|

市場調査レポート

商品コード

1737051

微生物発酵CMO市場:発現システムタイプ別、生物製剤タイプ別、企業規模別、ユーザー別、主要地域別Microbial Fermentation CMO Market Distribution by Type of Expression System, Type of Biologic, Company Size, End Users and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| 微生物発酵CMO市場:発現システムタイプ別、生物製剤タイプ別、企業規模別、ユーザー別、主要地域別 |

|

出版日: 2025年05月26日

発行: Roots Analysis

ページ情報: 英文 327 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

世界の微生物発酵CMOの市場規模は、2035年までの予測期間中に8.7%のCAGRで拡大し、現在の36億米ドルから2035年までに91億米ドルに成長すると予測されています。

市場セグメンテーションでは、市場規模および機会分析を以下のパラメータで区分しています:

発現システムタイプ別

- 細菌発現システム

- 酵母発現システム

- その他の発現システム

生物製剤タイプ別

- 組み換えタンパク質

- 酵素

- プラスミドDNA

- 抗体

- その他の生物製剤

企業規模別

- 小規模

- 中規模

- 大手および超大手

エンドユーザー別

- 製薬/バイオテクノロジー企業

- 学術/研究機関

主要地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

微生物発酵CMO市場:成長と動向

近年、微生物発酵の分野はルネッサンスを経験しており、微生物バイオ医薬品業界は、高度な微生物発現システムによる生物製剤の生産にますます焦点を当てています。様々な生物製剤を生産するための微生物発酵に基づく発現システムの改良と革新は、生物製剤の不適切な3次元フォールディングのような、不活性あるいは有害なタンパク質にさえつながる可能性のある、微生物発酵に関連する以前の懸念のいくつかを脇に追いやっています。その結果、微生物発酵システムは、高品質の生物製剤を大量に受託製造することを容易にしました。さらに、生物製剤の製造のための微生物発酵の採用が増加しているのは、主要微生物発酵企業が提供する革新的な技術とプラットフォームの進歩によるものです。時間の経過とともに、微生物発酵領域は著しく進化し、タンパク質を中心とする様々な生物製剤の生産につながってきました。

現在、多様な生物製剤、特にサイトカイン、成長因子、プラスミドDNA、核酸、シングルドメイン抗体、非グリコシル化抗体断片などの低分子を生産するために、細菌、真菌、酵母を利用した伝統的かつ先進的な微生物発現システム/プラットフォームが幅広く採用されています。その結果、微生物発酵は受託サービスプロバイダーにとって有利な市場成長機会をもたらす可能性が高く、微生物発酵CMO市場は今後数年で急成長すると予想されます。

微生物発酵CMO市場:主要インサイト

当レポートでは、微生物発酵CMO市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。当レポートの主な調査結果は以下の通り:

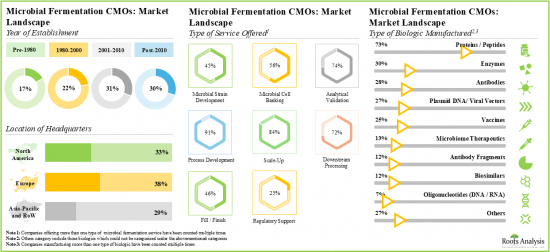

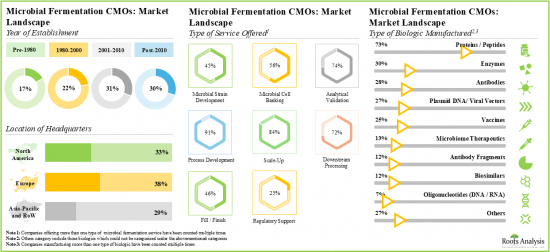

- 現在、120社以上の企業が世界中で微生物発酵受託製造サービスを提供しており、これらの企業の多くは欧州に本社を置いています。

- 微生物発酵CMOの現在の市場情勢は断片化されており、新規参入企業と既存企業の両方が存在します。

- 生物製剤に対する需要の高まりを受けて、サービス・プロバイダーや医薬品イノベーターは、微生物発現システムを用いて高品質な製品を効率的に製造するための技術的専門知識を向上させつつあります。

- この領域への関心が高まっていることは、提携活動の増加からも明らかです。事実、微生物発酵に関連する提携は、過去2年間で最も多く結ばれています。

- 業界各社は、臨床スケールと商業スケールの両方の微生物発酵のために、既存の能力と能力を拡大するための広範な努力を行っています。

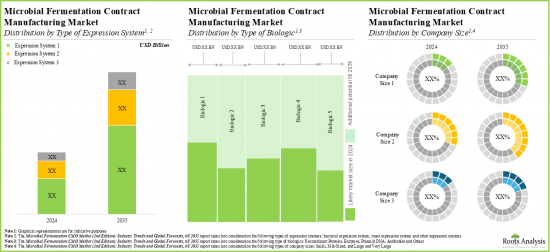

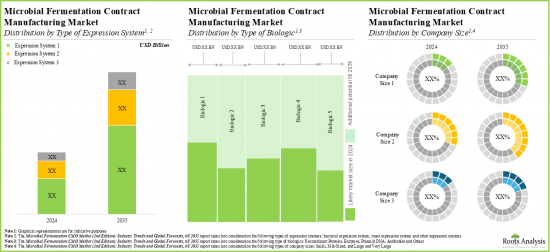

- 微生物発酵CMO市場は、2035年までCAGR 8.7%で成長するとみられます。現在、市場シェアの大半は上流の細菌発現システムが占めています。

- 微生物発酵受託製造市場は、主に生物製剤の需要増加別牽引されると予測され、2035年までに欧州が市場の大きなシェア(40%以上)を占めると予想されます。

微生物発酵CMO市場:主要セグメント

発現システムタイプ別では、市場は細菌発現システム、酵母発現システム、その他に区分されます。現在、細菌発現系セグメントは、培養における費用対効果、遺伝子操作の容易さ、組換えタンパク質の迅速な生産により、世界の微生物発酵CMO市場で最大のシェアを占めています。さらに、酵母発現システム分野は予測期間中により速いペースで成長すると思われます。

生物製剤タイプ別では、市場は組換えタンパク質、酵素、プラスミドDNA、抗体、その他に区分されます。現在、世界の微生物発酵CMO市場で最も高い割合を占めているのは組み換えタンパク質です。さらに、プラスミドDNAの微生物発酵CMO市場は、予測期間中に比較的高いCAGRで成長する可能性が高いです。これは、次世代治療薬に対する需要の増加に起因しています。

企業規模別では、市場は中小、中堅、大手、超大手に区分されます。現在、微生物発酵CMO市場では、大手および超大手の受託製造業者が最大シェアを占めています。さらに、中堅企業セグメントの微生物発酵CMO市場が比較的高いCAGRで成長する可能性が高いことは注目に値します。

