|

市場調査レポート

商品コード

1803907

セルロースの世界市場の予測(~2035年):誘導体タイプ別、原料別、改質タイプ別、製造プロセス別、純度別、用途別、企業規模別、ビジネスモデル別、エンドユーザー別、地域別、産業動向、将来の予測Cellulose Market Forecast Till 2035; Distribution by Derivative Type, Source, Modification Type, Manufacturing Process, Purity, Application, Company Size, Business Model, End User and Geographical Regions: Industry Trend and Future Forecast |

||||||

カスタマイズ可能

|

|||||||

| セルロースの世界市場の予測(~2035年):誘導体タイプ別、原料別、改質タイプ別、製造プロセス別、純度別、用途別、企業規模別、ビジネスモデル別、エンドユーザー別、地域別、産業動向、将来の予測 |

|

出版日: 2025年09月03日

発行: Roots Analysis

ページ情報: 英文 187 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

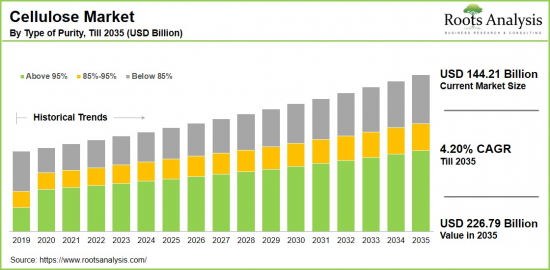

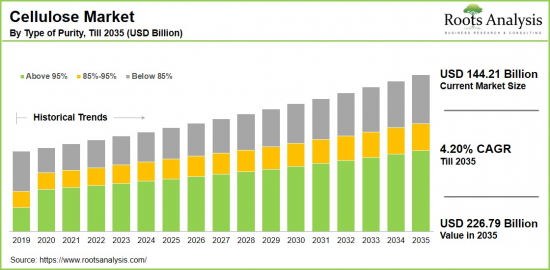

世界のセルロースの市場規模は、現在の1,442億1,000万米ドルから2035年までに2,267億9,000万米ドルに達すると予測され、2035年までの予測期間にCAGRで4.20%の成長が見込まれます。

セルロース市場:成長と動向

近年、さまざまな産業部門でセルロースの需要が増加しており、このことが今後数年間における市場の促進要因となる見込みです。木材パルプから生産される長繊維ポリマーであるセルロースは、環境にやさしく、通気性があり、耐久性に優れているという特性が広く認められているため、テキスタイル産業やその他の部門で、衣料品やセルロースをベースとしたさまざまな製品の生産によく利用されています。

テキスタイル以外にも、セルロース繊維、セルロースエーテル、セルロースエステル、微結晶セルロースといったセルロースの誘導体は、多くの食品製造業務に欠かせないものとなっています。セルロース繊維は、アイスクリームの増粘剤、乳化剤、ジェルの脂肪代用品としての役割を果たすほか、消化過程においても重要な役割を果たしています。さらに、セルロース繊維は生分解性包装や不織布材料としても高く支持されています。化粧品部門も美容・スキンケア製品の製造を目的としてセルロースに注目しており、市場の重要な成長要因となっています。

多様な産業でセルロースへの関心が高まるにつれて、多くの業界のリーダーが持続可能でコスト効率が高く、生分解性の高いセルロース由来の材料の開発に注力しています。さらに、さまざまな業界のリーダーが、紙、テキスタイルなどの産業におけるさまざまな用途向けに、次世代セルロース、再生セルロース、誘導体の開発を進めています。こうした継続的な取り組みにより、セルロース市場は予測期間に大きく成長する見込みです。

