|

|

市場調査レポート

商品コード

1723656

ゲノム編集市場 - 技術別、治療タイプ別、遺伝子編集アプローチ別、遺伝子導入方法別、遺伝子導入モダリティ別、応用分野別、エンドユーザータイプ別、主要参入企業別:2035年までの業界動向と世界の予測Genome Editing Market - Focus on Technology, Type of Therapy, Gene Editing Approach, Type of Gene Delivery Method, Gene Delivery Modality, Application Area, Type of End-User and Leading Industry Players: Industry Trends and Global Forecasts, till 2035 |

||||||

カスタマイズ可能

|

|||||||

| ゲノム編集市場 - 技術別、治療タイプ別、遺伝子編集アプローチ別、遺伝子導入方法別、遺伝子導入モダリティ別、応用分野別、エンドユーザータイプ別、主要参入企業別:2035年までの業界動向と世界の予測 |

|

出版日: 2025年05月09日

発行: Roots Analysis

ページ情報: 英文 226 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

ゲノム編集市場:概要

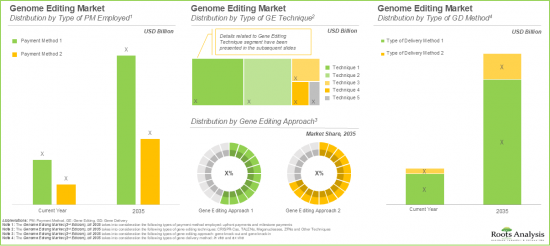

世界のゲノム編集の市場規模は、2024年に34億1,000万米ドルとなりました。同市場は、予測期間中に12.1%のCAGRで拡大し、現在の42億5,000万米ドルから、2035年までに133億6,000万米ドルに達すると予測されています。

ゲノム編集市場の機会は以下のセグメントに分布しています:

採用される決済方法

- 契約一時金

- マイルストーン支払い

遺伝子編集技術タイプ

- CRISPR-Casシステム

- TALENs

- メガヌクレアーゼ

- ZFN系

- その他の技術

遺伝子編集アプローチ

- 遺伝子ノックアウト

- 遺伝子ノックイン

遺伝子導入法

- 生体外

- インビボ

遺伝子導入方法

- ウイルスベクター

- 非ウイルス性ベクター

治療タイプ

- 細胞治療

- 遺伝子治療

- その他の治療法

応用分野

- 創薬と開発

- 診断薬

エンドユーザー

- 製薬会社およびバイオテクノロジー企業

- 学術・研究機関

主要地域

- 北米(米国、カナダ)

- 欧州(ドイツ、フランス、アイルランド)

- アジア太平洋(韓国、中国、日本)

ゲノム編集市場:成長と動向

ヒトゲノムは約30億塩基対からなり、その中には20,000~25,000のタンパク質をコードする遺伝子が含まれています。これらの遺伝子は、タンパク質合成を調節・制御するコードとして機能し、それによって遺伝子発現に影響を及ぼします。バイオテクノロジーの領域で進行中の進歩により、さまざまな医学研究者が、ゲノム編集またはゲノム工学と呼ばれる特殊な技術によってヒトゲノムの発現を改変できるようになっています。ゲノム編集は、遺伝子編集としても知られ、生物の単一遺伝子または遺伝子セットを挿入、欠失、置換し、それによってヌクレオチド組成を変化させることによってゲノムを改変することを可能にする技術です。希望する部位でのゲノム編集の必要性が高まっているため、この分野に携わる企業によってさまざまなゲノム編集ツールが開発されています。主要な技術には、ジンクフィンガーヌクレアーゼ(ZFN)、転写活性化因子様エフェクターヌクレアーゼ(TALEN)、CRISPR技術などがあります。特にZFNは1895年に発見された最初のゲノム工学技術であり、次いでTALEN(2011年)、CRISPRがゲノム編集領域における画期的なブレークスルーとして登場しました。これらの遺伝子編集ツールは、鎌状赤血球症、パーキンソン病、末梢動脈疾患、脊髄性筋萎縮症、自己免疫疾患、その他の遺伝性疾患など、遺伝子異常の結果として発症するさまざまな臨床症状の治療に広く用いられてきました。

さらに、治療用遺伝子を細胞に導入したり、変異した遺伝子を置き換えたりすることで、根本的な遺伝子異常に対処する有望なアプローチとして、遺伝子治療が脚光を浴びています。2024年4月現在、1,100以上の臨床試験が活発に行われており、様々な開発段階の遺伝子治療が研究されています。WHOによると、1,000人中10人が遺伝性疾患を患っており、世界中で7,000万人以上が影響を受けています。さらに、世界の乳幼児死亡率の40%以上が、さまざまな遺伝子疾患と関連しています。その可能性にもかかわらず、遺伝子組換え医薬品の開発には、創薬、開発、製造に多額の投資が必要です。そのため、これらの薬剤の効率、精度、安全なデリバリーを確保するために、製薬会社は先進的なゲノム編集技術を採用するようになってきています。その結果、正確な遺伝子改変によって臨床転帰を向上させるため、最先端技術の統合が重視されるようになっています。

ゲノム編集領域における技術革新の進行ペースは、細胞・遺伝子治療における有望な臨床試験結果と相まって、業界を前進させています。さらに、農業と食糧安全保障における遺伝子編集の応用拡大が、市場の成長をさらに促進しています。

ゲノム編集市場:主要インサイト

当レポートでは、ゲノム編集市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。当レポートの主要な要点は以下の通りです:

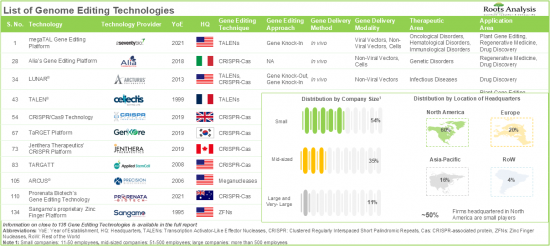

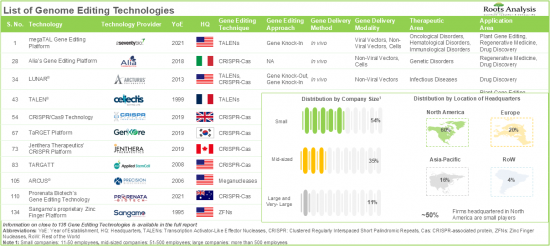

技術の85%近くがCRISPR-Cas技術を使用しており、そのうち30%近くがCRISPRツールを細胞に直接デリバリーすることを可能にし、主に創薬や再生医療に利用されています。

近年、パートナーシップの着実な成長が観察されており、技術ライセンシング契約が最も顕著なタイプのパートナーシップモデルとして浮上しています。

ゲノム編集に関連する2,400件以上の特許が、この分野で生み出された知的財産を保護するために、さまざまな技術開発者によって出願され、また技術開発者に付与されています。

