|

市場調査レポート

商品コード

1771313

コンピュータ支援創薬市場:業界動向と世界の予測 - 創薬ステップ別、企業規模別、治療領域別、主要地域別(北米、欧州、アジア太平洋、その他の地域)Computer Aided Drug Discovery Market: Industry Trends and Global Forecasts - Distribution by Drug Discovery Steps, Company Size, Therapeutic Area, and Key Geographical Regions (North America, Europe, and Asia-Pacific and Rest of the World) |

||||||

カスタマイズ可能

|

|||||||

| コンピュータ支援創薬市場:業界動向と世界の予測 - 創薬ステップ別、企業規模別、治療領域別、主要地域別(北米、欧州、アジア太平洋、その他の地域) |

|

出版日: 2025年07月15日

発行: Roots Analysis

ページ情報: 英文 290 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

コンピュータ支援創薬の世界市場:概要

世界のコンピュータ支援創薬の市場規模は2,900万米ドルで、予測期間中に15.6%のCAGRで拡大すると予測されています。

市場セグメンテーションと機会分析は、以下のパラメータでセグメント化されています:

創薬ステップ

- ターゲット同定

- ターゲット検証

- ヒットジェネレーション

- ヒット・ツー・リード(HTL)

- リード最適化

高分子タイプ

- 抗体

- タンパク質

- ペプチド

- 核酸

- ベクター

企業規模

- 小企業

- 中堅企業

- 大企業

治療領域

- 自己免疫疾患

- 血液疾患

- 心血管疾患

- 消化器疾患

- ホルモン疾患

- HIV/AIDS

- 感染症

- 代謝疾患

- 精神疾患

- 筋骨格系疾患

- 神経疾患

- 腫瘍学的障害

- 呼吸器疾患

- 皮膚障害

- 泌尿器系疾患

- その他

スポンサータイプ

- 業界参入企業

- 非業界参入企業

主要地域

- 北米(米国、カナダ)

- 欧州(イタリア、ドイツ、フランス、スペイン、その他)

- アジア太平洋(中国、インド、日本)

世界のコンピューター支援創薬市場:成長と動向

時間の経過とともに、創薬に伴う複雑さは増しており、特に高分子医薬品の場合は、従来の低分子医薬品よりも本質的に複雑です。その結果、医薬品受託製造/バイオテクノロジーセクターにおける研究開発費全体の増加が見られるようになっています。複雑さに加え、創薬プロセスは設備投資と時間の両面で非常に厳しいです。その結果、コンピューター支援による創薬サービスが、この問題の潜在的な解決策として浮上してきました。

長年にわたり、さまざまな計算ツールやサービスが登場し、潜在的なリード候補化合物の選択、モデリング、分析、最適化を可能にしてきました。コンピューター支援による創薬プロバイダーの予測力は、研究者が何百もの生物学的標的にわたって分子を無作為にスクリーニングすることを回避できるようにし、非常に有利であることが証明されています。さらに、このアプローチによって、新薬開発にかかる総コストの35%近くを節約できると推定されており、その結果、高分子を対象としたより効率的な創薬サービスに対する需要が高まっていることは注目に値します。その結果、CADDのような斬新なin-silico創薬サービスを提供する企業は、今や製薬業界に不可欠な存在となっています。

世界のコンピューター支援創薬市場:主要インサイト

当レポートでは、世界のコンピュータ支援創薬市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです。

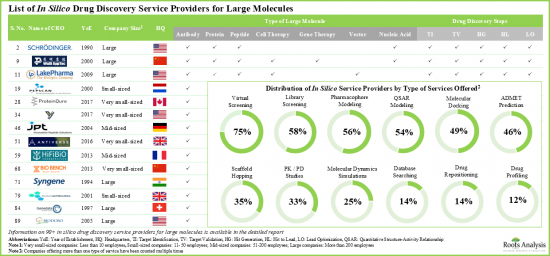

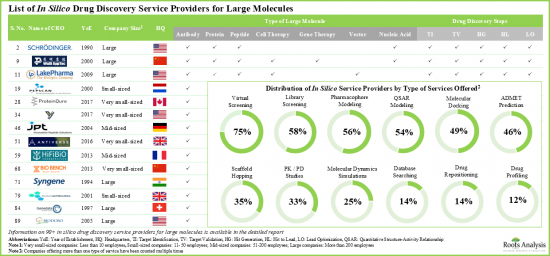

- 90社以上の企業が様々な種類の生物製剤の創薬にin silicoサービスを提供することに積極的に関与しており、このうち約30社が創薬の全ステップに対応するサービスを提供できると主張しています。

- このうち、約30社が創薬の全工程をカバーするサービスを提供できると主張しています。大半の企業は、抗体、タンパク質、ペプチドなど、さまざまな高分子の早期創薬に焦点を当てた構造ベースのドラッグデザインを提供しています。

- in silicoサービスを提供する大手企業の代表例としては、ChemPartner、Evotec、Jubilant Biosys、Schrodinger、Sygnature Discovery、WuXi AppTecなどが挙げられます。

- 30%以上のサービスプロバイダーが、創薬の全ステップに対してin silicoサービスを提供しています。対照的に、ターゲットベースの創薬ステップでは、広範な実験的サポートが必要です。

- 注目すべきは、in silicoサービスの60%近くが、あらゆる種類の抗体の中でもモノクローナル抗体を対象としていることです。これに続くのが、さまざまな種類のタンパク質やペプチドを対象としたin silico創薬サービスを提供する企業です。

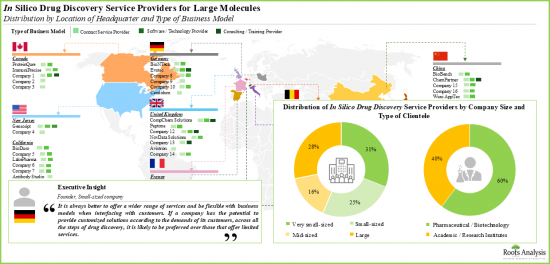

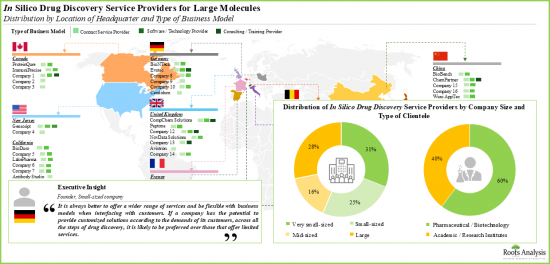

- 中小企業の存在を特徴とするin-silicoサービスプロバイダーは様々な地域に分散しており、これらの参入企業は顧客の進化するニーズに応えるために様々なビジネスモデルを採用しています。

- この領域に携わるいくつかの企業は、それぞれのin silicoベースのサービス・ポートフォリオを強化し、この業界における競争力を維持するために、着実に能力を拡大しています。

- 人工知能やクラウドベースのプラットフォームなどの新しい計算技術とin silicoアプローチの統合は、創薬プロセス全体に革命をもたらす可能性が高いです。

- サービスプロバイダーは、創薬のタイムラインを早め、製品の成功を向上させるとともに、大幅なコスト削減のメリットを提供し続けるために、さまざまなビジネス戦略を採用しています。

