|

市場調査レポート

商品コード

1762546

医薬品バイアル市場:業界動向と世界の予測 - 使用される製造材料タイプ別、滅菌状態別、主要地域別Pharmaceutical Vials Market: Industry Trends and Global Forecasts - Distribution by Type of Fabrication Material Used, Sterilization Status and Key Geographies |

||||||

カスタマイズ可能

|

|||||||

| 医薬品バイアル市場:業界動向と世界の予測 - 使用される製造材料タイプ別、滅菌状態別、主要地域別 |

|

出版日: 2025年07月04日

発行: Roots Analysis

ページ情報: 英文 220 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

医薬品バイアル市場:概要

世界の医薬品バイアルの市場規模は今年、110億3,000万米ドルとなりました。同市場は、予測期間中に6%のCAGRで拡大すると予測されています。

市場サイジングと機会分析は、以下のパラメータにわたってセグメント化されています:

使用される製造材料タイプ

- ガラス

- プラスチック

滅菌状態

- 滅菌前

- 未滅菌

主要地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・北アフリカ

- その他の地域

医薬品バイアル市場:成長と動向

医薬品ガラスバイアルなどの一次包装材は、包装された治療薬と直接接触するため、医薬品の安定性、有効性、安全性を維持する上で重要な役割を果たします。さらに、医薬品の一次包装材は、医薬品の無菌性と品質の維持を助けると同時に、その同一性に関連する情報や、場合によっては投与指示書を提供します。さらに、非経口製剤の需要が高く、ワクチン接種キャンペーンが増加していることから、このような製剤を大量に保管し、世界中に配布するための安全で高品質な医薬品バイアルが急務となっています。

最も好まれる包装システムであるにもかかわらず、従来のバイアルは、過酷な条件下での破損の可能性、パッケージ上の関連情報(シリアル番号やバッチ番号)の不在、剥離の可能性など、特定の課題を伴うことが多いです。そのため、いくつかの医薬品バイアルメーカーは、より優れたパッケージングソリューションを生み出すために、従来の医薬品バイアルに関連する前述の課題を克服する新しい技術を模索しています。実際、医薬品バイアルメーカーは、次世代医薬品の変化する需要に対応するため、常に革新し、より新しく優れたパッケージングソリューションを生み出しています。この分野における進歩の例としては、滅菌済みバイアルの使用、多数のコーティング材料の開発、スマートドラッグデリバリー技術の採用などがあります。

医薬品バイアル市場:主要インサイト

当レポートでは、世界の医薬品バイアル市場の現状を調査し、業界内の潜在的な成長機会を特定しています。当レポートの主な調査結果は以下の通りです:

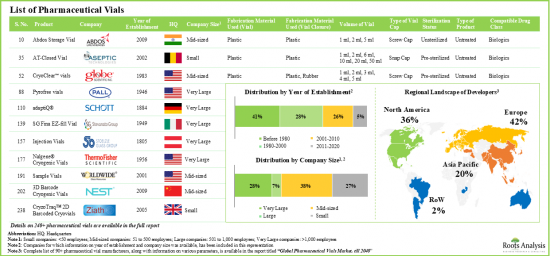

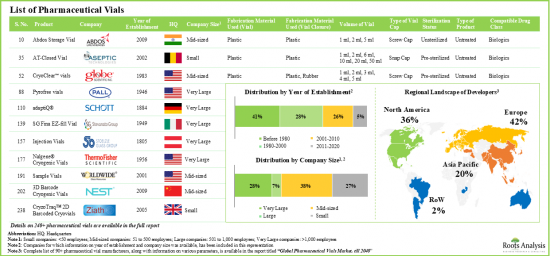

- 現在、240を超える医薬品バイアルが95社近くのメーカーにより販売/開発されており、これらのメーカーのほとんどは北米や欧州などの先進国に拠点を置いています。

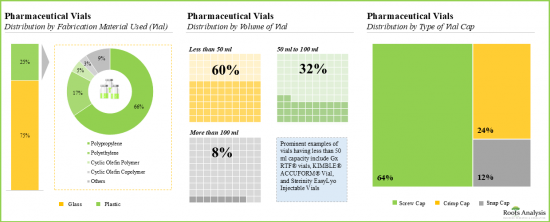

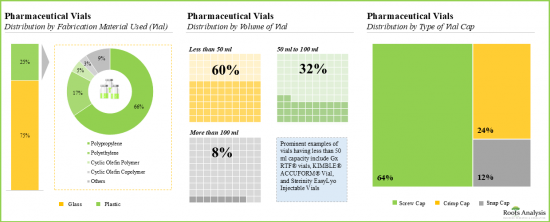

- 医薬品バイアルの大部分はガラス製で、様々な容量があります。

- 様々な利点のため、ガラスは医薬品バイアルに使用される最も好ましい製造材料として浮上しました。一般的に使用されるガラスの種類には、タイプIホウケイ酸ガラス(65%)およびタイプIIIソーダ石灰ガラス(16%)が含まれます。

- 医薬品バイアルの大部分(60%)は50ml未満の医薬品を収納する容量ですが、100ml以上の治療薬を収納できるバイアルはごくわずか(8%)です。

- 医薬品バイアルの60%以上はスクリューキャップで使用するように設計されており、そのようなバイアルの例としては、1-Clic(R)Vial System、CryoClear(TM)バイアル、NextGen(TM)V-Vial(R)、Pyrofreeバイアル、Sterile CryoSure(R)バイアルなどがあります。