- 有利なリターンを期待して、多くの公的および民間投資家が2018年以降141億米ドル相当の投資を行っており、この領域における資金調達活動はさまざまな地域に分散しています。

- ゲノム編集技術市場は、今後10年間で年率12.1%の成長が見込まれています。

- 製薬企業やバイオテクノロジー企業向けに開発されている技術の市場開拓機会が最も高くなるとみられ、治療の種類では遺伝子治療分野が大きく成長すると予測されます。

ゲノム編集市場:主要セグメント

採用されている決済方法別では、世界のゲノム編集市場は契約一時金とマイルストーン支払いに区分されます。現在、市場セグメンテーションは市場全体で最も高いシェアを占めています。しかし、マイルストーン支払いセグメントは予測期間中に大きな成長を示すと予測されていることに留意することが重要です。

遺伝子編集技術タイプ別では、世界のゲノム編集市場はCRISPR-Casシステム、TALEN、メガヌクレアーゼ、ZFN、およびその他に区分されます。現在、CRISP-Caseシステムセグメントがゲノム編集市場をリードしています。さらに、この動向は今後も変わりそうにないことを強調しておくことが重要です。この動向は、次世代CRISPR技術が、よりカスタマイズされた正確な結果を提供することで、従来の遺伝子編集技術に関連する限界を克服する有望な技術として浮上してきたという事実に起因しています。

遺伝子編集アプローチ別では、世界のゲノム編集市場は遺伝子ノックインアプローチと遺伝子ノックアウトアプローチに区分されます。現在、市場は遺伝子ノックアウトアプローチによって生み出される収益によって支配されています。これは、ノックインアプローチは複雑な最適化プロセスを必要とするため、ノックインアプローチと比較して、このアプローチのより大きな実現可能性とアクセシビリティに起因することができます。

遺伝子導入方法別では、世界のゲノム編集市場は生体外および生体内に区分されます。現在、生体外セグメントはゲノム編集市場で最大のシェアを獲得しています。これは、生体外遺伝子導入では、細胞が患者から採取され、研究室で改変された後、体内に再導入されるという事実に起因します。このため、実験室内で遺伝子改変を正確に制御できる一方、関連する標的外影響を最小限に抑えることができます。しかし、予測期間中、生体内セグメントは比較的高いCAGRで成長しそうです。

遺伝子導入モダリティ別では、世界のゲノム編集市場はウイルスベクターと非ウイルスベクターに分散しています。現在、ウイルスベクターセグメントがゲノム編集市場で最も高いシェアを占めています。しかし、遺伝子モダリティとしてのウイルスベクターの使用に伴うさまざまな課題(細胞毒性、免疫原性、スケールアップの問題など)のため、この傾向は今後数年で変化し、非ウイルスベクターが市場全体でほぼ同等のシェアを占めると予想されます。

治療タイプ別では、世界のゲノム編集市場は細胞治療、遺伝子治療、その他に区分されます。現在のところ、細胞療法分野が最大の市場シェアを占めています。さらに、幅広い疾患の治療に広く応用できることから、この動向は今後も変わりそうにありません。

応用分野別では、世界のゲノム編集市場は創薬と市場開拓、診断に区分されます。現在、創薬・開発分野が市場シェアの大半を占めています。

エンドユーザー別に見ると、世界のゲノム編集市場は製薬・バイオテクノロジー企業、学術・研究機関に分散しています。特筆すべきは、製薬およびバイオテクノロジーセグメントがゲノム編集市場の大半を占めていることです。これは、製薬およびバイオテクノロジー企業がこの領域で最大限の技術ライセンス/統合契約を締結しているためであり、したがって、業界プレーヤーが生み出す収益の大部分に寄与しています。

主要地域別に見ると、市場は北米、欧州、アジア太平洋に区分されます。現在のところ、北米が最大の市場シェアを占めています。さらに、欧州が予測期間中に比較的高いCAGRで成長すると予測されていることは注目に値します。

当レポートでお答えする主な質問

- 現在、何社がこの市場に参入しているか?

- この市場の主要企業はどこか?

- この市場の進化に影響を与えそうな要因は何か?

- 現在と将来の市場規模は?

- この市場のCAGRは?

- 現在および将来の市場機会は主要市場セグメントにどのように分配されそうか?

当レポートを購入する理由

- 当レポートは包括的な市場分析を提供し、市場全体と特定のサブセグメントに関する詳細な収益予測を提供します。この情報は、すでに市場をリードしている企業にとっても、新規参入企業にとっても貴重なものです。

- 利害関係者は、市場内の競争力学をより深く理解するためにレポートを活用することができます。競合情勢を分析することで、企業は、市場でのポジショニングを最適化し、効果的な市場参入戦略を開発するために、情報に基づいた意思決定を行うことができます。

- 当レポートは、主要促進要因・市場抑制要因・課題など、市場の包括的な概要を利害関係者に提供します。この情報は、利害関係者が市場動向を常に把握し、成長の見込みを活用するためのデータ主導の意思決定を行うための力となります。

その他の特典

- PPTインサイトパック

- レポート内の全分析モジュールの無料エクセルデータパック

- 10%の無料コンテンツカスタマイズ

- 調査チームによる詳細レポートのウォークスルーセッション

- レポートが6~12ヶ月以上前の場合、無料更新レポート

当レポートでは、世界のゲノム編集市場について調査し、市場の概要とともに、技術別、治療タイプ別、遺伝子編集アプローチ別、遺伝子導入方法別、遺伝子導入モダリティ別、応用分野別、エンドユーザータイプ別、主要参入企業別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