- 効果的な治療薬に対する需要の高まりと、幅広い治療領域にわたる様々な生物製剤の創薬活動の増加により、市場は今後も持続的な成長が見込まれます。

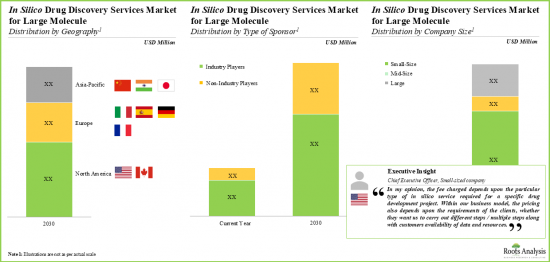

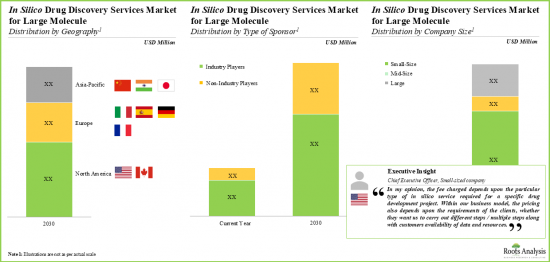

- 長期的には、さまざまな地域、スポンサーの種類、サービスプロバイダーの企業規模にわたって、予測される機会は十分に分散していると予想されます。

コンピュータ支援創薬市場の参入企業例

- BioDuro

- Creative Biostructure

- GenScript

- LakePharma

- Abzena

- BioNTech

- Sygnature Discovery

- ChemPartner

- Sundia MediTech

- Viva Biotech

当レポートでは、世界のコンピュータ支援創薬市場について調査し、市場の概要とともに、創薬ステップ別、企業規模別、治療領域別動向、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 章の概要

- 医薬品の発見と開発のタイムライン

- in silico創薬ツールの概要

- 創薬プロセスにおけるin silicoツールの応用

- 創薬業務におけるIn Silicoツールの利用の利点

- in silico創薬オペレーションの実施に伴う課題

- in silico創薬業務のアウトソーシング増加の予測

- 結論

第4章 市場情勢

- 章の概要

- 高分子を対象としたIn Silico創薬サービス:業界参入企業一覧

- in silico創薬サービス:ソフトウェア/テクノロジー一覧

第5章 重要な洞察

第6章 企業プロファイル

- 章の概要

- 北米に拠点を置く主要なin silico サービスプロバイダー

- BioDuro

- Creative Biostructure

- GenScript

- LakePharma

- 欧州に拠点を置く主要企業

- Abzena

- BioNTech

- Sygnature Discovery

- アジア太平洋に拠点を置く主要企業

- ChemPartner

- Sundia MediTech

- Viva Biotech

第7章 企業競争力分析

- 章の概要

- 主なパラメータ

- 調査手法

- 企業競争力分析:北米のin silico創薬サービスプロバイダー

- 企業競争力分析:欧州のin silico創薬サービスプロバイダー

- 企業競争力分析:アジア太平洋およびその他の地域のin silico創薬サービスプロバイダー

第8章 主要な機会分野

- 章の概要

- 主な前提とパラメータ

- 調査手法

- 抗体

- ペプチド

- タンパク質

- その他の先進治療法

第9章 新たなビジネスモデルと戦略

- 章の概要

- 主要な前提と調査手法

- in silicoサービスプロバイダー:対象となる高分子の数と創薬ステップ別分析

- 結論

第10章 ケーススタディ:小分子と高分子の創薬プロセスの比較

- 章の概要

- 低分子および高分子医薬品/治療法

- 高分子の発見プロセスを改善するためのアプローチ

第11章 調査の洞察

第12章 コスト削減分析

第13章 市場予測

- 章の概要

- 予測調査手法と主要な前提条件

- 2035年までの高分子向けin silico創薬サービス市場全体

- 高分子向けin silico創薬サービス市場:創薬ステップ別(2035年まで)

- 高分子向けin silico創薬サービス市場:高分子タイプ別(2035年まで)

- 高分子向けin silico創薬サービス市場:企業規模別(2035年まで)

- 高分子向けin silico創薬サービス市場:治療領域別(2035年まで)

- 高分子向けin silico創薬サービス市場:スポンサータイプ別(2035年まで)

- 高分子向けin silico創薬サービス市場:主要地域別(2035年まで)

第14章 創薬におけるin silicoツールと今後の動向

- 章の概要

- コストと時間に関する潜在的なメリットにより、創薬業務のアウトソーシングは今後増加する

- 技術の進歩は現在の創薬プロセスに革命をもたらす可能性が高め

- 結論

第15章 エグゼクティブ洞察

第16章 付録I:表形式データ

第17章 付録II:企業および組織の一覧

第18章 付録III:創薬のための非計算的手法

List of Tables

- Table 4.1. In Silico Drug Discovery Service Providers for Large Molecules: List of Industry Players

- Table 4.2. In Silico Drug Discovery Services for Large Molecules: Information on Drug Discovery Steps

- Table 4.3. In Silico Drug Discovery Service Providers for Large Molecules: Information on Type of In Silico Approach

- Table 4.4. In Silico Drug Discovery Service Providers for Large Molecules: Information on Type of Clientele

- Table 4.5. In Silico Drug Discovery Services for Large Molecules: Information on Type of Large Molecule

- Table 4.6. In Silico Drug Discovery Services for Large Molecules: Information on In Silico-based Service Offerings

- Table 4.7. In Silico Drug Discovery Services for Large Molecules: Additional Information

- Table 4.8. In Silico Drug Discovery Services: List of Software / Technologies

- Table 6.1. In Silico Service Providers: List of Companies Profiled

- Table 6.2. BioDuro: Key Highlights

- Table 6.3. BioDuro: List of Funding Instances and Investors

- Table 6.4. BioDuro: Recent Developments and Future Outlook

- Table 6.5. Creative Biostructure: Key Highlights

- Table 6.6. Creative Biostructure: List of Funding Instances and Investors

- Table 6.7. Creative Biostructure: Recent Developments and Future Outlook

- Table 6.8. GenScript: Key Highlights

- Table 6.9. GenScript: List of Funding Instances and Investors

- Table 6.10. GenScript: Recent Developments and Future Outlook

- Table 6.11. LakePharma: Key Highlights

- Table 6.12. LakePharma: List of Funding Instances and Investors

- Table 6.13. LakePharma: Recent Developments and Future Outlook

- Table 6.14. Abzena: Key Highlights

- Table 6.15. Abzena: List of Funding Instances and Investors

- Table 6.16. Abzena: Recent Developments and Future Outlook

- Table 6.17. BioNTech: Key Highlights

- Table 6.18. BioNTech: List of Funding Instances and Investors

- Table 6.19. BioNTech: Recent Developments and Future Outlook

- Table 6.20. Sygnature Discovery: Key Highlights

- Table 6.21. Sygnature Discovery: List of Funding Instances and Investors

- Table 6.22. Sygnature Discovery: Recent Developments and Future Outlook

- Table 6.23. ChemPartner: Key Highlights

- Table 6.24. ChemPartner: Recent Developments and Future Outlook

- Table 6.25. Sundia MediTech: Key Highlights

- Table 6.26. Sundia MediTech: List of Funding Instances and Investors

- Table 6.27. Sundia MediTech: Recent Developments and Future Outlook

- Table 6.28. Viva Biotech: Key Highlights

- Table 6.29. Viva Biotech: List of Funding Instances and Investors

- Table 6.30. Viva Biotech: Recent Developments and Future Outlook

- Table 10.1. Comparison of Strengths and Weaknesses of Small Molecules and Large Molecules

- Table 10.2. Comparison of Development Characteristics of Small Molecules and Large Molecules

