|

市場調査レポート

商品コード

1771407

人工芝市場:産業動向・世界の予測 (~2035年):用途・素材・適用地域・設置タイプ・企業規模・主要地域別Artificial Turf Market Till 2035: Distribution by Type of Usage, Type of Material, Areas of Application, Type of Installation, Company Size, Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| 人工芝市場:産業動向・世界の予測 (~2035年):用途・素材・適用地域・設置タイプ・企業規模・主要地域別 |

|

出版日: 2025年07月15日

発行: Roots Analysis

ページ情報: 英文 194 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

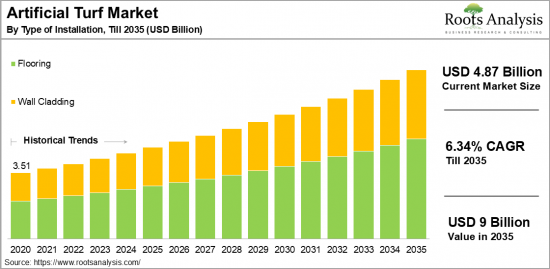

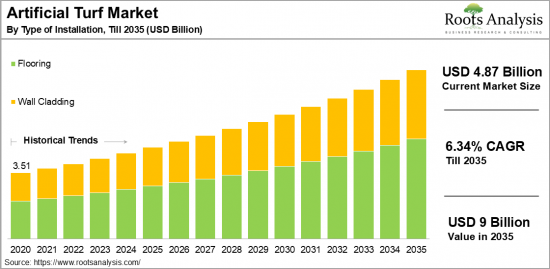

世界の人工芝の市場規模は、2035年までの予測期間中にCAGR 6.34%で推移し、現在の48億7,000万米ドルから、2035年には90億米ドルに成長すると予測されています。

人工芝の市場機会:セグメント別

用途別

- コンタクトスポーツ

- 情勢

- レジャー

- 非接触スポーツ

素材別

- ポリエチレン

- ポリアミド

- ポリプロピレン

- ナイロン

- サンドプラントインフィル材

利用エリア別

- 商用

- 家庭用

- スポーツ

設置タイプ別

- 床材

- 壁材

企業規模別

- 大企業

- 中小企業

地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米諸国

- 欧州

- オーストリア

- ベルギー

- デンマーク

- フランス

- ドイツ

- アイルランド

- イタリア

- オランダ

- ノルウェー

- ロシア

- スペイン

- スウェーデン

- スイス

- 英国

- その他の欧州諸国

- アジア

- 中国

- インド

- 日本

- シンガポール

- 韓国

- その他のアジア諸国

- ラテンアメリカ

- ブラジル

- チリ

- コロンビア

- ベネズエラ

- その他のラテンアメリカ諸国

- 中東・北アフリカ

- エジプト

- イラン

- イラク

- イスラエル

- クウェート

- サウジアラビア

- アラブ首長国連邦

- その他の中東・北アフリカ諸国

- 世界のその他の地域

- オーストラリア

- ニュージーランド

- その他の国

人工芝市場:成長と動向

人工芝は、天然芝に似せて作られた合成繊維で構成されており、主にポリオレフィンとポリアミドという2種類のポリマーから作られています。天然芝と比べてメンテナンスの手間が少ないことから、スポーツアリーナやスタジアム、住宅用および商業用の敷地に広く利用されています。近年では、造園への人工芝の導入が増加しており、今後の市場拡大を後押しすると見込まれています。

人工芝は特に、サッカーやラグビーなどのコンタクトスポーツで好まれており、信頼性の高いプレー環境を提供します。その汎用性の高さから、庭や縁石、歩道、中央分離帯、プール周辺などさまざまな場所に使用できるため、公共・民間問わず遊び場の設計にも最適な選択肢となっています。人工芝の大きな利点の一つは、その耐久性です。紫外線に強く、適切に管理すれば長年にわたって良好な状態を保つことが可能です。先進国および新興国の都市化が進む中で、人工芝の需要は今後さらに大幅に増加すると予想されており、人工芝市場は予測期間中、健全な成長率で拡大していくと見られています。

当レポートでは、世界の人工芝の市場を調査し、 市場概要、背景、市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

