|

|

市場調査レポート

商品コード

1652115

日本の自動車Tier1の先進技術と製品(2024年~2025年)Japanese Automotive Tier1s' Advanced Technologies and Products Research Report, 2024-2025 |

||||||

|

|||||||

| 日本の自動車Tier1の先進技術と製品(2024年~2025年) |

|

出版日: 2025年01月02日

発行: ResearchInChina

ページ情報: 英文 313 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

自動車の電化とインテリジェンスでは、中国のOEMとソリューションサプライヤーが動向をリードしており、特にインテリジェントアプリケーションの普及が加速しています。しかし、日本の自動車産業と部品サプライヤーは、中国、欧米の自動車メーカーに追いつくため、そのペースを速めています。一部の電化セグメントで技術的優位性を強化する活動を続ける一方で、AI開発、SDV(Software-Defined Vehicle)、チップを含むインテリジェンスへの投資も拡大しています。世界の売上の伸びを安定させることを前提条件に、中国のインテリジェント自動車産業との関係を促進することにも取り組んでいます。

2024年5月、日本の経済産業省と国土交通省は、今後10年間の日本の自動車産業のデジタルトランスフォーメーションに向けた戦略計画を発表し、SDV(Software-Defined Vehicle)、ロボットタクシー、車両データの価値を強調しました。その中で、SDVの開発は最優先課題とされています。日本政府は、2030年に世界のSDVの市場規模が4,100万台に達すると予測し、日本のOEMが30%のシェア、すなわち1,100万台から1,200万台を占めることを期待しています。これは野心的な目標と言えます。

1. 日本の自動車Tier1は、対外協力を強化し、電化セグメントでの優位性を固め、インテリジェンスの受け入れへの活動を惜しみません。

AIを搭載した電気自動車(AIEV)の開発には、AI開発支援、自動車用SoC、OS(オペレーティングシステム)などの社内での研究開発とイノベーションに加え、Tier1は当然のことながら社外との協力が必要です。

AI開発では、TURING、TIER IV、Sakana AI、Digital Realty、NTT、Denso、Alps Alpineなどの日本企業が、AI技術、ワールドモデル、LLMメモリ管理技術などの開発に力を入れており、自動車製品への統合を加速し、日本でのL4自動運転の大規模採用を可能にしようとしています。例えば、以下のようなものがあります。

2024年11月、DensoとQuadricは、AIの演算処理に特化した半導体であるNPU(ニューラルプロセッシングユニット)の共同開発を行うと発表しました。今回の合意により、DensoはQuadricのChimera GPNPUのIPコアライセンスを取得し、両社はこれをベースに高性能な自動車用半導体を共同開発します。

Alps Alpine + Qualcomm:2025年1月、両社はQualcomm Technologiesの最新世代Snapdragon(R)CockpitプラットフォームをAlps Alpineの自動車製品に統合する技術協力の拡大を発表しました。

自動運転向けのオープンソースソフトウェアを提供するTIER IVとMatsuo Instituteは、レベル4自動運転のオペレーションデザインドメイン(ODD)の大幅な拡大を目指し、Autonomy 2.0に向けた生成AIプロジェクトに着手しました。

チップの研究開発では、日本メーカーがTSMC、Nvidia、Intel、Microsoftといった大手企業との協力を精力的に進めています。

TSMC:日本初のウエハー工場は2024年末までに量産を開始し、2027年までに第2工場が稼働する予定です。

Microsoft:2024年11月、日本初の研究拠点を東京に開設しました。

Intel:2024年9月、IntelはAISTと協力し、先進チップの生産に特化した研究開発センターを新設することを計画しました。

NVIDIA:2024年4月、AISTとNVIDIAは量子コンピューティングシステムの構築に向けチームを組みました。

当レポートでは、中国と日本の自動車産業について調査分析し、日本の自動車Tier1の研究開発と製品、海外との関係などの情報を提供しています。

目次

第1章 日本の自動車Tier1と中国の関連性

- 中国と日本の自動車Tier1/OEMの産業関係(1)

- 中国と日本の自動車Tier1/OEMの産業関係(2)

- 中国と日本の自動車Tier1/OEMの産業関係(3)