- Table 10.3. Challenges in the Discovery of Different Types of Large Molecules

- Table 11.1. Survey Insights: Overview of Respondents

- Table 11.2. Survey Insights: Designation and Seniority Levels

- Table 11.3. Survey Insights: Drug Discovery Steps Covered in Service Portfolio

- Table 11.4. Survey Insights: Expertise Related to Different Types of Molecules

- Table 11.5. Survey Insights: In Silico Drug Discovery Focused Service Portfolio

- Table 11.6 Survey Insights: Other In Silico Services Offered

- Table 11.7. Survey Insights: Likely Adoption of In Silico Tools for Large Molecule Drug Discovery

- Table 11.8. Survey Insights: Opinions on Current Market Opportunity

- Table 11.8. Survey Insights: Opinions on Likely Growth Rate

- Table 11.9. Survey Insights: Opinions on Likely Cost Reduction using In Silico Tools in Large Molecule Drug Discovery

- Table 12.1. Likely Cost Reduction using In Silico Services for Large Molecules and Small Molecules

- Table 12.2 Drug Discovery Steps: Key Parameters

- Table 14.1. Companies Offering Artificial Intelligence and In Silico Services

- Table 14.2. Companies Offering Cloud Computing Platforms and In Silico Services

- Table 15.1. ProSciens: Company Snapshot

- Table 15.2. Conifer Point Pharmaceuticals: Company Snapshot

- Table 16.1. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Year of Establishment

- Table 16.2. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Company Size

- Table 16.3. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Location of Headquarters

- Table 16.4. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Type of Business Model

- Table 16.5. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Drug Discovery Steps

- Table 16.6. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Type of Large Molecule

- Table 16.7. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Type of Antibody

- Table 16.8. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Type of Protein

- Table 16.9. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Type of Designing Approach Used

- Table 16.10. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by In Silico Service Offering

- Table 16.11. In Silico Drug Discovery Service Providers for Large Molecules: Distribution by Type of Clientele

- Table 16.12. Tree Map Representation: Distribution by Company Size and Drug Discovery Steps

- Table 16.13. World Map Representation: Regional Analysis of Outsourcing Activity

- Table 16.14. Grid Representation: Distribution by Type of Large Molecule and Designing Approach

- Table 16.15. Small Molecule and Large Molecule Drugs: Historical Trend of FDA Approval

- Table 16.16. Survey Insights: Distribution of Respondents by Year of Establishment of Company

- Table 16.17. Survey Insights: Distribution of Respondents by Employee Size

- Table 16.18. Survey Insights: Distribution of Respondents by Location of Company Headquarters (Continent-Wise)

- Table 16.19. Survey Insights: Distribution of Respondents by Location of Company Headquarters (Country-Wise)

- Table 16.20. Survey Insights: Distribution by Designation and Seniority Level of Respondents

- Table 16.21. Survey Insights: Distribution by Drug Discovery Steps

- Table 16.22. Survey Insights: Distribution by Type of Molecule

- Table 16.23. Survey Insights: Distribution by In Silico-based Service Portfolio

- Table 16.24. Survey Insights: Distribution by Likely Adoption of In Silico Tools

- Table 16.25. Survey Insights: Distribution by Current Market Opportunity

- Table 16.26. Survey Insights: Distribution by Likely Growth Rate

- Table 16.27. Survey Insights: Distribution by Likely Cost Reduction using In Silico Tools in Large Molecule Drug Discovery

- Table 16.28. Overall Cost Saving Potential of In Silico Tools in Large Molecule Drug Discovery, Till 2035 (USD Billion)

- Table 16.29. Overall In Silico Drug Discovery Services Market for Large Molecules, Till 2035 (USD Million)

- Table 16.30. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Drug Discovery Steps

- Table 16.31. In Silico Drug Discovery Services Market for Large Molecules for Target Identification, Till 2035 (USD Million)

- Table 16.32. In Silico Drug Discovery Services Market for Large Molecules for Target Validation, Till 2035 (USD Million)

- Table 16.33. In Silico Drug Discovery Services Market for Large Molecules for Hit Generation, Till 2035 (USD Million)

- Table 16.34. In Silico Drug Discovery Services Market for Large Molecules for Hit-to-Lead, Till 2035 (USD Million)

- Table 16.35. In Silico Drug Discovery Services Market for Large Molecules for Lead Optimization, Till 2035 (USD Million)

- Table 16.36. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Large Molecule

- Table 16.37. In Silico Drug Discovery Services Market for Antibodies, Till 2035 (USD Million)

- Table 16.38. In Silico Drug Discovery Services Market for Proteins, Till 2035 (USD Million)

- Table 16.39. In Silico Drug Discovery Services Market for Peptides, Till 2035 (USD Million)

- Table 16.40. In Silico Drug Discovery Services Market for Nucleic Acid, Till 2035 (USD Million)

- Table 16.41. In Silico Drug Discovery Services Market for Vectors, Till 2035 (USD Million)

- Table 16.42. In Silico Drug Discovery Services Market for Other Large Molecules, Till 2035 (USD Million)

- Table 16.43. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Company Size

- Table 16.44. In Silico Drug Discovery Services Market for Large Molecules for Small Companies, Till 2035 (USD Million)

- Table 16.45. In Silico Drug Discovery Services Market for Large Molecules for Mid-sized Companies, Till 2035 (USD Million)

- Table 16.46. In Silico Drug Discovery Services Market for Large Molecules for Large Companies, Till 2035 (USD Million)

- Table 16.47. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Therapeutic Areas

- Table 16.48. In Silico Drug Discovery Services Market for Large Molecules for Autoimmune Disorders, Till 2035 (USD Million)

- Table 16.49. In Silico Drug Discovery Services Market for Large Molecules for Blood Disorders, Till 2035 (USD Million)

- Table 16.50. In Silico Drug Discovery Services Market for Large Molecules for Cardiovascular Disorders, Till 2035 (USD Million)

- Table 16.51. In Silico Drug Discovery Services Market for Large Molecules for Gastrointestinal and Digestive Disorders, Till 2035 (USD Million)

- Table 16.52. In Silico Drug Discovery Services Market for Large Molecules for Hormonal Disorders, Till 2035 (USD Million)

- Table 16.53. In Silico Drug Discovery Services Market for Large Molecules for HIV / AIDS, Till 2035 (USD Million)

- Table 16.54. In Silico Drug Discovery Services Market for Large Molecules for Infectious Diseases, Till 2035 (USD Million)

- Table 16.55. In Silico Drug Discovery Services Market for Large Molecules for Metabolic Disorders, Till 2035 (USD Million)

- Table 16.56. In Silico Drug Discovery Services Market for Large Molecules for Mental Disorders, Till 2035 (USD Million)

- Table 16.57. In Silico Drug Discovery Services Market for Large Molecules for Musculoskeletal Disorders, Till 2035 (USD Million)

- Table 16.58. In Silico Drug Discovery Services Market for Large Molecules for Neurological Disorders, Till 2035 (USD Million)

- Table 16.59. In Silico Drug Discovery Services Market for Large Molecules for Oncological Disorders, Till 2035 (USD Million)

- Table 16.60. In Silico Drug Discovery Services Market for Large Molecules for Respiratory Disorders, Till 2035 (USD Million)

- Table 16.61. In Silico Drug Discovery Services Market for Large Molecules for Skin Disorders, Till 2035 (USD Million)

- Table 16.62. In Silico Drug Discovery Services Market for Large Molecules for Urogenital Disorders, Till 2035 (USD Million)

- Table 16.63. In Silico Drug Discovery Services Market for Large Molecules for Others, Till 2035 (USD Million)

- Table 16.64. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Sponsor

- Table 16.65. In Silico Drug Discovery Services Market for Large Molecules for Industry Players, Till 2035 (USD Million)