エンドユーザー別では、世界市場は製薬/バイオテクノロジー企業と学術/研究機関に区分されます。現在、製薬/バイオテクノロジー企業が最大の市場シェアを占めています。実際、この動向は今後も変わらないと思われます。

主要地域別に見ると、市場は北米、欧州、アジア太平洋、その他の地域に区分されます。現在、欧州が世界の微生物発酵CMO市場を独占し、最大の収益シェアを占めています。さらに、アジア太平洋の市場は今後数年間、より高いCAGRで成長すると予想されています。

当レポートでは、世界の微生物発酵CMO市場について調査し、市場の概要とともに、発現システムタイプ別、生物製剤タイプ別、企業規模別、ユーザー別、主要地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 序文

第2章 調査手法

第3章 経済的およびその他のプロジェクト特有の考慮事項

第4章 エグゼクティブサマリー

第5章 イントロダクション

- 章の概要

- 発現システムタイプ

- 微生物製造プロセスの段階

- 契約製造の概要

- 微生物製造のアウトソーシングの必要性

- 微生物契約製造業界で一般的にアウトソーシングされる業務

- 製造サービスのアウトソーシングに伴うメリットとデメリット

- CMOパートナーを選択する際に考慮すべき重要な点

第6章 市場情勢:微生物発酵受託製造業者

- 章の概要

- 微生物発酵受託製造業者:市場情勢

第7章 企業競争力分析

第8章 企業プロファイル

- 章の概要

- 主要参入企業のプロファイル

- AGC Biologics

- Aldevron

- BioVectra

- EirGenix

- EtinPro

- Eurogentec

- Northway Biotech

- Stelis Biosource

- その他の企業のプロファイル

- 53Biologics

- AbbVie Contract Manufacturing

- Ajinomoto Bio-Pharma Services

- Aumgene Biosciences

- BioCina

- Creative Biogene

- Eubiologics

- Eurofins

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Lonza

- Menarini Biotech

- Mycenax Biotech

- WACKER

- WuXi Biologics

第9章 パートナーシップとコラボレーション

- 章の概要

- パートナーシップモデル

- 微生物発酵CMO:パートナーシップとコラボレーション

第10章 最近の拡大

第11章 大手製薬会社の微生物製造への取り組み

- 章の概要

- 大手製薬会社の微生物バイオ医薬品製造イニシアチブ一覧

- 大手製薬会社の競合ベンチマーキング

第12章 魅力度競合マトリックス

第13章 製造か購入かの意思意思決定の枠組み

第14章 ケーススタディI:微生物発酵技術プラットフォーム

第15章 ケーススタディII:小分子薬と大分子薬/治療法の比較

第16章 市場影響分析:促進要因、抑制要因、機会、課題

第17章 世界の微生物発酵CMO市場

- 章の概要

- 主要な前提と調査手法

- 世界の微生物発酵CMO市場、歴史的動向(2018年以降)および予測(2035年まで)

- 主要な市場セグメンテーション

第18章 微生物発酵CMO市場(使用される発現システムタイプ別)

第19章 微生物発酵CMO市場(生物製剤タイプ別)

第20章 微生物発酵CMO市場(企業規模別)

第21章 微生物発酵CMO市場(エンドユーザー別)

第22章 微生物発酵CMO市場(主要地域別)

第23章 結論

第24章 エグゼクティブ洞察

第25章 付録1:表形式データ

第26章 付録2:企業・団体一覧

List of Tables

- Table 5.1 Mammalian versus Microbial Expression Systems

- Table 6.1 List of Microbial Fermentation Contract Manufacturers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 6.2 List of Microbial Fermentation Contract Manufacturers: Information on Microbial Fermentation Service Offered and Microbial Expression System Used

- Table 6.3 List of Microbial Fermentation Contract Manufacturers: Information on GMP Compliance, Scale of Operation, Type of Biologic Manufactured and Type of Fermenter

- Table 6.4 List of Microbial Contract Manufacturers: Information on Location of Microbial Fermentation Facilities

- Table 8.1 Microbial Fermentation Contract Manufacturers: List of Companies Profiled

- Table 8.2 AGC Biologics: Company Overview

- Table 8.3 AGC Biologics: Microbial Fermentation Service Portfolio

- Table 8.4 AGC Biologics: Microbial Fermentation Facilities

- Table 8.5 AGC Biologics: Recent Developments and Future Outlook

- Table 8.6 Aldevron: Company Overview

- Table 8.7 Aldevron: Microbial Fermentation Service Portfolio

- Table 8.8 Aldevron: Microbial Fermentation Facilities

- Table 8.9 Aldevron: Recent Developments and Future Outlook

- Table 8.10 BioVectra: Company Overview

- Table 8.11 BioVectra: Microbial Fermentation Service Portfolio

- Table 8.12 BioVectra: Microbial Fermentation Facilities

- Table 8.13 BioVectra: Recent Developments and Future Outlook

- Table 8.14 EirGenix: Company Overview

- Table 8.15 EirGenix: Microbial Fermentation Service Portfolio

- Table 8.16 EirGenix: Microbial Fermentation Facilities

- Table 8.17 Etinpro: Company Overview

- Table 8.18 Etinpro: Microbial Fermentation Service Portfolio

- Table 8.19 Etinpro: Microbial Fermentation Facilities

- Table 8.20 Eurogentec: Company Overview

- Table 8.21 Eurogentec: Microbial Fermentation Service Portfolio

- Table 8.22 Eurogentec: Microbial Fermentation Facilities

- Table 8.23 Northway Biotech: Company Overview

- Table 8.24 Northway Biotech: Microbial Fermentation Service Portfolio

- Table 8.25 Northway Biotech: Microbial Fermentation Facilities

- Table 8.26 Northway Biotech: Recent Developments and Future Outlook

- Table 8.27 Stelis Biopharma: Company Overview

- Table 8.28 Stelis Biopharma: Microbial Fermentation Service Portfolio

- Table 8.29 Stelis Biopharma: Microbial Fermentation Facilities

- Table 8.30 53Biologics: Company Overview

- Table 8.31 53Biologics: Microbial Fermentation Service Portfolio

- Table 8.32 53Biologics: Microbial Fermentation Facilities

- Table 8.33 Abbvie Contract Manufacturing: Company Overview

- Table 8.34 Abbvie Contract Manufacturing: Microbial Fermentation Service Portfolio

- Table 8.35 Abbvie Contract Manufacturing: Microbial Fermentation Facilities

- Table 8.36 Ajinomoto Bio-Pharma Services: Company Overview

- Table 8.37 Ajinomoto Bio-Pharma Services: Microbial Fermentation Service Portfolio