- 中国と日本の自動車Tier1/OEMの産業関係(4)

- 中国と日本の自動車Tier1/OEMの産業関係(5)

- 中国と日本の自動車Tier1/OEMの産業関係(6)

- Densoの中国におけるレイアウト(1)

- Densoの中国におけるレイアウト(2)

- Densoの中国のR&Dセンター

- Densoの中国の生産レイアウト

- Sumitomo Electricの中国におけるレイアウト(1)

- Sumitomo Electricの中国におけるレイアウト(2)

- Sumitomo Electricの中国におけるレイアウト(3)

- Sumitomo Electricの中国におけるレイアウト(4)

- JTEKTの中国生産拠点のレイアウト

- NSK Steering & Controlの中国における生産拠点のレイアウト

- Hitachi Astemoの中国における生産拠点のレイアウト

- KYB Corporationの中国における生産拠点のレイアウト

- KEL Corporation'の中国の生産プラント

- Yazaki Corporationの中国におけるジョイントベンチャー

- Toyota Motorの中国における新完全所有プラント建設計画

- 日本の工作機械受注:中国の自動車市場からの受注

- 代表的な日本の工作機械メーカーのケース

第2章 日本の自動車Tier1のAI開発、SDV、チップ研究

- サマリー:日本のSDV目標

- サマリー:日本は国内の半導体産業に多額の投資をしている

- サマリー:日本の大手8社が半導体生産能力を拡大

- サマリー:国内外の自動車用チッププロセスの比較(1)

- サマリー:国内外の自動車用チッププロセスの比較(2)

- サマリー:TSMC、Nvidia、Intel、Microsoftと日本の協力(1)

- サマリー:TSMC、Nvidia、Intel、Microsoftと日本の協力(2)

- サマリー:日本が管理する5つの技術

- サマリー:日本のZetta級スーパーコンピューター

- サマリー:自動車用チップアライアンス(1)

- サマリー:自動車用チップアライアンス(2)

- サマリー:日本企業のAI開発の比較

- AI開発ケース1:TURING

- AI開発ケース2:Digital Realty

- AI開発ケース3:

- AI開発ケース4:

- AI開発ケース5:

- AI開発ケース6:

- AI開発ケース7:

- AI開発ケース8:

- AI開発ケース9:

- サマリー:日本企業におけるSDVケースの比較

- SDVケース1:

- SDVケース2:

- SDVケース3:

- SDVケース4:Honda + Amazon

- SDVケース5:Panasonic Automotive Systems + Arm(1)

- SDVケース6:

- サマリー:日本企業の自動車用チップケースの比較

- 自動車用チップケース1

- 自動車用チップケース2

- 自動車用チップケース3

- 自動車用チップケース4

- 自動車用チップケース5

第3章 日本の自動車Tier1の自動運転/ADAS技術と製品

- 自動運転に関する日本の政策(1)

- 自動運転に関する日本の政策(2)

- 日本の自動運転スケジュール

- オペレーティングシステム

- 自動運転/ADAS

第4章 日本の自動車Tier1のインテリジェントコックピット技術と製品

- 日本のインテリジェントコックピット部品の主要サプライヤー(1)

- 日本のインテリジェントコックピット部品の主要サプライヤー(2)

- 日本のインテリジェントコックピット部品の主要サプライヤー(3)

- 日本のインテリジェントコックピット部品の主要サプライヤー(4)

- 日本のインテリジェントコックピット部品の主要サプライヤー(5)

- 日本のインテリジェントコックピット部品の主要サプライヤー(6)

- インテリジェントコックピット部品サプライヤーの供給関係(1)- Toyota

- インテリジェントコックピット部品サプライヤーの供給関係(2)- Nissan

- インテリジェントコックピット部品サプライヤーの供給関係(3)- Honda

- インテリジェントコックピット部品サプライヤーの供給関係(4)- Mazda

- インテリジェントコックピット部品サプライヤーの供給関係(5)- Subaru

- インテリジェントコックピット部品サプライヤーの供給関係(6)- Suzuki

- インテリジェントコックピット部品サプライヤーの供給関係(7)- Mitsubishi

- インテリジェントコックピット部品サプライヤーの供給関係(8)- Daihatsu

- インテリジェントコックピット技術ケースのサマリー(1)