- Table 16.66. In Silico Drug Discovery Services Market for Large Molecules for Non-Industry Players, Till 2035 (USD Million)

- Table 16.67. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Key Geographical Regions

- Table 16.68. In Silico Drug Discovery Services Market for Large Molecules in North America, (USD Million)

- Table 16.69. In Silico Drug Discovery Services Market for Large Molecules in the US, Till 2035 (USD Million)

- Table 16.70. In Silico Drug Discovery Services Market for Large Molecules in Canada, Till 2035 (USD Million)

- Table 16.71. In Silico Drug Discovery Services Market for Large Molecules in Europe, (USD Million)

- Table 16.72. In Silico Drug Discovery Services Market for Large Molecules in Germany, Till 2035 (USD Million)

- Table 16.73. In Silico Drug Discovery Services Market for Large Molecules in France, Till 2035 (USD Million)

- Table 16.74. In Silico Drug Discovery Services Market for Large Molecules in the UK, Till 2035 (USD Million)

- Table 16.75. In Silico Drug Discovery Services Market for Large Molecules in Italy, Till 2035 (USD Million)

- Table 16.76. In Silico Drug Discovery Services Market for Large Molecules in Spain, Till 2035 (USD Million)

- Table 16.77. In Silico Drug Discovery Services Market for Large Molecules in Rest of Europe, Till 2035 (USD Million)

- Table 16.78. In Silico Drug Discovery Services Market for Large Molecules in Asia-Pacific and Rest of the World (USD Million)

- Table 16.79. In Silico Drug Discovery Services Market for Large Molecules in China, Till 2035 (USD Million)

- Table 16.80. In Silico Drug Discovery Services Market for Large Molecules in India, Till 2035 (USD Million)

- Table 16.81. In Silico Drug Discovery Services Market for Large Molecules in Japan, Till 2035 (USD Million)

- Table 16.82. In Silico Drug Discovery Services Market for Large Molecules in Other Asian Countries, Till 2035 (USD Million)

List of Figures

- Figure 3.1. Drug Discovery and Development Timeline

- Figure 3.2. Historical Evolution of Computational Drug Discovery Approaches

- Figure 3.3. Steps Involved in the Virtual Drug Discovery Process

- Figure 3.4. Comparison of Traditional and In Silico Drug Discovery Approaches

- Figure 3.5. Classification of In Silico Drug Discovery Approaches

- Figure 3.6. Flowchart of the In Silico Drug Discovery Approach

- Figure 3.7. In Silico Service Map for Drug Discovery Process

- Figure 3.8. Advantages of using In Silico Drug Discovery Services

- Figure 3.9. Types of Large Molecule Drugs

- Figure 4.1. In Silico Drug Discovery Services for Large Molecules: Distribution by Year of Establishment

- Figure 4.2. In Silico Drug Discovery Services for Large Molecules: Distribution by Company Size

- Figure 4.3. In Silico Drug Discovery Services for Large Molecules: Distribution by Location of Headquarters

- Figure 4.4 In Silico Drug Discovery Services for Large Molecules: Distribution by Company Size and Location of Headquarters

- Figure 4.5. In Silico Drug Discovery Services for Large Molecules: Distribution by Type of Business Model

- Figure 4.6. In Silico Drug Discovery Services for Large Molecules: Distribution by Drug Discovery Steps

- Figure 4.7. In Silico Drug Discovery Services for Large Molecules: Distribution by Type of Large Molecule

- Figure 4.8. In Silico Drug Discovery Services for Large Molecules: Distribution by Type of Antibody

- Figure 4.9. In Silico Drug Discovery Services for Large Molecules: Distribution by Type of Protein

- Figure 4.10. In Silico Drug Discovery Services for Large Molecules: Distribution by Type of In Silico Approach Used

- Figure 4.11. In Silico Drug Discovery Services for Large Molecules: Distribution by Types of In Silico Services Offered

- Figure 5.1. Logo Landscape: Distribution by Company Size and Location of Headquarters

- Figure 5.2. Tree Map Representation: Distribution by Company Size and Drug Discovery Steps

- Figure 5.3. World Map Representation: Regional Analysis of Outsourcing Activity

- Figure 5.4. Grid Representation: Distribution by Type of Large Molecule, Designing Approach Used and Type of Clientele

- Figure 6.1. BioDuro: In Silico-based Service Portfolio

- Figure 6.2. BioDuro: Peer Group Benchmark Comparison

- Figure 6.3. Creative Biostructure: In Silico-based Service Portfolio

- Figure 6.4. Creative Biostructure: Peer Group Benchmark Comparison

- Figure 6.5. GenScript: In Silico-based Service Portfolio

- Figure 6.6. GenScript: Peer Group Benchmark Comparison

- Figure 6.7. LakePharma: In Silico-based Service Portfolio

- Figure 6.8. LakePharma: Peer Group Benchmark Comparison

- Figure 6.9. Abzena: In Silico-based Service Portfolio

- Figure 6.10. Abzena: Company Benchmarking Output

- Figure 6.11. BioNTech: Peer Group Benchmark Comparison

- Figure 6.12. Sygnature Discovery: In Silico-based Service Portfolio

- Figure 6.13. Sygnature Discovery: Peer Group Benchmark Comparison

- Figure 6.14. ChemPartner: In Silico-based Service Portfolio

- Figure 6.15. ChemPartner: Peer Group Benchmark Comparison

- Figure 6.16. Sundia MediTech: In Silico-based Service Portfolio

- Figure 6.17. Sundia MediTech: Peer Group Benchmark Comparison

- Figure 6.18. Viva Biotech: In Silico-based Service Portfolio

- Figure 6.19. Viva Biotech: Peer Group Benchmark Comparison

- Figure 7.1. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in North America

- Figure 7.2. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in Europe

- Figure 7.3. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in Asia-Pacific and Rest of the World

- Figure 8.1. In Silico Drug Discovery Service Providers for Antibodies: 3D Bubble Representation

- Figure 8.2. In Silico Drug Discovery Service Providers for Peptides: 3D Bubble Representation

- Figure 8.3. In Silico Drug Discovery Service Providers for Proteins: 3D Bubble Representation

- Figure 8.4. In Silico Drug Discovery Service Providers for Other Advanced Therapies: 3D Bubble Representation

- Figure 9.1. In Silico Drug Discovery Service Providers: Popular Strategies or Business Models

- Figure 10.1. Small Molecule and Large Molecule Drugs: Historical Trend of FDA Approval

- Figure 10.2. Small Molecules versus Large Molecules: Comparison of Key Characteristics

- Figure 10.3. Small Molecules versus Large Molecules: Comparison of Manufacturing Process

- Figure 11.1. Survey Insights: Distribution of Respondents by Year of Establishment of Company

- Figure 11.2. Survey Insights: Distribution of Respondents by Company Size

- Figure 11.3. Survey Insights: Distribution of Respondents by Location of Company Headquarters (Continent-Wise)

- Figure 11.4. Survey Insights: Distribution of Respondents by Location of Company Headquarters (Country-Wise)

- Figure 11.5. Survey Insights: Distribution by Designation and Seniority Level of Respondents

- Figure 11.6. Survey Insights: Distribution by Drug Discovery Steps

- Figure 11.7. Survey Insights: Distribution by Type of Molecules Handled

- Figure 11.8. Survey Insights: Distribution by In Silico-based Service Portfolio

- Figure 11.9. Survey Insights: Distribution by Likely Adoption of In Silico Tools