- Table 8.38 Ajinomoto Bio-Pharma Services: Microbial Fermentation Facilities

- Table 8.39 Aumgene Biosciences: Company Overview

- Table 8.40 Aumgene Biosciences: Microbial Fermentation Service Portfolio

- Table 8.41 Aumgene Biosciences: Microbial Fermentation Facilities

- Table 8.42 BioCina: Company Overview

- Table 8.43 BioCina: Microbial Fermentation Service Portfolio

- Table 8.44 BioCina: Microbial Fermentation Facilities

- Table 8.45 Creative Biogene: Company Overview

- Table 8.46 Creative Biogene: Microbial Fermentation Service Portfolio

- Table 8.47 Creative Biogene: Microbial Fermentation Facilities

- Table 8.48 Eubiologics: Company Overview

- Table 8.49 Eubiologics: Microbial Fermentation Service Portfolio

- Table 8.50 Eubiologics: Microbial Fermentation Facilities

- Table 8.51 Eurofins: Company Overview

- Table 8.52 Eurofins: Microbial Fermentation Service Portfolio

- Table 8.53 Eurofins: Microbial Fermentation Facilities

- Table 8.54 FUJIFILM Diosynth Biotechnologies: Company Overview

- Table 8.55 FUJIFILM Diosynth Biotechnologies: Microbial Fermentation Service Portfolio

- Table 8.56 FUJIFILM Diosynth Biotechnologies: Microbial Fermentation Facilities

- Table 8.57 KBI Biopharma: Company Overview

- Table 8.58 KBI Biopharma: Microbial Fermentation Service Portfolio

- Table 8.59 KBI Biopharma: Microbial Fermentation Facilities

- Table 8.60 Lonza: Company Overview

- Table 8.61 Lonza: Microbial Fermentation Service Portfolio

- Table 8.62 Lonza: Microbial Fermentation Facilities

- Table 8.63 Menarini Biotech: Company Overview

- Table 8.64 Menarini Biotech: Microbial Fermentation Service Portfolio

- Table 8.65 Menarini Biotech: Microbial Fermentation Facilities

- Table 8.66 Mycenax Biotech: Company Overview

- Table 8.67 Mycenax Biotech: Microbial Fermentation Service Portfolio

- Table 8.68 Mycenax Biotech: Microbial Fermentation Facilities

- Table 8.69 WACKER: Company Overview

- Table 8.70 WACKER: Microbial Fermentation Service Portfolio

- Table 8.71 WACKER: Microbial Fermentation Facilities

- Table 8.72 WuXi Biologics: Company Overview

- Table 8.73 WuXi Biologics: Microbial Fermentation Service Portfolio

- Table 8.74 WuXi Biologics: Microbial Fermentation Facilities

- Table 9.1 Microbial Fermentation CMO: List of Partnerships and Collaborations, Since 2020

- Table 10.1 Microbial Fermentation CMO: List of Recent Expansions, Since 2020

- Table 11.1 Big Pharmaceutical Players: List of Initiatives

- Table 14.1 List of Technology / Platforms for Microbial Manufacturing

- Table 15.1 List of Microbial Contract Biomanufacturers

- Table 15.2 Small Molecules and Large Molecules: Comparison of Development Characteristics

- Table 25.1 Microbial Fermentation Contract Manufacturers: Distribution by Year of Establishment

- Table 25.2 Microbial Fermentation Contract Manufacturers: Distribution by Company Size

- Table 25.3 Microbial Fermentation Contract Manufacturers: Distribution by Location of Headquarters

- Table 25.4 Microbial Fermentation Contract Manufacturers: Distribution by Type of Microbial Fermentation Service Offered

- Table 25.5 Microbial Fermentation Contract Manufacturers: Distribution by Type of Microbial Expression System Used

- Table 25.6 Microbial Fermentation Contract Manufacturers: Distribution by GMP Compliance

- Table 25.7 Microbial Fermentation Contract Manufacturers: Distribution by Scale of Operation

- Table 25.8 Microbial Fermentation Contract Manufacturers: Distribution by Type of Biologic Manufactured

- Table 25.9 Microbial Fermentation Contract Manufacturers: Distribution by Type of Fermenter

- Table 25.10 Microbial Fermentation Contract Manufacturers: Distribution by Location of Microbial Fermentation Facilities

- Table 25.11 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2020

- Table 25.12 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 25.13 Partnerships and Collaborations: Distribution by Type of Biologic

- Table 25.14 Partnerships and Collaborations: Distribution by Type of Partner

- Table 25.15 Most Active Players: Distribution by Number of Partnerships

- Table 25.16 Partnerships and Collaborations: Intracontinental and Intercontinental Deals

- Table 25.17 Partnerships and Collaborations: Local and International Agreements

- Table 25.18 Recent Expansions: Cumulative Year-wise Trend, Since 2020

- Table 25.19 Recent Expansions: Distribution by Type of Expansion

- Table 25.20 Recent Expansions: Distribution by Year and Type of Expansion

- Table 25.21 Recent Expansions: Distribution by Microbial Fermentation Capacity

- Table 25.22 Recent Expansions: Distribution by Type of Biologic

- Table 25.23 Recent Expansions: Distribution by Location of Expanded Facility

- Table 25.24 Recent Expansions: Distribution by Type of Expansion and Location of Expanded Facility

- Table 25.25 Most Active Players: Distribution by Number of Recent Expansions

- Table 25.26 Recent Expansions: Distribution by Continent

- Table 25.27 Recent Expansions: Distribution by Location of Expanded Facility (Country)

- Table 25.28 Big Pharma Players: Distribution by Number of Microbial Biopharmaceutical Manufacturing Focused Initiatives

- Table 25.29 Big Pharma Players: Cumulative Distribution by Year of Initiative

- Table 25.30 Big Pharma Players: Distribution by Company and Year of Initiative

- Table 25.31 Big Pharma Players: Distribution by Purpose of Initiative

- Table 25.32 Big Pharma Players: Distribution by Company and Purpose of Initiative

- Table 25.33 Big Pharma Players: Distribution by Type of Initiative

- Table 25.34 Big Pharma Players: Distribution by Development Scale

- Table 25.35 Big Pharma Players: Distribution by Type of Drug Molecule

- Table 25.36 Big Pharma Players: Distribution by Type of Biologic Manufactured

- Table 25.37 Big Pharma Players: Distribution by Type of Microbial Expression System Used

- Table 25.37 Big Pharma Players: Distribution by Type of Microbial Expression System Used

- Table 25.38 Big Pharma Players: Distribution by Location of Initiative

- Table 25.39 Big Pharma Players: Distribution by Company and Location of Initiative

- Table 25.40 Fermentation Technology / Platform: Distribution by Type of Microbial Expression System Used

- Table 25.41 Fermentation Technology / Platform: Distribution by Purpose

- Table 25.42 Microbial Contract Manufacturing: Distribution by Type of Product

- Table 25.43 Microbial Contract Manufacturing: Distribution by Type of Microbial Expression System Used

- Table 25.44 Global Microbial Fermentation CMO Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.45 Global Microbial Fermentation CMO Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.46 Microbial Fermentation CMO Market: Distribution by Type of Expression System