セクションI:レポートの概要

第1章 背景

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクションII:定性的な洞察

第5章 エグゼクティブサマリー

第6章 イントロダクション

- 章の概要

- 遺伝子編集イントロダクション

- ゲノム編集技術の応用

- その他の新興技術

- 結論

セクションIII:競合情勢

第7章 市場情勢ゲノム編集技術

- 章の概要

- ゲノム編集:技術情勢

- ゲノム編集:技術プロバイダーの情勢

第8章 技術競争力分析

- 章の概要

- 前提/主要パラメータ

- 調査手法

- 技術競争力分析

セクションIV: 企業プロファイル

第9章 ゲノム編集市場:北米に拠点を置く企業プロファイル

- 章の概要

- Arcturus Therapeutics

- Arsenal Bio

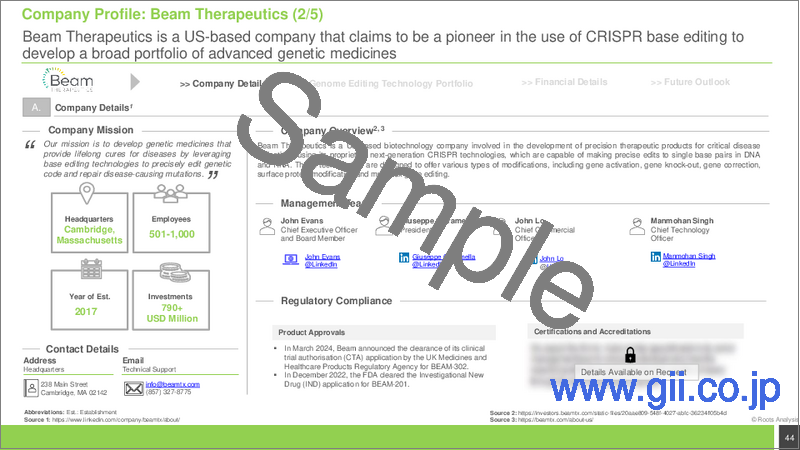

- Beam Therapeutics

- Caribou Biosciences

- Century Therapeutics

- CRISPR Therapeutics

- Editas Medicine

- Intellia Therapeutics

- Prime Medicine

- Vor Biopharma

第10章 ゲノム編集市場:欧州に拠点を置く企業プロファイル

- 章の概要

- Avectas

- Bio-Sourcing

- Flash Therapeutics

- Ntrans Technologies

- OXGENE(Acquired by WuXi AppTec)

- Revvity(formerly known as Horizon Discovery)

第11章 ゲノム編集市場:アジア太平洋およびその他の地域に拠点を置く企業プロファイル

- 章の概要

- Edigene

- Fortgen

- G+FLAS Life Sciences

- TargetGene Biotechnologies

セクションV: 市場動向

第12章 パートナーシップとコラボレーション

- 章の概要

- パートナーシップモデル

- ゲノム編集技術:パートナーシップとコラボレーション

第13章 特許分析

- 章の概要

- 範囲と調査手法

- ゲノム編集分野:特許分析

- ゲノム編集分野:特許ベンチマーク分析

- 特許評価分析

第14章 資金調達と投資分析

- 章の概要

- 資金調達モデル

- ゲノム編集市場:資金調達と投資分析

- 結論

セクションVI:市場機会分析

第15章 市場影響分析:促進要因、抑制要因、機会、課題

- 章の概要

- 市場の促進要因

- 市場の抑制要因

- 市場の機会

- 市場の課題

- 結論

第16章 ゲノム編集技術市場

- 章の概要

- 前提と調査手法

- ゲノム編集技術市場:2035年までの予測

- 主要な市場セグメンテーション

第17章 ゲノム編集技術市場(決済方法別)

第18章 ゲノム編集技術市場(遺伝子編集技術タイプ別)

第19章 ゲノム編集技術市場(遺伝子編集アプローチ別)

第20章 ゲノム編集技術市場(遺伝子導入方法別)

第21章 ゲノム編集技術市場(遺伝子導入モダリティ別)

第22章 ゲノム編集技術市場(治療タイプ別)

第23章 ゲノム編集技術市場(応用分野別)

第24章 ゲノム編集技術市場(エンドユーザー別)

第25章 ゲノム編集技術市場(主要地域別)

第26章 ゲノム編集技術市場:主要業界参入企業

セクションVII:その他の独占的洞察

第27章 結論

第28章 エグゼクティブ洞察

セクションVIII: 付録

第29章 付録1表形式データ

第30章 付録2企業・団体一覧

List of Tables

- Table 7.1 List of Genome Editing Technologies

- Table 7.2 Genome Editing Technologies: Information on Type of Gene Editing Technique

- Table 7.3 Genome Editing Technologies: Information on Type of Gene Editing Approach

- Table 7.4 Genome Editing Technologies: Information on Type of Gene Delivery Method

- Table 7.5 Genome Editing Technologies: Information on Type of Gene Delivery Modality

- Table 7.6 Genome Editing Technologies: Information on Highest Phase of Drug Development Supported

- Table 7.7 Genome Editing Technologies: Information on Therapeutic Area

- Table 7.8 Genome Editing Technologies: Information on Application Area

- Table 7.9 Genome Editing Technologies: List of Technology Providers

- Table 7.10 Genome Editing Technology Providers: Information on Operational Model

- Table 7.11 Genome Editing Technology Providers: Information on Product Centric Model and Technology Centric Model

- Table 8.1 Genome Editing Technologies Provided by Players Headquartered in North America

- Table 8.2 Genome Editing Technologies Provided by Players Headquartered in Europe

- Table 8.3 Genome Editing Technologies Provided by Players Headquartered in Asia-Pacific, Middle East and North Africa, and Latin America