- 競争優位性を構築するために、業界関係者はそれぞれの製品ポートフォリオを強化するために、既存の能力を積極的にアップグレードし、新しい能力を追加しています。

- 長年にわたり、業界各社は独自の医薬品バイアルの開発をさらに進め、改良を可能にするためにいくつかの取引を成立させてきました。

- この分野での提携活動は、過去数年間でCAGR 30%以上で増加しています。

- 既存企業も新規参入企業も、過去には戦略的パートナーシップを結んでいます。

- 現在の業界動向は、主に複雑化する医薬品の大規模かつ特殊な生産・包装要件に対応するため、革新的な包装ソリューションへのニーズが高まっていることを裏付けています。

- 40社近くの企業が、さまざまな自由度を持つ幅広いロボット機械を提供し、生産性とコストの最適化に顕著な機会を提供していると主張しています。

- 医薬品バイアルは、COVID-19パンデミックの間、新規ワクチンや実験的治療薬を大量に保管・包装するために高い需要があります。

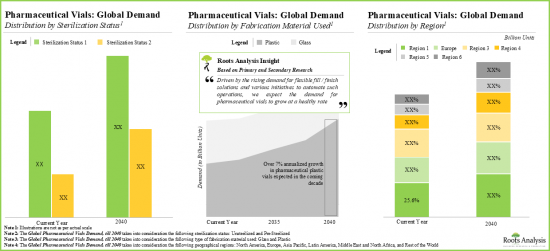

- 製薬用バイアルの推定市場機会は、さまざまな種類の製造材料、滅菌状態、および地理的地域にわたって十分に分布していると予想されます。

医薬品バイアル市場の参入企業例

- Chongqing Zhengchuan Pharmaceutical Packaging

- Corning

- DANYANG XIANGHE PHARMACEUTICAL PACKAGING

- DWK Life Sciences

- Gerresheimer

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Origin Pharma Packaging

- Pacific Vial Manufacturing

- SCHOTT

- SGD Pharma

- Shandong Pharmaceutical Glass

- Stevanato Group

- Thermo Fisher Scientific

- Worldwide Glass Resources

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 章の概要

- 医薬品包装

- 医薬品バイアル

- 医薬品バイアルにおけるイノベーション

第4章 市場情勢

- 章の概要

- 医薬品バイアル:市場情勢

- 医薬品バイアル:メーカー一覧

第5章 企業競争力分析

- 章の概要

- 前提と主要なパラメータ

- 調査手法

- 医薬品バイアル:企業競争力分析

第6章 企業プロファイル:北米の医薬品バイアル製造業者

- 章の概要

- Corning

- DWK Life Sciences

- Pacific Vial Manufacturing

- Thermo Fischer Scientific

- Worldwide Glass Resources

第7章 企業プロファイル:欧州の医薬品バイアル製造業者

- 章の概要

- Gerresheimer

- Origin Pharma Packaging

- SCHOTT

- SGD Pharma

- Stevanato Group

第8章 企業プロファイル:アジア太平洋の医薬品バイアル製造業者

- Chongqing Zhengchuan Pharmaceutical Packaging

- Danyang Xianghe Pharmaceutical Packaging

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Shandong Pharmaceutical Glass

第9章 パートナーシップとコラボレーション

- 章の概要

- パートナーシップモデル

- 医薬品バイアル:パートナーシップとコラボレーションのリスト

第10章 医薬品包装の今後の動向

- 章の概要

- 現代のドラッグデリバリーデバイスの使用別薬物の自己治療の好み

- 改良された包装部品の開発と製造コストの最適化への取り組み

- モジュラー施設の利用可能性

- パーソナライズされた治療に対する需要と嗜好の高まり

- 充填・仕上げ工程の自動化に関する規定の増加

- パートナーシップ活動の急増

- 発展途上地域における業界利害関係者別取り組みの増加

- 結論

第11章 需要分析

- 章の概要

- 範囲と調査手法

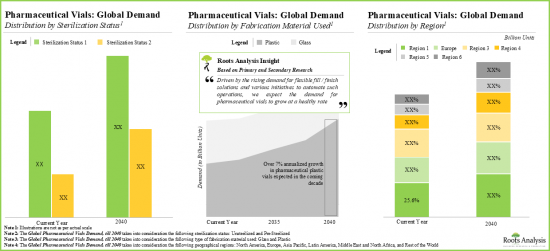

- 2035年までの医薬品バイアルの世界需要

- 結論

第12章 市場予測と機会分析

- 章の概要

- 予測調査手法と主要な前提条件

- 世界の医薬品バイアル市場(2035年まで)

第13章 ケーススタディ:医薬品包装におけるロボット

- 章の概要

- 製薬業界におけるロボットの役割

- ロボットシステムを選択する際に考慮すべき重要な点

- ロボットシステムの利点

- ロボットシステムの欠点

- 製薬業界向けロボットを提供する企業

- 医薬品包装用ロボットシステムを統合した機器を提供する企業

- Aseptic Technologies

- AST

- Bosch Packaging Technology

- Dara Pharmaceutical Packaging

- Fedegari Group

- IMA

- Steriline

- Vanrx Pharmasystems

第14章 ケーススタディ:滅菌済み/レディトゥーユース医薬品バイアル

- 章の概要

- 医薬品の包装と充填

- 従来の一次包装の限界

- レディトゥーユース一次包装

- 結論

第15章 結論

第16章 エグゼクティブ洞察

第17章 付録1:表形式データ

第18章 付録2:企業・団体一覧

List of Tables

- Table 3.1 Difference between Tubular and Moulded Glass Vials

- Table 4.1 Pharmaceutical Vials: List of Products

- Table 4.2 Pharmaceutical Vials: List of Manufacturers

- Table 6.1 Leading Manufacturers of Pharmaceutical Vials in North America

- Table 6.2 Corning: Company Snapshot

- Table 6.3 Corning: Pharmaceutical Vials

- Table 6.4 Corning: Recent Developments and Future Outlook

- Table 6.5 DWK Life Sciences: Company Snapshot

- Table 6.6 DWK Life Sciences: Pharmaceutical Vials

- Table 6.7 DWK Life Sciences: Recent Developments and Future Outlook

- Table 6.8 Pacific Vial Manufacturing: Company Snapshot

- Table 6.9 Pacific Vial Manufacturing: Pharmaceutical Vials

- Table 6.10 Thermo Fisher Scientific: Company Snapshot

- Table 6.11 Thermo Fisher Scientific: Pharmaceutical Vials

- Table 6.12 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 6.13 Worldwide Glass Resources: Company Snapshot