- Table 25.47 Bacterial Expression Systems Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.48 Bacterial Expression Systems Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.49 Yeast Expression Systems Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.50 Yeast Expression Systems Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.51 Other Expression Systems Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.52 Other Expression Systems Market: Forecasted Estimates Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.53 Microbial Fermentation CMO Market: Distribution by Type of Biologic

- Table 25.54 Recombinant Proteins Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.55 Recombinant Proteins Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.56 Enzymes Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.57 Enzymes Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.58 Plasmid DNA Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.59 Plasmid DNA Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.60 Antibodies Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.61 Antibodies Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.62 Others Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.63 Others Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.64 Microbial Fermentation CMO Market: Distribution by Company Size

- Table 25.65 Small Companies Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.66 Small Companies Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.67 Mid-Sized Companies Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.68 Mid-Sized Companies Market: Forecasted Estimates Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.69 Large and Very Large Companies Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.70 Large and Very Large Companies Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.71 Microbial Fermentation CMO Market: Distribution by End-User

- Table 25.72 Pharma/ Biotech Companies Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.73 Pharma/ Biotech Companies Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.74 Academic / Research Institutes Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.75 Academic / Research Institutes Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.76 Microbial Fermentation CMO Market: Distribution by Key Geographical Regions

- Table 25.77 North America Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.78 North America Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.79 Bacterial Expression System Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.80 Bacterial Expression Systems Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.81 Yeast Expression Systems Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.82 Yeast Expression Systems Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.83 Other Expression Systems Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.84 Other Expression Systems Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.85 Recombinant Proteins Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.86 Recombinant Proteins Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.87 Enzymes Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.88 Enzymes Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.89 Plasmid DNA Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.90 Plasmid DNA Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.91 Antibodies Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.92 Antibodies Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.93 Other Biologics Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.94 Other Biologics Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.95 Small Companies Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.96 Small Companies Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.97 Mid-Sized Companies Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.98 Mid-Sized Companies Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.99 Large and Very Large Companies Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.100 Large and Very Large Companies Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.101 Pharma / Biotech Companies Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.102 Pharma / Biotech Companies Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.103 Academic/ Research Institutes Market in North America: Historical Trends, Since 2018 (USD Billion)

- Table 25.104 Academic/ Research Institutes Market in North America: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.105 Europe Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.106 Europe Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.107 Bacterial Expression System Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.108 Bacterial Expression Systems Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.109 Yeast Expression Systems Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.110 Yeast Expression Systems Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.111 Other Expression Systems Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.112 Other Expression Systems Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.113 Recombinant Proteins Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.114 Recombinant Proteins Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.115 Enzymes Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.116 Enzymes Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.117 Plasmid DNA Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.118 Plasmid DNA Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.119 Antibodies Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.120 Antibodies Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.121 Other Biologics Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.122 Other Biologics Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.123 Small Companies Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.124 Small Companies Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.125 Mid-Sized Companies Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.126 Mid-Sized Companies Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.127 Large and Very Large Companies Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.128 Large and Very Large Companies Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.129 Pharma / Biotech Companies Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.130 Pharma / Biotech Companies Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.131 Academic/ Research Institutes Market in Europe: Historical Trends, Since 2018 (USD Billion)

- Table 25.132 Academic/ Research Institutes Market in Europe: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.133 Asia-Pacific Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.134 Asia-Pacific Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.135 Bacterial Expression System Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.136 Bacterial Expression Systems Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.137 Yeast Expression Systems Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.138 Yeast Expression Systems Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.139 Other Expression Systems Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.140 Other Expression Systems Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.141 Recombinant Proteins Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.142 Recombinant Proteins Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.143 Enzymes Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.144 Enzymes Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.145 Plasmid DNA Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.146 Plasmid DNA Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.147 Antibodies Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.148 Antibodies Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.149 Other Biologics Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.150 Other Biologics Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.151 Small Companies Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.152 Small Companies Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.153 Mid-Sized Companies Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.154 Mid-Sized Companies Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.155 Large and Very Large Companies Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.156 Large and Very Large Companies Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.157 Pharma / Biotech Companies Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.158 Pharma / Biotech Companies Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.159 Academic/ Research Institutes Market in Asia-Pacific: Historical Trends, Since 2018 (USD Billion)

- Table 25.160 Academic/ Research Institutes Market in Asia-Pacific: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.161 Rest of the World Market: Historical Trends, Since 2018 (USD Billion)

- Table 25.162 Rest of the World Market: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.163 Bacterial Expression System Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.164 Bacterial Expression Systems Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.165 Yeast Expression Systems Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.166 Yeast Expression Systems Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.167 Other Expression Systems Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.168 Other Expression Systems Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.169 Recombinant Proteins Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.170 Recombinant Proteins Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.171 Enzymes Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.172 Enzymes Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.173 Plasmid DNA Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.174 Plasmid DNA Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.175 Antibodies Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.176 Antibodies Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.177 Other Biologics Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.178 Other Biologics Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.179 Small Companies Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.180 Small Companies Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.181 Mid-Sized Companies Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.182 Mid-Sized Companies Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.183 Large and Very Large Companies Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.184 Large and Very Large Companies Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.185 Pharma / Biotech Companies Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.186 Pharma / Biotech Companies Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.187 Academic/ Research Institutes Market in Rest of the World: Historical Trends, Since 2018 (USD Billion)

- Table 25.188 Academic/ Research Institutes Market in Rest of the World: Forecasted Estimates, Till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 5.1 Types of Expression Systems

- Figure 5.2 Stages of Microbial Manufacturing Process

- Figure 5.3 Overview of Cell Bank Systems

- Figure 5.4 Types of Third-Party Service Providers

- Figure 5.5 Commonly Outsourced Microbial Contract Biomanufacturing Operations

- Figure 5.6 Advantages and Disadvantages Associated with Outsourcing Manufacturing Services

- Figure 6.1 Microbial Fermentation Contract Manufacturers: Distribution by Year of Establishment

- Figure 6.2 Microbial Fermentation Contract Manufacturers: Distribution by Company Size

- Figure 6.3 Microbial Fermentation Contract Manufacturers: Distribution by Location of Headquarters

- Figure 6.4 Microbial Fermentation Contract Manufacturers: Distribution by Type of Microbial Fermentation Service Offered

- Figure 6.5 Microbial Fermentation Contract Manufacturers: Distribution by Type of Microbial Expression System Used

- Figure 6.6 Microbial Fermentation Contract Manufacturers: Distribution by GMP Compliance

- Figure 6.7 Microbial Fermentation Contract Manufacturers: Distribution by Scale of Operation

- Figure 6.8 Microbial Fermentation Contract Manufacturers: Distribution by Type of Biologic Manufactured

- Figure 6.9 Microbial Fermentation Contract Manufacturers: Distribution by Type of Fermenter

- Figure 6.10 Microbial Fermentation Contract Manufacturers: Distribution by Location of Microbial Fermentation Facilities

- Figure 7.1 Company Competitiveness Analysis: Players based in North America (Peer Group I)

- Figure 7.2 Company Competitiveness Analysis: Players based in Europe (Peer Group II)

