Manufacturing: List of Mergers and Acquisitions, 2015-2022

- Table 16.2 Biopharmaceutical Contract Manufacturing Mergers and Acquisitions: Information on Key Value Drivers and Type of Biologic Manufactured, 2015- 2022

- Table 16.3 Mergers and Acquisitions: Information on Deal Multiples, 2015-2022

- Table 17.1 Biopharmaceutical Contract Manufacturing: List of Recent Expansions

- Table 18.1 Biopharmaceutical Contract Manufacturing Market: Funding and Investment

- Table 18.2 Funding and Investment Analysis: Summary of Investments

- Table 18.3 Funding and Investment Analysis: Summary of Venture Capital Funding

- Table 19.1 Capacity Analysis: Information on Contract Biomanufacturing Capacity

- Table 19.2 Capacity Analysis: Average Capacity per Category (Sample Data Set)

- Table 19.3 Capacity Analysis: Average Capacity for Mammalian Expression System (Sample Data Set)

- Table 19.4 Capacity Analysis: Average Capacity for Microbial Expression System (Sample Data Set)

- Table 19.5 Capacity Analysis: Global Contract Biomanufacturing Capacity

- Table 20.1 Annual Biomanufacturing Capacity, 2022-2035 (Million Liters)

- Table 20.2 ADC Therapeutics: Annual Demand for Outsourcing, 2022-2030 (in kilograms)

- Table 20.3 ADC Therapeutics: Annual Supply for Outsourcing, 2022-2030 (in kilograms)

- Table 23.1 List of Virtual Biopharmaceutical Companies

- Table 24.1 Global Biopharmaceuticals Market: Patent Approval and Expiry Details of Best- selling Biologics

- Table 26.1 Survey Analysis: Overview of Respondents

- Table 26.2 Survey Analysis: Distribution of Respondents by Designation

- Table 26.3 Survey Analysis: Biologics Manufacturing Expertise

- Table 26.4 Survey Analysis: Scale of Manufacturing

- Table 26.5 Survey Analysis: Location of Production Facilities

- Table 26.6 Survey Analysis: Type of Expression System Used

- Table 26.7 Survey Analysis: Type of Bioreactor Used

- Table 26.8 Survey Analysis: Mode of Operation of Bioreactor

- Table 29.1 Biopharmaceutical CMOs: Distribution by Year of Establishment

- Table 29.2 Biopharmaceutical CMOs: Distribution by Company Size

- Table 29.3 Biopharmaceutical CMOs: Distribution by Location of Headquarters (Region- wise)

- Table 29.4 Biopharmaceutical CMOs: Distribution by Location of Headquarters (Country- wise)

- Table 29.5 Biopharmaceutical CMOs: Distribution by Company Size, Year of Establishment and Location of Headquarters

- Table 29.6 Biopharmaceutical CMOs: Distribution by Type of Service(s) Offered

- Table 29.7 Biopharmaceutical CMOs: Distribution by Type of Biologic Manufactured

- Table 29.8 Biopharmaceutical CMOs: Distribution by Type of Biologic Manufactured and Location of Headquarters

- Table 29.9 Biopharmaceutical CMOs: Distribution by Type of Biologic Manufactured and Company Size

- Table 29.10 Biopharmaceutical CMOs: Distribution by Scale of Operation

- Table 29.11 Biopharmaceutical CMOs: Distribution by Type of Biologic Manufactured and Scale of Operation

- Table 29.12 Biopharmaceutical CMOs: Distribution by Type of Expression System Used

- Table 29.13 Biopharmaceutical CMOs: Distribution by Type of Expression System Used and Location of Headquarters

- Table 29.14 Biopharmaceutical CMOs: Distribution by Type of Bioreactor Used

- Table 29.15 Biopharmaceutical CMOs: Distribution by Mode of Operation of Bioreactor

- Table 29.16 Regional Distribution of Biopharmaceutical Contract Manufacturing Facilities

- Table 29.17 Biopharmaceutical Contract Manufacturing Facilities: Distribution of Type of Service(s) Offered

- Table 29.18 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Scale of Operation

- Table 29.19 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Type of Expression System Used

- Table 29.20 AGC Biologics: Annual Revenues FY 2017-Q1 2022 (JPY Billion)

- Table 29.21 Catalent: Annual Revenues, FY 2017-9M 2022 (USD Million)

- Table 29.22 Cytiva: Annual Revenues, FY 2017-FY 2021 (USD Million)

- Table 29.23 FUJIFILM Diosynth Biotechnologies: Annual Revenues, FY 2017-FY 2021 (JPY Billion)

- Table 29.24 FUJIFILM Holdings: Annual Revenues by Business Divisions (JPY Billion)

- Table 29.25 Patheon: Annual Revenues, FY 2017-FY 2021 (USD Million)

- Table 29.26 Piramal Enterprises: Annual Revenues, FY 2017-FY 2021 (INR Crores)

- Table 29.27 Boehringer Ingelheim: Annual Revenues, FY 2017-FY 2021 (EUR Billion)

- Table 29.28 Lonza: Annual Revenues, FY 2017-FY 2021 (CHF Billion)

- Table 29.29 Lonza: Annual Revenues by Business Divisions (CHF Billion)

- Table 29.30 Sandoz: Annual Revenues, FY 2017-Q1 2022 (USD Billion)

- Table 29.31 WuXi Biologics: Annual Revenues, FY 2017-FY 2021 (RMB Million)

- Table 29.32 Takara Bio: Annual Revenues, FY 2017-FY 2021 (JPY Million)

- Table 29.33 Celltrion: Annual Revenues, FY 2017-Q1 2022 (KRW Billion)

- Table 29.34 Samsung Biologics: Annual Revenues, FY 2017-Q1 2022 (KRW Billion)

- Table 29.35 Bispecific Antibody Therapeutics Pipeline: Distribution by Phase of Development

- Table 29.36 Bispecific Antibody Therapeutics Pipeline: Distribution by Target Indication

- Table 29.37 Antibody Drug Conjugates: Distribution by Status of Development

- Table 29.38 Antibody Drug Conjugates: Distribution by Target Indication

- Table 29.39 Key ADC Technology Providers: Distribution by Number of Candidates

- Table 29.40 Stem Cell Therapies: Distribution by Phase of Development

- Table 29.41 T-Cell Therapies: Distribution by Phase of Development

- Table 29.42 Gene Therapies: Distribution by Stage of Development

- Table 29.43 Gene Therapies: Distribution by Phase of Development

- Table 29.44 Clinical and Commercial Pipeline of Gene Therapies: Distribution by Type of Vector Used

- Table 29.45 Early-Stage Pipeline of Gene Therapies: Distribution by Type of Vector Used

- Table 29.46 Clinical and Commercial Pipeline of Gene Therapies: Distribution by Therapeutic Area

- Table 29.47 Early-Stage Pipeline of Gene Therapies: Distribution by Therapeutic Area

- Table 29.48 Viral Vector Manufacturers: Distribution by Location of Manufacturing Facility

- Table 29.49 Plasmid DNA Manufacturers: Distribution by Location of Manufacturing Facility

- Table 29.50 Biosimilars: Historical Trend of FDA Approval, 2015-2021

- Table 29.51 Small Molecule and Large Molecule Drugs: Historical Trend of FDA Approval, 2005-2021

- Table 29.52 Big Pharma Players: Distribution by Number of Biopharmaceutical Contract Manufacturing Focused Initiatives, 1980-2022

- Table 29.53 Big Pharma Players: Cumulative Distribution by Year of Initiative

- Table 29.54 Big Pharma Players: Distribution by Purpose of Initiative

- Table 29.55 Big Pharma Players: Distribution by Type of Initiative

- Table 29.56 Big Pharma Players: Distribution by Type of Expansion

- Table 29.57 Big Pharma Players: Distribution by Scale of Operation

- Table 29.58 Big Pharma Players: Distribution by Type of Biologic Manufactured

- Table 29.59 Big Pharma Players: Distribution by Purpose of Initiative and Company