- Table 6.14 Worldwide Glass Resources: Pharmaceutical Vials

- Table 7.1 Leading Manufacturers of Pharmaceutical Vials in Europe

- Table 7.2 Gerresheimer: Company Snapshot

- Table 7.3 Gerresheimer: Pharmaceutical Vials

- Table 7.4 Gerresheimer: Recent Developments and Future Outlook

- Table 7.5 Origin Pharma Packaging: Company Snapshot

- Table 7.6 Origin Pharma Packaging: Pharmaceutical Vials

- Table 7.7 SCHOTT: Company Snapshot

- Table 7.8 SCHOTT: Pharmaceutical Vials

- Table 7.9 SCHOTT: Recent Developments and Future Outlook

- Table 7.10 SGD Pharma: Company Snapshot

- Table 7.11 SGD Pharma: Pharmaceutical Vials

- Table 7.12 SGD Pharma: Recent Developments and Future Outlook

- Table 7.13 Stevanato Group: Company Snapshot

- Table 7.14 Stevanato Group: Pharmaceutical Vials

- Table 7.15 Stevanato Group: Recent Developments and Future Outlook

- Table 8.1 Leading Manufacturers of Pharmaceutical Vials in Asia Pacific

- Table 8.2 Chongqing Zhengchuan Pharmaceutical Packaging: Company Snapshot

- Table 8.3 Chongqing Zhengchuan Pharmaceutical Packaging: Pharmaceutical Vials

- Table 8.4 DANYANG XIANGHE PHARMACEUTICAL PACKAGING: Company Snapshot

- Table 8.5 DANYANG XIANGHE PHARMACEUTICAL PACKAGING: Pharmaceutical Vials

- Table 8.6 Ningbo Zhengli Pharmaceutical Packaging: Company Snapshot

- Table 8.7 Ningbo Zhengli Pharmaceutical Packaging: Pharmaceutical Vials

- Table 8.8 Ningbo Zhengli Pharmaceutical Packaging: Recent Developments and Future Outlook

- Table 8.9 Nipro: Company Snapshot

- Table 8.10 Nipro: Pharmaceutical Vials

- Table 8.11 Nipro: Recent Developments and Future Outlook

- Table 8.12 Shandong Pharmaceutical Glass: Company Snapshot

- Table 8.13 Shandong Pharmaceutical Glass: Pharmaceutical Vials

- Table 9.1 Pharmaceutical Vials: Partnerships and Collaborations, Since 2015

- Table 12.1 Tiered Pricing Structure of Prices of Pharmaceutical Vials across Different Geographies

- Table 13.1 List of Pharmaceutical Robotics Manufacturers

- Table 13.2 Aseptic Technologies: Company Overview

- Table 13.3 Aseptic Technologies: Key Specifications of Crystal L1 Robot Line

- Table 13.4 Aseptic Technologies: Key Specifications of Crystal SL1 Robot Line

- Table 13.5 AST: Company Overview

- Table 13.6 AST: Key Specifications of ASEPTiCell

- Table 13.7 AST: Key Specifications of GENiSYS R

- Table 13.8 AST: Key Specifications of GENiSYS C

- Table 13.9 AST: Key Specifications of GENiSYS Lab

- Table 13.10 Bosch Packaging Technology: Company Overview

- Table 13.11 Bosch Packaging Technology: Key Specifications of ATO

- Table 13.12 Dara Pharmaceutical Equipment: Company Overview

- Table 13.13 Dara Pharmaceutical Equipment: Key Specifications of SYX-E Cartridge + RABS

- Table 13.14 Fedegari Group: Company Overview

- Table 13.15 Fedegari Group: Key Specifications of Fedegari Isolator

- Table 13.16 IMA: Company Overview

- Table 13.17 IMA: Key Specifications of INJECTA

- Table 13.18 IMA: Key Specifications of STERI LIF3

- Table 13.19 Steriline: Company Overview

- Table 13.20 Steriline: Key Specifications of Robotic Nest Filling Machine

- Table 13.21 Steriline: Key Specifications of Robotic Vial Filling Machine

- Table 13.22 Steriline: Key Specifications of Robotic Vial Capping Machine

- Table 13.23 Vanrx Pharmasystems: Company Overview

- Table 13.24 Vanrx Pharmasystems: Key Specifications of Microcell Vial Filler

- Table 13.25 Vanrx Pharmasystems: Key Specifications of SA25 Aseptic Filling Workcell

- Table 14.1 Compatibility of Polymers with Ethylene Oxide Sterilization

- Table 14.2 Advantages and Disadvantages of Different Sterilization Techniques

- Table 14.3 List of Pre-sterilized / Ready-to-Use Pharmaceutical Vials

- Table 16.1 Aseptic Technologies: Company Snapshot

- Table 16.2 PYRAMID Laboratories: Company Snapshot

- Table 16.3 SiO2 Materials Science: Company Snapshot

- Table 17.1 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Container)

- Table 17.2 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Closure)

