|

市場調査レポート

商品コード

1762545

容器完全性試験市場:業界動向と世界の予測 - 検査対象容器タイプ別、検査対象容器材料タイプ別、主要地域別Container Closure Integrity Testing Market: Industry Trends and Global Forecasts - Distribution by Type of Container Tested, Type of Container Material Tested and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| 容器完全性試験市場:業界動向と世界の予測 - 検査対象容器タイプ別、検査対象容器材料タイプ別、主要地域別 |

|

出版日: 2025年07月04日

発行: Roots Analysis

ページ情報: 英文 212 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

容器完全性試験市場:概要

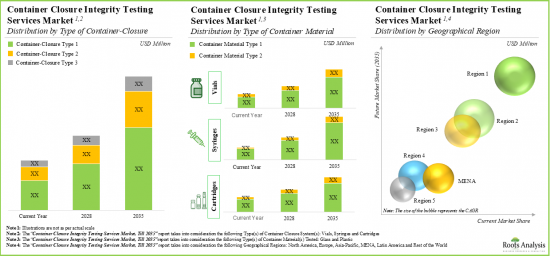

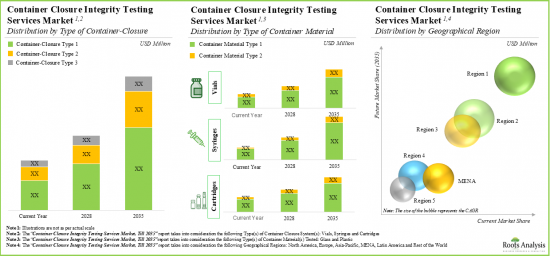

世界の容器完全性試験の市場規模は、2035年までの予測期間中に7%のCAGRで拡大し、現在の2億3,600万米ドルから2035年までに5億5,800万米ドルに成長すると予測されています。

市場規模と機会分析は、以下のパラメータで区分されています:

検査対象容器タイプ

- バイアル

- シリンジ

- カートリッジ

検査対象容器材料タイプ

- ガラス

- プラスチック

主な地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・北アフリカ

容器完全性試験市場:成長と動向

容器完全性試験とは、潜在的な汚染物質に対する無菌バリアを維持することに焦点を当てながら医薬品を包装するプロセスを指します。患者の健康と安全を考慮すると、医薬品は微生物汚染がなく、ライフサイクルを通じて安全に使用できることが求められます。そのため、製品の無菌性と安定性を確保するために、いくつかの品質チェックが行われます。品質保証を必要とする段階のひとつに、医薬品の二次包装があります。包装に欠陥があると、医薬品が劣化したり不安定になったりして、治療がうまくいかなくなったり、患者に危害が及ぶ可能性があるなど、深刻な結果を招く可能性があるからです。実際、容器閉鎖システムの包装にわずかな欠陥があっても、医薬品の無菌性と安定性に悪影響を及ぼし、反応性ガス、湿度、微生物の侵入による汚染を引き起こす可能性があります。従って、医薬品の安全性を確保し、リスクの可能性を防止するために、容器完全性試験が実施されます。また、製造から使用まで医薬品の品質が維持されることも保証されます。実際、この技術を使用することで、ミクロン単位の欠陥の検出が可能となり、製品回収の事例を最小限に抑えることができます。

いくつかの利点があるにもかかわらず、集中的な専門知識の欠如、空間的な制限、装置設置のための莫大な資本投資が、製造・包装企業にとっていくつかの課題となっています。そのため、この分野のいくつかの企業は、サービス・プロバイダーに支援を求めています。このことは、今後参入する企業や既存の利害関係者にとって、自社のサービスを拡大する有利な機会を生み出しています。

容器完全性試験市場:主要インサイト

当レポートでは、容器完全性試験市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです。

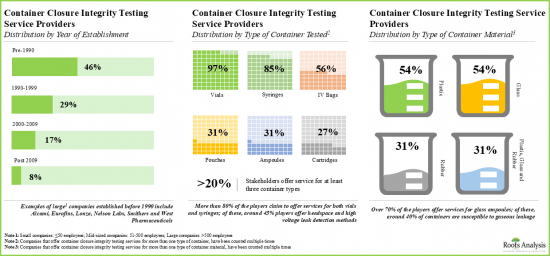

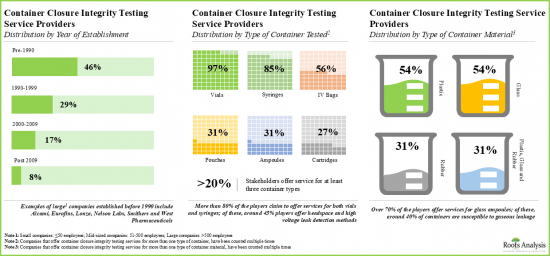

- 現在、40以上のサービスプロバイダーが世界中で容器完全性試験サービスを提供しています。

- 市場情勢の特徴として、容器完全性試験には新規参入企業と老舗企業の両方が存在します。

- 参入企業は、容器完全性試験施設を様々な地域に設置しており、これらの施設を組み合わせることで、分散されたサービスネットワークを提供しています。

- 競争優位を築くため、参入企業は信頼性の高い結果を提供する先進技術を統合することでサービス・ポートフォリオを強化しています。

- 容器完全性試験用に開発された機器は85を超え、その大半は臨床用と商業用の両方の規模に対応しています。

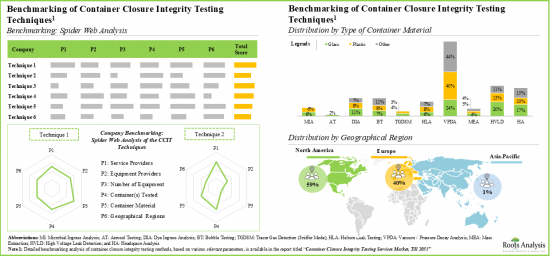

- 信頼性が高く精密な試験に対する要求が高まっていることから、進化する試験ベンチマークに適合する様々な先進技術が開発されています。

- 機器の相対的な競争力は、同業者グループ別異なります。これは、提供される機能、使用される分析方法、試験される容器の種類など、いくつかのパラメータによって左右されます。

- 容器閉鎖の完全性試験サービスに対する需要は、予測される将来において安定したペースで成長すると予想され、アジア太平洋地域が需要全体の大きな割合を占めると思われます。