- Table 29.60 Big Pharma Players: Distribution by Year and Type of Initiative

- Table 29.61 Big Pharma Players: Distribution by Region of Expansion and Company

- Table 29.62 Partnerships and Collaborations: Cumulative Year-wise Trend, 2015-2022

- Table 29.63 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 29.64 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured

- Table 29.65 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Biologic Manufactured

- Table 29.66 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured and Geography

- Table 29.67 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 29.68 Most Active Players: Distribution by Number of Partnerships

- Table 29.69 Partnerships and Collaborations: Local and International Agreements

- Table 29.70 Mergers and Acquisitions: Cumulative Year-Wise Trend (2015-2022)

- Table 29.71 Mergers and Acquisitions: Distribution by Type of Acquisition

- Table 29.72 Mergers and Acquisitions: Distribution by Region (Continent-wise)

- Table 29.73 Mergers and Acquisitions: Distribution by Region (Country-wise)

- Table 29.74 Mergers and Acquisitions: Year-Wise Trend in North America, Europe and Asia- Pacific (2015-2022)

- Table 29.75 Most Active Acquirers: Distribution by Number of Acquisitions

- Table 29.76 Mergers and Acquisitions: Distribution by Key Value Drivers

- Table 29.77 Mergers and Acquisitions: Distribution by Year of Acquisition and Key Value Drivers

- Table 29.78 Mergers and Acquisitions: Distribution by Type of Biologic Manufactured

- Table 29.79 Mergers and Acquisitions: Distribution by Key Value Drivers and Type of Biologic Manufactured

- Table 29.80 Mergers and Acquisitions: Year-wise Trend of Deal Multiple Amount (USD Million)

- Table 29.81 Recent Expansions: Cumulative Year-wise Trend, 2016-2022

- Table 29.82 Recent Expansions: Distribution by Purpose of Expansion

- Table 29.83 Recent Expansions: Distribution by Year and Purpose of Expansion

- Table 29.84 Recent Expansions: Distribution by Type of Biologic Manufactured

- Table 29.85 Recent Expansions: Distribution by Purpose of Expansion and Type of Biologic Manufactured

- Table 29.86 Recent Expansions: Distribution by Location of Expanded Facility

- Table 29.87 Most Active Players: Distribution by Number of Recent Expansions

- Table 29.88 Recent Expansions: Distribution by Location of Headquarters and Purpose of Expansion

- Table 29.89 Recent Expansions: Distribution by Amount Invested (USD Million)

- Table 29.90 Funding and Investment Analysis: Cumulative Year-wise Trend of Number of Funding Instances, 2016-2022

- Table 29.91 Funding and Investment Analysis: Cumulative Year-wise Trend of Total Amount Invested, 2016-2022 (USD Million)

- Table 29.92 Funding and Investment Analysis: Distribution of Number of Funding Instances by Type of Funding

- Table 29.93 Funding and Investment Analysis: Distribution of Total Amount Invested by Type of Funding (USD Million)

- Table 29.94 Funding and Investment Analysis: Distribution by Year and Type of Funding, 2016-2022

- Table 29.95 Funding and Investment Analysis: Distribution of Number of Funding Instances and Total Amount Invested by Geography (Continent-wise) (USD Million)

- Table 29.96 Funding and Investment Analysis: Distribution of Number of Funding Instances and Total Amount Invested by Geography (Country-wise) (USD Million)

- Table 29.97 Most Active Players: Distribution by Number of Funding Instances

- Table 29.98 Most Active Players: Distribution by Total Amount Raised (USD Million)

- Table 29.99 Most Active Investors: Distribution by Number of Funding Instances

- Table 29.100 Capacity Analysis: Distribution by Company Size

- Table 29.101 Capacity Analysis: Distribution by Type of Expression System Used

- Table 29.102 Capacity Analysis: Distribution by Scale of Operation

- Table 29.103 Capacity Analysis: Distribution by Region

- Table 29.104 Capacity Analysis: Biopharmaceutical Contract Manufacturing Capacity in North America

- Table 29.105 Capacity Analysis: Biopharmaceutical Contract Manufacturing Capacity in Europe

- Table 29.106 Capacity Analysis: Biopharmaceutical Contract Manufacturing Capacity in Asia- Pacific

- Table 29.107 Global Demand for Biopharmaceuticals, 2022-2035 (in kilograms)

- Table 29.108 Demand Analysis: Distribution of Annual Demand by Therapeutic Area

- Table 29.109 Demand and Supply Scenario for Biopharmaceuticals, 2022-2035 (Million Liters)

- Table 29.110 Demand Analysis: Annual Demand for ADC Therapeutics (in kilograms), 2022- 2030

- Table 29.111 Global Demand for Cell Therapies, 2022-2030 (in terms of Number of Patients)

- Table 29.112 Global Demand for Cell Therapies, 2022-2030 (Billion Cells)

- Table 29.113 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, 2022-2042 (USD Million)

- Table 29.114 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations: Distribution by CAPEX and OPEX, 2023 and 2042 (USD Million)

- Table 29.115 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, 2023: Distribution of CAPEX (USD Million)

- Table 29.116 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, 2023-2042: Distribution by OPEX (USD Million)

- Table 29.117 Global Biopharmaceutical Contract Manufacturing Market, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.118 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Service(s) Offered, 2022 and 2035

- Table 29.119 Biopharmaceutical Contract Manufacturing Market for APIs, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.120 Biopharmaceutical Contract Manufacturing Market for FDFs, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.121 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Biologic Manufactured

- Table 29.122 Biopharmaceutical Contract Manufacturing Market for Antibodies, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.123 Biopharmaceutical Contract Manufacturing Market for Cell Therapies, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.124 Biopharmaceutical Contract Manufacturing Market for Vaccines, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.125 Biopharmaceutical Contract Manufacturing Market for Other Biologics, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.126 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Expression System Used

- Table 29.127 Biopharmaceutical Contract Manufacturing Market for Mammalian Cell-based Operations, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.128 Biopharmaceutical Contract Manufacturing Market for Microbial Cell-based Operations, Conservative, Base and Optimistic Scenarios 2022-2035 (USD Billion)

- Table 29.129 Biopharmaceutical Contract Manufacturing Market for Other Expression System- based Operations, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.130 Biopharmaceutical Contract Manufacturing Market: Distribution by Scale of Operation

- Table 29.131 Biopharmaceutical Contract Manufacturing Market for Preclinical / Clinical Operations, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.132 Biopharmaceutical Contract Manufacturing Market for Commercial Operations, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.133 Biopharmaceutical Contract Manufacturing Market: Distribution by Company Size

- Table 29.134 Biopharmaceutical Contract Manufacturing Market for Small Companies, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.135 Biopharmaceutical Contract Manufacturing Market for Mid-sized Companies, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.136 Biopharmaceutical Contract Manufacturing Market for Large and Very Large Companies, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.137 Biopharmaceutical Contract Manufacturing Market: Distribution by Geography

- Table 29.138 Biopharmaceutical Contract Manufacturing Market in North America, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.139 Biopharmaceutical Contract Manufacturing Market in the US, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.140 Biopharmaceutical Contract Manufacturing Market in Canada, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.141 Biopharmaceutical Contract Manufacturing Market in Europe, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.142 Biopharmaceutical Contract Manufacturing Market in Italy, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.143 Biopharmaceutical Contract Manufacturing Market in Germany, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.144 Biopharmaceutical Contract Manufacturing Market in France, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.145 Biopharmaceutical Contract Manufacturing Market in Spain, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.146 Biopharmaceutical Contract Manufacturing Market in the UK, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.147 Biopharmaceutical Contract Manufacturing Market in Rest of Europe, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.148 Biopharmaceutical Contract Manufacturing Market in Asia-Pacific, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.149 Biopharmaceutical Contract Manufacturing Market in China, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.150 Biopharmaceutical Contract Manufacturing Market in India, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.151 Biopharmaceutical Contract Manufacturing Market in South Korea, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.152 Biopharmaceutical Contract Manufacturing Market in Japan, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.153 Biopharmaceutical Contract Manufacturing Market in Rest of Asia-Pacific, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.154 Biopharmaceutical Contract Manufacturing Market in Latin America, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.155 Biopharmaceutical Contract Manufacturing Market in Middle East and North Africa, Conservative, Base and Optimistic Scenarios, 2022-2035 (USD Billion)

