|

市場調査レポート

商品コード

1803912

再生可能エネルギー市場:産業動向・世界の予測 (~2035年):再生可能エネルギータイプ・用途・投資タイプ・企業タイプ・地域別Renewable Energy Market, Till 2035: Distribution by Type of Renewable Energy, Type of Application, Type of Investment, Type of Enterprise and Geographical Regions: Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| 再生可能エネルギー市場:産業動向・世界の予測 (~2035年):再生可能エネルギータイプ・用途・投資タイプ・企業タイプ・地域別 |

|

出版日: 2025年09月03日

発行: Roots Analysis

ページ情報: 英文 198 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

再生可能エネルギー:市場概要

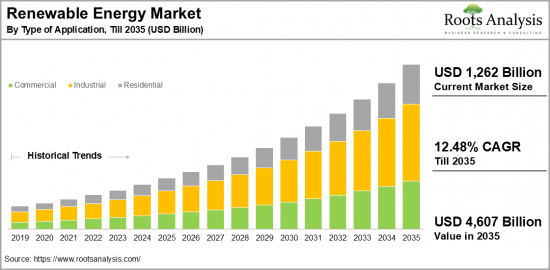

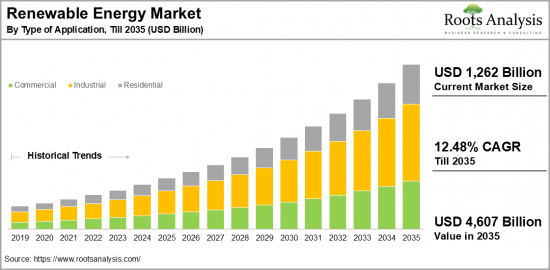

世界の再生可能エネルギーの市場規模は、予測期間中にCAGR 12.48%で推移し、現在の1兆2,620億米ドルから、2035年には4兆6,070億米ドルに成長すると予測されています。

再生可能エネルギー市場の機会:分類

再生可能エネルギータイプ

- バイオエネルギー

- 地熱

- 水力発電

- 太陽光発電

- 風力発電

- その他

用途

- 商業用

- 産業用

- 住宅用

投資タイプ

- 政府出資プロジェクト

- 民間投資

- 官民パートナーシップ

地域

- 北米

- 米国

- カナダ

- メキシコ

- その他

- 欧州

- オーストリア

- ベルギー

- デンマーク

- フランス

- ドイツ

- アイルランド

- イタリア

- オランダ

- ノルウェー

- ロシア

- スペイン

- スウェーデン

- スイス

- 英国

- その他

- アジア

- 中国

- インド

- 日本

- シンガポール

- 韓国

- その他

- ラテンアメリカ

- ブラジル

- チリ

- コロンビア

- ベネズエラ

- その他

- 中東・北アフリカ

- エジプト

- イラン

- イラク

- イスラエル

- クウェート

- サウジアラビア

- アラブ首長国連邦

- その他の中東・北アフリカ諸国

- 世界のその他の地域

- オーストラリア

- ニュージーランド

- その他

再生可能エネルギー市場:成長と動向

世界経済フォーラムによると、世界は再生可能エネルギーの設備容量を大幅に拡大しており、これは再生可能エネルギー発電の増加を示しています。再生可能エネルギー発電は、化石燃料への依存を減らし、気候変動に対抗する効果的な手段であることが証明されています。再生可能エネルギーは太陽光、風力、水力、バイオマスといった多様な資源から得られ、これらを利用しても温室効果ガスを排出することなく発電できる点で非常に重要です。

再生可能エネルギーの主な利点として、持続可能なエネルギー源であること、大気や水の浄化に寄与すること、費用対効果の高い発電を可能にすることが挙げられます。特に、再生可能エネルギー技術の急速な進歩と社会的認知の高まりを背景に、主要産業における太陽光エネルギーの利用が大幅に増加しており、風力エネルギーもそれに続いて拡大しています。注目すべき点として、インドでは2024年第1四半期の太陽光発電量が前年同期比で8.8%増加しました。