- 市場は今後10年間にCAGR 7%で成長すると予想され、その機会は様々なタイプの容器閉鎖システム別、容器材料別、地域別にうまく分散されると思われます。

容器閉鎖の完全性検査市場:主要セグメント

検査対象容器タイプ別では、市場はバイアル、シリンジ、カートリッジに区分されます。現在のところ、バイアルが製薬業界で最も一般的に使用されている容器のタイプであることから、バイアルセグメントが世界の容器完全性試験市場で最大のシェアを占めています。この動向は今後数年間も変わらないと思われます。

検査対象容器材料タイプ別では、市場はガラスとプラスチックに区分されます。現在、ガラス系は化学的安定性が高く、品質等級が規制当局に認められているため、世界の容器完全性試験市場で最も高い割合を占めています。

主要地域別に見ると、市場は北米、欧州、アジア太平洋、ラテンアメリカ、中東・北アフリカに区分されます。現在、アジア太平洋が閉鎖完全性試験市場を独占し、最大の収益シェアを占めています。これは、この地域で製薬産業が成長し、医薬品の生産が増加していることに起因しています。さらに、ラテンアメリカの市場は、今後より高いCAGRで成長する可能性が高いです。

容器完全性試験市場の参入企業例

- Berkshire Sterile Manufacturing

- Confarma

- Curia

- DDL and Nelson Labs

- Eurofins

- SGS

- Stevanato

- Wilco

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 章の概要

- 一次包装:容器閉鎖システム

- 容器閉鎖システムの種類

- 容器閉鎖システムに関連する問題

- 容器完全性試験(CCI試験)

- 容器完全性試験方法

- 無菌試験に対する容器完全性試験の利点

- CCITサービスプロバイダーの役割

- 将来の展望

第4章 市場情勢

- 章の概要

- 容器完全性試験サービスプロバイダー:市場情勢

第5章 企業競争力分析

- 章の概要

- 調査手法

- 主なパラメータ

- 競争力分析:北米で容器完全性試験サービスを提供する企業

- 競争力分析:欧州およびアジア太平洋で容器完全性試験サービスを提供する企業

- 競争力分析:単一の分析施設で容器完全性試験サービスを提供する企業

- 競争力分析:分析施設以外で容器完全性試験サービスを提供する企業

第6章 北米の容器完全性試験サービスプロバイダー:企業プロファイル

- 章の概要

- Berkshire Sterile Manufacturing

- Curia

- DDL

- Nelson Labs

第7章 欧州の容器完全性試験サービスプロバイダー:企業プロファイル

- 章の概要

- Confarma

- Eurofins

- SGS

- Stevanato

- Wilco

第8章 ケーススタディ:容器完全性試験装置プロバイダーの市場情勢

- 章の概要

- 容器完全性試験装置:市場情勢

- 容器完全性試験装置プロバイダー:開発者の情勢

第9章 製品競争力分析

- 章の概要

- 調査手法

- 前提/主要パラメータ

- 製品競争力分析:小規模企業が提供する容器完全性試験装置

- 製品競争力分析:中堅企業が提供する容器完全性試験装置

- 製品競争力分析:大手企業が提供する容器完全性試験装置

- 製品競争力分析:北米に本社を置く企業が提供する容器完全性試験装置

- 製品競争力分析:欧州に本社を置く企業が提供する容器完全性試験装置

- 製品競争力分析:アジア太平洋に本社を置く企業が提供する容器完全性試験装置

第10章 地域能力評価

- 章の概要

- 前提と主要なパラメータ

- 北米

- 欧州およびアジア太平洋

- 結論

第11章 ベンチマーク分析

第12章 ケーススタディ:医薬品包装におけるロボット工学

- 章の概要

- 製薬業界におけるロボットの役割

- 製薬業界向けロボットを提供する企業

- 医薬品包装用ロボットシステムを統合した機器を提供する企業

第13章 需要分析

- 章の概要

- 範囲と調査手法

- 2035年までの容器完全性試験サービスの世界需要

- 結論

第14章 市場予測と機会分析

- 章の概要

- 予測調査手法と主要な前提条件

- 世界の容器閉鎖部完全性試験サービス市場(2035年まで)

第15章 SWOT分析

第16章 結論

第17章 エグゼクティブ洞察

第18章 付録1:表形式データ

第19章 付録2:企業・団体一覧

List of Tables

- Table 4.1. List of Container Closure Integrity Testing Service Providers

- Table 8.1. List of Container Closure Integrity Testing Equipment

- Table 13.1. Company Providing Robots for Use in Pharmaceutical Industry

- Table 13.2. Crystal L1 Robot Line: Key Features

- Table 13.3. Crystal SL1 Robot Line: Key Features

- Table 13.4. ASEPTiCell: Key Features

- Table 13.5. GENiSYS R: Key Features

- Table 13.6. GENiSYS C: Key Features

- Table 13.7. GENiSYS Lab: Key Features

- Table 13.8. ATO: Key Features

- Table 13.9. Fedegari Isolator: Key Features

- Table 13.10. INJECTA: Key Features

- Table 13.11. STERI LIF3: Key Features

- Table 13.12. Microcell Vial Filler: Key Features

- Table 13.13. SA25 Aseptic Filling Workcell: Key Features

- Table 18.1. Container Closure Integrity Testing Service Provider: Distribution by Type(s) of Analytical Testing Method(s)

- Table 18.2. Container Closure Integrity Testing Service Provider: Distribution by Type of Container Material

- Table 18.3. Container Closure Integrity Testing Service Provider: Distribution by Leakage Susceptibility

- Table 18.4. Container Closure Integrity Testing Service Provider: Distribution by Type of Container(s) Tested

- Table 18.5. Container Closure Integrity Testing Service Provider: Distribution by Accreditations

- Table 18.6. Container Closure Integrity Testing Service Provider: Distribution by Year of Establishment

- Table 18.7. Container Closure Integrity Testing Service Provider: Geographical Distribution by Company Size

- Table 18.8. Container Closure Integrity Testing Service Provider: Geographical Distribution by Location of Analytical Facilities

- Table 18.9. Container Closure Integrity Testing Equipment Landscape: Distribution by Scale of Operation

- Table 18.10. Container Closure Integrity Testing Equipment Landscape: Distribution by Key Features