セクションI:レポートの概要

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクションII:定性的洞察

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 規制シナリオ

セクションIII:市場概要

第8章 主要企業の包括的データベース

第9章 競合情勢

第10章 ホワイトスペース分析

第11章 企業の競争力分析

第12章 人工芝市場におけるスタートアップエコシステム

セクションIV:企業プロファイル

第13章 企業プロファイル

- 章の概要

- Act Global

- Altus Sports &Leisure

- AstroTurf

- CCGrass

- Controlled Products

- DowDuPont

- Edel Grass

- FieldTurf

- ForestGrass

- Global Syn-Turf

- Limonta Sport

- Matrix Turf

- Shaw Sports Turf

- SIS Pitches

- Soccer Grass

- SportGroup

- Synthetic Turf International

- Tarkett

セクションV:市場動向

第14章 メガトレンド分析

第15章 アンメットニーズの分析

第16章 特許分析

第17章 最近の動向

セクションVI:市場機会の分析

第18章 世界の人工芝市場

第19章 用途別の市場機会

第20章 素材別の市場機会

第21章 利用エリア別の市場機会

第22章 設置タイプ別の市場機会

第23章 北米の人工芝の市場機会

第24章 欧州の人工芝の市場機会

第25章 アジアの人工芝の市場機会

第26章 中東・北アフリカの人工芝の市場機会

第27章 ラテンアメリカの人工芝の市場機会

第28章 世界のその他の地域における人工芝の市場機会

第29章 市場集中分析:主要企業の分布

第30章 隣接市場分析

セクションVII:戦略ツール

第31章 勝利の鍵となる戦略

第32章 ポーターのファイブフォース分析

第33章 SWOT分析

第34章 バリューチェーン分析

第35章 ROOTSの戦略提言

セクションVIII:その他の独占的洞察

第36章 1次調査からの洞察

第37章 報告書の結論

セクションIX:付録

第38章 表形式データ

第39章 企業・団体一覧

第40章 カスタマイズの機会

第41章 ROOTSサブスクリプションサービス

第42章 著者詳細

Artificial Turf Market Overview

As per Roots Analysis, the global artificial turf market size is estimated to grow from USD 4.87 billion in the current year to USD 9 billion by 2035, at a CAGR of 6.34% during the forecast period, till 2035.

The opportunity for artificial turf market has been distributed across the following segments:

Type of Usage

- Contact Sports

- Landscape

- Leisure

- Non-Contact Sports

Type of Material

- Polyethylene

- Polyamides

- Polypropylene

- Nylon

- Sand Plant Infill Material

Areas of Application

- Commercial

- Residential

- Sports

Type of Installation

- Flooring

- Wall Cladding

Company Size

- Large Enterprises

- Small and Medium Enterprises

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

ARTIFICIAL TURF MARKET: GROWTH AND TRENDS

Artificial turf consists of synthetic fibers crafted to resemble natural grass and is primarily made from two polymers, namely polyolefin and polyamide. It is widely used in sports arenas, stadiums, and both residential and commercial properties due to its low maintenance requirements when compared to real grass. The increasing trend of incorporating artificial turf in landscaping is likely to boost market expansion in the coming years.

Artificial turf is especially favored in contact sports such as soccer and rugby, as it provides a dependable playing surface. Its adaptability allows for use in diverse locations, including backyards, edges, walkways, medians, and around swimming pools, making it a superb option for designing playgrounds in both private and public settings. A significant benefit of artificial turf is its resilience; it is resistant to UV rays and can function effectively for numerous years if properly cared for. As urban growth continues in both advanced and emerging nations, the demand for artificial turf is projected to rise considerably, therefore the artificial turf market is expected to grow at a healthy rate during the forecast period.

ARTIFICIAL TURF MARKET: KEY SEGMENTS

Market Share by Type of Usage

Based on type of usage, the global artificial turf market is segmented into contact sports, landscape, leisure, and non-contact sports. According to our estimates, currently, contact sport segment captures the majority share of the market. This can be attributed to the rising popularity of sports like soccer, rugby, and hockey, which necessitate durable and high-quality surfaces that artificial turf can offer.

However, the landscape segment is expected to grow at a relatively higher CAGR during the forecast period. This growth can be attributed to the increasing popularity of residential and commercial landscaping, where the advantages of artificial grass include minimal maintenance, visual attractiveness, and water conservation. As urbanization continues and green areas become scarce, the uptake of artificial turf in landscaping is accelerating, thereby driving market expansion.