- Table 29.156 Overall Share of Virtual Biopharmaceutical Companies in the Biopharmaceutical Market in 2022 (USD Billion)

- Table 29.157 Global Biopharmaceuticals Market: Distribution of Number of FDA Approvals by Year, 2005-2022

- Table 29.158 Survey Analysis: Distribution of Respondents by Company Type

- Table 29.159 Survey Analysis: Distribution of Respondents by Location of Headquarters

- Table 29.160 Survey Analysis: Distribution of Respondents by Designation

- Table 29.161 Survey Analysis: Distribution by Biologics Manufacturing Expertise

- Table 29.162 Survey Analysis: Distribution by Scale of Manufacturing

- Table 29.163 Survey Analysis: Distribution by Location of Production Facilities

- Table 29.164 Survey Analysis: Distribution by Type of Expression System Used

- Table 29.168 Survey Analysis: Distribution by Mode of Operation of Bioreactor

LIST OF FIGURES

- Figure 2.1 Executive Summary: Overall Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.3 Executive Summary: Mergers and Acquisitions

- Figure 2.4 Executive Summary: Recent Expansions

- Figure 2.5 Executive Summary: Demand Analysis

- Figure 2.6 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Types of Biopharmaceuticals

- Figure 3.2 Types of Expression Systems Used for the Production of Biopharmaceuticals

- Figure 3.3 Stages of the Biomanufacturing Process

- Figure 3.4 Types of Third-Party Service Providers

- Figure 3.5 Commonly Outsourced Biopharmaceutical Contract Manufacturing Operations

- Figure 4.1 Biopharmaceutical Contract Manufacturers: Distribution by Year of Establishment

- Figure 4.2 Biopharmaceutical Contract Manufacturers: Distribution by Company Size

- Figure 4.3 Biopharmaceutical Contract Manufacturers: Distribution by Location of Headquarters (Region-wise)

- Figure 4.4 Biopharmaceutical Contract Manufacturers: Distribution by Location of Headquarters (Country-wise)

- Figure 4.5 Biopharmaceutical Contract Manufacturers: Distribution by Company Size, Year of Establishment and Location of Headquarters

- Figure 4.6 Biopharmaceutical CMOs: Distribution by Type of Service(s) Offered

- Figure 4.7 Biopharmaceutical CMOs: Distribution by Type of Biologic Manufactured

- Figure 4.8 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured and Location of Headquarters

- Figure 4.9 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured and Company Size

- Figure 4.10 Biopharmaceutical Contract Manufacturers: Distribution by Scale of Operation

- Figure 4.11 Biopharmaceutical Contract Manufacturers: Distribution by Type of Biologic Manufactured and Scale of Operation

- Figure 4.12 Biopharmaceutical Contract Manufacturers: Distribution by Type of Expression System Used

- Figure 4.13 Biopharmaceutical Contract Manufacturers: Distribution by Types of Expression Systems Used and Location of Headquarters

- Figure 4.14 Biopharmaceutical Contract Manufacturers: Distribution by Type of Bioreactor Used

- Figure 4.15 Biopharmaceutical Contract Manufacturers: Distribution by Mode of Operation of Bioreactor

- Figure 5.1 Regional Distribution of Biopharmaceutical Contract Manufacturing Facilities

- Figure 5.2 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Type of Service(s) Offered

- Figure 5.3 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Scale of Operation

- Figure 5.4 Biopharmaceutical Contract Manufacturing Facilities: Distribution by Type of Expression System Used

- Figure 5.5 Regional Capability Analysis: Biopharmaceutical Contract Manufacturers in North America

- Figure 5.6 Regional Capability Analysis: Biopharmaceutical Contract Manufacturers in Europe

- Figure 5.7 Regional Capability Analysis: Biopharmaceutical Contract Manufacturers in Asia-Pacific and Rest of the World

- Figure 6.1 Biopharmaceutical Industry: The US Market Scenario

- Figure 6.2 Biopharmaceutical Contract Manufacturing in the US: Growth Drivers and Challenges

- Figure 6.3 US FDA Guidelines: Elements of a Quality Agreement

- Figure 6.4 US FDA Guidelines: Key Considerations for Biologic Manufacturing Operations

- Figure 6.5 AGC Biologics: Annual Revenues, FY 2017-Q1 2022 (JPY Billion)

- Figure 6.6 Catalent: Service Portfolio

- Figure 6.7 Catalent: Biosimilars Service Portfolio

- Figure 6.8 Catalent: Annual Revenues, FY 2017-9M 2022 (USD Million)

- Figure 6.9 Cytiva: Service Portfolio

- Figure 6.10 Cytiva: Annual Revenues, FY 2017-FY 2021 (USD Million)

- Figure 6.11 FUJIFILM Diosynth Biotechnologies: Service Portfolio

- Figure 6.12 FUJIFILM Diosynth Biotechnologies: Annual Revenues, FY 2017-FY 2021 (JPY Billion)

- Figure 6.13 FUJIFILM Holdings: Annual Revenues by Business Divisions (JPY Billion)

- Figure 6.14 KBI Biopharma: Service Portfolio

- Figure 6.15 Patheon: Service Portfolio

- Figure 6.16 Patheon: Services and Solutions for Biologics

- Figure 6.17 Patheon: Annual Revenues, FY 2017-FY 2021 (USD Million)

- Figure 6.18 Piramal Enterprises: Annual Revenues, FY 2017-FY 2021 (INR Crores)

- Figure 7.1 Biopharmaceutical Contract Manufacturing in Europe: Growth Drivers and Challenges

- Figure 7.2 EMA GMP Guidelines: Key Considerations of the Contract Giver, Contract Acceptor and the Contract

- Figure 7.3 Boehringer Ingelheim: Service Portfolio

- Figure 7.4 Boehringer Ingelheim: Annual Revenues, FY 2017-FY 2021 (EUR Billion)

- Figure 7.5 Lonza: Service Portfolio

- Figure 7.6 Lonza: Annual Revenues, FY 2017-FY 2021 (CHF Billion)

- Figure 7.7 Lonza: Annual Revenues by Business Divisions (CHF Billion)

- Figure 7.8 Novasep: Product Portfolio

- Figure 7.9 Rentschler Biopharma: Service Portfolio

- Figure 7.10 Sandoz: Annual Revenues, FY 2017-Q1 2022 (USD Billion)

- Figure 8.1 Chinese Regulatory Guidelines: Key Considerations of the Contract Giver

- Figure 8.2 Chinese Regulatory Guidelines: Key Considerations of the Contract Acceptor

- Figure 8.3 Chinese Regulatory Guidelines: Key Aspects of the Contract

- Figure 8.4 Biopharmaceutical Contract Manufacturing in China: Challenges

- Figure 8.5 WuXi Biologics: Service Portfolio

- Figure 8.6 Wuxi Biologics: Annual Revenues, FY 2017-FY 2021 (RMB Million)

- Figure 8.7 Biopharmaceutical Contract Manufacturing in India: Growth Drivers

- Figure 8.8 Biopharmaceutical Contract Manufacturing in India: Challenges

- Figure 8.9 Minaris Regenerative Medicine: Service Portfolio

- Figure 8.10 Takara Bio: Service Portfolio

- Figure 8.11 Takara Bio: Annual Revenues, FY 2017-FY 2021 (JPY Million)

- Figure 8.12 Celltrion: Service Portfolio

- Figure 8.13 Celltrion: Annual Revenues, FY 2017-Q1 2022 (KRW Billion)

- Figure 8.14 Samsung BioLogics: Service Portfolio

- Figure 8.15 Samsung BioLogics: Annual Revenues, FY 2017-Q1 2022 (KRW Billion)