- Table 18.11. Container Closure Integrity Testing Equipment Landscape: Type(s) of Analytical Method(s)

- Table 18.12. Container Closure Integrity Testing Equipment Landscape: Distribution by Container Material

- Table 18.13. Container Closure Integrity Testing Equipment Landscape: Distribution by Type(s) of Container(s)

- Table 18.14. Container Closure Integrity Testing Equipment Providers: Distribution by Year of Establishment

- Table 18.15. Container Closure Integrity Testing Equipment Providers: Distribution by Company Size

- Table 18.16. Container Closure Integrity Testing Equipment Providers: Distribution by Geographical Region

- Table 18.17. Product Competitiveness Analysis: Equipment Offered by Small Players

- Table 18.18. Product Competitiveness Analysis: Equipment Offered by Mid-Sized Players

- Table 18.19. Product Competitiveness Analysis: Equipment Offered by Large Players

- Table 18.20. Product Competitiveness Analysis: Equipment Offered by Players Headquartered in North America

- Table 18.21. Product Competitiveness Analysis: Equipment Offered by Players Headquartered in Europe

- Table 18.22. Product Competitiveness Analysis: Equipment Offered by Players Headquartered in Asia-Pacific

- Table 18.23. Regional Capability Analysis: Distribution by Number of CCIT Service Providers

- Table 18.24. Regional Capability Analysis: Distribution by Number of Analytical Services

- Table 18.25. Regional Capability Analysis: Distribution by Number of CCIT Technology Providers

- Table 18.26. Regional Capability Analysis: Distribution by Number of CCIT Technologies

- Table 18.27. Regional Capability Analysis: Distribution by Number of Patents

- Table 18.28. Regional Capability Analysis: Distribution by Demand of CCIT

- Table 18.29. Demand Analysis: Distribution by Type(s) of Container(s) Tested

- Table 18.30. Demand Analysis: Distribution by Type(s) of Container(s) Material

- Table 18.31. Demand Analysis: Distribution by Geographical Region

- Table 18.32. Demand Analysis: Geographical Distribution of Type(s) of Container(s) Tested

- Table 18.33. Overall Container Closure Integrity Testing Services Market, Till 2035 (USD Million)

- Table 18.34. Container Closure Integrity Testing Services Market: Distribution by Type of Container Closure Systems, Till 2035 (USD Million)

- Table 18.35. Container Closure Integrity Testing Services Market: Distribution by Type of Container Material, Till 2035 (USD Million)

- Table 18.36. Container Closure Integrity Testing Services Market: Distribution by Geographical Region, Till 2035 (USD Million)

- Table 18.37. Container Closure Integrity Testing Services Market: Distribution by Key Geographical Regions, Till 2035 (USD Million)

- Table 18.38. Container Closure Integrity Testing Services Market: Market in North America (USD Million)

- Table 18.39. Container Closure Integrity Testing Services Market: Market in Europe (USD Million)

- Table 18.40. Container Closure Integrity Testing Services Market: Market in Asia-Pacific (USD Million)

- Table 18.41. Container Closure Integrity Testing Services Market: Market in Middle East North Africa (USD Million)

- Table 18.42. Container Closure Integrity Testing Services Market: Market in Latin America (USD Million)

- Table 18.43. Container Closure Integrity Testing Services Market: Market in Rest of the World (USD Million)

List of Figures

- Figure 3.1. Overview

- Figure 3.2. Type of Container Closure System

- Figure 3.3. Types of Contaminations

- Figure 3.4. Defects related to Container Closure Systems

- Figure 3.5. History of Container Closure Integrity Testing

- Figure 3.6. Method of Container Closure Integrity Testing (CCI Testing)

- Figure 3.7. Advantages of Container Closure Integrity Testing Over Sterility Testing

- Figure 3.8. Need for CCIT Service Providers

- Figure 3.9. Conclusion

- Figure 4.1. Container Closure Integrity Testing Service Provider: Distribution by Type(s) of Analytical Testing Method(s)

- Figure 4.2. Container Closure Integrity Testing Service Provider: Distribution by Type of Container Material

- Figure 4.3. Container Closure Integrity Testing Service Provider: Distribution by Leakage Susceptibility

- Figure 4.4. Container Closure Integrity Testing Service Provider: Distribution by Type of Container(s) Tested

- Figure 4.5. Container Closure Integrity Testing Service Provider: Distribution by Accreditations

- Figure 4.6. Container Closure Integrity Testing Service Provider: Distribution by Year of Establishment

- Figure 4.7. Container Closure Integrity Testing Service Provider: Geographical Distribution by Company Size

- Figure 4.8. Container Closure Integrity Testing Service Provider: Geographical Distribution by Location of Analytical Facilities

- Figure 5.1. Company Competitiveness Analysis: Service Providers based in North America

- Figure 5.2. Company Competitiveness Analysis: Service Providers based in Europe

- Figure 5.3. Company Competitiveness Analysis: Service Providers with One Analytical Facility

- Figure 5.4. Company Competitiveness Analysis: Service Providers with More than One Analytical Facility

- Figure 6.1. Berkshire Sterile Manufacturing: Company Overview

- Figure 6.2. Berkshire Sterile Manufacturing: Key Executives

- Figure 6.3. Berkshire Sterile Manufacturing: Financial Information

- Figure 6.4. Berkshire Sterile Manufacturing: Location of Facilities

- Figure 6.5. Berkshire Sterile Manufacturing: Accreditations

- Figure 6.6. Berkshire Sterile Manufacturing: Service Portfolio

- Figure 6.7. Berkshire Sterile Manufacturing: Testing Methods Offered

- Figure 6.8. Berkshire Sterile Manufacturing: Types of Containers Tested

- Figure 6.9. Berkshire Sterile Manufacturing: Recent Developments and Future Outlook