- Table 9.1 Genome Editing Technology Providers: List of Companies Profiled

- Table 9.2 Arcturus Therapeutics: Company Overview

- Table 9.3 Arcturus Therapeutics: Technology Portfolio

- Table 9.4 Arcturus Therapeutics: Recent Developments and Future Outlook

- Table 9.5 Arsenal Bio: Company Overview

- Table 9.6 Arsenal Bio: Technology Portfolio

- Table 9.7 Arsenal Bio: Recent Developments and Future Outlook

- Table 9.8 Beam Therapeutics: Company Overview

- Table 9.9 Beam Therapeutics: Technology Portfolio

- Table 9.10 Beam Therapeutics: Recent Developments and Future Outlook

- Table 9.11 Caribou Biosciences: Company Overview

- Table 9.12 Caribou Biosciences: Technology Portfolio

- Table 9.13 Caribou Biosciences: Recent Developments and Future Outlook

- Table 9.14 Century Therapeutics: Company Overview

- Table 9.15 Century Therapeutics: Technology Portfolio

- Table 9.16 Century Therapeutics: Recent Developments and Future Outlook

- Table 9.17 CRISPR Therapeutics: Company Overview

- Table 9.18 CRISPR Therapeutics: Technology Portfolio

- Table 9.19 CRISPR Therapeutics: Recent Developments and Future Outlook

- Table 9.20 Editas Medicine: Company Overview

- Table 9.21 Editas Medicine: Technology Portfolio

- Table 9.22 Editas Medicine: Recent Developments and Future Outlook

- Table 9.23 Intellia Therapeutics: Company Overview

- Table 9.24 Intellia Therapeutics: Technology Portfolio

- Table 9.25 Intellia Therapeutics: Recent Developments and Future Outlook

- Table 9.26 Prime Medicine: Company Overview

- Table 9.27 Prime Medicine: Technology Portfolio

- Table 9.28 Prime Medicine: Recent Developments and Future Outlook

- Table 9.29 Vor Biopharma: Company Overview

- Table 9.30 Vor Biopharma: Technology Portfolio

- Table 9.31 Vor Biopharma: Recent Developments and Future Outlook

- Table 10.1 Genome Editing Technology Providers: List of Companies Profiled

- Table 10.2 Avectas: Company Overview

- Table 10.3 Avectas: Technology Portfolio

- Table 10.4 Bio-Sourcing: Company Overview

- Table 10.5 Bio-Sourcing: Technology Portfolio

- Table 10.6 Flash BioSolutions: Company Overview

- Table 10.7 Flash BioSolutions: Technology Portfolio

- Table 10.8 Ntrans Technologies: Company Overview

- Table 10.9 Ntrans Technologies: Technology Portfolio

- Table 10.10 OXGENE: Company Overview

- Table 10.11 OXGENE: Technology Portfolio

- Table 10.12 Revvity: Company Overview

- Table 10.13 Revvity: Technology Portfolio

- Table 11.1 Genome Editing Technology Providers: List of Companies Profiled

- Table 11.2 Edigene: Company Overview

- Table 11.3 Edigene: Technology Portfolio

- Table 11.4 Fortgen: Company Overview

- Table 11.5 Fortgen: Technology Portfolio

- Table 11.6 G+FLAS Life Sciences: Company Overview

- Table 11.7 G+FLAS Life Sciences: Technology Portfolio

- Table 11.8 TargetGene Biotechnologies: Company Overview

- Table 11.9 TargetGene Biotechnologies: Technology Portfolio

- Table 12.1 Genome Editing Market: List of Partnerships and Collaborations

- Table 12.2 Technology Licensing / Integration Agreements: Information on Purpose of Partnership

- Table 12.3 Partnerships and Collaborations: Information on Type of Agreement

- Table 13.1 Patent Analysis: Top CPC Sections

- Table 13.2 Patent Analysis: Top CPC Symbols

- Table 13.3 Patent Analysis: Top CPC Codes

- Table 13.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 13.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 13.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 14.1 Genome Editing Market: List of Funding and Investments

- Table 16.1 Genome Editing Technologies: Average Upfront Payment and Average Milestone Payment, 2018-2024 (USD Million)

- Table 16.2 Licensing Deals: Tranches of Milestone Payments

- Table 26.1 Leading Industry Players: Based on General Market Understanding

- Table 26.2 Leading Industry Players: Based on Funding Amount Invested (USD Million)

- Table 26.3 Leading Industry Players: Based on Number of Technology Licensing / Integration Deals

- Table 28.1 Prorenata Biotech: Company Snapshot

- Table 29.1 Genome Editing Technologies: Distribution by Type of Gene Editing Technique

- Table 29.2 Genome Editing Technologies: Distribution by Type of Gene Editing Approach

- Table 29.3 Genome Editing Technologies: Distribution by Type of Gene Delivery Method

- Table 29.4 Genome Editing Technologies: Distribution by Type of Gene Delivery Modality

- Table 29.5 Genome Editing Technologies: Distribution by Highest Phase of Drug Development Supported

- Table 29.6 Genome Editing Technologies: Distribution by Therapeutic Area

- Table 29.7 Genome Editing Technologies: Distribution by Application Area

- Table 29.8 Genome Editing Technology Providers: Distribution by Year of Establishment

- Table 29.9 Genome Editing Technology Providers: Distribution by Company Size

- Table 29.10 Genome Editing Technology Providers: Distribution by Location of Headquarters

- Table 29.11 Genome Editing Technology Providers: Distribution by Company Size and Location of Headquarters

- Table 29.12 Most Active Players: Distribution by Number of Technologies

- Table 29.13 Genome Editing Technology Providers: Distribution by Operational Model

- Table 29.14 Genome Editing Technology Providers: Distribution by Product Centric Model

- Table 29.15 Genome Editing Technology Providers: Distribution by Technology Centric Model

- Table 29.16 Arcturus Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.17 Beam Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.18 Caribou Biosciences: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.19 Century Therapeutics: Annual Revenues, Since FY 2022 (USD Million)

- Table 29.20 CRISPR Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.21 Editas Medicine: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.22 Intellia Therapeutics: Annual Revenues, Since FY 2021 (USD Million)

- Table 29.23 Partnerships and Collaborations: Cumulative Year-wise Trend

- Table 29.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 29.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 29.26 Technology Licensing Agreements / Technology Integration Agreements: Distribution by Purpose of Partnership

- Table 29.27 Partnerships and Collaborations: Distribution by Type of Partner

- Table 29.28 Partnerships and Collaborations: Distribution by Location of Headquarters of Partner

- Table 29.29 Most Active Players: Distribution by Number of Partnerships

- Table 29.30 Partnership and Collaborations: Local and International Agreements

- Table 29.31 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 29.32 Patent Analysis: Distribution by Type of Patent

- Table 29.33 Patent Analysis: Distribution by Patent Application Year

- Table 29.34 Patent Analysis: Distribution by Patent Publication Year

- Table 29.35 Patent Analysis: Distribution by Type of Patents and Publication Year

- Table 29.36 Patent Analysis: Distribution by Patent Jurisdiction

- Table 29.37 Patent Analysis: Cumulative Year-wise Trend by Type of Applicant

- Table 29.38 Leading Industry Players: Distribution by Number of Patents

- Table 29.39 Leading Non-Industry Players: Distribution by Number of Patents

- Table 29.40 Leading Individual Assignees: Distribution by Number of Patents

- Table 29.41 Patent Analysis: Distribution by Patent Age

- Table 29.42 Genome editing: Patent Valuation

- Table 29.43 Funding and Investment Analysis: Cumulative Year-wise Trend

- Table 29.44 Funding and Investment Analysis: Cumulative Year-wise Trend of Amount Invested (USD Million)

- Table 29.45 Funding and Investment Analysis: Distribution of Funding Instances by Type of Funding

- Table 29.46 Funding and Investment Analysis: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 29.47 Funding and Investment Analysis: Distribution by Year and Type of Funding

- Table 29.48 Funding and Investments: Distribution of Funding Instances by Geography

- Table 29.49 Most Active Players: Distribution by Amount Invested and Number of Funding Instances

- Table 29.50 Leading Investors: Distribution by Number of Funding Instances

- Table 29.51 Global Genome Editing Technologies Market, Forecasted Estimates, till 2035 (USD Billion)

- Table 29.52 Global Genome Editing Technologies Market, Forecasted Estimates, till 2035: Conservative Scenario (USD Billion)

- Table 29.53 Global Genome Editing Technologies Market, Forecasted Estimates, till 2035: Optimistic Scenario (USD Billion)

- Table 29.54 Genome Editing Technologies Market: Distribution by Type of Payment Method Employed

- Table 29.55 Genome Editing Technologies Market for Milestone Payments: Forecasted Estimates, till 2035 (USD Million)

- Table 29.56 Genome Editing Technologies Market for Upfront Payments: Forecasted Estimates, till 2035 (USD Million)

- Table 29.57 Genome Editing Technologies Market: Distribution by Type of Gene Editing Technique

- Table 29.58 Genome Editing Technologies Market for CRISPR-Cas System: Forecasted Estimates, till 2035 (USD Million)

