|

|

市場調査レポート

商品コード

1597043

ニードルフリードラッグデリバリーデバイスの世界市場:2035年までの業界動向と予測:デバイスタイプ別、作用機序別、製品のユーザビリティ別、負荷タイプ別、投与経路別、適用領域別、製品タイプ別、使用材料タイプ別、介入タイプ別、地域別Needle Free Drug Delivery Devices Market: Industry Trends and Forecasted Estimates, till 2035 - Distribution by Type of Device, Route of Administration, Application Area, Product Type, Type of Material Used, Type of Intervention and Geography |

||||||

カスタマイズ可能

|

|||||||

| ニードルフリードラッグデリバリーデバイスの世界市場:2035年までの業界動向と予測:デバイスタイプ別、作用機序別、製品のユーザビリティ別、負荷タイプ別、投与経路別、適用領域別、製品タイプ別、使用材料タイプ別、介入タイプ別、地域別 |

|

出版日: 2024年09月12日

発行: Roots Analysis

ページ情報: 英文 340 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

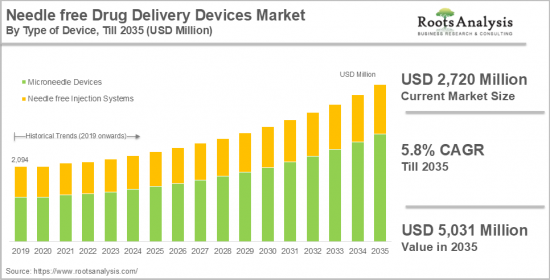

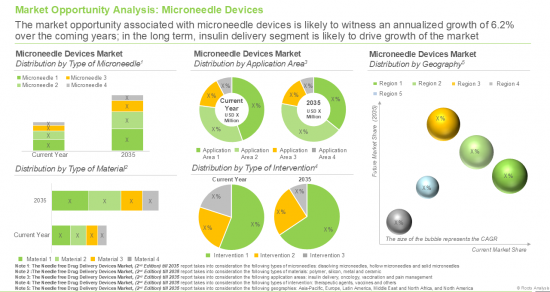

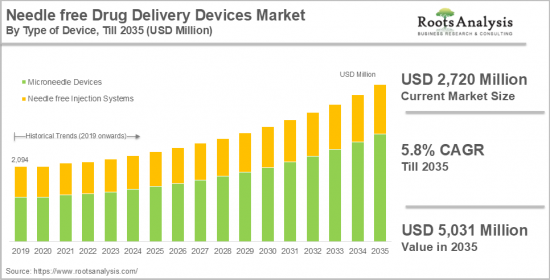

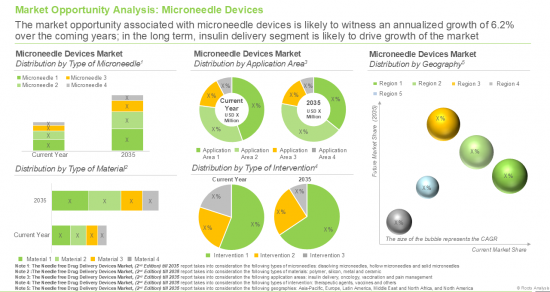

ニードルフリードラッグデリバリーデバイス市場は、ニードルフリー注射システムとマイクロニードルデバイスに区分されます。ニードルフリードラッグ注射システム市場は、2024年に6億600万米ドルと評価され、2035年までの予測期間中に4.0%のCAGRで拡大すると予測されています。一方、マイクロニードルデバイス市場は2024年に21億1,400万米ドルと評価され、2035年までの予測期間中に6.2%のCAGRで拡大すると予測されています。

近年、糖尿病、自己免疫疾患、心血管疾患、腫瘍性疾患など、さまざまな慢性疾患の罹患率が大幅に増加しています。実際、Center for Managing Chronic Disease at the University of Michiganによると、世界人口の50%以上が何らかの慢性疾患に苦しんでいます。特に、これらの疾患は、高額な費用と、時間の経過とともにエスカレートする傾向のある合併症のために、世界的に死亡と身体障害の主な原因となっています。このため、慢性疾患の負担増に対処するために、革新的な戦略や患者中心のアプローチを開発する必要性が生じています。

現在、慢性疾患の治療法には、経口および非経口投与があります。薬物投与経路の選択は、薬物の特性、患者の状態、確実な治療効果の必要性などの要因に影響されます。薬剤の非経口投与は、作用発現が早く、投与量を正確にコントロールでき、バイオアベイラビリティが高いため、広く受け入れられている投与経路です。従来の(非経口)ドラッグデリバリーアプローチにはこのような利点があるにもかかわらず、交差汚染のリスク、針刺し損傷、不正確な投与など、非経口投与に伴う様々な課題があります。これらの課題はさらに服薬アドヒアランスの阻害につながり、最終的には治療成績に影響を及ぼします。

時間の経過とともに、製薬業界は前述の課題に対処するための技術的進歩を目の当たりにしてきました。こうした技術進歩の結果、安全注射器や、使用後に注射針を自動的に引き込むことができる安全注射針など、より安全な代替品のイントロダクションが実現しました。さらに各社は、ニードルフリーシステム、ジェットインジェクター、ペン型インジェクター、マイクロニードルパッチなどのドラッグデリバリー機器の開発を進めてきました。デザイン、機能性、使い勝手が改善されたこれらのデバイスは、針刺し傷害の可能性を減らし、その結果、痛みを伴わず、真皮を越えて薬剤を自己投与することを容易にします。従来のドラッグデリバリーからユーザーフレンドリーなドラッグデリバリーオプションへの移行を考えると、世界のニードルフリードラッグデリバリーデバイス市場は予測期間中に大きな成長が見込まれます。

当レポートでは、世界のニードルフリードラッグデリバリーデバイス市場について調査し、市場の概要とともに、デバイスタイプ別、作用機序別、製品のユーザビリティ別、負荷タイプ別、投与経路別、適用領域別、製品タイプ別、使用材料タイプ別、介入タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 経済およびその他のプロジェクト特有の考慮事項

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 市場情勢:ニードルフリー注射システム

第8章 市場情勢:マイクロニードルデバイス

第9章 製品競争力分析:ニードルフリー注射システム

第10章 製品競争力分析:マイクロニードルデバイス

第11章 有望な薬剤候補:ニードルフリー注射システム

第12章 企業プロファイル:北米を拠点とするニードルフリードラッグデリバリーデバイスプロバイダー

第13章 企業プロファイル:欧州を拠点とするニードルフリードラッグデリバリーデバイスプロバイダー

第14章 企業プロファイル:アジア太平洋およびその他の地域に拠点を置くニードルフリードラッグデリバリーデバイスプロバイダー

第15章 メガトレンド分析

第16章 市場影響分析

- 章の概要

- 市場の促進要因

- 市場の抑制要因

- 市場の機会

- 市場の課題

- 結論

第17章 世界のニードルフリー注射システム市場

第18章 ニードルフリー注射システム市場(製品タイプ別)

第19章 ニードルフリー注射システム市場(作用機序別)

第20章 ニードルフリー注射システム市場(製品のユーザビリティ別)

第21章 ニードルフリー注射システム市場(負荷タイプ別)

第22章 ニードルフリー注射システム市場(投与経路別)

第23章 ニードルフリー注射システム市場(適用領域別)

第24章 ニードルフリー注射システム市場(地域別)

第25章 世界のマイクロニードルデバイス市場

第26章 マイクロニードルデバイス市場(マイクロニードルタイプ別)

第27章 マイクロニードルデバイス市場(使用材料別)

第28章 マイクロニードルデバイス市場(用途別)

第29章 マイクロニードルデバイス市場(介入タイプ別)

第30章 マイクロニードルデバイス市場(地域別)

第31章 結論

第32章 エグゼクティブ洞察

第33章 付録I:表形式データ

第34章 付録II企業および団体一覧

List of Tables

- Table 7.1 Needle-free Injection System Providers: Information on Year of Establishment, Company Size and Location of Headquarters (Region)

- Table 7.2 List of Needle-free Injection Systems

- Table 7.3 Needle-free Injection Systems: Information on Type of Actuation Mechanism

- Table 7.4 Needle-free Injection Systems: Information on Route of Administration

