|

市場調査レポート

商品コード

1920862

ヒトマイクロバイオーム市場(第5版):2035年までの業界動向と世界の予測 - 製品タイプ別、生物学的製剤タイプ別、投与経路別、薬剤の剤形別、対象適応症別、対象治療領域別、および地域別Human Microbiome Market (5th Edition): Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Product, Type of Biologic, Route of Administration, Drug Formulation, Target Indication, Target Therapeutic Area and Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| ヒトマイクロバイオーム市場(第5版):2035年までの業界動向と世界の予測 - 製品タイプ別、生物学的製剤タイプ別、投与経路別、薬剤の剤形別、対象適応症別、対象治療領域別、および地域別 |

|

出版日: 2026年01月23日

発行: Roots Analysis

ページ情報: 英文 552 Pages

納期: 即日から翌営業日

|

概要

ヒトマイクロバイオーム市場:概要

Roots Analysisの調査によると、ヒトマイクロバイオームの市場規模は、現在の8億5,000万米ドルから2035年までに32億7,000万米ドルへ成長すると予測されております。予測期間(2035年まで)におけるCAGRは16%と見込まれております。

ヒトマイクロバイオーム市場:成長と動向

ヒトマイクロバイオームは、細菌、古細菌、ウイルス、真菌など多様な微生物群で構成され、皮膚、腸管、口腔、その他の組織など人体の様々な部位に生息しています。ヒトマイクロバイオームの多様性に関する研究は、Antonie van Leeuwenhoekが口腔および糞便の微生物叢サンプルを観察した1680年代にまで遡ります。現在の人間マイクロバイオームの状況は非常にダイナミックであり、免疫、代謝、さらにはがん、炎症性疾患、神経変性疾患などの状態におけるその重要な機能が研究で強調されています。米国食品医薬品局(FDA)は、再発性クロストリジウム・ディフィシル感染症(rCDI)の予防を目的とした2つの糞便微生物叢治療法を承認しています。特に、Ferring Pharmaceuticalが開発したREBYOTAは2022年11月に承認を得た初のヒトマイクロバイオーム療法となり、Seres Therapeuticsが開発したVOWSTも2023年4月に経口投与の承認を取得しました。注目すべきは、Nestle Health Scienceが2024年6月にVOWSTの米国および全世界における権利を取得したことで、その商業的成功がさらに強化された点です。

DNAシーケンシング、バイオインフォマティクス、分析ツールの継続的な進歩により、健康や疾患に関連するヒトマイクロバイオームの理解が深まっていることを踏まえ、この分野は近い将来、二桁の市場成長が見込まれると予測されます。

促進要因:市場拡大の戦略的促進要因

次世代シーケンシングやメタゲノミクスといったマイクロバイオーム解析技術の進歩により、微生物群集のより深い分析が可能となり、診断と治療の加速が図られています。さらに、製薬会社、バイオテクノロジー企業、ベンチャーキャピタルからの投資増加により、胃腸障害、代謝疾患、がんなどの疾患に対する臨床パイプラインの拡大が支援されています。加えて、健康におけるマイクロバイオームへの認識の高まり、個別化されたプロバイオティクスの需要、予防医療、スタートアップと学術機関との連携が相まって、ヒトマイクロバイオーム市場の拡大をさらに推進しています。

市場の課題:進展を阻む重大な障壁

世界のヒトマイクロバイオーム市場は著しい成長を遂げていますが、この産業の発展を妨げる可能性のある特定の制約が存在します。生体微生物のためのGMP施設や複雑な臨床試験を含む、ヒトマイクロバイオーム市場分野における高い研究開発費および商業化コストは、拡張性と普及を妨げています。厳格な規制要件、標準化されたガイドラインの欠如、微生物株の多様性は、承認を遅らせ、地域間の参入障壁を高めています。また、一般の理解不足、マイクロバイオーム操作に関する倫理的懸念、一貫性のないエビデンスによる患者・医療提供者の導入の遅れも、進展を阻んでいます。

