|

市場調査レポート

商品コード

1821505

抗肥満薬市場:2035年までの業界動向と世界の予測 - 分子タイプ別、使用活性化合物別、作用機序別、アゴニストタイプ別、作用経路別、投与経路別、地域別、売上予測、主要企業Anti-Obesity Drugs Market: Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Molecule, Active Compound Used, Mechanism of Action, Agonist, Action Pathway, Route of Administration, Regions, Sales Forecast and Key Players |

||||||

カスタマイズ可能

|

|||||||

| 抗肥満薬市場:2035年までの業界動向と世界の予測 - 分子タイプ別、使用活性化合物別、作用機序別、アゴニストタイプ別、作用経路別、投与経路別、地域別、売上予測、主要企業 |

|

出版日: 2025年09月24日

発行: Roots Analysis

ページ情報: 英文 240 Pages

納期: 即日から翌営業日

|

概要

抗肥満薬市場:概要

世界の抗肥満薬の市場規模は現在の196億米ドルから2035年までに1,049億米ドルに成長すると推定され、予測期間中のCAGRは18.3%となる見込みです。

市場セグメンテーションでは、市場規模および市場機会を以下のパラメータで区分しています。

分子タイプ

- 生物製剤

- 低分子

使用活性化合物

- ティルゼパチド

- セマグルチド

- レタトルチド

- スルボジド

- カグリリンチドおよびセマグルチド

- オルフォグリプロン

- リラグルチド

- その他の活性化合物

作用機序

- GLP-1アゴニスト/GIPアゴニスト

- GLP-1アゴニスト/GCGRアゴニスト

- GLP-1アゴニスト

- GLP-1アゴニスト/アミリンアナログ

- GLP-1/GCGR/GIPアゴニスト

- その他の作用機序

アゴニストタイプ

- シングルアゴニスト

- デュアルアゴニスト

- トリ・アゴニスト

作用経路

- 中枢性作用

- 末梢性作用

- 中枢性作用と末梢性作用

投与経路

- 経口

- 非経口

地域

- 北米

- 欧州

- アジア

- ラテンアメリカ

- 中東・北アフリカ

医薬品売上予測

- コントレイブ/マイシンバ

- フェイスメイ

- イムシブリー

- ロマイラ

- QSYMIA

- サクセンダ

- ウェゴヴィ/ オゼンピック

- ゼップバウンド/ モンジャロ

- BI 456906

- カグリセマ

- HM11260C

- HRS-9531

- IBI362

- LM-008

- LY3437943

- LY3502970

- TG103

- セマグルチド7.2mg(皮下注)

- セマグルチド(経口)

- XW003

抗肥満薬市場成長と動向

世界的に蔓延する肥満症への対応が急務となっていることから、抗肥満薬市場が活性化しています。肥満の蔓延、可処分所得の増加、ヘルスケアサービスへのアクセス向上といった要因が、この動向を後押ししています。近年、抗肥満薬の承認が増加し、患者の治療選択肢が広がっています。これは、米国の成人の約40%が肥満と分類され、体格指数(BMI)が30以上であるという憂慮すべき統計の結果です。

抗肥満薬は、食欲、脂肪吸収、代謝プロセスを調節することによって体重減少を目標とします。これらの薬剤には、肥満やそれに関連する症状の管理を支援するためにデザインされた様々な治療オプションが含まれます。世界的に肥満率が上昇し、糖尿病、心血管疾患、特定のがんなど、関連する健康リスクに対する認識が高まるにつれ、効果的な抗肥満薬の必要性が高まっています。近年、多くの新しい抗肥満薬が規制当局の承認を得て、患者の選択肢を広げ、減量のための外科的処置に代わる選択肢を提供していることは特筆に値します。