- Table 7.5 Needle-free Injection Systems: Information on Type of Formulation Administered

- Table 7.6 Needle-free Injection Systems: Information on Type of Drug Delivered

- Table 7.7 Needle-free Injection Systems: Information on Therapeutic Area

- Table 7.8 Needle-free Injection Systems: Information on Usability

- Table 8.1 Microneedle Device Providers: Information on Year of Establishment, Company Size and Location of Headquarters (Region)

- Table 8.2 List of Microneedle Devices

- Table 8.3 Microneedle Devices: Information on Stage of Development

- Table 8.4 Microneedle Devices: Information on Type of Microneedle

- Table 8.5 Microneedle Devices: Information on Type of Formulation Administered

- Table 8.6 Microneedle Devices: Information on Route of Administration

- Table 8.7 Microneedle Devices: Information on Therapeutic Area

- Table 8.8 Microneedle Devices: Information on Type of Drug Delivered

- Table 11.1 Marketed Molecules: Most Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.2 Marketed Molecules: Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.3 Marketed Molecules: Less Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.4 Marketed Molecules: Least Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.5 Clinical Drug Candidates (Biologics): Most Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.6 Clinical Drug Candidates (Biologics): Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.7 Clinical Drug Candidates (Biologics): Less Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 11.8 Clinical Drug Candidates (Biologics): Least Likely Candidates for Delivery via Needle-Free Injection Systems

- Table 12.1 Antares Pharma: Company Snapshot

- Table 12.2 Antares Pharma: Product Portfolio

- Table 12.3 D' Antonio Consultants International: Company Snapshot

- Table 12.4 D' Antonio Consultants International: Product Portfolio

- Table 12.5 HNS International: Company Snapshot

- Table 12.6 HNS International: Product Portfolio

- Table 12.7 INOVIO Pharmaceuticals: Company Snapshot

- Table 12.8 INOVIO Pharmaceuticals: Product Portfolio

- Table 12.9 Medical International Technology: Company Snapshot

- Table 12.10 Medical International Technology: Product Portfolio

- Table 12.11 PharmaJet: Company Snapshot

- Table 12.12 PharmaJet: Product Portfolio

- Table 12.13 PharmaJet: Recent Developments and Future Outlook

- Table 12.14 Zogenix: Company Snapshot

- Table 12.15 Zogenix: Product Portfolio

- Table 12.16 3M: Company Snapshot

- Table 12.17 3M: Product Portfolio

- Table 12.18 TheraJect: Company Snapshot

- Table 12.19 TheraJect: Product Portfolio

- Table 13.1 INJEX Pharma: Company Snapshot

- Table 13.2 INJEX Pharma: Product Portfolio

- Table 13.3 Debiotech: Company Snapshot

- Table 13.4 Debiotech: Product Portfolio

- Table 13.5 Micropoint Technologies: Company Snapshot

- Table 13.6 Micropoint Technologies: Product Portfolio

- Table 13.7 Nemaura Pharma: Company Snapshot

- Table 13.8 Nemaura Pharma Product Portfolio

- Table 14.1 Mika Medical: Company Snapshot

- Table 14.2 Mika Medical: Product Portfolio

- Table 14.3 QS Medical Technology (Quinovare): Company Snapshot

- Table 14.4 QS Medical Technology (Quinovare): Product Portfolio

- Table 14.5 QS Medical Technology (Quinovare): Recent Developments and Future Outlook

- Table 14.6 INCYTO: Company Snapshot

- Table 14.7 INCYTO: Product Portfolio

- Table 14.8 NanoPass Technologies: Company Snapshot

- Table 14.9 NanoPass Technologies: Product Portfolio

- Table 32.1 Portal Instruments: Company Snapshot

- Table 32.2 Vaxess Technologies: Company Snapshot

- Table 32.3 Innoture: Company Snapshot

- Table 33.1 Needle-free Injection System Providers: Distribution by Year of Establishment

- Table 33.2 Needle-free Injection System Providers: Distribution by Company Size

- Table 33.3 Needle-free Injection System Providers: Distribution by Location of Headquarters (Region)

- Table 33.4 Needle-free Injection System Providers: Distribution by Location of Headquarters (Country)

- Table 33.5 Needle-free Injection System Providers: Distribution by Company Size and Location of Headquarters (Region)

- Table 33.6 Needle-free Injection Systems: Distribution by Type of Actuation Mechanism

- Table 33.7 Needle-free Injection Systems: Distribution by Route of Administration

- Table 33.8 Needle-free Injection Systems: Distribution by Type of Formulation Administered

- Table 33.9 Needle-free Injection Systems: Distribution by Type of Drug Delivered

- Table 33.10 Needle-free Injection Systems: Distribution by Therapeutic Area

- Table 33.11 Needle-free Injection Systems: Distribution by Usability

- Table 33.12 Needle-free Injection Systems: Distribution by Type of Formulation Administered and Actuation Mechanism

- Table 33.13 Microneedle Device Providers: Distribution by Year of Establishment

- Table 33.14 Microneedle Device Providers: Distribution by Company Size

- Table 33.15 Microneedle Device Providers: Distribution by Location of Headquarters (Region)

- Table 33.16 Microneedle Device Providers: Distribution by Location of Headquarters (Country)

- Table 33.17 Microneedle Devices Providers: Distribution by Company Size and Location of Headquarters (Region)

- Table 33.18 Microneedle Devices: Distribution by Stage of Development

- Table 33.19 Microneedle Devices: Distribution by Type of Microneedle

- Table 33.20 Microneedle Devices: Distribution by Type of Formulation Administered

- Table 33.21 Microneedle Devices: Distribution by Route of Administration

- Table 33.22 Microneedle Devices: Distribution by Therapeutic Area

- Table 33.23 Microneedle Devices: Distribution by Type of Drug Delivered

- Table 33.24 Microneedle Devices: Distribution by Type of Microneedle and Type of Formulation Administered

- Table 33.25 Global Needle-free Injection Systems Market, till 2035: Base Scenario (USD Million)

- Table 33.26 Needle-free Injection Systems Market, till 2035: Conservative Scenario (USD Million)

- Table 33.27 Needle-free Injection Systems Market, till 2035: Optimistic Scenario (USD Million)

- Table 33.28 Needle-free Injection Systems Market: Distribution by Product Type

- Table 33.29 Needle-free Injection Systems Market for Fillable Devices, till 2035 (USD Million)

- Table 33.30 Needle-free Injection Systems Market for Prefilled Devices, till 2035 (USD Million)

- Table 33.31 Needle-free Injection Systems Market: Distribution by Actuation Mechanism

- Table 33.32 Needle-free Injection Systems Market for Spring-powered Devices, till 2035 (USD Million)

- Table 33.33 Needle-free Injection Systems Market for Compressed-gas Devices, till 2035 (USD Million)

- Table 33.34 Needle-free Injection Systems Market for Other Devices, till 2035 (USD Million)

- Table 33.35 Needle-free Injection Systems Market: Distribution by Product Usability

- Table 33.36 Needle-free Injection Systems Market for Reusable Devices, till 2035 (USD Million)

- Table 33.37 Needle-free Injection Systems Market for Disposable Devices, till 2035 (USD Million)

- Table 33.38 Needle-free Injection Systems Market: Distribution by Type of Load

- Table 33.39 Needle-free Injection Systems Market for Liquid-based Devices, till 2035 (USD Million)

- Table 33.40 Needle-free Injection Systems Market for Powder-based Devices, till 2035 (USD Million)

- Table 33.41 Needle-free Injection Systems Market for Projectile / depot based Devices, till 2035 (USD Million)

- Table 33.42 Needle-free Injection Systems Market: Distribution by Route of Administration

- Table 33.43 Needle-free Injection Systems Market for Subcutaneous Route of Administration, till 2035 (USD Million)

- Table 33.44 Needle-free Injection Systems Market for Intramuscular Route of Administration, till 2035 (USD Million)

- Table 33.45 Needle-free Injection Systems Market for Intradermal Route of Administration, till 2035 (USD Million)

- Table 33.46 Needle-free Injection Systems Market: Distribution by Application Area

- Table 33.47 Needle-free Injection Systems Market for Insulin Delivery, till 2035 (USD Million)

- Table 33.48 Needle-free Injection Systems Market for Pain Management, till 2035 (USD Million)