- Figure 11.10. Survey Insights: Distribution by Current Market Opportunity

- Figure 11.11. Survey Insights: Distribution by Likely Growth Rate

- Figure 11.12. Survey Insights: Distribution by Likely Cost Reduction using In Silico Tools in Large Molecule Drug Discovery

- Figure 12.1. Overall Cost Saving Potential of In Silico Tools in Large Molecule Drug Discovery: Growth Scenarios

- Figure 12.2. Overall Cost Saving Potential of In Silico Tools in Large Molecule Drug Discovery, Till 2035 (USD Billion)

- Figure 13.1. Roots Analysis Forecasting Approach

- Figure 13.2. Overall In Silico Drug Discovery Services Market for Large Molecules, Till 2035 (USD Million)

- Figure 13.3. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Drug Discovery Steps (USD Million)

- Figure 13.4. In Silico Drug Discovery Services Market for Large Molecules for Target Identification, Till 2035 (USD Million)

- Figure 13.5. In Silico Drug Discovery Services Market for Large Molecules for Target Validation, Till 2035 (USD Million)

- Figure 13.6. In Silico Drug Discovery Services Market for Large Molecules for Hit Generation, Till 2035 (USD Million)

- Figure 13.7. In Silico Drug Discovery Services Market for Large Molecules for Hit-to-Lead, Till 2035 (USD Million)

- Figure 13.8. In Silico Drug Discovery Services Market for Large Molecules for Lead Optimization, Till 2035 (USD Million)

- Figure 13.9. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Large Molecule (USD Million)

- Figure 13.10. In Silico Drug Discovery Services Market for Large Molecules for Antibodies, Till 2035 (USD Million)

- Figure 13.11. In Silico Drug Discovery Services Market for Large Molecules for Proteins, Till 2035 (USD Million)

- Figure 13.12. In Silico Drug Discovery Services Market for Large Molecules for Peptides, Till 2035 (USD Million)

- Figure 13.13. In Silico Drug Discovery Services Market for Large Molecules for Nucleic Acid, Till 2035 (USD Million)

- Figure 13.14. In Silico Drug Discovery Services Market for Large Molecules for Vectors, Till 2035 (USD Million)

- Figure 13.15. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Company Size (USD Million)

- Figure 13.16. In Silico Drug Discovery Services Market for Large Molecules for Small Companies, Till 2035 (USD Million)

- Figure 13.17. In Silico Drug Discovery Services Market for Large Molecules for Mid-sized Companies, Till 2035 (USD Million)

- Figure 13.18. In Silico Drug Discovery Services Market for Large Molecules for Large Companies, Till 2035 (USD Million)

- Figure 13.19. In Silico Drug Discovery Services Market for Large Molecules: Market Attractiveness Analysis by Type of Therapeutic Area (USD Million)

- Figure 13.20. In Silico Drug Discovery Services Market for Large Molecules for Autoimmune Disorders, Till 2035 (USD Million)

- Figure 13.21. In Silico Drug Discovery Services Market for Large Molecules for Blood Disorders, Till 2035 (USD Million)

- Figure 13.22. In Silico Drug Discovery Services Market for Large Molecules for Cardiovascular Disorders, Till 2035 (USD Million)

- Figure 13.23. In Silico Drug Discovery Services Market for Large Molecules for Gastrointestinal and Digestive Disorders, Till 2035 (USD Million)

- Figure 13.24. In Silico Drug Discovery Services Market for Large Molecules for Hormonal Disorders, Till 2035 (USD Million)

- Figure 13.25. In Silico Drug Discovery Services Market for Large Molecules for HIV / AIDS, Till 2035 (USD Million)

- Figure 13.26. In Silico Drug Discovery Services Market for Large Molecules for Infectious Diseases, Till 2035 (USD Million)

- Figure 13.27. In Silico Drug Discovery Services Market for Large Molecules for Metabolic Disorders, Till 2035 (USD Million)

- Figure 13.28. In Silico Drug Discovery Services Market for Large Molecules for Mental Disorders, Till 2035 (USD Million)

- Figure 13.29. In Silico Drug Discovery Services Market for Large Molecules for Musculoskeletal Disorders, Till 2035 (USD Million)

- Figure 13.30. In Silico Drug Discovery Services Market for Large Molecules for Neurological Disorders, Till 2035 (USD Million)

- Figure 13.31. In Silico Drug Discovery Services Market for Large Molecules for Oncological Disorders, Till 2035 (USD Million)

- Figure 13.32. In Silico Drug Discovery Services Market for Large Molecules for Respiratory Disorders, Till 2035 (USD Million)

- Figure 13.33. In Silico Drug Discovery Services Market for Large Molecules for Skin Disorders, Till 2035 (USD Million)

- Figure 13.34. In Silico Drug Discovery Services Market for Large Molecules for Urogenital Disorders, Till 2035 (USD Million)

- Figure 13.35. In Silico Drug Discovery Services Market for Large Molecules for Others, Till 2035 (USD Million)

- Figure 13.36. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Sponsor (USD Million)

- Figure 13.37. In Silico Drug Discovery Services Market for Large Molecules for Industry Players, Till 2035 (USD Million)

- Figure 13.38. In Silico Drug Discovery Services Market for Large Molecules for Non-Industry Players, Till 2035 (USD Million)

- Figure 13.39. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Key Geographical Regions (USD Million)

- Figure 13.40. In Silico Drug Discovery Services Market for Large Molecules in North America (USD Million)

- Figure 13.41. In Silico Drug Discovery Services Market for Large Molecules in the US, Till 2035 (USD Million)

- Figure 13.42. In Silico Drug Discovery Services Market for Large Molecules in Canada, Till 2035 (USD Million)

- Figure 13.43. In Silico Drug Discovery Services Market for Large Molecules in Europe (USD Million)

- Figure 13.44. In Silico Drug Discovery Services Market for Large Molecules in Germany, Till 2035 (USD Million)

- Figure 13.45. In Silico Drug Discovery Services Market for Large Molecules in France, Till 2035 (USD Million)

- Figure 13.46. In Silico Drug Discovery Services Market for Large Molecules in the UK, Till 2035 (USD Million)

- Figure 13.47. In Silico Drug Discovery Services Market for Large Molecules in Italy, Till 2035 (USD Million)

- Figure 13.48. In Silico Drug Discovery Services Market for Large Molecules in Spain, Till 2035 (USD Million)

- Figure 13.49. In Silico Drug Discovery Services Market for Large Molecules in Rest of Europe, Till 2035 (USD Million)

- Figure 13.50. In Silico Drug Discovery Services Market for Large Molecules in Asia-Pacific and Rest of the World (USD Million)

- Figure 13.51. In Silico Drug Discovery Services Market for Large Molecules in China, Till 2035 (USD Million)

- Figure 13.52. In Silico Drug Discovery Services Market for Large Molecules in India, Till 2035 (USD Million)

- Figure 13.53. In Silico Drug Discovery Services Market for Large Molecules in Japan, Till 2035 (USD Million)

- Figure 14.1. Upcoming Trends in Drug Discovery: Future Growth Opportunities

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: OVERVIEW

As per Roots Analysis, the global computer aided drug discovery market valued at USD 29 million in anticipated to grow at a CAGR of 15.6% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Drug Discovery Steps

- Target Identification

- Target Validation

- Hit Generation

- Hit-to-Lead

- Lead Optimization

Type of Large Molecule

- Antibodies

- Proteins

- Peptides

- Nucleic Acids

- Vectors

Company Size

- Small Companies

- Mid-sized Companies

- Large Companies

Therapeutic Area

- Autoimmune Disorders

- Blood Disorders

- Cardiovascular Disorders

- Gastrointestinal and Digestive Disorders

- Hormonal Disorders

- HIV / AIDS

- Infectious Diseases

- Metabolic Disorders

- Mental Disorders

- Musculoskeletal Disorders

- Neurological Disorders

- Oncological Disorders

- Respiratory Disorders

- Skin Disorders

- Urogenital Disorders

- Others

Type of Sponsor

- Industry Players

- Non-Industry Players

Key Geographical Regions

- North America (US and Canada)

- Europe (Italy, Germany, France, Spain and Rest of Europe)

- Asia-Pacific (China, India and Japan)

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: GROWTH AND TRENDS

Over time, the complexities associated with drug discovery have increased, especially in case of large molecule drugs, which are inherently more complex than conventional small molecules. As a result, an increase in the overall research and development (R&D) expenditure in the pharmaceutical contract manufacturing / biotechnology sector has been witnessed. In addition to the complexities involved, the drug discovery process is extremely demanding, both in terms of capital expenses and time. Consequently, computer-aided drug discovery services have emerged as a potential solution to the cause.