- インテリジェントコックピット技術ケースのサマリー(2)

- インテリジェントコックピット技術ケースのサマリー(3)

第5章 日本のTier1の電化技術と製品

- IGBT/SiC/GaNパワー半導体のサマリー(1)

- IGBT/SiC/GaNパワー半導体のサマリー(2)

- IGBT/SiC/GaNパワー半導体のサマリー(3)

- eアクスル

- モーター製品のサマリー(1)

- モーター製品のサマリー(2)

- モーター製品のサマリー(3)

- バッテリー/全固体電池

第6章 日本のTier1サプライヤーの供給関係

- Denso

- Aisin

- Nidec

- Sumitomo Electric

- 日本の電動パワーステアリング(EPS)サプライヤーとその供給関係

- 日本市場における主要ADASレーダー・LiDARサプライヤーと各社のOEMとの供給関係

第7章 日本のOEMの国内協力と国際関係

- 日本の新車売上(2024年1月~11月)

- 日本のOEMの国外生産拠点のレイアウト

- 日本のOEMの国外生産データ

- 日本の自動車メーカー間の技術協力(1)

- 日本の自動車メーカー間の技術協力(2)

- 日本の国内の自動車・部品製造プラントの分布

- 日本 - 中国の自動車産業との関係

- 日本 - 米国の自動車産業との関係

- 日本 - 欧州の自動車産業との関係

- 日本の自動車メーカーの電化/インテリジェンス

Japanese Tier1s' advanced technologies research: accelerate external cooperation, intensify internal collaboration, and further upgrade "fine manufacturing"

In vehicle electrification and intelligence, Chinese OEMs and solution suppliers are leading the trend, especially at a time when intelligent application speeds up. Japan's automotive industry and parts suppliers are however quickening their pace to catch up with their Chinese, European and American counterparts. While making continuous efforts to reinforce their technical superiority in some electrification segments, they are also still investing more in intelligence, involving AI development, software-defined vehicles (SDV) and chips. On the basis of stabilizing global sales growth, they also work to expedite connection with China's intelligent vehicle industry.

In May 2024, the Ministry of Economy, Trade and Industry (METI) and the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) of Japan announced a strategic plan for digital transformation of the Japanese automotive industry in the next decade, highlighting software-defined vehicles (SDV), robotaxi, and vehicle data value. Wherein, the development of SDVs is considered a top priority. The Japanese government predicts that the scale of the global SDV market will reach 41 million vehicles in 2030, and hopes that Japanese OEM can take a 30% share, or 11 million to 12 million vehicles. It can be seen that the goal is ambitious.

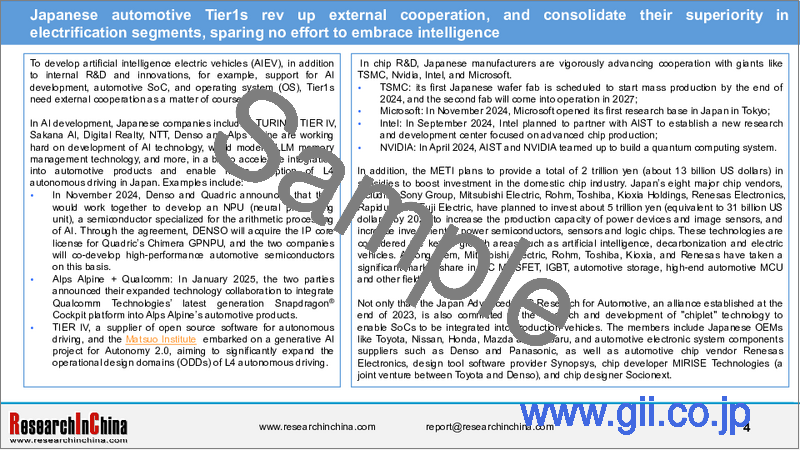

1. Japanese automotive Tier1s rev up external cooperation, and consolidate their superiority in electrification segments, sparing no effort to embrace intelligence.

To develop artificial intelligence electric vehicles (AIEV), in addition to internal R&D and innovations, for example, support for AI development, automotive SoC, and operating system (OS), Tier1s need external cooperation as a matter of course.