- Table 33.49 Needle-free Injection Systems Market for Dermatology, till 2035 (USD Million)

- Table 33.50 Needle-free Injection Systems Market for Vaccination, till 2035 (USD Million)

- Table 33.51 Needle-free Injection Systems Market: Distribution by Geography

- Table 33.52 Needle-free Injection Systems Market in North America, till 2035 (USD Million)

- Table 33.53 Needle-free Injection Systems Market in the US, till 2035 (USD Million)

- Table 33.54 Needle-free Injection Systems Market in Canada, till 2035 (USD Million)

- Table 33.55 Needle-free Injection Systems Market in Europe, till 2035 (USD Million)

- Table 33.56 Needle-free Injection Systems Market in Germany, till 2035 (USD Million)

- Table 33.57 Needle-free Injection Systems Market in the UK, till 2035 (USD Million)

- Table 33.58 Needle-free Injection Systems Market in France, till 2035 (USD Million)

- Table 33.59 Needle-free Injection Systems Market in Italy, till 2035 (USD Million)

- Table 33.60 Needle-free Injection Systems Market in Spain, till 2035 (USD Million)

- Table 33.61 Needle-free Injection Systems Market in Asia-Pacific, till 2035 (USD Million)

- Table 33.62 Needle-free Injection Systems Market in China, till 2035 (USD Million)

- Table 33.63 Needle-free Injection Systems Market in India, till 2035 (USD Million)

- Table 33.64 Needle-free Injection Systems Market in Japan, till 2035 (USD Million)

- Table 33.65 Needle-free Injection Systems Market in Australia, till 2035 (USD Million)

- Table 33.66 Needle-free Injection Systems Market in Middle East and North Africa, till 2035 (USD Million)

- Table 33.67 Needle-free Injection Systems Market in Egypt, till 2035 (USD Million)

- Table 33.68 Needle-free Injection Systems Market in Saudi Arabia, till 2035 (USD Million)

- Table 33.69 Needle-free Injection Systems Market in Israel, till 2035 (USD Million)

- Table 33.70 Needle-free Injection Systems Market in Latin America, till 2035 (USD Million)

- Table 33.71 Needle-free Injection Systems Market in Brazil, till 2035 (USD Million)

- Table 33.72 Needle-free Injection Systems Market in Mexico, till 2035 (USD Million)

- Table 33.73 Needle-free Injection Systems Market in Argentina, till 2035 (USD Million)

- Table 33.74 Global Microneedles Devices Market, till 2035: (USD Million)

- Table 33.75 Microneedles Devices Market, till 2035: Conservative Scenario (USD Million)

- Table 33.76 Microneedles Devices Market, till 2035: Optimistic Scenario (USD Million)

- Table 33.77 Microneedles Devices Market: Distribution by Type of Microneedle Devices

- Table 33.78 Microneedles Devices Market for Hollow Microneedles, till 2035 (USD Million)

- Table 33.79 Microneedles Devices Market for Solid Microneedles, till 2035 (USD Million)

- Table 33.80 Microneedles Devices Market for Dissolving Microneedles, till 2035 (USD Million)

- Table 33.81 Microneedles Devices Market for Coated Microneedles, till 2035 (USD Million)

- Table 33.82 Microneedles Devices Market: Distribution by Type of Material Used

- Table 33.83 Microneedles Devices Market for Polymer Microneedles, till 2035 (USD Million)

- Table 33.84 Microneedles Devices Market for Silicon Microneedles, till 2035 (USD Million)

- Table 33.85 Microneedles Devices Market for Metal Microneedles, till 2035 (USD Million)

- Table 33.86 Microneedles Devices Market for Ceramic Microneedles, till 2035 (USD Million)

- Table 33.87 Microneedle Devices Market: Distribution by Application Area

- Table 33.88 Microneedle Devices Market for Insulin Delivery, till 2035 (USD Million)

- Table 33.89 Microneedle Devices Market for Vaccination, till 2035 (USD Million)

- Table 33.90 Microneedle Devices Market for Pain Management, till 2035 (USD Million)

- Table 33.91 Microneedle Devices Market for Oncology, till 2035 (USD Million)

- Table 33.92 Microneedle Devices Market: Distribution by Type of Intervention

- Table 33.93 Microneedle Devices Market for Vaccines, till 2035 (USD Million)

- Table 33.94 Microneedle Devices Market for Therapeutic Agents, till 2035 (USD Million)

- Table 33.95 Microneedle Devices Market for Other Interventions, till 2035 (USD Million)

- Table 33.96 Microneedle Devices Market: Distribution by Geography

- Table 33.97 Microneedle Devices Market in North America, till 2035 (USD Million)

- Table 33.98 Microneedle Devices Market in the US, till 2035 (USD Million)

- Table 33.99 Microneedle Devices Market in Canada, till 2035 (USD Million)

- Table 33.100 Microneedle Devices Market in Europe, till 2035 (USD Million)

- Table 33.101 Microneedle Devices Market in Germany, till 2035 (USD Million)

- Table 33.102 Microneedle Devices Market in the UK, till 2035 (USD Million)

- Table 33.103 Microneedle Devices Market in France, till 2035 (USD Million)

- Table 33.104 Microneedle Devices Market in Italy, till 2035 (USD Million)

- Table 33.105 Microneedle Devices Market in Spain, till 2035 (USD Million)

- Table 33.106 Microneedle Devices Market in Asia-Pacific, till 2035 (USD Million)

- Table 33.107 Microneedle Devices Market in China, till 2035 (USD Million)

- Table 33.108 Microneedle Devices Market in India, till 2035 (USD Million)

- Table 33.109 Microneedle Devices Market in Japan, till 2035 (USD Million)

- Table 33.110 Microneedle Devices Market in Australia, till 2035 (USD Million)

- Table 33.111 Microneedle Devices Market in Middle East and North Africa, till 2035 (USD Million)

- Table 33.112 Microneedle Devices Market in Egypt, till 2035 (USD Million)

- Table 33.113 Microneedle Devices Market in Saudi Arabia, till 2035 (USD Million)

- Table 33.114 Microneedle Devices Market in Israel, till 2035 (USD Million)

- Table 33.115 Microneedle Devices Market in Latin America, till 2035 (USD Million)

- Table 33.116 Microneedle Devices Market in Brazil, till 2035 (USD Million)

- Table 33.117 Microneedle Devices Market in Argentina, till 2035 (USD Million)

- Table 33.118 Microneedle Devices Market in Mexico, till 2035 (USD Million)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Key Market Segmentation

- Figure 3.3 Market Dynamics: Robust Quality Control

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Needle-free Injection Systems Market Landscape (I / II)

- Figure 5.2 Executive Summary: Needle-free Injection Systems Market Landscape (II / II)

- Figure 5.3 Executive Summary: Microneedle Devices Market Landscape (I / II)

- Figure 5.4 Executive Summary: Microneedle Devices Market Landscape (II / II)

- Figure 5.5 Executive Summary: Needle-free Injection Systems Market Sizing and Opportunity Analysis

- Figure 5.6 Executive Summary: Microneedle Devices Market Sizing and Opportunity Analysis

- Figure 6.1 Minimally Invasive Drug Delivery Systems: Driving Factors

- Figure 6.2 Needle-free Jet Injectors: Key Components

- Figure 6.3 Needle-free Jet Injection: Stages of Drug Delivery

- Figure 6.4 Microneedle Devices: Drug Delivery Mechanism

- Figure 7.1 Needle-free Injection System Providers: Distribution by Year of Establishment

- Figure 7.2 Needle-free Injection System Providers: Distribution by Company Size

- Figure 7.3 Needle-free Injection System Providers: Distribution by Location of Headquarters (Region)

- Figure 7.4 Needle-free Injection System Providers: Distribution by Location of Headquarters (Country)

- Figure 7.5 Needle-free Injection System Providers: Distribution by Company Size and Location of Headquarters (Region)

- Figure 7.6 Needle-free Injection Systems: Distribution by Type of Actuation Mechanism

- Figure 7.7 Needle-free Injection Systems: Distribution by Route of Administration

- Figure 7.8 Needle-free Injection Systems: Distribution by Type of Formulation Administered

- Figure 7.9 Needle-free Injection Systems: Distribution by Type of Drug Delivered