- Figure 8.16 Cell Therapies: Service Portfolio

- Figure 8.17 Luina Bio: Service Portfolio

- Figure 9.1 Structure of a Bispecific Antibody

- Figure 9.2 Bispecific Antibody Therapeutics Pipeline: Distribution by Phase of Development

- Figure 9.3 Bispecific Antibody Therapeutics Pipeline: Distribution by Target Indication

- Figure 9.4 Structure of an Antibody Drug Conjugate (ADC)

- Figure 9.5 Antibody Drug Conjugates: Distribution by Status of Development

- Figure 9.6 Antibody Drug Conjugates: Distribution by Target Indication

- Figure 9.7 Key ADC Technology Providers: Distribution by Number of Candidates

- Figure 9.8 Decentralized Manufacturing: Process Model

- Figure 9.9 Cell Therapy Manufacturing: Challenges and Growth Drivers

- Figure 9.10 Cell Therapy: Potency as Critical Quality Attribute

- Figure 9.11 Stem Cell Therapies: Distribution by Phase of Development

- Figure 9.12 T-Cell Therapies: Distribution by Phase of Development

- Figure 9.13 Gene Therapies: Distribution by Stage of Development

- Figure 9.14 Gene Therapies: Distribution by Phase of Development

- Figure 9.15 Clinical and Commercial Pipeline of Gene Therapies: Distribution by Type of Vector Used

- Figure 9.16 Early-Stage Pipeline of Gene Therapies: Distribution by Type of Vector Used

- Figure 9.17 Clinical and Commercial Pipeline of Gene Therapies: Distribution by Therapeutic Area

- Figure 9.18 Early-Stage Pipeline of Gene Therapies: Distribution by Therapeutic Area

- Figure 9.19 Viral Vector Manufacturers: Distribution by Location of Manufacturing Facility

- Figure 9.20 Plasmid DNA Manufacturers: Distribution by Location of Manufacturing Facility

- Figure 10.1 Manufacturing Stages of a Biosimilar Product

- Figure 10.2 Analytical and Functional Characterization Methods for Key Biosimilar Product

- Figure 10.3 Regulatory Process Adopted for Licensing of a Biosimilar Product

- Figure 10.4 Need for Outsourcing Biosimilar Manufacturing Operations

- Figure 10.5 Biosimilars: Historical Trend of FDA Approval, 2015-2021

- Figure 10.6 Challenges Associated with Outsourcing Biosimilar Manufacturing Operations

- Figure 11.1 Small Molecule and Large Molecule Drugs: Historical Trend of FDA Approval, 2005-2021

- Figure 11.2 Small Molecules versus Large Molecules: Comparison of Manufacturing Process

- Figure 12.1 Benefits Associated with In-House Manufacturing

- Figure 12.2 Risks Associated with In-House Manufacturing

- Figure 12.3 Advantages and Disadvantages of Different Types of Outsourcing Partnerships

- Figure 13.1 Make versus Buy Decision Making Framework

- Figure 13.2 Make versus Buy Decision Making: Possible Scenario Descriptions

- Figure 14.1 Big Pharma Players: Distribution by Number of Biopharmaceutical Contract Manufacturing Focused Initiatives, 1980-2022

- Figure 14.2 Big Pharma Players: Cumulative Distribution by Year of Initiative

- Figure 14.3 Big Pharma Players: Distribution by Purpose of Initiative

- Figure 14.4 Big Pharma Players: Distribution by Type of Initiative

- Figure 14.5 Big Pharma Players: Distribution by Type of Partnership

- Figure 14.6 Big Pharma Players: Distribution by Type of Expansion

- Figure 14.7 Big Pharma Players: Distribution by Scale of Operation

- Figure 14.8 Big Pharma Players: Distribution by Type of Biologic Manufactured

- Figure 14.9 Big Pharma Players: Distribution by Year of Initiative and Company (Heat Map Representation)

- Figure 14.10 Big Pharma Players: Distribution by Purpose of Initiative and Company

- Figure 14.11 Big Pharma Players: Distribution by Year and Type of Initiative

- Figure 14.12 Big Pharma Players: Distribution by Region of Expansion and Company

- Figure 14.13 Big Pharma Players: Distribution by Type of Biologic Manufactured and Company

- Figure 14.14 Big Pharma Players: Distribution of Top Pharmaceutical Companies (Heat Map Representation)

- Figure 15.1 Partnerships and Collaborations: Cumulative Year-wise Trend, 2015-2022

- Figure 15.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 15.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 15.4 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured

- Figure 15.5 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Biologic Manufactured

- Figure 15.6 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Biologic Manufactured

- Figure 15.7 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured and Geography

- Figure 15.8 Partnerships and Collaborations: Distribution by Therapeutic Area

- Figure 15.9 Most Active Players: Distribution by Number of Partnerships

- Figure 15.10 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 15.11 Partnerships and Collaborations: Local and International Agreements

- Figure 16.1 Mergers and Acquisitions: Year-Wise Cumulative Trend (2015- 2022)

- Figure 16.2 Mergers and Acquisitions: Distribution by Type of Acquisition

- Figure 16.3 Mergers and Acquisitions: Distribution by Region (Continent-wise)

- Figure 16.4 Mergers and Acquisitions: Distribution by Region (Country-wise)

- Figure 16.5 Mergers and Acquisitions: Year-Wise Trend in North America, Europe and Asia-Pacific (2015- 2022)

- Figure 16.6 Most Active Acquirers: Distribution by Number of Acquisitions

- Figure 16.7 Catalent Biologics: Information on Key Acquisitions

- Figure 16.8 Mergers and Acquisitions: Distribution by Key Value Drivers

- Figure 16.9 Mergers and Acquisitions: Distribution by Year of Acquisition and Key Value Drivers

- Figure 16.10 Mergers and Acquisitions: Distribution by Type of Biologic Manufactured

- Figure 16.11 Mergers and Acquisitions: Distribution by Key Value Drivers and Type of Biologic Manufactured

- Figure 16.12 Mergers and Acquisitions: Year-Wise Trend of Deal Multiple Amount (USD Million)

- Figure 17.1 Recent Expansions: Cumulative Year-wise Trend, 2016-2022

- Figure 17.2 Recent Expansions: Distribution by Purpose of Expansion

- Figure 17.3 Recent Expansions: Distribution by Year and Purpose of Expansion

- Figure 17.4 Recent Expansions: Distribution by Type of Biologic Manufactured

- Figure 17.5 Recent Expansions: Distribution by Purpose of Expansion and Type of Biologic Manufactured

- Figure 17.6 Recent Expansions: Distribution by Location of Expanded Facility

- Figure 17.7 Most Active Players: Distribution by Number of Recent Expansions

- Figure 17.8 Recent Expansions: Distribution by Location of Headquarters and Purpose of Expansion

- Figure 17.9 Recent Expansions: Distribution by Amount Invested (USD Million)

- Figure 17.10 Recent Expansions: Regional Comparison 2016-2020 and 2016-2022 Scenario

- Figure 18.1 Funding and Investment Analysis: Cumulative Year-wise Trend of Number of Funding Instances, 2016-2022

- Figure 18.2 Funding and Investments: Cumulative Year-wise Trend of Total Amount Invested, 2016-2022 (USD Million)

- Figure 18.3 Funding and Investment Analysis: Distribution of Number of Instances by Type of Funding

- Figure 18.4 Funding and Investment Analysis: Distribution of Total Amount Invested by Type of Funding (USD Million)

- Figure 18.5 Funding and Investment Analysis: Distribution by Year and Type of Funding

- Figure 18.6 Funding and Investment Analysis: Distribution of Number of Funding Instances and Total Amount Invested by Geography (Continent-wise) (USD Million)

- Figure 18.7 Funding and Investment Analysis: Distribution of Number of Funding Instances and Total Amount Invested by Geography (Country-wise) (USD Million)

- Figure 18.8 Most Active Players: Distribution by Number of Funding Instances

- Figure 18.9 Most Active Players: Distribution by Total Amount Invested (USD Million)

