|

市場調査レポート

商品コード

1891239

バイオ医薬品添加剤市場(第2版):業界動向と世界の予測:事業規模別、モダリティ別、添加剤別、化学成分別、企業規模別、製造拠点別、エンドユーザー別、地域別分布(2025年~2035年)Biopharmaceutical Excipients Market (2nd Edition): Industry Trends and Global Forecasts: Distribution by Scale of Operation, Modality, Excipient, Chemical Components, Company Size, Source of Manufacturing, End User and Geographical Regions 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| バイオ医薬品添加剤市場(第2版):業界動向と世界の予測:事業規模別、モダリティ別、添加剤別、化学成分別、企業規模別、製造拠点別、エンドユーザー別、地域別分布(2025年~2035年) |

|

出版日: 2025年12月18日

発行: Roots Analysis

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

概要

バイオ医薬品添加剤市場:概要

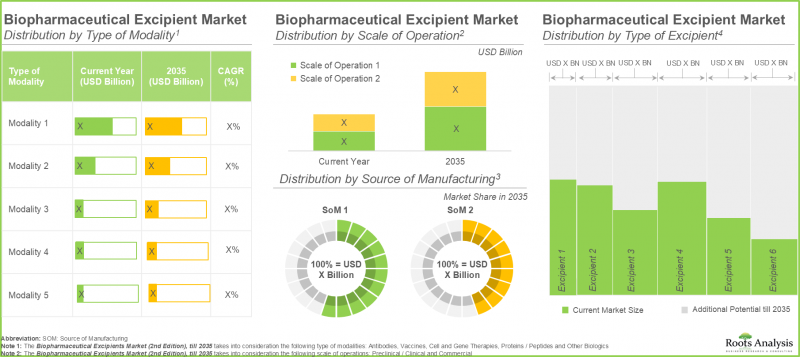

世界のバイオ医薬品添加剤の市場規模は、現在の33億米ドルから2035年までに63億米ドルへ成長し、予測期間(2035年まで)におけるCAGRは6.6%と推定されています。

事業規模

- 前臨床/臨床規模

- 商業規模

モダリティ

- 抗体

- ワクチン

- 細胞・遺伝子治療

- タンパク質/ペプチド

- その他の生物学的製剤

添加剤タイプ

- 緩衝剤

- 凍結保護剤

- 可溶化剤および界面活性剤

- 浸透圧調整剤

- pH調整剤

- その他

化学成分

- 炭水化物

- ポリマー

- ポリオール

- タンパク質/アミノ酸

- その他

企業規模

- 小規模事業者

- 中規模企業

- 大企業および超大企業

製造拠点

- 自社内

- 外部委託

エンドユーザー

- 受託製造業者

- 医薬品開発企業

- ハイブリッド事業者

主要地域

- 北米

- 欧州

- アジア太平洋

- 中東・北アフリカ

- ラテンアメリカ

バイオ医薬品添加剤市場:成長と動向

近年、生物学的製剤の普及が進むにつれ、医療分野において大きな変化が生じています。過去10年間において、米国食品医薬品局(USFDA)によるバイオ医薬品(モノクローナル抗体、組換えタンパク質、ワクチン、遺伝子治療などを含む)の年間承認率は着実に上昇し、新規承認薬全体の40%以上を生物学的製剤が占めています。2024年10月現在、世界中で1万2,700件以上の生物学的製剤が臨床試験段階にあり、この分野における革新の度合いが強調されています。低分子化合物と比較した際の効果の向上、精密な標的化、優れた安全性プロファイルといった独自の利点を考慮すると、生物学的製剤は、がん、自己免疫疾患、希少疾患、遺伝性疾患の治療における進歩を引き続き推進すると予測されます。