- Figure 7.10 Needle-free Injection Systems: Distribution by Therapeutic Area

- Figure 7.11 Needle-free Injection Systems: Distribution by Usability

- Figure 7.12 Needle-free Injection Systems: Distribution by Type of Formulation Administered and Actuation Mechanism

- Figure 8.1 Microneedle Device Providers: Distribution by Year of Establishment

- Figure 8.2 Microneedle Device Providers: Distribution by Company Size

- Figure 8.3 Microneedle Device Providers: Distribution by Location of Headquarters (Region)

- Figure 8.4 Microneedle Device Providers: Distribution by Location of Headquarters (Country)

- Figure 8.5 Microneedle Devices Providers: Distribution by Company Size and Location of Headquarters (Region)

- Figure 8.6 Microneedle Devices: Distribution by Stage of Development

- Figure 8.7 Microneedle Devices: Distribution by Type of Microneedle

- Figure 8.8 Microneedle Devices: Distribution by Type of Formulation Administered

- Figure 8.9 Microneedle Devices: Distribution by Route of Administration

- Figure 8.10 Microneedle Devices: Distribution by Therapeutic Area

- Figure 8.11 Microneedle Devices: Distribution by Type of Drug Delivered

- Figure 8.12 Microneedle Devices: Distribution by Type of Microneedle and Formulation Administered

- Figure 9.1 Product Competitiveness Analysis: Spring-based Needle-free Injection Systems

- Figure 9.2 Product Competitiveness Analysis: Gas-powered Needle-free Injection Systems

- Figure 9.3 Product Competitiveness Analysis: Other Needle-free Injection Systems

- Figure 10.1 Product Competitiveness Analysis: Dissolving Microneedle Devices

- Figure 10.2 Product Competitiveness Analysis: Hollow Microneedle Devices

- Figure 10.3 Product Competitiveness Analysis: Solid Microneedle Devices

- Figure 10.4 Product Competitiveness Analysis: Other Microneedle Devices

- Figure 15.1 Megatrends in the Needle-free Drug Delivery Devices Market

- Figure 17.1 Global Needle-free Injection Systems Market, till 2035 (USD Million)

- Figure 17.2 Needle-free Injection Systems Market, till 2035: Conservative Scenario (USD Million)

- Figure 17.3 Needle-free Injection Systems Market, till 2035: Optimistic Scenario (USD Million)

- Figure 18.1 Needle-free Injection Systems Market: Distribution by Product Type

- Figure 18.2 Needle-free Injection Systems Market for Fillable Devices, till 2035 (USD Million)

- Figure 18.3 Needle-free Injection Systems Market for Prefilled Devices, till 2035 (USD Million)

- Figure 19.1 Needle-free Injection Systems Market: Distribution by Actuation Mechanism

- Figure 19.2 Needle-free Injection Systems Market for Spring-powered Devices, till 2035 (USD Million)

- Figure 19.3 Needle-free Injection Systems Market for Compressed-gas Devices, till 2035 (USD Million)

- Figure 19.4 Needle-free Injection Systems Market for Other Devices, till 2035 (USD Million)

- Figure 20.1 Needle-free Injection Systems Market: Distribution by Product Usability

- Figure 20.2 Needle-free Injection Systems Market for Reusable Devices, till 2035 (USD Million)

- Figure 20.3 Needle-free Injection Systems Market for Disposable Devices, till 2035 (USD Million)

- Figure 21.1 Needle-free Injection Systems Market: Distribution by Type of Load

- Figure 21.2 Needle-free Injection Systems Market for Liquid-based Devices, till 2035 (USD Million)

- Figure 21.3 Needle-free Injection Systems Market for Powder-based Devices, till 2035 (USD Million)

- Figure 21.4 Needle-free Injection Systems Market for Projectile / Depot based Devices, till 2035 (USD Million)

- Figure 22.1 Needle-free Injection Systems Market: Distribution by Route of Administration

- Figure 22.2 Needle-free Injection Systems Market for Subcutaneous Route, till 2035 (USD Million)

- Figure 22.3 Needle-free Injection Systems Market for Intramuscular Route, till 2035 (USD Million)

- Figure 22.4 Needle-free Injection Systems Market for Intradermal Route, till 2035 (USD Million)

- Figure 23.1 Needle-free Injection Systems Market: Distribution by Application Area

- Figure 23.2 Needle-free Injection Systems Market for Insulin Delivery, till 2035 (USD Million)

- Figure 23.3 Needle-free Injection Systems Market for Pain Management, till 2035 (USD Million)

- Figure 23.4 Needle-free Injection Systems Market for Dermatology, till 2035 (USD Million)

- Figure 23.5 Needle-free Injection Systems Market for Vaccination, till 2035 (USD Million)

- Figure 24.1 Needle-free Injection Systems Market: Distribution by Geography

- Figure 24.2 Needle-free Injection Systems Market in North America, till 2035 (USD Million)

- Figure 24.3 Needle-free Injection Systems Market in the US, till 2035 (USD Million)

- Figure 24.4 Needle-free Injection Systems Market in Canada, till 2035 (USD Million)

- Figure 24.5 Needle-free Injection Systems Market in Europe, till 2035 (USD Million)

- Figure 24.6 Needle-free Injection Systems Market in Germany, till 2035 (USD Million)

- Figure 24.7 Needle-free Injection Systems Market in the UK, till 2035 (USD Million)

- Figure 24.8 Needle-free Injection Systems Market in France, till 2035 (USD Million)

- Figure 24.9 Needle-free Injection Systems Market in Italy, till 2035 (USD Million)

- Figure 24.10 Needle-free Injection Systems Market in Spain, till 2035 (USD Million)

- Figure 24.11 Needle-free Injection Systems Market in Asia-Pacific, till 2035 (USD Million)

- Figure 24.12 Needle-free Injection Systems Market in China, till 2035 (USD Million)

- Figure 24.13 Needle-free Injection Systems Market in India, till 2035 (USD Million)

- Figure 24.14 Needle-free Injection Systems Market in Japan, till 2035 (USD Million)

- Figure 24.15 Needle-free Injection Systems Market in Australia, till 2035 (USD Million)

- Figure 24.16 Needle-free Injection Systems Market in Middle East and North Africa, till 2035 (USD Million)

- Figure 24.17 Needle-free Injection Systems Market in Egypt, till 2035 (USD Million)

- Figure 24.18 Needle-free Injection Systems Market in Saudi Arabia, till 2035 (USD Million)

- Figure 24.19 Needle-free Injection Systems Market in Israel, till 2035 (USD Million)

- Figure 24.20 Needle-free Injection Systems Market in Latin America, till 2035 (USD Million)

- Figure 24.21 Needle-free Injection Systems Market in Brazil, till 2035 (USD Million)

- Figure 24.22 Needle-free Injection Systems Market in Mexico, till 2035 (USD Million)

- Figure 24.23 Needle-free Injection Systems Market in Argentina, till 2035 (USD Million)

- Figure 25.1 Global Microneedle Devices Market, till 2035 (USD Million)

- Figure 25.2 Microneedle Devices Market, till 2035: Conservative Scenario (USD Million)

- Figure 25.3 Microneedle Devices Market, till 2035: Optimistic Scenario (USD Million)

- Figure 26.1 Microneedle Devices Market: Distribution by Type of Microneedle

- Figure 26.2 Microneedle Devices Market for Hollow Microneedles, till 2035 (USD Million)

- Figure 26.3 Microneedle Devices Market for Solid Microneedles, till 2035 (USD Million)

- Figure 26.4 Microneedle Devices Market for Dissolving Microneedles, till 2035 (USD Million)

- Figure 26.5 Microneedle Devices Market for Coated Microneedles, till 2035 (USD Million)

- Figure 27.1 Microneedle Devices Market: Distribution by Type of Material Used

- Figure 27.2 Microneedle Devices Market for Polymer Microneedles, till 2035 (USD Million)

- Figure 27.3 Microneedle Devices Market for Silicon Microneedles, till 2035 (USD Million)

- Figure 27.4 Microneedle Devices Market for Metal Microneedles, till 2035 (USD Million)

- Figure 27.5 Microneedle Devices Market for Ceramic Microneedles, till 2035 (USD Million)

- Figure 28.1 Microneedle Devices Market: Distribution by Application Area

- Figure 28.2 Microneedle Devices Market for Insulin Delivery, till 2035 (USD Million)