In AI development, Japanese companies including TURING, TIER IV, Sakana AI, Digital Realty, NTT, Denso and Alps Alpine are working hard on development of AI technology, world models, LLM memory management technology, and more, in a bid to accelerate integration into automotive products and enable mass adoption of L4 autonomous driving in Japan. Examples include:

In November 2024, Denso and Quadric announced that they would work together to develop an NPU (neural processing unit), a semiconductor specialized for the arithmetic processing of AI. Through the agreement, DENSO will acquire the IP core license for Quadric's Chimera GPNPU, and the two companies will co-develop high-performance automotive semiconductors on this basis.

Alps Alpine + Qualcomm: In January 2025, the two parties announced their expanded technology collaboration to integrate Qualcomm Technologies' latest generation Snapdragon(R) Cockpit platform into Alps Alpine's automotive products.

TIER IV, a supplier of open source software for autonomous driving, and the Matsuo Institute embarked on a generative AI project for Autonomy 2.0, aiming to significantly expand the operational design domains (ODDs) of Level 4 autonomous driving.

In chip R&D, Japanese manufacturers are vigorously advancing cooperation with giants like TSMC, Nvidia, Intel, and Microsoft.

TSMC: its first Japanese wafer fab is scheduled to start mass production by the end of 2024, and the second fab will come into operation in 2027;

Microsoft: In November 2024, Microsoft opened its first research base in Japan in Tokyo;

Intel: In September 2024, Intel planned to partner with AIST to establish a new research and development center focused on advanced chip production;

NVIDIA: In April 2024, AIST and NVIDIA teamed up to build a quantum computing system.

In addition, the METI plans to provide a total of 2 trillion yen (about 13 billion US dollars) in subsidies to boost investment in the domestic chip industry. Japan's eight major chip vendors, including Sony Group, Mitsubishi Electric, Rohm, Toshiba, Kioxia Holdings, Renesas Electronics, Rapidus, and Fuji Electric, have planned to invest about 5 trillion yen (equivalent to 31 billion US dollars) by 2029 to increase the production capacity of power devices and image sensors, and increase investment in power semiconductors, sensors and logic chips. These technologies are considered the key to growth areas such as artificial intelligence, decarbonization and electric vehicles. Among them, Mitsubishi Electric, Rohm, Toshiba, Kioxia, and Renesas have taken a significant market share in SiC MOSFET, IGBT, automotive storage, high-end automotive MCU and other fields.

Not only that, the Japan Advanced SoC Research for Automotive, an alliance established at the end of 2023, is also committed to the research and development of "chiplet" technology to enable SoCs to be integrated into production vehicles. The members include Japanese OEMs like Toyota, Nissan, Honda, Mazda and Subaru, and automotive electronic system components suppliers such as Denso and Panasonic, as well as automotive chip vendor Renesas Electronics, design tool software provider Synopsys, chip developer MIRISE Technologies (a joint venture between Toyota and Denso), and chip designer Socionext.

In electrification, Japanese companies have technological advantages in some segments and keep improving competitive edges of products (see table below), such as motors and power semiconductors (IGBT/SiC/GaN).

As concerns motors, Japan has multiple superior suppliers like Fukuta Electric & Machinery (flat wire hairpin motor), JFE Precision (cold forged hollow shaft, e-Axle motor hollow shaft), Tokai Rika (5th generation hub motor), Toshiba (TB9084FTG, a MOSFET gate driver IC for motors), THK (variable flux in-wheel motor), ELEMEC (XPEAC internal direct cooling motor), Nitto (hairpin stator winding, EESM rotor winding), and Nidec (motor). Take automotive Tier1 Nidec as an example to see its external supply cases.