抗肥満薬は、特に重度の肥満関連健康問題を抱える患者にとって、減量効果を高めるために不可欠です。さらに、これらの薬剤は生活の質の向上に寄与し、肥満に関連する合併症を予防することでヘルスケア費用を削減することができます。ドラッグの製剤化とデリバリー・システムの革新、新規化合物の統合により、より安全で効果的な抗肥満薬の開発が進んでいます。個別化医療と薬理ゲノミクスが重視されるようになったことで、個々の患者のニーズに対応したオーダーメイド治療の可能性がさらに高まっています。さらに、遠隔医療サービスやデジタル治療アプリケーションの増加は、患者のより良い関与と治療計画の遵守を促進しています。

官民セクターは、イノベーションの促進や最先端の治療法の開発とともに、抗肥満分野における研究開発を行うために積極的に投資を行っています。長期的な管理が必要な慢性疾患としての肥満への注目が高まるにつれ、抗肥満薬市場は大幅な成長を遂げ、今後数年間で利害関係者に大きな機会をもたらすものと思われます。

抗肥満薬市場主要インサイト

当レポートでは、抗肥満薬市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです。

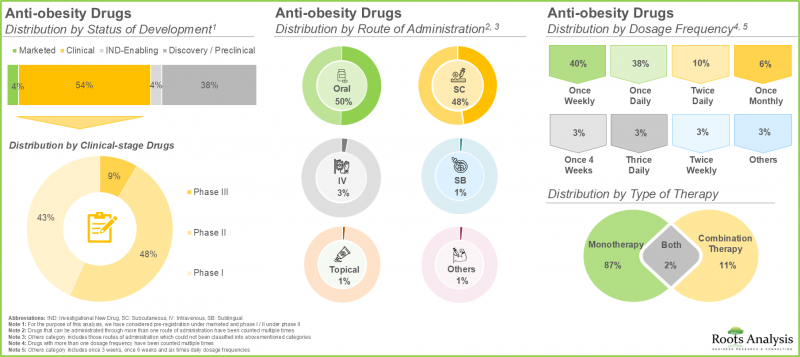

- 現在、肥満症治療薬として225品目近くが上市/開発されており、そのうち約50%は経口投与が可能です。

- 現在、抗肥満薬の約55%が臨床開発段階にあり、そのうち大半は単剤療法として評価されています。

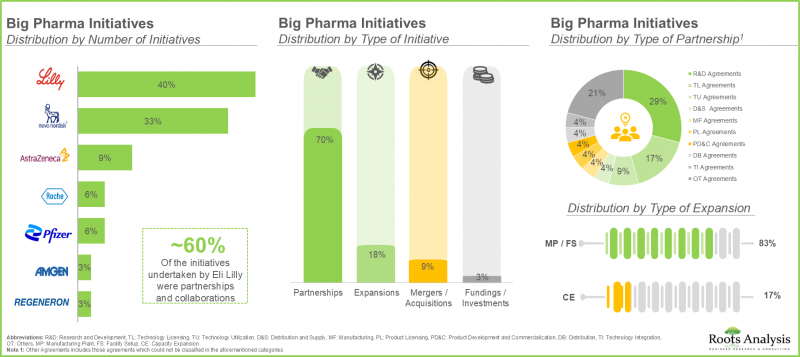

- 大手製薬企業のかなりの割合(70%)が、抗肥満薬のポートフォリオを拡大するために様々な提携を結んでいます。これらの提携の大部分(~30%)は研究開発契約です。