- Figure 6.10. Curia: Company Overview

- Figure 6.11. Curia: Key Executives

- Figure 6.12. Curia: Location of Facilities

- Figure 6.13. Curia: Service Portfolio

- Figure 6.14. Curia: Type of Testing Methods Offered

- Figure 6.15. Curia: Types of Containers Tested

- Figure 6.16. Curia: Recent Developments and Future Outlook

- Figure 6.17. DDL: Company Overview

- Figure 6.18. DDL: Key Executives

- Figure 6.19. DDL: Location of Facilities

- Figure 6.20. DDL: Service Portfolio

- Figure 6.21. DDL: Type of Testing Methods Offered

- Figure 6.22. DDL: Types of Containers Tested

- Figure 6.23. DDL: Recent Developments and Future Outlook

- Figure 6.23. Nelson Labs: Company Overview

- Figure 6.24. Nelson Labs: Key Executives

- Figure 6.25. Nelson Labs: Financial Information

- Figure 6.26. Nelson Labs: Location of Facilities

- Figure 6.27. Nelson Labs: Type of Accreditations Received

- Figure 6.28. Nelson Labs: Service Portfolio

- Figure 6.29. Nelson Labs: Type of Testing Methods Offered

- Figure 6.30. Nelson Labs: Types of Containers Tested

- Figure 6.31. Nelson Labs: Recent Developments and Future Outlook

- Figure 7.1. Confarma: Company Overview

- Figure 7.2. Confarma: Key Executives

- Figure 7.3. Confarma: Location of Facilities

- Figure 7.4. Confarma: Type of Accreditations Received

- Figure 7.5. Confarma: Service Portfolio

- Figure 7.6. Confarma: Type of Testing Methods Offered

- Figure 7.7. Confarma: Types of Containers Tested

- Figure 7.8. Eurofins: Company Overview

- Figure 7.9. Eurofins: Key Executives

- Figure 7.10. Eurofins: Financial Information

- Figure 7.11. Eurofins: Location of Facilities

- Figure 7.12. Eurofins: Type of Accreditations Received

- Figure 7.13. Eurofins: Service Portfolio

- Figure 7.14. Eurofins: Type of Testing Methods Offered

- Figure 7.15. Eurofins: Types of Containers Tested

- Figure 7.16. Eurofins: Recent Developments and Future Outlook

- Figure 7.17. SGS: Company Overview

- Figure 7.18. SGS: Key Executives

- Figure 7.19. SGS: Financial Information

- Figure 7.20. SGS: Location of Facilities

- Figure 7.21. SGS: Type of Accreditations Received

- Figure 7.22. SGS: Service Portfolio

- Figure 7.23. SGS: Type of Testing Methods Offered

- Figure 7.24. SGS: Types of Containers Tested

- Figure 7.25. SGS: Recent Developments and Future Outlook

- Figure 7.26. Stevanato: Company Overview

- Figure 7.27. Stevanato: Key Executives

- Figure 7.28. Stevanato: Financial Information

- Figure 7.29. Stevanato: Location of Facilities

- Figure 7.30. Stevanato: Service Portfolio

- Figure 7.31. Stevanato: Type of Testing Methods Offered

- Figure 7.32. Stevanato: Types of Containers Tested

- Figure 7.33. Stevanato: Recent Developments and Future Outlook

- Figure 7.34. Wilco: Company Overview

- Figure 7.35. Wilco: Key Executives

- Figure 7.36. Wilco: Location of Facilities

- Figure 7.37. Wilco: Service Portfolio

- Figure 7.38. Wilco: Type of Testing Methods Offered

- Figure 7.39. Wilco: Types of Containers Tested

- Figure 7.40. Wilco: Recent Developments and Future Outlook

- Figure 8.1. Container Closure Integrity Testing Equipment Landscape: Distribution by Scale of Operation

- Figure 8.2. Container Closure Integrity Testing Equipment Landscape: Distribution by Key Features

- Figure 8.3. Container Closure Integrity Testing Equipment Landscape: Type(s) of Analytical Method(s)

- Figure 8.4. Container Closure Integrity Testing Equipment Landscape: Distribution by Container Material

- Figure 8.5. Container Closure Integrity Testing Equipment Landscape: Distribution by Type(s) of Container(s)

- Figure 8.6. Container Closure Integrity Testing Equipment Providers: Distribution by Year of Establishment

- Figure 8.7. Container Closure Integrity Testing Equipment Providers: Distribution by Company Size

- Figure 8.8. Container Closure Integrity Testing Equipment Providers: Distribution by Geographical Region

- Figure 9.1. Product Competitiveness Analysis: Equipment Offered by Small Players

- Figure 9.2. Product Competitiveness Analysis: Equipment Offered by Mid-Sized Players

- Figure 9.3. Product Competitiveness Analysis: Equipment Offered by Large Players

- Figure 9.4. Product Competitiveness Analysis: Equipment Offered by Players Headquartered in North America

- Figure 9.5. Product Competitiveness Analysis: Equipment Offered by Players Headquartered in Europe

- Figure 9.6. Product Competitiveness Analysis: Equipment Offered by Players Headquartered in Asia-Pacific

- Figure 10.1. Regional Capability Analysis: Distribution by Number of CCIT Service Providers

- Figure 10.2. Regional Capability Analysis: Distribution by Number of Analytical Services

- Figure 10.3. Regional Capability Analysis: Distribution by Number of CCIT Technology Providers

- Figure 10.4. Regional Capability Analysis: Distribution by Number of CCIT Technologies

- Figure 10.5. Regional Capability Analysis: Distribution by Number of Patents

- Figure 10.6. Regional Capability Analysis: Distribution by Demand of CCIT

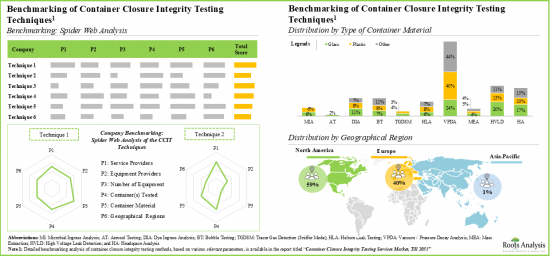

- Figure 11.1. Benchmarking Analysis: Benchmarking of CCIT Techniques

- Figure 11.2. Benchmarking Analysis: Distribution by Type(s) of Container(s) Tested