- Figure 28.3 Microneedle Devices Market for Vaccination, till 2035 (USD Million)

- Figure 28.4 Microneedle Devices Market for Pain Management, till 2035 (USD Million)

- Figure 28.5 Microneedle Devices Market for Oncology, till 2035 (USD Million)

- Figure 29.1 Microneedle Devices Market: Distribution by Type of Intervention

- Figure 29.2 Microneedle Devices Market for Vaccines, till 2035 (USD Million)

- Figure 29.3 Microneedle Devices Market for Therapeutic Agents, till 2035 (USD Million)

- Figure 29.4 Microneedle Devices Market for Other Interventions, till 2035 (USD Million)

- Figure 30.1 Microneedle Devices Market: Distribution by Geography

- Figure 30.2 Microneedle Devices Market in North America, till 2035 (USD Million)

- Figure 30.3 Microneedle Devices Market in the US, till 2035 (USD Million)

- Figure 30.4 Microneedle Devices Market in Canada, till 2035 (USD Million)

- Figure 30.5 Microneedle Devices Market in Europe, till 2035 (USD Million)

- Figure 30.6 Microneedle Devices Market in Germany, till 2035 (USD Million)

- Figure 30.7 Microneedle Devices Market in the UK, till 2035 (USD Million)

- Figure 30.8 Microneedle Devices Market in France, till 2035 (USD Million)

- Figure 30.9 Microneedle Devices Market in Italy, till 2035 (USD Million)

- Figure 30.10 Microneedle Devices Market in Spain, till 2035 (USD Million)

- Figure 30.11 Microneedle Devices Market in Asia-Pacific, till 2035 (USD Million)

- Figure 30.12 Microneedle Devices Market in China, till 2035 (USD Million)

- Figure 30.13 Microneedle Devices Market in India, till 2035 (USD Million)

- Figure 30.14 Microneedle Devices Market in Japan, till 2035 (USD Million)

- Figure 30.15 Microneedle Devices Market in Australia, till 2035 (USD Million)

- Figure 30.16 Microneedle Devices Market in Middle East and North Africa, till 2035 (USD Million)

- Figure 30.17 Microneedle Devices Market in Egypt, till 2035 (USD Million)

- Figure 30.18 Microneedle Devices Market in Saudi Arabia, till 2035 (USD Million)

- Figure 30.19 Microneedle Devices Market in Israel, till 2035 (USD Million)

- Figure 30.20 Microneedle Devices Market in Latin America, till 2035 (USD Million)

- Figure 30.21 Microneedle Devices Market in Brazil, till 2035 (USD Million)

- Figure 30.22 Microneedle Devices Market in Argentina, till 2035 (USD Million)

- Figure 30.23 Microneedle Devices Market in Mexico, till 2035 (USD Million)

- Figure 31.1 Concluding Remarks: Needle-free Injection Systems: Market Landscape

- Figure 31.2 Concluding Remarks: Microneedle Devices: Market Landscape

- Figure 31.3 Concluding Remarks: Needle-free Injection Systems: Market Sizing and Opportunity Analysis

- Figure 31.4 Concluding Remarks: Microneedle Devices: Market Sizing and Opportunity Analysis

Needle free drug delivery devices market is segmented into needle free injection systems and microneedle devices. The needle-free drug injection systems market is valued at USD 606 million in 2024 and is projected to grow at a CAGR of 4.0% during the forecast period, till 2035. While the microneedle devices market is valued at USD 2,114 million in 2024, growing at a CAGR of 6.2% during the forecast period, till 2035.

Recent years have witnessed a significant increase in incidence rates of various chronic diseases, such as diabetes, autoimmune diseases, cardiovascular diseases, and oncological diseases. In fact, according to the Center for Managing Chronic Disease at the University of Michigan, over 50% of the global population is suffering from some form of chronic disease. Notably, these conditions are the leading cause of death and disability worldwide, due to high cost and associated complications that tend to escalate over time. This has necessitated the need to develop innovative strategies and patient centered approaches in order to tackle the increasing burden of chronic diseases.

Presently, the treatment options available for chronic conditions include administration of drugs via oral and parenteral routes. The choice of route for medication administration is influenced by factors such as drug properties, patient condition, and the need for reliable therapeutic effect. Since, parenteral administration of drugs involves rapid onset of action, precise dosing control and higher bioavailability, it is the widely accepted route of administration. Despite these advantages offered by the conventional (parenteral) drug delivery approaches, there are various challenges associated with parenteral administration, including risk of cross contamination, needlestick injuries, and inaccurate dosing. These challenges further lead to hindrance in medication adherence and ultimately impact the therapeutic outcomes.

Over time, the pharmaceutical industry has witnessed technological breakthroughs in order to counter the aforementioned challenges. These technological advancements have resulted in the introduction of safer alternatives, such as safety syringes and safety needles that allow automatic retraction of needles after use. In addition, the companies have advanced the development of drug delivery devices which include needle free systems, jet injectors, pen injectors and microneedle patches. With improved design, functionality and usability, these devices reduce the possibility of needlestick injuries, thereby facilitating pain-free and self-administration of medications across the dermis. Given this transition from conventional to user-friendly drug delivery options, the global needle free drug delivery devices market is expected to experience significant growth during the forecast period.

Key Market Segments

Route of Administration (Needle free drug delivery devices)

- Subcutaneous

- Intramuscular

- Intradermal

Actuation Mechanism (Needle free drug delivery devices)

- Spring-powered Devices

- Compressed-gas Devices

- Other Devices

Application Area (Needle free drug delivery devices)

- Insulin Delivery

- Pain Management

- Dermatology

- Vaccination

Product Type (Needle free drug delivery devices)

- Fillable Devices

- Prefilled Devices

Type of Load (Needle free drug delivery devices)

- Liquid-based Devices

- Powder-based Devices

- Projectile/Depot-based Devices

Geography (Needle free drug delivery devices)

- North America (US and Canada)

- Europe (Germany, UK, France, Italy and Spain)

- Asia-Pacific (India, China, Japan and Australia)

- Middle East and North Africa (Saudi Arabia, Egypt and Israel)

- Latin America Africa (Brazil, Argentina and Mexico)

Type of Microneedle (Microneedle devices)

- Hollow Microneedles

- Solid Microneedles

- Dissolving Microneedles

- Coated Microneedles

Application Area (Microneedle devices)

- Insulin Delivery

- Pain Management

- Vaccination

- Oncology

Type of Material Used (Microneedle devices)

- Polymer Microneedle

- Silicon Microneedle

- Metal Microneedle

- Ceramic Microneedle

Type of Intervention (Microneedle devices)

- Vaccines

- Therapeutic Agents

- Other Interventions

Geography (Microneedle devices)

- North America (US and Canada)

- Europe (France, Germany, Italy, Spain, UK and Rest of Europe)

- Asia-Pacific (India, China, Japan, Australia and Rest of Asia-Pacific)

- Middle East and North Africa (Saudi Arabia, Egypt and Israel)

- Latin America Africa (Brazil, Argentina and Mexico)

Research Coverage:

The report on needle free drug delivery devices market provides insights into various aspects, including:

- A preface introducing the full report, Needle Free Drug Delivery Devices Market, till 2035.

- A detailed outline of the structured research methodology used in the study, covering research assumptions, project and forecast methodologies, primary and secondary research approaches, along with the various analytical frameworks applied.

- A summary of the diverse methodologies and frameworks used to forecast and analyze market trends, highlighting the core factors affecting dynamics. It also underlines the stringent quality control framework employed to maintain transparency and reliability throughout the report.

- A brief analysis of the economic variables affecting the needle free drug delivery devices market, such as currency fluctuations, foreign exchange rates, and known trade barriers. Additionally, it considers the impact of global recession and inflation using historical trends to project future market conditions.

- An executive summary that provides the insights derived from our research, presenting key takeaways from the current market landscape of needle free drug delivery devices. The section also provides details on market evolution in the short to mid to long term.

- A brief introduction to needle free injection systems and microneedles, highlighting the growing demand for devices that enable painless administration of medication in the home healthcare setting. The section emphasizes the need for such devices, specifically in terms of the rising incidence and prevalence of chronic diseases. Subsequently, it provides an overview of the different types of needle free injectors and microneedles, detailing their specifications, mechanisms of action, R&D challenges, and expected future trends.