Market Share by Type of Material

Based on type of material, the artificial turf market is segmented into polyethylene, polyamides, polypropylene, nylon, and sand plant infill material. According to our estimates, currently, polyethylene segment captures the majority of the market. This growth can be attributed to its features like durability, softness, and resilience. This material is commonly utilized in both sports fields and landscaping applications as it mimics the natural grass look effectively. Additionally, it offers outstanding performance attributes, such as adequate drainage and a soft feel underfoot.

However, the nylon segment is expected to grow at a relatively higher CAGR during the forecast period. This growth can be attributed to the remarkable strength and durability of nylon, making it a favored choice in contact sports such as soccer and rugby, where issues of wear and tear are prominent. Nylon fibers can endure intense foot traffic while preserving their structural integrity over time.

Market Share by Areas of Application

Based on areas of application, the artificial turf market is segmented into commercial, residential, and sports. According to our estimates, currently, sports segment captures the majority share of the market. This can be attributed to the rising involvement of the youth in outdoor sports around the world, leading to a demand for the development of new stadiums and sports fields, which in turn drives market growth. Further, the establishment of sports facilities and stadiums for widely played outdoor sports like rugby and tennis is also playing a crucial role in the growth of this market segment.

However, the commercial segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period, owing to the extensive use of artificial turf in commercial settings, including public gardens, pathways, amusement parks, and hotels, as well as other public utility.

Market Share by Type of Installation

Based on type of installation, the artificial turf market is segmented into flooring and wall cladding. According to our estimates, currently, flooring segment captures the majority share of the market. Additionally, this segment is projected to experience a relatively higher compound annual growth rate (CAGR) during the forecast period. This growth can be attributed to the extensive use of artificial turf in sports complexes, playgrounds, and landscaping, where flooring applications are vital for both functionality and visual appeal. However, the wall cladding segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period.

Market Share by Company Size

Based on company size, the artificial turf market is segmented into large and small and medium enterprise. According to our estimates, currently, large enterprise captures the majority share of the market. On the other hand, small and medium enterprises are projected to experience a relatively higher growth rate during the forecast period. This growth can be attributed to their flexibility, innovation, emphasis on niche markets, and capacity to adjust to evolving customer needs and market dynamics.

Market Share by Geographical Regions

Based on geographical regions, the artificial turf market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Europe captures the majority share of the market. This can be attributed to the region's well-established industrial base and a strong focus on high-quality pitches for sports. Countries, such as Germany, UK, and France play a significant role in driving this growth, bolstered by substantial investments in sports facilities and recreational spaces.

Example Players in Artificial Turf Market

- Act Global

- Altus Sports & Leisure

- AstroTurf

- CCGrass

- Controlled Products

- DowDuPont

- Edel Grass

- FieldTurf

- ForestGrass

- Global Syn-Turf

- Limonta Sport

- Matrix Turf

- Shaw Sports Turf

- SIS Pitches

- Soccer Grass

- SportGroup

- Synthetic Turf International

- Tarkett

- TenCate Grass

- TigerTurf

- Victoria PLC

ARTIFICIAL TURF MARKET: RESEARCH COVERAGE

The report on the artificial turf market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the artificial turf market, focusing on key market segments, including [A] type of usage, [B] type of material, [C] areas of application, [D] type of installation, [E] company size, and [F] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the artificial turf market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the artificial turf market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the artificial turf industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the artificial turf domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the artificial turf market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the artificial turf market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in artificial turf market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Artificial Turf Market

- 6.2.1. Type of Usage

- 6.2.2. Type of Material

- 6.2.3. Areas of Application

- 6.2.4. Type of Installation

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Artificial Turf: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE ARTIFICIAL TURF MARKET

- 12.1. Artificial Turf Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Act Global*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Altus Sports & Leisure