- Figure 7.3 Company Competitiveness Analysis: Players based in Asia-Pacific and Rest of the World (Peer Group III)

- Figure 8.1 EirGenix: Annual Revenues, Since FY 2019 (TWD Million)

- Figure 9.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2020

- Figure 9.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 9.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 9.4 Partnerships and Collaborations: Distribution by Type of Biologic Manufactured

- Figure 9.5 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 9.6 Most Active Players: Distribution by Number of Partnerships

- Figure 9.7 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 9.8 Partnerships and Collaborations: International and Local Deals

- Figure 10.1 Recent Expansions: Cumulative Year-wise Trend, Since 2020

- Figure 10.2 Recent Expansions: Distribution by Type of Expansion

- Figure 10.3 Recent Expansions: Distribution by Year and Type of Expansion

- Figure 10.4 Recent Expansions: Distribution by Microbial Fermentation Capacity

- Figure 10.5 Recent Expansions: Distribution by Type of Biologic Manufactured

- Figure 10.6 Recent Expansions: Distribution by Location of Expanded Facility

- Figure 10.7 Recent Expansions: Distribution by Type of Expansion and Location of Expanded Facility

- Figure 10.8 Most Active Players: Distribution by Number of Recent Expansions

- Figure 10.9 Recent Expansions: Distribution by Continent

- Figure 10.10 Recent Expansions: Distribution by Location of Expanded Facility (Country)

- Figure 11.1 Big Pharma Players: Distribution by Number of Microbial Biopharmaceutical Manufacturing Focused Initiatives

- Figure 11.2 Big Pharma Players: Cumulative Distribution by Year of Initiative

- Figure 11.3 Big Pharma Players: Distribution by Company and Year of Initiative

- Figure 11.4 Big Pharma Players: Distribution by Purpose of Initiative

- Figure 11.5 Big Pharma Players: Distribution by Company and Purpose of Initiative

- Figure 11.6 Big Pharma Players: Distribution by Type of Initiative

- Figure 11.7 Big Pharma Players: Distribution by Scale of Operation

- Figure 11.8 Big Pharma Players: Distribution by Type of Drug Molecule

- Figure 11.9 Big Pharma Players: Distribution by Type of Biologic Manufactured

- Figure 11.10 Big Pharma Players: Distribution by Type of Microbial Expression System Used

- Figure 11.11 Big Pharma Players: Distribution by Location of Initiative

- Figure 11.12 Big Pharma Players: Distribution by Company and Location of Initiative

- Figure 11.13 Harvey Ball Analysis: Big Pharma Investment Summary

- Figure 12.1 Attractiveness Competition Matrix: Pictorial Representation

- Figure 12.2 Attractiveness Competition Matrix: Positioning of Different Biologics in North America

- Figure 12.3 Attractiveness Competition Matrix: Positioning of Different Biologics in Europe

- Figure 12.4 Attractiveness Competition Matrix: Positioning of Different Biologics in Asia Pacific and Middle East

- Figure 13.1 Make versus Buy Decision Making Framework

- Figure 13.2 Make versus Buy Decision Making: Possible Scenario Descriptions

- Figure 14.1 Fermentation Technology / Platform: Distribution by Type of Microbial Expression System Used

- Figure 14.2 Fermentation Technology / Platform: Distribution by Purpose

- Figure 15.1 Small Molecules versus Large Molecules: Comparison of Key Characteristics

- Figure 15.2 Small Molecules versus Large Molecule: Comparison of Manufacturing Process

- Figure 15.3 Microbial Contract Manufacturing: Distribution by Type of Product

- Figure 15.4 Microbial Contract Manufacturing: Distribution by Type of Microbial Expression System Used

- Figure 17.1 Global Microbial Fermentation CMO Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.2 Global Microbial Fermentation CMO Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 17.3 Global Microbial Fermentation CMO Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 18.1 Microbial Fermentation CMO Market: Distribution by Type of Expression System

- Figure 18.2 Bacterial Expression Systems Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Yeast Expression Systems Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.4 Other Expression Systems Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Microbial Fermentation CMO Market: Distribution by Type of Biologic

- Figure 19.2 Recombinant Proteins Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Enzymes Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.4 Plasmid DNA Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.5 Antibodies Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.6 Other Biologics Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.1 Microbial Fermentation CMO Market: Distribution by Company Size, 2018, 2024 and 2035

- Figure 20.2 Small Companies Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.3 Mid-Sized Companies Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 20.4 Large and Very Large Companies Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.1 Microbial Fermentation CMO Market: Distribution by End-User

- Figure 21.2 Pharma/ Biotech Companies Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 21.3 Academic/ Research Institutes Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.1 Microbial Fermentation CMO Market: Distribution by Key Geographical Regions

- Figure 22.2 North America Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.3 Bacterial Expression Systems Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.4 Yeast Expression Systems Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.5 Other Expression Systems Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.6 Recombinant Proteins Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.7 Enzymes Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.8 Plasmid DNA Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.9 Antibodies Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.10 Other Biologics Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.11 Small Companies Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.12 Mid-Sized Companies Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.13 Large and Very Large Companies Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.14 Pharma/ Biotech Companies Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.15 Academic / Research Institutes Market in North America, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.16 Europe Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.17 Bacterial Expression Systems Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.18 Yeast Expression Systems Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.19 Other Expression Systems Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.20 Recombinant Proteins Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.21 Enzymes Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.22 Plasmid DNA Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.23 Antibodies Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.24 Other Biologics Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.25 Small Companies Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.26 Mid-Sized Companies Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.27 Large and Very Large Companies Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.28 Pharma / Biotech Companies Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.29 Academic / Research Institutes Market in Europe, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.30 Asia-Pacific Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.31 Bacterial Expression Systems Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.32 Yeast Expression Systems Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.33 Other Expression Systems Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.34 Recombinant Proteins Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.35 Enzymes Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.36 Plasmid DNA Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.37 Antibodies Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.38 Other Biologics Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.39 Small Companies Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.40 Mid-Sized Companies Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.41 Large and Very Large Companies Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.42 Pharma / Biotech Companies Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.43 Academic / Research Institutes Market in Asia-Pacific, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.44 Rest of the World Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.45 Bacterial Expression System Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.46 Yeast Expression System Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.47 Other Expression System Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.48 Recombinant Proteins Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.49 Enzymes Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.50 Plasmid DNA Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.51 Antibodies Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.52 Other Biologics Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.53 Small Companies Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.54 Mid-Sized Companies Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.55 Large and Very Large Companies Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.56 Pharma/ Biotech Companies Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 22.57 Academic/ Research Institutes Market in Rest of the World, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 23.1 Concluding Remarks: Market Landscape of Microbial Fermentation Contract Manufacturers

- Figure 23.2 Concluding Remarks: Partnerships and Collaborations

- Figure 23.3 Concluding Remarks: Recent Expansions

- Figure 23.4 Concluding Remarks: Market Sizing and Opportunity Analysis

MICROBIAL FERMENTATION CMO MARKET: OVERVIEW

As per Roots Analysis, the global microbial fermentation CMO market is estimated to grow from USD 3.6 billion in the current year to USD 9.1 billion by 2035, at a CAGR of 8.7% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Expression System