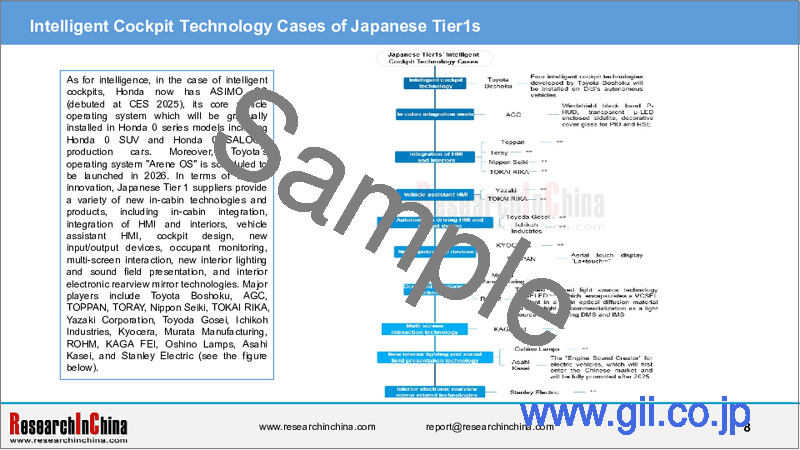

As for intelligence, in the case of intelligent cockpits, Honda now has ASIMO OS (debuted at CES 2025), its core vehicle operating system which will be gradually installed in Honda 0 series models including Honda 0 SUV and Honda 0 SALOON production cars. Moreover, Toyota's operating system "Arene OS" is scheduled to be launched in 2026. In terms of cockpit innovation, Japanese Tier 1 suppliers provide a variety of new in-cabin technologies and products, including in-cabin integration, integration of HMI and interiors, vehicle assistant HMI, cockpit design, new input/output devices, occupant monitoring, multi-screen interaction, new interior lighting and sound field presentation, and interior electronic rearview mirror technologies. Major players include Toyota Boshoku, AGC, TOPPAN, TORAY, Nippon Seiki, TOKAI RIKA, Yazaki Corporation, Toyoda Gosei, Ichikoh Industries, Kyocera, Murata Manufacturing, ROHM, KAGA FEI, Oshino Lamps, Asahi Kasei, and Stanley Electric.

2. Japanese Tier1s work together and collaborate to help Japanese OEMs with rapider global development.

In May 2024, the Ministry of Economy, Trade and Industry announced implementation of stricter regulatory measures in five key industrial sectors, namely, semiconductors, advanced electronic components, batteries, machine tools and industrial robots, and aircraft components, to curb the risk of technology leakage. Japan requires that these technologies should be "developed locally", and the most advanced factories also should "remain at home", and even sales and exports will be regulated.

The Japanese machine tool order data (final value) for November 2024, released by the Japan Machine Tool Builders' Association (JMA) on December 25, 2024, show that the total value of machine tool orders in November was 119.327 billion yen, an increase of 3.0% compared with the same period of the previous year, sustaining growth for two consecutive months. By region, the value of orders from the Chinese market jumped by 33.0% from the prior-year period to 29.319 billion yen, achieving eight consecutive months of growth. Especially in the automotive industry, the value of orders surged by 56.3% to 11.6 billion yen. This is mainly thanks to China's domestic competitiveness enhancement measures around electric vehicles and aggressive investments in overseas factories. The great investment willingness in the Chinese market has become an important source of income for Japanese machine tool manufacturers.

Examples of fine manufacturing process include:

DMG MORI: it has developed a solution based on a five-axis machining center. This solution enables a mode of "one machine, multiple functions" from gear roughing to precision grinding. This system covers the entire process from workpiece turning, milling, and gear roughing (e.g., gear shaping) to final precision grinding, even deburring. At the grinding stage, the grinding modules will be automatically loaded onto the spindle and ground precisely one by one by detecting the gear phase. The system is suitable for internal/external gear machining, with the machining accuracy up to ISO 4.

Nachi-Fujikoshi: it has launched "GSGT260", a gear grinder that enables high-precision and high-efficiency grinding. It is mainly suitable for production of external gears, with the machining accuracy up to Grade 1 of the new JIS. Through form grinding on multiple tooth surfaces at the same time, this equipment is particularly fit to meet the needs of mass-producing reducers for electric vehicle drive modules (e-Axle).

The close internal and external supply relationships of Japanese auto parts Tier1s, and the innovative upgrades in manufacturing process are helping Japanese companies to go steady and far in the global market.