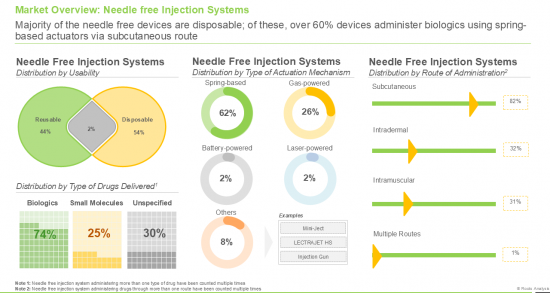

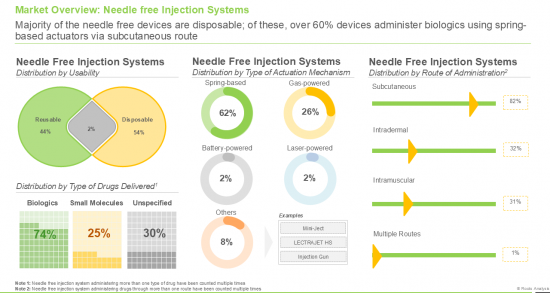

- A comprehensive assessment of the overall market landscape of needle free drug delivery providers, based on several relevant parameters including year of establishment, company size (based on the employee count), location of their headquarters (region and country), actuation mechanism (spring-powered, gas-powered, battery-powered, laser-powered and others), route of administration (subcutaneous, intradermal, intramuscular and multiple), type of formulation administered (liquids, solids and powders), type of drug delivered (biologics, small molecules and unspecified), therapeutic area (metabolic disorders, dermatological disorders, infectious diseases, musculoskeletal disorders, neurological disorders, autoimmune / inflammatory disorders, genetic disorders, ophthalmological disorders and renal disorders), and usability (reusable and disposable).

- A detailed assessment of the overall market landscape of microneedle device providers, based on several relevant parameters. The parameters include year of establishment, company size (based on the employee count), location of their headquarters (region and country), stage of development (marketed / under development), type of microneedle (hollow, solid and dissolving), type of formulation administered (liquids, solids and powders), route of administration (intradermal, transdermal, subcutaneous, topical, intraocular, trans buccal, intravenous, subretinal and intravitreal) therapeutic area (metabolic disorders, dermatological disorders, infectious diseases, oncological disorders, musculoskeletal disorders, neurological disorders, cardiovascular disorders, ophthalmic disorders and others) and type of drug delivered (biologics, small molecules and unspecified).

- A detailed product competitiveness analysis of needle-free injection systems, based on the supplier power and product specifications. The analysis allows the companies providing needle-free injection systems to compare their existing capabilities and identify opportunities to achieve a competitive edge in the industry.

- A detailed product competitiveness analysis of microneedle devices, based on the supplier power and product specifications. The analysis enables microneedle device providers to benchmark their existing capabilities and identify opportunities to achieve a competitive edge in the industry.

- A detailed likely drug candidate analysis presenting information on the list of marketed drugs / therapies and pipeline candidates that are anticipated to be developed in combination with needle free injectors in the near future. The analysis is based on a variety of relevant parameters including (in alphabetical order) current status of development, dose concentration, dosing frequency, route of administration, type of dose (standard / weight dependent), expected patent expiry (relevant only for marketed drugs) and information on product sales (relevant only for marketed drugs).

- A detailed likely drug candidate analysis presenting information on the list of marketed drugs/ therapies and pipeline candidates that are anticipated to be developed in combination with microneedles in the near future. The analysis is based on a variety of relevant parameters, such as (in alphabetical order) current status of development, dose concentration, dosing frequency, route of administration, type of dose (standard / weight dependent), expected patent expiry (relevant only for marketed drugs) and information on product sales (relevant only for marketed drugs).

- An elaborate set of profiles of prominent companies in needle free drug delivery devices market headquartered in North America, Europe, Asia-Pacific and rest of the world. Each profile provides a brief overview of the company, along with information on its product portfolio, and an insightful recent development and future outlook.

- A comprehensive outlook of the various ongoing megatrends in the needle free drug delivery devices market, including technological advancements in design, functionality, usability and features, along with expanded applications of needle free systems and increasing focus on personalized medicine.

- A detailed market impact analysis providing details on the factors that can impact the growth of needle free drug delivery devices market. It features insights on key drivers, potential restraints, emerging opportunities, and existing challenges in this industry.

- A comprehensive evaluation of the current market size and future market growth potential of the needle-free injection system market (first product category within the needle free drug delivery devices market) over the next 11 years. On the basis of multiple parameters, likely adoption trends and through primary validations, we have provided an informed estimate on the market size, till 2035.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across different product types, including fillable devices and prefilled devices.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across different actuation mechanisms, including spring-powered devices, compressed-gas devices and other devices.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across product usability, including reusable devices and disposable devices.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across type of load, including liquid-based devices, powder-based devices and projectile / depot-based devices.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across different routes of administration, including subcutaneous, intramuscular and intradermal.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across application area, including insulin delivery, pain management, vaccination and dermatology.

- Detailed forecast projections of the current and future opportunity within the needle-free injection system market across key geographical regions including North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America.

- A comprehensive assessment of the current microneedle market size (second product category within the needle free drug delivery devices market), along with the future market growth potential over the next 11 years. On the basis of several relevant parameters including likely adoption trends and through primary validations, we have provided an informed estimate on the market size till 2035.

- A detailed evaluation of the current and future opportunity within the microneedle device market (second product category within the needle free drug delivery devices market) segmented by different types of microneedles, such as hollow microneedles, solid microneedles, dissolving microneedles and coated microneedles.

- A detailed evaluation of the current and future opportunity within the microneedle device market segmented by different types of material used, such as polymer microneedles, silicon microneedles, metal microneedles and ceramic microneedles.

- A detailed evaluation of the current and future opportunity within the microneedle device market segmented by different application areas, such as insulin delivery, vaccination, pain management and oncology.

- A detailed evaluation of the current and future opportunity within the microneedle device market segmented by different types of intervention, such as vaccines, therapeutic agents and other interventions.

- A detailed evaluation of the current and future opportunity within the microneedle device market segmented by key geographical regions including North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America.

Key Benefits of Buying this Report

- The report provides valuable insights to market leaders and newcomers related to the revenue estimations of the overall market and its sub-segments.

- Stakeholders can utilize the report to enhance their understanding of the competitive landscape, allowing for improved business positioning and more effective go-to-market strategies.

- The report provides stakeholders with a comprehensive outlook of the needle free drug delivery devices market, furnishing them with essential information on significant market drivers, barriers, opportunities, and challenges.

Example Companies Profiled

- 3M

- Debiotech

- INCYTO

- Micropoint Technologies

- NanoPass Technologies

- Nemaura Pharma

- Theraject

- Antares Pharma

- D'Antonio Consultants International

- HNS International

- Injex

- INOVIO Pharmaceuticals

- Medical International Technology

- Mika Medical

- Pharmajet

- QS Medical Technology (Quinovare)

- Zogenix

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Historical Evolution of Drug Delivery Devices

- 6.3. Conventional Parenteral Delivery

- 6.3.1. Needlestick Injuries

- 6.3.1.1. Incidence Rate and Cost Burden of Needlestick Injuries

- 6.3.1. Needlestick Injuries

- 6.4. Minimally Invasive Drug Delivery

- 6.4.1. Factors Influencing Growth of Minimally Invasive Drug Delivery Systems

- 6.4.1.1. Rising Burden of Chronic Diseases

- 6.4.1.2. Healthcare Cost Savings

- 6.4.1.3. Need for Immediate Treatment in Emergency Situations

- 6.4.1.4. Growing Injectable Drugs Market

- 6.4.1.5. Need for Improving Medication Adherence

- 6.4.1. Factors Influencing Growth of Minimally Invasive Drug Delivery Systems

- 6.5. Needle-free Injection Technology

- 6.5.1. Key Components of Needle-free Injection Systems

- 6.5.1.1. Injection Device

- 6.5.1.2. Nozzle

- 6.5.1.3. Pressure Source

- 6.5.1. Key Components of Needle-free Injection Systems

- 6.6. Operating Mechanism of Needle-free Injection Systems

- 6.7. Classification based on Type of Load

- 6.7.1. Powder-based Injectors

- 6.7.2. Liquid-based Injectors

- 6.7.3. Depot or Projectile Injectors

- 6.8. Classification based on Actuation Mechanism

- 6.8.1. Spring Loaded Jet Injectors

- 6.8.2. Battery Powered Jet Injectors

- 6.8.3. Gas Powered Jet Injectors

- 6.8.4. Laser Powered Injectors

- 6.8.5. Lorentz Force-based Injectors

- 6.9. Microneedle Devices

- 6.9.1. Types of Microneedle Devices

- 6.9.2. Advantages of Microneedle Devices

- 6.9.3. Operating Mechanism of Microneedle Devices

- 6.10. Key Challenges related to Needle-free Injection Systems and Microneedle Devices