- Table 17.3 Pharmaceutical Vials: Distribution by Volume of Vial

- Table 17.4 Pharmaceutical Vials: Distribution by Type of Vial Cap

- Table 17.5 Pharmaceutical Vials: Distribution by Sterilization Status

- Table 17.6 Pharmaceutical Vials: Distribution by Type of Product

- Table 17.7 Pharmaceutical Vials: Distribution by Compatible Drug Class

- Table 17.8 Pharmaceutical Vials: Distribution by Type of Formulation Stored

- Table 17.9 Pharmaceutical Vials Manufacturers: Distribution by Year of Establishment

- Table 17.10 Pharmaceutical Vials Manufacturers: Distribution by Company Size

- Table 17.11 Pharmaceutical Vials Manufacturers: Distribution by Location of Headquarters

- Table 17.12 Leading Manufacturers: Distribution by Number of Products

- Table 17.13 Corning: Annual Revenues, Since 2016 (USD Billion)

- Table 17.14 Thermo Fisher Scientific: Annual Revenues, Since 2016 (USD Billion)

- Table 17.15 Gerresheimer: Annual Revenues, Since 2016 (EUR Billion)

- Table 17.16 SCHOTT: Annual Revenues, Since 2016 (EUR Billion)

- Table 17.17 Nipro: Annual Revenues, Since 2016 (JPY Billion)

- Table 17.18 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Table 17.19 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 17.20 Partnerships and Collaborations: Year-wise Trend by Type of Partnership

- Table 17.21 Partnerships and Collaborations: Distribution by Type of Fabrication Material Used

- Table 17.22 Partnerships and Collaborations: Year-wise Trend by Type of Fabrication Material Used

- Table 17.23 Partnerships and Collaborations: Distribution by Sterilization Status

- Table 17.24 Partnerships and Collaborations: Year-wise Trend by Sterilization Status

- Table 17.25 Partnerships and Collaborations: Distribution by Analysis by Type of Partner

- Table 17.26 Partnerships and Collaborations: Year-wise Trend by Analysis by Type of Partner

- Table 17.27 Most Active Players: Distribution by Number of Partnerships

- Table 17.28 Partnerships and Collaborations: Distribution by Region (Continent-wise)

- Table 17.29 Partnerships and Collaborations: Distribution by Region (Country-wise)

- Table 17.30 Global Demand for Pharmaceutical Vials, Till 2035 (Billion Units)

- Table 17.31 Global Demand for Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Billion Units)

- Table 17.32 Global Demand for Pharmaceutical Glass Vials, Till 2035 (Billion Units)

- Table 17.33 Global Demand for Pharmaceutical Plastic Vials, Till 2035 (Billion Units)

- Table 17.34 Global Demand for Pharmaceutical Vials: Distribution by Sterilization Status (Billion Units)

- Table 17.35 Global Demand for Unsterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Table 17.36 Global Demand for Pre-sterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Table 17.37 Global Demand for Pharmaceutical Vials: Distribution by Geography

- Table 17.38 Demand for Pharmaceutical Vials in North America, Till 2035 (Billion Units)

- Table 17.39 Demand for Pharmaceutical Vials in Europe, Till 2035 (Billion Units)

- Table 17.40 Demand for Pharmaceutical Vials in Asia Pacific, Till 2035 (Billion Units)

- Table 17.41 Demand for Pharmaceutical Vials in Middle East and North Africa, Till 2035 (Billion Units)

- Table 17.42 Demand for Pharmaceutical Vials in Latin America, Till 2035 (Billion Units)

- Table 17.43 Demand for Pharmaceutical Vials in Rest of the World, Till 2035 (Billion Units)

- Table 17.44 Global Pharmaceutical Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.45 Pharmaceutical Vials: Likely Growth Scenarios

- Table 17.46 Pharmaceutical Vials Market: Distribution by Type of Fabrication Material Used, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.47 Pharmaceutical Glass Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.48 Pharmaceutical Plastic Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.49 Pharmaceutical Vials Market: Distribution by Sterilization Status, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.50 Unsterilized Pharmaceutical Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.51 Pre-sterilized Pharmaceutical Vials Market, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.52 Pharmaceutical Vials Market: Distribution by Geography, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.53 Pharmaceutical Vials Market in North America, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.54 Pharmaceutical Vials Market in Europe, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.55 Pharmaceutical Vials Market in Asia-Pacific, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.56 Pharmaceutical Vials Market in Middle East and North Africa, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.57 Pharmaceutical Vials Market in Latin America, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 17.58 Pharmaceutical Vials Market in Rest of the World, Till 2035: Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 3.1 Advantages of Pharmaceutical Packaging

- Figure 3.2 Types of Pharmaceutical Packaging

- Figure 3.3 Advantages of Glass Vials

- Figure 3.4 Innovation in Pharmaceutical Packaging and Value Chain

- Figure 4.1 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Container)

- Figure 4.2 Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Closure)

- Figure 4.3 Pharmaceutical Vials: Distribution by Volume of Vial

- Figure 4.4 Pharmaceutical Vials: Distribution by Type of Vial Cap

- Figure 4.5 Pharmaceutical Vials: Distribution by Sterilization Status

- Figure 4.6 Pharmaceutical Vials: Distribution by Type of Product

- Figure 4.7 Pharmaceutical Vials: Distribution by Compatible Drug Class

- Figure 4.8 Pharmaceutical Vials: Distribution by Type of Formulation Stored

- Figure 4.9 Pharmaceutical Vials Manufacturers: Distribution by Year of Establishment

- Figure 4.10 Pharmaceutical Vials Manufacturers: Distribution by Company Size

- Figure 4.11 Pharmaceutical Vials Manufacturers: Distribution by Location of Headquarters