しかしながら、生物学的製剤は複雑な構造を有し、低分子化合物に比べて本質的に不安定であるため、物理的劣化(凝集、沈殿、変性など)や化学的劣化(酸化、脱アミド化、加水分解など)の影響を受けやすい特性があります。これらの課題を克服するため、糖類(スクロースやトレハロースなど)、アミノ酸(アルギニンなど)、界面活性剤(ポリソルベートなど)、高分子剤(PEGなど)といった様々なバイオ医薬品用添加剤が用いられ、製剤の安定化、溶解性の向上、pHおよび浸透圧の調整、ならびに全体的な生物学的利用能の向上を図っています。実際、市販されている生物学的製剤の70%以上が安定化剤としてポリソルベートに依存しており、増量剤、抗酸化剤、保存剤はそれらの機能的有効性を高めています。さらに、添加剤は凍結乾燥バイアル、プレフィルドシリンジ、即用型液剤など、先進的な医薬品形態の実現に不可欠となっています。特にmRNAワクチンや治療薬向けの脂質系添加剤における継続的な革新により、添加剤の応用範囲はさらに拡大しています。アウトソーシングの増加傾向や革新的な添加剤に対する規制支援の強化と相まって、バイオ医薬品添加剤の応用は予測期間を通じて市場成長を継続する見込みです。

バイオ医薬品添加剤市場:主要な洞察

当レポートは、バイオ医薬品添加剤市場の現状を詳細に分析し、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです:

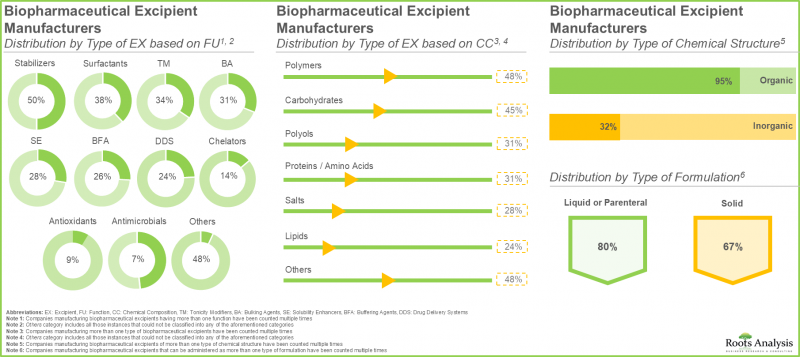

- 現在の市場情勢では、世界中でバイオ医薬品添加剤のサービスを提供すると主張する約60社のメーカーが存在します。そのうち、大多数(40%)は欧州に本社を置いています。

- 約50%の企業がポリマーベースのバイオ医薬品添加剤を製造しており、そのうち大半(約65%)の添加剤は薬剤製剤の安定剤として使用されています。

- 利害関係者は、自社ポートフォリオの強化とバイオ医薬品添加剤製造分野における競合他社に対する優位性獲得を目的として、既存能力の積極的な向上に取り組んでおります。

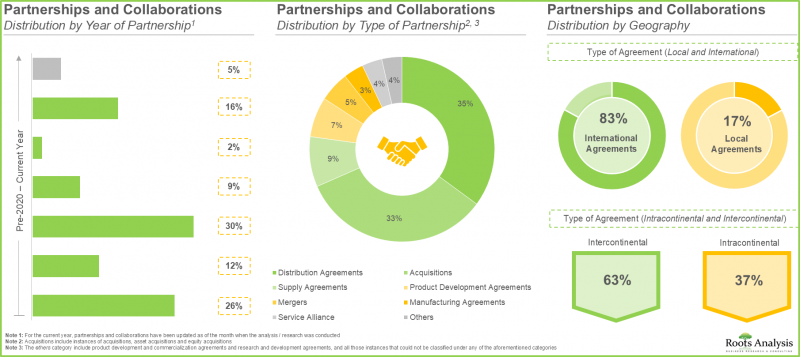

- この分野で締結された契約の大半は販売代理店契約であり、市場範囲の拡大と、多様な地域における特殊な添加剤の広範な供給確保への戦略的焦点が示されています。

- バイオ医薬品に対する需要の高まりに後押しされ、CMO(受託製造機関)は既存の生産能力と機能を大幅に拡大しています。特に、拡大イニシアチブの大部分は欧州に拠点を置く企業別実施されています。