当レポートでは、世界のセルロース市場について調査分析し、市場規模の推計と機会の分析、競合情勢、企業プロファイルなどの情報を提供しています。

目次

第1章 序文

第2章 調査手法

第3章 経済的考慮事項、その他のプロジェクト特有の考慮事項

第4章 マクロ経済指標

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 競合情勢

第8章 企業プロファイル

- 章の概要

- Ashland

- Akzo Nobel NV

- Borregaard

- CP Kelco

- China RuiTai International Holdings

- Dow

- DKS

- Daicel Corporation

- Fenchem

- J. RettenmaierandSohne GmbH+Co.Kg

- LOTTE Chemical Corporation

- Lotte Fine Chemical

- MAZRUI INTERNATIONAL

- Reliance Cellulose Products

- Rayonier

- Shin-Etsu Chemical

- SE Tylose GmbH and Co. Kg

- Shandong Head

- Shin-Etsu Chemical

- Tembec

- Zhejiang Kehong Chemical

第9章 セルロース市場におけるスタートアップエコシステム

第10章 バリューチェーンの分析

第11章 SWOTの分析

第12章 世界のセルロース市場

第13章 市場機会:誘導体タイプ別

第14章 市場機会:原料別

第15章 市場機会:改質タイプ別

第16章 市場機会:製造プロセス別

第17章 市場機会:純度別

第18章 市場機会:用途別

第19章 市場機会:エンドユーザー別

第20章 市場機会:企業規模別

第21章 市場機会:ビジネスモデル別

第22章 北米のセルロース市場の機会

第23章 欧州のセルロース市場の機会

第24章 アジアのセルロース市場の機会

第25章 中東・北アフリカ(MENA)のセルロース市場の機会

第26章 ラテンアメリカのセルロース市場の機会

第27章 その他の地域のセルロース市場の機会

第28章 表形式データ

第29章 企業・団体のリスト

第30章 カスタマイズの機会

第31章 Rootsのサブスクリプションサービス

第32章 著者詳細

Cellulose Market Overview

As per Roots Analysis, the global cellulose market size is estimated to grow from USD 144.21 billion in the current year to USD 226.79 billion by 2035, at a CAGR of 4.20% during the forecast period, till 2035.

The opportunity for cellulose market has been distributed across the following segments:

Derivative Type

- Commodity Cellulose Pulp

- Cellulose Fibers

- Cellulose Ethers

- Cellulose Esters

- Microcrystalline Cellulose

- Nanocellulose

- Others

Source

- Natural

- Crop

- Fruit

- Treewood

- Synthetic

Modification Type

- Modified

- Microcrystalline Cellulose

- Cellulose Ethers

- Others

- Unmodified

Manufacturing Process

- Viscose

- Ethers

Purity

- Above 95%

- 85%-95%

- Below 85%

Application

- Food

- Pharmaceuticals

- Paper

- Cosmetics

- Textiles

- Paints and Coatings

Company Size

- Large Enterprises

- Small and Medium-Sized Enterprises

Business Model

- B2B

- B2C

- B2B2C

End User

- Textile Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Paper Industry

- Pain and Coatings Manufacturers

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Cellulose Market: Growth and Trends

In recent times, the demand for cellulose has increased across different industrial sectors, which is expected to drive the market forward in the coming years. Cellulose, a lengthy polymer produced from plant wood pulp, is widely recognized for its eco-friendly, breathable, and durable characteristics, making it a popular choice in the textile industry and other sectors for creating apparel and various cellulose-based products.

Beyond textiles, derivatives of cellulose like cellulose fiber, cellulose ethers, cellulose esters, and microcrystalline cellulose have become essential in many food manufacturing operations. It serves as a binder for ice cream, an emulsifier, a fat replacer in gels, and plays a significant role in the digestive process. Moreover, cellulose fiber is highly favored for biodegradable packaging and non-woven materials. The cosmetics sector has also gravitated toward cellulose for creating beauty and skincare products, representing a critical growth factor for the market.

As the interest in cellulose grows across diverse industries, numerous industry leaders are concentrating on the development of cellulose-based materials that are sustainable, cost-efficient, and biodegradable. Additionally, various industry leaders are advancing the development of next-generation cellulose, regenerated cellulose, and its derivatives for various applications in the paper, textile, and other industries. Due to these ongoing initiatives, the cellulose market is expected to experience significant growth during the forecast period.

Cellulose Market: Key Segments

Market Share by Derivative Type

Based on derivative type, the global cellulose market is segmented into commodity cellulose pulp, cellulose fibers, cellulose ethers, cellulose esters, microcrystalline cellulose, nitrocellulose and others. According to our estimates, currently, the commodity cellulose pulp captures the majority share of the market.

This can be attributed to the widespread application of cellulose in various sectors such as packaging materials and products. Given the increasing preference for microcrystalline cellulose, we anticipate that this segment will experience a higher compound annual growth rate (CAGR) during the forecast period.

Market Share by Source

Based on source, the cellulose market is segmented into natural and synthetic. According to our estimates, currently, the natural cellulose segment captures the majority of the market. Moreover, this segment is expected to grow at a higher CAGR during the forecast period. This growth can be attributed to the rising need for sustainable and biodegradable materials in the production of clothing, paper, and packaging.