Table of Contents

1 Relevance between Japanese Automotive Tier1s and China

- 1.1 China-Japan Automotive Tier1/OEM Industrial Connections (1)

- 1.1 China-Japan Automotive Tier1/OEM Industrial Connections (2)

- 1.1 China-Japan Automotive Tier1/OEM Industrial Connections (3)

- 1.1 China-Japan Automotive Tier1/OEM Industrial Connections (4)

- 1.1 China-Japan Automotive Tier1/OEM Industrial Connections (5)

- 1.1 China-Japan Automotive Tier1/OEM Industrial Connections (6)

- 1.2 Denso's Layout in China (1)

- 1.2 Denso's Layout in China (2)

- 1.2 Denso's R&D Centers in China

- 1.2 Denso's Production Layout in China

- 1.3 Sumitomo Electric's Layout in China (1)

- 1.3 Sumitomo Electric's Layout in China (2)

- 1.3 Sumitomo Electric's Layout in China (3)

- 1.3 Sumitomo Electric's Layout in China (4)

- 1.4 JTEKT's Production Base Layout in China

- 1.5 NSK Steering & Control's Production Base Layout in China

- 1.6 Hitachi Astemo's Production Base Layout in China

- 1.7 KYB Corporation's Production Base Layout in China

- 1.8 KEL Corporation's Production Plants in China

- 1.9 Yazaki Corporation's Joint Ventures in China

- 1.10 Toyota Motor's Plan for New Wholly-Owned Plants in China

- 1.11 Japan's Machine Tool Orders: Orders from the Chinese Automotive Market

- 1.12 Cases of Typical Japanese Machine Tool Manufacturers

2 Japanese Automotive Tier1s' AI Development, SDV and Chip Research

- Summary: Japan's SDV Goals

- Summary: Japan Lavishes on the Domestic Chip Industry

- Summary: Japan's Eight Giants Expand Chip Production Capacity

- Summary: Comparison between Domestic and Foreign Automotive Chip Processes (1)

- Summary: Comparison between Domestic and Foreign Automotive Chip Processes (2)

- Summary: Japan's Cooperation with TSMC, Nvidia, Intel, and Microsoft (1)

- Summary: Japan's Cooperation with TSMC, Nvidia, Intel, and Microsoft (2)

- Summary: Five Technologies Controlled by Japan

- Summary: Japan's Zetta-class Supercomputer

- Summary: Automotive Chip Alliances (1)

- Summary: Automotive Chip Alliances (2)

- Summary: Comparison of AI Development between Japanese Companies

- 2.1 AI Development Case 1: TURING

- 2.2 AI Development Case 2: Digital Realty

- 2.3 AI Development Case 3:

- 2.4 AI Development Case 4:

- 2.5 AI Development Case 5:

- 2.6 AI Development Case 6:

- 2.7 AI Development Case 7:

- 2.8 AI Development Case 8:

- 2.9 AI Development Case 9:

- Summary: Comparison of SDV Cases between Japanese Companies

- 2.10 SDV Case 1:

- 2.11 SDV Case 2:

- 2.12 SDV Case 3:

- 2.13 SDV Case 4: Honda + Amazon

- 2.14 SDV Case 5: Panasonic Automotive Systems + Arm (1)

- 2.15 SDV Case 6:

- Summary: Comparison of Automotive Chip Cases between Japanese Companies

- 2.16 Automotive Chip Case 1

- 2.17 Automotive Chip Case 2

- 2.18 Automotive Chip Case 3

- 2.19 Automotive Chip Case 4

- 2.20 Automotive Chip Case 5

3 Japanese Automotive Tier1s' Autonomous Driving/ADAS Technologies and Products

- 3.1 Japan's Policies Concerning Autonomous Driving (1)

- 3.1 Japan's Policies Concerning Autonomous Driving (2)

- 3.2 Japan's Autonomous Driving Schedule

- 3.3 Operating System

- Case 1:

- Case 2:

- 3.4 Autonomous Driving/ADAS

- Case 1: Hitachi Astemo

- Case 2: Ricoh

- Case 3: Panasonic Automotive

- Case 4: TDK

- Case 5: Murata

- Case 6: KOITO LiDAR

- Case 7: Sony Semiconductor + Lumotive

- Case 8: Sony Semiconductor (CIS)