ヒトマイクロバイオーム市場:主要な知見

当レポートはヒトマイクロバイオーム市場の現状を分析し、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです:

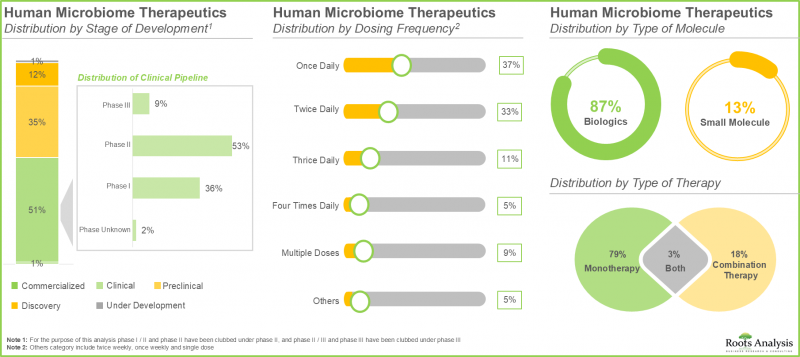

- 現在、約55の開発者別開発された215種類近いヒトマイクロバイオーム治療薬が、様々な開発段階において承認済みまたは調査中であり、多様な疾患の治療を目的としています。

- ヒトマイクロバイオーム治療薬の50%以上が臨床開発段階にあります。特に、大半の薬剤/治療プログラムは生物学的製剤、主に生きた生物学的製剤の開発に焦点を当てています。

- この分野では75社が約140種類のヒトマイクロバイオーム診断検査を開発中であり、特筆すべきは開発企業の約55%が2015年以降に設立されたことです。

- 約80%の企業が、微生物叢の構成と機能の分析を目的としたヒトマイクロバイオーム診断を提供しており、55%の企業が診断にシーケンシング/メタゲノミクス技術を採用しています。

- 糞便微生物叢療法の開発企業の大半は2000年から2015年の間に設立されました。そのうち65%以上が北米に本社を置き、次いで欧州(約35%)となっています。

- 糞便細菌療法は、健康な個人から採取した糞便細菌を患者の胃、大腸/小腸に移植/注入するものです。これらの療法の大半(50%)は臨床段階にあります。

- これまでに、様々な糞便微生物叢療法の安全性と有効性を評価するための臨床試験が205件近く登録されています。これらの研究の大部分は、欧州の様々な試験施設で実施されています。

- ここ数年、スタートアップ企業は自社のマイクロバイオーム治療・診断ポートフォリオを強化するため、複数の取り組みを進めております。その大半は潰瘍性大腸炎の治療を目的としたものでした。

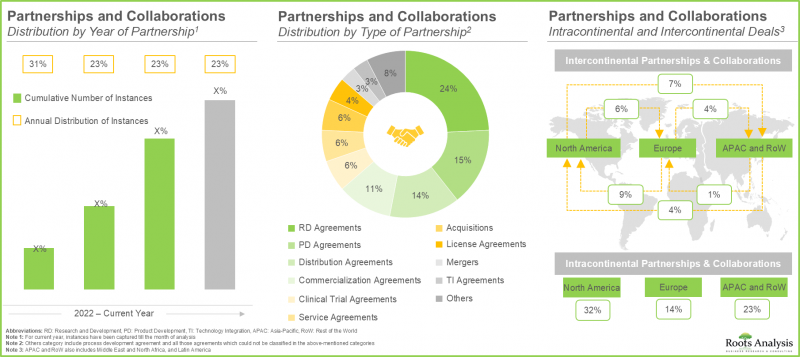

- この市場への関心の高まりは、近年、様々な利害関係者間で結ばれた多様な提携関係にも反映されています。実際、取引の45%以上が過去2年間に締結されました。

- 2022年以降、この分野では12億米ドル以上の資金が調達されています。特に、助成金・賞金もマイクロバイオーム医薬品開発者が採用する非常に顕著な資金調達モデルとなっています。