- Bacterial Expression Systems

- Yeast Expression Systems

- Other Expression Systems

Type of Biologic

- Recombinant Proteins

- Enzymes

- Plasmid DNA

- Antibodies

- Other Biologics

Company Size

- Small

- Mid-Sized

- Large and Very Large

End Users

- Pharma / Biotech Companies

- Academic / Research Institutes

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

MICROBIAL FERMENTATION CMO MARKET: GROWTH AND TRENDS

In recent years, the field of microbial fermentation has experienced a renaissance, with the microbial biopharmaceutical industry increasingly focusing on the production of biologics through advanced microbial expression systems. The modification and innovation in microbial fermentation-based expression systems for the production of various biologics have sidelined some of the earlier concerns associated with them like improper 3D folding of the biologics that can lead to inactive or even harmful proteins. As a result, microbial fermentation systems have facilitated the contract manufacturing of high-quality biologics in larger quantity. Further, the increasing adoption of microbial fermentation for the production of biologics has been driven by the advancements in innovative technologies and platforms offered by leading microbial fermentation companies. Over time, the microbial fermentation domain has significantly evolved and has led to the production of various biologics, primarily proteins.

Currently, a wide range of traditional and advanced microbial expression systems / platforms, utilizing bacteria, fungi, and yeast, are employed to produce diverse biologics, particularly smaller molecules such as cytokines, growth factors, plasmid DNA, nucleic acids, single-domain antibodies, and non-glycosylated antibody fragments. Consequently, microbial fermentation is likely to present lucrative market growth opportunities for contract service providers and the microbial fermentation CMO market is anticipated to grow faster in the coming years.

MICROBIAL FERMENTATION CMO MARKET: KEY INSIGHTS

The report delves into the current state of the microbial fermentation CMO market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Presently, more than 120 players are engaged in offering microbial fermentation contract manufacturing services across the globe; most of these players are headquartered in Europe.

- The current market landscape of microbial fermentation CMOs is fragmented, featuring the presence of both new entrants and established players; majority of these players offer process development services.

- Owing to the rise in demand for biologics, service providers and drug innovators are upgrading their technical expertise to efficiently manufacture high-quality products using microbial expression systems.

- The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to microbial fermentation were inked in the last two years.

- Industry players are making extensive efforts to expand their existing capacities and capabilities for both clinical and commercial scale microbial fermentation.

- The microbial fermentation CMO market is likely to grow at a CAGR of 8.7%, till 2035; presently, majority of the market share is occupied by upstream bacterial expression system.

- The microbial fermentation contract manufacturing market is anticipated to be primarily driven by the rising demand for biologics; Europe is expected to capture a larger share (over 40%) of the market by 2035

MICROBIAL FERMENTATION CMO MARKET: KEY SEGMENTS

Bacterial Expression System Segment Occupies the Largest Share of the Microbial Fermentation CMO Market

Based on the type of expression system, the market is segmented into bacterial expression systems, yeast expression systems and other expression systems. At present, the bacterial expression systems segment holds the maximum share of the global microbial fermentation CMO market owing to its cost-effectiveness in culturing, ease of genetic manipulation, and fast production of recombinant proteins. Additionally, the yeast expression systems segment is likely to grow at a faster pace during the forecasted period.

By Type of Biologic, Plasmid DNA is the Fastest Growing Segment of the Global Microbial Fermentation CMO Market

Based on the type of biologic, the market is segmented into recombinant proteins, enzymes, plasmid DNA, antibodies and other biologics. Currently, the recombinant proteins segment captures the highest proportion of the global microbial fermentation CMO market. Further, the microbial fermentation CMO market for plasmid DNA is likely to grow at a relatively higher CAGR during the forecast period. This can be attributed to the increasing demand for the next- generation therapeutics.

Large and Very Large Contract Manufacturers Occupy the Largest Share of the Microbial Fermentation CMO Market by Company Size

Based on the company size, the market is segmented into small, mid-sized, large and very large companies. At present, large and very large contract manufacturers hold the maximum share of the microbial fermentation CMO market. Further, it is worth highlighting that the microbial fermentation CMO market for the mid-sized players segment is likely to grow at a relatively higher CAGR.

Currently, the Pharma / Biotech Companies Segment Holds the Largest Share of the Microbial Fermentation CMO Market

Based on the end users, the global market is segmented into pharma / biotech companies and academic / research institutes. Currently, the pharma / biotech companies segment holds the largest market share. In fact, this trend is likely to remain the same in the coming future.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Currently, Europe dominates the global microbial fermentation CMO market and accounts for the largest revenue share. Further, the market in Asia-Pacific is expected to grow at a higher CAGR in the coming years.

Example Players in the Microbial Fermentation CMO Market

- AbbVie

- BOC Sciences

- Eurofins

- FUJIFILM Diosynth Biotechnologies

- GSK

- Lonza

- Sandoz

MICROBIAL FERMENTATION CMO MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global microbial fermentation CMO market, focusing on key market segments, including [A] type of expression system, [B] type of biologic, [C] company size, [D] end users and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of the companies engaged in microbial fermentation CMO market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] types of services offered, [E] affiliated services, [F] AI support, [G] analytical techniques used, [H] therapeutic areas and [I] regulatory certifications / accreditations.

- Company Competitiveness Analysis: A comprehensive competitive analysis of service providers in the microbial fermentation industry, examining factors, such as [A] developer strength and [B] product portfolio strength.

- Company Profiles: In-depth profiles of key service providers engaged in the microbial fermentation market, focusing on [A] overview of the company, [B] financial information (if available), [C] service portfolio, and [D] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the microbial fermentation market, based on several parameters, such as [A] year of partnership, [B] type of biologic, [D] type of partner, [E] most active players (in terms of the number of partnerships signed) and [F] geographical distribution of partnership activity.

- Recent Expansions: In-depth analysis of the various expansion initiatives undertaken by contract biomanufacturers in this domain, based on several parameters, such as [A] year of expansion, [B] type of expansion, [C] microbial fermentation capacity, [D] type of biologic manufactured, [E] location of expanded facility, [F] type of expansion, [G] most active players and [H] geography.

- Big Pharma Initiatives in Microbial Manufacturing: An insightful analysis of big pharma players initiatives, based on several parameters, such as [A] number of initiatives, [B] year of initiative, and [C] types of initiatives.

- Attractiveness Competition Matrix: A detailed discussion on proprietary 2X2 representation to assess the current market scenario across emerging and established market segments.

- Make Versus Buy Decision Making Framework: An insightful analysis of the various factors that biopharmaceutical therapeutics / drug developers should consider while deciding whether to manufacture their respective products in-house or engage the services of CMOs.