- Figure 11.3. Benchmarking Analysis: Distribution by Container Material Tested

- Figure 11.4. Benchmarking Analysis: Distribution by Geographical Region

- Figure 12.1. Aseptic Technologies: Company Overview

- Figure 12.2. Aseptic Technologies: Crystal L1 Robot Line

- Figure 12.3. Aseptic Technologies: Crystal SL1 Robot Line

- Figure 12.4. AST: Company Overview

- Figure 12.5. AST: ASEPTiCell

- Figure 12.6. AST: GENiSYS R

- Figure 12.7. AST: GENiSYS C

- Figure 12.8. AST: GENiSYS Lab

- Figure 12.9. Bosch: Company Overview

- Figure 12.10. Bosch: ATO

- Figure 12.11. Dara Pharma: Company Overview

- Figure 12.13. Dara Pharma: SYX-E Cartridge + RABS

- Figure 12.14. Fedegari: Company Overview

- Figure 12.15. Fedegari: Fedegari Isolator

- Figure 12.16. IMA: Company Overview

- Figure 12.17. IMA: INJECTA

- Figure 12.18. IMA: STERI LIF3

- Figure 12.19. Varnx: Company Overview

- Figure 12.20. Varnx: Microcell Vial Filler

- Figure 12.21. Varnx: SA25 Aseptic Filling Workcell

- Figure 13.1. Demand Analysis: Distribution by Type(s) of Container(s) Tested

- Figure 13.2. Demand Analysis: Distribution by Type(s) of Container(s) Material

- Figure 13.3. Demand Analysis: Distribution by Geographical Region

- Figure 13.4. Demand Analysis: Geographical Distribution of Type(s) of Container(s) Tested

- Figure 14.1. Overall Container Closure Integrity Testing Services Market, Till 2035 (USD Million)

- Figure 14.2. Container Closure Integrity Testing Services Market: Distribution by Type of Container Closure Systems, Till 2035 (USD Million)

- Figure 14.3. Container Closure Integrity Testing Services Market: Distribution by Type of Container Material, Till 2035 (USD Million)

- Figure 14.4. Container Closure Integrity Testing Services Market: Distribution by Geographical Region, Till 2035 (USD Million)

- Figure 14.5. Container Closure Integrity Testing Services Market: Distribution by Key Geographical Regions, Till 2035 (USD Million)

- Figure 14.6. Container Closure Integrity Testing Services Market: Market in North America (USD Million)

- Figure 14.7. Container Closure Integrity Testing Services Market: Market in Europe (USD Million)

- Figure 14.8. Container Closure Integrity Testing Services Market: Market in Asia-Pacific (USD Million)

- Figure 14.9. Container Closure Integrity Testing Services Market: Market in Middle East North Africa (USD Million)

- Figure 14.10. Container Closure Integrity Testing Services Market: Market in Latin America (USD Million)

- Figure 14.11. Container Closure Integrity Testing Services Market: Market in Rest of the World (USD Million)

- Figure 15.1. SWOT Analysis: Harvey Ball Analysis

- Figure 15.2. SWOT Analysis: Strengths and Weakness

- Figure 15.3. SWOT Analysis: Opportunities and Threats

CONTAINER CLOSURE INTEGRITY TESTING MARKET: OVERVIEW

As per Roots Analysis, the global container closure integrity testing market is estimated to grow from USD 236 million in the current year to USD 558 million by 2035, at a CAGR of 7% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Container Tested

- Vials

- Syringes

- Cartridges

Type of Container Material Tested

- Glass

- Plastic

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

CONTAINER CLOSURE INTEGRITY TESTING MARKET: GROWTH AND TRENDS

Container closure integrity testing refers to the process of packaging a drug product while focusing on maintaining the sterile barrier against potential contaminants. Considering patients' health and safety, the drug products are expected to be free from microbial contamination and safe for use throughout its life cycle. Therefore, several quality checks are performed in order to ensure the product's sterility and stability. One of the stages that require quality assurance is secondary packaging of the drug product, as compromised packaging could have serious consequences, such as drugs may degrade or become unstable, leading to ineffective treatments and potential harm to patients. In fact, even minor defects in the packaging of container closure system could adversely affect the sterility and stability of the drug, allowing contamination via reactive gases, humidity and microbial ingress. Thus, to ensure the safety of drug and prevent any chance of risk, container closure integrity testing is performed. It also ensures that the quality of a drug product is maintained from manufacturing to its use. In fact, by using this technique, detection of micron defects is possible which facilitates minimum cases of product recalls.

Despite several advantages, lack of focused expertise, spatial limitation and huge capital investment in the installation of equipment poses a few challenges for the manufacturing and packaging companies. Therefore, several companies in this area are seeking assistance from service providers. This has created lucrative opportunities for upcoming and existing stakeholders to expand their offerings.

CONTAINER CLOSURE INTEGRITY TESTING MARKET: KEY INSIGHTS

The report delves into the current state of the container closure integrity testing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Presently, over 40 service providers provide container closure integrity testing services across the globe; majority of the service providers use deterministic methods for testing purposes.

- The market landscape features the presence of both new entrants and well-established players for testing integrity of container closure systems.

- Players have established their container closure integrity testing facilities in various geographical locations; these facilities, combined, offer a well distributed services network.

- In pursuit of building a competitive edge, players are enhancing their service portfolio by integrating advanced technologies that offer reliable results.

- Over 85 pieces of equipment have been developed for container closure integrity testing; majority of the equipment is designed for both clinical / commercial scale operations.

- Given the increasing demand for reliable and precise testing, various advanced techniques have been developed to comply to the evolving testing benchmarks.

- The relative competitiveness of equipment varies across different peer groups; this is driven by several parameters, such as features offered, the analytical methods used, and type of container tested.

- The demand for container closure integrity testing services is expected to grow at a steady pace in the foreseen future; Asia-Pacific will drive a significant proportion of the overall demand.

- The market is expected to grow at a CAGR of 7% in the coming decade; the opportunity is likely to be well distributed across various types of container closure systems, container materials and geographical regions.

CONTAINER CLOSURE INTEGRITY TESTING MARKET: KEY SEGMENTS

Vials Occupy the Largest Share of the Global Container Closure Integrity Testing Market

Based on the type of container tested, the market is segmented into vials, syringes and cartridges. At present, the vials segment holds the maximum share of the global container closure integrity testing market owing to the fact that vials are the most commonly used type of container in the pharmaceutical industry. This trend is likely to remain the same in the coming years.

By Type of Container Material Tested, Glass System Accounts for the largest share of the Global Container Closure Integrity Testing Market

Based on the type of container material tested, the market is segmented into glass and plastic materials. Currently, the glass segment captures the highest proportion of the global container closure integrity testing market due to its higher chemical stability and regulatory acceptance in terms of its quality grade.