- 市場影響分析は、市場全体の進化に影響を与える潜在的要因を概説するものであり、特定の領域における促進要因、制約、機会、課題を特定するために活用できます。

- 腸内健康に対する消費者の意識の高まり、慢性疾患の増加、マイクロバイオームシーケンシング技術の進歩に後押しされ、市場は今後も着実な成長が見込まれています。

- 現在、様々な投与経路の中で、経口投与経路は安全性、利便性、口腔内での直接的な治療介入への適性から、市場で最も高いシェア(55%)を占めています。

- 感染症サブセグメントは、ヒトマイクロバイオーム治療薬がこうした疾患の治療に有効であることから、今年度は市場全体のシェアを獲得すると推定されています。

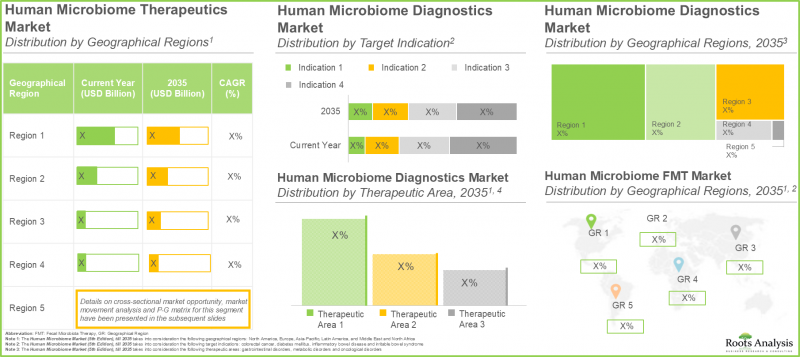

- 特に、様々な地域の中で、北米は予測期間中にヒトマイクロバイオーム市場全体を支配すると予想されます。

- 北米地域ではヒトマイクロバイオームシーケンシング技術が急速に進歩していることから、今年度は同地域がヒトマイクロバイオーム市場全体の大きなシェアを占めると予想されます。

- 米国の有力企業別開発された承認済みマイクロバイオーム治療薬の急速な成功に牽引され、ヒトマイクロバイオーム治療薬市場は安定したCAGRで成長すると予想されます。

ヒトマイクロバイオーム市場

市場規模および機会分析は、以下のパラメータに基づいてセグメント化されています:

製品タイプ別

- 治療薬

- 診断薬

- 糞便微生物叢療法

生物学的製剤タイプ別

- 生体生物学的製剤

- その他

投与経路別

- 経口投与

- 直腸投与

薬剤の剤形別

- カプセル

- 懸濁液

- 浣腸

- 粉末

対象適応症別

- クロストリジウム・ディフィシル感染症

- 壊死性腸炎

- 過敏性腸症候群

- 急性移植片対宿主病

- 糖尿病

- 過敏性腸症候群

- 大腸がん

治療対象領域別

- 感染症

- 消化器疾患

- 希少疾患

- 代謝性疾患

- 腫瘍学領域

地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- その他欧州諸国

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- ラテンアメリカ

- ブラジル

- 中東および北アフリカ

- イスラエル

- サウジアラビア

ヒトマイクロバイオーム市場:主要セグメント

製品タイプ別市場シェア:診断セグメントが最大のシェアを占める

本年、ヒトマイクロバイオーム市場レポートによれば、代謝障害やがん関連疾患など様々な状態の早期発見を目的としたマイクロバイオーム中心の診断検査の導入増加により、診断セグメントが最大の市場シェア(約45%)を占めております。治療薬セグメントは、予測期間中に32%という大幅な成長率が見込まれています。これは、個別化治療の研究開発の増加、特定の疾患に対する糞便微生物移植(FMT)などの既存治療法の有効性、および開発中の新薬や新治療法によるものです。