- Figure 18.10 Most Active Investors: Analysis by Number of Funding Instances

- Figure 19.1 Capacity Analysis: Distribution by Company Size

- Figure 19.2 Capacity Analysis: Distribution by Type of Expression System Used

- Figure 19.3 Capacity Analysis: Distribution by Scale of Operation

- Figure 19.4 Capacity Analysis: Distribution by Region

- Figure 19.5 Capacity Analysis: Biopharmaceutical Contract Manufacturing Capacity in North America

- Figure 19.6 Capacity Analysis: Biopharmaceutical Contract Manufacturing Capacity in Europe

- Figure 19.7 Capacity Analysis: Biopharmaceutical Contract Manufacturing Capacity in Asia-Pacific

- Figure 20.1 Global Demand for Biopharmaceuticals, 2022-2035 (in kilograms)

- Figure 20.2 Demand Analysis: Distribution of Annual Demand by Therapeutic Area

- Figure 20.3 Demand and Supply Scenario for Biopharmaceuticals, 2022-2035 (Million Liters)

- Figure 20.4 Demand Analysis: Annual Demand for ADC Therapeutics (in kilograms), 2022-2030

- Figure 20.5 ADC Therapeutics: Demand and Supply Scenario, 2022-2030

- Figure 20.6 Global Demand for Cell Therapies, 2022-2030 (in terms of Number of Patients)

- Figure 20.7 Global Demand for Cell Therapies, 2022-2030 (Billion Cells)

- Figure 21.1 Total Cost of Ownership: Capital Expenditures (CAPEX)

- Figure 21.2 Total Cost of Ownership: Operational Expenditures (OPEX)

- Figure 21.3 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, 2022-2042 (USD Million)

- Figure 21.4 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations: Distribution by CAPEX and OPEX, 2023 and 2042 (USD Million)

- Figure 21.5 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, 2023: Distribution by CAPEX (USD Million)

- Figure 21.6 Total Cost of Ownership for Mid-sized Biopharmaceutical Contract Manufacturing Organizations, 2023-2042: Distribution by OPEX (USD Million)

- Figure 22.1 Global Biopharmaceutical Contract Manufacturing Market, 2022-2035 (USD Billion)

- Figure 22.2 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Service(s) Offered

- Figure 22.3 Biopharmaceutical Contract Manufacturing Market for APIs, 2022-2035 (USD Billion)

- Figure 22.4 Biopharmaceutical Contract Manufacturing Market for FDFs, 2022-2035 (USD Billion)

- Figure 22.5 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Biologic Manufactured

- Figure 22.6 Biopharmaceutical Contract Manufacturing Market for Antibodies, 2022-2035 (USD Billion)

- Figure 22.7 Biopharmaceutical Contract Manufacturing Market for Cell Therapies, 2022-2035 (USD Billion)

- Figure 22.8 Biopharmaceutical Contract Manufacturing Market for Vaccines, 2022-2035 (USD Billion)

- Figure 22.9 Biopharmaceutical Contract Manufacturing Market for Other Biologics, 2022-2035 (USD Billion)

- Figure 22.10 Biopharmaceutical Contract Manufacturing Market: Distribution by Type of Expression System Used

- Figure 22.11 Biopharmaceutical Contract Manufacturing Market for Mammalian Cell-based Operations, 2022-2035 (USD Billion)

- Figure 22.12 Biopharmaceutical Contract Manufacturing Market for Microbial Cell-based Operations, 2022-2035 (USD Billion)

- Figure 22.13 Biopharmaceutical Contract Manufacturing Market for Other Expression System-based Operations, 2022-2035 (USD Billion)

- Figure 22.14 Biopharmaceutical Contract Manufacturing Market: Distribution by Scale of Operation

- Figure 22.15 Biopharmaceutical Contract Manufacturing Market for Clinical Operations, 2022-2035 (USD Billion)

- Figure 22.16 Biopharmaceutical Contract Manufacturing Market for Commercial Operations, 2022-2035 (USD Billion)

- Figure 22.17 Biopharmaceutical Contract Manufacturing Market: Distribution by Company Size

- Figure 22.18 Biopharmaceutical Contract Manufacturing Market for Small Companies, 2022-2035 (USD Billion)

- Figure 22.19 Biopharmaceutical Contract Manufacturing Market for Mid-sized Companies, 2022-2035 (USD Billion)

- Figure 22.20 Biopharmaceutical Contract Manufacturing Market for Large and Very Large Companies, 2022-2035 (USD Billion)

- Figure 22.21 Biopharmaceutical Contract Manufacturing Market: Distribution by Geography

- Figure 22.22 Biopharmaceutical Contract Manufacturing Market in North America, 2022-2035 (USD Billion)

- Figure 22.23 Biopharmaceutical Contract Manufacturing Market in the US, 2022-2035 (USD Billion)

- Figure 22.24 Biopharmaceutical Contract Manufacturing Market in Canada, 2022-2035 (USD Billion)

- Figure 22.25 Biopharmaceutical Contract Manufacturing Market in Europe, 2022-2035 (USD Billion)

- Figure 22.26 Biopharmaceutical Contract Manufacturing Market in Italy, 2022-2035 (USD Billion)

- Figure 22.27 Biopharmaceutical Contract Manufacturing Market in Germany, 2022-2035 (USD Billion)

- Figure 22.28 Biopharmaceutical Contract Manufacturing Market in France, 2022-2035 (USD Billion)

- Figure 22.29 Biopharmaceutical Contract Manufacturing Market in Spain, 2022-2035 (USD Billion)

- Figure 22.30 Biopharmaceutical Contract Manufacturing Market in the UK, 2022-2035 (USD Billion)

- Figure 22.31 Biopharmaceutical Contract Manufacturing Market in Rest of Europe, 2022-2035 (USD Billion)

- Figure 22.32 Biopharmaceutical Contract Manufacturing Market in Asia-Pacific, 2022-2035 (USD Billion)

- Figure 22.33 Biopharmaceutical Contract Manufacturing Market in China, 2022-2035 (USD Billion)

- Figure 22.34 Biopharmaceutical Contract Manufacturing Market in India, 2022-2035 (USD Billion)

- Figure 22.35 Biopharmaceutical Contract Manufacturing Market in South Korea, 2022-2035 (USD Billion)

- Figure 22.36 Biopharmaceutical Contract Manufacturing Market in Japan, 2022-2035 (USD Billion)

- Figure 22.37 Biopharmaceutical Contract Manufacturing Market in Rest of Asia-Pacific, 2022-2035 (USD Billion)

- Figure 22.38 Biopharmaceutical Contract Manufacturing Market in Latin America, 2022-2035 (USD Billion)

- Figure 22.39 Biopharmaceutical Contract Manufacturing Market in Middle East and North Africa, 2022-2035 (USD Billion)

- Figure 23.1 Overall Share of Virtual Biopharmaceutical Companies in the Biopharmaceutical Market (USD Billion)

- Figure 23.2 Overall Share of Virtual Biopharmaceutical Companies in the Biopharmaceutical Contract Manufacturing Market in 2022 (USD Billion)

- Figure 24.1 Biopharmaceutical Contract Manufacturing: SWOT Analysis

- Figure 24.2 Global Biopharmaceuticals Market: Distribution of Number of FDA Approvals by Year, 2005-2022

- Figure 24.3 Comparison of SWOT Factors: Harvey Ball Analysis

- Figure 26.1 Survey Analysis: Distribution of Respondents by Company Type

- Figure 26.2 Survey Analysis: Distribution of Respondents by Location of Headquarters