Asia-Pacific Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East and North Africa. Currently, Asia-Pacific dominates the closure integrity testing market and accounts for the largest revenue share. This can be attributed to the growing pharmaceutical industry and increasing production of pharmaceutical products in this region. Further, the market in Latin America is likely to grow at a higher CAGR in the coming future.

Example Players in the Container Closure Integrity Testing Market

- Berkshire Sterile Manufacturing

- Confarma

- Curia

- DDL and Nelson Labs

- Eurofins

- SGS

- Stevanato

- Wilco

CONTAINER CLOSURE INTEGRITY TESTING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global container closure integrity testing market, focusing on key market segments, including [A] type of container tested, [B] type of container material tested and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of container closure integrity testing service providers, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of analytical facilities, [E] type(s) of analytical method(s) offered, [F] type(s) of probabilistic method(s), [F] type(s) of deterministic method(s) offered, [G] leakage susceptibility, [H] type(s) of container(s) tested and [I] accreditations.

- Company Competitiveness Analysis: A comprehensive competitive analysis of container closure integrity testing service providers, examining factors, such as [A] supplier power and [B] service strength.

- Company Profiles: In-depth profiles of key players providing container closure integrity testing, focusing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, [D] location of analytical facilities, [E] type(s) of analytical method(s) used, [F] types(s) of container(s) tested and [G] recent developments and an informed future outlook.

- Case Study: A detailed assessment of equipment used by various manufacturers to test container closure integrity, focusing on key features, such as [A] type(s) of analytical method(s) offered, [B] type(s) of container(s) tested and [C] container material(s) of container closure integrity testing technologies.

- Product Competitiveness Analysis: A comprehensive competitive analysis of container closure integrity testing equipment, examining factors, such as [A] product strength and [B] product applicability.

- Regional Capability Assessment: A detailed assessment of container closure integrity testing capability across key geographies, based on a number of parameters, such as [A] number of container closure integrity testing service providers, [B] number of analytical testing facilities, [C] number of container closure integrity technology manufacturers, [D] number of container closure integrity testing technologies, [E] number of patents and [F] demand of container closure integrity testing service.

- Benchmarking Analysis: An insightful analysis of the various container closure integrity testing analytical techniques, based on various parameters, such as [A] the number of service providers offering analytical technique for testing purpose, [B] equipment providers developing equipment for particular technique, [C] number of equipment, [D] number of container closure systems tested and [E] benchmarking of analytical techniques.

- Demand Analysis: An in-depth analysis of the current and future demand of container closure integrity testing service, based on various relevant parameters, such as [A] type of container closure system tested and [B] type of material used, across different regions

- SWOT Analysis: An analysis of industry affiliated trends, opportunities and challenges, which are likely to impact the evolution of container closure integrity testing market; it includes a Harvey ball analysis, assessing the relative impact of each SWOT parameter on industry dynamics.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Primary Packaging: Container Closure Systems

- 3.3. Types of Container Closure Systems

- 3.4. Problems Related to Container Closure Systems

- 3.4.1. Types of Contamination

- 3.4.2. Defects in Container Closure Systems

- 3.5. Container Closure Integrity testing (CCI Testing)

- 3.6. Methods of Container Closure Integrity Testing

- 3.7. Advantages of Container Closure Integrity Testing Over Sterility Testing

- 3.8. Role of CCIT Service Providers

- 3.9. Future Perspective

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Container Closure Integrity Testing Service Providers: Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Location of Analytical Facilities

- 4.2.6. Analysis by Type(s) of Analytical Method(s) Offered

- 4.2.6.1. Analysis by Type(s) of Probabilistic Method(s) Offered

- 4.2.6.2. Analysis by Type(s) of Deterministic Method(s) Offered

- 4.2.7. Analysis by Leakage Susceptibility

- 4.2.8. Analysis by Type(s) of Container(s) Tested

- 4.2.9. Analysis by Type(s) of Container Material(s) Tested

- 4.2.10. Analysis by Accreditation(s) Received

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Methodology

- 5.3. Key Parameters

- 5.4. Competitiveness Analysis: Companies Offering Container Closure Integrity Testing Services in North America

- 5.5. Competitiveness Analysis: Companies Offering Container Closure Integrity Testing Services in Europe and Asia-Pacific

- 5.6. Competitiveness Analysis: Companies Offering Container Closure Integrity Testing Services in One Analytical Facility

- 5.7. Competitiveness Analysis: Companies Offering Container Closure Integrity Testing Services in More than Analytical Facility

6. CONTAINER CLOSURE INTEGRITY TESTING SERVICE PROVIDERS IN NORTH AMERICA: COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Berkshire Sterile Manufacturing

- 6.2.1. Company Overview

- 6.2.2. Financial Information

- 6.2.3. Service Portfolio

- 6.2.4. Recent Developments and Future Outlook

- 6.3. Curia

- 6.3.1. Company Overview

- 6.3.2. Financial Information

- 6.3.3. Service Portfolio

- 6.3.4. Recent Developments and Future Outlook

- 6.4. DDL

- 6.4.1. Company Overview

- 6.4.2. Financial Information

- 6.4.3. Service Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Nelson Labs

- 6.5.1. Company Overview

- 6.5.2. Financial Information

- 6.5.3. Service Portfolio

- 6.5.4. Recent Developments and Future Outlook

7. CONTAINER CLOSURE INTEGRITY TESTING SERVICE PROVIDERS IN EUROPE: COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. Confarma

- 7.2.1. Company Overview

- 7.2.2. Financial Information

- 7.2.3. Service Portfolio

- 7.2.4. Recent Developments and Future Outlook

- 7.3. Eurofins

- 7.3.1. Company Overview

- 7.3.2. Financial Information

- 7.3.3. Service Portfolio

- 7.3.4. Recent Developments and Future Outlook

- 7.4. SGS

- 7.4.1. Company Overview

- 7.4.2. Financial Information

- 7.4.3. Service Portfolio

- 7.4.4. Recent Developments and Future Outlook

- 7.5. Stevanato

- 7.5.1. Company Overview

- 7.5.2. Financial Information

- 7.5.3. Service Portfolio

- 7.5.4. Recent Developments and Future Outlook

- 7.6. Wilco

- 7.6.1. Company Overview

- 7.6.2. Financial Information

- 7.6.3. Service Portfolio

- 7.6.4. Recent Developments and Future Outlook

8. CASE STUDY: MARKET LANDSCAPE OF CONTAINER CLOSURE INTEGRITY TESTING EQUIPMENT PROVIDERS

- 8.1. Chapter Overview

- 8.2. Container Closure Integrity Testing Equipment: Market Landscape

- 8.2.1. Analysis by Scale of Operation

- 8.2.2. Analysis by Key Features

- 8.2.3. Analysis by Type(s) of Analytical Method(s) Offered

- 8.2.4. Analysis by Type(s) of Container Material(s) Tested

- 8.2.5. Analysis by Type(s) of Container(s) Tested

- 8.3. Container Closure Integrity Testing Equipment Providers: Developer Landscape