ヒトマイクロバイオームベース治療薬の市場シェアに関する洞察

生物学的製剤タイプ別市場シェア:生体生物学的製剤セグメントが最大のシェアを占める

現在、生体生物学的製剤セグメントは、消化器疾患、代謝障害、がん関連疾患など様々な状態の治療におけるマイクロバイオーム標的治療の応用拡大により、ヒトマイクロバイオーム市場(治療薬分野)のシェア全体を占めております。特に、その他のセグメント(ファージ生物製剤、ワクチン、その他の抗体を含む)は、予測期間中に64%のCAGRで著しい成長率を示すと予想されています。

投与経路別市場シェア:経口投与セグメントが最大の収益を占める

本年、経口投与経路はヒトマイクロバイオーム治療薬市場において最大の市場シェア(55%)を占めております。注目すべきは、経口投与経路による治療法が予測期間中に38%という大幅なCAGRを記録する可能性が高い点です。これは安全性、利便性、そして口腔内での直接的な治療的相互作用による全身への効果達成能力に関連しております。

剤形別市場シェア:懸濁液セグメントがより高いCAGRで成長

様々なセグメントの中でも、カプセルセグメントは2025年にヒトマイクロバイオーム治療薬市場で最大のシェア(55%)を占めています。これは、カプセル形態のマイクロバイオーム中心療法における強力な臨床試験パイプラインに起因します。特に注目すべきは、懸濁液セグメント市場が予測期間を通じて著しく高いCAGR(38%)で拡大すると見込まれている点です。これは、生きた微生物製剤の生存性と安定性を維持する能力、投与量の調整を容易にする特性、そして多様な治療用途における長年の応用実績に起因しています。

対象適応症別市場シェア:クロストリジウム・ディフィシル感染症セグメントが主導

現在、クロストリジウム・ディフィシル感染症セグメントがヒトマイクロバイオーム治療薬市場全体の規模を占めております。これは、クロストリジウム・ディフィシル感染症の発生頻度と重症度が増加していることに加え、抗生物質による腸内細菌叢の乱れと本感染症との関連性が確立されているためです。

さらに、急性移植片対宿主病を対象とした治療薬市場は、2027年から2035年の期間において、比較的高いCAGR(35%)で成長する見込みです。これは、消化器系が関与する急性移植片対宿主病(GVHD)患者における未充足ニーズに対応するために設計された先駆的な微生物叢中心の治療法であるMaaT013(Xervyteg(R))の承認が期待されていることに起因します。この疾患では、既存の生存率が危険なほど低く、承認済みの代替治療法が存在しません。

治療領域別市場シェア:感染症セグメントが市場を独占

現在、感染症分野がヒトマイクロバイオーム治療薬市場全体の規模を占めており(シェア100%)、この動向は今後も変化しない見込みです。これは、免疫機能や病原体防御への直接的な関与に加え、再発性クロストリジウム・ディフィシル感染症などに対するマイクロバイオームベース治療の有効性が実証されていることに起因します。特に、希少疾患分野は2027年から2035年にかけて、比較的高めのCAGR(35%)で成長すると予測されています。

地域別市場シェア:北米が最大の収益を占める

当社の予測によれば、北米は2025年にヒトマイクロバイオーム治療薬市場シェアの大部分(95%)を占める見込みです。これは、北米の先進的な医療インフラが開発者に多数の臨床試験の実施を可能にし、承認機関の規制ガイドラインを満たすためです。特筆すべきは、欧州市場が2025年から2032年の期間において、比較的高いCAGR(75%)で成長する見込みであることです。