- Figure 4.12 Leading Manufacturers: Distribution by Number of Products

- Figure 5.1 Company Competitiveness Analysis: Small Manufacturers

- Figure 5.2 Company Competitiveness Analysis: Mid-sized Manufacturers

- Figure 5.3 Company Competitiveness Analysis: Large Manufacturers

- Figure 5.4 Company Competitiveness Analysis: Very Large Manufacturers

- Figure 6.1 Corning: Annual Revenues, Since 2016 (USD Billion)

- Figure 6.2 Thermo Fisher Scientific: Annual Revenues, Since 2016 (USD Billion)

- Figure 7.1 Gerresheimer: Annual Revenues, Since 2016 (EUR Billion)

- Figure 7.2 SCHOTT: Annual Revenues, Since 2016 (EUR Billion)

- Figure 8.1 Nipro: Annual Revenues, Since 2016 (JPY Billion)

- Figure 9.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2015

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Year-wise Trend by Type of Partnership

- Figure 9.4 Partnerships and Collaborations: Distribution by Type of Fabrication Material Used

- Figure 9.5 Partnerships and Collaborations: Year-wise Trend by Type of Fabrication Material Used

- Figure 9.6 Partnerships and Collaborations: Distribution by Sterilization Status

- Figure 9.7 Partnerships and Collaborations: Year-wise Trend by Sterilization Status

- Figure 9.8 Partnerships and Collaborations: Distribution by Analysis by Type of Partner

- Figure 9.9 Partnerships and Collaborations: Year-wise Trend by Analysis by Type of Partner

- Figure 9.10 Most Active Players: Distribution by Number of Partnerships

- Figure 9.11 Partnerships and Collaborations: Distribution by Region (Continent-wise)

- Figure 9.12 Partnerships and Collaborations: Distribution by Region (Country-wise)

- Figure 10.1 Upcoming Trends Related to Pharmaceutical Packaging

- Figure 10.2 Future Growth Opportunities of Innovative Pharmaceutical Packaging based on Recent Trends

- Figure 11.1 Global Demand for Pharmaceutical Vials, Till 2035 (Billion Units)

- Figure 11.2 Global Demand for Pharmaceutical Vials: Distribution by Type of Fabrication Material Used (Billion Units)

- Figure 11.3 Global Demand for Pharmaceutical Glass Vials, Till 2035 (Billion Units)

- Figure 11.4 Global Demand for Pharmaceutical Plastic Vials, Till 2035 (Billion Units)

- Figure 11.5 Global Demand for Pharmaceutical Vials: Distribution by Sterilization Status (Billion Units)

- Figure 11.6 Global Demand for Unsterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Figure 11.7 Global Demand for Pre-sterilized Pharmaceutical Vials, Till 2035 (Billion Units)

- Figure 11.8 Global Demand for Pharmaceutical Vials: Distribution by Geography

- Figure 11.9 Demand for Pharmaceutical Vials in North America, Till 2035 (Billion Units)

- Figure 11.10 Demand for Pharmaceutical Vials in Europe, Till 2035 (Billion Units)

- Figure 11.11 Demand for Pharmaceutical Vials in Asia Pacific, Till 2035 (Billion Units)

- Figure 11.12 Demand for Pharmaceutical Vials in Middle East and North Africa, Till 2035 (Billion Units)

- Figure 11.13 Demand for Pharmaceutical Vials in Latin America, Till 2035 (Billion Units)

- Figure 11.14 Demand for Pharmaceutical Vials in Rest of the World, Till 2035 (Billion Units)

- Figure 12.1 Global Pharmaceutical Vials Market, Till 2035 (USD Billion)

- Figure 12.2 Pharmaceutical Vials: Likely Growth Scenarios

- Figure 12.3 Pharmaceutical Vials Market : Distribution by Type of Fabrication Material Used (USD Billion)

- Figure 12.4 Pharmaceutical Glass Vials Market, Till 2035 (USD Billion)

- Figure 12.5 Pharmaceutical Plastic Vials Market, Till 2035 (USD Billion)

- Figure 12.6 Pharmaceutical Vials Market : Distribution by Sterilization Status (USD Billion)

- Figure 12.7 Unsterilized Pharmaceutical Vials Market, Till 2035 (USD Billion)

- Figure 12.8 Pre-sterilized Pharmaceutical Vials Market, Till 2035 (USD Billion)

- Figure 12.9 Pharmaceutical Vials Market : Distribution by Geography (USD Billion)

- Figure 12.10 Pharmaceutical Vials Market in North America, Till 2035 (USD Billion)

- Figure 12.11 Pharmaceutical Vials Market in Europe, Till 2035 (USD Billion)

- Figure 12.12 Pharmaceutical Vials Market in Asia-Pacific, Till 2035 (USD Billion)

- Figure 12.13 Pharmaceutical Vials Market in Middle East and North Africa, Till 2035 (USD Billion)

- Figure 12.14 Pharmaceutical Vials Market in Latin America, Till 2035 (USD Billion)

- Figure 12.15 Pharmaceutical Vials Market in Rest of the World, Till 2035 (USD Billion)

- Figure 13.1 Key Considerations for Selecting a Robotic System

- Figure 13.2 Advantages Associated with Use of Robotic Systems in Pharmaceutical Manufacturing

- Figure 14.1 Traditional Aseptic Pharmaceutical Filling

- Figure 14.2 Ready-to-Use Enabled Flexible, Aseptic Processing

- Figure 14.3 Advantages of Ready-to-Use Platform

- Figure 14.4 Cost Comparison of Ready-to-Use and Conventional Container Systems

- Figure 14.5 Drivers of Ready-to-Use Platform

- Figure 16.1 Concluding Remarks: Overall Market Landscape

- Figure 16.2 Concluding Remarks: Partnerships and Collaborations

- Figure 16.3 Concluding Remarks: Global Demand for Pharmaceutical Vials

- Figure 16.4 Concluding Remarks: Market Forecast

PHARMACEUTICAL VIALS MARKET: OVERVIEW

As per Roots Analysis, the global pharmaceutical vials market valued at USD 11.03 billion in the current year is anticipated to grow at a CAGR of 6% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Fabrication Material Used