- 8.3.1. Analysis by Year of Establishment

- 8.3.2. Analysis by Company Size

- 8.3.3. Analysis by Location of Headquarters

- 8.3.4. Analysis by Company Size and Location of Headquarters

- 8.3.5. Leading Developers: Analysis by Number of Products

9. PRODUCT COMPETITIVENESS ANALYSIS

- 9.1. Chapter Overview

- 9.2. Methodology

- 9.3. Assumptions / Key Parameters

- 9.4. Product Competitiveness Analysis: Container Closure Integrity Testing Equipment Offered by Small Players

- 9.5. Product Competitiveness Analysis: Container Closure Integrity Testing Equipment Offered by Mid-Sized Players

- 9.6. Product Competitiveness Analysis: Container Closure Integrity Testing Equipment Offered by Large Players

- 9.7. Product Competitiveness Analysis: Container Closure Integrity Testing Equipment Offered by Players Headquartered in North America

- 9.8. Product Competitiveness Analysis: Container Closure Integrity Testing Equipment Offered by Players Headquartered in Europe

- 9.9. Product Competitiveness Analysis: Container Closure Integrity Testing Equipment Offered by Players Headquartered in Asia-Pacific

10. REGIONAL CAPABILITY ASSESSMENT

- 10.1. Chapter Overview

- 10.2. Assumptions and Key Parameters

- 10.3. Container Closure Integrity Testing Capabilities in North America

- 10.4. Container Closure Integrity Testing Capabilities in Europe and Asia-Pacific

- 10.5. Concluding Remarks

11. BENCHMARKING ANALYSIS

- 11.1. Chapter Overview

- 11.2. Methodology Assumptions and Key Assumption

- 11.3. Advantages and Disadvantages of Deterministic Methods

- 11.4. Advantages and Disadvantages of Probabilistic Methods

- 11.5. Benchmarking of CCIT Techniques

- 11.5.1. Distribution by Type(s) of Container(s) Tested

- 11.5.2. Distribution by Type of Container Material Tested

- 11.5.3. Distribution by Key Geographical Regions

12. CASE STUDY: ROBOTICS IN PHARMACEUTICAL PACKAGING

- 12.1. Chapter Overview

- 12.2. Role of Robots in the Pharmaceutical Industry

- 12.2.1. Key Considerations for Selecting a Robotic System

- 12.2.2. Advantages of Robotic Systems

- 12.2.3. Disadvantages of Robotic Systems

- 12.3. Companies Providing Robots for Pharmaceutical Industry

- 12.4. Companies Providing Equipment Integrated with Robotic Systems for Pharmaceutical Packaging

- 12.4.1. Aseptic Technologies

- 12.4.1.1. Crystal(R) L1 Robot Line

- 12.4.1.2. Crystal(R) SL1 Robot Line

- 12.4.2. AST

- 12.4.2.1. ASEPTiCell(R) Series

- 12.4.2.2. ASEPTiCell(R) VSM-25

- 12.4.3. Bosch Packaging Technology

- 12.4.3.1. ATO

- 12.4.4. Dara Pharmaceutical Packaging

- 12.4.4.1. SYX-E CARTRIDGE + RABS

- 12.4.5. Fedegari Group

- 12.4.5.1. Fedegari Isolator

- 12.4.6. IMA

- 12.4.6.1. INJECTA

- 12.4.6.2. STERI LIF3

- 12.4.7. Steriline

- 12.4.7.1. Nest Filling Line RNFM

- 12.4.8. Vanrx Pharmasystems

- 12.4.8.1. Microcell Vial Filler

- 12.4.8.2. SA25 Aseptic Filling Workcell

- 12.4.1. Aseptic Technologies

13. DEMAND ANALYSIS

- 13.1. Chapter Overview

- 13.2. Scope and Methodology

- 13.3. Global Demand for Container Closure Integrity Testing Services, Till 2035

- 13.3.1. Analysis by Type of Container

- 13.3.1.1. Global Demand for Vials, Till 2035

- 13.3.1.2. Global Demand for Syringes, Till 2035

- 13.3.1.3. Global Demand for Cartridges, Till 2035

- 13.3.2. Analysis by Type of Container Material

- 13.3.2.1. Global Demand for Glass Containers, Till 2035

- 13.3.2.1.1. Global Demand for Glass Vials, Till 2035

- 13.3.2.1.2. Global Demand for Glass Syringes, Till 2035

- 13.3.2.1.3. Global Demand for Glass Cartridges, Till 2035

- 13.3.2.2. Global Demand for Plastic Containers, Till 2035

- 13.3.2.2.1. Global Demand for Plastic Vials, Till 2035

- 13.3.2.2.2. Global Demand for Plastic Syringes, Till 2035

- 13.3.2.2.3. Global Demand for Plastic Cartridges, Till 2035

- 13.3.2.1. Global Demand for Glass Containers, Till 2035

- 13.3.3. Analysis by Geography

- 13.3.3.1. Demand for Container Closure Integrity Testing Services in North America, Till 2035

- 13.3.3.1.1. Demand for Vials in North America, Till 2035

- 13.3.3.1.2. Demand for Syringes in North America, Till 2035

- 13.3.3.1.3. Demand for Cartridges in North America, Till 2035

- 13.3.3.2. Demand for Container Closure Integrity Testing Services in Europe, Till 2035

- 13.3.3.2.1. Demand for Vials in Europe, Till 2035

- 13.3.2.2.2. Demand for Syringes in Europe, Till 2035

- 13.3.3.2.3. Demand for Cartridges in Europe, Till 2035

- 13.3.3.3. Demand for Container Closure Integrity Testing Services in Asia Pacific, Till 2035