- Table 29.59 Genome Editing Technologies Market for TALENs: Forecasted Estimates, till 2035 (USD Million)

- Table 29.60 Genome Editing Technologies Market for Meganucleases: Forecasted Estimates, till 2035 (USD Million)

- Table 29.61 Genome Editing Technologies Market for ZFNs: Forecasted Estimates, till 2035 (USD Million)

- Table 29.62 Genome Editing Technologies Market for Other Techniques: Forecasted Estimates, till 2035 (USD Million)

- Table 29.63 Genome Editing Technologies Market: Distribution by Type of Gene Editing Approach

- Table 29.64 Genome Editing Technologies Market for Gene Knock-Out: Forecasted Estimates, till 2035 (USD Million)

- Table 29.65 Genome Editing Technologies Market for Gene Knock-In: Forecasted Estimates, till 2035 (USD Million)

- Table 29.66 Genome Editing Technologies Market: Distribution by Type of Gene Delivery Method

- Table 29.67 Genome Editing Technologies Market for Ex vivo: Forecasted Estimates, till 2035 (USD Million)

- Table 29.68 Genome Editing Technologies Market for In vivo: Forecasted Estimates, till 2035 (USD Million)

- Table 29.69 Genome Editing Technologies Market: Distribution by Type of Gene Delivery Modality

- Table 29.70 Genome Editing Technologies Market for Viral Vectors: Forecasted Estimates, till 2035 (USD Million)

- Table 29.71 Genome Editing Technologies Market for Non-Viral Vectors: Forecasted Estimates, till 2035 (USD Million)

- Table 29.72 Genome Editing Technologies Market: Distribution by Type of Therapy

- Table 29.73 Genome Editing Technologies Market for Cell Therapies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.74 Genome Editing Technologies Market for Gene Therapies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.75 Genome Editing Technologies Market for Other Therapies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.76 Genome Editing Technologies Market: Distribution by Application Area

- Table 29.77 Genome Editing Technologies Market for Drug Discovery and Development: Forecasted Estimates, till 2035 (USD Million)

- Table 29.78 Genome Editing Technologies Market for Diagnostics: Forecasted Estimates, till 2035 (USD Million)

- Table 29.79 Genome Editing Technologies Market: Distribution by Type of End-User

- Table 29.80 Genome Editing Technologies Market for Pharmaceutical and Biotechnology Companies: Forecasted Estimates, till 2035 (USD Million)

- Table 29.81 Genome Editing Technologies Market for Academic and Research Institutes: Forecasted Estimates, till 2035 (USD Million)

- Table 29.82 Genome Editing Technologies Market: Distribution by Geographical Regions

- Table 29.83 Genome Editing Technologies Market in North America: Forecasted Estimates, till 2035 (USD Million)

- Table 29.84 Genome Editing Technologies Market in the US: Forecasted Estimates, till 2035 (USD Million)

- Table 29.85 Genome Editing Technologies Market in Canada: Forecasted Estimates, till 2035 (USD Million)

- Table 29.86 Genome Editing Technologies Market in Europe: Forecasted Estimates till 2035 (USD Million)

- Table 29.87 Genome Editing Technologies Market in Germany: Forecasted Estimates till 2035 (USD Million)

- Table 29.88 Genome Editing Technologies Market in France: Forecasted Estimates till 2035 (USD Million)

- Table 29.89 Genome Editing Technologies Market in Ireland: Forecasted Estimates till 2035 (USD Million)

- Table 29.90 Genome Editing Technologies Market in Asia-Pacific: Forecasted Estimates, till 2035 (USD Million)

- Table 29.91 Genome Editing Technologies Market in South Korea: Forecasted Estimates, till 2035 (USD Million)

- Table 29.92 Genome Editing Technologies Market in China: Forecasted Estimates, till 2035 (USD Million)

- Table 29.93 Genome Editing Technologies Market in Japan: Forecasted Estimates, till 2035 (USD Million)

GENOME EDITING MARKET: OVERVIEW

As per Roots Analysis, the global genome editing market size is currently valued at USD 3.41 billion in 2024, is projected to reach USD 4.25 billion in the current year and USD 13.36 billion by 2035, growing at a CAGR of 12.1% during the forecast period.

The opportunity for genome editing market has been distributed across the following segments:

Payment Method Employed

- Upfront Payments

- Milestone Payments

Type of Gene Editing Technique

- CRISPR-Cas System

- TALENs

- Meganucleases

- ZFNs

- Other Techniques

Gene Editing Approach

- Gene Knock-out

- Gene Knock-in

Gene Delivery Methods

- Ex vivo

- In vivo

Gene Delivery Modality

- Viral Vectors

- Non-Viral Vectors

Type of Therapy

- Cell Therapies

- Gene Therapies

- Other Therapies

Application Area

- Drug Discovery and Development

- Diagnostics

Type of End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

Key Geographical Regions

- North America (US, Canada)

- Europe (Germany, France and Ireland)

- Asia-Pacific (South Korea, China and Japan)

GENOME EDITING MARKET: GROWTH AND TRENDS

The human genome comprises nearly three billion nucleotide base pairs, which contain ~20,000-25,000 protein-coding genes. These genes act as a code that regulates and controls protein synthesis, thereby influencing gene expression. The ongoing advancements in the biotechnology domain have enabled various medical researchers to modify human genome expression through specialized techniques called genome editing or genome engineering. Genome editing, also known as gene editing, is a technique that allows genome modification by inserting, deleting or replacing a single gene or a set of genes in an organism, thereby altering the nucleotide composition. The growing need for genome editing at the desired site has led to the development of various genome editing tools by companies engaged in this domain. Key technologies include zinc finger nucleases (ZFNs), transcription activator-like effector nucleases (TALENs) and CRISPR technology. Notably, ZFN was the first genome engineering technique discovered in 1895, followed by TALENs (in 2011) and CRISPR, which emerged as a transformative breakthrough in the genome editing domain. These gene editing tools have been widely used for the treatment of various clinical conditions developed as a result of genetic abnormalities, such as sickle cell disease, Parkinson's disease, peripheral artery disease, spinal muscular atrophy, autoimmune diseases, and other genetic disorders.

Moreover, gene therapies have gained prominence as a promising approach to addressing the underlying genetic abnormalities by introducing therapeutic genes into the cells or by replacing mutated genes. As of April 2024, over 1,100 active clinical trials are investigating gene therapies at various stages of development. According to the WHO, 10 out of every 1,000 individuals suffer from genetic disorders, affecting more than 70 million people worldwide. Further, more than 40% of infant mortality globally is associated with various genetic disorders. Despite its potential, gene edited drug development requires substantial investment in drug discovery, development, and manufacturing. Therefore, in order to ensure the efficiency, precision and safe delivery of these drugs, pharmaceutical companies are increasingly adopting advanced genome editing technologies. As a result, there is a growing emphasis on integrating cutting-edge technologies to enhance clinical outcomes through precise genetic modifications.