- 肥満に伴う健康リスクに対する患者の意識の高まりと肥満の蔓延が、抗肥満薬市場を牽引し、当面は安定した成長が見込まれます。

- 抗肥満薬市場は、2035年まで年率21.1%(CAGR)で成長すると予測されており、2035年までに北米が市場の大半(60%)を占めると予想されています。

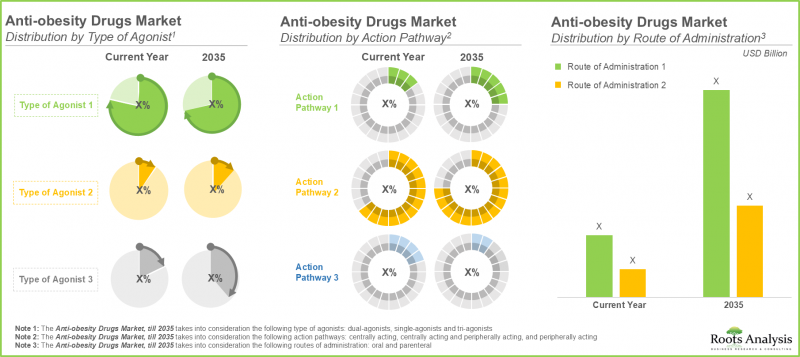

- 現在、中枢作用型の抗肥満薬が市場を独占しているが、特に非経口投与が2035年までに市場の大半のシェア(85%)を占めると予想されます。

抗肥満薬市場:主要セグメント

分子タイプ別に見ると、抗肥満薬市場は生物学的製剤や低分子製剤など、さまざまなタイプの分子に区分されます。市場シェアの大部分(54%)を占める低分子は、有効性が実証されていること、投与が容易であること、製造コストが低いこと、入手しやすいこと、安全な薬物プロファイルが確立されていることなどがその理由です。しかし、肥満症に関連する生物学的経路の根本的治療薬として生物学的製剤が有望かつより効果的な代替薬として登場するにつれ、その状況は変化していくと予想されます。

分子タイプから見ると、抗肥満薬市場は、セマグルチド、レタトルチド、サルボデュチド、カグリリンチド、オルフォグリプロン、リラグルチド、その他の活性化合物など、使用されるさまざまな活性化合物に区分されます。体重管理と糖尿病コントロールに強い効果を発揮することから、抗肥満薬市場の大半は現在セマグルチドが占めています。しかし、研究が進むにつれて、ティルゼパチドはGLP-1およびGIP受容体アゴニストとしての二重作用で注目を集め、臨床試験で優れた体重減少効果を示しています。この革新的なアプローチは、様々な代謝経路を標的とし、より包括的な肥満症治療を提供します。ティルゼパチドは、より高い有効性と患者の転帰改善の可能性を持つことから、今後数年間で、最終的に最大の市場シェアを確保し、台頭してくると予想されます。

抗肥満薬/減量薬市場は、作用機序の観点から、GLP-1アゴニスト/GIPアゴニスト、GLP-1アゴニスト/GCGRアゴニスト、GLP-1アゴニスト、GLP-1アゴニスト/アミリンアナログ、GLP-1/GCGR/GIPアゴニストおよびその他の作用機序に区分されます。現在の市場はGLP-1市場が支配的です。これはGLP-1の作用機序が確立されているためであり、血糖コントロールを改善することで大幅な体重減少を促します。満腹感を高め、食欲を減退させるその能力は、肥満治療の基盤となっています。しかし、デュアルGLP-1およびGIPアゴニストは、複数の代謝経路を標的とする能力を有することから、比較的高いCAGRで成長すると予想されています。臨床研究では、デュアルアゴニストはGLP-1アゴニスト単独と比較して、より大きな体重減少と代謝プロファイルの改善をもたらすことが示唆されています。

市場は、シングルアゴニスト、デュアルアゴニスト、トライアゴニストなど、さまざまなタイプのアゴニストに区分されます。患者の服薬アドヒアランスを促進するための使い勝手の良さから、現在、抗肥満薬の市場シェアはシングルアゴニストセグメントが最大(68%)を占めています。これらの薬剤には長年にわたる臨床的成功の歴史があるため、ヘルスケアプロバイダーは豊富なデータに基づいて自信を持って処方することができます。これに続いて、複数の生理学的メカニズムを同時に標的とすることで、複雑な肥満症に対処できるデュアルアゴニストの市場シェアが大きく伸びると思われます。これにより、個々の患者のニーズや状態に適応した、よりオーダーメイドの治療が可能になります。デュアルアゴニストは、ヘルスケアが個別化医療にシフトするにつれて普及し、その結果、開発への投資も拡大するとみられます。