- Case 9: Sony Semiconductor + Ansys

- Case 10: Kyocera Corporation

- Case 11: Toyota, Nissan and Momenta Cooperate on ADAS

- Case 12: Honda's Joint Ventures and ADAS for Global Use

- Case 13: Independent + Joint Venture Brands Cooperating with Huawei Intelligent Driving Solutions

4 Japanese Automotive Tier1s' Intelligent Cockpit Technologies and Products

- 4.1 Major Intelligent Cockpit Components Suppliers in Japan (1)

- 4.1 Major Intelligent Cockpit Components Suppliers in Japan (2)

- 4.1 Major Intelligent Cockpit Components Suppliers in Japan (3)

- 4.1 Major Intelligent Cockpit Components Suppliers in Japan (4)

- 4.1 Major Intelligent Cockpit Components Suppliers in Japan (5)

- 4.1 Major Intelligent Cockpit Components Suppliers in Japan (6)

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (1) - Toyota

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (1) - Toyota

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (2) - Nissan

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (3) - Honda

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (4) - Mazda

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (5) - Subaru

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (6) - Suzuki

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (7) - Mitsubishi

- 4.2 Supply Relationship of Intelligent Cockpit Components Suppliers (8) - Daihatsu

- 4.3 Summary of Intelligent Cockpit Technology Cases (1)

- 4.3 Summary of Intelligent Cockpit Technology Cases (2)

- 4.3 Summary of Intelligent Cockpit Technology Cases (3)

- Case 1: Toyota Boshoku (China) + Didi

- Case 2: Asahi Glass Co., Ltd. (AGC)

- Case 3: Toppan

- Case 4: Toray

- Case 5: Nippon Seiki

- Case 6: Tokai Rika

- Case 7: Yazaki

- Case 8: Tokai Rika

- Case 9: Toyota Gosei

- Case 10: Ichikoh Industries

- Case 11: Kyocera Corporation

- Case 12: Murata Manufacturing Co., Ltd.

- Case 13: Rohm

- Case 14: Kaga FEI Co., Ltd.

- Case 15: Oshino Electric Mfg. Co., Ltd.

- Case 16: Asahi Kasei

- Case 17: Stanley Electric Co., Ltd.

- Case 18: Nidec

5 Japanese Tier1s' Electrification Technologies and Products

- 5.1 Summary of IGBT/SiC/GaN Power Semiconductors (1)

- 5.1 Summary of IGBT/SiC/GaN Power Semiconductors (2)

- 5.1 Summary of IGBT/SiC/GaN Power Semiconductors (3)

- Case 1: Fuji Electric IGBT

- Case 2: Fuji Electric + Denso SiC

- Case 3: Mitsubishi Electric SiC

- Case 4: Rohm SiC

- Case 5: Rohm + Valeo SiC

- Case 6: Rohm IGBT

- Case 7: Rohm GaN

- Case 8: Japanese Material Manufacturers Work on Mass Production of GaN Substrates

- 5.2 e-Axle

- Case 1: Nidec

- Case 2: INAC

- Case 3: Aisin

- 5.3 Summary of Motor Products (1)

- 5.3 Summary of Motor Products (2)

- 5.3 Summary of Motor Products (3)

- Case 1: Tomita Electric

- Case 2: JFE Precision

- Case 3: Tokai Rika & Toshiba

- Case 4: THK

- Case 5: ELEMEC

- Case 6: Nidec

- Case 7: Odawara Mechanical Engineering

- Case 8: Nitto

- Case 9: Kuroda Seiko

- Case 10: Shin-Etsu Chemical

- Case 11: Sumitomo Electric Industries

- Case 12: Toshiba + MIKROE

- 5.4 Battery/Solid State Battery

- Supply Assurance Plan for Batteries Approved by the Ministry of Economy, Trade and Industry

- Battery Association for Supply Chain (BASC)

- Japan Vigorously Develops All-solid-state Batteries

- Honda's All-solid-state Battery Production Line

- Toyota's All-solid-state Battery Production

- Case 1: TDK

- Case 2: Panasonic

- Case 3: Shibaura Machine

- Case 4: PXP

- Case 5: Toshiba

- Case 6: Yazaki

- Case 7: AM Batteries

6 Supply Relationship of Japanese Tier1s

- 6.1 Denso

- 6.1.1 Supply Relationship with OEMs (1)