ヒトマイクロバイオーム市場における代表的な参入企業

- Becton, Dickinson and Company

- Biome Diagnostics

- Ferring Pharmaceuticals

- GoodGut

- Infant Bacterial Therapeutics

- MaaT Pharma

- Microbiomik

- NutriPATH

- Seres Therapeutics

- Tiny Health

- OxThera

- Vedanta Bisociences

- Zybio

ヒトマイクロバイオーム市場:調査範囲

- 市場規模と機会分析:当レポートでは、ヒトマイクロバイオーム市場について、[A]製品タイプ、[B]生物学的製剤タイプ、[C]投与経路、[D]薬剤製剤、[E]対象適応症、[F]対象治療領域、[G]地理的地域といった主要市場セグメントに焦点を当てた詳細な分析を掲載しています。

- ヒトマイクロバイオーム治療薬- 市場情勢:ヒトマイクロバイオーム治療薬の現在の市場情勢に関する詳細な概要に加え、[A]開発段階、[B]分子タイプ、[C]生物学的製剤タイプ、[D]対象適応症、[E]治療領域、[F]投与経路、[G]製剤タイプ、[H]投与頻度、[I]治療法タイプ、[J]設立年、[K]企業規模、[L]本社所在地、[M]最も活発な企業に関する情報を含みます。

- ヒトマイクロバイオーム診断およびスクリーニング/プロファイリング検査- 市場情勢2:各種診断・スクリーニング/プロファイリング検査の現在の市場情勢に関する詳細な概要、ならびに以下の関連パラメータに関する情報:[A]開発段階、[B]分析対象検体の種類、[C]スクリーニング技術の種類、[D]対象適応症、[E]治療領域、[F]検査目的、[G]設立年、[H]企業規模、[I]本社所在地に関する情報を含みます。

- ヒトマイクロバイオーム糞便微生物叢療法(FMT)-市場情勢3:FMT療法のその他の関連側面に関する現在の市場情勢の詳細な概要、ならびに以下の関連パラメータに関する情報:[A]開発段階、[B]分析対象サンプルの種類、[C]スクリーニング技術の種類、[D]対象適応症、[E]治療領域、[F]検査目的、[G]設立年、[H]企業規模、[I]本社所在地。

- 企業および薬剤プロファイル:[A]設立年、[B]本社所在地、[C]微生物叢ベースの薬剤ポートフォリオ、[D]最近の動向、[E]将来展望に基づき、微生物叢治療薬、微生物叢診断・スクリーニング/プロファイリング検査、および糞便微生物叢療法の開発に携わる主要企業の詳細なプロファイル。

- 臨床試験分析:便微生物叢療法に関する完了済みおよび進行中の臨床研究について、[A]試験登録年、[B]登録患者数、[C]患者の性別、[D]試験段階、[E]試験状況、[F]治療領域、[G]スポンサー/協力機関の種類、[H]研究デザイン、[I]最も活発な企業(臨床試験数に基づく)、[J]地域。

- 魅力度・競争力分析:9ボックスACマトリクスフレームワークに基づき、調査対象の様々な治療領域における主要適応症について、洞察に富んだ事業ポートフォリオ分析を行います。さらに、最も一般的な疾患適応症における相対的な市場の魅力と既存の競合状況についての考察を含みます。

- 提携・協力関係:ヒトマイクロバイオーム開発企業間で締結された提携・協力関係を、[A]提携年、[B]提携形態、[C]対象適応症、[D]治療領域、[E]パートナーの種類、[F]最も活発な企業(提携件数ベース)といった関連パラメータに基づき詳細に分析します。

- 資金調達と投資:本分野における資金調達と投資の詳細な分析。以下の関連パラメータに基づき実施:[A]資金調達年[B]資金調達の種類[C]投資額[D]資金調達の目的[E]対象適応症[F]治療領域[G]地域[H]最も活発な企業[I]主要投資家

- ケーススタディ1:マイクロバイオーム治療薬の開発・製造に関わる各工程の詳細な考察に加え、受託製造企業(CMO)の参考リストを掲載。各社の設立年、本社所在地、企業規模、事業規模、製造製品の種類、製剤タイプなどの詳細情報を併記。さらに、CMO/CROパートナー選定における主要な考慮事項を重点的に解説。