- 13.4. AstroTurf

- 13.5. CCGrass

- 13.6. Controlled Products

- 13.7. DowDuPont

- 13.8. Edel Grass

- 13.9. FieldTurf

- 13.10. ForestGrass

- 13.11. Global Syn-Turf

- 13.12. Limonta Sport

- 13.13. Matrix Turf

- 13.14. Shaw Sports Turf

- 13.15. SIS Pitches

- 13.16. Soccer Grass

- 13.17. SportGroup

- 13.18. Synthetic Turf International

- 13.19. Tarkett

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL ARTIFICIAL TURF MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Artificial Turf Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF USAGE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Artificial Turf Market for Contact Sports: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.7. Artificial Turf Market for Landscape: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.8. Artificial Turf Market for Leisure: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.9. Artificial Turf Market for Non-Contact Sports: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.10. Data Triangulation and Validation

- 19.10.1. Secondary Sources

- 19.10.2. Primary Sources

- 19.10.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF MATERIAL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Artificial Turf Market for Polyethylene: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.7. Artificial Turf Market for Polyamides: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.8. Artificial Turf Market for Polypropylene: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.9. Artificial Turf Market for Nylon: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.10. Artificial Turf Market for Sand Plant Infill Material: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.11. Data Triangulation and Validation

- 20.11.1. Secondary Sources

- 20.11.2. Primary Sources

- 20.11.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON AREAS OF APPLICATION

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Artificial Turf Market for Commercial: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.7. Artificial Turf Market for Residential: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.8. Artificial Turf Market for Sports: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

- 21.9.1. Secondary Sources

- 21.9.2. Primary Sources

- 21.9.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF INSTALLATION

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Artificial Turf Market for Flooring: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.7. Artificial Turf Market for Wall Cladding: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES FOR ARTIFICIAL TURF IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Artificial Turf Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.1. Artificial Turf Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.2. Artificial Turf Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.3. Artificial Turf Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.4. Artificial Turf Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR ARTIFICIAL TURF IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Artificial Turf Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.1. Artificial Turf Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.2. Artificial Turf Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.3. Artificial Turf Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.4. Artificial Turf Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.5. Artificial Turf Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.6. Artificial Turf Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.7. Artificial Turf Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.8. Artificial Turf Market in Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.9. Artificial Turf Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.10. Artificial Turf Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.11. Artificial Turf Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.12. Artificial Turf Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.13. Artificial Turf Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.14. Artificial Turf Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.15. Artificial Turf Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.16. Artificial Turf Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR ARTIFICIAL TURF IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Artificial Turf Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.1. Artificial Turf Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.2. Artificial Turf Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.3. Artificial Turf Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.4. Artificial Turf Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.5. Artificial Turf Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.6. Artificial Turf Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR ARTIFICIAL TURF IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Artificial Turf Market in Middle East and North Africa (MENA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.1. Artificial Turf Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 26.6.2. Artificial Turf Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.3. Artificial Turf Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.4. Artificial Turf Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.5. Artificial Turf Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.6. Artificial Turf Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.7. Artificial Turf Market in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.6.8. Artificial Turf Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR ARTIFICIAL TURF IN LATIN AMERICA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Artificial Turf Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.1. Artificial Turf Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.2. Artificial Turf Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.3. Artificial Turf Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.4. Artificial Turf Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.5. Artificial Turf Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.6.6. Artificial Turf Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR ARTIFICIAL TURF IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Artificial Turf Market in Rest of the World: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.1. Artificial Turf Market in Australia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.2. Artificial Turf Market in New Zealand: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 28.6.3. Artificial Turf Market in Other Countries

- 28.7. Data Triangulation and Validation

29. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 29.1. Leading Player 1

- 29.2. Leading Player 2

- 29.3. Leading Player 3

- 29.4. Leading Player 4

- 29.5. Leading Player 5

- 29.6. Leading Player 6

- 29.7. Leading Player 7

- 29.8. Leading Player 8

30. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

31. KEY WINNING STRATEGIES

32. PORTER'S FIVE FORCES ANALYSIS

33. SWOT ANALYSIS

34. VALUE CHAIN ANALYSIS

35. ROOTS STRATEGIC RECOMMENDATIONS

- 35.1. Chapter Overview

- 35.2. Key Business-related Strategies

- 35.2.1. Research & Development

- 35.2.2. Product Manufacturing

- 35.2.3. Commercialization / Go-to-Market

- 35.2.4. Sales and Marketing

- 35.3. Key Operations-related Strategies

- 35.3.1. Risk Management

- 35.3.2. Workforce

- 35.3.3. Finance

- 35.3.4. Others