- Case Study 1: A detailed discussion on the microbial fermentation technology / platforms that are available in the market. Additionally, a detailed discussion on emerging microbial fermentation technologies.

- Case Study 2: A detailed discussion on the key characteristics of large and small molecule drugs, along with information on the steps involved in their respective manufacturing processes.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2.RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rates

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

- 4.1. Chapter Overview

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Types of Expression Systems

- 5.2.1. Microbial Expression Systems

- 5.2.1.1. Bacterial Expression Systems

- 5.2.1.2. Fungal Expression Systems

- 5.2.1.3. Yeast Expression Systems

- 5.2.1.4. Mammalian versus Microbial Expression Systems

- 5.2.1. Microbial Expression Systems

- 5.3. Stages of the Microbial Manufacturing Process

- 5.3.1. Cell Banking

- 5.3.2. Upstream Bioprocessing

- 5.3.3. Fermentation

- 5.3.4. Downstream Bioprocessing

- 5.4. Overview of Contract Manufacturing

- 5.5. Need for Outsourcing Microbial Manufacturing

- 5.6. Commonly Outsourced Operations in Microbial Contract Manufacturing Industry

- 5.7. Advantages and Disadvantages Associated with Outsourcing Manufacturing Services

- 5.8. Key Considerations while Selecting a CMO Partner

6. MARKET LANDSCAPE: MICROBIAL FERMENTATION CONTRACT MANUFACTURERS

- 6.1. Chapter Overview

- 6.2. Microbial Fermentation Contract Manufacturers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Type of Microbial Fermentation Service Offered

- 6.2.5. Analysis by Type of Microbial Expression System Used

- 6.2.6. Analysis by GMP Compliance

- 6.2.7. Analysis by Scale of Operation

- 6.2.8. Analysis by Type of Biologic Manufactured

- 6.2.9. Analysis by Type of Fermenter

- 6.2.10. Analysis by Location of Microbial Fermentation Facilities

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Company Competitiveness Analysis: Microbial Fermentation Contract Manufacturers

- 7.4.1. Players based in North America (Peer Group I)

- 7.4.2. Players based in Europe (Peer Group II)

- 7.4.3. Players based in Asia-Pacific and Rest of the World (Peer Group III)

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Detailed Profiles of Leading Players