- ケーススタディ2:ビッグデータの新たな役割を評価し、マイクロバイオーム研究から生成されるデータを分析するための様々なアルゴリズム/ツールの開発・実装に焦点を当てた取り組みを強調するとともに、過去10年間における利害関係者のマイクロバイオーム研究支援のためのビッグデータツール活用への関心の高まりを示す、洞察に富んだGoogleトレンド分析を提示します。

目次

第1章 序文

第2章 調査手法

第3章 市場力学

- 章の概要

- 予測調査手法

- 市場評価フレームワーク

- 予測ツールとテクニック

- 重要な考慮事項

- 制限事項

第4章 マクロ経済指標

第5章 エグゼクティブサマリー

第6章 イントロダクション

- 章の概要

- 微生物叢とマイクロバイオームの概念

- 腸内フローラの概要

- マイクロバイオームと関連疾患

- 薬物動態に対する微生物叢の影響

- 微生物叢が治療結果に与える影響

- マイクロバイオーム治療

- ヒトマイクロバイオームプロジェクト(HMP)

- 生生物製剤(LBP)に関する規制ガイドライン

- マイクロバイオーム治療薬の開発における主な課題

- 将来の展望

第7章 ヒトマイクロバイオーム治療薬:市場情勢

- 章の概要

- ヒトマイクロバイオーム治療薬:市場情勢

- ヒトマイクロバイオーム治療薬:開発状況

第8章 ヒトマイクロバイオーム診断およびスクリーニング/プロファイリング検査:市場情勢

- 章の概要

- マイクロバイオーム診断とスクリーニング/プロファイリング検査の概要

- マイクロバイオーム診断およびスクリーニング/プロファイリング検査:市場情勢

- マイクロバイオーム診断およびスクリーニング/プロファイリング検査:プロバイダーの状況

第9章 ヒトマイクロバイオーム糞便マイクロバイオーム療法:市場情勢

- 章の概要

- 糞便微生物療法(FMT)入門

- 歴史的概要

- 便中微生物療法:手順と臨床的意義

- 便中微生物療法に関する規制ガイドライン

- 便中微生物療法の保険適用

- 糞便微生物療法:市場情勢

第10章 ヒトマイクロバイオーム治療薬:企業と薬剤のプロファイル

- 章の概要

- Ferring Pharmaceuticals

- Infant Bacterial Therapeutics

- MaaT Pharma

- Mikrobiomik

- Seres Therapeutics

- OxThera

- Vedanta Biosciences

- Zhiyi Biotech

第11章 マイクロバイオーム診断およびスクリーニング/プロファイリング検査プロバイダー:企業プロファイル

- 章の概要

- Becton, Dickinson and Company

- Biome Diagnostics

- GoodGut

- NutriPATH

- Tiny Health

第12章 臨床試験の分析

- 章の概要

- 範囲と調査手法

- 便中微生物療法:臨床試験分析

第13章 魅力と競争力(AC)マトリックス

第14章 スタートアップの健全性指標

- 章の概要

- 範囲と調査手法

- スタートアップのベンチマーキング

第15章 ケーススタディ:主要治療領域

- 章の概要

- 代謝障害

- 消化器系および胃腸系の疾患

- 腫瘍学的適応症

- 皮膚疾患

- 感染症

第16章 パートナーシップとコラボレーション

第17章 資金調達と投資

第18章 ケーススタディ:マイクロバイオーム治療薬および生体バイオ治療薬の契約サービス

第19章 ケーススタディ:ビッグデータとマイクロバイオーム治療

第20章 ヒトマイクロバイオーム治療薬市場

- 章の概要

- 前提と調査手法

- 世界のヒトマイクロバイオーム治療薬市場:予測推定値(2035年まで)

- ヒトマイクロバイオーム市場:製品タイプ別分布

- 主要な市場セグメンテーション