- Glass

- Plastic

Sterilization Status

- Pre-sterilized

- Unsterilized

Key Geographies

- North America

- Europe

- Asia- Pacific

- Latin America

- Middle East and North Africa

- Rest of the World

PHARMACEUTICAL VIALS MARKET: GROWTH AND TRENDS

Primary packaging material such as pharmaceutical glass vials play a crucial role in preserving the stability, efficacy and safety of the drug as it is in direct contact with the packaged therapeutic. Additionally, pharmaceutical primary packaging material assists in maintaining the sterility and quality of a drug product, while also providing information related to its identity and, in certain cases, dosing instructions. Moreover, given the high demand for parenteral formulations and rising vaccination campaigns, there is an urgent need for safe and high-quality pharmaceutical vials, for storing and distributing such formulations in large quantities, across the world.

Despite being the most preferred packaging system, traditional vials are often associated with certain challenges, including chances of breakage under extreme conditions, absence of relevant information (serial or batch number) on the package and potential to delaminate. As a result, several pharmaceutical vials manufacturers are exploring novel techniques to overcome the aforementioned challenges associated with conventional pharmaceutical vials in order to create better packaging solutions. In fact, pharmaceutical vial manufacturers are constantly innovating and creating newer and better packaging solutions in order to meet the changing demands of next generation drug products. Examples of some advancements in this domain include the use of pre-sterilized vials, development of numerous coating materials and adoption of smart drug delivery technologies.

PHARMACEUTICAL VIALS MARKET: KEY INSIGHTS

The report delves into the current state of the global pharmaceutical vials market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, more than 240 pharmaceutical vials are available / being developed by close to 95 manufacturers; most of these players are based in the developed such as North America and Europe.

- Majority of the pharmaceutical vials are fabricated using glass and are available in a variety of volumes; screw caps are amongst the preferred type of vial caps used for such containers.

- Owing to the various benefits, glass emerged as the most preferred fabrication material used for pharmaceutical vials; common types of glass used include type I borosilicate glass (65%) and type III soda-lime glass (16%).

- Majority (60%) of the pharmaceutical vials have a capacity to hold less than 50 ml of drug product; however, very few (8%) vials are capable of storing more than 100 ml of therapeutic products.

- More than 60% of the pharmaceutical vials are designed to be used with screw caps; examples of such vials include 1-Clic(R) Vial System, CryoClear(TM) vials, NextGen(TM) V-Vial(R), Pyrofree vials and Sterile CryoSure(R) Vial.

- In pursuit of building a competitive edge, industry stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective product portfolios.

- Over the years, industry players have established several deals to further advance the development / enable the improvement of their proprietary pharmaceutical vials.

- The partnership activity in this domain has increased at a CAGR of over 30% in the past few years.

- Both established players and new entrants have forged strategic partnerships in the recent past; acquisitions emerged as the prominent type of partnership model.

- Current industry trends support the growing need for innovative packaging solutions, primarily to accommodate large scale and specialized production / packaging requirements of increasingly complex drug products.

- Close to 40 players claim to provide a wide range of robotic machinery, having different degrees of freedom, offering notable productivity and cost optimization opportunities.

- Pharmaceutical vials have been in high demand during the COVID-19 pandemic to store and package the novel vaccines and experimental therapies in large quantities.

- The estimated market opportunity for pharmaceutical vials is expected to be well distributed across different types of fabrication material, sterilization status and geographical regions.

Example Players in the Pharmaceutical Vials Market

- Chongqing Zhengchuan Pharmaceutical Packaging

- Corning

- DANYANG XIANGHE PHARMACEUTICAL PACKAGING

- DWK Life Sciences

- Gerresheimer

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Origin Pharma Packaging

- Pacific Vial Manufacturing

- SCHOTT

- SGD Pharma

- Shandong Pharmaceutical Glass

- Stevanato Group

- Thermo Fisher Scientific

- Worldwide Glass Resources

PHARMACEUTICAL VIALS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the pharmaceutical vials market, focusing on key market segments, including [A] type of fabrication material used, [B] sterilization status and [C] key geographies.

- Market Landscape: A comprehensive evaluation of pharmaceutical vials, based on several relevant parameters, such as [A] type of fabrication material used for container, [B] type of fabrication material used for closure, [C] volume of vial, [D] type of vial cap, [D] sterilization status, [E] type of product, [F] compatible drug class and [G] type of formulation stored. Additionally, a comprehensive evaluation of pharmaceutical vial manufacturers based on several relevant parameters, including [A] year of establishment, [B] company size, [C] location of headquarters and [D] key players (in terms of number of products).

- Company Competitiveness Analysis: A comprehensive competitive analysis of pharmaceutical vial manufacturers, examining factors, such as [A] supplier power and [B] key product specifications.

- Company Profiles: In-depth profiles of the players engaged in the development of pharmaceutical vials, focusing on [A] overview of the company, [B] financial information (if available), [C] product portfolio and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the pharmaceutical vial domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of fabrication material involved, [D] sterilization status, [E] type of partners and [F] regional distribution of the partnerships.

- Upcoming Trends in Pharmaceutical Packaging: An in-depth analysis of key trends that are likely to impact the future adoption of novel primary packaging systems. Further, a Harvey ball analysis, focusing on the relative effect of each trend on the overall pharmaceutical packaging industry.