The ongoing pace of innovation in the genome editing domain, coupled with the promising clinical trial results in cell and gene therapies are driving the industry forward. Additionally, the expanding applications of gene editing in agriculture and food security are further propelling the market growth.

GENOME EDITING MARKET: KEY INSIGHTS

The report delves into the current state of the genome editing market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

Close to 85% of technologies use CRISPR-Cas technique; of these, nearly 30% enable the delivery of the CRISPR tool directly into the cells, primarily utilized for drug discovery and regenerative medicine.

A steady growth in partnership activity has been observed in recent years; technology licensing agreements have emerged as the most prominent type of partnership model.

Over 2,400 patents related to genome editing have been filed by / granted to various technology developers in order to protect the intellectual property generated within this field.

- Foreseeing lucrative returns, many public and private investors have made investments worth USD 14.1 billion since 2018; the funding activity in this domain is well distributed across different geographical regions.

- The genome editing technologies market is anticipated to witness an annualized growth rate of 12.1% over the next decade.

- The market opportunity for technologies being developed for pharmaceutical and biotechnology companies is likely to be the highest; in terms of type of therapy, gene therapy segment is anticipated to grow substantially.

GENOME EDITING MARKET: KEY SEGMENTS

Based on the type of Payment Mode Employed, Upfront Payments Captures the Majority of the Current Market Share

Based on the type of payment method employed, the global genome editing market is segmented into upfront payments and milestone payments. Presently, the upfront payment segment occupies the highest share of the overall market. However, it is important to note that the milestone payment segment is anticipated to witness significant growth during the forecast period.

CRISPR-Cas System is Likely to Hold the Largest Share in the Genome Editing Market During the Forecast Period

Based on the type of gene editing techniques, the global genome editing market is segmented into CRISPR-Cas Systems, TALENs, Meganucleases, ZFNs, and others. Currently, CRISP-Case systems segment leads the genome editing market. Further, it is important to highlight that this trend is unlikely to change in the future as well. This trend can be attributed to the fact that next-generation CRISPR technologies have emerged as a promising technique to overcome the limitations associated with conventional gene editing techniques, by offering more customized and precise results.

Genome Editing Market for Gene Knock-out is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the type of gene editing approach, the global genome editing market is segmented across gene knock-in and gene knock-out approaches. Presently, the market is dominated by the revenues generated through gene knock-out approach. This can be attributed to the greater feasibility and accessibility of this approach, in comparison to knock-in approach, since knock-in approaches require a complex optimization process.

Genome Editing Market for In-vivo is Likely to Grow at a Higher CAGR During the Forecast Period

Based on the gene delivery method, the global genome editing market is segmented into ex-vivo and in-vivo. Currently, the ex-vivo segment captures the maximum share of the genome editing market. This can be attributed to the fact that in ex vivo gene delivery, cells are taken from the patient, modified in the lab and then reintroduced into the body. This allows precise control over the genetic modification in a lab setting, while minimizing the associated off-target effects. However, the in-vivo segment is likely to grow at a relatively higher CAGR during the forecast period.

Viral Vectors are Likely to Dominate the Genome Editing Market During the Forecast Period

Based on the gene delivery modality, the global genome editing market is distributed across viral vectors and non-viral vectors. Presently, the viral vector segment occupies the highest share of the genome editing market. However, due to various challenges associated with the use of viral vectors as gene modality (such as cytotoxicity, immunogenicity and scale-up issues), this trend is anticipated to change in the coming years, with non-viral vectors occupying an approximately equal market share in the overall market.

Cell Therapies Hold the Largest Share in the Genome Editing Market

Based on the type of therapy, the global genome editing market is segmented into cell therapies, gene therapies, and others. Presently, the cell therapies segment accounts for the largest market share. Additionally, owing to its wider applicability in treating a wide array of diseases this trend is unlikely to change in the future as well.

Drug Discovery and Development Hold the Largest Share in the Genome Editing Market

Based on the application area, the global genome editing market is segmented into drug discovery and development, and diagnostics. Currently, drug discovery and development segment capture the majority of the market share.

Revenues Generated from Pharmaceutical and Biotechnology Companies are Likely to Dominate the Genome Editing Market During the Forecast Period

Based on the end-user, the global genome editing market is distributed across pharmaceutical and biotechnology companies, and academic and research institutions. Notably, the pharmaceutical and biotechnology segment captures the majority of the genome editing market. This is due to the fact that pharmaceutical and biotechnology companies have signed maximum technology licensing / integration agreements in this domain, thus contributing to the majority of the revenue generated by industry players.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, and Asia Pacific. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that Europe is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Genome Editing Market

- Arcturus Therapeutics

- ArsenalBio

- Avectas

- Beam Therapeutics

- Bio-Sourcing

- Caribou Biosciences

- Century Therapeutics

- CRISPR Therapeutics

- Editas Medicine

- Flash Biosolutions

- Graphite Bio

- Intellia Therapeutics

- NTrans Technologies

- OXGENE

- Prime Medicine

- Revvity

- Vor Biopharma

GENOME EDITING MARKET: RESEARCH COVERAGE

The report on the genome editing market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of genome editing market, focusing on key market segments, including [A] payment method employed, [B] type of gene editing technique, [C] gene editing approach, [D] gene delivery methods, [E] gene delivery modality, [F] type of therapy, [G] application area, [H] type of end-user, [I] key geographical regions, and [J] leading industry players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of genome editing technologies, based on several relevant parameters, such as [A] type of gene editing technique, [B] type of gene editing approach, [C] type of gene delivery method, [D] type of gene delivery modality, [E] highest phase of drug development supported, [F] therapeutic area, and [G] application area.

- Genome Editing Technology Providers Landscape: The report features a list of technology providers engaged in the genome editing domain, along with analyses based on [A] year of establishment, [B] company size, and [C] location of headquarters, [D] most active players, and [E] operational model.

- Technology Competitiveness Analysis: An insightful competitiveness analysis of the genome technologies in this domain, based on various relevant parameters, such as [A] company strength, and [B] technology strength.

- Company Profiles: Comprehensive profiles of key industry players in the genome editing domain based in regions, such as North America, Europe, and Asia-Pacific and rest of the world, featuring information on [A] company overview, [B] financial information (if available), [C] technology portfolio, [D] recent developments, and [E] future outlook statements.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the genome editing market, since 2018, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] purpose of partnership, [D] type of partner, [E] location of headquarters of partner, [F] most active players (in terms of number of partnerships), and [G] geography.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted by various technology providers related to genome editing, since 2018, based on various relevant parameters, such as [A] type of patent, [B] publication year, [C] geography, [D] CPC symbols, [E] leading industry players (in terms of number of patents), [F] patent benchmarking, [G] patent characteristics, [H] leading industry players, and [I] patent valuation.