同市場は、中枢に作用する経路、末梢に作用する経路、中枢と末梢に作用する経路など、さまざまな作用経路に対応しています。中枢作用性セグメントは現在、抗肥満薬市場で最も高いシェア(86%)を獲得しており、予測期間中は市場を独占すると予想されます。これは、中枢神経系との直接的な相互作用を通じて食欲とエネルギー消費を調節する効果があるためです。さらに、中枢作用薬は安全性プロファイルが確立されており、臨床現場での地位をさらに強固なものにしています。さらに、中枢に作用する経路への依存は、体重管理に対する包括的なアプローチを提供することから、今後も強いと思われます。代替経路の研究が進行中であるにもかかわらず、中枢作用薬の有効性を支持する確固たる臨床エビデンスがあるため、市場での優位は揺るがないです。その結果、新たな治療法が登場する可能性はあるもの、肥満管理における基本的な役割を反映し、中枢作用経路の動向は持続すると予想されます。

投与経路の観点から、抗肥満薬市場は経口経路と非経口経路に区分されます。調査によると、経口剤に比べて作用発現が早く、バイオアベイラビリティが高いことから、非経口剤が市場の大半のシェア(98%)を占めています。非経口投与は、薬剤が消化管を確実にバイパスするため、吸収のばらつきを抑え、治療効果を高めることができます。非経口投与は、最適な減量効果を得るために正確な投与と安定した血漿中濃度を必要とする薬剤に有利です。さらに、注射剤への嗜好が高まっていることも、非経口投与への傾向を強めています。その結果、経口投与の選択肢は依然として残っているもの、抗肥満薬における非経口投与の優位性は将来的にも続くものと思われます。

世界の市場規模は、北米、欧州、アジア太平洋、ラテンアメリカなど、さまざまな地域に区分されます。当社の予測によると、北米地域が抗肥満薬市場の主要シェア(70%)を占めており、予測期間中もこれは変わらないと思われます。これは、同地域に高度なヘルスケアインフラが整備されていること、製薬研究に多額の投資が行われていること、新規治療法の開発と承認を促進する強固な規制の枠組みがあることなどが背景にあります。アジア太平洋地域の抗肥満薬市場は、2035年まで比較的高いCAGR(40%)で成長すると予想されることは注目に値します。

抗体受託製造市場の参入企業例

- Boehringer Ingelheim

- Eli Lilly

- Novo Nordisk

- Eli Lilly

- Pfizer

- Regeneron

- Kallyope

- CinFina Pharma

- Viking Therapeutics

- AstraZeneca

- Novo Nordisk

- Roche

- Adocia

- Boehringer Ingelheim

- Zealand Pharma

- Hanmi Pharm

- Jiangsu Hengrui Pharmaceuticals

- Gmax Biopharma

- PegBio

- QL Biopharm

- Sciwind Biosciences

抗肥満薬市場調査対象

- 市場規模と機会分析:当レポートでは、世界の抗肥満薬市場を、[A]分子タイプ、[B]使用活性化合物、[C]作用機序、[D]アゴニストタイプ、[E]作用経路、[F]投与経路、[G]地域などの主要市場セグメント別に徹底分析しています。

- 市場情勢:A]市場開拓状況、[B]分子タイプ、[C]作用機序、[D]アゴニストタイプ、[E]投与経路、[F]投与頻度、[G]治療の種類など、いくつかの関連パラメータに基づいて、抗肥満薬市場に関与する企業を詳細に評価します。

- 競合分析:抗肥満薬に関する包括的な競合分析を行い、[A]企業力、[B]パイプラインポートフォリオなどの要因を検証します。

- 企業プロファイル:A]企業概要、[B]財務情報(入手可能な場合)、[C]パイプライン・ポートフォリオ、[D]最近の動向と将来展望に焦点を当てた、抗肥満薬市場に従事する主要サービス・プロバイダーの詳細プロファイル。