- 8.2.1. AGC Biologics

- 8.2.1.1. Company Overview

- 8.2.1.2. Microbial Fermentation Service Portfolio

- 8.2.1.3. Microbial Fermentation Facilities

- 8.2.1.4. Recent Developments and Future Outlook

- 8.2.2. Aldevron

- 8.2.2.1. Company Overview

- 8.2.2.2. Microbial Fermentation Service Portfolio

- 8.2.2.3. Microbial Fermentation Facilities

- 8.2.2.4. Recent Developments and Future Outlook

- 8.2.3. BioVectra

- 8.2.3.1. Company Overview

- 8.2.3.2. Microbial Fermentation Service Portfolio

- 8.2.3.3. Microbial Fermentation Facilities

- 8.2.3.4. Recent Developments and Future Outlook

- 8.2.4. EirGenix

- 8.2.4.1. Company Overview

- 8.2.4.2. Financial Information

- 8.2.4.3. Microbial Fermentation Service Portfolio

- 8.2.4.4. Microbial Fermentation Facilities

- 8.2.4.5. Recent Developments and Future Outlook

- 8.2.5. EtinPro

- 8.2.5.1. Company Overview

- 8.2.5.2. Microbial Fermentation Service Portfolio

- 8.2.5.3. Microbial Fermentation Facilities

- 8.2.5.4. Recent Developments and Future Outlook

- 8.2.6. Eurogentec

- 8.2.6.1. Company Overview

- 8.2.6.2. Microbial Fermentation Service Portfolio

- 8.2.6.3. Microbial Fermentation Facilities

- 8.2.6.4. Recent Developments and Future Outlook

- 8.2.7. Northway Biotech

- 8.2.7.1. Company Overview

- 8.2.7.2. Microbial Fermentation Service Portfolio

- 8.2.7.3. Microbial Fermentation Facilities

- 8.2.7.4. Recent Developments and Future Outlook

- 8.2.8. Stelis Biosource

- 8.2.8.1. Company Overview

- 8.2.8.2. Microbial Fermentation Service Portfolio

- 8.2.8.3. Microbial Fermentation Facilities

- 8.2.8.4. Recent Developments and Future Outlook

- 8.2.1. AGC Biologics

- 8.3. Short Profiles of Other Prominent Players

- 8.3.1. 53Biologics

- 8.3.1.1. Company Overview

- 8.3.1.2. Microbial Fermentation Service Portfolio

- 8.3.1.3. Microbial Fermentation Facilities

- 8.3.2. AbbVie Contract Manufacturing

- 8.3.2.1. Company Overview

- 8.3.2.2. Microbial Fermentation Service Portfolio

- 8.3.2.3. Microbial Fermentation Facilities

- 8.3.3. Ajinomoto Bio-Pharma Services

- 8.3.3.1. Company Overview

- 8.3.3.2. Microbial Fermentation Service Portfolio

- 8.3.3.3. Microbial Fermentation Facilities

- 8.3.4. Aumgene Biosciences

- 8.3.4.1. Company Overview

- 8.3.4.2. Microbial Fermentation Service Portfolio

- 8.3.4.3. Microbial Fermentation Facilities

- 8.3.5. BioCina

- 8.3.5.1. Company Overview

- 8.3.5.2. Microbial Fermentation Service Portfolio

- 8.3.5.3. Microbial Fermentation Facilities

- 8.3.6. Creative Biogene

- 8.3.6.1. Company Overview

- 8.3.6.2. Microbial Fermentation Service Portfolio

- 8.3.6.3. Microbial Fermentation Facilities

- 8.3.7. Eubiologics

- 8.3.7.1. Company Overview

- 8.3.7.2. Microbial Fermentation Service Portfolio

- 8.3.7.3. Microbial Fermentation Facilities

- 8.3.8. Eurofins

- 8.3.8.1. Company Overview

- 8.3.8.2. Microbial Fermentation Service Portfolio

- 8.3.8.3. Microbial Fermentation Facilities

- 8.3.9. FUJIFILM Diosynth Biotechnologies

- 8.3.9.1. Company Overview

- 8.3.9.2. Microbial Fermentation Service Portfolio

- 8.3.9.3. Microbial Fermentation Facilities

- 8.3.10. KBI Biopharma

- 8.3.10.1. Company Overview

- 8.3.10.2. Microbial Fermentation Service Portfolio

- 8.3.10.3. Microbial Fermentation Facilities

- 8.3.11. Lonza

- 8.3.11.1. Company Overview

- 8.3.11.2. Microbial Fermentation Service Portfolio

- 8.3.11.3. Microbial Fermentation Facilities

- 8.3.12. Menarini Biotech

- 8.3.12.1. Company Overview

- 8.3.12.2. Microbial Fermentation Service Portfolio

- 8.3.12.3. Microbial Fermentation Facilities

- 8.3.13. Mycenax Biotech

- 8.3.13.1. Company Overview

- 8.3.13.2. Microbial Fermentation Service Portfolio

- 8.3.13.3. Microbial Fermentation Facilities

- 8.3.14. WACKER

- 8.3.14.1. Company Overview

- 8.3.14.2. Microbial Fermentation Service Portfolio

- 8.3.14.3. Microbial Fermentation Facilities

- 8.3.15. WuXi Biologics

- 8.3.15.1. Company Overview

- 8.3.15.2. Microbial Fermentation Service Portfolio

- 8.3.15.3. Microbial Fermentation Facilities

- 8.3.1. 53Biologics

9. PARTNERSHIPS AND COLLABORATIONS

- 9.1. Chapter Overview

- 9.2. Partnership Models

- 9.3. Microbial Fermentation CMO: Partnerships and Collaborations

- 9.3.1. Analysis by Year of Partnerships

- 9.3.2. Analysis by Type of Partnership

- 9.3.3. Analysis by Year and Type of Partnership

- 9.3.4. Analysis by Type of Biologic Manufactured

- 9.3.5. Analysis by Type of Partner

- 9.3.6. Most Active Players: Distribution by Number of Partnerships

- 9.3.7. Analysis by Geography

- 9.3.7.1. Intracontinental and Intercontinental Agreements

- 9.3.7.2. International and Local Deals

10. RECENT EXPANSIONS

- 10.1. Chapter Overview

- 10.2. Microbial Fermentation CMO: Recent Expansions

- 10.2.1. Analysis by Year of Expansion

- 10.2.2. Analysis by Type of Expansion

- 10.2.3. Analysis by Year and Type of Expansion

- 10.2.4. Analysis by Microbial Fermentation Capacity

- 10.2.5. Analysis by Type of Biologic Manufactured

- 10.2.6. Analysis by Location of Expanded Facility

- 10.2.7. Analysis by Type of Expansion Location of Expanded Facility

- 10.2.8. Most Active Players: Distribution by Number of Recent Expansions

- 10.2.9. Analysis by Geography

- 10.2.9.1. Analysis by Continent

- 10.2.9.2. Analysis by Country

11. BIG PHARMA INITITATIVES IN MICROBIAL MANUFACTURING

- 11.1. Chapter Overview

- 11.2. List of Microbial Biopharmaceutical Manufacturing Initiatives of Big Pharma Players

- 11.2.1. Analysis by Number of Initiatives

- 11.2.2. Analysis by Year of Initiative Undertaken

- 11.2.3. Analysis by Company and Year of Initiative Undertaken

- 11.2.4. Analysis by Purpose of Initiative Undertaken

- 11.2.5. Analysis by Company and Purpose of Initiative Undertaken

- 11.2.6. Analysis by Type of Initiative

- 11.2.7. Analysis by Scale of Operation

- 11.2.8. Analysis by Type of Drug Molecule

- 11.2.9. Analysis by Type of Microbial Expression System Used

- 11.2.10. Geographical Analysis by Amount Invested

- 11.3. Competitive Benchmarking of Big Pharmaceutical Players

- 11.3.1. Concluding Remarks

12. ATTRACTIVENESS COMPETITION MATRIX

- 12.1. Chapter Overview

- 12.2. AC Matrix: An Overview

- 12.2.1. Strong Business Segment

- 12.2.2. Average Business Segment

- 12.2.3. Weak Business Segment

- 12.3. AC Matrix: Analytical Methodology

- 12.4. AC Matrix: Contract Manufacturing Scenario in North America

- 12.5. AC Matrix: Contract Manufacturing Scenario in Europe

- 12.6. AC Matrix: Contract Manufacturing Scenario in Asia Pacific and Middle East

13. MAKE VERSUS BUY DECISION MAKING FRAMEWORK

- 13.1. Chapter Overview

- 13.2. Assumptions and Parameter Definitions

- 13.2.1. Scenario 1

- 13.2.2. Scenario 2

- 13.2.3. Scenario 3

- 13.2.4. Scenario 4

- 13.3. Concluding Remarks

14. CASE STUDY I: MICROBIAL FERMENTATION TECHNOLOGY PLATFORMS

- 14.1. Chapter Overview

- 14.2. Technology Platforms Commonly Used for Microbial Fermentation

- 14.3. Upcoming Platforms-General Technologies

15. CASE STUDY II: COMPARISON OF SMALL MOLECULE AND LARGE MOLECULE DRUGS / THERAPIES

- 15.1. Chapter Overview

- 15.2. Small Molecule and Large Molecule Drugs / Therapies

- 15.2.1. Comparison of Key Characteristics

- 15.2.2. Comparison of Microbial Manufacturing Process

- 15.2.2.1. Microbial Contract Manufacturers Providing Services for Small Molecules

- 15.2.3. Comparison of Key Manufacturing-related Challenges

16. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. GLOBAL MICROBIAL FERMENTATION CMO MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Microbial Fermentation CMO Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3.1. Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1. Scenario Analysis

- 17.4. Key Market Segmentations

18. MICROBIAL FERMENTATION CMO MARKET, BY TYPE OF EXPRESSION SYSTEM USED

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Microbial Fermentation CMO Market: Distribution by Type of Expression System Used

- 18.3.1. Bacterial Expression Systems Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.2. Yeast Expression Systems Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3.3. Other Expression Systems Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

19. MICROBIAL FERMENTATION CMO MARKET, BY TYPE OF BIOLOGIC

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Microbial Fermentation CMO Market: Distribution by Type of Biologic

- 19.3.1. Recombinant Proteins Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.2. Enzymes Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.3. Plasmid DNA Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.4. Antibodies Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.5. Other Biologics Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. MICROBIAL FERMENTATION CMO MARKET, BY COMPANY SIZE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Microbial Fermentation CMO Market: Distribution by Company Size

- 20.3.1. Small Companies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.2. Mid-Sized Companies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.3. Large and Very Large Companies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. MICROBIAL FERMENTATION CMO MARKET, BY END-USERS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Microbial Fermentation CMO Market: Distribution by End-User

- 21.3.1. Pharma / Biotech Companies Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3.2. Academic / Research Institutes Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. MICROBIAL FERMENTATION CMO MARKET, BY KEY GEOGRAPHICAL REGIONS

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Microbial Fermentation CMO Market: Distribution by Key Geographical Regions

- 22.3.1. North America Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.1. Bacterial Expression Systems Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.2. Yeast Expression Systems Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.3. Other Expression Systems Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.4. Recombinant Proteins Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.5. Enzymes Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.6. Plasmid DNA Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.7. Antibodies Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.8. Other Biologics Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.9. Small Companies Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.10. Mid-Sized Companies Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.11. Large and Very Large Companies Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.12. Pharma / Biotech Companies Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.1.13. Academic / Research Institutes Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2. Europe Market: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)