- 弊社の独自フレームワークは、開発者向けの戦略的ツールとして機能し、バイオ医薬品添加剤製造における特定の要件に基づいてベンダーを評価することを可能にします。

- 生物学的製剤療法の普及拡大や多機能性添加剤の革新に牽引され、バイオ医薬品添加剤市場は今後数年間で堅調な成長が見込まれています。

- 現在、市場シェアの大部分は抗体サブセグメントが占めています。これは、がん、自己免疫疾患、感染症の標的療法において重要な役割を果たすモノクローナル抗体の普及が背景にあります。

- 炭水化物サブセグメントは、生物学的製剤の安定剤および増量剤として、デンプン、ショ糖、ブドウ糖が医薬品製剤に広く使用されていることから、今年度は市場シェアの大部分を占めると推定されています。

バイオ医薬品添加剤市場:主要セグメント

バイオ医薬品添加剤市場において最大のシェアを占めるのは商業規模の運用です

操業規模の観点から、バイオ医薬品添加剤市場は前臨床/臨床規模と商業規模に区分されます。本年度において、商業規模セグメントはバイオ医薬品添加剤市場で高いシェア(約90%)を占めており、予測期間中はより高いCAGR(6.8%)で成長する見込みです。この優位性は、生物学的製剤の需要増加に起因しており、大規模生産において製品の安定性、溶解性、有効性を維持するために多量の添加剤が必要とされているためです。商業製造段階に進む生物学的製剤の数が増加するにつれて、添加剤の需要は大幅に上昇し、商業規模の事業における市場シェア拡大につながっています。

固形がんセグメントがバイオ医薬品添加剤市場で最大の収益を占める見込み

今年度、抗体セグメントはバイオ医薬品添加剤市場規模の大部分(約50%)を占めており、予測期間中はより高いCAGR(8.7%)で成長する見込みです。これは、モノクローナル抗体および抗体駆動型療法の急速な拡大と大量生産により、これらの複雑な生物学的製剤の安定性、溶解性、安全性を維持するために様々な添加剤が必要となるためです。

欧州がバイオ医薬品添加剤市場の最大シェアを占める

地域別では、欧州が今年度のバイオ医薬品添加剤市場シェアの大半(35%)を占めると見込まれており、この動向は今後も変わらないでしょう。これは、同分野に確立されたバイオテクノロジー企業や製薬企業が多数存在していることに起因します。主要業界リーダーの注力により、多額の資金が投入され、医薬品製造におけるAI技術の統合が加速しています。さらに、この分野は、発達した医薬品エコシステム、強力な研究開発能力、有利な規制枠組みから優位性を得ており、その主導的立場を強化しています。特に、アジア太平洋市場は、2035年までの予測期間を通じて最高CAGR(7.7%)で拡大すると予想されています。

バイオ医薬品添加剤市場の代表的な企業例

- Avantor

- Spectrum Chemical Manufacturing

- Actylis

- Pfanstiehl

- Biospectra

- BOC Sciences

- Merck KGaA

- CG Chemkalien

- Evonik

- BASF Pharma

- Mass Chemicals

- Gangwal

- Mitushi Biopharma

- Nagase Vitta

バイオ医薬品添加剤市場:調査範囲

- 市場規模と機会分析:当レポートでは、バイオ医薬品添加剤市場について、[A]モダリティタイプ、[B]添加剤タイプ、[C]化学成分、[D]企業規模、[E]製造拠点、[F]エンドユーザー、[G]主要地域といった主要市場セグメントに焦点を当てた詳細な分析を掲載しています。

- 市場情勢:バイオ医薬品添加剤企業に関する包括的な評価を実施し、[A]設立年、[B]企業規模、[C]本社所在地、[D]製造施設所在地、[E]添加剤タイプ、[F]事業規模、[G]製剤タイプ、[H]生物学的製剤タイプ、[I]世界の規制対応状況などの様々なパラメータを考慮しています。

- 企業プロファイル:北米、欧州、アジア太平洋に本社を置くバイオ医薬品添加剤製造企業の詳細なプロファイル。[A]企業概要、[B]バイオ医薬品添加剤製品ライン、[C]最近の動向、[D]将来展望に焦点を当てています。