- Figure 26.3 Survey Analysis: Distribution of Respondents by Designation

- Figure 26.4 Survey Analysis: Distribution by Biologics Manufacturing Expertise

- Figure 26.5 Survey Analysis: Distribution by Scale of Manufacturing

- Figure 26.6 Survey Analysis: Distribution by Location of Production Facilities

- Figure 26.7 Survey Analysis: Distribution by Type of Expression System Used

- Figure 26.8 Survey Analysis: Distribution by Type of Bioreactor Used

- Figure 26.9 Survey Analysis: Distribution by Mode of Operation of Bioreactor

- Figure 27.1 Concluding Remarks: Overall Market Landscape

- Figure 27.2 Concluding Remarks: Partnerships and Collaborations

- Figure 27.3 Concluding Remarks: Mergers and Acquisitions

- Figure 27.4 Concluding Remarks: Recent Expansions

- Figure 27.5 Concluding Remarks: Capacity Analysis

- Figure 27.6 Concluding Remarks: Demand Analysis

- Figure 27.7 Concluding Remarks: Market Forecast and Opportunity Analysis

- Figure 27.8 Concluding Remarks: Market Forecast and Opportunity Analysis

INTRODUCTION

Over the last few decades, the development landscape of small molecule drugs has been significantly impacted by various biotechnology breakthroughs. Further, with the advent of novel technologies, biologics have made a significant impact in the pharmaceutical domain, delivering ground-breaking treatment for a myriad of disease indications, including immunological, oncological and rare disorders. In this context, it is worth highlighting those 14 biopharmaceutical products (including cell therapies, gene therapies, monoclonal antibodies and recombinant proteins) were approved in the US alone, in 2021. Further, promising results from ongoing clinical research initiatives have encouraged various government and private firms to make significant investments in this domain. For instance, in 2021, a sum of over USD 70 billion was invested in the cell and gene therapy domain. However, manufacturing of biologics is fraught with various challenges. Some of the key concerns of contemporary innovators include rate of attrition of pipeline drugs / therapies, prolonged development timelines, current facility limitations, regulatory and compliance-related issues, and inconsistencies related to quality attributes of the final product. Therefore, therapy developers are actively exploring avenues that enable them to overcome the existing challenges. Amongst other alternatives, outsourcing has emerged as a lucrative option for biologic drug developers.

Currently, a significant number of players engaged in the biopharmaceutical domain prefer to outsource various operations to contract service providers. In fact, currently over 275 companies claim to offer contract manufacturing services for biologic therapeutics, in compliance with the regulatory standards. It is also worth highlighting that biopharmaceutical contract manufacturers are actively trying to consolidate their presence in this field by entering into strategic alliances in order to meet the indubitably rising demand for biologics. For this purpose, substantial expansions, and mergers and acquisitions have been reported in this market, as service providers strive to become one-stop-shops, to cater to the diverse needs of their clientele. With outsourcing being increasingly accepted as a viable and beneficial business model within this field, we anticipate the biopharmaceutical contract manufacturing market to grow at a commendable pace in the coming years.

SCOPE OF THE REPORT

The "Biopharmaceutical Contract Manufacturing Market by Type of Service(s) Offered (API, FDF), Type of Biologic Manufactured (Antibodies, Cell Therapies, Vaccines and Other Biologics), Type of Expression System Used (Mammalian, Microbial and Others), Scale of Operation (Preclinical / Clinical and Commercial), Company Size (Small, Mid-sized, and Large and Very Large), and Key Geographical Regions (North America, Europe, Asia-Pacific, Latin America and MENA): Industry Trends and Global Forecasts, 2022 - 2035" report features an extensive study of the current market landscape and the likely future potential associated with the biopharmaceutical contract manufacturing market, over the next decade.

The study also includes a detailed analysis of key drivers and trends within this evolving market. Amongst other elements, the report features:

- A detailed overview of the overall landscape of companies engaged in offering contract manufacturing services for biologics, including a detailed analysis based on several relevant parameters, such as year of establishment, company size (based on number of employees), location of headquarters, type of service(s) offered (API and FDF manufacturing), type of biologic manufactured (ADCs, antibodies, biosimilars, cell therapies, gene therapies, nucleic acids / oligonucleotides, plasmid DNA / viral vectors, proteins / peptides, vaccines and others), scale of operation (preclinical, clinical and commercial), type of expression system used (mammalian, microbial and others), type of bioreactor used (single use, stainless steel and others) and mode of operation of bioreactor (batch, fed batch and perfusion / continuous).

- A detailed landscape of the biopharmaceutical manufacturing facilities established across the key geographical regions (North America, Europe, Asia-Pacific and Rest of the World), highlighting the manufacturing hubs for biologics.

- Elaborate profiles of key industry players based in North America, Europe and Asia-Pacific that offer contract manufacturing services for biologics. Each profile features a brief overview of the company, details related to its biologic-related service portfolio, manufacturing facilities, recent developments, and an informed future outlook.

- A detailed discussion on the key enablers in this domain, including certain niche product classes, such as antibody drug conjugates (ADCs), bispecific antibodies, cell therapies, gene therapies and viral vectors, which are likely to have a significant impact on the growth of the contract services market.

- A case study on the growing global biosimilars market, highlighting the associated opportunities for biopharmaceutical CMOs and CDMOs.

- A case study comparing the key characteristics of small and large molecule drugs, along with details on the various steps involved in their respective manufacturing processes.

- A detailed discussion on the benefits and challenges associated with in-house manufacturing, featuring a brief overview of the various parameters that a drug / therapy developer may need to take into consideration while deciding whether to manufacture its products in-house or outsource the production operations.

- A qualitative analysis, highlighting various factors that need to be taken into consideration by biopharmaceutical developers while deciding whether to manufacture their respective products in-house or engage the services of a CMO.

- A review of the various biopharmaceutical-focused manufacturing initiatives undertaken by top 10 big pharma players (shortlisted on the basis of 2021 revenues), highlighting trends across various parameters, such as number of initiatives, year of initiative, purpose of initiative, type of initiative, scale of operation and type of biologic manufactured.

- An analysis of the recent collaborations within the biopharmaceutical contract manufacturing industry, based on several relevant parameters, such as year of partnership, type of partnership, type of biologic manufactured, therapeutic area, most active players (in terms of number of deals inked) and regional distribution of partnership activity that have taken place in this domain, during the period 2015-2022.

- A detailed analysis of the various mergers and acquisitions that have taken place within this domain, during the period 2015-2022, based on several relevant parameters, such as year of agreement, type of deal, geographical location of companies, type of acquisition, type of biologic manufactured and key value drivers.

- A detailed review of expansion initiatives undertaken by biopharmaceutical contract manufacturers, during the period 2016-2022, along with information on several relevant parameters, such as year of expansion, purpose of expansion, type of biologic manufactured and location of expanded facility.

- An analysis of the recent developments within the biopharmaceutical contract manufacturing industry, highlighting information on the funding investments made during the period 2016-2022, along with information on the technology advancements related to biomanufacturing.

- An estimate of the overall, installed capacity for the manufacturing of biopharmaceuticals, based on information reported by various industry stakeholders in the public domain, highlighting the distribution of the available capacity, based on size of manufacturer (small, mid-sized and large and very large), scale of operation (preclinical, clinical and commercial), type of expression system used (mammalian, microbial and others) and geography (North America, Europe, Asia-Pacific and Rest of the World).

- An informed estimate of the annual demand for biologics, taking into account the top 20 biologics, based on various relevant parameters, such as target patient population, dosing frequency and dose strength of the abovementioned products.

- A company size-wise, detailed analysis of the total cost of ownership for biopharmaceuticals contract manufacturing organizations, during the period 2022-2042.

- A case study on the virtual business model concept, along with its role in the overall biopharmaceutical industry. It also features a discussion on the advantages and risks / challenges associated with outsourcing operations from virtual service providers.

- A discussion on affiliated trends, key drivers and challenges, under an elaborate SWOT framework, which are likely to impact the industry's evolution, including a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall biopharmaceutical industry.

- A survey analysis featuring inputs solicited from various experts who are directly / indirectly involved in providing contract manufacturing services to biopharmaceutical developers.

One of the key objectives of the report was to estimate the existing market size and estimate the future size of biopharmaceutical contract manufacturing market. We have provided informed estimates on the evolution of the market, over the period 2022-2035. Our year-wise projections of the current and future opportunity have further been segmented on the basis of [A] type of service(s) offered (API, FDF), [B] type of biologic manufactured (antibodies, cell therapies, vaccines and other biologics), [C] type of expression system used (mammalian, microbial and others), [D] scale of operation (preclinical / clinical and commercial), [E] company size (small, mid-sized, and large and very large), and [F] key geographical regions (North America, Europe, Asia-Pacific, Latin America and MENA).