Over the years, various computational tools and services have emerged, enabling the selection, modelling, analysis and optimization of potential lead candidates. The predictive power of computer aided drug discovery providers has proven to be extremely advantageous, allowing researchers to bypass the random screening of molecules across hundreds of biological targets. Moreover, it is worth highlighting that this approach has been estimated to save nearly 35% of the total cost involved in developing a new drug, resulting in growing demand for more efficient drug discovery services for large molecules. As a result, players offering novel in-silico drug discovery services, such as CADD, have now become an integral part of the pharmaceutical industry.

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: KEY INSIGHTS

The report delves into the current state of global computer aided drug discovery market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Over 90 firms are actively involved in providing in silico services for drug discovery of different types of biologics; of these, around 30 players claim to have the capabilities to offer services for all steps of discovery.

- Majority of the companies offer structure-based drug design focused on early-stage drug discovery of a range of large molecules, including antibodies, proteins and peptides.

- Prominent examples of large companies that offer in-silico services include ChemPartner, Evotec, Jubilant Biosys, Schrodinger, Sygnature Discovery, WuXi AppTec.

- More than 30% of the service providers offer in-silico services for all the steps of drug discovery; in contrast, target-based drug discovery steps require extensive experimental support.

- Notably, nearly 60% of the in-silico services are offered for monoclonal antibodies among all types of antibodies; this is followed by companies offering in silico drug discovery services for different types of proteins and peptides.

- Featuring the presence of small and mid-sized firms, the in-silico service provider landscape is well distributed across various regions; these players have adopted various business models to cater to the evolving needs of the clients.

- Several players involved in this domain are steadily expanding their capabilities in order to enhance their respective in-silico-based service portfolios and maintain a competitive edge in this industry.

- The integration of novel computational techniques, such as artificial intelligence and cloud-based platforms, with in-silico approaches, is likely to revolutionize the overall drug discovery process.

- Service providers are adopting various business strategies in order to continue providing significant cost saving advantages, along with expediting discovery timelines and improving product success.

- Driven by the growing demand for effective therapeutics and increase in drug discovery efforts of various biologics across a wide range of therapeutic areas, the market is expected to witness sustained growth in future.

- In the long-term, the projected opportunity is anticipated to be well distributed across various geographies, type of sponsors and company sizes of service providers.

Example Players in the Computer Aided Drug Discovery Market

- BioDuro

- Creative Biostructure

- GenScript

- LakePharma

- Abzena

- BioNTech

- Sygnature Discovery

- ChemPartner

- Sundia MediTech

- Viva Biotech

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Founder and Chief Executive Officer, Company A

- Chief Executive Officer and Chief Technical Officer, Company B

- Senior Vice President, Drug Discovery, Company C

- Founder, Company D

GLOBAL COMPUTER AIDED DRUG DISCOVERY MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global computer aided drug discovery market, focusing on key market segments, including [A] drug discovery steps, [B] type of large molecule, [C] company size, [D] therapeutic area, [E] type of sponsor and [F] key geographical regions.

- Market Landscape: A comprehensive evaluation of companies offering in silico drug discovery services for large molecules, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of business model used, [E] number of drug discovery step(s) for which the company offers services involving the use of in silico approaches, [F] type of large molecules(s) handled, [G] type of in silico approach used, [H] type of in silico service(s) offered and [I] type of clientele served.

- Key Insights: An insightful analysis of contemporary market trends that have been depicted using four schematic representations, including [A] an analysis of the industry players engaged in this domain, distributed based on the location of their company size and respective headquarters, [B] an analysis of in silico service providers, [C] a detailed analysis, highlighting the key hubs with respect to outsourcing activity within this domain, and [D] an insightful grid analysis, presenting the distribution of companies based on the type of large molecule, in silico approach used and type of clientele.

- Company Profiles: In-depth profiles of companies that offer in silico drug discovery services, focusing on [A] company overview, [B] financial information (if available), [C] in silico-based service(s) portfolio and [D] recent developments and an informed future outlook.

- Company Competitiveness Analysis: A comprehensive competitive analysis of at-home self-testing kit manufacturers, examining factors, such as strength of their respective service portfolios, taking into consideration the [A] experience of a service provider, [B] number of drug discovery services offered and [C] number of large molecules, for which the aforementioned services are offered.

- Key Opportunity Areas: In-depth analysis of current opportunity within in-silico drug discovery services market, comparing the number of pipeline products and current market size based on [A] type of large molecule and the availability and capabilities of affiliated in silico drug discovery service providers.

- Emerging Business Models and Strategies: A comprehensive discussion on the various business strategies that can be adopted by in-silico drug discovery service providers, based on [A] the different types of large molecules handled and [B] the technical expertise of service providers, in terms of capabilities across different steps of drug discovery.

- Cost Saving Analysis: A detailed analysis focusing on the cost saving potential associated with the use of in-silico approaches in the drug discovery process.

- Case Study: A detailed discussion on the key challenges associated with the [A] discovery and production of large molecules, [B] affiliated product development timelines, and [C] manufacturing protocols, with those of small molecule drugs.

- Survey Insights: Comprehensive insights from an industry-wide survey, highlighting inputs solicited from various experts who are directly or indirectly engaged in providing in silico services for discovery of large molecule drugs.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Drug Discovery and Development Timelines

- 3.3. Overview of In Silico Drug Discovery Tools

- 3.3.1. Historical Evolution of the In Silico Approach

- 3.3.2. Comparison of Traditional Drug Discovery Approaches and In Silico / Computer Aided Methods

- 3.3.3. In Silico / Computed Aided Approaches for Drug Design and Development

- 3.4. Applications of In Silico Tools in the Drug Discovery Process

- 3.4.1. Target Identification

- 3.4.1.1. Chemoinformatics-based Tools

- 3.4.1.2. Network-based Drug Discovery

- 3.4.1.3. Computational Platforms and Interaction Repositories

- 3.4.2. Target Validation

- 3.4.3. Hit Generation

- 3.4.3.1. High-Throughput Screening

- 3.4.3.2. Fragment Based Screening

- 3.4.3.3. Virtual Screening

- 3.4.4. Hit-to-Lead

- 3.4.4.1. Pharmacodynamics and Pharmacokinetics Modeling

- 3.4.4.2. Other Novel Approaches

- 3.4.5. Lead Optimization

- 3.4.5.1. Pharmacophore Modeling

- 3.4.5.2. Docking

- 3.4.5.3. Structure Activity Relationships (SAR) / Quantitative Structure Activity Relationship (QSAR)