Market Share by Modification Type

Based on modification type, the cellulose market is segmented into modified and unmodified cellulose. According to our estimates, currently, the modified cellulose segment captures the majority share of the market. This is due to the modifications like cross-linking, etherification, and esterification, which enhance its properties and allow for diverse applications.

Due to these unique characteristics, it serves as a stabilizer, thickener, film-former, and binder. However, the modified cellulose segment is expected to grow at a higher CAGR during the forecast period.

Market Share by Modification Process

Based on modification process, the cellulose market is segmented into viscose, esters and ethers. According to our estimates, currently, the viscose segment captures the majority share of the market. This is due to the growing demand for viscose or rayon within the textile industry for clothing manufacturing.

Its notable breathability, versatility, and silk-like texture contribute to its popularity. Additionally, it is important to highlight that the viscose segment is expected to experience a relatively higher CAGR during the forecast period.

Market Share by Purity

Based on purity, the cellulose market is segmented into above 95%, 85%-95% and below 85%. According to our estimates, currently, the 95% pure cellulose segment captures the majority share of the market. This is due to the increasing demand for high-purity cellulose in both the pharmaceutical and paper industries.

Market Share by Application

Based on application, the cellulose market is segmented into food, pharmaceutical, paper, cosmetics, textile, and paint and coating. According to our estimates, currently, the paper industry captures the majority share of the market. This can be attributed to the fact that cellulose serves as a crucial raw material for the paper sector.

Cellulose is utilized in the production of high-quality paper, drafting paper, and printing paper, which consequently increases the demand for these materials within the paper industry. However, the pharmaceutical sector is expected to grow at a higher CAGR during the forecast period, due to the rising use of cellulose derivatives in tablet manufacturing.

Market Share by Company Size

Based on company size, the cellulose market is segmented into large enterprises and small and medium enterprises. According to our estimates, currently, the large enterprises segment captures the majority share of the market. This can be attributed to the heightened development initiatives aimed at producing cellulose derivatives, which broadens their applications in various sectors.

Market Share by End User

Based on end user, the cellulose market is segmented into textile industry, pharmaceutical industry, cosmetic industry, paper industry, and pain and coatings manufacturers. According to our estimates, currently, the paper industry captures the majority share of the market, due to the substantial demand for cellulose within the paper sector.

This is due to the fact that cellulose serves as the fundamental material in paper production, leading to a strong demand for paper products made from cellulose, such as tissues, napkins, and wet wipes.

Market Share by Geographical Regions

Based on geographical regions, the cellulose market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Asia-Pacific captures the majority share of the market. This is due to fact that it is a central hub for industrial sectors like chemicals, textiles, and manufacturing, which increases the demand for cellulose within that market.

However, North America is expected to witness a relatively higher CAGR during the forecast period, driven by the advancing research and development in cellulose applications in the pharmaceutical and paper industries.

Example Players in Cellulose Market

- Ashland

- Akzo Nobel N.V.

- Borregaard

- CP Kelco

- China RuiTai International Holdings

- Dow

- DKS

- Daicel Corporation

- Fenchem

- J. RettenmaierandSohne GmbH + Co.Kg

- LOTTE Chemical CORPORATION

- Lotte Fine Chemical

- MAZRUI INTERNATIONAL

- Reliance Cellulose Products

- Rayonier

- Shin-Etsu Chemical

- SE Tylose GmbH and Co. Kg

- Shandong Head

- Shin-Etsu Chemical

- Tembec

- Zhejiang Kehong Chemical

Cellulose Market: Research Coverage

The report on the cellulose market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the cellulose market, focusing on key market segments, including [A] derivative type, [B] source, [C] modification type, [D] manufacturing process, [E] purity, [F] application, [G] company size, [H] business model, [H] end user and [I] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the cellulose market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the cellulose market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] cellulose portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the cellulose market

Key Questions Answered in this Report

- How many companies are currently engaged in cellulose market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Cellulose Market

- 6.2.1. Key Characteristics of Cellulose Market

- 6.2.2. Type of Derivatives

- 6.2.3. Type of Source

- 6.2.4. Type of Modification Type

- 6.2.5. Type of Modification Process

- 6.2.6. Type of Purity

- 6.2.7. Type of Application

- 6.2.8. Company Size

- 6.2.9. Type of Business Model

- 6.2.10. Type of End User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Cellulose: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Ashland

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. Akzo Nobel N.V.