In order to account for future uncertainties associated with some of the key parameters and to add robustness to our forecast model, we have provided three market forecast scenarios, portraying the conservative, base and optimistic tracks of the market's evolution.

All actual figures have been sourced and analyzed from publicly available information forums and primary research discussions. Financial figures mentioned in this report are in USD, unless otherwise specified.

KEY QUESTIONS ANSWERED

- Who are the key players engaged in offering contract manufacturing services for biopharmaceuticals?

- What are the different partnerships and expansion initiatives undertaken by biopharmaceutical contract manufacturers in the recent past?

- Which regions represent the current key contract manufacturing hubs for biopharmaceuticals?

- What is the current, installed capacity for contract manufacturing of biopharmaceuticals?

- What is the current, global demand for biologics? How is the demand for such candidates likely to evolve in the foreseen future?

- What percentage of the biopharmaceuticals manufacturing operations are presently outsourced?

- What factors should be taken into consideration while deciding whether the manufacturing operations for biopharmaceuticals should be kept in-house or outsourced?

- How is the current and future opportunity likely to be distributed across key market segments?

CHAPTER OUTLINES

Chapter 2 is an executive summary of key insights captured during our research. It offers a high-level view on the current state of biopharmaceutical contract manufacturing market and its likely evolution in the short to mid-term and long-term.

Chapter 3 provides a general introduction to biopharmaceuticals and biopharmaceutical manufacturing processes. The chapter also includes an overview of the various expression systems used for the development of different types of biotherapeutic products. It features a brief overview of contract manufacturing, along with a detailed discussion on the need for outsourcing within the biopharmaceutical industry. Furthermore, it provides information on the challenges faced by players currently engaged in this domain.

Chapter 4 provides a detailed assessment of the current market landscape of companies engaged in offering contract manufacturing services for biologics, including a detailed analysis based on several relevant parameters, such as year of establishment, company size (based on number of employees), location of headquarters, type of service(s) offered (API and FDF manufacturing), type of biologic manufactured (ADCs, antibodies, biosimilars, cell therapies, gene therapies, nucleic acids / oligonucleotides, plasmid DNA / viral vectors, proteins / peptides, vaccines and others), scale of operation (preclinical, clinical and commercial), type of expression system used (mammalian, microbial and others), type of bioreactor used (single use, stainless steel and others) and mode of operation of bioreactor (batch, fed batch and perfusion / continuous).

Chapter 5 provides a detailed landscape of the biopharmaceutical manufacturing facilities established across the key geographical regions (North America, Europe, Asia-Pacific and Rest of the World), highlighting the manufacturing hubs for biologics.

Chapter 6 provides elaborate profiles of key industry players based in North America that offer contract manufacturing services for biologics. Each profile features a brief overview of the company, details related to its biologic-related service portfolio, manufacturing facilities, recent developments, and an informed future outlook.

Chapter 7 provides elaborate profiles of key industry players based in Europe that offer contract manufacturing services for biologics. Each profile features a brief overview of the company, details related to its biologic-related service portfolio, manufacturing facilities, recent developments, and an informed future outlook.

Chapter 8 provides elaborate profiles of key industry players based in Asia-Pacific that offer contract manufacturing services for biologics. Each profile features a brief overview of the company, details related to its biologic-related service portfolio, manufacturing facilities, recent developments, and an informed future outlook.

Chapter 9 provides a detailed discussion on the key enablers in this domain, including certain niche product classes, such as antibody drug conjugates (ADCs), bispecific antibodies, cell therapies, gene therapies and viral vectors, which are likely to have a significant impact on the growth of the contract services market.

Chapter 10 presents a case study on the growing global biosimilars market, highlighting the associated opportunities for biopharmaceutical CMOs and CDMOs.

Chapter 11 presents a case study comparing the key characteristics of small and large molecule drugs, along with details on the various steps involved in their respective manufacturing processes.

Chapter 12 provides a detailed discussion on the benefits and challenges associated with in-house manufacturing, featuring a brief overview of the various parameters that a drug / therapy developer may need to take into consideration while deciding whether to manufacture its products in-house or outsource the production operations.

Chapter 13 presents a qualitative analysis, highlighting various factors that need to be taken into consideration by biopharmaceutical developers while deciding whether to manufacture their respective products in-house or engage the services of a CMO.

Chapter 14 provides a review of the various biopharmaceutical-focused manufacturing initiatives undertaken by top 10 big pharma players (shortlisted on the basis of 2021 revenues), highlighting trends across various parameters, such as number of initiatives, year of initiative, purpose of initiative, type of initiative, scale of operation and type of biologic manufactured.

Chapter 15 presents an analysis of the recent collaborations within the biopharmaceutical contract manufacturing industry, based on several relevant parameters, such as year of partnership, type of partnership, type of biologic manufactured, therapeutic area, most active players (in terms of number of deals inked) and regional distribution of partnership activity that have taken place in this domain, during the period 2015-2022.

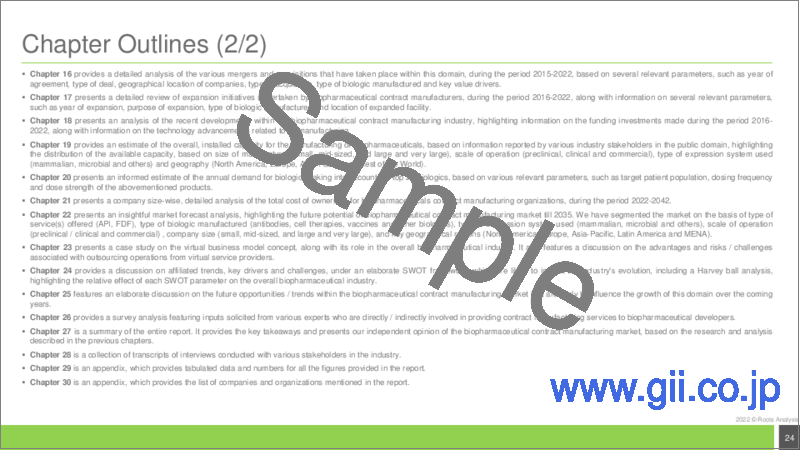

Chapter 16 provides a detailed analysis of the various mergers and acquisitions that have taken place within this domain, during the period 2015-2022, based on several relevant parameters, such as year of agreement, type of deal, geographical location of companies, type of acquisition, type of biologic manufactured and key value drivers.

Chapter 17 presents a detailed review of expansion initiatives undertaken by biopharmaceutical contract manufacturers, during the period 2016-2022, along with information on several relevant parameters, such as year of expansion, purpose of expansion, type of biologic manufactured and location of expanded facility.

Chapter 18 presents an analysis of the recent developments within the biopharmaceutical contract manufacturing industry, highlighting information on the funding investments made during the period 2016-2022, along with information on the technology advancements related to biomanufacturing.

Chapter 19 provides an estimate of the overall, installed capacity for the manufacturing of biopharmaceuticals, based on information reported by various industry stakeholders in the public domain, highlighting the distribution of the available capacity, based on size of manufacturer (small, mid-sized, and large and very large), scale of operation (preclinical, clinical and commercial), type of expression system used (mammalian, microbial and others) and geography (North America, Europe, Asia-Pacific and Rest of the World).

Chapter 20 presents an informed estimate of the annual demand for biologics, taking into account the top 20 biologics, based on various relevant parameters, such as target patient population, dosing frequency and dose strength of the abovementioned products.

Chapter 21 presents a company size-wise, detailed analysis of the total cost of ownership for biopharmaceuticals contract manufacturing organizations, during the period 2022-2042.

Chapter 22 presents an insightful market forecast analysis, highlighting the future potential of biopharmaceutical contract manufacturing market till 2035. We have segmented the market on the basis of type of service(s) offered (API, FDF), type of biologic manufactured (antibodies, cell therapies, vaccines and other biologics), type of expression system used (mammalian, microbial and others), scale of operation (preclinical / clinical and commercial) , company size (small, mid-sized, and large and very large), and key geographical regions (North America, Europe, Asia-Pacific, Latin America and MENA).