- 3.4.5.4. Molecular Modeling

- 3.4.1. Target Identification

- 3.5. Advantages of using In Silico Tools for Drug Discovery Operations

- 3.6. Challenges Associated with Conducting In Silico Drug Discovery Operations

- 3.7. Anticipated Rise in Outsourcing In Silico Drug Discovery Operations

- 3.8. Concluding Remarks

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. In Silico Drug Discovery Services for Large Molecules: List of Industry Players

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Type of Business Model

- 4.2.6. Analysis by Drug Discovery Steps

- 4.2.7. Analysis by Type of Large Molecule

- 4.2.7.1. Analysis by Type of Antibody

- 4.2.7.2. Analysis by Type of Protein

- 4.2.8. Analysis by Type of In Silico Approach Used

- 4.2.9. Analysis by Types of In Silico Services Offered

- 4.2.10. Analysis by Type of Clientele

- 4.3. In Silico Drug Discovery Services: List of Software / Technologies

5. KEY INSIGHTS

- 5.1. Chapter Overview

- 5.2. Logo Landscape: Analysis by Company Size and Location of Headquarters

- 5.3. Tree Map Representation: Analysis by Company Size and Drug Discovery Steps

- 5.4. World Map Representation: Regional Analysis of Outsourcing Activity

- 5.5. Grid Representation: Analysis by Type of Large Molecule, In Silico Approach Used and Type of Clientele

6. COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Key In Silico Service Providers Based in North America

- 6.2.1. BioDuro

- 6.2.1.1. Company Overview

- 6.2.1.2. Funding and Investment Information

- 6.2.1.3. In Silico-based Service Portfolio

- 6.2.1.4. Recent Developments and Future Outlook

- 6.2.1.5. Peer Group Benchmark Comparison

- 6.2.2. Creative Biostructure

- 6.2.2.1. Company Overview

- 6.2.2.2. Funding and Investment Information

- 6.2.2.3. In Silico-based Service Portfolio

- 6.2.2.4. Recent Developments and Future Outlook

- 6.2.2.5. Peer Group Benchmark Comparison

- 6.2.3. GenScript

- 6.2.3.1. Company Overview

- 6.2.3.2. Funding and Investment Information

- 6.2.3.3. In Silico-based Service Portfolio

- 6.2.3.4. Recent Developments and Future Outlook

- 6.2.3.5. Peer Group Benchmark Comparison

- 6.2.4. LakePharma

- 6.2.4.1. Company Overview

- 6.2.4.2. Funding and Investment Information

- 6.2.4.3. In Silico-based Service Portfolio

- 6.2.4.4. Recent Developments and Future Outlook

- 6.2.4.5. Peer Group Benchmark Comparison

- 6.2.1. BioDuro

- 6.3. Leading Players Based in Europe

- 6.3.1. Abzena

- 6.3.1.1. Company Overview

- 6.3.1.2. Funding and Investment Information

- 6.3.1.3. In Silico-based Service Portfolio

- 6.3.1.4. Recent Developments and Future Outlook

- 6.3.1.5. Peer Group Benchmark Comparison

- 6.3.2. BioNTech

- 6.3.2.1. Company Overview

- 6.3.2.2. Funding and Investment Information

- 6.3.2.3. Recent Developments and Future Outlook

- 6.3.2.4. Peer Group Benchmark Comparison

- 6.3.3. Sygnature Discovery

- 6.3.3.1. Company Overview

- 6.3.3.2. Funding and Investment Information

- 6.3.3.3. In Silico-based Service Portfolio

- 6.3.3.4. Recent Developments and Future Outlook

- 6.3.3.5. Peer Group Benchmark Comparison

- 6.3.1. Abzena

- 6.4. Leading Players Based in Asia-Pacific

- 6.4.1. ChemPartner

- 6.4.1.1. Company Overview

- 6.4.1.2. In Silico-based Service Portfolio

- 6.4.1.3. Recent Developments and Future Outlook

- 6.4.1.4. Peer Group Benchmark Comparison

- 6.4.2. Sundia MediTech

- 6.4.2.1. Company Overview

- 6.4.2.2. Funding and Investment Information

- 6.4.2.3. In Silico-based Service Portfolio

- 6.4.2.4. Recent Development and Future Outlook

- 6.4.2.5. Peer Group Benchmark Comparison

- 6.4.3. Viva Biotech

- 6.4.3.1. Company Overview

- 6.4.3.2. Funding and Investment Information

- 6.4.3.3. In Silico-based Service Portfolio

- 6.4.3.4. Recent Development and Future Outlook

- 6.4.3.5. Peer Group Benchmark Comparison

- 6.4.1. ChemPartner

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Key Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in North America

- 7.5. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in Europe

- 7.6. Company Competitiveness Analysis: In Silico Drug Discovery Service Providers in Asia-Pacific and Rest of the World

8. KEY OPPORTUNITY AREAS

- 8.1. Chapter Overview

- 8.2. Key Assumptions and Parameters

- 8.3. Methodology

- 8.4. Antibodies

- 8.4.1. Developer Landscape

- 8.4.1.1. Number of Pipeline Molecules

- 8.4.1.2. Affiliated Market Size and Growth Rate

- 8.4.2. In Silico Service Providers for Antibodies: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.4.1. Developer Landscape

- 8.5. Peptides

- 8.5.1. Developer Landscape

- 8.5.1.1. Number of Pipeline Molecules

- 8.5.1.2. Affiliated Market Size and Growth Rate

- 8.5.2. In Silico Service Providers for Peptides: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.5.1. Developer Landscape

- 8.6. Proteins

- 8.6.1. Developer Landscape

- 8.6.1.1. Number of Pipeline Molecules

- 8.6.1.2. Affiliated Market Size and Growth Rate

- 8.6.2. In Silico Service Providers for Proteins: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.6.1. Developer Landscape

- 8.7. Other Advanced Therapies

- 8.7.1. Developer Landscape

- 8.7.1.1. Number of Pipeline Molecules

- 8.7.1.2. Affiliated Market Size and Growth Rate

- 8.7.2. In Silico Service Providers for Vectors: 3D Bubble Analysis Based on Number of Drug Discovery Steps, Strength of Service Portfolio and Company Size

- 8.7.1. Developer Landscape

9. EMERGING BUSINESS MODELS AND STRATEGIES

- 9.1. Chapter Overview

- 9.2. Key Assumptions and Methodology

- 9.3. In Silico Service Providers: Analysis by Number of Large Molecules and Drug Discovery Steps Covered

- 9.3.1. Strategies for Short Term Success

- 9.3.2. Strategies for Long Term Success

- 9.4. Concluding Remarks

10. CASE STUDY: COMPARISON OF DRUG DISCOVERY PROCESSES OF SMALL MOLECULES AND LARGE MOLECULES

- 10.1. Chapter Overview

- 10.2. Small Molecule and Large Molecule Drugs / Therapies

- 10.2.1. Comparison of Key Specifications

- 10.2.2. Comparison of Manufacturing Processes

- 10.2.3. Comparison of Drug Discovery Processes

- 10.3. Approaches to Improve Discovery Process of Large Molecules

11. SURVEY INSIGHTS

- 11.1. Chapter Overview

- 11.2. Overview of Respondents

- 11.2.1. Designation of Respondents

- 11.3. Survey Insights

- 11.3.1. Drug Discovery Steps

- 11.3.2. Type of Molecules Handled

- 11.3.3. In Silico Drug Design Focused Service Portfolio

- 11.3.4. Likely Adoption of In Silico Tools for Large Molecules Drug Discovery

- 11.3.5. Current Market Opportunity

- 11.3.6. Likely Growth Rate

- 11.3.7. Cost Saving Potential of the In Silico Approach

12. COST SAVING ANALYSIS

- 12.1. Chapter Overview

- 12.2. Key Assumptions

- 12.3. Methodology

- 12.4. Overall Cost Saving Potential of In Silico Tools in Large Molecule Drug Discovery, Till 2035