再生可能エネルギー分野は、持続可能なイノベーションとデジタルの進展を通じて、エネルギー生産を高めるための世界的な移行に不可欠な要素となっています。洋上風力発電所の開発は勢いを増しており、より強く安定した風を活用しています。さらに、ペロブスカイト太陽電池は、従来のシリコンパネルに比べて高効率かつ低コストで製造できることから、太陽光発電分野を大きく変革し、世界の再生可能エネルギー市場の効率性向上に寄与しています。

このように、AIやIoTの導入を含む再生可能エネルギー技術の継続的な進歩により、再生可能エネルギー市場は予測期間中に大きな成長を遂げると見込まれています。

当レポートでは、世界の再生可能エネルギーの市場を調査し、 市場概要、背景、市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

セクションI:レポート概要

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクションII:定性的洞察

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 規制シナリオ

セクションIII:市場概要

第8章 主要企業の包括的なデータベース

第9章 競合情勢

第10章 ホワイトスペース分析

第11章 企業の競争力分析

第12章 再生可能エネルギー市場におけるスタートアップエコシステム

セクションIV:企業プロファイル

第13章 企業プロファイル

- 章の概要

- ABB

- Acconia

- Canadian Solar

- EDP Renovaveis

- Enel Spa

- Engie

- General Electric

- Iberdrola

- Innergex

- Invenergy

- National Grid Renewables

- NextEra Energy

- Orsted

- Schneider Electric

- Siemens

- Suzlon Energy

- Tata Power

- Xcel Energy

セクションV:市場動向

第14章 メガトレンド分析

第15章 アンメットニーズの分析

第16章 特許分析

第17章 最近の動向

セクションVI:市場機会の分析

第18章 世界の再生可能エネルギー市場

第19章 再生可能エネルギータイプ別の市場機会

第20章 用途別の市場機会

第21章 投資タイプ別の市場機会

第22章 企業規模別の市場機会

第23章 北米における再生可能エネルギーの市場機会

第24章 欧州における再生可能エネルギーの市場機会

第25章 アジアにおける再生可能エネルギーの市場機会

第26章 中東・北アフリカにおける再生可能エネルギーの市場機会

第27章 ラテンアメリカにおける再生可能エネルギーの市場機会

第28章 世界のその他の地域における再生可能エネルギーの市場機会

第29章 市場集中分析:主要企業別の分布

第30章 隣接市場分析

セクションVII:戦略ツール

第31章 勝利の鍵となる戦略

第32章 ポーターのファイブフォース分析

第33章 SWOT分析

第34章 バリューチェーン分析

第35章 ROOTS戦略提言

セクションVIII:その他の独占的洞察

第36章 1次調査からの洞察

第37章 報告書の結論

セクションIX:付録

第38章 表形式データ

第39章 企業・団体一覧

第40章 カスタマイズの機会

第41章 ROOTSサブスクリプションサービス

第42章 著者詳細

Renewable Energy Market Overview

As per Roots Analysis, the global renewable energy market size is estimated to grow from USD 1,262 billion in the current year to USD 4,607 billion by 2035, at a CAGR of 12.48% during the forecast period, till 2035.

The opportunity for renewable energy market has been distributed across the following segments:

Type of Renewable Energy

- Bio Energy

- Geothermal

- Hydroelectric Power

- Solar Power

- Wind Power

- Others

Type of Application

- Commercial

- Industrial

- Residential

Type of Investment

- Government-funded projects

- Private sector investments

- Public-private partnerships

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Renewable Energy Market: Growth and Trends

According to the World Economic Forum, the world has significantly increased its renewable energy capacity, which indicates the rise of renewable energy generation, that has proven to be an effective way to lessen dependency on fossil fuels and combat climate change. It is important to note that renewable energy comes from various sources, such as sunlight, wind, water, and biomass, and using these resources generates electricity without producing greenhouse gas emissions.