- 6.11. Recent Advancements

- 6.12. Future Perspectives

7. MARKET LANDSCAPE: NEEDLE-FREE INJECTION SYSTEMS

- 7.1 Chapter Overview

- 7.2. Needle-free Injection System Providers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Company Size and Location of Headquarters

- 7.3. Needle-free Injection Systems: Overall Market Landscape

- 7.3.1. Analysis by Actuation Mechanism

- 7.3.2. Analysis by Route of Administration

- 7.3.3. Analysis by Type of Formulation Administered

- 7.3.4. Analysis by Type of Drug Delivered

- 7.3.5. Analysis by Therapeutic Area

- 7.3.6. Analysis by Usability

- 7.3.7. Analysis by Type of Formulation Administered and Actuation Mechanism

8. MARKET LANDSCAPE: MICRONEEDLE DEVICES

- 8.1 Chapter Overview

- 8.2. Microneedle Device Providers: Overall Market Landscape

- 8.2.1. Analysis by Year of Establishment

- 8.2.2. Analysis by Company Size

- 8.2.3. Analysis by Location of Headquarters

- 8.2.4. Analysis by Company Size and Location of Headquarters

- 8.3. Microneedle Devices: Overall Market Landscape

- 8.3.1. Analysis by Stage of Development

- 8.3.2. Analysis by Type of Microneedle

- 8.3.3. Analysis by Type of Formulation Administered

- 8.3.4. Analysis by Route of Administration

- 8.3.5. Analysis by Therapeutic Area

- 8.3.6. Analysis by Type of Drug Delivered

- 8.3.7. Analysis by Type of Microneedle and Type of Formulation Administered

9. PRODUCT COMPETITIVENESS ANALYSIS: NEEDLE-FREE INJECTION SYSTEMS

- 9.1 Chapter Overview

- 9.2. Assumptions and Key Parameters

- 9.3. Methodology

- 9.4. Product Competitiveness Analysis: Needle-free Injection Systems

- 9.4.1. Spring-based Needle-free Injection Systems

- 9.4.2. Gas-powered Needle-free Injection Systems

- 9.4.3. Other Needle-free Injection Systems

10. PRODUCT COMPETITIVENESS ANALYSIS: MICRONEEDLE DEVICES

- 10.1 Chapter Overview

- 10.2. Assumptions and Key Parameters

- 10.3. Methodology

- 10.4. Product Competitiveness Analysis: Microneedle Devices

- 10.4.1. Dissolving Microneedle Devices

- 10.4.2. Hollow Microneedle Devices

- 10.4.3. Solid Microneedle Devices

- 10.4.4. Other Microneedle Devices

11. LIKELY DRUG CANDIDATES: NEEDLE-FREE INJECTION SYSTEMS

- 11.1 Chapter Overview

- 11.2. Marketed Drugs Candidates

- 11.2.1. Most Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.2.2. Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.2.3. Less Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.2.4. Least Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.3. Clinical Drug Candidates (Biologics)

- 11.3.1. Most Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.3.2. Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.3.3. Less Likely Candidates for Delivery via Needle-Free Injection Systems

- 11.3.4. Least Likely Candidates for Delivery via Needle-Free Injection Systems

12. COMPANY PROFILES: NEEDLE-FREE DRUG DELIVERY DEVICE PROVIDERS BASED IN NORTH AMERICA

- 12.1. Chapter Overview

- 12.2. Leading Needle-free Drug Delivery Device Providers in North America

- 12.2.1. Antares Pharma (Acquired by Halozyme)

- 12.2.1.1. Company Overview

- 12.2.1.2. Product Portfolio

- 12.2.1.3. Recent Development and Future Outlook

- 12.2.2. D'Antonio Consultants International

- 12.2.3. HNS International

- 12.2.4. INOVIO Pharmaceuticals

- 12.2.5. Medical International Technology

- 12.2.6. PharmaJet

- 12.2.7. Zogenix (acquired by UCB)

- 12.2.1. Antares Pharma (Acquired by Halozyme)

- 12.3. Other Leading Needle-free Drug Delivery Device Providers in North America

- 12.3.1. 3M

- 12.3.1.1. Company Overview

- 12.3.1.2. Product Portfolio

- 12.3.2. TheraJect

- 12.3.1. 3M

13. COMPANY PROFILES: NEEDLE-FREE DRUG DELIVERY DEVICE PROVIDERS BASED IN EUROPE

- 13.1. Chapter Overview

- 13.2. Leading Needle-free Drug Delivery Device Providers in Europe

- 13.2.1. INJEX Pharma

- 13.2.1.1. Company Overview

- 13.2.1.2. Product Portfolio

- 13.2.1.3. Recent Development and Future Outlook

- 13.2.1. INJEX Pharma

- 13.3. Other Leading Needle-free Drug Delivery Device Providers in North America

- 13.3.1. Debiotech

- 13.3.1.1. Company Overview

- 13.3.1.2. Product Portfolio

- 13.3.2. Micropoint Technologies

- 13.3.3. Nemaura Pharma

- 13.3.1. Debiotech

14. COMPANY PROFILES: NEEDLE-FREE DRUG DELIVERY DEVICE PROVIDERS BASED IN ASIA-PACIFIC AND REST OF THE WORLD

- 14.1. Chapter Overview

- 14.2. Leading Needle-free Drug Delivery Device Providers in Asia-Pacific and Rest of the World

- 14.2.1. MIKA MEDICAL

- 14.2.1.1. Company Overview

- 14.2.1.2. Product Portfolio

- 14.2.1.3. Recent Development and Future Outlook

- 14.2.2. QS Medical Technology (Quinovare)

- 14.2.1. MIKA MEDICAL

- 14.3. Other Leading Needle-free Drug Delivery Device Providers in North America

- 14.3.1. INCYTO

- 14.3.1.1. Company Overview

- 14.3.1.2. Product Portfolio

- 14.3.2. NanoPass Technologies

- 14.3.1. INCYTO

15. MEGATRENDS ANALYSIS

- 15.1. Chapter Overview

- 15.2. Key Megatrends

- 15.2.1. Technological Innovations

- 15.2.2. Applications in Personalized Medicine

- 15.2.3. Telemedicine Integration

- 15.2.4. Promising Potential in Driving Sustainability

- 15.2.5. Robust Regulatory Framework

- 15.2.6. Increase in Clinical Trial Activity

16. MARKET IMPACT ANALYSIS

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. GLOBAL NEEDLE-FREE INJECTION SYSTEMS MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Needle-free Injection Systems Market, till 2035

- 17.3.1. Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1. Scenario Analysis

- 17.4. Key Market Segmentations

18. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY PRODUCT TYPE

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Needle-free Injection Systems Market: Distribution by Product Type

- 18.3.1. Needle-free Injection Systems Market for Fillable Devices, till 2035

- 18.3.2. Needle-free Injection Systems Market for Prefilled Devices, till 2035

- 18.4. Data Triangulation and Validation

19. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY ACTUATION MECHANISM

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Needle-free Injection Systems Market: Distribution by Actuation Mechanism

- 19.3.1. Needle-free Injection Systems Market for Spring-powered Devices, till 2035

- 19.3.2. Needle-free Injection Systems Market for Compressed-gas Devices, till 2035

- 19.3.3. Needle-free Injection Systems Market for Other Devices, till 2035

- 19.4. Data Triangulation and Validation

20. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY PRODUCT USABILITY

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Needle-free Injection Systems Market: Distribution by Product Usability