- 12.5. Concluding Remarks

13. MARKET FORECAST

- 13.1. Chapter Overview

- 13.2. Forecast Methodology and Key Assumptions

- 13.3. Overall In Silico Drug Discovery Services Market for Large Molecules, Till 2035

- 13.3.1. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Drug Discovery Steps, Till 2035

- 13.3.1.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Target Identification, Till 2035

- 13.3.1.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Target Validation, Till 2035

- 13.3.1.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Hit Generation, Till 2035

- 13.3.1.4. In Silico Drug Discovery Services Market for Large Molecules: Share of Hit-to-Lead, Till 2035

- 13.3.1.5. In Silico Drug Discovery Services Market for Large Molecules: Share of Lead Optimization, Till 2035

- 13.3.2. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Large Molecule, Till 2035

- 13.3.2.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Antibodies, Till 2035

- 13.3.2.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Proteins, Till 2035

- 13.3.2.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Peptides, Till 2035

- 13.3.2.4. In Silico Drug Discovery Services Market for Large Molecules: Share of Nucleic Acids, Till 2035

- 13.3.2.5. In Silico Drug Discovery Services Market for Large Molecules: Share of Vectors, Till 2035

- 13.3.3. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Company Size, Till 2035

- 13.3.3.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Small Companies, Till 2035

- 13.3.3.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Mid-sized Companies, Till 2035

- 13.3.3.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Large Companies, Till 2035

- 13.3.4. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Therapeutic Area, Till 2035

- 13.3.4.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Autoimmune Disorders, Till 2035

- 13.3.4.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Blood Disorders, Till 2035

- 13.3.4.3. In Silico Drug Discovery Services Market for Large Molecules: Share of Cardiovascular Disorders, Till 2035

- 13.3.4.4. In Silico Drug Discovery Services Market for Large Molecules: Share of Gastrointestinal and Digestive Disorders, Till 2035

- 13.3.4.5. In Silico Drug Discovery Services Market for Large Molecules: Share of Hormonal Disorders, Till 2035

- 13.3.4.6. In Silico Drug Discovery Services Market for Large Molecules: Share of Human Immunodeficiency Virus (HIV) / Acquired Immunodeficiency Syndrome (AIDS), Till 2035

- 13.3.4.7. In Silico Drug Discovery Services Market for Large Molecules: Share of Infectious Diseases, Till 2035

- 13.3.4.8. In Silico Drug Discovery Services Market for Large Molecules: Share of Metabolic Disorders, Till 2035

- 13.3.4.9. In Silico Drug Discovery Services Market for Large Molecules: Share of Mental Disorders, Till 2035

- 13.3.4.10. In Silico Drug Discovery Services Market for Large Molecules: Share of Musculoskeletal Disorders, Till 2035

- 13.3.4.11. In Silico Drug Discovery Services Market for Large Molecules: Share of Neurological Disorders, Till 2035

- 13.3.4.12. In Silico Drug Discovery Services Market for Large Molecules: Share of Oncological Disorders Till 2035

- 13.3.4.13. In Silico Drug Discovery Services Market for Large Molecules: Share of Respiratory Disorders, Till 2035

- 13.3.4.14. In Silico Drug Discovery Services Market for Large Molecules: Share of Skin Disorders, Till 2035

- 13.3.4.15. In Silico Drug Discovery Services Market for Large Molecules: Share of Urogenital Disorders, Till 2035

- 13.3.4.16. In Silico Drug Discovery Services Market for Large Molecules: Share of Others, Till 2035

- 13.3.5. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Type of Sponsor, Till 2035

- 13.3.5.1. In Silico Drug Discovery Services Market for Large Molecules: Share of Industry Players, Till 2035

- 13.3.5.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Non-Industry Players, Till 2035

- 13.3.6. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Key Geographical Regions, Till 2035

- 13.3.6.1. In Silico Drug Discovery Services Market for Large Molecules: Share of North America, Till 2035

- 13.3.6.1.1. In Silico Drug Discovery Services Market for Large Molecules: Share of US, Till 2035

- 13.3.6.1.2. In Silico Drug Discovery Services Market for Large Molecules: Share of Canada, Till 2035

- 13.3.6.2. In Silico Drug Discovery Services Market for Large Molecules: Share in Europe, Till 2035

- 13.3.6.2.1. In Silico Drug Discovery Services Market for Large Molecules: Share in Germany, Till 2035

- 13.3.6.2.2. In Silico Drug Discovery Services Market for Large Molecules: Share in France, Till 2035

- 13.3.6.2.3. In Silico Drug Discovery Services Market for Large Molecules: Share in the UK, Till 2035

- 13.3.6.2.4. In Silico Drug Discovery Services Market for Large Molecules: Share in Italy, Till 2035

- 13.3.6.2.5. In Silico Drug Discovery Services Market for Large Molecules: Share in Spain, Till 2035

- 13.3.6.2.6. In Silico Drug Discovery Services Market for Large Molecules: Share in Rest of Europe, Till 2035

- 13.3.6.3. In Silico Drug Discovery Services Market for Large Molecules: Share in Asia-Pacific and Rest of the World, Till 2035

- 13.3.6.3.1. In Silico Drug Discovery Services Market for Large Molecules: Share in China, Till 2035

- 13.3.6.3.2. In Silico Drug Discovery Services Market for Large Molecules: Share in India, Till 2035

- 13.3.6.3.3. In Silico Drug Discovery Services Market for Large Molecules: Share in Japan, Till 2035

- 13.3.6.1. In Silico Drug Discovery Services Market for Large Molecules: Share of North America, Till 2035

- 13.3.1. In Silico Drug Discovery Services Market for Large Molecules: Distribution by Drug Discovery Steps, Till 2035

14. IN SILICO TOOLS AND UPCOMING TRENDS IN DRUG DISCOVERY

- 14.1. Chapter Overview

- 14.2. Owing to Potential Cost and Time-related Benefits, Outsourcing of Drug Discovery Operations is Expected to Increase in the Future

- 14.3. Technological Advancements are Likely to Revolutionize the Current Drug Discovery Processes

- 14.3.1. Integration of Artificial Intelligence in the Drug Discovery Process is Expected to Improve Overall Efficiency and Productivity

- 14.3.2. Increased Adoption of Cloud Based Technology Platforms is Anticipated to Enhance the Scalability and Flexibility of the Drug Discovery Process

- 14.3.3. Rising Interest in Use of Force Fields for In Silico Drug Discovery

- 14.4. Concluding Remarks

15. EXECUTIVE INSIGHTS

- 15.1. Chapter Overview

- 15.2. Company A

- 15.2.1. Company Snapshot

- 15.2.2. Interview Transcript: Founder and Chief Executive Officer

- 15.3. Company B

- 15.3.1. Company Snapshot

- 15.3.2. Interview Transcript: Chief Executive Officer and Chief Technical Officer

- 15.4. Company C

- 15.4.1. Company Snapshot

- 15.4.2. Interview Transcript: Senior Vice President, Drug Discovery

- 15.5. Company D

- 15.5.1. Company Snapshot

- 15.5.2. Interview Transcript: Founder