- 6.1.1 Supply Relationship with OEMs (2)

- 6.1.1 Supply Relationship with OEMs (3)

- 6.1.1 Supply Relationship with OEMs (4)

- 6.1.1 Supply Relationship with OEMs (5)

- 6.1.1 Supply Relationship with OEMs (6)

- 6.1.1 Supply Relationship with OEMs (7)

- 6.1.1 Supply Relationship with OEMs (8)

- 6.1.2 Main Customers

- 6.2 Aisin

- 6.2.1 Supply Relationship with OEMs (1)

- 6.2.1 Supply Relationship with OEMs (2)

- 6.2.1 Supply Relationship with OEMs (3)

- 6.2.2 Main Customers

- 6.2.3 Aisin Group's Revenue Structure (by Customer), FY2023-FY2025

- 6.3 Nidec

- 6.3.1 Supply Relationship with OEMs

- 6.3.2 Main Customers

- 6.3.3 Main Subsidiaries and Businesses

- 6.3.4 Sales by Product

- 6.3.4 Sales by Region

- 6.4 Sumitomo Electric

- 6.4.1 Supply Relationship with OEMs (1)

- 6.4.1 Supply Relationship with OEMs (2)

- 6.4.1 Supply Relationship with OEMs (3)

- 6.4.1 Supply Relationship with OEMs (4)

- 6.4.2 Sales by Division

- 6.4.2 Sales by Region

- 6.4.2 Sales by Product

- 6.5 Japanese Electric Power Steering (EPS) Suppliers and Their Supply Relationship

- 6.5.1 Major Japanese EPS Parts Suppliers and Their Customers (Japan-made Models)

- 6.5.2 OEM Customers of Japanese EPS Suppliers

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (1) - Toyota

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (1) - Toyota

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (1) - Toyota

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (2) - Nissan

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (3) - Honda

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (4) - Subaru

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (5) - Mazda

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (6) - Mitsubishi

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (7) - Suzuki

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (7) - Suzuki

- 6.5.3 Supply Relationship of Major Japanese EPS Parts Suppliers (8) - Daihatsu

- 6.6 Major ADAS Radar & LiDAR Suppliers and Their Supply Relationship with OEMs in the Japanese Market

- 6.6.1 Major ADAS Radar & LiDAR Suppliers and Their Supply Relationship with OEMs in the Japanese Market (1) - Toyota

- 6.6.2 Major ADAS Radar & LiDAR Suppliers and Their Supply Relationship with OEMs in the Japanese Market (2) - Nissan/Honda/Subaru/Mazda/Mitsubishi

- 6.6.3 Major ADAS Radar & LiDAR Suppliers and Their Supply Relationship with OEMs in the Japanese Market (2) - Suzuki/Daihatsu

7 Internal Cooperation and International Connections of Japanese OEMs

- 7.1 Japan's New Vehicle Sales, Jan-Nov 2024

- 7.2 Layout of Overseas Production Bases of Japanese OEMs

- 7.3 Overseas Production Data of Japanese OEMs

- 7.4 Technical Cooperation between Japanese OEMs (1)

- 7.4 Technical Cooperation between Japanese OEMs (2)

- 7.5 Distribution of Vehicle/Parts Manufacturing Plants in Japan

- 7.6 Japan - Connection with China's Automotive Industry

- 7.7 Japan - Connection with US Automotive Industry

- 7.8 Japan - Connection with Europe's Automotive Industry

- 7.9 Electrification/Intelligence of Japanese OEMs

- Toyota's Electrification Plan

- Toyota's Battery R&D Plan (1)

- Toyota's Battery R&D Plan (2)

- Toyota's Intelligent Electric Vehicle R&D in China

- GAC Toyota's Intelligence

- FAW Toyota's Intelligence

- Honda's Electric Transformation Plan

- Honda's Battery and Production Capacity Layout

- Honda's All-solid-state Battery Production Line

- Nissan's Electric Vehicle Model Launch Plan

- Nissan Accelerates Its Electrification Transformation

- Nissan Accelerates Its Intelligence Layout

- Dongfeng Nissan's Intelligence