- 企業競争力分析:バイオ医薬品メーカーの包括的な競争力分析。供給能力、サービス力、製造施設数などの要素を検証します。

- 提携・協力関係:バイオ医薬品添加剤市場における利害関係者の提携関係を、[A]提携年、[B]提携形態、[C]提携年と形態、[D]提携活動の地理的分布など、複数の関連パラメータに基づき詳細に分析します。

- 最近の拡張動向:様々なバイオ医薬品添加剤メーカー別最近の拡張活動について、以下の関連パラメータに基づき詳細に分析します:[A]拡張実施年、[B]拡張タイプ、[C]添加剤タイプ、[D]拡張タイプ(地域・国別)、[E]拡張施設の所在地(地域)、[F]拡張施設の所在地(国)、[G]最近の拡張件数における主要参入企業、[H]地理的分布(地域および国)などに基づきます。

- 生産能力分析:バイオ医薬品添加剤の世界の設置済み生産能力の推定値。各バイオ医薬品添加剤メーカーの生産能力を考慮するとともに、[A]企業規模、[B]操業規模、[C]主要地理的地域といった複数の関連パラメータに基づく、利用可能な世界のバイオ医薬品添加剤生産能力の分布に関する情報を提供します。

- ベンダー選定フレームワーク:バイオ医薬品添加剤の製造業務を外部委託する際に考慮すべきパラメータを明確に示す、洞察に富んだベンダー選定フレームワーク。

- 市場影響分析:バイオ医薬品添加剤市場の成長に影響を与え得る要因に関する詳細な分析です。また、[A]主な促進要因、[B]潜在的な制約要因、[C]新たな機会、[D]既存の課題の特定と市場分析も特徴としています。

目次

第1章 序文

第2章 調査手法

第3章 市場力学

- 章の概要

- 予測調査手法

- 市場評価フレームワーク

- 予測ツールとテクニック

- 重要な考慮事項

- 制限事項

第4章 マクロ経済指標

- 章の概要

- 市場力学

- 結論

第5章 エグゼクティブサマリー

第6章 イントロダクション

- 章の概要

- バイオ医薬品添加剤

- 理想的な賦形剤の特性

- バイオ医薬品添加剤の分類

- バイオ医薬品添加剤の用途

- 規制シナリオ

- 結論

第7章 市場情勢:バイオ医薬品添加剤メーカー

- 章の概要

- バイオ医薬品添加剤メーカー:市場情勢

第8章 企業競争力分析

- 章の概要

- 前提と主要なパラメータ

- 調査手法

- ピアグループの概要

- 企業競争力分析

第9章 バイオ医薬品添加剤メーカー:北米に拠点を置く企業プロファイル

- 章の概要

- Avantor

- Spectrum Chemical Manufacturing

- Actylis

- Pfanstiehl

- Biospectra

- BOC Sciences

第10章 バイオ医薬品添加剤メーカー:欧州に拠点を置く企業プロファイル

- 章の概要

- Merck KGaA

- CG Chemkalien

- Evonik

- BASF Pharma

第11章 バイオ医薬品添加剤メーカー:アジア太平洋に拠点を置く企業プロファイル

- 章の概要

- Mass Chemicals

- Gangwal

- Mitushi Biopharma

- Nagase Vitta

第12章 パートナーシップとコラボレーション

第13章 最近の拡張

- 章の概要

- バイオ医薬品添加剤製造市場:最近の拡大

第14章 容量分析

- 章の概要

- 主要な前提と調査手法

- バイオ医薬品添加剤製造:世界の設備容量

- 結論

第15章 ベンダー選定フレームワーク

- 同位体製造におけるアウトソーシングの理由

- 同位体製造における一般的なアウトソーシング業務

- 主なパラメータ

- ベンダー選定フレームワークの調査手法

- パラメータのベンチマーク

- 付加価値と評価の複雑さのマトリックス

- メルクのケーススタディ評価

- ベンダー評価ダッシュボードの概要