Some key benefits of renewable energy include being a sustainable energy source, contributing to cleaner air and water, and providing cost-efficient power generation. Notably, there is a significant increase in the use of solar energy in major industries driven by the rapid advancement of renewable technologies and growing public awareness, with wind energy also following closely behind. Interestingly, India experienced a notable increase of 8.8% in total solar power generation in the first quarter of 2024 compared to the previous year.

The renewable energy sector is becoming an essential element in the global transition towards sustainable innovation and digital progress to achieve heightened energy production. The development of offshore wind farms is gaining momentum, making use of stronger and more steady wind patterns. Furthermore, perovskite solar cells are transforming the solar energy landscape by providing greater efficiency and reduced manufacturing costs compared to conventional silicon panels, which is crucial for enhancing the efficiency of the global renewable energy market analysis.

As a result, with ongoing advancements in renewable energy technology, including the incorporation of artificial intelligence and the Internet of Things (IoT), the renewable energy market is expected to experience significant growth during this forecast period.

Renewable Energy Market: Key Segments

Market Share by Type of Renewable Energy

Based on the type of renewable energy, the global renewable energy market is segmented into bio energy, geothermal, hydroelectric power, solar power, wind power and others. According to our estimates, currently, solar power segment captures the majority share of the market.

Additionally, this sector is anticipated to grow at a relatively higher CAGR during the forecast period. This can be attributed to several factors, including decreasing costs, technological advancements that improve efficiency and accessibility, and its established presence in countries like the US and China.

Market Share by Type of Application

Based on the type of application, the renewable energy market is segmented into commercial, industrial and residential. According to our estimates, currently, the industrial sector captures the majority of the market. Additionally, this sector is anticipated to grow at a relatively higher CAGR during the forecast period. This can be attributed to the increasing demand for renewable energy sources from industrial players aiming to lower carbon emissions and cut operational expenses, along with technological advancements.

Market Share by Type of Investment

Based on type of investment, the renewable energy market is segmented into government-funded projects, private sector investments and public-private partnerships. According to our estimates, currently, private sector investments segment captures the majority share of the market. Additionally, this sector is anticipated to grow at a relatively higher CAGR during the forecast period.

This can be attributed to the technological advancements in renewable energy that have significantly reduced costs; further, private sector investments tend to be more agile and responsive to market needs compared to government-funded initiatives.

Market Share by Type of Enterprise

Based on type of enterprise, the renewable energy market is segmented into large and small and medium enterprise. According to our estimates, currently, large-scale farms captures the majority share of the market. Additionally, this sector is anticipated to grow at a relatively higher CAGR during the forecast period. This can be attributed to its ability to invest in state-of-the-art renewable energy generation technologies and methods, take advantage of government programs, enhance economies of scale, and promote business expansion.

Market Share by Geographical Regions

Based on geographical regions, the renewable energy market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, Asia captures the majority share of the market. Additionally, this market in this region is anticipated to grow at a relatively higher CAGR during the forecast period. This can be attributed to abundant capacity for solar and wind energy, supportive government policies and investments, rapid population growth, and escalated energy demand in nations such as China and India.

Example Players in Renewable Energy Market

- ABB

- Acconia

- Canadian Solar

- EDP Renovaveis

- Enel Spa

- Engie

- General Electric

- Iberdrola

- Innergex

- Invenergy

- National Grid Renewables

- NextEra Energy

- Orsted

- Schneider Electric

- Siemens

- Suzlon Energy

- Tata Power

- Xcel Energy

Renewable Energy Market: Research Coverage

The report on the renewable energy market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the renewable energy market, focusing on key market segments, including [A] type of renewable energy, [B] type of application, [C] type of investment, [D] types of enterprise [E] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the renewable energy market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the renewable energy market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] renewable energy portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in renewable energy industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the Renewable energy domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the renewable energy market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the renewable energy market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

Key Questions Answered in this Report

- How many companies are currently engaged in renewable energy market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Renewable Energy Market

- 6.2.1. Type of Renewable Energy

- 6.2.2. Type of Application

- 6.2.3. Type of Investment

- 6.2.4. Type of Enterprise

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Renewable Energy: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE RENEWABLE ENERGY MARKET