- Funding and Investments Analysis: A detailed analysis of the various funding and investments raised in the genome editing domain, based on several relevant parameters, such as [A] year of funding, [B] amount of funding, [C] type of funding, [D] geography, [E] most active players (in terms of number of funding instances), and [F] leading investors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Introduction to Gene Editing

- 6.2.1. Evolution of Gene Editing

- 6.2.2. Gene Editing Technologies

- 6.2.2.1. CRISPR - CAS System

- 6.2.2.2. Transcription Activator-Like Effector Nucleases (TALENs)

- 6.2.2.3. Zinc Finger Nucleases (ZFNs)

- 6.2.2.4. Meganucleases / Homing Endonucleases

- 6.3. Applications of Genome Editing Technologies

- 6.4. Other Emerging Technologies

- 6.5. Concluding Remarks

SECTION III: COMPETITIVE LANDSCAPE

7. MARKET LANDSCAPE: GENOME EDITING TECHNOLOGIES

- 7.1. Chapter Overview

- 7.2. Genome Editing: Technology Landscape

- 7.2.1. Analysis by Type of Gene Editing Technique

- 7.2.2. Analysis by Type of Gene Editing Approach

- 7.2.3. Analysis by Type of Gene Delivery Method

- 7.2.4. Analysis by Type of Gene Delivery Modality

- 7.2.5. Analysis by Highest Phase of Drug Development Supported

- 7.2.6. Analysis by Therapeutic Area

- 7.2.7. Analysis by Application Area

- 7.3. Genome Editing: Technology Providers Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Company Size and Location of Headquarters

- 7.3.5. Most Active Players: Analysis by Number of Technologies

- 7.3.6. Analysis by Operational Model

8. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions / Key Parameters

- 8.3. Methodology

- 8.4. Technology Competitiveness Analysis

- 8.4.1. Genome Editing Technologies Offered by Players Headquartered in North America

- 8.4.2. Genome Editing Technologies Offered by Players Headquartered in Europe

- 8.4.3. Genome Editing Technologies Offered by Players Headquartered in Asia-Pacific, Middle East and North Africa, and Latin America

SECTION IV: COMPANY PROFILES

9. GENOME EDITING MARKET: COMPANY PROFILES OF PLAYERS BASED IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2. Arcturus Therapeutics

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Technology Portfolio

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Arsenal Bio

- 9.3.1. Company Overview

- 9.3.2. Technology Portfolio

- 9.3.3. Recent Developments and Future Outlook

- 9.4. Beam Therapeutics

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Technology Portfolio

- 9.4.4. Recent Developments and Future Outlook

- 9.5. Caribou Biosciences

- 9.5.1. Company Overview

- 9.5.2. Financial Information

- 9.5.3. Technology Portfolio

- 9.5.4. Recent Developments and Future Outlook

- 9.6. Century Therapeutics

- 9.6.1. Company Overview

- 9.6.2. Financial Information

- 9.6.3. Technology Portfolio

- 9.6.4. Recent Developments and Future Outlook

- 9.7. CRISPR Therapeutics

- 9.7.1. Company Overview

- 9.7.2. Financial Information

- 9.7.3. Technology Portfolio

- 9.7.4. Recent Developments and Future Outlook

- 9.8. Editas Medicine

- 9.8.1. Company Overview

- 9.8.2. Financial Information

- 9.8.3. Technology Portfolio

- 9.8.4. Recent Developments and Future Outlook

- 9.9. Intellia Therapeutics

- 9.9.1. Company Overview

- 9.9.2. Financial Information

- 9.9.3. Technology Portfolio

- 9.9.4. Recent Developments and Future Outlook

- 9.10. Prime Medicine

- 9.10.1. Company Overview

- 9.10.2. Technology Portfolio

- 9.10.3. Recent Developments and Future Outlook

- 9.11. Vor Biopharma

- 9.11.1. Company Overview

- 9.11.2. Technology Portfolio

- 9.11.3. Recent Developments and Future Outlook

10. GENOME EDITING MARKET: COMPANY PROFILES OF PLAYERS BASED IN EUROPE

- 10.1. Chapter Overview

- 10.2. Avectas

- 10.2.1. Company Overview

- 10.2.2. Technology Portfolio

- 10.3. Bio-Sourcing

- 10.3.1. Company Overview

- 10.3.2. Technology Portfolio

- 10.4. Flash Therapeutics

- 10.4.1. Company Overview

- 10.4.2. Technology Portfolio

- 10.5. Ntrans Technologies

- 10.5.1. Company Overview

- 10.5.2. Technology Portfolio

- 10.6. OXGENE (Acquired by WuXi AppTec)

- 10.6.1. Company Overview

- 10.6.2. Technology Portfolio

- 10.7. Revvity (formerly known as Horizon Discovery)

- 10.7.1. Company Overview

- 10.7.2. Technology Portfolio

11. GENOME EDITING MARKET: COMPANY PROFILES OF PLAYERS BASED IN ASIA-PACIFIC AND REST OF THE WORLD

- 11.1. Chapter Overview

- 11.2. Edigene

- 11.2.1. Company Overview

- 11.2.2. Technology Portfolio

- 11.3. Fortgen

- 11.3.1. Company Overview

- 11.3.2. Technology Portfolio

- 11.4. G+FLAS Life Sciences

- 11.4.1. Company Overview

- 11.4.2. Technology Portfolio

- 11.5. TargetGene Biotechnologies

- 11.5.1. Company Overview

- 11.5.2. Technology Portfolio

SECTION V: MARKET TRENDS

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Genome Editing Technologies: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Purpose of Partnership

- 12.3.5. Analysis by Type of Partner

- 12.3.6. Analysis by Location of Headquarters of Partner

- 12.3.7. Most Active Players: Analysis by Number of Partnerships

- 12.3.8. Analysis by Geography

- 12.3.8.1. Local and International Agreements

- 12.3.8.2. Intercontinental and Intracontinental Agreements

13. PATENT ANALYSIS

- 13.1. Chapter Overview

- 13.2. Scope and Methodology

- 13.3. Genome Editing Domain: Patent Analysis

- 13.3.1. Analysis by Publication Year

- 13.3.2. Analysis by Type of Patent and Publication Year

- 13.3.3. Analysis by Geography

- 13.3.4. Analysis by CPC Symbols

- 13.3.5. Leading Industry Players: Analysis by Number of Patents

- 13.4. Genome Editing Domain: Patent Benchmarking Analysis

- 13.4.1. Analysis by Patent Characteristics

- 13.4.2. Analysis by Leading Industry Players

- 13.5. Patent Valuation Analysis

14. FUNDING AND INVESTMENT ANALYSIS

- 14.1. Chapter Overview

- 14.2. Funding Models

- 14.3. Genome Editing Market: Funding and Investment Analysis

- 14.3.1. Analysis by Year of Funding

- 14.3.1.1. Cumulative Year-wise Trend of Funding Instances

- 14.3.1.2. Cumulative Year-wise Trend of Amount Invested

- 14.3.2. Analysis by Type of Funding

- 14.3.2.1. Analysis by Funding Instances

- 14.3.2.2. Analysis by Amount Invested

- 14.3.3. Analysis by Year and Type of Funding

- 14.3.4. Analysis by Geography

- 14.3.5. Most Active Players: Analysis by Amount Invested and Number of Funding Instances