- 13.3.3.3.1. Demand for Vials in Asia Pacific, Till 2035

- 13.3.3.3.2. Demand for Syringes in Asia Pacific, Till 2035

- 13.3.3.3.3. Demand for Cartridges in Asia Pacific, Till 2035

- 13.3.3.4. Demand for Container Closure Integrity Testing Services in Middle East and North Africa, Till 2035

- 13.3.3.4.1. Demand for Vials in Middle East and North Africa, Till 2035

- 13.3.3.4.2. Demand for Syringes in Middle East and North Africa, Till 2035

- 13.3.3.4.3. Demand for Cartridges in Middle East and North Africa, Till 2035

- 13.3.3.5. Demand for Container Closure Integrity Testing Services in Latin America, Till 2035

- 13.3.3.5.1. Demand for Vials in Latin America, Till 2035

- 13.3.3.5.2. Demand for Syringes in Latin America, Till 2035

- 13.3.3.5.3. Demand for Cartridges in Latin America, Till 2035

- 13.3.3.6. Demand for Container Closure Integrity Testing Services in Rest of the World, Till 2035

- 13.3.3.6.1. Demand for Vials in Rest of the World, Till 2035

- 13.3.3.6.2. Demand for Syringes in Rest of the World, Till 2035

- 13.3.3.6.3. Demand for Cartridges in Rest of the World, Till 2035

- 13.3.3.1. Demand for Container Closure Integrity Testing Services in North America, Till 2035

- 13.3.1. Analysis by Type of Container

- 13.4. Concluding Remarks

14. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Forecast Methodology and Key Assumptions

- 14.3. Global Container Closure Integrity Testing Services Market, Till 2035

- 14.3.1. Container Closure Integrity Testing Services Market, Till 2035: Distribution by Type of Container

- 14.3.1.1. Container Closure Integrity Testing Services Market for Vials, Till 2035

- 14.3.1.2. Container Closure Integrity Testing Services Market for Syringes, Till 2035

- 14.3.1.3. Container Closure Integrity Testing Services Market for Cartridges, Till 2035

- 14.3.2. Container Closure Integrity Testing Services Market, Till 2035: Distribution by Type of Container Material Tested

- 14.3.2.1. Container Closure Integrity Testing Services Market for Glass Containers, Till 2035

- 14.3.2.1.1. Container Closure Integrity Testing Services Market for Glass Vials, Till 2035

- 14.3.2.1.2. Container Closure Integrity Testing Services Market for Glass Syringes, Till 2035

- 14.3.2.1.3. Container Closure Integrity Testing Services Market for Glass Cartridges, Till 2035

- 14.3.2.2. Container Closure Integrity Testing Services Market for Plastic Containers Market, Till 2035

- 14.3.2.2.1. Container Closure Integrity Testing Services Market for Plastic Vials, Till 2035

- 14.3.2.2.2. Container Closure Integrity Testing Services Market for Plastic Syringes, Till 2035

- 14.3.2.2.3. Container Closure Integrity Testing Services Market for Plastic Cartridges, Till 2035

- 14.3.2.1. Container Closure Integrity Testing Services Market for Glass Containers, Till 2035

- 14.3.3. Container Closure Integrity Testing Services Market, Till 2035: Distribution by Geography

- 14.3.3.1. Container Closure Integrity Testing Services Market in North America, Till 2035

- 14.3.3.1.1. Container Closure Integrity Testing Services Market for Vials in North America, Till 2035

- 14.3.3.1.2. Container Closure Integrity Testing Services Market for Syringes in North America, Till 2035

- 14.3.3.1.3. Container Closure Integrity Testing Services Market for Cartridges in North America, Till 2035

- 14.3.3.1. Container Closure Integrity Testing Services Market in Europe, Till 2035

- 14.3.3.1.1. Container Closure Integrity Testing Services Market for Vials in Europe, Till 2035

- 14.3.3.1.2. Container Closure Integrity Testing Services Market for Syringes in Europe, Till 2035

- 14.3.3.1.3. Container Closure Integrity Testing Services Market for Cartridges in Europe, Till 2035

- 14.3.3.1. Container Closure Integrity Testing Services Market in Asia-Pacific, Till 2035

- 14.3.3.1.1. Container Closure Integrity Testing Services Market for Vials in Asia-Pacific, Till 2035

- 14.3.3.1.2. Container Closure Integrity Testing Services Market for Syringes in Asia-Pacific, Till 2035

- 14.3.3.1.3. Container Closure Integrity Testing Services Market for Cartridges in Asia-Pacific, Till 2035

- 14.3.3.1. Container Closure Integrity Testing Services Market in Middle East and North Africa, Till 2035

- 14.3.3.1.1. Container Closure Integrity Testing Services Market for Vials in Middle East and North Africa, Till 2035

- 14.3.3.1.2. Container Closure Integrity Testing Services Market for Syringes in Middle East and North Africa, Till 2035

- 14.3.3.1.3. Container Closure Integrity Testing Services Market for Cartridges in Middle East and North Africa, Till 2035

- 14.3.3.1. Container Closure Integrity Testing Services Market in Latin America, Till 2035

- 14.3.3.1.1. Container Closure Integrity Testing Services Market for Vials in Latin America, Till 2035

- 14.3.3.1.2. Container Closure Integrity Testing Services Market for Syringes in Latin America, Till 2035

- 14.3.3.1.3. Container Closure Integrity Testing Services Market for Cartridges in Latin America, Till 2035

- 14.3.3.1. Container Closure Integrity Testing Services Market in Rest of the World, Till 2035

- 14.3.3.1.1. Container Closure Integrity Testing Services Market for Vials in Rest of the World, Till 2035

- 14.3.3.1.2. Container Closure Integrity Testing Services Market for Syringes in Rest of the World, Till 2035

- 14.3.3.1.3. Container Closure Integrity Testing Services Market for Cartridges in Rest of the World, Till 2035

- 14.3.3.1. Container Closure Integrity Testing Services Market in North America, Till 2035

- 14.3.1. Container Closure Integrity Testing Services Market, Till 2035: Distribution by Type of Container

15. SWOT ANALYSIS

- 15.1. Chapter Overview

- 15.2. Strengths

- 15.3. Weaknesses

- 15.4. Opportunities

- 15.5. Threats

- 15.6. Comparison of SWOT Factors

16. CONCLUSION

- 16.1. Chapter Overview