- 12.1. Renewable Energy Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. ABB*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Acconia

- 13.4. Canadian Solar

- 13.5. EDP Renovaveis

- 13.6. Enel Spa

- 13.7. Engie

- 13.8. General Electric

- 13.9. Iberdrola

- 13.10. Innergex

- 13.11. Invenergy

- 13.12. National Grid Renewables

- 13.13. NextEra Energy

- 13.14. Orsted

- 13.15. Schneider Electric

- 13.16. Siemens

- 13.17. Suzlon Energy

- 13.18. Tata Power

- 13.19. Xcel Energy

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMEET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL RENEWABLE ENERGY MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Renewable Energy Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF RENEWABLE ENERGY

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Renewable Energy Market for Bio Energy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Renewable Energy Market for Geothermal: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Renewable Energy Market for Hydroelectric Power: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Renewable Energy Market for Wind Power: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Renewable Energy Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. Data Triangulation and Validation

- 19.11.1. Secondary Sources

- 19.11.2. Primary Sources

- 19.11.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Renewable Energy Market for Commercial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Renewable Energy Market for Industrial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Renewable Energy Market for Residential: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

- 20.9.1. Secondary Sources

- 20.9.2. Primary Sources

- 20.9.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF INVESTMENT

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Renewable Energy Market for Government-Funded Projects: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Renewable Energy Market for Private Sector Investments: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Renewable Energy Market for Public-Private Partnerships: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

- 21.9.1. Secondary Sources

- 21.9.2. Primary Sources

- 21.9.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF ENTERPRISE SIZE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Renewable Energy Market for Large Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Renewable Energy Market for Small and Medium Enterprise: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES FOR RENEWABLE ENERGY IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Renewable Energy Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Renewable Energy Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Renewable Energy Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Renewable Energy Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Renewable Energy Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR RENEWABLE ENERGY IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Renewable Energy Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Renewable Energy Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Renewable Energy Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Renewable Energy Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Renewable Energy Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Renewable Energy Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Renewable Energy Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. Renewable Energy Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. Renewable Energy Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.9. Renewable Energy Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.10. Renewable Energy Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.11. Renewable Energy Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.12. Renewable Energy Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.13. Renewable Energy Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.14. Renewable Energy Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.15. Renewable Energy Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.16. Renewable Energy Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR RENEWABLE ENERGY IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Renewable Energy Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Renewable Energy Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Renewable Energy Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Renewable Energy Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Renewable Energy Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Renewable Energy Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Renewable Energy Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR RENEWABLE ENERGY IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Renewable Energy Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Renewable Energy Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 26.6.2. Renewable Energy Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Renewable Energy Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Renewable Energy Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Renewable Energy Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Renewable Energy Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.7. Renewable Energy Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.8. Renewable Energy Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR RENEWABLE ENERGY IN LATIN AMERICA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Renewable Energy Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Renewable Energy Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Renewable Energy Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Renewable Energy Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Renewable Energy Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Renewable Energy Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Renewable Energy Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR RENEWABLE ENERGY IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Renewable Energy Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Renewable Energy Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. Renewable Energy Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Renewable Energy Market in Other Countries

- 28.7. Data Triangulation and Validation

29. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 29.1. Leading Player 1

- 29.2. Leading Player 2

- 29.3. Leading Player 3

- 29.4. Leading Player 4

- 29.5. Leading Player 5

- 29.6. Leading Player 6

- 29.7. Leading Player 7

- 29.8. Leading Player 8

30. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

31. KEY WINNING STRATEGIES

32. PORTER FIVE FORCES ANALYSIS

33. SWOT ANALYSIS

34. VALUE CHAIN ANALYSIS

35. ROOTS STRATEGIC RECOMMENDATIONS

- 35.1. Chapter Overview

- 35.2. Key Business-related Strategies

- 35.2.1. Research & Development

- 35.2.2. Product Manufacturing

- 35.2.3. Commercialization / Go-to-Market

- 35.2.4. Sales and Marketing

- 35.3. Key Operations-related Strategies

- 35.3.1. Risk Management

- 35.3.2. Workforce

- 35.3.3. Finance

- 35.3.4. Others