- 8.4. Borregaard

- 8.5. CP Kelco

- 8.6. China RuiTai International Holdings

- 8.7. Dow

- 8.8. DKS

- 8.9. Daicel Corporation

- 8.10. Fenchem

- 8.11. J. RettenmaierandSohne GmbH + Co.Kg

- 8.12. LOTTE Chemical Corporation

- 8.13. Lotte Fine Chemical

- 8.14. MAZRUI INTERNATIONAL

- 8.15. Reliance Cellulose Products

- 8.16. Rayonier

- 8.17. Shin-Etsu Chemical

- 8.18. SE Tylose GmbH and Co. Kg

- 8.19. Shandong Head

- 8.20. Shin-Etsu Chemical

- 8.21. Tembec

- 8.22. Zhejiang Kehong Chemical

9. STARTUP ECOSYSTEM IN THE CELLULOSE MARKET

- 9.1. Cellulose Market: Market Landscape of Startups

- 9.1.1. Analysis by Year of Establishment

- 9.1.2. Analysis by Company Size

- 9.1.3. Analysis by Company Size and Year of Establishment

- 9.1.4. Analysis by Location of Headquarters

- 9.1.5. Analysis by Company Size and Location of Headquarters

- 9.1.6. Analysis by Ownership Structure

- 9.2. Key Findings

10. VALUE CHAIN ANALYSIS

11. SWOT ANALYSIS

12. GLOBAL CELLULOSE MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Trends Disruption Impacting Market

- 12.4. Global Cellulose Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.5. Multivariate Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. MARKET OPPORTUNITIES BASED ON DERIVATIVE TYPE

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Cellulose Market for Commodity Cellulose Pulp: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Cellulose Market for Cellulose Fibers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Cellulose Market for Cellulose Ethers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Cellulose Market for Cellulose Esters: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Cellulose Market for Microcrystalline Cellulose: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Cellulose Market for Nanocellulose: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.12. Cellulose Market for Other: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.13. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON SOURCE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Cellulose Market for Natural: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.6.1. Cellulose Market for Crop: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.6.2. Cellulose Market for Fruit: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.6.3. Cellulose Market for Treewood: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Cellulose Market for Synthetic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON MODIFICATION TYPE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Cellulose Market for Modified: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.1. Cellulose Market for Microcrystalline Cellulose: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.2. Cellulose Market for Cellulose Ethers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.3. Cellulose Market for Cellulose Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Cellulose Market for Unmodified: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON MANUFACTURING PROCESS

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Cellulose Market for Viscose: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Cellulose Market for Ethers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON PURITY

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Cellulose Market for Above 95%: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Cellulose Market for 85%-95%: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Cellulose Market for Below 85%: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON APPLICATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Cellulose Market for Food: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Cellulose Market for Pharmaceuticals: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Cellulose Market for Paper: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Cellulose Market for Cosmetics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.10. Cellulose Market for Textiles: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.11. Cellulose Market for Paint and Coatings: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.12. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Cellulose Market for Textile Industry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Cellulose Market for Pharmaceutical Industry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Cellulose Market for Cosmetic Industry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Cellulose Market for Paper Industry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Cellulose Market for Paint and Coating Manufacturers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Cellulose Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Cellulose Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Cellulose Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Cellulose Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Cellulose Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR CELLULOSE IN NORTH AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Cellulose Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. Cellulose Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. Cellulose Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. Cellulose Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. Cellulose Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR CELLULOSE IN EUROPE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Cellulose Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Cellulose Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Cellulose Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Cellulose Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Cellulose Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Cellulose Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Cellulose Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.7. Cellulose Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.8. Cellulose Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.9. Cellulose Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.10. Cellulose Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.11. Cellulose Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.12. Cellulose Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.13. Cellulose Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.14. Cellulose Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.15. Cellulose Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR CELLULOSE IN ASIA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Cellulose Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Cellulose Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Cellulose Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Cellulose Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Cellulose Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Cellulose Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Cellulose Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR CELLULOSE IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Cellulose Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Cellulose Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 25.6.2. Cellulose Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Cellulose Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Cellulose Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Cellulose Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Cellulose Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Cellulose Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Cellulose Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR CELLULOSE IN LATIN AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Cellulose Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Cellulose Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Cellulose Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Cellulose Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Cellulose Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Cellulose Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Cellulose Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR CELLULOSE IN REST OF THE WORLD

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Cellulose Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Cellulose Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Cellulose Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Cellulose Market in Other Countries

- 27.7. Data Triangulation and Validation