- Demand Analysis: A detailed analysis of the current and future demand for pharmaceutical vials, based on various parameters, such as [A] type of fabrication material used, [B] sterilization status and [C] regions.

- Case Study: A detailed discussion on the use of robotic machinery in pharmaceutical manufacturing and fill / finish operations, describing the advantages of using automation / automated technologies in such processes.

- Case Study: A detailed discussion on pre-sterilized / RTU pharmaceutical vials that are currently available. Additionally, the section discusses various sterilization techniques used for primary packaging materials and the advantages of RTU container-closure systems.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Pharmaceutical Packaging

- 3.2.1. Need for Pharmaceutical Packaging

- 3.2.2. Types of Pharmaceutical Packaging

- 3.3. Pharmaceutical Vials

- 3.3.1. Types of Fabrication Materials Used for Vials

- 3.3.1.1. Glass Vials

- 3.3.1.2. Plastic Vials

- 3.3.2. Vial Caps

- 3.3.1. Types of Fabrication Materials Used for Vials

- 3.4. Innovation in Pharmaceutical Vials

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Pharmaceutical Vials: Overall Market Landscape

- 4.2.1. Analysis by Type of Fabrication Material Used (Container)

- 4.2.2. Analysis by Type of Fabrication Material Used (Closure)

- 4.2.3. Analysis by Volume of Vial

- 4.2.4. Analysis by Type of Vial Cap

- 4.2.5. Analysis by Sterilization Status

- 4.2.6. Analysis by Type of Product

- 4.2.7. Analysis by Compatible Drug Class

- 4.2.8. Analysis by Type of Formulation Stored

- 4.3. Pharmaceutical Vials: List of Manufacturers

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Leading Manufacturers: Analysis by Number of Products

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Assumptions and Key Parameters

- 5.3. Methodology

- 5.4. Pharmaceutical Vials: Company Competitiveness Analysis

- 5.4.1. Company Competitiveness: Small Manufacturers

- 5.4.2. Company Competitiveness: Mid-sized Manufacturers

- 5.4.3. Company Competitiveness: Large Manufacturers

- 5.4.4. Company Competitiveness: Very Large Manufacturers

6. COMPANY PROFILES: PHARMACEUTICAL VIAL MANUFACTURERS IN NORTH AMERICA

- 6.1. Chapter Overview

- 6.2. Corning

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Pharmaceutical Vials Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. DWK Life Sciences

- 6.3.1. Company Overview

- 6.3.2. Pharmaceutical Vials Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. Pacific Vial Manufacturing

- 6.4.1. Company Overview

- 6.4.2. Pharmaceutical Vials Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. Thermo Fischer Scientific

- 6.5.1. Company Overview

- 6.5.2. Financial Information

- 6.5.3. Pharmaceutical Vials Portfolio

- 6.5.4. Recent Developments and Future Outlook

- 6.6. Worldwide Glass Resources

- 6.6.1. Company Overview

- 6.6.2. Pharmaceutical Vials Portfolio

- 6.6.3. Recent Developments and Future Outlook

7. COMPANY PROFILES: PHARMACEUTICAL VIAL MANUFACTURERS IN EUROPE

- 7.1. Chapter Overview

- 7.2. Gerresheimer

- 7.2.1. Company Overview

- 7.2.2. Financial Information

- 7.2.3. Pharmaceutical Vials Portfolio

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Origin Pharma Packaging

- 7.3.1. Company Overview

- 7.3.2. Pharmaceutical Vials Portfolio

- 7.3.3. Recent Developments and Future Outlook

- 7.4. SCHOTT

- 7.4.1. Company Overview

- 7.4.2. Financial Information

- 7.4.3. Pharmaceutical Vials Portfolio

- 7.4.4. Recent Developments and Future Outlook

- 7.5. SGD Pharma

- 7.5.1. Company Overview

- 7.5.2. Financial Information

- 7.5.3. Pharmaceutical Vials Portfolio

- 7.5.4. Recent Developments and Future Outlook

- 7.6. Stevanato Group

- 7.6.1. Company Overview

- 7.6.2. Pharmaceutical Vials Portfolio

- 7.6.3. Recent Developments and Future Outlook

8. COMPANY PROFILES: PHARMACEUTICAL VIAL MANUFACTURERS IN ASIA PACIFIC

- 8.1. Chongqing Zhengchuan Pharmaceutical Packaging

- 8.1.1. Company Overview

- 8.1.2. Pharmaceutical Vials Portfolio

- 8.1.3. Recent Developments and Future Outlook

- 8.2. Danyang Xianghe Pharmaceutical Packaging

- 8.2.1. Company Overview

- 8.2.2. Pharmaceutical Vials Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Ningbo Zhengli Pharmaceutical Packaging

- 8.3.1. Company Overview

- 8.3.2. Pharmaceutical Vials Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. Nipro

- 8.4.1. Company Overview

- 8.4.2. Financial Information

- 8.4.3. Pharmaceutical Vials Portfolio

- 8.4.4. Recent Developments and Future Outlook

- 8.5. Shandong Pharmaceutical Glass

- 8.5.1. Company Overview

- 8.5.2. Pharmaceutical Vials Portfolio

- 8.5.3. Recent Developments and Future Outlook

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. Pharmaceutical Vials: List of Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnership

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Type of Fabrication Material Used

- 9.3.5. Analysis by Sterilization Status

- 9.3.6. Analysis by Type of Partner

- 9.3.7. Most Active Players: Analysis by Number of Partnerships

- 9.3.8. Analysis by Geography

- 9.3.8.1. Region-wise Distribution

- 9.3.8.2. Country-wise Distribution

10. UPCOMING TRENDS IN PHARMACEUTICAL PACKAGING

- 10.1. Chapter Overview

- 10.2. Preference for Self-medication of Drugs, Through the Use of Modern Drug Delivery Devices