- 大手製薬企業の取り組み大手製薬企業が実施した様々な抗肥満イニシアチブをレビューし、[A]イニシアチブの数、[B]イニシアチブの年、[C]イニシアチブのタイプ、[D]パートナーシップのタイプ、[D]拡大のタイプなど、様々なパラメータにわたる動向を明らかにします。

目次

第1章 背景

第2章 調査手法

第3章 市場力学

- 章の概要

- 予測調査手法

- 市場評価フレームワーク

- 予測ツールとテクニック

- 重要な考慮事項

- 主要市場セグメント

- 堅牢な品質管理

- 制限事項

第4章 経済的およびその他のプロジェクト特有の考慮事項

- 章の概要

- 市場力学

第5章 エグゼクティブサマリー

第6章 イントロダクション

- 抗肥満薬の概要

- 長期肥満に関連する健康リスク

- 現在承認されている抗肥満薬の種類

- 抗肥満薬に伴う課題

- 将来の展望

第7章 市場情勢:抗肥満薬

- 市場情勢:抗肥満薬

- 開発者の情勢:抗肥満薬

第8章 企業プロファイル:北米を拠点とする抗肥満薬開発企業

- 章の概要

- 詳細な企業プロファイル

- Eli Lilly

- Pfizer

- Regeneron

- 簡潔な企業プロファイル

- CinFina Pharma

- Kallyope

- Viking Therapeutics

第9章 企業プロファイル:欧州を拠点とする抗肥満薬開発企業

- 章の概要

- 詳細な企業プロファイル

- AstraZeneca

- Novo Nordisk

- Roche

- 簡潔な企業プロファイル

- Adocia

- Boehringer Ingelheim

- Zealand Pharma

第10章 企業プロファイル:アジア太平洋およびその他の地域を拠点とする抗肥満薬開発企業

- 章の概要

- 詳細な企業プロファイル

- Hanmi Pharmaceuticals

- Jiangsu Hengrui Pharmaceuticals

- 簡潔な企業プロファイル

- Gmax Biopharma

- PegBio

- QL Biopharm

- Sciwind Biosciences

第11章 大手製薬会社の取り組み

- 調査手法

- 大手製薬会社:肥満対策に重点を置いた取り組み

第12章 市場影響分析:促進要因、抑制要因、機会、課題

第13章 世界の抗肥満薬市場

- 予測調査手法と主要な前提条件

- 世界の抗肥満薬市場、歴史的動向(2019年以降)および予測推定(2035年まで)

- 主要な市場セグメンテーション

第14章 抗肥満薬市場(分子タイプ別)

第15章 抗肥満薬市場(使用活性化合物別)

第16章 抗肥満薬市場(作用機序別)

第17章 抗肥満薬市場(アゴニストタイプ別)

第18章 抗肥満薬市場(作用経路別)

第19章 抗肥満薬市場(投与経路別)

第20章 抗肥満薬市場(地域別)

第21章 抗肥満薬市場、市販薬および第3相臨床試験薬の売上予測

- 市販薬:売上予測

- コントレイブ/ミシンバ(ナルトレキソン、ブプロピオン)

- フェイズメイ(ベイナグルチド)

- イムシブリー(セトメラノチド)

- ロマイラ(フェンテルミン塩酸塩)

- QSYMIA(フェンテルミンとトピラマート)

- サクセンダ(リラグルチド)

- ウェゴビ/オゼンピック(セマグルチド)

- ゼップバウンド/ ムンジャロ(ティルゼパタイド)

- 第III相医薬品:売上予測

- BI 456906(スルボデュチド)

- カグリセマ(カグリリンチドおよびセマグルチド)

- HM11260C(エフペグレナチド)

- HRS-9531

- IBI362(マズドゥティド)

- LM-008

- LY3437943(レタトルチド)

- LY3502970(オルフォルグリプロン)

- TG103

- セマグルチド7.2mg(皮下注射)

- セマグルチド(経口)

- XW003