Chapter 23 presents a case study on the virtual business model concept, along with its role in the overall biopharmaceutical industry. It also features a discussion on the advantages and risks / challenges associated with outsourcing operations from virtual service providers.

Chapter 24 provides a discussion on affiliated trends, key drivers and challenges, under an elaborate SWOT framework, which are likely to impact the industry's evolution, including a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall biopharmaceutical industry.

Chapter 25 features an elaborate discussion on the future opportunities / trends within the biopharmaceutical contract manufacturing market that are likely to influence the growth of this domain over the coming years.

Chapter 26 provides a survey analysis featuring inputs solicited from various experts who are directly / indirectly involved in providing contract manufacturing services to biopharmaceutical developers.

Chapter 27 is a summary of the entire report. It provides the key takeaways and presents our independent opinion of the biopharmaceutical contract manufacturing market, based on the research and analysis described in the previous chapters.

Chapter 28 is a collection of transcripts of interviews conducted with various stakeholders in the industry.

Chapter 29 is an appendix, which provides tabulated data and numbers for all the figures provided in the report.

Chapter 30 is an appendix, which provides the list of companies and organizations mentioned in the report.

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Market Segmentations

- 1.3. Research Methodology

- 1.4. Key Questions Answered

- 1.5. Chapter Outlines

2. EXECUTIVE SUMMARY

- 2.1. Chapter Overview

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Biopharmaceuticals

- 3.3. Expression Systems for Biopharmaceuticals

- 3.3.1. Insect Expression Systems

- 3.3.2. Mammalian Expression Systems

- 3.3.3. Microbial Expression Systems

- 3.3.3.1. Bacterial Expression Systems

- 3.3.3.2. Fungal Expression Systems

- 3.3.3.3. Yeast Expression Systems

- 3.3.4. Plant Expression Systems

- 3.3.5. Mammalian versus Microbial Expression Systems

- 3.4. Manufacturing Process of Biopharmaceuticals

- 3.4.1. Upstream Processing

- 3.4.2. Fermentation

- 3.4.3. Downstream Processing

- 3.5. Overview of Contract Manufacturing

- 3.6. Need for Outsourcing Biopharmaceutical Manufacturing Operations

- 3.6.1. Commonly Outsourced Manufacturing Operations for Biopharmaceuticals

- 3.6.2. Advantages of Outsourcing Biopharmaceutical Manufacturing Operations

- 3.6.3. Risks and Challenges Associated with Outsourcing Biopharmaceutical Manufacturing Operations

- 3.7. Key Considerations While Selecting a Contract Manufacturing Partner

- 3.8. Future Perspectives

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Biopharmaceutical Contract Manufacturers: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Type of Service(s) Offered

- 4.2.5. Analysis by Type of Biologic Manufactured

- 4.2.6. Analysis by Scale of Operation

- 4.2.7. Analysis by Type of Expression System Used

- 4.2.8. Analysis by Type of Bioreactor Used

- 4.2.9. Analysis by Mode of Operation of Bioreactor

5. REGIONAL CAPABILITY ANALYSIS

- 5.1. Chapter Overview

- 5.2. Key Assumptions and Methodology

- 5.3. Overall Landscape of Biopharmaceutical Contract Manufacturing Facilities

- 5.3.1. Analysis by Type of Service(s) Offered

- 5.3.2. Analysis by Scale of Operation

- 5.3.3. Analysis by Type of Expression System Used

- 5.4. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in North America

- 5.5. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in Europe

- 5.6. Regional Capability Analysis: Biopharmaceutical Contract Manufacturing Facilities in Asia-Pacific and Rest of the World

6. BIOPHARMACEUTICAL CONTRACT MANUFACTURING IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. Regulatory Scenario of Biopharmaceutical Contract Manufacturing in the US

- 6.3. Leading Biopharmaceutical CMOs in North America

- 6.3.1. AGC Biologics

- 6.3.1.1. Company Overview

- 6.3.1.2. Service Portfolio

- 6.3.1.2.1. Process Development

- 6.3.1.2.2. cGMP Manufacturing

- 6.3.1.2.3. Quality and Regulatory

- 6.3.1.2.4. Process Validation

- 6.3.1.3. Financial Information

- 6.3.1.4. Manufacturing Facilities

- 6.3.1.5. Recent Developments and Future Outlook

- 6.3.2. Catalent (Catalent Pharma Solutions)

- 6.3.2.1. Company Overview

- 6.3.2.2. Service Portfolio

- 6.3.2.2.1. Cell Line Development

- 6.3.2.2.2. Manufacturing (Biomanufacturing)

- 6.3.2.2.3. ADCs and Bioconjugates Manufacturing

- 6.3.2.2.4. Biosimilars Development and Manufacturing

- 6.3.2.2.5. Proprietary Delivery and Fill / Finish Solutions

- 6.3.2.2.6. Analytical Services

- 6.3.2.3. Clinical Supply Services

- 6.3.2.4. Financial Information

- 6.3.2.5. Manufacturing Facilities

- 6.3.2.6. Recent Developments and Future Outlook

- 6.3.3. Cytiva (GE Healthcare)

- 6.3.3.1. Company Overview

- 6.3.3.2. Service Portfolio

- 6.3.3.2.1. Biomanufacturing Services

- 6.3.3.2.2. Scientific Support

- 6.3.3.2.3. OptiRun Service Solutions

- 6.3.3.2.4. Instruments Qualification Services

- 6.3.3.3. Financial Information

- 6.3.3.4. Manufacturing Facilities

- 6.3.3.5. Recent Developments and Future Outlook

- 6.3.4. FUJIFILM Diosynth Biotechnologies

- 6.3.4.1. Company Overview

- 6.3.4.2. Service Portfolio

- 6.3.4.2.1. Strain Development

- 6.3.4.2.2. Process Development

- 6.3.4.2.3. GMP Contract Manufacturing

- 6.3.4.2.4. Analytical Solutions

- 6.3.4.3. Financial Information

- 6.3.4.4. Manufacturing Facilities

- 6.3.4.5. Recent Developments and Future Outlook

- 6.3.5. KBI Biopharma

- 6.3.5.1. Company Overview

- 6.3.5.2. Service Portfolio

- 6.3.5.2.1. Process Development

- 6.3.5.2.2. Analytical Development

- 6.3.5.2.3. GMP Manufacturing

- 6.3.5.2.4. Clinical Cell Therapy Support

- 6.3.5.3. Recent Developments and Future Outlook

- 6.3.6. Patheon (acquired by Thermo Fisher Scientific)

- 6.3.6.1 Company Overview

- 6.3.6.2. Service Portfolio

- 6.3.6.2.1. Biologics

- 6.3.6.2.1.1. Drug Substance

- 6.3.6.2.2. Analytical Services

- 6.3.6.2.3. Product Development

- 6.3.6.2.4. Commercial Product Supply

- 6.3.6.2.1. Biologics

- 6.3.6.3. Financial Information

- 6.3.6.4. Manufacturing Facilities

- 6.3.6.5. Recent Developments and Future Outlook

- 6.3.7. Piramal Pharma Solutions

- 6.3.7.1 Company Overview

- 6.3.7.2. Service Portfolio

- 6.3.7.2.1. Antibody Drug Conjugation Services

- 6.3.7.2.2. Other Services

- 6.3.7.3. Financial Information

- 6.3.7.4. Manufacturing Facilities

- 6.3.7.5. Recent Developments and Future Outlook

- 6.3.1. AGC Biologics

7. BIOPHARMACEUTICAL CONTRACT MANUFACTURING IN EUROPE

- 7.1. Chapter Overview

- 7.2. Biopharmaceutical Contract Manufacturing in Europe: Regulatory Scenario

- 7.2.1. EMA's cGMP Regulations

- 7.3. Leading Biopharmaceutical CMOs in Europe

- 7.3.1. Boehringer Ingelheim (BioXcellence)

- 7.3.1.1. Company Overview