- 20.3.1. Needle-free Injection Systems Market for Reusable Devices, till 2035

- 20.3.2. Needle-free Injection Systems Market for Disposable Devices, till 2035

- 20.4. Data Triangulation and Validation

21. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY TYPE OF LOAD

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Needle-free Injection Systems Market: Distribution by Type of Load

- 21.3.1. Needle-free Injection Systems Market for Liquid-based Devices, till 2035

- 21.3.2. Needle-free Injection Systems Market for Powder-based Devices, till 2035

- 21.3.3. Needle-free Injection Systems Market for Projectile / Depot-based Devices, till 2035

- 21.4. Data Triangulation and Validation

22. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY ROUTE OF ADMINISTRATION

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Needle-free Injection Systems Market: Distribution by Route of Administration

- 22.3.1. Needle-free Injection Systems Market for Subcutaneous Route, till 2035

- 22.3.2. Needle-free Injection Systems Market for Intramuscular Route, till 2035

- 22.3.3. Needle-free Injection Systems Market for Intradermal Route, till 2035

- 22.4. Data Triangulation and Validation

23. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY APPLICATION AREA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Needle-free Injection Systems Market: Distribution by Application Area

- 23.3.1. Needle-free Injection Systems Market for Insulin Delivery, till 2035

- 23.3.2. Needle-free Injection Systems Market for Pain Management, till 2035

- 23.3.3. Needle-free Injection Systems Market for Dermatology, till 2035

- 23.3.4. Needle-free Injection Systems Market for Vaccination, till 2035

- 23.4. Data Triangulation and Validation

24. NEEDLE-FREE INJECTION SYSTEMS MARKET, BY GEOGRAPHY

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Needle-free Injection Systems Market: Distribution by Geography

- 24.3.1. Needle-free Injection Systems Market in North America, till 2035

- 24.3.1.1. Needle-free Injection Systems Market in the US, till 2035

- 24.3.1.2. Needle-free Injection Systems Market in Canada, till 2035

- 24.3.2. Needle-free Injection Systems Market in Europe, till 2035

- 24.3.2.1. Needle-free Injection Systems Market in Germany, till 2035

- 24.3.2.2. Needle-free Injection Systems Market in the UK, till 2035

- 24.3.2.3. Needle-free Injection Systems Market in France, till 2035

- 24.3.2.4. Needle-free Injection Systems Market in Italy, till 2035

- 24.3.2.5. Needle-free Injection Systems Market in Spain, till 2035

- 24.3.3. Needle-free Injection Systems Market in Asia-Pacific, till 2035

- 24.3.3.1. Needle-free Injection Systems Market in China, till 2035

- 24.3.3.2. Needle-free Injection Systems Market in India, till 2035

- 24.3.3.3. Needle-free Injection Systems Market in Japan, till 2035

- 24.3.3.4. Needle-free Injection Systems Market in Australia, till 2035

- 24.3.4. Needle-free Injection Systems Market in Middle East and North Africa, till 2035

- 24.3.4.1. Needle-free Injection Systems Market in Egypt, till 2035

- 24.3.4.2. Needle-free Injection Systems Market in Saudi Arabia, till 2035

- 24.3.4.3. Needle-free Injection Systems Market in Israel, till 2035

- 24.3.5. Needle-free Injection Systems Market in Latin America, till 2035

- 24.3.5.1. Needle-free Injection Systems Market in Brazil, till 2035

- 24.3.5.2. Needle-free Injection Systems Market in Mexico, till 2035

- 24.3.5.3. Needle-free Injection Systems Market in Argentina, till 2035

- 24.3.1. Needle-free Injection Systems Market in North America, till 2035

- 24.4. Data Triangulation and Validation

25. GLOBAL MICRONEEDLE DEVICES MARKET

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Global Microneedle Devices Market, till 2035

- 25.3.1. Scenario Analysis

- 25.3.1.1. Conservative Scenario

- 25.3.1.2. Optimistic Scenario

- 25.3.1. Scenario Analysis

- 25.4. Key Market Segmentations

26. MICRONEEDLE DEVICES MARKET, BY TYPE OF MICRONEEDLE

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Microneedle Devices Market: Distribution by Type of Microneedle

- 26.3.1. Microneedle Devices Market for Hollow Microneedles, till 2035

- 26.3.2. Microneedle Devices Market for Solid Microneedles, till 2035

- 26.3.3. Microneedle Devices Market for Dissolving Microneedles, till 2035

- 26.3.4. Microneedle Devices Market for Coated Microneedles, till 2035

- 26.4. Data Triangulation and Validation

27. MICRONEEDLE DEVICES MARKET, BY TYPE OF MATERIAL USED

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Microneedle Devices Market: Distribution by Type of Material Used

- 27.3.1. Microneedle Devices Market for Polymer Microneedles, till 2035

- 27.3.2. Microneedle Devices Market for Silicon Microneedles, till 2035

- 27.3.3. Microneedle Devices Market for Metal Microneedles, till 2035

- 27.3.4. Microneedle Devices Market for Ceramic Microneedles, till 2035

- 27.4. Data Triangulation and Validation

28. MICRONEEDLE DEVICES MARKET, BY APPLICATION AREA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Microneedle Devices Market: Distribution by Application Area

- 28.3.1. Microneedle Devices Market for Insulin Delivery, till 2035

- 28.3.2. Microneedle Devices Market for Pain Management, till 2035

- 28.3.3. Microneedle Devices Market for Vaccination, till 2035

- 28.3.4. Microneedle Devices Market for Oncology, till 2035

- 28.4. Data Triangulation and Validation

29. MICRONEEDLE DEVICES MARKET, BY TYPE OF INTERVENTION

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Microneedle Devices Market: Distribution by Type of Intervention

- 29.3.1. Microneedle Devices Market for Vaccines, till 2035

- 29.3.2. Microneedle Devices Market for Therapeutic Agents, till 2035

- 29.3.3. Microneedle Devices Market for Other Interventions, till 2035

- 29.4. Data Triangulation and Validation

30. MICRONEEDLE DEVICES MARKET, BY GEOGRAPHY

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Microneedle Devices Market: Distribution by Geography

- 30.3.1. Microneedle Devices Market in North America, till 2035

- 30.3.1.1. Microneedle Devices Market in the US, till 2035

- 30.3.1.2. Microneedle Devices Market in Canada, till 2035

- 30.3.2. Microneedle Devices Market in Europe, till 2035

- 30.3.2.1. Microneedle Devices Market in France, till 2035

- 30.3.2.2. Microneedle Devices Market in Spain, till 2035

- 30.3.2.3. Microneedle Devices Market in the UK, till 2035

- 30.3.2.4. Microneedle Devices Market in Germany, till 2035

- 30.3.2.5. Microneedle Devices Market in Italy, till 2035

- 30.3.3. Microneedle Devices Market in Asia-Pacific, till 2035

- 30.3.3.1. Microneedle Devices Market in China, till 2035

- 30.3.3.2. Microneedle Devices Market in Japan, till 2035

- 30.3.3.3. Microneedle Devices Market in India, till 2035

- 30.3.3.4. Microneedle Devices Market in Australia, till 2035

- 30.3.4. Microneedle Devices Market in Middle East and North Africa, till 2035

- 30.3.4.1. Microneedle Devices Market in Egypt, till 2035

- 30.3.4.2. Microneedle Devices Market in Saudi Arabia, till 2035

- 30.3.4.3. Microneedle Devices Market in Israel, till 2035

- 30.3.5. Microneedle Devices Market in Latin America, till 2035

- 30.3.5.1. Microneedle Devices Market in Brazil, till 2035

- 30.3.5.2. Microneedle Devices Market in Mexico, till 2035

- 30.3.5.3. Microneedle Devices Market in Argentina, till 2035

- 30.3.1. Microneedle Devices Market in North America, till 2035

- 30.4. Data Triangulation and Validation

31. CONCLUDING REMARKS

32. EXECUTIVE INSIGHTS

- 32.1. Chapter Overview

- 32.2. Portal Instruments

- 32.2.1. Company Snapshot

- 32.2.2. Interview Transcript

- 32.3. Vaxess Technologies

- 32.3.1 Company Snapshot

- 32.3.2. Interview Transcript

- 32.4. Innoture

- 32.4.1. Company Snapshot

- 32.4.2. Interview Transcript