- 10.3. Development of Improved Packaging Components and Efforts to Optimize Manufacturing Costs

- 10.4. Availability of Modular Facilities

- 10.5. Growing Demand and Preference for Personalized Therapies

- 10.6. Rise in Provisions for Automating Fill / Finish Operations

- 10.7. Surge in Partnership Activity

- 10.8. Increase in Initiatives Undertaken by Industry Stakeholders in Developing Regions

- 10.9. Concluding Remarks

11. DEMAND ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Global Demand for Pharmaceutical Vials, Till 2035

- 11.3.1. Analysis by Type of Fabrication Material Used

- 11.3.1.1. Global Demand for Pharmaceutical Glass Vials, Till 2035

- 11.3.1.2. Global Demand for Pharmaceutical Plastic Vials, Till 2035

- 11.3.2. Analysis by Sterilization Status

- 11.3.2.1. Global Demand for Unsterilized Pharmaceutical Vials, Till 2035

- 11.3.2.2. Global Demand for Pre-sterilized Pharmaceutical Vials, Till 2035

- 11.3.3. Analysis by Geography

- 11.3.3.1. Demand for Pharmaceutical Vials in North America, Till 2035

- 11.3.3.2. Demand for Pharmaceutical Vials in Europe, Till 2035

- 11.3.3.3. Demand for Pharmaceutical Vials in Asia Pacific, Till 2035

- 11.3.3.4. Demand for Pharmaceutical Vials in Middle East and North Africa, Till 2035

- 11.3.3.5. Demand for Pharmaceutical Vials in Latin America, Till 2035

- 11.3.3.6. Demand for Pharmaceutical Vials in Rest of the World, Till 2035

- 11.3.1. Analysis by Type of Fabrication Material Used

- 11.4. Concluding Remarks

12. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 12.1. Chapter Overview

- 12.2. Forecast Methodology and Key Assumptions

- 12.3. Global Pharmaceutical Vials Market, Till 2035

- 12.3.1. Pharmaceutical Vials Market : Distribution by Type of Fabrication Material Used

- 12.3.1.1. Pharmaceutical Glass Vials Market, Till 2035

- 12.3.1.2. Pharmaceutical Plastic Vials Market, Till 2035

- 12.3.2. Pharmaceutical Vials Market : Distribution by Sterilization Status

- 12.3.2.1. Unsterilized Pharmaceutical Vials Market, Till 2035

- 12.3.2.2. Pre-sterilized Pharmaceutical Vials Market, Till 2035

- 12.3.3. Pharmaceutical Vials Market : Distribution by Geography

- 12.3.3.1. Pharmaceutical Vials Market in North America, Till 2035

- 12.3.3.2. Pharmaceutical Vials Market in Europe, Till 2035

- 12.3.3.3. Pharmaceutical Vials Market in Asia Pacific, Till 2035

- 12.3.3.4. Pharmaceutical Vials Market in Middle East and North Africa, Till 2035

- 12.3.3.5. Pharmaceutical Vials Market in Latin America, Till 2035

- 12.3.3.6. Pharmaceutical Vials Market in Rest of the World, Till 2035

- 12.3.1. Pharmaceutical Vials Market : Distribution by Type of Fabrication Material Used

13. CASE STUDY: ROBOTS IN PHARMACEUTICAL PACKAGING

- 13.1. Chapter Overview

- 13.2. Role of Robots in the Pharmaceutical Industry

- 13.2.1. Key Considerations for Selecting a Robotic System

- 13.2.2. Advantages of Robotic Systems

- 13.2.3. Disadvantages of Robotic Systems

- 13.3. Companies Providing Robots for Use in the Pharmaceutical Industry

- 13.4. Companies Providing Equipment Integrated with Robotic Systems for Pharmaceutical Packaging

- 13.4.1. Aseptic Technologies

- 13.4.2. AST

- 13.4.3. Bosch Packaging Technology

- 13.4.4. Dara Pharmaceutical Packaging

- 13.4.5. Fedegari Group

- 13.4.6. IMA

- 13.4.7. Steriline

- 13.4.8. Vanrx Pharmasystems

14. CASE STUDY: PRE-STERILIZED / READY-TO-USE PHARMACEUTICAL VIALS

- 14.1. Chapter Overview

- 14.2. Pharmaceutical Packaging and Filling

- 14.3. Limitations of Traditional Primary Packaging

- 14.4. Ready-to-Use Primary Packaging

- 14.4.1. Sterilization of Primary Packaging Material

- 14.4.1.1. Sterilization Techniques

- 14.4.2. Advantages of Ready-to-Use Primary Packaging

- 14.4.3. Cost Saving Opportunities associated with Ready-To-Use Primary Packaging

- 14.4.4. Current Demand for Ready-To-Use Primary Packaging and Key Enablers

- 14.4.5. List of Pre-Sterilized / Ready-to-Use Pharmaceutical Vials

- 14.4.1. Sterilization of Primary Packaging Material

- 14.5. Concluding Remarks

15. CONCLUDING REMARKS

16. EXECUTIVE INSIGHTS

- 16.1. Chapter Overview

- 16.2. Company A

- 16.2.1. Company Snapshot

- 16.2.2. Interview Transcript: Business Development and Technology Director

- 16.3. Company B

- 16.3.1. Company Snapshot

- 16.3.2. Interview Transcript: Former Project Manager of Business Development

- 16.4. Company C

- 16.4.1. Company Snapshot

- 16.4.2. Interview Transcript: SiO2 Materials Science