- 14.3.6. Leading Investors: Analysis by Number of Funding Instances

- 14.3.1. Analysis by Year of Funding

- 14.4. Concluding Remarks

SECTION VI: MARKET OPPORTUNITY ANALYSIS

15. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 15.1. Chapter Overview

- 15.2. Market Drivers

- 15.3. Market Restraints

- 15.4. Market Opportunities

- 15.5. Market Challenges

- 15.6. Conclusion

16. GENOME EDITING TECHNOLOGIES MARKET

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Genome Editing Technologies Market: Forecasted Estimates, till 2035

- 16.3.1. Scenario Analysis

- 16.3.1.1. Conservative Scenario

- 16.3.1.2. Optimistic Scenario

- 16.3.1. Scenario Analysis

- 16.4. Key Market Segmentations

17. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF PAYMENT METHOD EMPLOYED

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Genome Editing Technologies Market: Distribution by Type of Payment Method Employed

- 17.3.1. Genome Editing Technologies Market for Milestone Payments: Forecasted Estimates, till 2035

- 17.3.2. Genome Editing Technologies Market for Upfront Payments: Forecasted Estimates, till 2035

- 17.4. Data Triangulation

18. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF GENE EDITING TECHNIQUE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Genome Editing Technologies Market: Distribution by Type of Gene Editing Technique

- 18.3.1. Genome Editing Technologies Market for CRISPR-Cas System: Forecasted Estimates, till 2035

- 18.3.2. Genome Editing Technologies Market for TALENs: Forecasted Estimates, till 2035

- 18.3.3. Genome Editing Technologies Market for Meganucleases: Forecasted Estimates, till 2035

- 18.3.4. Genome Editing Technologies Market for ZFNs: Forecasted Estimates, till 2035

- 18.3.5. Genome Editing Technologies Market for Other Techniques: Forecasted Estimates, till 2035

- 18.4. Data Triangulation

19. GENOME EDITING TECHNOLOGIES MARKET, BY GENE EDITING APPROACH

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Genome Editing Technologies Market: Distribution by Gene Editing Approach

- 19.3.1. Genome Editing Technologies Market for Gene Knock-Out Approaches: Forecasted Estimates, till 2035

- 19.3.2. Genome Editing Technologies Market for Gene Knock-In Approaches: Forecasted Estimates, till 2035

- 19.4. Data Triangulation

20. GENOME EDITING TECHNOLOGIES MARKET, BY GENE DELIVERY METHOD

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Genome Editing Technologies Market: Distribution by Gene Delivery Method

- 20.3.1. Genome Editing Technologies Market for Ex Vivo Delivery Methods: Forecasted Estimates, till 2035

- 20.3.2. Genome Editing Technologies Market for In Vivo Delivery Methods: Forecasted Estimates, till 2035

- 20.4. Data Triangulation

21. GENOME EDITING TECHNOLOGIES MARKET, BY GENE DELIVERY MODALITY

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Genome Editing Technologies Market: Distribution by Gene Delivery Modality

- 21.3.1. Genome Editing Technologies Market for Viral Vectors: Forecasted Estimates, till 2035

- 21.3.2. Genome Editing Technologies Market for Non-Viral Vectors: Forecasted Estimates, till 2035

- 21.4. Data Triangulation

22. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF THERAPY

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Genome Editing Technologies Market: Distribution by Type of Therapy

- 22.3.1. Genome Editing Technologies Market for Cell Therapies: Forecasted Estimates, till 2035

- 22.3.2. Genome Editing Technologies Market for Gene Therapies: Forecasted Estimates, till 2035

- 22.3.3. Genome Editing Technologies Market for Other Therapies: Forecasted Estimates, till 2035

- 22.4. Data Triangulation

23. GENOME EDITING TECHNOLOGIES MARKET, BY APPLICATION AREA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Genome Editing Technologies Market: Distribution by Application Area

- 23.3.1. Genome Editing Technologies Market for Drug Discovery and Development: Forecasted Estimates, till 2035

- 23.3.2. Genome Editing Technologies Market for Diagnostics: Forecasted Estimates, till 2035

- 23.4. Data Triangulation

24. GENOME EDITING TECHNOLOGIES MARKET, BY TYPE OF END USER

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Genome Editing Technologies Market: Distribution by Type of End User

- 24.3.1. Genome Editing Technologies Market for Pharmaceutical and Biotechnology Companies: Forecasted Estimates, till 2035

- 24.3.2. Genome Editing Technologies Market for Academic and Research Institutes: Forecasted Estimates, till 2035

- 24.4. Data Triangulation

25. GENOME EDITING TECHNOLOGIES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Genome Editing Technologies Market: Distribution by Key Geographical Regions

- 25.3.1. Genome Editing Technologies Market in North America: Forecasted Estimates, till 2035

- 25.3.1.1. Genome Editing Technologies Market in the US: Forecasted Estimates, till 2035

- 25.3.1.2. Genome Editing Technologies Market in Canada: Forecasted Estimates, till 2035

- 25.3.2. Genome Editing Technologies Market in Europe: Forecasted Estimates, till 2035

- 25.3.2.1. Genome Editing Technologies Market in Germany: Forecasted Estimates, till 2035

- 25.3.2.2. Genome Editing Technologies Market in France: Forecasted Estimates, till 2035

- 25.3.2.3. Genome Editing Technologies Market in Ireland: Forecasted Estimates, till 2035

- 25.3.3. Genome Editing Technologies Market in Asia-Pacific: Forecasted Estimates, till 2035

- 25.3.3.1. Genome Editing Technologies Market in South Korea: Forecasted Estimates, till 2035

- 25.3.3.2. Genome Editing Technologies Market in China: Forecasted Estimates, till 2035

- 25.3.3.3. Genome Editing Technologies Market in Japan: Forecasted Estimates, till 2035

- 25.3.1. Genome Editing Technologies Market in North America: Forecasted Estimates, till 2035

- 25.4. Market Dynamics Assessment

- 25.4.1. Penetration Growth (P-G) Matrix

- 25.5. Data Triangulation

26. GENOME EDITING TECHNOLOGIES MARKET: LEADING INDUSTRY PLAYERS

- 26.1. Chapter Overview

- 26.2. Leading Industry Players